Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BITS MBA Finanace Comprehensive Exam Paper

Caricato da

Mohana KrishnaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BITS MBA Finanace Comprehensive Exam Paper

Caricato da

Mohana KrishnaCopyright:

Formati disponibili

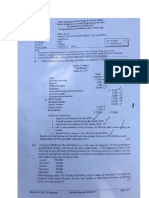

Birla Institute of Technology & Science, Pilani

Work-Integrated Learning Programmes Division

Second Semester 2018-2019

Comprehensive Examination (EC-3 Regular)

Course No. : BA ZG521

Course Title : FINANCIAL MANAGEMENT

Nature of Exam : Open Book

Weightage : 45% No. of Pages =2

Duration : 3 Hours No. of Questions = 6

Date of Exam : 05/05/2019 (AN)

Note:

1. Please follow all the Instructions to Candidates given on the cover page of the answer book.

2. All parts of a question should be answered consecutively. Each answer should start from a fresh page.

3. Assumptions made if any, should be stated clearly at the beginning of your answer.

Q.1. The capital structure of XYZ Ltd. is as follows: [12]

Debentures 13.5 percent (500,000 debentures, Rs 100 par) Rs 50 million

Equity Capital (10 million shares, Rs 10 par) Rs 100 million

Term loans, 12 percent Rs 80 million

Preference capital, 11 percent (100,000 shares, Rs 100 par) Rs 10 million

The next expected dividend per share is Rs 1.50. The dividend per share is expected to grow

at the rate of 7 percent. The market price per share is Rs 20. Preference stock, redeemable

after 10 years, is currently selling for Rs 75 per share. Debentures, redeemable after 6 years,

are selling for Rs 80 per debenture. The tax rate for the company is 50 percent. Calculate the

WACC using market value as weights?

Q.2 (a) The required return on the market portfolio is 15 percent. The beta of stock A is 1.5. The

required return on the stock is 20 percent. The expected dividend growth on stock A is 6

percent. The price per share of stock A is Rs.86. What is the expected dividend per share

of stock A next year? [1]

Q.2 (b) In continuation of the above case, what will be the combined effect of the following on

the price per share of stock? [5]

(a) The inflation premium increases by 3 percent.

(b) The decrease in the degree of risk-aversion reduces the differential between the

return on market portfolio and the risk-free return by one-fourth.

(c) The expected growth rate of dividend on stock A decrease to 3 percent.

(d) The beta of stock A falls to 1.2

Q.3. A firm's current assets and current liabilities are 25,000 and 18,000 respectively. How much

additional funds can it borrow from banks for short term, without reducing the current ratio

below 1.35? [5]

Q.4. For ABC & Co. we have the following data:

Unit selling price = Rs.300

Variable cost per unit = Rs. 200

Fixed costs = Rs. 4,000

Interest costs = Rs. 3,000

(a) Calculate DOL, DFL and DTL when the output is 100 units? [3]

(b) Calculate Break even output? [3]

BA ZG521 (EC-3 Regular) Second Semester 2018-2019 Page - 1 - of 2

BA ZG521 (EC-3 Regular) Second Semester 2018-2019 Page 2

Q.5 (a) ABC Ltd is facing gloomy prospects. The earnings and dividends are expected to decline

at the rate of 5 percent. The previous dividend was Rs.2.00. If the current market price is

Rs.10.00, what rate of return do investors expect from the stock of ABC? [3]

Q.5 (b) The risk-free return is 8 percent and the return on market portfolio is 16 percent. Stock

X's beta is 1.2; its dividends and earnings are expected to grow at the constant rate of 10

percent. If the previous dividend per share of stock X was Rs.3.00, what should be the

price per share of stock X? [3]

Q.6. ABC Ltd. is evaluating a project whose expected cash flows are as follows:

Year Cash flow

0 -530,000

1 150,000

2 180,000

3 240,000

4 250,000

The cost of capital for ABC is 15 percent.

(a) What is the NPV of the project? [4]

(b) What is the IRR of the project? [3]

What is the BCR of the project? [3]

**********

BA ZG521 (EC-3 Regular) Second Semester 2018-2019 Page - 2 - of 2

Potrebbero piacerti anche

- Chapter - 8 Management of ReceivablesDocumento6 pagineChapter - 8 Management of ReceivablesadhishcaNessuna valutazione finora

- Sample PaperDocumento8 pagineSample Paperneilpatrel31Nessuna valutazione finora

- Sapm Ete 2019-20 BDocumento7 pagineSapm Ete 2019-20 BRohit Kumar Pandey0% (1)

- FM - Assignment Batch 19 - 21 IMS IndoreDocumento3 pagineFM - Assignment Batch 19 - 21 IMS IndoreaskjdfaNessuna valutazione finora

