Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Universiti Teknologi Mara Faculty of Accountancy Tax737: Tax Fraud and Investigation Tutorial Questions: Tax Administration A. General Questions

Caricato da

iskandar027Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Universiti Teknologi Mara Faculty of Accountancy Tax737: Tax Fraud and Investigation Tutorial Questions: Tax Administration A. General Questions

Caricato da

iskandar027Copyright:

Formati disponibili

UNIVERSITI TEKNOLOGI MARA

FACULTY OF ACCOUNTANCY

TAX737: TAX FRAUD AND INVESTIGATION

TUTORIAL QUESTIONS: TAX ADMINISTRATION

A. GENERAL QUESTIONS

1) State circumstances where income tax liability arises under Section 3 of the Income Tax Act

1967 and any exemption in respect of the taxability.

2) State the classes of income and its relevant sections that are chargeable to tax under Section 4

of the Income Tax Act 1967

3) Briefly explain powers of the Director General of Inland Revenue Board according to the

provisions in the Income Tax Act 1967.

4) Briefly explain Schedular Tax Deduction System (PCB system).

5) Briefly explain on the differences between Official Assessment System and Self-Assessment

System.

6) There are various types of return forms issued by the tax authorities for the different categories

of tax payers. State all types of return forms together with the category of taxpayer as issued by

the Inland Revenue Board (IRB).

7) There are various classes of taxpayers such as individuals, businessmen, employers, landlord

and others. List their responsibilities.

8) Briefly explain all assessment issued by the tax authorities to the chargeable person.

9) List offences on which penalties can be imposed by Director General of Inland Revenue on

taxpayers who failed to follow the requirements given under the Income Tax Act 1967.

10) List down offences stipulated under Income Tax Act 1967.

11) When should the following persons submit their tax returns in order to avoid penalty for the year

of assessment 2009:

a) Individual without business income

b) Individual with business income

12) Briefly explain on the 6 stages to determine Chargeable Income as stated in Section 5 of ITA

1967.

B. DISCUSSION QUESTIONS

1) How you would explain on the roles of tax Authorities, taxpayers and tax agents on the recent tax

administration issues and challenges?

2) What judgement would you make about benefits, issues and challenges of electronic tax

administration system?

3) What inferences can you make on the taxation systems, organisational structure, and tax rates in

Southeast Asia Countries?

Potrebbero piacerti anche

- Q4 PCBDocumento7 pagineQ4 PCBiskandar027100% (1)

- Project Management Phases: Class 6Documento22 pagineProject Management Phases: Class 6Nat TikusNessuna valutazione finora

- Project SchedulingDocumento38 pagineProject Schedulingmehra.harshal25Nessuna valutazione finora

- Scheme of Work Bi SVM Sem 2Documento34 pagineScheme of Work Bi SVM Sem 2amalcr07Nessuna valutazione finora

- Arrow Diagram Method: Forward PassDocumento19 pagineArrow Diagram Method: Forward PassYAMINNessuna valutazione finora

- February 2023 Maf661Documento6 pagineFebruary 2023 Maf661Shazwan ShahzanNessuna valutazione finora

- TMC 451 Syllabus Content PDFDocumento1 paginaTMC 451 Syllabus Content PDFnorshaheeraNessuna valutazione finora

- ASSIGNMENT 1 HalalDocumento6 pagineASSIGNMENT 1 HalalNur AishaNessuna valutazione finora

- AC4391 Accounting and Business Ethics Assignment 5 Presentation Group 4Documento25 pagineAC4391 Accounting and Business Ethics Assignment 5 Presentation Group 4Ashtar Ali BangashNessuna valutazione finora

- Case StudyDocumento30 pagineCase StudyRed John100% (1)

- Chapter 5 SCHEDULING & TRACKING WORK (Part 2)Documento90 pagineChapter 5 SCHEDULING & TRACKING WORK (Part 2)Zahirah SaffriNessuna valutazione finora

- Chapter 10 Winding Up (Law485)Documento77 pagineChapter 10 Winding Up (Law485)TelsunTVNessuna valutazione finora

