Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Agri, Ppe

Caricato da

Jobelle Candace Flores AbreraTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Agri, Ppe

Caricato da

Jobelle Candace Flores AbreraCopyright:

Formati disponibili

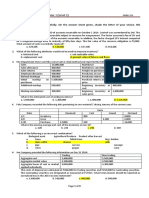

Practical Accounting 1 Review jca

AGRICULTURE- PAS 41

1. Which of the following is an agricultural produce?

a. Yarn b. logs c. cheese d. carcass

2. Bearer plant is a living plant that:

a. Is used in the production or supply of agricultural produce

b. Is expected to bear produce for more than one period

c. Has a remote likelihood of being sold as agricultural produce, except for incidental scrap

sales

d. All of the above

3. Produce growing on bearer plants are

a. Biological assets b. Inventory c. PPE d. Other Asset

4. PAS 41 takes the view that the fair value of agricultural produce at the point of harvest can always

be measured reliably.

All costs related to biological assets that are measured at fair value are recognized as expenses

when incurred, other than costs to purchase such biological assets.

a. False, True b. True, False c. False, False d. True, True

5. The following pertains to Smile Company’s biological assets:

FV based on quoted price in an active market for similar asset P5100

FV based on quoted price in an active market for identical asset 5000

FV based on unobservable inputs for the asset 4900

Selling price in a binding contract to sell 5200

Est commission to broker 500

Est transport costs necessary to bring the asset to the market 300

The entity’s biological assets should be valued at:

a. P4600 b. P4500 c. P4300 d. P4200

6. The following pertains to Frown Company’s biological assets:

Price of the asset in the market P5000

Est commission to broker 500

Est transport costs necessary to bring the asset to the market 300

Selling price in a binding contract to sell 5200

The entity’s biological assets should be valued at:

b. P4700 b. P4500 c. P4400 d. P4200

A herd of 10 2-year old animals were held at January 1. On July 1, one animal aged 2.5 years was

purchased for 108 and one animal was born. No animals were sold or purchased during the period. Per

unit fair value less costs to sell were as follows:

2-year old animal on Jan 1 100

Newborn animal at July 1 70

2.5-year old animal on July 1 108

Newborn animal on Dec 31 72

.5-year old animal on Dec 31 80

2-year old animal on Dec 31 105

2.5-year old animal on Dec 31 111

3-year old animal on Dec 31 120

7. The carrying amount of biological assets as of Dec 31 is

a. 1292 b. 1400 c. 1338 d. 1320

8. The increase in FV of biological assets due to price change is

a. 55 b. 222 c. 53 d. 212

9. The increase in FV of biological assets due to physical change is

a. 70 b. 229 c. 237 d. 167

10. The total value of he entity’s forest assets is P200 million comprising: Freestanding trees; Land

under trees at P20 million; and roads in forests at P10 million. How much should be classified as

biological assets?

a. 200 million b. 170 million c. 190 million d. Nil

PPE- ACQUISITION AND SUBSEQUENT EXPENDITURES- PAS 16

1. The cost of an item of PPE comprises:

Practical Accounting 1 Review jca

i. Purchase price, plus import duties and nonrefundable purchases taxes, after

deducting trade discounts and rebates

ii. Any costs directly attributable to bringing the asset to the location and condition

necessary for it to be capable of operating in the manner intended by management

iii. Initial estimate of dismantling costs and removing the item and restoring the site, the

obligation for which the entity incurs when the item is acquired or as a consequence

for using the item

a. I, ii, iii b. I and ii c. I and iii d. I only

2. Cabiao co. purchased a new printing machine on December 2, 2018 at an invoice price of P4

million with terms 2/10, net 30. On Dec 10, Cabiao paid the required amount. The installation costs

were P50,000 and the employees received training at a cost if P20,000. A test was undertaken and

cost P5000. What amount should be capitalized as cost of the machine?

a. 4,075,000 b.3,995,000 c. 3,975,000 d. 3, 970, 000

3. Seller co. sold a used asset to Buyer co.. for P800,000, accepting a 5-year 6% note for the entire

amount. Incremental Borrowing rate was 14%. The annual payment of principal and interest on the

note was to be P189,930. The asset could have been sold at an established cash price of

P651,460. The present value of an ordinary annuity of P1 at 8% for 5 periods is 3.99. The asset

should be capitalized on Buyer’s books at:

a. P949,650 b.P800,000 c. P757,820 d. P651,460

Company A had a machine with a carrying amount of P450,000. Company B had a delivery vehicle with a

carrying amount of P300,000. Companies A and B exchanged the machine and vehicle, and Company B

paid an additional P90,000 cash as part of the exchange. Assume that the FV of the delivery vehicle is

P420,000. The exchange has commercial substance.