- ABC Wealth AdvisorsDocumento5 pagineABC Wealth AdvisorsUjwalsagar Sagar33% (3)

- Hull RMFI4 e CH 10Documento36 pagineHull RMFI4 e CH 10jlosamNessuna valutazione finora

- Ogfj201601 DLDocumento68 pagineOgfj201601 DLJasgeoNessuna valutazione finora

- Bazg521 Nov25 AnDocumento2 pagineBazg521 Nov25 AnDheeraj RaiNessuna valutazione finora

- This Test Is Only For Students of MS Consultancy ManagementDocumento2 pagineThis Test Is Only For Students of MS Consultancy ManagementrudypatilNessuna valutazione finora

- Problem SetDocumento6 pagineProblem SetAnirban BhowmikNessuna valutazione finora

- Mba ZC417 Ec-3m First Sem 2018-2019Documento6 pagineMba ZC417 Ec-3m First Sem 2018-2019shiintuNessuna valutazione finora

- Problems On Hire Purchase and LeasingDocumento5 pagineProblems On Hire Purchase and Leasingprashanth mvNessuna valutazione finora

- 4 - Estimating The Hurdle RateDocumento61 pagine4 - Estimating The Hurdle RateDharmesh Goyal100% (1)

- Corporate Finance Current Papers of Final Term PDFDocumento35 pagineCorporate Finance Current Papers of Final Term PDFZahid UsmanNessuna valutazione finora

- Industry and Life Cycle AnalysisDocumento31 pagineIndustry and Life Cycle AnalysisASK ME ANYTHING SMARTPHONENessuna valutazione finora

- Ba Mba ZC411 Ec 2M Ak 1605956890574Documento2 pagineBa Mba ZC411 Ec 2M Ak 1605956890574AAKNessuna valutazione finora

- Capital RevenueDocumento20 pagineCapital RevenueYatin SawantNessuna valutazione finora

- Unit 2 Capital Budgeting Decisions: IllustrationsDocumento4 pagineUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNessuna valutazione finora

- Project Appraisal Under RiskDocumento2 pagineProject Appraisal Under RiskSigei LeonardNessuna valutazione finora

- CS Executive MCQ and Risk AnalysisDocumento17 pagineCS Executive MCQ and Risk Analysis19101977Nessuna valutazione finora

- Working Capital MGTDocumento14 pagineWorking Capital MGTrupaliNessuna valutazione finora

- Tme 601Documento14 pagineTme 601dearsaswatNessuna valutazione finora

- FINANCIAL MANAGEMENT AssignmentDocumento9 pagineFINANCIAL MANAGEMENT AssignmentMayank BhavsarNessuna valutazione finora

- 2 - Time Value of MoneyDocumento68 pagine2 - Time Value of MoneyDharmesh GoyalNessuna valutazione finora

- Chapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsDocumento54 pagineChapter 5 Digital Marketing Strategy Definition - Fundamentals of Digital Marketing, 2 - e - Dev TutorialsViruchika PahujaNessuna valutazione finora

- Operation Scheduling PDFDocumento26 pagineOperation Scheduling PDFMd. Mahbub-ul- Huq Alvi, 170021144Nessuna valutazione finora

- Model PAPER-Analysis of Financial Statement - MBA-BBADocumento5 pagineModel PAPER-Analysis of Financial Statement - MBA-BBAvelas4100% (1)

- Capital Budgeting Illustrative NumericalsDocumento6 pagineCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- Animal HealthDocumento3 pagineAnimal Healthkritigupta.may1999Nessuna valutazione finora

- Case StudyDocumento3 pagineCase Studyjohnleh1733% (3)

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocumento15 pagineQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshNessuna valutazione finora

- Dire Dawa University: College of Business and Economic Department of ManagementDocumento20 pagineDire Dawa University: College of Business and Economic Department of ManagementEng-Mukhtaar CatooshNessuna valutazione finora

- Course Outline For Quantitative AnalysisDocumento6 pagineCourse Outline For Quantitative Analysiswondimu teshomeNessuna valutazione finora

- MM ZG523Documento18 pagineMM ZG523mdasifkhan2013Nessuna valutazione finora

- Tata Motors ValuationDocumento38 pagineTata Motors ValuationAkshat JainNessuna valutazione finora

- Numericals On Cost of Capital and Capital StructureDocumento2 pagineNumericals On Cost of Capital and Capital StructurePatrick AnthonyNessuna valutazione finora

- Ca Ipcc Costing and Financial Management Suggested Answers May 2015Documento20 pagineCa Ipcc Costing and Financial Management Suggested Answers May 2015Prasanna KumarNessuna valutazione finora

- DT, Cem, RadrDocumento46 pagineDT, Cem, RadrShivaprasadNessuna valutazione finora

