Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tamilnadu: Petroproclucts Limitecl

Caricato da

jagdish cbeDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tamilnadu: Petroproclucts Limitecl

Caricato da

jagdish cbeCopyright:

Formati disponibili

Tamilnadu Petroproclucts Limitecl

F E-mail: secy-legal@tnpetro.com

Secy / 189 / BM 199 / 2019 20th February 2019

The Listing Department

National Stock Exchange of India Ltd

Exchange Plaza, 5th Floor

Plot No:C/1 'G' Block

Bandra - Kurla Complex

Bandra (E)

Mumbai- 400 051

Scrip lD / Symbol:TNPETRO

Dear Sir / Madam,

Sub: Clarification on Financial Results

Ref: Letter No: NSE / LIST / FR 12442 dated 18th February 2019

We thank you for your above letter regarding segment reporting in the unaudited financial results for the

quarter ended 31 -12-201 8.

In this connection we wish to submit that the Company operates in a single segment, viz., manufacture of

Industrial intermediate Chemicals and so segment reporting is not applicable.

We had been including the relevant note in the results but we now find that the same was inadvertently

omitted to be included in the unaudited financial results for the quarter ended 31't December 2018 which

was submitted on 12th February 2019.

We are now enclosing the revised results format duly incorporating the note on segment for your reference

and records. We request you to kindly take on record the above information.

We regret the inconvenience caused to you in this regard and assure you that adequate care would be

exercised to avoid such omissions in future.

Thanking you,

Yours faithfully,

K Priya

Company Secretary & Compliance Officer

Encl: as stated

Cc:The BSE Limited. Mumbai

Regd. Office & Factory :

Post Box No. 9, Manali Express Highway, Manali, Chennai - 600 068. India.

Tel. : (0091) - 44 - 25945500 to 09 Telefax : 044-25945588

Website : www.tnpetro.com CIN : 123200TN1984P1C010931

TPL GSTIN ' 33AMCT1295M1Z6

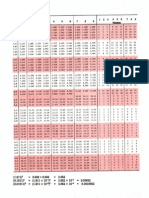

TAMILNADU PETROPRODUCTS LIMITED

Registered Office : Manali Express Hlghway, Manali, Chennai-600068

Website: www.tnpetro.com ; Telefax: 044-25945588; E-Mail: secy-legal@tnpetro.com

CIN: 123200TN1984P1C010931, Scrip Code: 500777, Scrip Id: TNPETRO

Rs- in lr

STATEMENT OF STANDALONE UNAUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 31ST DECEMBER 2018

(tuerter Nine Months ended Year ended

3t -De.-2O ?O-San-tOl 3l -De.-?Oi 7 ?l -Da.-rnl f 3 1-Dec-2()1? 31-MaF201

Unaudited unaudited Unaudited Unaudited Unaudited Audited

30,299 33,37t 29,L45 90,982 az,360 108,183

56 r47 94 271 229 326

3 rL4 96 70 563 382 730

4 30,469 33,6L4 29,309 91,816 f,2,971 1O9,239

L9,443 1A q70 13,810 51,534 42,L45 58,639

L,230 1,230 1,270

(2,7s8) (68e) (507) (628) (3s8) (3,460)

? 410 ? Kl o

/JO 931 745 1 E<t 2,436 3,204

t54 208 69 505 322 r,021

493 561 L,470 1 A7A 2,222

6,950 6,777 5,613 10 1A') t6,263 20,604

3,686 4,t37 6,188 11 7AE 10,951 15,851

2E,724 3L'42e 27,649 86,352 78t284 LO2,97O

6 Profit/(Loss) from ordinary activities before exceptional L,745 2,186 1,660 s,464 4,647 6,269

items (4-5)

7 ExceDtional items oLz 922 922

8 Profit before tax (6 + 7) 1t745 2,185 2,272 5,464 5,6O9 7,19L

9 Tax expense:

a) Current tax 670 740 485 2,027 I 147 7,5L7

b) MAT Credit

- Entit ement (48s) ( 1,197) (1,10s)

