Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hegemony in An Era of Turmoil - Essay (1995)

Caricato da

robertolofaroDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hegemony in An Era of Turmoil - Essay (1995)

Caricato da

robertolofaroCopyright:

Formati disponibili

Hegemony in an era of turmoil (July 1995) DRAFT

This is the re-print of an Essay on "Hegemony in an Era of Turmoil"

I wrote the essay in 1995, as part of my participation of a Summer School at LSE in London.

The official title of the school? The Politics of Global Finance.

Visit GettingAroundTheWorld.Net to read the essay- and the 2010 follow-up.

If you have any comments- write me

http://www.twitter.com/robertolofaro

http://www.facebook.com/robertolofaro

http://www.linkedin.com/in/robertolofaro

0. Preface

Why the reprint, and why now?

First, because many of the issues that were developing in the early 1990s are still with

us- including the extensive and conflicting priorities and interests of countries and markets or

multinational companies.

The “transitional economies” are now partially members of an enlarged European

Union- an entity that is still looking to solve the same issues that I had in 1995 presented in the

“EU outline” (see http://www.scribd.com/doc/42800189, or the article containing also the mind

maps on http://tinyurl.com/322lntd or http://tinyurl.com/35jo28x).

Second, because I believe that any analyst should be intellectually honest- and present

both what (s)he was able to predict- and where (s)he was wrong: to help both her/himself and

the readers to identify the potential sources of bias that could affect her/his judgement.

If you have not been in politics or negotiations, this point would probably seem

irrelevant.

But when you make decisions (in business or elsewhere) based on somebody else's

advice, being able to understand that being human could influence their judgement (and how)

is as important as any advice that they will actually give you.

Third, because recent economic and political news made me think about then- and,

before adding something more to some articles that I posted over the last few months on

GettingAroundTheWorld.Net (or gettingaroundtheworldnet.wordpress.com), I wanted to

“travel back in time”.

If you want- I tried to use myself in 1995 as a business analyst to help myself in 2010 to

see how things evolved.

Therefore, I enclose the draft of that essay, a draft that I had to retype (floppies and

backup fail after 15 years, but paper drafts stay!), with really limited fixes to typos, but leaving

the syntactic structures that I used at the time (except when could generate misunderstandings).

Roberto Lofaro “Hegemony in an Era of Turmoil”, page 1 of 7

Hegemony in an era of turmoil (July 1995) DRAFT

This essay will try to analize the role of hegemony in an era of ever increasing changes.

While the subject in itself would require also to analyze the relationship between both

economic and military policies, this essay will focus only on the former, hinting at the latter

only as much as needed for explaining the economic perspective.

The “turmoil” in the title conveys many meanings, and both the turmoil's positive and

negative side-effects will be briefly covered in the following sections.

The underlining thesis is simply that more than bringing a mere decline of the

hegemonic power (USA), the 90s and the first decade of the next century will probably bring

some kind of new global political and economic order. Odds are for this new order to be based

on a multilateral system of regional hegemonies, with the global hegemon, the USA, playing a

wider role (strategy and goal setting), delegating similar responsibilities to regional hegemons

if and when needed. Also, evidence will be given of a general rise of overlapping and sometime

simply conflicting loyalties/interests, that the new order should help to solve.

Obviously, this argument requires at least some supporting evidence, that will be

introduced whenever needed in the following sections of the essay:

1. Introduction

2. Economy, democracy and mass-media

3. The global reach of financial markets

4. The transnational corporations: thinking globally, acting locally

5. A new balance of power

6. Overlapping interests

7. Conclusions.

The following short bibliography, referenced through the text, contains relevant

material used as supporting evidence:

[Buzan 1994] Buzan, Barry “The interdependence of Security and Economic Issues in the 'New World Order'”, in “Political

Economy and the Changing Global Order”, eds. R. Stubbs and G. R. D. Underhill

[Cassell 1995] Cassell, Michael “Warsaw, Wales or West Java”, FT 11/7/95

[Cooper 1985] Cooper, Richard N. “Economic Interdependence and coordination of economic policies”, 1985, Handbook

of International Economics, vol. II

[Dawkins 1995] Dawkins, William “Self-confidence has been shaken”, FT 10/7/95

[George 1995] George, Susan “Le danger d'un chaos financier généralisé”, Le Monde Diplomatique Juillet 1995

[IMF 1994] International Monetary Fund “World Economic Outlook – October 1994”, pagg. 1-8, 42-45, 98-104

[Ohmae 1995] Ohmae, Kenichi “Letter from Japan”, Harvard Business Review Vol. 73, No. 3

[Vanderwicken 1995] Vanderwicken, Peter “Why the news is not the truth”, Harvard Business Review Vol. 73, No. 3

[State 1995] State of the World 1995

Other supporting evidence coming from the lectures will be referred to as in the Course

Outline.