- Chandler, Alfred 1981 “The United States: Seedbed of Managerial M4 Capitalism” in eds. Alfred Chandler and Herman Daems Managerial Hierarchies: Comparative Perspectives on the Rise of the Modern Industrial Enterprise Cambridge, Massachusetts: Harvard University PressDocumento12 pagineChandler, Alfred 1981 “The United States: Seedbed of Managerial M4 Capitalism” in eds. Alfred Chandler and Herman Daems Managerial Hierarchies: Comparative Perspectives on the Rise of the Modern Industrial Enterprise Cambridge, Massachusetts: Harvard University PressCarmela Ledesma100% (1)

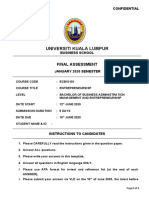

- Universiti Kuala Lumpur: Final AssessmentDocumento5 pagineUniversiti Kuala Lumpur: Final AssessmentisqmaNessuna valutazione finora

- Lesson 5 Planning and SchedulingDocumento14 pagineLesson 5 Planning and SchedulingQuán Cóc Sài GònNessuna valutazione finora

- Fau PDFDocumento122 pagineFau PDFGrace EtwaruNessuna valutazione finora

- Nota Fizik (Gerakan Harmonik Ringkas)Documento1 paginaNota Fizik (Gerakan Harmonik Ringkas)Chai Ming KuangNessuna valutazione finora

- LABDocumento5 pagineLABMohd Hafiz AimanNessuna valutazione finora

- Industrial Training Report (Nor Aisyah Asyira Binti Nazli-2019475676)Documento45 pagineIndustrial Training Report (Nor Aisyah Asyira Binti Nazli-2019475676)kun faridNessuna valutazione finora

- Critical Path AnalysisDocumento12 pagineCritical Path AnalysisfatimalakhaniNessuna valutazione finora

- Perimeter Are A VolumeDocumento37 paginePerimeter Are A VolumeAdrian CayabyabNessuna valutazione finora

- List of Article AnalysisDocumento4 pagineList of Article Analysisremyzer09Nessuna valutazione finora

- Sample 3 - 1 PDFDocumento12 pagineSample 3 - 1 PDFAimi SuhailaNessuna valutazione finora

- Application For Registration of Company 1Documento2 pagineApplication For Registration of Company 1api-536569860Nessuna valutazione finora

- Cat Fau S21Documento122 pagineCat Fau S21gene houNessuna valutazione finora

- Lesson 4 Project Management 1Documento36 pagineLesson 4 Project Management 1Michelle Paunil DelovergesNessuna valutazione finora

- Module 2.0 - Pert-CpmDocumento9 pagineModule 2.0 - Pert-CpmTyron TayloNessuna valutazione finora

- Excercise 4 Correlation Is AlyaDocumento6 pagineExcercise 4 Correlation Is AlyaXvia98Nessuna valutazione finora

- SAT Math PracticeDocumento6 pagineSAT Math PracticeKyle Alexander HillegassNessuna valutazione finora

- Storage SystemsDocumento31 pagineStorage SystemsPartha Pratim SenguptaNessuna valutazione finora

- Project Scheduling by CPM & PertDocumento51 pagineProject Scheduling by CPM & PertMd. Mizanur RahamanNessuna valutazione finora

- BASIC Ladder Uk 2.20Documento129 pagineBASIC Ladder Uk 2.20nitinsomanathanNessuna valutazione finora

- Afiq ThesisDocumento116 pagineAfiq ThesisJagathisswary SateeNessuna valutazione finora

- Law485 c10 Winding UpDocumento35 pagineLaw485 c10 Winding UpndhtzxNessuna valutazione finora

- Tutorial MS Project Lab 1,2,3,4,5Documento36 pagineTutorial MS Project Lab 1,2,3,4,5hamza razaNessuna valutazione finora

- Fundamentals of Multimedia. Ze-Nian Li and Mark S. DrewDocumento115 pagineFundamentals of Multimedia. Ze-Nian Li and Mark S. Drewraoul85Nessuna valutazione finora

- Spenmo Malaysia - Draft IncorporationDocumento4 pagineSpenmo Malaysia - Draft IncorporationChan Wei FengNessuna valutazione finora

- Welcome: Pra U / STPM Physics 960Documento7 pagineWelcome: Pra U / STPM Physics 960ROSAIMI BIN ABD WAHAB MoeNessuna valutazione finora

- Planning Scheduling Pert CPMDocumento34 paginePlanning Scheduling Pert CPMlorraine atienzaNessuna valutazione finora

