Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Deductions TAXATION 1 Case Digest Jong P. Batayo CIR vs. Isabela Cultural Corporation

Caricato da

Jong PerrarenTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Deductions TAXATION 1 Case Digest Jong P. Batayo CIR vs. Isabela Cultural Corporation

Caricato da

Jong PerrarenCopyright:

Formati disponibili

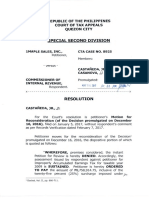

ISSUE (2): WON CA correctly held that ICC did not

DEDUCTIONS understate its interest income from the promissory

TAXATION 1 Case Digest notes of Realty Investment, Inc; that ICC withheld the

Jong P. Batayo required 1% withholding tax from the deduction for

security services.

CIR vs. Isabela Cultural Corporation

HELD:

Isabela Cultural Corp.(ICC for brevity) , a domestic Sustaining the finding of the CTA and CA that no such

corporation received from BIR assessment notice no. understatement exist and that only simple interest

FAS-1-86-90000680 (680 for brevity) for deficiency computation and not a compounded one should have

income tax in the amount of PhP 333,196.86 and been applied by the BIR. There is no indeed no

assessment notice no. FAS-1-86-90-000681 (681 for stipulation between the latter and ICC on the

brevity) for deficiency expanded withholding tax in the application of compound interest.

amount of PhP 4,897.79, inclusive of surcharge and

Under Article 1959 of the Civil Code, unless there is a

interest both for the taxable year 1986. The deficiency

stipulation to the contrary, interest due should not

income tax of PhP 333,196 arose from BIR

further earn interest.

disallowance of ICC claimed expenses deductions for

professional and security services billed to and paid by ING BANK N.V. vs.

ICC in 1986. COMMISSIONER OF INTERNAL REVENUE

On January 3, 2000, ING received a FAN dated

The deficiency expanded withholding tax of December 3, 1999. The FAN also contained the Details

PhP4,897.79 was allegedly due to the failure of ICC to of Assessment and 13 Assessment Notices. The FAN

withhold 1% expanded withholding tax on its claimed covered the deficiency tax assessments for years 1996

PhP244,890 deduction for security services. and 1997.

Court of Tax Appeal and Court of Appeal affirmed that ING Bank paid the deficiency assessments for the year

the professional services were rendered to ICC in 1984 1996 and 1997 deficiency final tax. ING Bank,

and 1985, the cost of the service was not yet however, protested the remaining 10 deficiency tax

determinable at that time, hence, it could be assessments.

considered as deductible expenses only in 1986 when

ING Bank filed a Petition for Review before the CTA to

ICC received the billing statement for said service. It

seek cancellation and withdrawal of the deficiency tax

further ruled that ICC did not state its interest income

assessments for the years 1996 and 1997,

from the promissory notes of Realty Investment and

that ICC properly withheld the remitted taxes on the CTA partially granted the petition, ING Bank appealed

payment for security services for the taxable year to the CTA En Banc. CTA denied for lack of merit.

1986.

ING Bank filed a Motion to the SC that it had availed

itself of the tax amnesty under RA 9480 covering all

national internal revenue taxes for the taxable year

Petitioner contend that since ICC is using the accrual

2005 and prior years.

method of accounting, the expenses for the

professional services that accrued in 1984 and 9185 ING Bank prayed that the SC issue a resolution of its

should have been declared as deductions from income availment of the tax amnesty, and confirming its

during the said years and the failure of ICC to do so entitlement to all the immunities and privileges under

bars it from claiming said expenses as deduction for Section 6 of RA 9480.

the taxable year 1986.

However, ING Bank availed itself of the tax amnesty

under RA 9480, with respect to its liabilities for

deficiency documentary stamp taxes on its special

ISSUE (1): WON CA is correct in sustaining the

savings accounts for the taxable years 1996 and 1997

deduction of the expenses for professionals and

and deficiency tax on onshore interest income under

security services form ICC gross income?

the foreign currency deposit system for taxable year

HELD: NO 1996.

Revenue Audit Memorandum Order No.1-2000 ISSUES:

provides that under the accrual method of accounting,

1. Whether ING Bank may validly avail itself of the tax

expenses not being claimed as deductions by a tax

amnesty granted by Republic Act No. 9480; and

payer in the current year when they are incurred cannot

be claimed as deductions from the income for the 2. Whether petitioner ING Bank is liable for deficiency

succeeding year. withholding tax on accrued bonuses for the taxable

years 1996 and 1997.