- Tcs Slot 1 - 19th Aug - 9 Am - QuestionsDocumento12 pagineTcs Slot 1 - 19th Aug - 9 Am - QuestionsSanjana ymNessuna valutazione finora

- Kota Tutoring: Financing The ExpansionDocumento7 pagineKota Tutoring: Financing The ExpansionAmanNessuna valutazione finora

- EVA Practice SheetDocumento17 pagineEVA Practice SheetVinushka GoyalNessuna valutazione finora

- Quanti Question and AnswersDocumento22 pagineQuanti Question and AnswersOFORINessuna valutazione finora

- Did United Technologies Overpay For Rockwell CollinsDocumento2 pagineDid United Technologies Overpay For Rockwell CollinsRadNessuna valutazione finora

- Unit - IvDocumento40 pagineUnit - IvjitendraNessuna valutazione finora

- SFM May 2015Documento25 pagineSFM May 2015Prasanna SharmaNessuna valutazione finora

- Questions On LeasingDocumento5 pagineQuestions On Leasingriteshsoni100% (2)

- We Have Taken 10-Year Government Bond Rate (G) FCF × (1 + G) ÷ (R - G) TV / (1 + R)Documento3 pagineWe Have Taken 10-Year Government Bond Rate (G) FCF × (1 + G) ÷ (R - G) TV / (1 + R)mayankNessuna valutazione finora

- Project Financial Appraisal - NumericalsDocumento5 pagineProject Financial Appraisal - NumericalsAbhishek KarekarNessuna valutazione finora

- MBA QuestionsDocumento15 pagineMBA QuestionsKhanal NilambarNessuna valutazione finora

- Case Study - Nilgai Foods: Positioning Packaged Coconut Water in India (Cocofly)Documento6 pagineCase Study - Nilgai Foods: Positioning Packaged Coconut Water in India (Cocofly)prathmesh kulkarniNessuna valutazione finora

- FinancialManagement MB013 QuestionDocumento31 pagineFinancialManagement MB013 QuestionAiDLo50% (2)

- Mini CaseDocumento15 pagineMini CaseSammir Malhotra0% (1)

- Chapter - 12: Risk Analysis in Capital BudgetingDocumento28 pagineChapter - 12: Risk Analysis in Capital Budgetingrajat02Nessuna valutazione finora

- ACPC Cut Off 2019 For MBADocumento9 pagineACPC Cut Off 2019 For MBAParth PatelNessuna valutazione finora

- 2nd Internals - QTDocumento3 pagine2nd Internals - QTZiya KhanNessuna valutazione finora

- Sample Test Questions For EOQDocumento5 pagineSample Test Questions For EOQSharina Mhyca SamonteNessuna valutazione finora

- Documents - MX - FM Questions MsDocumento7 pagineDocuments - MX - FM Questions MsgopalNessuna valutazione finora

- Dividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)Documento23 pagineDividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)amiNessuna valutazione finora

- Determination of Forward and Futures Prices: Practice QuestionsDocumento3 pagineDetermination of Forward and Futures Prices: Practice Questionshoai_hm2357Nessuna valutazione finora

- InventoryDocumento46 pagineInventoryAnkit SharmaNessuna valutazione finora

- It’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceDa EverandIt’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceNessuna valutazione finora

- MM ZG627 Ec-2r First Sem 2017-2018Documento1 paginaMM ZG627 Ec-2r First Sem 2017-2018UDAYAN BIPINKUMAR SHAHNessuna valutazione finora

- FIN ZG 518: Multinational Finance: BITS PilaniDocumento30 pagineFIN ZG 518: Multinational Finance: BITS PilaniMohana KrishnaNessuna valutazione finora

- Course Hand OutDocumento13 pagineCourse Hand OutMohana KrishnaNessuna valutazione finora

- Response Sheet: Overall ResultDocumento2 pagineResponse Sheet: Overall ResultMohana KrishnaNessuna valutazione finora

- BITS Pilani: Managing People and OrganizationsDocumento11 pagineBITS Pilani: Managing People and OrganizationsMohana KrishnaNessuna valutazione finora

- Chapter 8: An Introduction To Asset Pricing ModelsDocumento43 pagineChapter 8: An Introduction To Asset Pricing ModelsMohana KrishnaNessuna valutazione finora

- 1.7 Class Exercises - Data Descriptive Statistics SolutionDocumento19 pagine1.7 Class Exercises - Data Descriptive Statistics SolutionMohana KrishnaNessuna valutazione finora

- BITS Pilani: Managing People and OrganizationsDocumento46 pagineBITS Pilani: Managing People and OrganizationsMohana KrishnaNessuna valutazione finora

- BITS MBA Finance Old Question PapersDocumento23 pagineBITS MBA Finance Old Question PapersMohana KrishnaNessuna valutazione finora

