Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Slip PDF

Caricato da

PratikDutta0%(1)Il 0% ha trovato utile questo documento (1 voto)

221 visualizzazioni1 paginaTitolo originale

Slip.pdf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0%(1)Il 0% ha trovato utile questo documento (1 voto)

221 visualizzazioni1 paginaSlip PDF

Caricato da

PratikDuttaCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

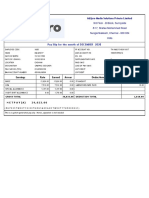

ISON BPO INDIA PRIVATE LIMITED.

A 14-15 SEC-16 NOIDA-201301

Pay Slip for the month of August 2019

Name ANSHUMAN SAHOO Emp. Code ISNG00146

Designation CUSTOMER SERVICES REPRESENTIVE Date of Joining 13/07/2017

Department OPERATIONS :Payment Mode HDFC BANK

Payable Days : 31.00

Gender Male Bank A/c No. 50100294632841

Location NOIDA UAN No: 101148877755 PF No. GNGGN00333140000031814

Process GOIBIBO ESI No : 6716779391 PAN FFLPS8591R

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic Salary 11,247 11,247.00 363.00 11,610.00 Provident Fund 1,393

House Rent 10,512 10,512.00 339.00 10,851.00

Bonus_Allo 734.00 24.00 758.00

ERN_CARALL 1,950.00 1,950.00

GROSS PAY 24,443.00 726.00 25,169.00 GROSS DEDUCTION 1,393

NET PAY : 23,776.00

Income Tax Worksheet for the Period April 2019 - March 2020

Description Gross Exempt Taxable Deduction Under Chapter VI-A HRA Calculation

Basic Salary 135,327 135,327 Investments u/s 80C Rent Paid (For Non-Metro )

HRA 128,685 128,685 PF+VPF 16,544 From

PRJ_CARALL 3,975 3,975 To

Other Earnings 3,300 3,300 1. Actual HRA 128,685

BONUS_ALLO 6,630 6,630 2. 40% or 50% of Basic

3. Rent > 10% Basic

Least of above is exempt

Taxable HRA 128,685

Gross Salary 277,917 277,917 Total of Investment u/s 80C 16,544

Standard Deduction 50,000.00 DEDU 80CCD Tax Deducted Till Date

Professional Tax Month Amount

Any Other Income April 2019 0

Under Chapter VI-A 16,544 May 2019 0

Taxable Income 211,370 June 2019 0

Total Tax July 2019 0

Tax Rebate 0.00 Total 0

Balance Tax 0.00

Surcharge

Educational Cess 0

Net Tax

Tax Deducted (Previous Employer)

Tax Deducted Till Date

Tax to be Deducted

Additional Tax Total of Ded Under Chapter VI-A

Average Tax / Month

Tax Deduction for this month

General Note :This is computer generated pay slip no need for signature.

Potrebbero piacerti anche

- Kirandeep September SalaryDocumento1 paginaKirandeep September Salaryprince.gill07Nessuna valutazione finora

- BSNL Payslip February 2019Documento1 paginaBSNL Payslip February 2019pankajNessuna valutazione finora

- HTMLReportsDocumento1 paginaHTMLReportsRashmi Awanish PandeyNessuna valutazione finora

- Uni-Com India PVT - LTDDocumento1 paginaUni-Com India PVT - LTDcredit cardNessuna valutazione finora

- UnknownDocumento1 paginaUnknownSumanth MopideviNessuna valutazione finora

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocumento1 paginaPay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNessuna valutazione finora

- Salary Slip - February 2023 - Gurjeet Singh SainiDocumento1 paginaSalary Slip - February 2023 - Gurjeet Singh SainiGurjeet SainiNessuna valutazione finora

- PAY May 2022Documento1 paginaPAY May 2022Rohit raagNessuna valutazione finora

- Reliance HR Payslip for Sept 2019Documento1 paginaReliance HR Payslip for Sept 2019Bhavesh MishraNessuna valutazione finora

- Amit JiDocumento1 paginaAmit JiRohit RajNessuna valutazione finora

- Fortis Hospital February 2019 PayslipDocumento1 paginaFortis Hospital February 2019 PayslipmkumarsejNessuna valutazione finora

- Pay Slip DetailsDocumento1 paginaPay Slip DetailsTirumalesha DadigeNessuna valutazione finora

- Appraisal Letter Salary IncrementDocumento2 pagineAppraisal Letter Salary Incrementmitendra pratap singhNessuna valutazione finora

- Salma Saifi May SlipDocumento2 pagineSalma Saifi May Slipsalma saifiNessuna valutazione finora

- Wipro FebruaryDocumento1 paginaWipro FebruaryDeum degOnNessuna valutazione finora

- Aug - 23 Salary SlipDocumento1 paginaAug - 23 Salary SlipBack-End MarketingNessuna valutazione finora

- Chola Business Services Pay SlipDocumento3 pagineChola Business Services Pay SlipsathyaNessuna valutazione finora

- Salary Slip April 2022Documento1 paginaSalary Slip April 2022Rohit raagNessuna valutazione finora

