Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accenture Global Payments Pulse Survey 2019

Caricato da

Valter SilveiraCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accenture Global Payments Pulse Survey 2019

Caricato da

Valter SilveiraCopyright:

Formati disponibili

TWO WAYS TO

WIN IN PAYMENTS

Banks can add value in the world of

Instant, Invisible and Free payments via scale and differentiation

Accenture Global Payments Pulse Survey 2019

What the global payments industry is

becoming, and could become, continues

to give incumbent banks reason to worry.

Market trends are converging on a future where payments are inevitably becoming instant, invisible and

free (IIF). In this new payments world, how will incumbent banks add value and raise their game? What can

they do now to reinvent themselves for IIF payments? How can banks both mitigate and capitalize on the upcoming

payments disruption to grow customer loyalty, revenues and profitability?

We recently posed these and other payments-related questions to 240 payments executives at banks from

22 countries. Drawing upon our deep experience in the payments industry and findings from the Accenture Global

Payments Pulse Survey 2019, we see two complementary, interconnected and interdependent ways

on how banks can use innovation to add value in the IIF payments world and win big: via scale and differentiation.

2 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

$500 BILLION IS UP FOR GRABS

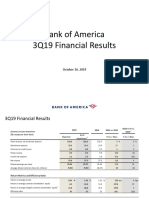

We estimate that global Figure 1. Global payments revenue

payments revenue is likely to 2,093

grow at a respectable compound

annual growth rate of 5.5 percent +5.5%

to reach US$2 trillion over the 1,514 44%

next six years (Figure 1).

Consumer payments accounts for 58 percent 42%

of this total revenue and are expected to grow at

5.1 percent by 2025; corporate payments comprise

the rest and are expected to grow at a slightly faster

6.1 percent.1 Non-cash transactions are expected

56%

to grow at 5.0 percent over the same period.2 This

58%

projected growth is offering banks that operate in the

payments industry the chance to grab US$500 billion Commercial

in incremental revenue. Consumer

2019 2025

*RoW = Latin America + Middle East and Africa

Source: Accenture Research Global Payments Revenue Model

3 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

BUT, SEIZING THIS

OPPORTUNITY WON’T BE

EASY IN THE NEW WORLD

OF IIF PAYMENTS

4 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

Capturing the revenue growth Forty percent of the banking payments executives On average, 77 percent of respondents agree that

we polled see payments as already being instant and payments are generally becoming more invisible as

opportunity of payments won’t another 38 percent say that payments will become they are progressively incorporated into third-party

be easy for those banks which are instant over the next 12 months. More than 90 percent apps or devices, such as wearables, digital wallets,

unable to shift to digital business of bankers globally (98 percent in Asia Pacific) agree

that payments are becoming more instant for business-

IoT devices and smart contracts. Seventy-three percent

believe payments are already invisible or will be so

models, a critical mission for to-business transactions. In fact, 46 countries now over the next 12 months; even more so for consumer-

winning in an IIF payments world. have in place an instant payment solution and 12 more to-consumer (84 percent) and consumer-to-business

plan to implement one soon.3 UK’s Request to Pay, set (83 percent) payments. Uber is a prime example of

We see a mix of progressive and disruptive market for launch this year, is a secure messaging service that a service that takes physical payment options, such

drivers at work. These include customers’ and will be overlaid on existing payments infrastructures as cash, cards and wearables, completely out of the

merchants’ rising expectations for speed and as a flexible way to settle bills between businesses, equation. The no-checkout-required Amazon Go retail

convenience; technical innovations like open APIs, organizations and friends.4 PayPal, as another example store is another good example. With its Just Walk Out

Internet of Things and high-speed mobile connectivity; of this trend, is partnering with banks and card issuers Shopping experience, shoppers simply use the Amazon

AI and blockchain; digital and regulator-driven fee to offer its Instant Transfer capability to individuals Go app to enter the store, take the products they want

compression; national infrastructure upgrades; and and small businesses in North America, giving them and leave with no lines and no checkout.7

new providers entering the market, such as third-party quick access to their money.5 Finally, Ripple is using

payment initiation service providers. The combination blockchain technology to make cross-border payments

of all of these trends is what leads us to the conclusion easier and instant with minimal fees and that, in turn,

that we are heading towards a new world in which all is stimulating established cross-border payment

payments are IIF. players, like Swift, to up their innovation game.6

5 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

Seventy-one percent of bankers and payments Figure 2. Global payments revenue at risk (US$B)

executives agree that payments are becoming free.