- (A) (B) (C) (D) : No. of Questions 7Documento4 pagine(A) (B) (C) (D) : No. of Questions 7Mohana KrishnaNessuna valutazione finora

- (A) (B) (C) (D) : No. of Questions 7Documento4 pagine(A) (B) (C) (D) : No. of Questions 7Mohana KrishnaNessuna valutazione finora

- Hydril Ram Annular Good Diagrams BOP ProductsDocumento44 pagineHydril Ram Annular Good Diagrams BOP ProductsSharad Chandra Naik100% (7)

- File: Chapter 06 - Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues Multiple ChoiceDocumento53 pagineFile: Chapter 06 - Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues Multiple Choicejana ayoubNessuna valutazione finora

- Industry AvDocumento4 pagineIndustry Avapi-3710417Nessuna valutazione finora

- Hotel Companies CompetitorsDocumento16 pagineHotel Companies CompetitorsOladipupo Mayowa PaulNessuna valutazione finora

- Difference Between MB & IBDocumento2 pagineDifference Between MB & IBShubham BhatiaNessuna valutazione finora

- SQE First Year - Answer KeyDocumento4 pagineSQE First Year - Answer KeyNicolaus CopernicusNessuna valutazione finora

- Quiz Adv 2 CH 16-18Documento2 pagineQuiz Adv 2 CH 16-18farhan100% (1)

- Start-Up Costs and Capital Sources ByobDocumento18 pagineStart-Up Costs and Capital Sources Byobjogam5Nessuna valutazione finora

- Evaluation of StockDocumento48 pagineEvaluation of StockMd Zainuddin IbrahimNessuna valutazione finora

- Wyckoff Power Charting. Happy Birthday!: Click Here For A LinkDocumento5 pagineWyckoff Power Charting. Happy Birthday!: Click Here For A LinkACasey101Nessuna valutazione finora

- Ancilliary Services of BanksDocumento25 pagineAncilliary Services of Bankspawan_019Nessuna valutazione finora

- RCMP Investment Presentation: NAP NDocumento27 pagineRCMP Investment Presentation: NAP NInter 4DMNessuna valutazione finora

- IndividualDocumento4 pagineIndividualAbiaNessuna valutazione finora

- Russia M&ADocumento48 pagineRussia M&Adshev86Nessuna valutazione finora

- Relative Valuation: Aswath DamodaranDocumento130 pagineRelative Valuation: Aswath Damodaranvivek102Nessuna valutazione finora

- The Impact of Personal and Corporate Taxation On Capital Structure ChoicesDocumento35 pagineThe Impact of Personal and Corporate Taxation On Capital Structure ChoicesDevikaNessuna valutazione finora

- Motaal Analysis TheoryDocumento5 pagineMotaal Analysis TheoryKrishnamohan VaddadiNessuna valutazione finora

- EDP Renewaldes North America Tax Equity Financial Asset Rotation UVAF1757Documento28 pagineEDP Renewaldes North America Tax Equity Financial Asset Rotation UVAF1757Kryon CloudNessuna valutazione finora

- FM QuizDocumento3 pagineFM QuizSam SasumanNessuna valutazione finora

- Solved, MF0011 - Mergers & AcquisitionsDocumento3 pagineSolved, MF0011 - Mergers & AcquisitionsArvind K100% (1)

- Eagle High Plantations: A New Chapter BeginsDocumento23 pagineEagle High Plantations: A New Chapter BeginsSimeon GhobrialNessuna valutazione finora

- The Statements of Financial Position of Mars PLC and Jupiter PLC at 31 December 20x2 Are AsDocumento3 pagineThe Statements of Financial Position of Mars PLC and Jupiter PLC at 31 December 20x2 Are AsCharlotteNessuna valutazione finora

- Quiz 1: Spring 1998: Business Average Beta Average D/E RatioDocumento43 pagineQuiz 1: Spring 1998: Business Average Beta Average D/E RatioDenisse SánchezNessuna valutazione finora

- Gujarat Piplav Statement AnalysisDocumento2 pagineGujarat Piplav Statement AnalysisArish QureshiNessuna valutazione finora

- AppendixDocumento4 pagineAppendixJayanga JayathungaNessuna valutazione finora

- Sources of Long-Term FinanceDocumento26 pagineSources of Long-Term Financerrajsharmaa100% (2)

- Technical Guide On Internal Audit of Mutual FundDocumento105 pagineTechnical Guide On Internal Audit of Mutual Fundaarshshah10Nessuna valutazione finora

- Financial Navigator - TW vs. MW ReturnsDocumento8 pagineFinancial Navigator - TW vs. MW ReturnsSohini Mo BanerjeeNessuna valutazione finora