4. How much gain or loss should be recorded by Company A?

a. 30000 loss b. 60000 gain c. 120000 loss d. 120000 gain

5. How much gain or loss should be recorded by Company B?

a. 30000 loss b. 60000 gain c. 120000 loss d. 120000 gain

Payor and Recipient had an exchange with no commercial substance. The asset given up by Payor had a

book value of P12000 and a FV of P15000. The asset given up by Recipient had a book value of P20000

and a FV of P19000. Boot of P4000 is received by Recipient.

6. Payor should record the asset at:

a. 15000 b. 16000 c. 19000 d. 20000

7. Recipient should record the asset at:

a. 15000 b. 16000 c. 19000 d. 20000

8. An entity acquired a piece of land with existing building with the intention to demolish the old

building right away in order to construct a new building on its site as part of its planned

redevelopment. In accordance with PIC Q and A No. 2012-02, it is appropriate to account for the

carrying value of the old building as part of the cost of the new building if

a. It will be used as owner-occupied property

b. It will be held as investment property

c. It will be sold as inventory

d. None of these situations

9. An entity acquired a piece of land with existing building with the intention to initially use the old

building as owner-occupied property and then demolish and replace it with a new one. In

accordance with PIC Q and A No. 2012-02, it is appropriate to account for the carrying value of the

old building as part of the cost of the new building if

a. It will be used as owner-occupied property

b. It will be held as investment property

c. It will be sold as inventory

d. None of these situations

10. In accordance with PIC Q and A No. 2012-02, demolition costs of the old building to give way for

the construction of a replacement building should preferable be

a. Expensed

b. Capitalized as part of the cost of land

c. Capitalized as land improvements

d. Capitalized as part of the cost of the new building

Potrebbero piacerti anche

- This Study Resource Was: FAR EasyDocumento9 pagineThis Study Resource Was: FAR EasyPM HauglgolNessuna valutazione finora

- REO CPA Review: Revaluation and ImaprimentDocumento4 pagineREO CPA Review: Revaluation and ImaprimentAdan NadaNessuna valutazione finora

- FAR.3202 InventoriesDocumento8 pagineFAR.3202 InventoriesMira Louise HernandezNessuna valutazione finora

- FAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018Documento5 pagineFAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018kai luvNessuna valutazione finora

- Of Alabang: ISO 9001:2015 CERTIFIEDDocumento8 pagineOf Alabang: ISO 9001:2015 CERTIFIEDNita Costillas De MattaNessuna valutazione finora

- Quiz 4 (Period 2) AgricultureDocumento4 pagineQuiz 4 (Period 2) AgricultureHon Ney Joy Fadol IINessuna valutazione finora

- MQ1 - Topics FAR.2901 To 2915.Documento7 pagineMQ1 - Topics FAR.2901 To 2915.Waleed MustafaNessuna valutazione finora

- Accounting 102 Intermediate Accounting Part 1 PPE, Government Grant, Borrowing Costs QuizDocumento10 pagineAccounting 102 Intermediate Accounting Part 1 PPE, Government Grant, Borrowing Costs QuizKissy LorNessuna valutazione finora

- Discussion Problems: FAR Ocampo/Ocampo FAR.2902-InventoriesDocumento8 pagineDiscussion Problems: FAR Ocampo/Ocampo FAR.2902-InventoriesCV CVNessuna valutazione finora

- FAR.3402 InventoriesDocumento8 pagineFAR.3402 InventoriesMonica GarciaNessuna valutazione finora

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocumento8 pagineIdentify The Choice That Best Completes The Statement or Answers The QuestionGabrielle100% (1)

- Assessment 4 2024 FARDocumento7 pagineAssessment 4 2024 FARmarinel pioquidNessuna valutazione finora