2.7% up to

That number is greater in Europe (93 percent) and 3.9%

14.5% at

Asia Pacific (75 percent) where fee income accounts risk for

8.0% 1,649

for the lion share of total payments revenue compared banks

1,514 38.5%

to North America (61 percent) where the revenue

pool is more diverse. Consider that consumer 8.1% 1,393

payments for debit card revenue per transaction

dropped 14.6 percent, from $0.34 in 2015 to

$0.29 in 2018.8 Credit card revenue per transaction

dropped 11.6 percent, from $1.21 in 2015 to $1.07

in 2018.9 In corporate payments, credit card revenue

per transaction dropped 33.3 percent, from $2.76

in 2015 to $1.84 in 2018.10 We are also seeing increased

regulatory pressure on fees, including the recent

European Central Bank restrictions on non-EU

card transactions in Europe and the plenty of

new entrants, like Revolut, that are building their

customer proposition on lower payment fees.

The impact of IIF payments will be significant.

Total Non-bank Bank Bank organic Card Competition Pricing Bank

Based on our analysis, it is likely to decrease the Payments Payments Revenues growth displacement from non banks compression Payments

payments revenue pool by 15 percent by 2025 Revenues Revenues 2019 2019-25 by real time and digital Revenues

2019 2019 payments attackers 2025

and may cost complacent banks up to $280 billion

in revenue opportunity loss, globally (Figure 2).

Instant Invisible Free

While the volume/value tradeoff is still driving Payments Payments Payments

growth in total payments revenue, our survey

results clearly show an acceleration towards IIF. Source: Accenture Research

6 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

We also estimate that Figure 3. Global payments operating margin at risk by 2025

IIF payments could push

14.5%

the operating margin for

payments down to 4.3 percent

by 2025 (Figure 3).

With such compression, 100% 68.5%

margins may become razor

thin and even negative for

the least-efficient players.

12.7%

4.3%

Bank Payments Revenues Payment Cost of risk Operating

Revenues loss operating costs margin

Source: Accenture Research on annual reports

7 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

TWO WAYS PROVIDERS

CAN EXTRACT MORE

PAYMENTS VALUE

To protect the economics of their payments businesses, banks will

need to define their business and innovation strategies around

two approaches that address the challenges of IIF payments.

First, scale technology to reimagine how their core payments

operations are done to ensure that they continue to benefit from

the volume/value tradeoff and second, differentiate themselves

by adding value in a low-margin, high-volume business.

8 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

CREATING SCALE BY REIMAGINING

HOW PAYMENTS ARE DONE

Innovation in scale is how banks What’s driving this invisibility and disintermediation? Leaders get it. They are implementing scale

According to our survey respondents, it is customer initiatives, such as consolidation, to grow quickly

can address new competitors, experience at 28 percent and efficiency at 27 percent. and efficiently and remain competitive. Fiserv, for

market oversupply and maintain example, is buying First Data12 which should enable

So, when providers in the IIF payments world lose

differentiation. speed as a distinguishing factor, they will need

it to offer a wider range of technology-powered

payments and financial services—from card issuer

to set their sights on leading in price, service and processing to the Clover™ cloud-based point-of-sale

There’s a host of digital payment solutions

overall quality. Improving any one of these requires solution. Online payment processor Stripe acquired

available today, many of them powerful and popular.

the ability to act quickly and with precision. a laser focus on, first, principles, smart processes

It has created a global environment of undeniable

oversupply, despite customers’ increased demand and effective hiring to scale its business, growing

In essence, the must-do play is scale. Being able to

for instant payments and settlements. Consider that its employee base to more than 1,400 people and

quickly develop secure, convenient and completely

every year the number of unique fintech payments processing billions of dollars for millions of users

frictionless payment experiences through digital

companies (that also receive funding) skyrocketed worldwide.13 Fintechs, in general, are tapping into

services and capabilities without any significant

97 percent from 2015 to 2018, based on our analysis.11 the customer base and stable capital pools of banks

increase in costs (including regulatory compliance

This is exacerbated by the growing pervasiveness of to reach both customer and efficiency scale.

and IT maintenance/upgrade) isn’t just an operational

embedded payments that are being completed via aspiration; it’s both a matter of survival and ambition.

smart assistants or third-party or branded mobile

apps—adding to the abundance of payments options.