TAXATION ! NOTES [Type here] [Type here]

RULING: Here, petitioner ING Bank already recognized a

definite liability on its part considering that it had

1. YES. Taxpayers with pending tax cases may avail deducted as business expense from its gross income

themselves of the tax amnesty program under RA the accrued bonuses due to its employees. Underlying

9480. its accrual of the bonus expense was a reasonable

Both R.A. 9480 and DOF Order No. 29-07 are quite expectation or probability that the bonus would be

precise in declaring that "tax cases subject of final and achieved. In this sense, there was already a

executory judgment by the courts" are the ones constructive payment for income tax purposes as these

excepted from the benefits of the law. accrued bonuses were already allotted or made

available to its officers and employees.

Petitioner ING Bank showed that it complied with the

requirements under RA 9480. The CIR never

questioned that petitioner ING Bank fully complied with CIR VS GENERAL FOODS

the requirements for tax amnesty under the law.

Facts:

RA 9480 confers no discretion on the CIR, its authority

under RA 9480 is limited to determining whether (a) the Respondent corporation General Foods (Phils), which

taxpayer is qualified to avail oneself of the tax amnesty; is engaged in the manufacture of “Tang”, “Calumet”

(b) all the requirements for availment under the law and “Kool-Aid”, filed its income tax return for the fiscal

were complied with; and (c) the correct amount of year ending February 1985 and claimed as deduction,

amnesty tax was paid within the period prescribed by among other business expenses, P9,461,246 for

law. media advertising for “Tang”.

2. YES. An expense, whether the same is paid or The Commissioner disallowed 50% of the deduction

payable, shall be allowed as a deduction only if it is claimed and assessed deficiency income taxes of

shown that the tax required to be deducted and P2,635,141.42 against General Foods, prompting the

withheld therefrom was paid to the BIR. latter to file an MR which was denied.

Under the NIRC, every form of compensation for

personal services is subject to income tax and,

consequently, to withholding tax. Petitioner ING Bank General Foods later on filed a petition for review at CA,

insists that the bonus accruals in 1996 and 1997 were which reversed and set aside an earlier decision by

not yet subject to withholding tax because these CTA dismissing the company’s appeal.

bonuses were actually distributed only in the Issue:

succeeding years of their accrual when the amounts

were finally determined. W/N the subject media advertising expense for “Tang”

was ordinary and necessary expense fully deductible

The tax on compensation income is withheld at source under the NIRC

under the creditable withholding tax system wherein

the tax withheld is intended to equal or at least Held:

approximate the tax due of the payee on the said

income. No. Tax exemptions must be construed in stricissimi

juris against the taxpayer and liberally in favor of the

It is true that the law and implementing regulations taxing authority, and he who claims an exemption must

require the employer to deduct and pay the income tax be able to justify his claim by the clearest grant of

on compensation paid to its employees, either actually organic or statute law. Deductions for income taxes

or constructively. partake of the nature of tax exemptions; hence, if tax

exemptions are strictly construed, then deductions

When the employer or other person required to deduct must also be strictly construed.

and withhold the tax under this Chapter XI, Title II of

the Tax Code has withheld and paid such tax to the

Commissioner of Internal Revenue or to any

authorized collecting officer, then such employer or To be deductible from gross income, the subject

person shall be relieved of any liability to any person. advertising expense must comply with the following

(Emphasis supplied) requisites: (a) the expense must be ordinary and

necessary; (b) it must have been paid or incurred

On the other hand, it is also true that under Section 45 during the taxable year; (c) it must have been paid or

of the 1997 National Internal Revenue Code (then incurred in carrying on the trade or business of the

Section 39 of the 1977 National Internal Revenue taxpayer; and (d) it must be supported by receipts,

Code, as amended), deductions from gross income are records or other pertinent papers.

taken for the taxable year in which "paid or accrued" or

"paid or incurred" is dependent upon the method of

accounting income and expenses adopted by the

While the subject advertising expense was paid or

taxpayer.

incurred within the corresponding taxable year and was

TAXATION ! NOTES [Type here] [Type here]

incurred in carrying on a trade or business, hence for that year under review. Petition granted, judgment

necessary, the parties’ views conflict as to whether or reversed and set aside.

not it was ordinary. To be deductible, an advertising

expense should not only be necessary but also

ordinary.