- Utilisation (2e3) (282) (Bss)

c) Provision for tax relating to prior years 198

d) Deferred Tax 14q\ (20s) 79L (1s4) 1 A?4 2,108

Total Tax Expenses[9(a)+9(b)+9(c )+9(d)] 332 253 79L L,176 L,934 2,52O

10 Net Profit/(Loss) after tax (8 - 9) 1,413 1,933 L,481 4,288 3t675 4,67L

11 Other Comprehensive income (OCI)

a) Items that will not be reclassified to Profit & Loss - (27) (7) 47 (21) (8e)

remeasurement of defined benefit obliqations (Net of Taxes)

b) Items that will be reclassified Profit LOSS un real ised 35

gain/loss (net) on forward contrac[

t2 Total Comprehensive income (10+/-11) 1,5O9 L,941 1,474 4,335 3,654 4,582

13 Paid up equity share capital Face value per share of Rs.10/- each) 8,997 8,997 e oo7 8,997 4,997 8,997

L4 Reserves excluding revaluation reserve 26,43a

15 Earnings per share in Rs.

Basic and diluted +(not annualised) L.57* 2.!5* 1.65* 4 77* 4.08* 5.19

1 The above results were reviewed and recommended by the Audit Committee at thef meeting held on llth February, 2019 and approved by

the Board,

Directors at their meeting held on l2th February, 2019 and have been subjected to limited review by the Statutory Auditors of the Company. The above resul

have been prepared in accordance with the Indian Accounting Standards - (hd AS) as prescribed under Section 133 of the Companies Act 2013,

read with

3 of Companies (Indian Accounting Standards) Rules, 2015.

2 Consequent to the introduction of Goods and Services Tax(GST) with effect from lst July 2017, Central excise, Value Added Tax (VAT) etc., havo

replaced by GST. In accordance with Indian Accounting Standards on revenue recognition and Schedule III ofthe Companies Act 2013, GST is not

inclucled

revenue from operations with effect from lst July 2017. ln view ofthe aforesaid restructuring oflndirect taxes, revenue from operations for the

nine rnonl

period ended 3lst December 2018 are not comparable with corresponding figure ofthe previous financial year.

3 The Chief Operating Decision Maker (CODM) has considered manufacturing of Industrial lntermediate Chemicals as the single operating segment as defined

under Ind AS 108- Operating Segments.

For Tamilnadu Petroprq imited

Place: Chennai

v"l

K.T. Vijayagopal

l2th February 2019 Whole Time Director (Finance) & CFO

Potrebbero piacerti anche

- Swastivinayalg,': Synthetics LimitedDocumento4 pagineSwastivinayalg,': Synthetics LimitedAmrut BhattNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Apex Plus CCDocumento8 pagineApex Plus CCDhruv GholapNessuna valutazione finora

- Monthly New Registration of Motor Vehicles - 2075 Sep 9,802 Ro, 372Documento1 paginaMonthly New Registration of Motor Vehicles - 2075 Sep 9,802 Ro, 372DanushkaNessuna valutazione finora

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2016 (Result)Documento5 pagineAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Archive 4Documento2 pagineArchive 4B N SRIVIDYANessuna valutazione finora

- CPFI Dairy Plus Total Manhour (Version 1)Documento14 pagineCPFI Dairy Plus Total Manhour (Version 1)roland magoNessuna valutazione finora

- To Of: Steel Strips WheelsDocumento4 pagineTo Of: Steel Strips WheelsanuragNessuna valutazione finora

- 120.121.125 SeriesDocumento2 pagine120.121.125 SeriesAhad VavdiwalaNessuna valutazione finora

- Hdeil: Steel Strips WheelsDocumento3 pagineHdeil: Steel Strips WheelsSiddharth ShekharNessuna valutazione finora

- Sanghvimov Q3fy11Documento4 pagineSanghvimov Q3fy11mukeshmodiNessuna valutazione finora

- Standalone & Consolidated Financial Results For December 31, 2016 (Result)Documento7 pagineStandalone & Consolidated Financial Results For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Selling Price File Update 11.4.2022Documento192 pagineSelling Price File Update 11.4.2022Myatko KoNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Icici Term InsuranceDocumento1 paginaIcici Term InsurancesathishNessuna valutazione finora

- Jspdi Stubs Boq For Di Khan ProjectDocumento6 pagineJspdi Stubs Boq For Di Khan ProjectFarhan IlyasNessuna valutazione finora

- 10 25 Imo Result 20230215Documento19 pagine10 25 Imo Result 20230215Contra Value BetsNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- RSM - FC MT - Sulawesi - Update 7-13 Juni 2021 - +Documento2 pagineRSM - FC MT - Sulawesi - Update 7-13 Juni 2021 - +Mariki BelajarNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Aitpauthorization11 Oct 2022 - 1665475768337Documento1 paginaAitpauthorization11 Oct 2022 - 1665475768337Aamir KhanNessuna valutazione finora

- THR PNS 2024 BanyuasinDocumento127 pagineTHR PNS 2024 Banyuasinfaizfachrudin06Nessuna valutazione finora

