Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Business License 1

Caricato da

Jerion Paragon Evans0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

55 visualizzazioni2 pagineLamar County, GA Business DBA form

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoLamar County, GA Business DBA form

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

55 visualizzazioni2 pagineBusiness License 1

Caricato da

Jerion Paragon EvansLamar County, GA Business DBA form

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 2

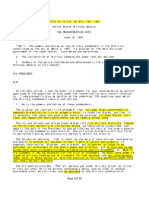

APPLICATION

LAMAR COUNTY OCCUPATIONAL TAX & LICENSE,

LAMAR COUNTY ZONING ADMINISTRATION

4408 THOMASTON STREET, SUITE B

BARNESVILLE, GEORGIA 30204

PHONE NUMBER: 770-358-5364 FAX NUMBER: 770-358-5821

BUSINESS NAME: OWNER:

BUSINESS ADDRESS:

MAILING ADDRES!

‘TELEPHONE NUMBER: DATE ESTABLISHED:

BUSINESS PURPOSE:

For all paris engaged ino carrying on busines inthe unincorporated aren of Lamar County,

‘ccpational Lense tax shall be levied on all business and practitioners of profesio

ccupatons wih one or more lotions andlor offies in the unnebrporated area of Lamar County

‘Ai Besinesses with more than 10" employees must submit an Annual Compliance Report on

‘Occupation Taxes (Busines Licenses) that Includes an E-Verlfy mumber (hp. dhsgovie

verity.

Using the lst below, compute your tax amount,

+#*Total # of Employees "=**Occupational Tax for # of Employees

1-9 (inchudes Business Owner) $50.00

099 75.00

100-499" 3150.00

mF $250.00

Number of Employees: ‘Tax Identification #

Social Security #:,

5 +320.00 = 5,

License Fee (Admin, Fee) Total Tax Fee Due

LATE FEE: ADD 10% TO “TOTAL TAX FEE DUE” AFTER MARCH 31°

‘ADD 15% AFTER APRIL 30" / ADD 20% AFTER MAY 31

ADD 25% AFTER JUNE 30™

‘*+4ection below to be filled in by Lamar County Tax Offic

‘Has applicant filed a current Personal Property Return? ___Yes __No

‘Tax Assessor's Initials

Are all taxes current? Yes No “Tax Comm. Initials

+++] certify that all information Is true and correct.

‘Siguature of Applicant Date

[NOTE: With yur application, lease submit the busines lcense fe as you have computed Upon

‘recip, your Busines license wil be mailed to you within 7 business days. Please make checks

payable to Lamar Count. Ifa rate lenses required, plese encose a copy. Yowr busines lense

‘wnat be processed, and business not be conducted unl proof of holding a required state

‘sins lease Is eclved.

Private Employer Exemption Affidavit Pursuant To 0.C.G.A. Section 36-60-6(d)

By executing this afidavit, the undersigned private employer verifies that it is exempt from

‘compliance with O.C.G.A, Section 36-6046, stating affirmatively that the individual, firm or

corporation employs ten (20) employees o less and therefore, is not required to register with

and/or utlize the federal work authorization program commonly known as E-Verify, or any

subsequent replacement program, in accordance with the applicable provisions and deadlines

established in 0.C.G.A Section 13-10-90,

Signature of Exempt Private Employer” Printed Name of Exempted Private Employer

I hereby declare under penalty of perjury thatthe foregoing is true and correct.

Executed on __ 201_ In Barnesville, Georgia

Signature of Authorized Officer or Agerit Printed Name and Title of Authorized Oificer/Agent

‘SUBSCRIBED AND SWORN BEFOR ME ON THIS THE

DAY Of seca 204

{NOTARY PUBLIC) My Commission Expires:

Potrebbero piacerti anche

- Apply for SS benefits - handwrite fields & take copiesDocumento1 paginaApply for SS benefits - handwrite fields & take copiesJerion Paragon Evans100% (1)

- Getting Started PDFDocumento14 pagineGetting Started PDFCeliz MedinaNessuna valutazione finora

- Mortgage Discharged RedactedDocumento9 pagineMortgage Discharged RedactedJerion Paragon EvansNessuna valutazione finora

- Carey Currency Letter PDFDocumento7 pagineCarey Currency Letter PDFJerion Paragon EvansNessuna valutazione finora

- The Non Statutory Abatement Handbook PDFDocumento86 pagineThe Non Statutory Abatement Handbook PDFJo Cheyanne100% (1)

- C K A L G, S S: Certificate of Assumed Name ASNDocumento2 pagineC K A L G, S S: Certificate of Assumed Name ASNJerion Paragon EvansNessuna valutazione finora

- English Translation of Birth CertificateDocumento1 paginaEnglish Translation of Birth CertificateJerion Paragon EvansNessuna valutazione finora

- 12 U.S. Op. Atty. Gen. 182 1867Documento15 pagine12 U.S. Op. Atty. Gen. 182 1867Tom Harkins100% (2)

- 03 - PD Killer (If Necessary) PDFDocumento1 pagina03 - PD Killer (If Necessary) PDFJerion Paragon EvansNessuna valutazione finora

- Common Law Abatement PDFDocumento88 pagineCommon Law Abatement PDFPat Riot96% (53)

- Judicial Notice of Right of SubrogationDocumento1 paginaJudicial Notice of Right of SubrogationJerion Paragon Evans100% (6)

- Solar SecretsDocumento44 pagineSolar SecretsKen HeathNessuna valutazione finora

- US Court Clerk Notice of Non-Representative CapacityDocumento1 paginaUS Court Clerk Notice of Non-Representative CapacityJerion Paragon EvansNessuna valutazione finora

- Notice of Special Appearance and Motion to DismissDocumento2 pagineNotice of Special Appearance and Motion to DismissMichael Flynn92% (12)

- Bills of Attainder - What You Should KnowDocumento7 pagineBills of Attainder - What You Should KnowJerion Paragon EvansNessuna valutazione finora

- Law-Redemption in CourtDocumento51 pagineLaw-Redemption in CourtRedfieldHasArrived92% (12)

- Symbols, Sex and The StarsDocumento418 pagineSymbols, Sex and The StarsDanny Ofthefamily Edwards90% (10)

- Chart of Self-Mastery With ExplanationDocumento2 pagineChart of Self-Mastery With ExplanationJerion Paragon EvansNessuna valutazione finora

- Horned DeityDocumento10 pagineHorned DeityJerion Paragon EvansNessuna valutazione finora

- Sri Yukteswar Kaivalya DarshanamDocumento108 pagineSri Yukteswar Kaivalya DarshanamGanesh Jayakumar100% (2)

- Debt Validation LetterDocumento4 pagineDebt Validation LetterJerion Paragon Evans100% (1)

- Isis UnveiledDocumento420 pagineIsis Unveileddaniells_2008100% (1)

- Self HealingDocumento16 pagineSelf HealingJerion Paragon Evans100% (3)

- Walter Russell - The Message of The Divine Iliad (Vol. 1)Documento171 pagineWalter Russell - The Message of The Divine Iliad (Vol. 1)skydionNessuna valutazione finora

- Walter Russell - The Message of The Divine Iliad (Vol. 1)Documento171 pagineWalter Russell - The Message of The Divine Iliad (Vol. 1)skydionNessuna valutazione finora

- Pupul Jayakar Fire in The Mind Dialogues With J KrishnamurtiDocumento271 paginePupul Jayakar Fire in The Mind Dialogues With J KrishnamurtiJerion Paragon Evans100% (3)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)