- Pay Slip - 604316 - Mar-23Documento1 paginaPay Slip - 604316 - Mar-23ArchanaNessuna valutazione finora

- Upspl Pay Slip Dec 2022 EngineerDocumento1 paginaUpspl Pay Slip Dec 2022 EngineerpraveenNessuna valutazione finora

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Documento1 paginaVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghNessuna valutazione finora

- Payslip Aug2022Documento1 paginaPayslip Aug2022Raut AbhimanNessuna valutazione finora

- Salary Slips 3Documento2 pagineSalary Slips 3Pramod KumarNessuna valutazione finora

- Itr 22 23Documento1 paginaItr 22 23biswa chakrabortyNessuna valutazione finora

- Pay Slip - 604316 - Feb-23Documento1 paginaPay Slip - 604316 - Feb-23ArchanaNessuna valutazione finora

- BSNL Payslip March 2021Documento1 paginaBSNL Payslip March 2021SDOT Ashta0% (1)

- Amount in Words Is Rupees Eleven Thousand Six OnlyDocumento1 paginaAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNessuna valutazione finora

- Pay Slip - 604316 - May-22Documento1 paginaPay Slip - 604316 - May-22ArchanaNessuna valutazione finora

- Pushparaj R PayslipDocumento3 paginePushparaj R PayslipHenry suryaNessuna valutazione finora

- SCOM Pay Slips July August 2013Documento2 pagineSCOM Pay Slips July August 2013Diwakar MishraNessuna valutazione finora

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocumento1 paginaEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNessuna valutazione finora

- Salary Slip Feb 2019 of SandeepDocumento1 paginaSalary Slip Feb 2019 of SandeepSawan YadavNessuna valutazione finora

- Salary Slip 07Documento1 paginaSalary Slip 07Parveen SainiNessuna valutazione finora

- Adecco India Private Limited: Payslip For The Month of October 2022Documento1 paginaAdecco India Private Limited: Payslip For The Month of October 2022VeereshPammarNessuna valutazione finora

- Payslip For The Month of January 2018: Earnings DeductionsDocumento1 paginaPayslip For The Month of January 2018: Earnings DeductionsDevmalya ChandaNessuna valutazione finora

- Capgemini Technology Services India LimitedDocumento2 pagineCapgemini Technology Services India LimitedFlawsome FoodsNessuna valutazione finora

- You Have Opted For Old Tax RegimeDocumento2 pagineYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Itr Ay 2022-23Documento1 paginaItr Ay 2022-23Soumya SwainNessuna valutazione finora

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocumento3 pagineThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNessuna valutazione finora

- CRM Services Payslip for September 2021Documento1 paginaCRM Services Payslip for September 2021Phagun BehlNessuna valutazione finora

- Payslip Oct-2022 NareshDocumento3 paginePayslip Oct-2022 NareshDharshan Raj0% (1)

- Pay Slip - 604316 - Nov-22Documento1 paginaPay Slip - 604316 - Nov-22ArchanaNessuna valutazione finora

- March 2019Documento1 paginaMarch 2019Anonymous 2uvubjzzNessuna valutazione finora

- December Payslip for Sharath Pundamalli at Gem Source IT ConsultingDocumento1 paginaDecember Payslip for Sharath Pundamalli at Gem Source IT ConsultingSharathPundamalliNessuna valutazione finora

- Salary Slip January 2023Documento1 paginaSalary Slip January 2023SYAHRIL 25071991Nessuna valutazione finora

- Form16 Fiserv 2018-19Documento8 pagineForm16 Fiserv 2018-19SiddharthNessuna valutazione finora

- Salary January2023Documento1 paginaSalary January2023AKM Enterprises Pvt LtdNessuna valutazione finora

- Payslip For The Month of March 2015 Earnings DeductionsDocumento1 paginaPayslip For The Month of March 2015 Earnings Deductionsmadhusudhan N RNessuna valutazione finora

- Pay Slip Title Under 40 CharactersDocumento1 paginaPay Slip Title Under 40 CharactersMickey CreationNessuna valutazione finora

- Pay Slip For January 2018: Cybage Software Private LimitedDocumento1 paginaPay Slip For January 2018: Cybage Software Private LimitedSudheerNessuna valutazione finora

- Unknown PDFDocumento2 pagineUnknown PDFbijoytvknrNessuna valutazione finora

- CRM Services India Private Limited: Earnings DeductionsDocumento1 paginaCRM Services India Private Limited: Earnings DeductionsInnama SayedNessuna valutazione finora

- Amazon Development Center India Pvt. LTD: Amount in INRDocumento1 paginaAmazon Development Center India Pvt. LTD: Amount in INRMaaz Uddin Siddiqui0% (1)

- AugustDocumento1 paginaAugustNikhil DubeyNessuna valutazione finora

- December PayslipDocumento1 paginaDecember PayslipPrasanth karcherlaNessuna valutazione finora

- Tata Consultancy Services PayslipDocumento2 pagineTata Consultancy Services PayslipRahimaNessuna valutazione finora

- October 2022: Employee Details Payment & Leave Details Location DetailsDocumento1 paginaOctober 2022: Employee Details Payment & Leave Details Location DetailsPritam GoswamiNessuna valutazione finora