- Discussion Problems: FAR Ocampo/Cabarles/Soliman/Ocampo FAR.2902-Inventories OCTOBER 2020Documento8 pagineDiscussion Problems: FAR Ocampo/Cabarles/Soliman/Ocampo FAR.2902-Inventories OCTOBER 2020music niNessuna valutazione finora

- VIRAY, NHICOLE S. Asset - PPE - 1 - For PostingDocumento4 pagineVIRAY, NHICOLE S. Asset - PPE - 1 - For PostingZeeNessuna valutazione finora

- Pas 40-41 & Pfrs 1 QuizDocumento3 paginePas 40-41 & Pfrs 1 QuizWendy Cagape0% (1)

- Biological AssetsDocumento15 pagineBiological AssetsAIKO MAGUINSAWANNessuna valutazione finora

- Business Combi and Conso FSDocumento56 pagineBusiness Combi and Conso FSlachimolaluv chim50% (12)

- FAR03 - Accounting For Property, Plant, and EquipmentDocumento4 pagineFAR03 - Accounting For Property, Plant, and EquipmentDisguised owlNessuna valutazione finora

- Deadline of Submission Will Be On June 15, 2020.: Accounting 10 and 11Documento5 pagineDeadline of Submission Will Be On June 15, 2020.: Accounting 10 and 11Clara San MiguelNessuna valutazione finora

- Property, Plant and Equipment (With Answers)Documento16 pagineProperty, Plant and Equipment (With Answers)gazer beamNessuna valutazione finora

- Quiz Chapter 16Documento16 pagineQuiz Chapter 16Ms VampireNessuna valutazione finora

- Quiz 1 & 2 (Far)Documento26 pagineQuiz 1 & 2 (Far)Leane MarcoletaNessuna valutazione finora

- Intermediate Accounting 1amp2 PDF FreeDocumento20 pagineIntermediate Accounting 1amp2 PDF FreeShao LiNessuna valutazione finora

- EXAMDocumento6 pagineEXAMJulius B. OpriasaNessuna valutazione finora

- ACCTG102 FinalsSW3 DepreciationDepletionRevaluationImpairmentDocumento8 pagineACCTG102 FinalsSW3 DepreciationDepletionRevaluationImpairmentAnn Marie Dela FuenteNessuna valutazione finora

- Quiz 3 Conceptual Framework 0 Accounting Standards Answer KeyDocumento5 pagineQuiz 3 Conceptual Framework 0 Accounting Standards Answer Keymaliaerica738Nessuna valutazione finora

- Conceptual FrameworkDocumento4 pagineConceptual FrameworkVenus PalmencoNessuna valutazione finora

- Seatwork - Module 2Documento4 pagineSeatwork - Module 2Alyanna Alcantara100% (1)

- Quiz - Chapter 15 - Ppe Part 1 1Documento4 pagineQuiz - Chapter 15 - Ppe Part 1 1Rheu Reyes20% (5)

- 3 Mock FAR 3rd LEDocumento9 pagine3 Mock FAR 3rd LENatalia LimNessuna valutazione finora

- 2nd Year QuestionnairesDocumento7 pagine2nd Year QuestionnaireswivadaNessuna valutazione finora

- Conceptual Framework and Accounting StandardsDocumento11 pagineConceptual Framework and Accounting StandardsAngela TalastasNessuna valutazione finora

- QUIZ - PPE PART 1 Answer KeyDocumento4 pagineQUIZ - PPE PART 1 Answer KeyRena Rose MalunesNessuna valutazione finora

- Fin Act - PUP-Manila - July 2009Documento8 pagineFin Act - PUP-Manila - July 2009Lara Lewis AchillesNessuna valutazione finora

- FAR - Learning Assessment 2 - For PostingDocumento6 pagineFAR - Learning Assessment 2 - For PostingDarlene JacaNessuna valutazione finora

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocumento9 paginePrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloNessuna valutazione finora

- Accounting 102 Depreciation, Depletion, Revaluation, Impairment Summary QuizDocumento8 pagineAccounting 102 Depreciation, Depletion, Revaluation, Impairment Summary Quizjhean dabatosNessuna valutazione finora

- 1st Finale 11252018FARAPDocumento3 pagine1st Finale 11252018FARAPGletzmar IgcasamaNessuna valutazione finora