Roberto Lofaro “Hegemony in an Era of Turmoil”, page 2 of 7

Hegemony in an era of turmoil (July 1995) DRAFT

1. Introduction

The hegemonic role played in the XIX century by Britain was in a way different from that that

the USA enjoyed during the “Cold War”, at least for the differing sizes of their economies, dependence

from foreign trade, and the political changes occurred in the XX century, like the advent of democracy.

The 60s saw an increase in Global Financial Markets' (GFMs) size, also to cover for the needs

of the Transnational Corporations (TNCs), increasing also the markets' independence and overall

influence on Governments' decisions.

The Cold War and the strategic issues related with it justified first financial support from the

USA to its allies (Marshall Plan), and then its policy to support their reconstruction and development,

using direct aid, FDI, and international organizations like IMF, IBRD.

The strategic hegemonic role also involved high defense costs for the hegemon 1 and allowing

allies like Japan and Germany to use the USA as a market2.

The need of Western allies to maintain free trade and democracy allowed for some “truce” in

trade relationships, also with growing trade deficits and costs needed to maintain the hegemonic role.

The 80s brought an increased ideological interest in promoting free trade and deregulation

(1978 Thatcher election in UK and 1980 Reagan), with increasing pressures on the allies for a burden

sharing of the defense role and a re-assessment of economic issues like trade and financial markets'

openness.

On the military side, “USSR's Vietnam”, the Afghan War, shows the weaknesses of the Soviet

Bloc in military, political (dissent between allies) and industrial matters, lowering the perceived

effectiveness of “The Empire of Evil” threat.

The end of the Cold War, along with the increasing power and independence of financial

markets and the aging of population in the higher developing countries plunged political economical

relationships under strain.

The “New World Order” called by Mr. Bush, then-president of the USA, has been described as a

“New World Disorder”. The financial markets seem to pursue their own objectives, sometimes also

conflicting with the state objectives of governments.

The increasing integration of the more advanced economies has shown an increased strain

imposed to the traditional stage-based political economy, along with a growing difference in economic

development between the Industrialized countries and LDCs 3. The end of the Cold War implies a lower

interest toward LDCs, with less resources available for their development, and greater instability 4 in the

periphery. Maybe we will see an increase in “economic wars” in the center, real ones in the periphery.

But what are the economical effects of these political changes?

1 [State 1995] in 1970 relative to GDP the defense expenses were: USA 7.7% vs. Germany 3.3% and Japan's

0.8% (constitutionally limited to 1%)

2 [State 1995] in 1970 USA were by far the largest market for Japan, with 31.1% of exports

3 [George 1995] the richer 20% consumes 85% of World total output (70% in 1965), while the poorer 20%

consumes a mere 1.4% (5% in 1965)

4 [George 1995] there are now 47 million refugees vs. 35 in 1990

Roberto Lofaro “Hegemony in an Era of Turmoil”, page 3 of 7

Hegemony in an era of turmoil (July 1995) DRAFT

2. Economy, democracy and mass-media

The era of the “pax americana” was characterized by an increasing development of democracies

in the Western world, accelerating during the 80s and after the end of the Cold War, also for ideological

purposes of the hegemon. With Mr. Reagan and Lady Thatcher, this democracy meant also deregulation

and initiatives to promote private investment, while reducing the role of the nation state to a provider of

basic services, defence, infrastructures.

I think that the Reagan-Thatcher program didn't really promote democracy in the market,

because their “survival of the fittest” approach to economy reduces income distribution, expelling from

the market the less useful in economic terms, and lowering their possibility of reentering it, but the

discussion of their political economy is here relevant only for its side-effect: increasing the degree of

freedom of GFMs vs. Governments.