- HQ Tour 26-06-2018Documento100 pagineHQ Tour 26-06-2018Kashif NiaziNessuna valutazione finora

- Osur Square Pile JHSDocumento4 pagineOsur Square Pile JHSMartinusNessuna valutazione finora

- Karnataka Bank LTD.: Listing D Ep Artment National Stock Exchange of India Limited BSE LimitedDocumento2 pagineKarnataka Bank LTD.: Listing D Ep Artment National Stock Exchange of India Limited BSE LimitedSaravanan PillaiNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Flat Electricity BillDocumento1 paginaFlat Electricity BillPravin Balasaheb GunjalNessuna valutazione finora

- Aitppermit25 Dec 2023 - 1703445967772Documento1 paginaAitppermit25 Dec 2023 - 1703445967772eprints51Nessuna valutazione finora

- Report Penilaian Kpi Toko Periode November 2021: Key Performance Indicator Proses OperasionalDocumento13 pagineReport Penilaian Kpi Toko Periode November 2021: Key Performance Indicator Proses OperasionalAldi PwdNessuna valutazione finora

- Police Clearance Verification Certificate: Office of Superintendent of Police, KaithalDocumento1 paginaPolice Clearance Verification Certificate: Office of Superintendent of Police, KaithalKunal BansalNessuna valutazione finora

- TD2204191164271907Documento1 paginaTD2204191164271907Shashank PandeyNessuna valutazione finora

- Yukon Bureau of Statistics: Tourism Employment 2019Documento2 pagineYukon Bureau of Statistics: Tourism Employment 2019彭湃Nessuna valutazione finora

- Screenshot 2023-05-08 at 8.32.05 PMDocumento22 pagineScreenshot 2023-05-08 at 8.32.05 PMSomnath DasNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Renewal Premium Receipt - 00755988Documento1 paginaRenewal Premium Receipt - 00755988Tarun KushwahaNessuna valutazione finora

- Iit Ropar - Collection Details 30.5.2019Documento2 pagineIit Ropar - Collection Details 30.5.2019VINOD SACHDEVANessuna valutazione finora

- Aitpauthorization08 Sep 2023 - 1694142838767Documento1 paginaAitpauthorization08 Sep 2023 - 1694142838767P KrishnaNessuna valutazione finora

- Bản sao của Check căn - bảng giá phân khu RubyDocumento8 pagineBản sao của Check căn - bảng giá phân khu RubyNguyễn Hà MyNessuna valutazione finora

- Il - Il Lil I Ffilil - LLLL - Il I Iilillii) Iltililt - ) L: DanamolilDocumento2 pagineIl - Il Lil I Ffilil - LLLL - Il I Iilillii) Iltililt - ) L: DanamolilRey FirmanNessuna valutazione finora

- Not Needed Annual Report 2017 VBL SubsidiariesDocumento121 pagineNot Needed Annual Report 2017 VBL SubsidiariesRAJAN SHAHINessuna valutazione finora

- Aitpauthorization10 Sep 2023 - 1694342513173Documento1 paginaAitpauthorization10 Sep 2023 - 1694342513173P KrishnaNessuna valutazione finora

- Astral 2018Documento12 pagineAstral 2018Jupe JonesNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Tatasky Bill PDFDocumento1 paginaTatasky Bill PDFBhavani Gujjari100% (1)

- Tatasky Bill PDFDocumento2 pagineTatasky Bill PDFRam RatanNessuna valutazione finora

- Tata Sky BillDocumento1 paginaTata Sky BillsapariyahiteshNessuna valutazione finora

- Police Clearance Verification Certificate: Office of Superintendent of Police, KaithalDocumento1 paginaPolice Clearance Verification Certificate: Office of Superintendent of Police, Kaithalsk9979221Nessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- 1 SambasDocumento100 pagine1 SambasDayatx DxdNessuna valutazione finora

- Wadena County Redistricting March 2022 Map ProposalsDocumento9 pagineWadena County Redistricting March 2022 Map ProposalsinforumdocsNessuna valutazione finora

- Aitpauthorization17 May 20234836Documento1 paginaAitpauthorization17 May 20234836Nagesh SharmaNessuna valutazione finora

- Icma WorkDocumento6 pagineIcma WorkIndra KainatNessuna valutazione finora

- Aitp PermitDocumento1 paginaAitp PermitPrashant MannNessuna valutazione finora

- Sqaure Root TableDocumento5 pagineSqaure Root TableTANG PEI PEI100% (1)

- Budgeting and FinancingDocumento3 pagineBudgeting and FinancingMondrei TVNessuna valutazione finora

