Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Case 1

Caricato da

Carl Marx Fernandez0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

52 visualizzazioni3 pagine1) Koruga, a minority stockholder of Banco Filipino, filed a complaint in the Makati Regional Trial Court against the bank's directors alleging various violations of the Corporation Code. 2) The directors argued the case should be dismissed as the Bangko Sentral ng Pilipinas (BSP) has exclusive jurisdiction over matters relating to the operations and activities of banks. 3) The Supreme Court ruled in favor of the directors, finding that the BSP has sole authority over cases involving the conduct of a bank's business. The RTC therefore had no jurisdiction over Koruga's claims.

Descrizione originale:

Case 1

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documento1) Koruga, a minority stockholder of Banco Filipino, filed a complaint in the Makati Regional Trial Court against the bank's directors alleging various violations of the Corporation Code. 2) The directors argued the case should be dismissed as the Bangko Sentral ng Pilipinas (BSP) has exclusive jurisdiction over matters relating to the operations and activities of banks. 3) The Supreme Court ruled in favor of the directors, finding that the BSP has sole authority over cases involving the conduct of a bank's business. The RTC therefore had no jurisdiction over Koruga's claims.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

52 visualizzazioni3 pagineCase 1

Caricato da

Carl Marx Fernandez1) Koruga, a minority stockholder of Banco Filipino, filed a complaint in the Makati Regional Trial Court against the bank's directors alleging various violations of the Corporation Code. 2) The directors argued the case should be dismissed as the Bangko Sentral ng Pilipinas (BSP) has exclusive jurisdiction over matters relating to the operations and activities of banks. 3) The Supreme Court ruled in favor of the directors, finding that the BSP has sole authority over cases involving the conduct of a bank's business. The RTC therefore had no jurisdiction over Koruga's claims.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

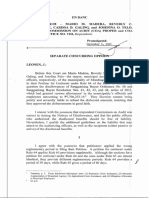

ANA MARIA A. KORUGA v. TEODORO O. ARCENAS, GR No.

168332, 2009-06-19

Facts:

G.R. No. 168332

Koruga is a minority stockholder of Banco Filipino

On August 20, 2003, she filed a complaint before the Makati RTC

Koruga's complaint alleged:

1. 1 Violation of Sections 31 to 34 of the Corporation Code ("Code") which prohibit

self-dealing and conflicts of interest of directors and officers

10.2 Right of a stockholder to inspect the records of a corporation (including financial

statements) under Sections 74 and 75 of the Code

10.3 Receivership and Creation of a Management Committee

On September 12, 2003, Arcenas, et al. filed their Answer raising, among others, the

trial court's lack of jurisdiction to take cognizance of the case. They also filed a

Manifestation and Motion seeking the dismissal of the case

In an Order dated October 18, 2004, the trial court denied the Manifestation and

Motion

On February 9, 2005, the CA issued a 60-day TRO enjoining Judge Marella from

conducting further proceedings in the case.

On February 22, 2005, the RTC issued a Notice of Pre-trial[9] setting the case for

pre-trial on June 2 and 9, 2005. Arcenas, et al. filed a Manifestation and Motion[10]

before the CA, reiterating their application for a writ of... preliminary injunction. Thus,

on April 18, 2005, the CA issued the assailed Resolution, which reads in part:

(C)onsidering that the Temporary Restraining Order issued by this Court on February

9, 2005 expired on April 10, 2005, it is necessary that a writ of preliminary injunction be

issued in order not to render ineffectual whatever final resolution this Court may

render... in this case, after the petitioners shall have posted a bond

Dissatisfied, Koruga filed this Petition for Certiorari under Rule 65 of the Rules of Court.

Koruga alleged that the CA effectively gave due course to Arcenas, et al.'s petition

when it issued a writ of preliminary injunction without factual or legal basis

Meanwhile, on March 13, 2006, this Court issued a Resolution granting the prayer for a

TRO and enjoining the Presiding Judge of Makati RTC, Branch 138, from proceeding

with the hearing of the case upon the filing by Arcenas, et al. of a P50,000.00 bond.