Anyway, the hegemonic role was played mainly defining the direction (goal setting) of this

evolution and being the first to apply it, while urging Allies to do the same. Due to the relative size of

Wall Street's market, that market relevance has been increased by the increased freedom. With the

caveat shown above, the market's democracy was also enhanced through the establishment of markets

like the NASDAQ, that allows both small companies and small investors to be players.

Another side-effect of the ideological push of the 80s was in promoting freedom of press while

the technological means allow a non-stop information flow. Nowadays, only backward countries like

North Korea are more or less able to stop information from flowing. Also , the increased quantity of

information hasn't increased its quality (e.g. reliability of sources, etc). As Vanderwicken

[Vanderwicken 1995] relates, companies can “doctor” the news exploiting the global information

network, and giving different information in different markets.

While the hegemonic role of the USA has suffered some setbacks from the internal pressure

deriving from the mass-media (Somalia, Bosnia, etc), this “democratic pressure from below” shouldn't

be considered only positive. After 7 days the front page title becomes unattractive, and some other

subject has to be considered in order to prop up the newspaper selling. Vanderwicken aptly describes

how sometimes the news are only what is published. The leadership of the USA, due to internal political

pressure exerted also through the media, sometimes has disappointed the Allies' governments, with

swinging foreign and economic politicies.

Instead, GFMs and TNCs aren't supposed to be subject to such democratic pressures, having

just only their economic objectives and market rules to comply with.

This widening gap between Governments' and GFMs' perspectives has also brought to the fore

another subject: who is supposed to intervene when some financial crisis will happen? Past experiences

with BCCI, Banco Ambrosiano, Barings have shown the risks of GFMs, but no common solution has

been devised.

Roberto Lofaro “Hegemony in an Era of Turmoil”, page 4 of 7

Hegemony in an era of turmoil (July 1995) DRAFT

3. The global reach of financial markets

As shown in [Vanderwicken 1995] and discussed by [Strange 30/6], GFMs work on a 24 hours

a day basis, allowing transactions to be initiated in countries like Luxembourg, involving EU investors

buying US stocks or bonds, escaping the control of their country of origin.

If the markets were efficient, the information would have immediate effect on prices.

Unfortunately, while having increased their efficiency also thanks to the new communication systems,

the GFMs aren't yet so transparent, as testifies also the proposal for the new International Accounting

Standards.

The unregulated markets have been able to achieve size well above the possibilities of

individual countries, like the British Pound and Italian Lira have shown in 1992.

4. The transnational corporations: thinking globally, acting locally

As Kenichi Ohmae said, transnational companies are increasingly looking for new ways to

behave in their markets, their country of origin notwithstanding.

The obvious side-effect is that TNCs have no incentive to behave like ITT in the 60s or to act as

an Ambassador of their country of origin: mostly, they have strong incentives to “behave as good

citizens” wherever they are, looking after their own and their stakeholders' well-being.

The sheer size of the largest TNCs exceeds not only LDCs', but also some EU's countries GNP.

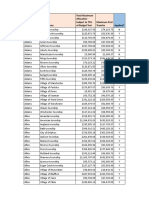

Source: UN Research Institute for Social Development, all data in USD Billions

GM 132.4

Indonesia 126.4

Denmark 123.5

Exxon 115.7

Norway 12.9

South Africa 103.6

Ford 100.1

Turkey 99.7

Royal Dutch/Shell 96.6

Poland 83.8

Toyota 81.3

Portugal 79.5

IBM 64.5

Venezuela 61.1

Malaysia 57.6

Unilever 43.7

Pakistan 41.9

Nestle' 38.4

Sony 34.4

Egypt 33.5

Nigeria 29.6

Roberto Lofaro “Hegemony in an Era of Turmoil”, page 5 of 7

Hegemony in an era of turmoil (July 1995) DRAFT

5. A new balance of power

Size, democratic un-accountability, purposes: this allows GFMs and TNCs to operate outside

the interest of the global hegemon, US.

As shown by [Cassell 1995], Japan's TNCs are now using the limit of the actual balance of

power between GFMs and states by forcing them to compete for FDI.

USA, the only superpower left, act more as a catalyzer than a real single hegemon.