- Slip PDFDocumento1 paginaSlip PDFPratikDuttaNessuna valutazione finora

- SlipDocumento1 paginaSlipPratikDuttaNessuna valutazione finora

- March PDFDocumento1 paginaMarch PDFRNessuna valutazione finora

- Dna BHP AllInOne 2021-04 ENDocumento1 paginaDna BHP AllInOne 2021-04 ENKevin Patrick PalmerNessuna valutazione finora

- Myth of Population Control: Family, Caste and Class in An Indian VillageDocumento2 pagineMyth of Population Control: Family, Caste and Class in An Indian VillageSaurabh MisalNessuna valutazione finora

- Jecoliah J. Joel: Brampton, ON Phone: (647) - 980-1712 Email: Skills and AbilitiesDocumento2 pagineJecoliah J. Joel: Brampton, ON Phone: (647) - 980-1712 Email: Skills and Abilitiesapi-347643327Nessuna valutazione finora

- November 2017 (v1) QP - Paper 4 CIE Chemistry IGCSEDocumento16 pagineNovember 2017 (v1) QP - Paper 4 CIE Chemistry IGCSEGhulam Mehar Ali ShahNessuna valutazione finora

- GENBIO2 MOD3 Howlifebeganonearth Forfinalcheck.Documento26 pagineGENBIO2 MOD3 Howlifebeganonearth Forfinalcheck.Kris LaglivaNessuna valutazione finora

- Role of NGOs in RehabilitationDocumento9 pagineRole of NGOs in RehabilitationShamim HossainNessuna valutazione finora

- Eyebrow Tattoos Bản EnglishhDocumento3 pagineEyebrow Tattoos Bản EnglishhThùy Dương nèNessuna valutazione finora

- Aerobic BodybuilderDocumento38 pagineAerobic Bodybuildercf strength80% (5)

- CHEMIST LICENSURE EXAM TABLEDocumento8 pagineCHEMIST LICENSURE EXAM TABLEJasmin NewNessuna valutazione finora

- Therapeutic Interventions in The Treatment of Dissociative DisordersDocumento18 pagineTherapeutic Interventions in The Treatment of Dissociative DisordersCarla MesquitaNessuna valutazione finora

- Nadilla Choerunnisa 2B S.KepDocumento3 pagineNadilla Choerunnisa 2B S.KepNadilla ChoerunnisaNessuna valutazione finora

- SWOT Analysis AuchanDocumento2 pagineSWOT Analysis AuchanDaniela DogaruNessuna valutazione finora

- Varicella Zoster VirusDocumento11 pagineVaricella Zoster VirusJayaram SNessuna valutazione finora

- Water Plant SOPDocumento6 pagineWater Plant SOPIndrie AgustinaNessuna valutazione finora

- PME4 KeyDocumento2 paginePME4 KeyyazicigaamzeNessuna valutazione finora

- MHWirth PileTopDrillRigs Brochure Web2Documento12 pagineMHWirth PileTopDrillRigs Brochure Web2geobyun100% (1)

- Cell Membrane TransportDocumento37 pagineCell Membrane TransportMaya AwadNessuna valutazione finora

- PSY406-MidTerm SolvedbymeDocumento6 paginePSY406-MidTerm SolvedbymeAhmed RajpootNessuna valutazione finora

- ICAEW Professional Level Business Planning - Taxation Question & Answer Bank March 2016 To March 2020Documento382 pagineICAEW Professional Level Business Planning - Taxation Question & Answer Bank March 2016 To March 2020Optimal Management SolutionNessuna valutazione finora

- Ch-19 Gas Welding, Gas Cutting & Arc WeldingDocumento30 pagineCh-19 Gas Welding, Gas Cutting & Arc WeldingJAYANT KUMARNessuna valutazione finora

- LPT22Documento3 pagineLPT22Leonardo Vinicio Olarte CarrilloNessuna valutazione finora

- 5090 w11 Ms 62Documento3 pagine5090 w11 Ms 62mstudy123456Nessuna valutazione finora

- Numerical Reasoning Practice Test Answers: de Roza Education and Research 2016Documento2 pagineNumerical Reasoning Practice Test Answers: de Roza Education and Research 2016johnNessuna valutazione finora

- Opioids For Chronic Pain ManagementDocumento45 pagineOpioids For Chronic Pain ManagementaartiNessuna valutazione finora

- Railway Recruitment Board Level-1 Exam DetailsDocumento2 pagineRailway Recruitment Board Level-1 Exam Detailsrajesh naikNessuna valutazione finora

- All India Test Series (2023-24)Documento22 pagineAll India Test Series (2023-24)Anil KumarNessuna valutazione finora

- Memoir of Glicerio Abad - 2005 - v2Documento6 pagineMemoir of Glicerio Abad - 2005 - v2Jane JoveNessuna valutazione finora

- DengueDocumento46 pagineDengueMuhammad Ayub KhanNessuna valutazione finora

- MR Safe Conditional PDFDocumento4 pagineMR Safe Conditional PDFAKSNessuna valutazione finora