9 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

Players can focus on two key actions

to optimize their efforts around scale.

1. Drive down costs faster than their 2. Obtain the technological abilities,

revenue decrease to ensure that the such as intelligent automation, to

volume/value tradeoff remains positive. process payments innovation at scale.

This means establishing greater economies In our survey, 18 percent of respondents said that

of scale in reaching enough new customers building security into the retail payments transaction

at a pace necessary to justify further investment will be the main priority for banks; 22 percent cited

in digital innovation and capture moments of scale artificial intelligence, robotics, machine learning

and growth opportunities. Tactical examples of and innovative payments hubs as the key platform

this include pursuing inorganic growth to increase technology capabilities that they need in adapting core

scale and reduce unit costs, attracting new customers systems to high-speed and continuous payment flows.

and revenue streams through new value-added

services and playing the volume game on price

by massively lowering remittance margins

in exchange for higher volume.

10 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

FINDING NEW MARKET DISTINCTION

IN THE EYES OF CUSTOMERS

In the IIF payments world, That being said, a piece of banking that is making

lots of money and growing is transaction services.

differentiation will go to Revenues at the 10 largest global transaction banks hit

whomever owns the customer an eight-year high in 2018 due in large part to a cash

relationship. Rather than management surge and stabilization in traditional

trade finance.14 Important opportunities still exist in

become the dumb-funding certain payment areas, such as FX. For example, the

platforms for other companies’ flow of money between individuals across national

boundaries totaled $689 billion in 2018, benefitting

information-rich payments companies such as Western Union and Moneygram15

businesses, banks must find new but also creating an attractive market opportunity

ways to add value to customers, for new entrants, like Transferwise.

make money and grow.

11 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

To build off that money-making momentum, banks can

draw on three tactics to better differentiate their payments

business and increase revenue and profitability.

1. Customer-centric 2. Open Banking for corporates insight, far beyond the typical of income, gender,

marital status and location. Based on our research,

value-added services Borrow from the retail business as a model and 69 percent of banks aspire to sell raw data within

zero-in on providing the last-mile of connectivity three years. Already 20 percent of banks monetize

Focus on customer-centric and value-added services,

to offer solutions to corporate customers as part data delivering actionable insights and 75 percent

even if the payment itself is free. This might include

of Open Banking ecosystems, even if it is invisible aspire to do so in the next three years. However,

building an aggregator role in the online, mobile and

to the end customer. For 17 percent of the survey customers’ data protection concerns (14 percent)

instant payment segments, and developing cross-

respondents, establishing internal start-up incubation and operational complexity (13 percent) are the

channel payment platforms (for example, PoS, APIs and

units that are isolated from legacy processes to top barriers to monetizing customers’ data.

microservices). Or, establish digitalized and differentiated

boost innovation will be the main priority for banks.

customer experiences for priority segments, such as

tailoring service packages for commercial payments. Fraud management is a good example of a data-

3. Data monetization driven service. Other forms of data monetization,

Stripe, for example, offers online payment processing such as offer presentment and redemption, are far

Focus on monetizing data flows—selling raw data or

for e-commerce businesses of all sizes through a suite less developed. The potential for data monetization

delivering actionable insights—arising from payments

of payment APIs.16 BBVA and other banks are launching remains strong but will evolve over the long term

activity to compensate for core payments becoming

apps for ordering ahead and paying through the app. with services more loosely aligned to core processing

free, even if data plays are still early in their maturity

The apps automate payments but also lets customers while other data monetization services progress

cycle. Modern data analytics enables new levels of

reserve a table, order food, pick it up, check the bill, pay more slowly from concept to revenue generation.

target segmentation where banks and their corporate

the bill and so on without waiting in line.17 These types

clients can plan and execute more relevant products

of integrated payments are now becoming standard

and services based on much broader consumer

in many quick service restaurant chains around the

world, helping improve the dining experience.

12 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

UNLOCK SCALE,

DIFFERENTIATION OR BOTH

IIF payments are no longer a question of if, but how soon. And when they come, how will traditional payments

players protect the economics of their payments business, differentiate themselves, stay relevant and make money?

Those that embrace and acquire the ability to scale their businesses and deliver for their customers will be

positioned for breakthrough outcomes, including differentiating experiences…even in the IIF payments world.