G.R. No. 169053

In their Petition, Arcenas, et al. asked the Court to set aside the Decision[14] dated

July 20, 2005 of the CA in CA-G.R. SP No. 88422, which denied their petition, having

found no grave abuse of discretion on the part of the Makati RTC. The CA said that...

the RTC Orders were interlocutory in nature and, thus, may be assailed by certiorari or

prohibition only when it is shown that the court acted without or in excess of jurisdiction

or with grave abuse of discretion.

Issues:

Which body has jurisdiction over the Koruga Complaint, the RTC or the BSP?

Ruling:

We hold that it is the BSP that has jurisdiction over the case.

the acts complained of pertain to the conduct of Banco Filipino's banking business.

The law vests in the BSP the supervision over operations and activities of banks.

Specifically, the BSP's supervisory and regulatory powers include:... conduct of

examination to determine compliance with laws and regulations if the circumstances

so warrant as determined by the Monetary Board;

Overseeing to ascertain that laws and Regulations are complied with;

Regular investigation which shall not be oftener than once a year from the last date of

examination to determine whether an institution is conducting its business on a safe or

sound basis

Inquiring into the solvency and liquidity of the institution

Correlatively, the General Banking Law of 2000 specifically deals with loans

contracted by bank directors or officers, thus:

SECTION 36. Restriction on Bank Exposure to Directors, Officers, Stockholders and

Their Related Interests.

The Monetary Board may regulate the amount of loans, credit accommodations and

guarantees that may be extended, directly or indirectly, by a bank to its directors,

officers, stockholders and their related interests, as well as investments of such bank

in enterprises owned or... controlled by said directors, officers, stockholders and their

related interests.

Furthermore, the authority to determine whether a bank is conducting business in an

unsafe or unsound manner is also vested in the Monetary Board.

Finally, the New Central Bank Act grants the Monetary Board the power to impose

administrative sanctions on the erring bank:

Section 37.

the Monetary Board may, at its discretion, impose upon... any bank or quasi-bank, their

directors and/or officers... or any commission of irregularities, and/or conducting

business in an unsafe or unsound manner as may be determined by the Monetary

Board

Koruga's invocation of the provisions of the Corporation Code is misplaced. In an

earlier case with similar antecedents, we ruled that:

The Corporation Code, however, is a general law applying to all types of corporations,

while the New Central Bank Act regulates specifically banks and other financial

institutions, including the dissolution and liquidation thereof. As between a general and

special... law, the latter shall prevail - generalia specialibus non derogant.

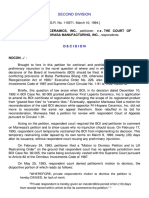

Consequently, it is not the Interim Rules of Procedure on Intra-Corporate

Controversies,[32] or Rule 59 of the Rules of Civil Procedure on Receivership, that

would apply to this case. Instead, Sections 29 and 30 of the New Central Bank Act

should be... followed

, viz.:

Section 30.

the Monetary Board may summarily and without need for prior... hearing forbid the

institution from doing business in the Philippines and designate the Philippine Deposit

Insurance Corporation as receiver of the banking institution.

actions of the Monetary Board taken under this section or under Section 29 of this Act

shall be final and executory, and may not be restrained or set aside by the court except

on petition for certiorari on the ground that the action taken was in excess of...

jurisdiction or with such grave abuse of discretion as to amount to lack or excess of

jurisdiction.

the appointment of a receiver under this section shall be vested exclusively with the

Monetary Board.

On the strength of these provisions, it is the Monetary Board that exercises exclusive

jurisdiction over proceedings for receivership of banks.

