Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ho3 Cash and Marketable Securities Management

Caricato da

Mae ShoppCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ho3 Cash and Marketable Securities Management

Caricato da

Mae ShoppCopyright:

Formati disponibili

CASH and MARKETABLE SECURITIES MANAGEMENT

CASH MANAGEMENT – involves the maintenance of the appropriate level of

cash to meet the firm’s cash requirements and to maximize income on idle

funds.

MARKETABLE SECURITIES MANAGEMENT- involves the process of planning and

controlling investment in marketable securities to meet the firm’s cash

requirements and to maximize income on idle funds.

OBJECTIVE: To minimize the amount of cash on hand while retaining

sufficient liquidity to satisfy business requirements (e.g., take advantage of

cash discounts, maintain credit rating, meet unexpected needs.)

REASONS FOR HOLDING CASH: “Why would a firm hold cash when, being idle,

it is a non-earning asset?”

1. TRANSACTION motive (Liquidity motive)

Cash is held to facilitate normal transactions of the business.

2. PRECAUTIONARY motive (Contingent motive)

Cash is held beyond the normal operating requirement level to

provide for buffer against contingencies, such as slow-down in

accounts receivable collection, possibilities of strikes, etc.

3. SPECULATIVE motive

Cash is held to avail of business incentives (e.g., discounts) and

investment opportunities.

4. CONTRACTUAL motive- Compensating Balance Requirements

A company is required by a bank to maintain a certain compensating

balance in its demand deposit account as condition of a loan

extended to it.

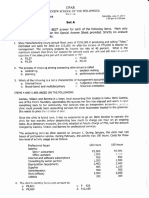

OPTIMAL CASH BALANCE: BAUMUL MODEL

OCB= √(2)(Annual Cash Requirement )(Cost Per Transaction)

Opportunity Cost of Holding Cash

Total Costs of Cash Balance= Holding Costs + Transaction Costs

• Holding Costs = Average cash balance* x opportunity cost

• Transaction Costs= Number of transactions** x Cost per Transaction

*Average cash balance= OCB/2

**Number of transactions= Annual Cash Requirement/.OCB

CASH CONVERSION CYCLE

-is the average length of time a peso is tied up in current assets. It runs from the

date the company makes payment of raw materials to the date company

receives cash inflows thru collection of accounts receivable. It is also known as

the cash flow cycle.

Inventory conversion period (Inventory/CGS* per day

+ Receivable Collection period (Receivables/Sales per day)

- Payable deferral period (Payables/ Purchases per day)

CASH CONVERSION CYCLE

*Alternatively, sales per day may be also used to compute conversion period.

The intention is to use an amount in proportion to unit sales.

The firm’s goal should be to shorten its cash conversion cycle without hurting

operations. The longer the cash conversion cycle, the greater the need for

external financing (hence, the more cost of financing).

CASH MANAGEMENT STRATEGIES

1. Accelerating collections (e.g. lockbox system)

2. Slowing disbursements (e.g., playing the floats)

3. Reducing precautionary idle cash (e.g., zero-balance accounts)

THE CONCEPT OF FLOAT

FLOAT- generally defined as the difference between the cash balance per BANK

and the cash balance per BOOK as of a particular period, primarily due to

outstanding checks or other similar reasons.

Types of float:

1. POSITIVE(Disbursement) Float: Bank balance> Book Balance

Example: Outstanding checks issued by the firm that have not cleared yet

2. NEGATIVE (Collection) Float: Book Balance> Bank Balance

Examples:

a. MAIL Float- Amount of customers’ payments that have been

mailed by customers but not yet received by the seller-company.

b. PROCESSING Float- Amount of customers’ payments that have

been received by the seller but not yet deposited

c. CLEARING Float- Amount of customers’ checks that have been

deposited but have not cleared yet.

Good cash management suggests that positive float should be maximized

(negative float minimized).

MARKETABLE SECURITIES

-short-term money market instruments that can easily be converted to cash.

CERTICATES OF DEPOSITS (CD)- savings deposits at financial institutions (e.g., time

deposit)

MONEY MARKET FUNDS- shares in a fund that purchases higher-yielding bank

CDs, commercial paper, and other large-denomination, higher-yielding securities

GOVERNMENT SECURITIES

• Treasury bills- debt instruments representing obligations of the

National Government issued by the Central Bank and usually sold

at a discount through competitive bidding.

• CB Bills or Certificate of Indebtedness (CBCIs)- represent

indebtedness by the Central Bank.

FACTORS INFLUENCING THE CHOICE OF MARKETABLE SECURITIES

1. RISK

• Default Risk- refers to the chances that the issuer may not be able

to pay the interest or principal on time or at all

• Interest Rate Risk- refers to fluctuations in MS prices caused by

changes in market interest rates

• Inflation Risk- Refers to the risk that inflation will reduce the relevant

value of the investment.