The Commissioner maintains that the subject

advertising expense was not ordinary on the ground

that it failed the two conditions set by U.S. COMMISSIONER OF INTERNAL REVENUE v.

jurisprudence: first, “reasonableness” of the amount LANCASTER PHILIPPINES, INC.

incurred and second, the amount incurred must not be

a capital outlay to create “goodwill” for the product G.R. No. 183408, July 12, 2017

and/or private respondent’s business. Otherwise, the

expense must be considered a capital expenditure to

be spread out over a reasonable time. Facts:

Lancaster Philippines, Inc. is a domestic corporation

engaged in the production, processing and marketing

There is yet to be a clear-cut criteria or fixed test for

of tobacco. BIR issued a Letter of Authority (LOA)

determining the reasonableness of an advertising

authorizing its revenue officers to examine Lancaster’s

expense. There being no hard and fast rule on the

books of accounts and other accounting records for all

matter, the right to a deduction depends on a number

internal revenue taxes due from taxable year 1998 to

of factors such as but not limited to: the type and size

an unspecified date.

of business in which the taxpayer is engaged; the

volume and amount of its net earnings; the nature of After the conduct of an examination pursuant to the

the expenditure itself; the intention of the taxpayer and LOA, the BIR issued a Preliminary Assessment Notice

the general economic conditions. It is the interplay of (PAN) which cited Lancaster for: (1) overstatement of

these, among other factors and properly weighed, that its purchases for the fiscal year April 1998 to March

will yield a proper evaluation. 1999; (2) noncompliance with the generally accepted

accounting principle of proper matching of cost and

revenue; and (3) disallowance of purchases of tobacco

The Court finds the subject expense for the from farmers for the months of February and March

advertisement of a single product to be inordinately 1998 as deductions against income for the fiscal year

large. Therefore, even if it is necessary, it cannot be April 1998 to March 1999.

considered an ordinary expense deductible under then

Lancaster replied to the PAN contending that it had

Section 29 (a) (1) (A) of the NIRC.

used an entire “tobacco cropping season” to determine

its total purchases covering a one-year period from

October 1 to September 30 of the following year; that it

Advertising is generally of two kinds: (1) advertising to has been adopting the 6-month timing difference to

stimulate the current sale of merchandise or use of conform to the matching concept; It concluded that

services and (2) advertising designed to stimulate the they correctly posted the subject purchases in the fiscal

future sale of merchandise or use of services. The year ending March 1999 as it was the only in this year

second type involves expenditures incurred, in whole that the gross income from the crop was realized.

or in part, to create or maintain some form of goodwill

for the taxpayer’s trade or business or for the industry Subsequently, Lancaster received from the BIR a final

or profession of which the taxpayer is a member. If the assessment notice (FAN) which assessed Lancaster’s

expenditures are for the advertising of the first kind, deficiency income tax as a consequence of the

then, except as to the question of the reasonableness disallowance of purchases claimed for the taxable year

of amount, there is no doubt such expenditures are ending March 31, 1999

deductible as business expenses. If, however, the

Lancaster filed a petition for review before CTA

expenditures are for advertising of the second kind,

Division.

then normally they should be spread out over a

reasonable period of time. CTA Division granted the petition filed by Lancaster.

CTA En Banc affirmed the cancellation of assessment

against Lancaster.

The company’s media advertising expense for the

promotion of a single product is doubtlessly Issues:

unreasonable considering it comprises almost one-half

of the company’s entire claim for marketing expenses Whether BIR revenue officers exceeded their authority.

– YES

TAXATION ! NOTES [Type here] [Type here]

Whether CTA can resolve an issue (scope of authority taxpayer’s books and records, in relation to internal

of the revenue examiners) which was not raised by the revenue tax liabilities for a particular period.

parties. – YES

The taxable year covered by the assessment being

Held: outside of the period specified in the LOA in this case,

the assessment issued against Lancaster is, therefore,

SC denied the petition for review on certiorari filed by void.

Commissioner of Internal Revenue.

AGUINALDO INDUSTRIES (FISHING NETS) vs.

Jurisdiction of CTA COMMISSIONER OF INTERNAL REVENUE G.R.