From the foregoing disquisition, there is no doubt that the RTC has no jurisdiction to

hear and decide a suit that seeks to place Banco Filipino under receivership.

the court's jurisdiction could only have been invoked after the Monetary Board had

taken action on the matter and only on the ground that the action taken was in excess

of jurisdiction or with such grave abuse of discretion as to amount to lack or excess of...

jurisdiction.

Potrebbero piacerti anche

- Directors' Duties Case Falls Under BSP JurisdictionDocumento3 pagineDirectors' Duties Case Falls Under BSP JurisdictionI took her to my penthouse and i freaked itNessuna valutazione finora

- Koruga v. ArcenasDocumento2 pagineKoruga v. ArcenasKara MolinarNessuna valutazione finora

- Koruga Vs ArcenasDocumento2 pagineKoruga Vs ArcenasJoshua Erik MadriaNessuna valutazione finora

- Minority Stockholder Dispute Over Bank's Operations Ruled Under BSP JurisdictionDocumento2 pagineMinority Stockholder Dispute Over Bank's Operations Ruled Under BSP JurisdictionEmmanuel MabolocNessuna valutazione finora

- Koruga Vs ArcenasDocumento3 pagineKoruga Vs ArcenasPaolo MendioroNessuna valutazione finora

- 9) Ana Maria A. Koruga vs. Teodoro O. Arcenas, JR., Et. Al - Teodoro O. Arcenas Et. Al. vs. Hon. Sixto Marella (2009)Documento2 pagine9) Ana Maria A. Koruga vs. Teodoro O. Arcenas, JR., Et. Al - Teodoro O. Arcenas Et. Al. vs. Hon. Sixto Marella (2009)AlexandraSoledadNessuna valutazione finora

- Koruga v. Arcenas, Et. Al, G.R. No. 168332Documento2 pagineKoruga v. Arcenas, Et. Al, G.R. No. 168332xxxaaxxxNessuna valutazione finora

- 295 Koruga V Arcenas AlquizalasDocumento2 pagine295 Koruga V Arcenas AlquizalasLindolf de CastroNessuna valutazione finora

- Central Bank vs. CADocumento3 pagineCentral Bank vs. CAcmv mendozaNessuna valutazione finora

- CB Resolution Placing Bank Under Receivership UpheldDocumento2 pagineCB Resolution Placing Bank Under Receivership UpheldBion Henrik PrioloNessuna valutazione finora

- Case Digest4Documento5 pagineCase Digest4myles15Nessuna valutazione finora

- Koruga v. ArcenasDocumento28 pagineKoruga v. ArcenasTimmy GonzalesNessuna valutazione finora

- BANKING LAWS-ReportDocumento17 pagineBANKING LAWS-ReportJoel ElunaNessuna valutazione finora

- CIVPRO 37. Koruga v. Arcenas, G.R. 168332-16903, 19 June 2009Documento2 pagineCIVPRO 37. Koruga v. Arcenas, G.R. 168332-16903, 19 June 2009Kim SimagalaNessuna valutazione finora

- Koruga Vs ArcenasDocumento2 pagineKoruga Vs ArcenasClrzNessuna valutazione finora

- Central Bank vs. CADocumento5 pagineCentral Bank vs. CABonD.J.DomingoNessuna valutazione finora

- Chamber of Agriculture v. Central BankDocumento123 pagineChamber of Agriculture v. Central BankRay Joshua ValdezNessuna valutazione finora

- Central Bank of The Philippines Vs CADocumento2 pagineCentral Bank of The Philippines Vs CALyceum LawlibraryNessuna valutazione finora

- SEC rules on one-year term limit for directors of Baguio Country ClubDocumento12 pagineSEC rules on one-year term limit for directors of Baguio Country ClubArjayNessuna valutazione finora

- Maglalang Vs PagcorDocumento4 pagineMaglalang Vs Pagcorcmptmarissa0% (1)

- Central Bank of The Phils. vs. C.A, G.R. No. 7618, March 30, 1993, 220 SCRA 536Documento5 pagineCentral Bank of The Phils. vs. C.A, G.R. No. 7618, March 30, 1993, 220 SCRA 536Carlos JamesNessuna valutazione finora