Accenture Payments can help. We assist payments providers in transforming their payments systems and

operations to grow and win in the digital ecosystem. We offer services that support the entire payments value

chain and can help improve provider costs and value outcomes—thus creating innovative, compelling payments

offerings and experiences for businesses and consumers.

13 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

References 12. MarketWatch, “Five payment system deals that

could follow an already big wave of M&A,” April 3,

Contact the authors

1. Accenture Research Global Payments Revenue 2019. https://www.marketwatch.com/story/here-

Model 2019 are-5-payment-system-deals-that-could-follow- Alan McIntyre

an-already-big-wave-of-ma-2019-04-03 Senior Managing Director – Banking

2. Accenture Research analysis on global data 2019

13. SAASTR, “Avoid Trapdoor decisions: 5 lessons a.mcintyre@accenture.com

3. InstaPay Tracker. https://www.instapay.today/tracker learned from scaling stripe,” March 26, 2019.

https://www.saastr.com/avoid-trapdoor-

4. Request to Pay. https://www.requesttopay.co.uk

decisions-5-lessons-learned-from-scaling-stripe Sulabh Agarwal

5. Digital Transactions, “PayPal launches Instant Transfer Managing Director – Payments

14. S&P Global, “Global transaction bank revenues

in Canada using Visa Direct,” July 2, 2019. https:// sulabh.agarwal@accenture.com

hit highest level since 2010,” March 6, 2019.

www.digitaltransactions.net/paypal-launches-instant-

https://www.spglobal.com/marketintelligence/en/

transfer-in-canada-using-visa-direct

news-insights/latest-news-headlines/50403778

6. Ripple. https://www.ripple.com Gareth Wilson

15. CNBC, “Money transfers in seconds.

7. Amazon.com. https://www.amazon.com/ A start-up that is trying to usurp Western Managing Director – Global Payments

b?ie=UTF8&node=16008589011 Union and shake up the $689 billion money gareth.wilson@accenture.com

transfer market,” May, 18 2019. https://www.cnbc.

8. Accenture Research analysis on Global Data. com/2019/05/17/a-start-up-trying-to-upsurp-

Revenue per transaction includes interchange fee western-union-in-money-transfer-market.html Luca Gagliardi

and currency conversion fee; other fees are excluded. Senior Principal –

16. Stripe. https://stripe.com

9. Accenture Research analysis on Global Data. Accenture Research, Banking

Revenue per transaction includes interchange 17. The Banker, “Invisible payments move luca.gagliardi@accenture.com

fee and currency conversion fee; other fees into sight,” May 1, 2019. https://www.thebanker.

and interest revenue are excluded. com/Transactions-Technology/Invisible-

10. Accenture Research analysis on Global Data.

payments-move-into-sight

Contributor

Dominika Bosek-Rak

11. Accenture Research analysis on CB Insights data.

Research Specialist –

Accenture Research, Banking

dominika.bosek@accenture.com

14 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

About the Accenture 2019 About Accenture About Accenture Research

Global Payments Survey Accenture is a leading global professional services Accenture Research shapes trends and creates data

Accenture conducted an online survey of 240 retail company, providing a broad range of services and driven insights about the most pressing issues global

and corporate payments executives globally from the solutions in strategy, consulting, digital, technology organizations face. Combining the power of innovative

largest banks in the following countries: United States, and operations. Combining unmatched experience research techniques with a deep understanding of

Canada, United Kingdom, Germany, France, Spain, and specialized skills across more than 40 industries our clients’ industries, our team of 300 researchers

Italy, Sweden, Finland, Denmark, Norway, Australia, and all business functions—underpinned by the world’s and analysts spans 20 countries and publishes hundreds

Japan, India, Hong Kong, China, Singapore, Thailand, largest delivery network—Accenture works at the of reports, articles and points of view every year.

Indonesia, Malaysia, United Arab Emirates, Brazil and intersection of business and technology to help clients Our thought-provoking research—supported by

Mexico. The survey was conducted between February improve their performance and create sustainable proprietary data and partnerships with leading

14, 2019 and March 10, 2019. The overall margin value for their stakeholders. With 482,000 people organizations, such as MIT and Harvard—guides our

of error is +/- 1.55 percentage points at the midpoint serving clients in more than 120 countries, Accenture innovations and allows us to transform theories and fresh

of the 95th percentile confidence level. drives innovation to improve the way the world works ideas into real-world solutions for our clients. For more

and lives. Visit us at www.accenture.com. information, visit www.accenture.com/research

Stay Connected www.accenture.com/banking

www.accenture.com/PaymentsPulse

Accenture Banking

@BankingInsights

Accenture Banking Blog

Copyright © 2019 Accenture. 190743

All rights reserved.