Also, recent experiences with Transitional Economies and Mexico 5 are probably the best

example od the new way of acting as an economic hegemon.

While, after NAFTA, also for internal US political reasons, helping Mexico is an high priority

issue, USA exerts its hegemonic influence rallying its allies in the industrialized world ehind a common

purpose. Instead, Eastern Europe and former USSR aren't so high in the priority list of USA's interests,

and the burden has been partly shared with the regional would-be hegemon, Germany (and EU).

In areas like Africa, not anymore interesting to USA, South Africa is increasingly forging new

economic links and South African TNCs are developing railways and trying to exert their regional

hegemonic power.

Japan, having no military power by itself, is using economic means (FDI, grants, etc) to assert

its relative power in South-East Asia.

On strategic issues, USA acts as a global player, its political and economical alliances

notwithstanding. In Central Asia, USA has intervened politically to support Russia's attempt to get

control of the oil coming from oil-rich Islamic countries. USA interfered with Turkey's and Iran's, in

order to defend the Russia's position as regional hegemon.

This new balance of power, yet to be stabilized, seems to involve the USA as the nly global

player, delegating to the other regional players the tasks of caring after the development of their regions.

South-Africa, expanding its financila power in the rest of Sub-Saharian Africa is virtually expelling

from the region European companies, mainly coming from France. Germany, expanding to East Europe,

founds no interference from USA.

Less clear is Asia: Japan is not strong enough, while China has already announced that Taiwan,

some islands and the Chinese Sea are to be considered its area. Recently, USA and other countries

started to analyze a new policy of “contention”, due to the overwhelming military power of China (the

rapprochement between USA and Vietnam has been interpreted as such a sign).

5 [George 1995] Recently, USA “collected” 50 bln for Mexico to cope with the crisis, in few days, while in Sept.

1994 the IMF Director, Mr. Camdessus, found less than half that amount for all the Transitional Economies

Roberto Lofaro “Hegemony in an Era of Turmoil”, page 6 of 7

Hegemony in an era of turmoil (July 1995) DRAFT

6. Overlapping interests

GFMs' and TNCs' interests overlap with the global hegemon's interests and these, in turn,

overlap with the interests of regional hegemons.

The security role, anyway, allows US to require support from other countries, also if this

interferes with regional hegemons' order of priorities, like when US asked for financial support during

the Gulf War from Japan and Germany.

As stated in the introduction, if what happened in the first half of 90s will continue, we will see

more wars, not less, also if in the Industrialized world this will mean trade wars.

The industrialized countries are facing increasing internal problems due also to what has been

called an “age of diminishing expectations”.

The post-war economic book raised expectations of increasing levels of welfare, raising the

share of the GNP used for social purposes. The aging of Industrialized countries' citizens will probably

require a structural change in their economies, with an increasing burden due to contributions to retiring

schemes, etc. Also, a reduction of the savings rate in Japan and Germany is forecasted, due to increased

consumption by an older population.

This demographic trend could increase the US's hegemonic role vs. its former allies, due to the

immigration from Mexico and other countries, while bringing a decline of Europe. Instead, Japanese

TNCs are already “looking forward”, by shifting production outside Japan.

7. Conclusions

More than a decline of the US hegemony, I believe that the evidence given in the previous

sections can show as there has been a shift in priorities and policies.

Instead of acting as a global superpower confronting another superpower, as during the Cold

War, the USA seems now more focused on maintaining its economic power. Also, USA is the only

country that is inside every major organization in the Pacific and Atlantic, allowing it to exert its

structural power as the only global player.

The new hegemon has probably selected a role of catalyst and coordinator, setting the agenda

for the global economy, using the military leverage as a tool to assert its power.