- Banking and Allied Laws CasesDocumento330 pagineBanking and Allied Laws Casesalmostthere22Nessuna valutazione finora

- BusuegoDocumento35 pagineBusuegoJay EmmanuelNessuna valutazione finora

- Sps. Balangauan Digest (#7)Documento213 pagineSps. Balangauan Digest (#7)Jaja GkNessuna valutazione finora

- Case Digest Banking LawsDocumento422 pagineCase Digest Banking LawsRonald LasinNessuna valutazione finora

- Leonen PDFDocumento14 pagineLeonen PDFAbby ReyesNessuna valutazione finora

- Marquez Vs DisiertoDocumento6 pagineMarquez Vs DisiertoVanessa Canceran AlporhaNessuna valutazione finora

- Busuego V. Ca: Supervision and Examination of Banks. Capital Structure of Banks and Quasi-BanksDocumento9 pagineBusuego V. Ca: Supervision and Examination of Banks. Capital Structure of Banks and Quasi-BanksMasterboleroNessuna valutazione finora

- Leonen Case Digest 90Documento4 pagineLeonen Case Digest 90Marshan GualbertoNessuna valutazione finora

- PSBANK Concurring BRIONDocumento7 paginePSBANK Concurring BRIONAlthea M. SuerteNessuna valutazione finora

- First Lepanto Ceramics, Inc Vs CADocumento7 pagineFirst Lepanto Ceramics, Inc Vs CAInghridBusaNessuna valutazione finora

- 67 People v. JumawanDocumento27 pagine67 People v. JumawanJia Chu ChuaNessuna valutazione finora

- G.R. No. 76118 Central Bank V TriumphDocumento9 pagineG.R. No. 76118 Central Bank V TriumphRache BaodNessuna valutazione finora

- 18 CB v. CA PDFDocumento11 pagine18 CB v. CA PDFMico FernandezNessuna valutazione finora

- First Lepanto Ceramics, Inc. vs. CA, 231 SCRA 30 (1994)Documento5 pagineFirst Lepanto Ceramics, Inc. vs. CA, 231 SCRA 30 (1994)Jellie Grace CañeteNessuna valutazione finora

- SEC vs. 1accountants Party-List, Inc.Documento3 pagineSEC vs. 1accountants Party-List, Inc.bernadeth ranolaNessuna valutazione finora

- Yu v. Yukayguan - .Stock and Transfer Book (Sec. 74)Documento28 pagineYu v. Yukayguan - .Stock and Transfer Book (Sec. 74)rapturereadyNessuna valutazione finora

- 35 Sec V Baguio Country 2015Documento20 pagine35 Sec V Baguio Country 2015doc dacuscosNessuna valutazione finora

- Montenegro vs. COA, GR 218544, June 2, 2020Documento5 pagineMontenegro vs. COA, GR 218544, June 2, 2020Judel MatiasNessuna valutazione finora

- VestilDocumento2 pagineVestilKeo C. LausNessuna valutazione finora

- Heirs of Reinoso Sr. vs CA ruling on non-payment of docket feesDocumento11 pagineHeirs of Reinoso Sr. vs CA ruling on non-payment of docket feesmimisabaytonNessuna valutazione finora

- Vivas vs Monetary Board rulingDocumento5 pagineVivas vs Monetary Board rulingmimisabayton100% (1)

- Esteves v. SarmientoDocumento34 pagineEsteves v. SarmientoMikaela PamatmatNessuna valutazione finora

- 206.CB v. CA 220 SCRA 536Documento7 pagine206.CB v. CA 220 SCRA 536Trebx Sanchez de GuzmanNessuna valutazione finora

- GSIS v. Court of AppealsDocumento5 pagineGSIS v. Court of AppealsAnonymous YNTVcDNessuna valutazione finora