- Chapter 3 ElectrochemistryDocumento8 pagineChapter 3 Electrochemistrymeshal retteryNessuna valutazione finora

- Act 564 Telemedicine Act 1997 PDFDocumento11 pagineAct 564 Telemedicine Act 1997 PDFAdam Haida & CoNessuna valutazione finora

- Contoh Bajet KahwinDocumento22 pagineContoh Bajet KahwinNurul FarhanahNessuna valutazione finora

- WBS Codes in Microsoft Project 2019Documento4 pagineWBS Codes in Microsoft Project 2019muhammad iqbalNessuna valutazione finora

- Lesson 5 - Network DiagramDocumento47 pagineLesson 5 - Network DiagramLakshan UdayangaNessuna valutazione finora

- Business Law AssignmentDocumento5 pagineBusiness Law AssignmentTehseen BalochNessuna valutazione finora

- Phasmophobia Ghost Hidden Abilities Cheat SheetDocumento6 paginePhasmophobia Ghost Hidden Abilities Cheat SheetToxico PaidakiNessuna valutazione finora

- Unit 1Documento8 pagineUnit 1Diksha ReddyNessuna valutazione finora

- 3 MarksDocumento8 pagine3 MarksAaleyahIamarNessuna valutazione finora

- 1mba FM 042mbaDocumento3 pagine1mba FM 042mbaAtindra ShahiNessuna valutazione finora

- TaxLaw 12marks PYDocumento2 pagineTaxLaw 12marks PYCoimbatore IndustryNessuna valutazione finora

- Taxation Question BankDocumento3 pagineTaxation Question BankRishikesh BhujbalNessuna valutazione finora

- Pointers On Special Laws Taxation 112Documento2 paginePointers On Special Laws Taxation 112Sara Mae Albina-Dela CruzNessuna valutazione finora

- Fayaz Hussain Abro, Assistant CommissionerDocumento34 pagineFayaz Hussain Abro, Assistant CommissionerInder KeswaniNessuna valutazione finora

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocumento2 pagineInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiNessuna valutazione finora

- Tax Law SemesterDocumento13 pagineTax Law Semesterarfaimteyaz39Nessuna valutazione finora

- 9 - Naila Shifa Ramadhana - RPS 1 FADocumento9 pagine9 - Naila Shifa Ramadhana - RPS 1 FANaila shifaNessuna valutazione finora

- U1A OverviewDocumento7 pagineU1A Overview4mggxj68cyNessuna valutazione finora

- Damodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaDocumento15 pagineDamodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaAnonymous 0ppGK23hNessuna valutazione finora

- Basic Tax QuestionDocumento7 pagineBasic Tax QuestionMonirul Islam MoniirrNessuna valutazione finora

- 2015 MCQS and NotesDocumento26 pagine2015 MCQS and NotesKb AliNessuna valutazione finora

- d14 p7sgp QPDocumento7 pagined14 p7sgp QPiskandar027Nessuna valutazione finora

- Tutorial 1 - A1Documento4 pagineTutorial 1 - A1iskandar027Nessuna valutazione finora

- 9 The Aims of Punishment and Principles of SentencingDocumento14 pagine9 The Aims of Punishment and Principles of Sentencingiskandar027Nessuna valutazione finora

- Onq Tools Monthly Project Report TemplateDocumento3 pagineOnq Tools Monthly Project Report Templateiskandar027Nessuna valutazione finora

- Diagram IsuzuDocumento1 paginaDiagram Isuzuiskandar027Nessuna valutazione finora

- Application Checklist (7 Aug 2012)Documento6 pagineApplication Checklist (7 Aug 2012)iskandar027Nessuna valutazione finora

- Cooperate FinanceDocumento42 pagineCooperate Financeiskandar027100% (1)

- Class Notes - An Introduction To Forensic Accounting S1, 2014-2015Documento9 pagineClass Notes - An Introduction To Forensic Accounting S1, 2014-2015iskandar02750% (2)

- ConclusionDocumento3 pagineConclusioniskandar027Nessuna valutazione finora

- MfrsDocumento12 pagineMfrsiskandar027Nessuna valutazione finora

- Accounting Practices & Development in Public Sector: Prepared byDocumento77 pagineAccounting Practices & Development in Public Sector: Prepared byiskandar027Nessuna valutazione finora

- MemorandumDocumento23 pagineMemorandumiskandar027Nessuna valutazione finora