- EO EncounterDocumento12 pagineEO EncounterMJ YaconNessuna valutazione finora

- Bank Recon and Cash and Cash Equivalent and PCF FA ProblemsDocumento5 pagineBank Recon and Cash and Cash Equivalent and PCF FA ProblemsCruxzelle BajoNessuna valutazione finora

- Auditing: T I C A PDocumento3 pagineAuditing: T I C A Psecret studentNessuna valutazione finora

- Consultant: II. General Conditions of Contract 87Documento2 pagineConsultant: II. General Conditions of Contract 87Anonymous ufMAGXcskMNessuna valutazione finora

- 2016 Bank MuamalatDocumento383 pagine2016 Bank MuamalatZati TyNessuna valutazione finora

- Forensic Accounting and FraudDocumento12 pagineForensic Accounting and FraudKunle100% (1)

- Credit Audit FormatDocumento14 pagineCredit Audit FormatRAGAVINessuna valutazione finora

- Chapter 3 - Ethics, Fraud and Internal ControlDocumento8 pagineChapter 3 - Ethics, Fraud and Internal ControlHads LunaNessuna valutazione finora

- Resume, John Bernard MejiaDocumento3 pagineResume, John Bernard MejiaAnonymous YtNessuna valutazione finora

- Professional Review and Training Center (PRTC) : Forming The Auditor's Opinion and Report ContentDocumento71 pagineProfessional Review and Training Center (PRTC) : Forming The Auditor's Opinion and Report ContentMark LagsNessuna valutazione finora

- Control Matrix - Premiums (PC)Documento9 pagineControl Matrix - Premiums (PC)Jose SasNessuna valutazione finora

- Chapter 7 HW 7-4Documento6 pagineChapter 7 HW 7-4GuinevereNessuna valutazione finora

- FEDO ProfileDocumento20 pagineFEDO ProfileBinodh DanielNessuna valutazione finora

- 1-RFP For Hiring Consultant To Evaluate SAP ERP (Final) 06-11-2014Documento33 pagine1-RFP For Hiring Consultant To Evaluate SAP ERP (Final) 06-11-2014azzam_aliNessuna valutazione finora

- Auditing Theory - Risk AssessmentDocumento10 pagineAuditing Theory - Risk AssessmentYenelyn Apistar CambarijanNessuna valutazione finora

- Module 4 - Government AccountingDocumento14 pagineModule 4 - Government AccountingJoanna TiuzenNessuna valutazione finora

- NPV & Payback Period: Question 2 Ul-Haq and Utley LimitedDocumento7 pagineNPV & Payback Period: Question 2 Ul-Haq and Utley LimitedPui YanNessuna valutazione finora

- Unit 03 The Financial Statement AuditDocumento31 pagineUnit 03 The Financial Statement AuditYeobo DarlingNessuna valutazione finora

- Navy IfaDocumento368 pagineNavy IfaJoao Noronha EmilianoNessuna valutazione finora

- Chapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsDocumento22 pagineChapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsOBC LingayenNessuna valutazione finora

- Integrated Case Study - Supermart Case StudyDocumento18 pagineIntegrated Case Study - Supermart Case StudyAdma Wahyu Dwi ShaniaNessuna valutazione finora

- A Qualitative and Quantitative Analysis of Public Health Expenditure in India: 2005-06 To 2014-15Documento70 pagineA Qualitative and Quantitative Analysis of Public Health Expenditure in India: 2005-06 To 2014-15sonali mishraNessuna valutazione finora

- Ethics, Fraud, and Internal ControlDocumento50 pagineEthics, Fraud, and Internal ControlontykerlsNessuna valutazione finora

- Indias Forests and The JudiciaryDocumento587 pagineIndias Forests and The JudiciaryNainesh JoshiNessuna valutazione finora

- PWD 1519650414 - 74793 - 30008crsuDocumento118 paginePWD 1519650414 - 74793 - 30008crsupmcmbharat264Nessuna valutazione finora

- Moore Blockchain and Digital Assets JHB (Pty) LTDDocumento6 pagineMoore Blockchain and Digital Assets JHB (Pty) LTDlambohstxckchxngxsNessuna valutazione finora

- Tendernotice 1 PDFDocumento56 pagineTendernotice 1 PDFHarshvardhan Mishra100% (1)

- Partnership Organization ChartDocumento1 paginaPartnership Organization ChartAlfred Mendoza Huntington50% (4)

- 02-Pimentel v. Aguirre G.R. No. 132988 July 19, 2000 PDFDocumento16 pagine02-Pimentel v. Aguirre G.R. No. 132988 July 19, 2000 PDFlilnightrainNessuna valutazione finora