- Close Now Hear Later - Exercise of Police Power Over BanksDocumento20 pagineClose Now Hear Later - Exercise of Police Power Over BanksJosh Migo G. MordenoNessuna valutazione finora

- Acuña - Central Bank VS CaDocumento7 pagineAcuña - Central Bank VS CaKaisser John Pura AcuñaNessuna valutazione finora

- Smart vs. NTCDocumento3 pagineSmart vs. NTCCDMNessuna valutazione finora

- First Lepanto vs. CA, G.R. No. 110571, Mar. 10, 1994Documento7 pagineFirst Lepanto vs. CA, G.R. No. 110571, Mar. 10, 1994Yna Marei AguilarNessuna valutazione finora

- Camera Relative To Various Accounts Maintained at Union Bank of The Philippines, Julia VargasDocumento6 pagineCamera Relative To Various Accounts Maintained at Union Bank of The Philippines, Julia VargasMark TeaNessuna valutazione finora

- Go vs. Bangko SentralDocumento14 pagineGo vs. Bangko SentralEvan NervezaNessuna valutazione finora

- Go Vs BSPDocumento7 pagineGo Vs BSPALLYSSA JANE R. RUALLONessuna valutazione finora

- SEC jurisdiction over proxy validation disputesDocumento8 pagineSEC jurisdiction over proxy validation disputesAnonymous vTBEE2Nessuna valutazione finora

- Koruga vs. Arcenas, Et. Al., G.R. No. 168332, June 19, 2009Documento16 pagineKoruga vs. Arcenas, Et. Al., G.R. No. 168332, June 19, 2009Gilbert John LacorteNessuna valutazione finora

- Eumelia R. M-Wps OfficeDocumento94 pagineEumelia R. M-Wps OfficeNhaz Pasandalan0% (1)

- BAGUIO COOP Vs CABATO-CORTESDocumento2 pagineBAGUIO COOP Vs CABATO-CORTESI took her to my penthouse and i freaked itNessuna valutazione finora

- Supreme Court: Custom SearchDocumento6 pagineSupreme Court: Custom SearchGraile Dela CruzNessuna valutazione finora

- Maglalang v. PagcorDocumento3 pagineMaglalang v. PagcorgorgeousveganNessuna valutazione finora

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersDa EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNessuna valutazione finora

- Digest Adreso 9 16Documento8 pagineDigest Adreso 9 16Carl Marx FernandezNessuna valutazione finora

- Digest Adreso 9 16Documento8 pagineDigest Adreso 9 16Carl Marx FernandezNessuna valutazione finora

- Philippine Legal Doctrines: Hernandez DoctrineDocumento19 paginePhilippine Legal Doctrines: Hernandez DoctrineCarl Marx FernandezNessuna valutazione finora

- Test 1: Improve The Following Sentences.: Fernandez, Carlo MartinDocumento8 pagineTest 1: Improve The Following Sentences.: Fernandez, Carlo MartinCarl Marx FernandezNessuna valutazione finora

- Affidavit of Acknowledgement of Relationship 2Documento2 pagineAffidavit of Acknowledgement of Relationship 2Carl Marx FernandezNessuna valutazione finora

- ENGLAD Module 3Documento79 pagineENGLAD Module 3Carl Marx FernandezNessuna valutazione finora

- English For Legal AdvocacyDocumento52 pagineEnglish For Legal AdvocacyCarl Marx FernandezNessuna valutazione finora

- Digest Adreso 9 16Documento8 pagineDigest Adreso 9 16Carl Marx FernandezNessuna valutazione finora

- English For Legal AdvocacyDocumento52 pagineEnglish For Legal AdvocacyCarl Marx FernandezNessuna valutazione finora

- England AnswersDocumento8 pagineEngland AnswersCarl Marx FernandezNessuna valutazione finora

- Affidavit of Acknowledgement of RelationshipDocumento1 paginaAffidavit of Acknowledgement of RelationshipCarl Marx Fernandez100% (1)