Roberto Lofaro “Hegemony in an Era of Turmoil”, page 7 of 7

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Demand Letter To The Department of JusticeDocumento4 pagineDemand Letter To The Department of JusticeGordon Duff100% (1)

- Sarah Street - British National Cinema (National Cinemas) (1997) PDFDocumento234 pagineSarah Street - British National Cinema (National Cinemas) (1997) PDFDeea Paris-PopaNessuna valutazione finora

- 03 Civics Flash Cards For The Naturalization Test m-623 RedDocumento53 pagine03 Civics Flash Cards For The Naturalization Test m-623 Redapi-309082881Nessuna valutazione finora

- Budget Fy21Documento138 pagineBudget Fy21ForkLogNessuna valutazione finora

- Melissa Nelson - Re-Indigenizing Our Bodies and Minds Through Native FoodsDocumento8 pagineMelissa Nelson - Re-Indigenizing Our Bodies and Minds Through Native FoodsXuejun QiNessuna valutazione finora

- Status of Whether Ohio Municipalities Have Applied For Federal StimulusDocumento54 pagineStatus of Whether Ohio Municipalities Have Applied For Federal StimulusDougNessuna valutazione finora

- CRITICAL ANALYSES OF ‘SPORT’ IN A SOCIAL CONTEXTDocumento9 pagineCRITICAL ANALYSES OF ‘SPORT’ IN A SOCIAL CONTEXTAysha MalikNessuna valutazione finora

- Facing East From Indian Country PDFDocumento2 pagineFacing East From Indian Country PDFJoseph25% (4)

- Global Traffic Signal Control System Market Research Report 2021Documento8 pagineGlobal Traffic Signal Control System Market Research Report 2021Hellina MartinsNessuna valutazione finora

- Essay 3 - BDocumento5 pagineEssay 3 - BNipuna WanninayakeNessuna valutazione finora

- Importance of VotingDocumento5 pagineImportance of Votingapi-358839199Nessuna valutazione finora

- Imperial Blues by Fiona I.B. NgôDocumento48 pagineImperial Blues by Fiona I.B. NgôDuke University Press100% (1)

- A GuideDocumento23 pagineA GuideMuhajir AlarabiNessuna valutazione finora

- Robot Installations Surpass 422,000 Units in 2018 as Automation ContinuesDocumento4 pagineRobot Installations Surpass 422,000 Units in 2018 as Automation ContinuesSalvador VilcaNessuna valutazione finora

- Half-King TanacharisonDocumento2 pagineHalf-King Tanacharisonnickwedig5000Nessuna valutazione finora

- 10 Day Unit Plan TemplateDocumento19 pagine10 Day Unit Plan Templateapi-315535379Nessuna valutazione finora

- Jean Monnet - Memorandum-1Documento5 pagineJean Monnet - Memorandum-1S_MoraruNessuna valutazione finora

- Debellare SuperbosDocumento382 pagineDebellare SuperbosVirgilio_Ilari100% (5)

- RTRW Kota BekasiDocumento290 pagineRTRW Kota BekasiErnest V SNessuna valutazione finora

- Letter On SFUSD After School CutsDocumento2 pagineLetter On SFUSD After School CutsMissionLocalNessuna valutazione finora

- Treaty With The DelawaresDocumento5 pagineTreaty With The DelawaresTruthsPress100% (1)

- Final Censure ResolutionDocumento2 pagineFinal Censure ResolutionPennLiveNessuna valutazione finora

- Foreign Policy Containment Final EssayDocumento6 pagineForeign Policy Containment Final EssayAndrea WisniewskiNessuna valutazione finora

- The Baptist Pietist Clarion, May 2011Documento20 pagineThe Baptist Pietist Clarion, May 2011cgehrzNessuna valutazione finora

- API NPL DS2 en Excel v2 4252871Documento485 pagineAPI NPL DS2 en Excel v2 4252871Zaka HassanNessuna valutazione finora

- USA History Exam Questions on Economic Challenges, New England Confederation, FDR PresidencyDocumento36 pagineUSA History Exam Questions on Economic Challenges, New England Confederation, FDR PresidencyEraj NoumanNessuna valutazione finora

- CJIAUSA Jerry E. Brewer, Sr. CEODocumento2 pagineCJIAUSA Jerry E. Brewer, Sr. CEOJerry E. Brewer, Sr.Nessuna valutazione finora

- Darlana FurnitureDocumento3 pagineDarlana FurnitureWidyawan Widarto 闘志Nessuna valutazione finora

- Verbal Ability Module 2-G Review and KeyDocumento4 pagineVerbal Ability Module 2-G Review and KeyRussel Bob G BorromeoNessuna valutazione finora

- Racism in John Grisham's Novel A Time To Kill PresentationDocumento22 pagineRacism in John Grisham's Novel A Time To Kill PresentationBoujemaa Al MallamNessuna valutazione finora