- Gewsessss PDFDocumento5 pagineGewsessss PDFGwen Stefani DaugdaugNessuna valutazione finora

- Name: Date: Financial Accounting and ReportingDocumento3 pagineName: Date: Financial Accounting and ReportingLeizzamar BayadogNessuna valutazione finora

- Financial Accounting and Reporting - QUIZ 6Documento4 pagineFinancial Accounting and Reporting - QUIZ 6JINGLE FULGENCIONessuna valutazione finora

- UNIT 2 Discussion ProblemsDocumento6 pagineUNIT 2 Discussion ProblemsCal PedreroNessuna valutazione finora

- 2nd Year QuestionnairesDocumento7 pagine2nd Year QuestionnaireswivadaNessuna valutazione finora

- FAR.2902 Inventories PDFDocumento8 pagineFAR.2902 Inventories PDFNah HamzaNessuna valutazione finora

- IA2 Prelim Quiz No. 2 Bio Assets 1Documento6 pagineIA2 Prelim Quiz No. 2 Bio Assets 1Djunah ArellanoNessuna valutazione finora

- Far Week 6 Investment Properties RevieweesDocumento4 pagineFar Week 6 Investment Properties RevieweesAdan NadaNessuna valutazione finora

- Galatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Documento5 pagineGalatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Kei TsukishimaNessuna valutazione finora

- Own Mock QualiDocumento10 pagineOwn Mock QualiDarwin John SantosNessuna valutazione finora

- Quizbee 2Documento3 pagineQuizbee 2Haizii PritziiNessuna valutazione finora

- Discussion Problems: InventoriesDocumento6 pagineDiscussion Problems: InventoriesDrie LimNessuna valutazione finora

- Galatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Documento5 pagineGalatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Kei Tsukishima100% (2)

- Questionnaire For Quiz Bee Level 2 FARDocumento10 pagineQuestionnaire For Quiz Bee Level 2 FARJasmin GalacioNessuna valutazione finora

- 02 inDocumento8 pagine02 inPauline De VillaNessuna valutazione finora

- F FAR PBFPBOCT19.pdf 93604515Documento16 pagineF FAR PBFPBOCT19.pdf 93604515Athena AthenaNessuna valutazione finora

- Far First Set ADocumento8 pagineFar First Set APaula Villarubia100% (1)

- 06.2 Accounting For PPEDocumento4 pagine06.2 Accounting For PPECALERO CATHERINE CNessuna valutazione finora

- Far Set1Documento5 pagineFar Set1bea kullinNessuna valutazione finora

- Forest Products: Advanced Technologies and Economic AnalysesDa EverandForest Products: Advanced Technologies and Economic AnalysesNessuna valutazione finora

- Capital: The Process of Capitalist Production as a WholeDa EverandCapital: The Process of Capitalist Production as a WholeNessuna valutazione finora

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Da EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Nessuna valutazione finora

- 3 Review RecDocumento8 pagine3 Review RecJobelle Candace Flores AbreraNessuna valutazione finora

- 2 Rev Cce2Documento2 pagine2 Rev Cce2Jobelle Candace Flores AbreraNessuna valutazione finora

- 1 Review CceDocumento10 pagine1 Review CceJobelle Candace Flores AbreraNessuna valutazione finora

- Fundamentals of PartnershipsDocumento6 pagineFundamentals of PartnershipsJobelle Candace Flores AbreraNessuna valutazione finora

- Financial Assets ReviewDocumento3 pagineFinancial Assets ReviewJobelle Candace Flores AbreraNessuna valutazione finora

- Intangibles, Wasting A, ImpairmentDocumento4 pagineIntangibles, Wasting A, ImpairmentJobelle Candace Flores AbreraNessuna valutazione finora

- Inventories, Biological Assets, Etc.Documento3 pagineInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNessuna valutazione finora

- Quiz No. 1 Answer KeyDocumento4 pagineQuiz No. 1 Answer KeyJobelle Candace Flores Abrera63% (8)

- Keynes Presentation - FINALDocumento62 pagineKeynes Presentation - FINALFaith LuberasNessuna valutazione finora