- Partnership Agreement: Accordance Republic ActDocumento9 paginePartnership Agreement: Accordance Republic ActCarl Marx FernandezNessuna valutazione finora

- England AnswersDocumento8 pagineEngland AnswersCarl Marx FernandezNessuna valutazione finora

- Deed of DonationDocumento2 pagineDeed of DonationCarl Marx FernandezNessuna valutazione finora

- ENGLAD Module 2Documento68 pagineENGLAD Module 2Carl Marx FernandezNessuna valutazione finora

- DEED OF ABSOLUTE SALE (FOR LEAH P) WordDocumento3 pagineDEED OF ABSOLUTE SALE (FOR LEAH P) WordCarl Marx FernandezNessuna valutazione finora

- Labrev CasesDocumento8 pagineLabrev CasesCarl Marx FernandezNessuna valutazione finora

- PARTNERSHIP AGREEMENT For Further EditngDocumento8 paginePARTNERSHIP AGREEMENT For Further EditngCarl Marx FernandezNessuna valutazione finora

- ADR Cases Last 8 CasesDocumento12 pagineADR Cases Last 8 CasesCarl Marx FernandezNessuna valutazione finora

- Minority Shareholders Lie in A Precarious WorldDocumento9 pagineMinority Shareholders Lie in A Precarious WorldCarl Marx FernandezNessuna valutazione finora

- REFERENCESDocumento1 paginaREFERENCESCarl Marx FernandezNessuna valutazione finora

- Marital Nullity Themes in PhilippinesDocumento23 pagineMarital Nullity Themes in PhilippinesJesus MenguriaNessuna valutazione finora

- MINORITY SHAREHOLDERS RIGHTS and PROTECTIONDocumento11 pagineMINORITY SHAREHOLDERS RIGHTS and PROTECTIONCarl Marx FernandezNessuna valutazione finora

- Confessions People vs. BokingoDocumento6 pagineConfessions People vs. BokingoCarl Marx FernandezNessuna valutazione finora

- Case LawsDocumento3 pagineCase LawsCarl Marx FernandezNessuna valutazione finora

- Corpo AddDocumento11 pagineCorpo AddCarl Marx FernandezNessuna valutazione finora

- MINORITY SHAREHOLDERS RIGHTS and PROTECTIONDocumento11 pagineMINORITY SHAREHOLDERS RIGHTS and PROTECTIONCarl Marx FernandezNessuna valutazione finora

- Corpo AddDocumento11 pagineCorpo AddCarl Marx FernandezNessuna valutazione finora

- Case 1Documento3 pagineCase 1Carl Marx FernandezNessuna valutazione finora

- Case LawsDocumento3 pagineCase LawsCarl Marx FernandezNessuna valutazione finora

- December 2, 2015 Tribune Record GleanerDocumento16 pagineDecember 2, 2015 Tribune Record GleanercwmediaNessuna valutazione finora

- Correction of Entry of BirthDocumento18 pagineCorrection of Entry of BirthMaximo Isidro100% (2)

- Limited Liability Partnership AgreementDocumento12 pagineLimited Liability Partnership AgreementNooria YaqubNessuna valutazione finora

- Guilty of Attempted RapeDocumento9 pagineGuilty of Attempted RapeJohn Vladimir A. BulagsayNessuna valutazione finora

- Age Is Allowed in This Title.: May AdoptDocumento18 pagineAge Is Allowed in This Title.: May AdoptLASNessuna valutazione finora

- Consti - Montejo LecturesDocumento119 pagineConsti - Montejo LecturesAngel Deiparine100% (1)

- Artex Development Co. vs. Wellington Ins. CoDocumento2 pagineArtex Development Co. vs. Wellington Ins. CoJohn Mark RevillaNessuna valutazione finora

- Manila motel ordinance caseDocumento64 pagineManila motel ordinance caseShasharu Fei-fei LimNessuna valutazione finora