2. RETURNS- The higher the MS’s risk involved the higher its required return.

While MS must consist of highly liquid short-term investments, the company

should not sacrifice safety, for higher rates of return.

3. MATURITY- Maturity dates of MS held should coincide, whenever possible,

with the date at which the firm needs cash, or when the firm will no longer

have cash to invest

4. MARKETABILITY- refers to how quickly a security can be sold before

maturity date without a significant price concession

Potrebbero piacerti anche

- At - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Documento85 pagineAt - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Waleed MustafaNessuna valutazione finora

- Chapter 10 Test BankDocumento48 pagineChapter 10 Test BankDAN NGUYEN THE100% (1)

- Taxation Report - Valuation of Properties - Vanishing DeductionDocumento49 pagineTaxation Report - Valuation of Properties - Vanishing DeductionAnonymous S6CQnxuJcINessuna valutazione finora

- Special Taxpayers Subject To Preferential Tax RatesDocumento42 pagineSpecial Taxpayers Subject To Preferential Tax RatesErneylou RanayNessuna valutazione finora

- CHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocumento2 pagineCHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNessuna valutazione finora

- C. A System of Quality ControlsDocumento11 pagineC. A System of Quality ControlsMC ExtNessuna valutazione finora

- Afar 2019Documento9 pagineAfar 2019TakuriNessuna valutazione finora

- Chapter 10 Investments in Debt SecuritiesDocumento24 pagineChapter 10 Investments in Debt SecuritiesChristian Jade Lumasag NavaNessuna valutazione finora

- Op Aud Quizzes 9 Files MergedDocumento166 pagineOp Aud Quizzes 9 Files MergedAlliahDataNessuna valutazione finora

- Business Combination Part 3Documento4 pagineBusiness Combination Part 3Aljenika Moncada GupiteoNessuna valutazione finora

- Working Capital and Short-Term FinancingDocumento5 pagineWorking Capital and Short-Term FinancingDivine VictoriaNessuna valutazione finora

- Audit of Receivable PDFDocumento7 pagineAudit of Receivable PDFRyan Prado Andaya100% (1)

- Jeter Advanced Accounting 4eDocumento14 pagineJeter Advanced Accounting 4eMinh NguyễnNessuna valutazione finora

- RFBT-07-01a Law On Obligations Notes With MCQs Practice SetDocumento110 pagineRFBT-07-01a Law On Obligations Notes With MCQs Practice SetAiza S. Maca-umbosNessuna valutazione finora

- Solution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentDocumento39 pagineSolution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentCaryll Joy BisnanNessuna valutazione finora

- Semis Tax PPTSDocumento271 pagineSemis Tax PPTSTeam MindanaoNessuna valutazione finora

- Conditions foreign CPAs practice accountancy PhilippinesDocumento3 pagineConditions foreign CPAs practice accountancy PhilippinesANGELU RANE BAGARES INTOLNessuna valutazione finora

- Income Taxation GuideDocumento543 pagineIncome Taxation Guidemae annNessuna valutazione finora

- Chapter 3 Liquidation ValueDocumento11 pagineChapter 3 Liquidation ValueJIL Masapang Victoria ChapterNessuna valutazione finora

- Exercise No.4 Bus. Co.Documento56 pagineExercise No.4 Bus. Co.Jeane Mae BooNessuna valutazione finora

- RFBT-09 (Banking Laws)Documento13 pagineRFBT-09 (Banking Laws)Erlinda MolinaNessuna valutazione finora

- B. A Liability of Uncertain Timing or AmountDocumento15 pagineB. A Liability of Uncertain Timing or Amountcherry blossomNessuna valutazione finora

- Finals Handout TaxDocumento3 pagineFinals Handout TaxFlorenz AmbasNessuna valutazione finora

- QuizDocumento13 pagineQuizPearl Morni AlbanoNessuna valutazione finora

- Auditing Chapter 1Documento7 pagineAuditing Chapter 1Sigei LeonardNessuna valutazione finora

- REGULATORY FRAMEWORK MCQDocumento17 pagineREGULATORY FRAMEWORK MCQabcdefgNessuna valutazione finora

- AISDocumento11 pagineAISJezeil DimasNessuna valutazione finora

- Standard Costing and Analysis of VarianceDocumento13 pagineStandard Costing and Analysis of VarianceRuby P. Madeja100% (1)

- IFRS 15 New FridayDocumento73 pagineIFRS 15 New Fridaynati67% (3)

- Mixed PDFDocumento8 pagineMixed PDFChris Tian FlorendoNessuna valutazione finora

- CASH MANAGEMENT AND WORKING CAPITAL OPTIMIZATIONDocumento2 pagineCASH MANAGEMENT AND WORKING CAPITAL OPTIMIZATIONR100% (1)