Accenture, its logo, and New Applied Now are trademarks of Accenture.

15 GLOBAL PAYMENTS PULSE SURVEY 2019 TWO WAYS TO WIN IN PAYMENTS

Potrebbero piacerti anche

- Hyperscale and Microcare: The Digital Business CookbookDa EverandHyperscale and Microcare: The Digital Business CookbookNessuna valutazione finora

- Global Fraud Report 2023 enDocumento37 pagineGlobal Fraud Report 2023 enSiew Meng WongNessuna valutazione finora

- Digital Banking Transformation A Complete Guide - 2021 EditionDa EverandDigital Banking Transformation A Complete Guide - 2021 EditionNessuna valutazione finora

- Payments in The Wild PWC Fintech SurveyDocumento20 paginePayments in The Wild PWC Fintech SurveyCrowdfundInsiderNessuna valutazione finora

- Accenture Next Generation FinanceDocumento8 pagineAccenture Next Generation FinanceIam DonNessuna valutazione finora

- GPR Digital All Pages Singles RGB FNL9Documento138 pagineGPR Digital All Pages Singles RGB FNL9André Carvalho de AndradeNessuna valutazione finora

- Impact of Digital Banks On Incumbents in SingaporeDocumento20 pagineImpact of Digital Banks On Incumbents in SingaporeVarun MittalNessuna valutazione finora

- Why DBS Is Not The "World's Best Bank" .. - Emmanuel DanielDocumento16 pagineWhy DBS Is Not The "World's Best Bank" .. - Emmanuel DanielVibWho R Eah100% (1)

- Backbase - The ROI of Omni-Channel - Whitepaper PDFDocumento50 pagineBackbase - The ROI of Omni-Channel - Whitepaper PDFHenriqueVitalValentimNessuna valutazione finora

- Content Dam Deloitte Ce Documents Financial-Services Ce-Digital-Banking-Maturity-2020Documento37 pagineContent Dam Deloitte Ce Documents Financial-Services Ce-Digital-Banking-Maturity-2020Nikhil RajNessuna valutazione finora

- Netguru Ebook Scalling SaasDocumento51 pagineNetguru Ebook Scalling Saasoanh leNessuna valutazione finora

- Global Investors Target Latin American Fintech LendIt Finnovista PDFDocumento18 pagineGlobal Investors Target Latin American Fintech LendIt Finnovista PDFcristiansearNessuna valutazione finora

- Innovation in Retail BankingDocumento102 pagineInnovation in Retail BankingAlina DamaschinNessuna valutazione finora

- 54 20190823 - FiinGroup - Vietnam Retail Market 2019 Previewpptx - Repaired - TPLXXXXX - 20190826135133 PDFDocumento17 pagine54 20190823 - FiinGroup - Vietnam Retail Market 2019 Previewpptx - Repaired - TPLXXXXX - 20190826135133 PDFHai Dang LuongNessuna valutazione finora

- IBM Banking: Core Systems Transformation For BankingDocumento2 pagineIBM Banking: Core Systems Transformation For BankingIBMBankingNessuna valutazione finora

- Open Banking Opening Opportunities For Customer ValueDocumento4 pagineOpen Banking Opening Opportunities For Customer Valueapi-239489234Nessuna valutazione finora

- Customer Retention Guide SegmentDocumento11 pagineCustomer Retention Guide Segmentunreal2100% (2)

- Accenture Open Platform Banking New EraDocumento12 pagineAccenture Open Platform Banking New EraKaren L YoungNessuna valutazione finora

- The State of Revenue Operations 2019Documento24 pagineThe State of Revenue Operations 2019Kanon Kanon100% (1)

- DBSDocumento14 pagineDBSBenson ChooNessuna valutazione finora

- Dealroom Embedded Finance v2Documento32 pagineDealroom Embedded Finance v2Sushma KazaNessuna valutazione finora

- GS - Latin America Internet - E-Commerce - Shopee's Push Into LatAm Ecommerce Expands The Pie Buy SEA, MELI and MGLUDocumento24 pagineGS - Latin America Internet - E-Commerce - Shopee's Push Into LatAm Ecommerce Expands The Pie Buy SEA, MELI and MGLURojana ChareonwongsakNessuna valutazione finora