- Consti Law PP V PomarDocumento1 paginaConsti Law PP V PomarRenz FactuarNessuna valutazione finora

- Republic Vs MupasDocumento3 pagineRepublic Vs MupasJanskie Mejes Bendero Leabris100% (2)

- Deed of Donation of A Portion of LandDocumento1 paginaDeed of Donation of A Portion of LandMarj ApolinarNessuna valutazione finora

- TM-1862 AVEVA Everything3D™ (2.1) - Lexicon Rev 1.0Documento99 pagineTM-1862 AVEVA Everything3D™ (2.1) - Lexicon Rev 1.0Emavwodia SolomonNessuna valutazione finora

- By-Laws of Purok SambagDocumento5 pagineBy-Laws of Purok SambagMelvin Miscala100% (4)

- Banking and Insurance (Bbh461) - 1515423225879Documento8 pagineBanking and Insurance (Bbh461) - 1515423225879SamarthGoelNessuna valutazione finora

- Wallem Maritime Services, Inc. vs. TanawanDocumento2 pagineWallem Maritime Services, Inc. vs. TanawanBruce EstilloteNessuna valutazione finora

- Court upholds personal liabilityDocumento8 pagineCourt upholds personal liabilityinno KalNessuna valutazione finora

- IAAF Track & Field RulesDocumento229 pagineIAAF Track & Field Rulesjlpark20100% (6)

- Namibia's Microlending Act of 2018Documento41 pagineNamibia's Microlending Act of 2018PaulNessuna valutazione finora

- Section 100, Indian Penal Code. AIR 1960 SC 67: (1960) 1 SCR 646:1960 SCJ 126Documento2 pagineSection 100, Indian Penal Code. AIR 1960 SC 67: (1960) 1 SCR 646:1960 SCJ 126Awan Ajmal AziziNessuna valutazione finora

- Missouri v. Illinois, 200 U.S. 496 (1906)Documento8 pagineMissouri v. Illinois, 200 U.S. 496 (1906)Scribd Government DocsNessuna valutazione finora

- Calculate DensityDocumento3 pagineCalculate Densitybeta paramitaNessuna valutazione finora

- Nekrilov v. City of Jersey City, No. 21-1786 (3d Cir. Aug. 16, 2022)Documento48 pagineNekrilov v. City of Jersey City, No. 21-1786 (3d Cir. Aug. 16, 2022)RHTNessuna valutazione finora

- Exotic Animals DocumentDocumento4 pagineExotic Animals DocumentLas Vegas Review-JournalNessuna valutazione finora

- Formation of A CompanyDocumento22 pagineFormation of A CompanyHimura SanzouNessuna valutazione finora

- Task 2 - Analysis The Significance of Consumer Protection Laws and Online Trading in CanadaDocumento5 pagineTask 2 - Analysis The Significance of Consumer Protection Laws and Online Trading in CanadaPhu Khet NaingNessuna valutazione finora

- Advocate's Business Conduct Raises ConcernsDocumento8 pagineAdvocate's Business Conduct Raises ConcernsNur Fatin Mohamad FaridNessuna valutazione finora

- Attempted Rape Conviction AffirmedDocumento2 pagineAttempted Rape Conviction AffirmedClavel TuasonNessuna valutazione finora

- Who Moved The StoneDocumento93 pagineWho Moved The StonedanstoicastefanNessuna valutazione finora

- Contents of The Memorandum of AssociationDocumento2 pagineContents of The Memorandum of AssociationSonia DalviNessuna valutazione finora

- 2SK30ATM: Low Noise Pre-Amplifier, Tone Control Amplifier and DC-AC High Input Impedance Amplifier Circuit ApplicationsDocumento4 pagine2SK30ATM: Low Noise Pre-Amplifier, Tone Control Amplifier and DC-AC High Input Impedance Amplifier Circuit ApplicationsIee Jimmy Zambrano LNessuna valutazione finora