- Lecture Notes On Trade and Other ReceivablesDocumento5 pagineLecture Notes On Trade and Other Receivablesjudel ArielNessuna valutazione finora

- CPA Review School of The Philippines ManilaDocumento4 pagineCPA Review School of The Philippines ManilaSophia PerezNessuna valutazione finora

- Assets 1Documento84 pagineAssets 1librarypublisher67% (3)

- International Business 3Documento45 pagineInternational Business 3Ken TuazonNessuna valutazione finora

- Unit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1Documento5 pagineUnit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1MARK JHEN SALANGNessuna valutazione finora

- Chapter 1 AbcDocumento24 pagineChapter 1 AbcChennie Mae Pionan SorianoNessuna valutazione finora

- Audit Testing (Audttheo)Documento5 pagineAudit Testing (Audttheo)marieieiem100% (1)

- RFBT (2 of 2) Preweek B94 - QuestionnaireDocumento16 pagineRFBT (2 of 2) Preweek B94 - QuestionnaireSilver LilyNessuna valutazione finora

- Pas 40 Investment PropertyDocumento4 paginePas 40 Investment PropertykristineNessuna valutazione finora

- FAR Final Preboard SolutionsDocumento6 pagineFAR Final Preboard SolutionsVillanueva, Mariella De VeraNessuna valutazione finora

- True or False Chapter 4 and 5 QuestionsDocumento2 pagineTrue or False Chapter 4 and 5 Questionswaiting4y100% (1)

- Cash To InventoriesDocumento63 pagineCash To InventoriesPrincess Grace Baarde CastroNessuna valutazione finora

- CH 12 - Fraud and ErrorDocumento5 pagineCH 12 - Fraud and ErrorJwyneth Royce DenolanNessuna valutazione finora

- Bonds Payable Accounting & ReportingDocumento12 pagineBonds Payable Accounting & ReportingJehPoyNessuna valutazione finora

- Ap 06 REO Receivables - PDF 074431Documento19 pagineAp 06 REO Receivables - PDF 074431ChristianNessuna valutazione finora

- Audit Exam QuestionnaireDocumento12 pagineAudit Exam QuestionnaireKathleenNessuna valutazione finora

- Handout 1 - Nonprofit Organizations - RevisedDocumento10 pagineHandout 1 - Nonprofit Organizations - RevisedPaupauNessuna valutazione finora

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Documento6 paginePhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)verycooling100% (1)

- Pert 2 - Derivative Hedge AccountingDocumento48 paginePert 2 - Derivative Hedge AccountingDian Nur IlmiNessuna valutazione finora

- Auditing Cash BalancesDocumento6 pagineAuditing Cash BalancesCJ GranadaNessuna valutazione finora

- Business Combination Problems SolvedDocumento2 pagineBusiness Combination Problems SolvedcpacpacpaNessuna valutazione finora

- Understanding Entity EnvironmentDocumento4 pagineUnderstanding Entity EnvironmentKathleenNessuna valutazione finora

- ReportsDocumento5 pagineReportsLeanne FaustinoNessuna valutazione finora

- Allowable Deductions Part 1Documento3 pagineAllowable Deductions Part 1John Rich GamasNessuna valutazione finora

- Philippine Deposit Insurance Corporation (PDIC) policies on insured depositsDocumento5 paginePhilippine Deposit Insurance Corporation (PDIC) policies on insured depositsAngelo Raphael B. DelmundoNessuna valutazione finora

- FINALS - Theory of AccountsDocumento8 pagineFINALS - Theory of AccountsAngela ViernesNessuna valutazione finora

- KEY Level 2 QuestionsDocumento5 pagineKEY Level 2 QuestionsDarelle Hannah MarquezNessuna valutazione finora

- Chap 011Documento36 pagineChap 011Angel TumamaoNessuna valutazione finora

- BSC in EEE Full Syllabus (Credit+sylabus)Documento50 pagineBSC in EEE Full Syllabus (Credit+sylabus)Sydur RahmanNessuna valutazione finora

- Crypto Is New CurrencyDocumento1 paginaCrypto Is New CurrencyCM-A-12-Aditya BhopalbadeNessuna valutazione finora

- Soal Pat Inggris 11Documento56 pagineSoal Pat Inggris 11dodol garutNessuna valutazione finora

- X Ay TFF XMST 3 N Avx YDocumento8 pagineX Ay TFF XMST 3 N Avx YRV SATYANARAYANANessuna valutazione finora

- Power Efficiency Diagnostics ReportDocumento16 paginePower Efficiency Diagnostics Reportranscrib300Nessuna valutazione finora

- PrefaceDocumento16 paginePrefaceNavaneeth RameshNessuna valutazione finora

- Break-Even Analysis: Margin of SafetyDocumento2 pagineBreak-Even Analysis: Margin of SafetyNiño Rey LopezNessuna valutazione finora