- Banking Industry 2020Documento24 pagineBanking Industry 2020Rishi SrivastavaNessuna valutazione finora

- Uk Payment Markets SUMMARY 2020: June 2020Documento8 pagineUk Payment Markets SUMMARY 2020: June 2020Ankit GuptaNessuna valutazione finora

- ENGPR2022Documento156 pagineENGPR2022Trader CatNessuna valutazione finora

- Taking All The Credit:: Success For Buy NowDocumento10 pagineTaking All The Credit:: Success For Buy NowtamaldNessuna valutazione finora

- KPMG Digital Enterprise Cio Checklist 1Documento8 pagineKPMG Digital Enterprise Cio Checklist 1Amit KumarNessuna valutazione finora

- Demystifying Digital Lending PDFDocumento44 pagineDemystifying Digital Lending PDFHitesh DhaddhaNessuna valutazione finora

- Matchmaking Services-CompressedDocumento33 pagineMatchmaking Services-CompressedDelfi RianaNessuna valutazione finora

- AI in Focus - The Bank Technology Roadmap PlaybookDocumento18 pagineAI in Focus - The Bank Technology Roadmap PlaybookAnasNessuna valutazione finora

- Forrester Wave For Digital Banking Q3 2017Documento17 pagineForrester Wave For Digital Banking Q3 2017Ahmed NasrNessuna valutazione finora

- Bus Continuity 1Documento24 pagineBus Continuity 1api-3733759Nessuna valutazione finora

- Bain - Consumer of FutureDocumento36 pagineBain - Consumer of FutureturkeyegyptNessuna valutazione finora

- Future of Southeast Asia Digital Financial ServicesDocumento52 pagineFuture of Southeast Asia Digital Financial ServicesMaria HanyNessuna valutazione finora

- Digital Future of FinanceDocumento16 pagineDigital Future of Financesohaibmuzaffar007Nessuna valutazione finora

- Capgemini - World Payments Report 2013Documento60 pagineCapgemini - World Payments Report 2013Carlo Di Domenico100% (1)

- State of India Fintech 1694501298Documento60 pagineState of India Fintech 1694501298Onkar BhagatNessuna valutazione finora

- Benchmark KPI (On Desk)Documento4 pagineBenchmark KPI (On Desk)indah7575Nessuna valutazione finora

- SF Banking - Indonesia Banks Digital Banks On The HorizonDocumento20 pagineSF Banking - Indonesia Banks Digital Banks On The HorizonAmalia Mega BerlianaNessuna valutazione finora

- Accenture Report: Fintech - Did Someone Cancel The RevolutionDocumento16 pagineAccenture Report: Fintech - Did Someone Cancel The RevolutionCrowdfundInsider100% (1)

- Latin America Payments Solution: November 2018Documento19 pagineLatin America Payments Solution: November 2018Jairo MartinezNessuna valutazione finora

- The SaaS CFO Finance-Accounting Tech Stack Survey v1.0Documento22 pagineThe SaaS CFO Finance-Accounting Tech Stack Survey v1.0Marc ONessuna valutazione finora

- Crypto-Assets - The Global Regulatory PerspectiveDocumento20 pagineCrypto-Assets - The Global Regulatory PerspectiveJeremy CorrenNessuna valutazione finora

- KPMG Market Place Lending PaperDocumento16 pagineKPMG Market Place Lending PaperPotukuchi SidhardhaNessuna valutazione finora

- Fintech 100Documento112 pagineFintech 100Meghana VyasNessuna valutazione finora

- Gender Diversity-MckinseyDocumento11 pagineGender Diversity-MckinseyMitali TalukdarNessuna valutazione finora

- ANA Marketing Automation Software SelectionDocumento14 pagineANA Marketing Automation Software SelectionDemand Metric100% (2)

- World Retail Banking Report 2020 PDFDocumento36 pagineWorld Retail Banking Report 2020 PDFBui Hoang Giang100% (1)

- q1 2023 Quarterly Fintech InsightsDocumento127 pagineq1 2023 Quarterly Fintech InsightsMuluken AlemuNessuna valutazione finora

- Small Business Lending in The Digital AgeDocumento27 pagineSmall Business Lending in The Digital AgeCrowdfundInsiderNessuna valutazione finora