- My Kind of Cakes: An Expansion Dilemma: Case AnalysisDocumento10 pagineMy Kind of Cakes: An Expansion Dilemma: Case AnalysisvinayNessuna valutazione finora

- Case Digest Ace Food v. Micro PacificDocumento2 pagineCase Digest Ace Food v. Micro PacificLee0% (1)

- Utility Cost Breakdown ThailandDocumento5 pagineUtility Cost Breakdown ThailandColin HolmesNessuna valutazione finora

- Far PreweekDocumento18 pagineFar PreweekHarvey OchoaNessuna valutazione finora

- PL AccountDocumento13 paginePL AccountShashikanta RoutNessuna valutazione finora

- Sri Lanka Banking Sector Report - 02 01 2015 PDFDocumento26 pagineSri Lanka Banking Sector Report - 02 01 2015 PDFRandora LkNessuna valutazione finora

- Rsi 5Documento9 pagineRsi 5Senyum Sentiasa TenangNessuna valutazione finora

- Economic OptimizationDocumento22 pagineEconomic Optimizationraja_maqsood_jamaliNessuna valutazione finora

- Irfan Habib Capital Accumulation Pre Colonial IndiaDocumento25 pagineIrfan Habib Capital Accumulation Pre Colonial IndiaNajaf HaiderNessuna valutazione finora

- Supreme CashDocumento68 pagineSupreme CashTibor BesedesNessuna valutazione finora

- Strategic Management: Course Code: 18MBA25 Sem-2 MBA 2018-20Documento18 pagineStrategic Management: Course Code: 18MBA25 Sem-2 MBA 2018-20Mr. M. Sandeep KumarNessuna valutazione finora

- Britania ReportDocumento26 pagineBritania Reportravi.p23Nessuna valutazione finora

- Hetzner 2021-02-09 R0012797297Documento1 paginaHetzner 2021-02-09 R0012797297Eduardo FilhoNessuna valutazione finora

- 76 TA RudraMurthy.391ppDocumento391 pagine76 TA RudraMurthy.391ppbikash upadhyay0% (1)

- (PAPER) Oskar Lange - The Role of Planning in Socialist Economy PDFDocumento16 pagine(PAPER) Oskar Lange - The Role of Planning in Socialist Economy PDFSyahriza RizaNessuna valutazione finora

- Chapter 2Documento50 pagineChapter 2junrexNessuna valutazione finora

- George's T Shirts FinalDocumento5 pagineGeorge's T Shirts FinalKamal Ahmmad40% (5)

- BCC620 Business Financial Management Main (NOV) E1 21-22Documento9 pagineBCC620 Business Financial Management Main (NOV) E1 21-22Rukshani RefaiNessuna valutazione finora

- Certified US GAAP Professional BrochureDocumento7 pagineCertified US GAAP Professional BrochureAnamika VermaNessuna valutazione finora

- 5 Key Takeaways From Buffett's 2013 LetterDocumento2 pagine5 Key Takeaways From Buffett's 2013 Letterbhuiyan1Nessuna valutazione finora

- Notes: by Felipe Tudela © Felipe TudelaDocumento6 pagineNotes: by Felipe Tudela © Felipe TudelaSamado ZOURENessuna valutazione finora

- Fundamentals of Investments. Chapter1: A Brief History of Risk and ReturnDocumento34 pagineFundamentals of Investments. Chapter1: A Brief History of Risk and ReturnNorina100% (1)

- Pricing of Products in GAILDocumento32 paginePricing of Products in GAILSimmi SharmaNessuna valutazione finora

- Balance Sheet ExamplesDocumento10 pagineBalance Sheet Examples9036673667Nessuna valutazione finora

- Kieso Inter Ch22 - IfRS (Accounting Changes)Documento59 pagineKieso Inter Ch22 - IfRS (Accounting Changes)Restika FajriNessuna valutazione finora

- Poor Highs and Poor Lows ExplainedDocumento8 paginePoor Highs and Poor Lows ExplainedRichard JonesNessuna valutazione finora

- Inventory 2Documento42 pagineInventory 2ganeshantreNessuna valutazione finora

- NetFlix Case StudyDocumento24 pagineNetFlix Case Studykaran dattaniNessuna valutazione finora

- Hill Country SnackDocumento8 pagineHill Country Snackkiller dramaNessuna valutazione finora