- AAFA Webinar Intertek Jan 2012 V5Documento29 pagineAAFA Webinar Intertek Jan 2012 V5rabiulfNessuna valutazione finora

- Accor vs Airbnb: Business Models in Digital EconomyDocumento4 pagineAccor vs Airbnb: Business Models in Digital EconomyAkash PayunNessuna valutazione finora

- West Systems Fiberglass Boat Repair & MaintenanceDocumento91 pagineWest Systems Fiberglass Boat Repair & MaintenanceDonát Nagy100% (2)

- Danielle Smith: To Whom It May ConcernDocumento2 pagineDanielle Smith: To Whom It May ConcernDanielle SmithNessuna valutazione finora

- Depressurization LED Solar Charge Controller with Constant Current Source SR-DL100/SR-DL50Documento4 pagineDepressurization LED Solar Charge Controller with Constant Current Source SR-DL100/SR-DL50Ria IndahNessuna valutazione finora

- Balance NettingDocumento20 pagineBalance Nettingbaluanne100% (1)

- Solid Waste On GHG Gas in MalaysiaDocumento10 pagineSolid Waste On GHG Gas in MalaysiaOng KaiBoonNessuna valutazione finora

- Wyckoff e BookDocumento43 pagineWyckoff e BookIan Moncrieffe95% (22)

- SISU Datenblatt 7-ZylDocumento2 pagineSISU Datenblatt 7-ZylMuhammad rizkiNessuna valutazione finora

- Computer Science Practical File WorkDocumento34 pagineComputer Science Practical File WorkArshdeep SinghNessuna valutazione finora

- Analytic Solver Platform For Education: Setting Up The Course CodeDocumento2 pagineAnalytic Solver Platform For Education: Setting Up The Course CodeTrevor feignarddNessuna valutazione finora

- Environmental Pollution and Need To Preserve EnvironmentDocumento3 pagineEnvironmental Pollution and Need To Preserve EnvironmentLakshmi Devar100% (1)

- Application For Freshman Admission - PDF UA & PDocumento4 pagineApplication For Freshman Admission - PDF UA & PVanezza June DuranNessuna valutazione finora

- Private Car Package Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleDocumento3 paginePrivate Car Package Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleijustyadavNessuna valutazione finora

- Lessee Information StatementDocumento1 paginaLessee Information Statementmja.carilloNessuna valutazione finora

- Keys and Couplings: Definitions and Useful InformationDocumento10 pagineKeys and Couplings: Definitions and Useful InformationRobert Michael CorpusNessuna valutazione finora

- Torta de Riso Business PlanDocumento25 pagineTorta de Riso Business PlanSalty lNessuna valutazione finora

- Nº SSR-1 NS-R-3 Draf R1 Site Evaluation For Nuclear Installations FRDocumento33 pagineNº SSR-1 NS-R-3 Draf R1 Site Evaluation For Nuclear Installations FRdaniel addeNessuna valutazione finora

- Yamaha Stagepas 300Documento54 pagineYamaha Stagepas 300Ammar MataradzijaNessuna valutazione finora

- Examples 5 PDFDocumento2 pagineExamples 5 PDFskaderbe1Nessuna valutazione finora

- Chapter 2 FlywheelDocumento24 pagineChapter 2 Flywheelshazwani zamriNessuna valutazione finora

- ICT FX4Model FrameworkDocumento20 pagineICT FX4Model FrameworkSnowNessuna valutazione finora

- Ubaf 1Documento6 pagineUbaf 1ivecita27Nessuna valutazione finora

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingDa EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingValutazione: 5 su 5 stelle5/5 (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Da EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Valutazione: 4.5 su 5 stelle4.5/5 (24)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora

- Profit First for Therapists: A Simple Framework for Financial FreedomDa EverandProfit First for Therapists: A Simple Framework for Financial FreedomNessuna valutazione finora

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDa EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyValutazione: 5 su 5 stelle5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDa EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesValutazione: 4.5 su 5 stelle4.5/5 (30)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- Basic Accounting: Service Business Study GuideDa EverandBasic Accounting: Service Business Study GuideValutazione: 5 su 5 stelle5/5 (2)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesDa EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNessuna valutazione finora

- Accounting: The Ultimate Guide to Understanding More about Finances, Costs, Debt, Revenue, and TaxesDa EverandAccounting: The Ultimate Guide to Understanding More about Finances, Costs, Debt, Revenue, and TaxesValutazione: 5 su 5 stelle5/5 (4)

- Accounting Policies and Procedures Manual: A Blueprint for Running an Effective and Efficient DepartmentDa EverandAccounting Policies and Procedures Manual: A Blueprint for Running an Effective and Efficient DepartmentNessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungDa EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungValutazione: 4 su 5 stelle4/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)