- PWC - Payment Trends in APACDocumento18 paginePWC - Payment Trends in APACVinay SudershanNessuna valutazione finora

- Comviva Mobile Money Deck May-2019Documento97 pagineComviva Mobile Money Deck May-2019thanhhungtmaNessuna valutazione finora

- Backbase The ROI of Omni Channel WhitepaperDocumento21 pagineBackbase The ROI of Omni Channel Whitepaperpk8barnesNessuna valutazione finora

- BCG Creating A More Digital Resilient Bank Mar 2019 Tcm9 217187Documento25 pagineBCG Creating A More Digital Resilient Bank Mar 2019 Tcm9 217187somnath_iiiNessuna valutazione finora

- Gartner Magic Quadrant - b2b Marketing Automation Platforms - 2021Documento36 pagineGartner Magic Quadrant - b2b Marketing Automation Platforms - 2021Wygor AlvesNessuna valutazione finora

- The Future of PaymentsDocumento6 pagineThe Future of Paymentszing65Nessuna valutazione finora

- Accenture Banking Top 10 Trends 2022Documento38 pagineAccenture Banking Top 10 Trends 2022selinNessuna valutazione finora

- TCS Lending and SecuritisationDocumento12 pagineTCS Lending and SecuritisationSoumiya MuthurajaNessuna valutazione finora

- World: Banking'S Digital Future A Whole New: 2020 REPORTDocumento27 pagineWorld: Banking'S Digital Future A Whole New: 2020 REPORTHoang LeeNessuna valutazione finora

- Backbase Deployment GuideDocumento16 pagineBackbase Deployment GuidedondarwinNessuna valutazione finora

- Exibir DocumentoDocumento113 pagineExibir DocumentoValter SilveiraNessuna valutazione finora

- The Presentation MaterialsDocumento28 pagineThe Presentation MaterialsValter SilveiraNessuna valutazione finora

- Morgan Stanley Third Quarter 2019 Earnings Results: Morgan Stanley Reports Net Revenues of $10.0 Billion and EPS of $1.27Documento9 pagineMorgan Stanley Third Quarter 2019 Earnings Results: Morgan Stanley Reports Net Revenues of $10.0 Billion and EPS of $1.27Valter SilveiraNessuna valutazione finora

- Jpmorgan Chase Reports Net Income of $9.1 Billion, or $2.68 Per Share, For The Third Quarter of 2019Documento8 pagineJpmorgan Chase Reports Net Income of $9.1 Billion, or $2.68 Per Share, For The Third Quarter of 2019Valter SilveiraNessuna valutazione finora

- The Press ReleaseDocumento18 pagineThe Press ReleaseValter SilveiraNessuna valutazione finora

- 234 5 6789:96 234 6789:9 2 8?@ 6789:9a 4 B C76?@ 4 BBDocumento3 pagine234 5 6789:96 234 6789:9 2 8?@ 6789:9a 4 B C76?@ 4 BBValter SilveiraNessuna valutazione finora

- Press Release: WTO Lowers Trade Forecast As Tensions Unsettle Global EconomyDocumento7 paginePress Release: WTO Lowers Trade Forecast As Tensions Unsettle Global EconomyValter SilveiraNessuna valutazione finora

- OECD Interim Economic Outlook September 2019Documento19 pagineOECD Interim Economic Outlook September 2019Valter SilveiraNessuna valutazione finora

- R 20190920Documento3 pagineR 20190920Valter SilveiraNessuna valutazione finora

- PressDocumento4 paginePressValter SilveiraNessuna valutazione finora

- IEO106 Handout FinalDocumento16 pagineIEO106 Handout FinalValter SilveiraNessuna valutazione finora

- Statement On Monetary Policy: (Note 1)Documento5 pagineStatement On Monetary Policy: (Note 1)Valter SilveiraNessuna valutazione finora

- Form 8-K: (Exact Name of Registrant As Specified in Charter)Documento42 pagineForm 8-K: (Exact Name of Registrant As Specified in Charter)Valter SilveiraNessuna valutazione finora

- Trade Statistics: Ministry of Finance Release August 19, 2019Documento26 pagineTrade Statistics: Ministry of Finance Release August 19, 2019Valter SilveiraNessuna valutazione finora

- Switch v7LAB StudentDocumento206 pagineSwitch v7LAB Studentkcf4scribdNessuna valutazione finora

- GCC TutorialDocumento4 pagineGCC Tutorialistanbulizma5803100% (5)

- Steel-Concrete Composite Building Under Seismic Forces, D. R. Panchal (Research) PDFDocumento9 pagineSteel-Concrete Composite Building Under Seismic Forces, D. R. Panchal (Research) PDFsmartman35100% (1)

- Oral Presentations Ormrod 2015 06Documento23 pagineOral Presentations Ormrod 2015 06Miguel GonzalezNessuna valutazione finora

- CCR Equipment ListDocumento1 paginaCCR Equipment Listbehzad parsiNessuna valutazione finora

- CAM Charges Working For The Month of May 2023Documento1 paginaCAM Charges Working For The Month of May 2023adnandani2882Nessuna valutazione finora

- Diesel GateDocumento41 pagineDiesel Gateanon_934477879100% (1)

- Hospital Management Information SystemDocumento47 pagineHospital Management Information SystemNisarg100% (1)

- Current Volt Meter Ina219Documento40 pagineCurrent Volt Meter Ina219sas999333Nessuna valutazione finora

- TA125Documento4 pagineTA125WaqasjamNessuna valutazione finora

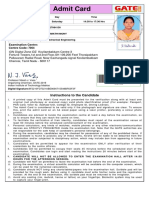

- Admit Card: Examination Centre: Centre CodeDocumento1 paginaAdmit Card: Examination Centre: Centre CodekrishnaNessuna valutazione finora

- About Some Important Items of Composite Insulators Design: February 1999Documento6 pagineAbout Some Important Items of Composite Insulators Design: February 1999ipraoNessuna valutazione finora

- MN5200 Issue1.1 APR2009Documento2 pagineMN5200 Issue1.1 APR2009Roger ReisNessuna valutazione finora

- Airframe Essay QuestionsDocumento12 pagineAirframe Essay QuestionsRaul DeonarainNessuna valutazione finora

- Case Study #3 ThermodynamicsDocumento6 pagineCase Study #3 ThermodynamicsColeene Forteza100% (1)

- Strategic Planning ToolkitDocumento19 pagineStrategic Planning ToolkitStephen OliekaNessuna valutazione finora

- ECS Florida SOQ - 2018 - FT MyersDocumento11 pagineECS Florida SOQ - 2018 - FT MyersPaul BenvieNessuna valutazione finora

- MARTA: 2012 KPMG Phase II Final DraftDocumento114 pagineMARTA: 2012 KPMG Phase II Final DraftthomaswheatleyNessuna valutazione finora

- PS2 VerilogDocumento11 paginePS2 Veriloglizhi0007Nessuna valutazione finora

- The Healthy PC. Preventive Care and Home Remedies For Your Computer - Carey Holzman PDFDocumento257 pagineThe Healthy PC. Preventive Care and Home Remedies For Your Computer - Carey Holzman PDFLeonardoMartinNessuna valutazione finora

- Starter MP EecDocumento21 pagineStarter MP EecIshan 96Nessuna valutazione finora

- Sample Detailed Estimates PDFDocumento9 pagineSample Detailed Estimates PDFJj Salazar Dela CruzNessuna valutazione finora

- Palfinger PK 15500 Load ChartDocumento2 paginePalfinger PK 15500 Load ChartD Chandra Sekhar100% (2)

- Railway-4 Permanent Way & Alignment (Lecture-4)Documento17 pagineRailway-4 Permanent Way & Alignment (Lecture-4)OBIDUR RAHMAN 1701085Nessuna valutazione finora

- External Command in 10 Steps For Revit 2015Documento2 pagineExternal Command in 10 Steps For Revit 2015JigneshNessuna valutazione finora

- Communication With Energy Meter and Field Devices Using PLCDocumento3 pagineCommunication With Energy Meter and Field Devices Using PLCIJRASETPublicationsNessuna valutazione finora

- Abu Dhabi Certification Scheme For Assistant EngineerDocumento12 pagineAbu Dhabi Certification Scheme For Assistant EngineersureshNessuna valutazione finora

- The Dilemma of The Last FilipinoDocumento12 pagineThe Dilemma of The Last FilipinoEunice Delos SantosNessuna valutazione finora

- DPP Series 1 PDFDocumento1 paginaDPP Series 1 PDFsukainaNessuna valutazione finora

- Richard Feynman BiographyDocumento5 pagineRichard Feynman Biographyapi-284725456100% (1)