The jurisdiction of the CTA is not limited only to cases No. L-29790 February 25, 1982 Income Tax, Tax

which involve decisions or inactions of the CIR on Exemption, Necessary Expense

matters relating to assessments or refunds but also OCTOBER 23, 2017

includes other cases arising from the NIRC or related

laws administered by the BIR. This court has once held FACTS:

that the question of whether or not to impose a

deficiency tax assessment comes within the purview of

the words “other matters arising under the NIRC.” It Aguinaldo Industries Corp. is engaged in the

must be stressed that the assessment of internal manufacture of fishing nets, a tax-exempt industry, and

revenue taxes is one of the duties of the BIR. Thus, the manufacture of furniture. For accounting purposes,

CIR may authorize the examination of any taxpayer each division is provided with separate books of

and correspondingly make an assessment whenever accounts. Previously, Aguinaldo Industries acquired a

necessary. parcel of land in Muntinglupa,Rizal, as site of the

Authority of CTA to rule on issues not raised by the fishing net factory. This transaction was entered in the

parties books of the Fish Nets Division of the Company.

Under Section 1 of the Revised Rules of the Court of

Tax Appeals, the Court (CTA) may not limit itself to the Later, Aguinaldo Industries, it sold the said property,

issues stipulated by the parties but may also rule upon the profit from this sale which was entered in the books

related issues necessary to achieve an orderly of the Fish Nets Division as miscellaneous income to

disposition of the case. The CTA, therefore, was well distinguish it from its tax-exempt income. Petitioner

within the authority to consider in its decision the filed two separate income tax returns and after

question on the scope of authority of the revenue investigation of these returns, the examiners of the BIR

officers who were named in the LOA even though the found that the Fish Nets Division deducted from its

parties had not raised the same in their pleadings or gross income P61,187.48 as additional remuneration

memoranda. paid to the officers of Aguinaldo Industries. The

examiner recommended the disallowance of the

deduction. It appears from the books that such

BIR Revenue Officers exceeds the authority granted by deduction was claimed as part of the selling expenses

LOA of the land in Muntinglupa. Aguinaldo Industries insists

that said amount should be allowed as deduction

because it was paid to its officers as allowance or

SC agreed with the trial court when it ruled the LOA bonus pursuant to Section 3 of its by-laws.

authorizing BIR Revenue Officers to examine the ISSUE:

books of account of Lancaster for the taxable year

1998 only or since Lancaster adopted a fiscal year for Whether the bonus given to the officers of Aguinaldo

the period April 1, 1997 to March 31, 1998. However, upon the sale of its Muntinglupa land is an ordinary and

the deficiency income tax assessment which the BIR necessary business expense deductible for income tax

eventually issue against Lancaster was based on the purposes?

disallowance of expenses reported in FY 1999, or for

the period April 1, 1998 to March 31, 1999. The CTA RULING:

concluded that the revenue examiners had exceeded No. In general, only those ordinary and necessary

their authority when they issued the assessment expenses paid or incurred during the taxable year in

against Lancaster and, consequently, declared such carrying on any trade or business, including a

assessment to be without force and effect. reasonable allowance for personal services actually

The LOA gives notice to the taxpayer that it is under rendered can be claimed as a deductible. The bonus

investigation for possible deficiency tax assessment; at given to the officers of the Aguinaldo Industries as their

the same time it authorizes or empowers a designated share of the profit realized from the sale of the land

revenue officer to examine, verify, and scrutinize a cannot be deemed a deductible expense for tax

purposes, even if the aforesaid sale could be

considered as a transact ion for Carrying on the trade

TAXATION ! NOTES [Type here] [Type here]

or business of the Aguinaldo Industries and the grant April 15, 1993, and not on every end of the applicable

of the bonus to the corporate officers pursuant to quarters; and that the certification of the independent

Aguinaldo Industries’ by -laws could, as an intra- CPA attesting to the correctness of the contents of the

corporate matter, be sustained. summary of suppliers’ invoices or receipts examined,

evaluated and audited by said CPA should

substantiate its claims.

Evidence show that the sale was effected through a

broker who was paid by Aguinaldo Industries a

commission for his services. On the other hand, there ISSUE: Did the petitioner corporation sufficiently

is absolutely no evidence of any service actually establish the factual bases for its applications for

rendered by Aguinaldo Industries’ officers which could refund/credit of input VAT?

be the basis of a grant to them of a bonus out of the

profit derived from the sale. This being so, the payment

of a bonus to them out of the gain realized from the sale HELD: No. Although the Court agreed with the

cannot be considered as a selling expense; nor can it petitioner corporation that the two-year prescriptive

be deemed reasonable and necessary so as to make period for the filing of claims for refund/credit of input

it deductible for tax purposes. Thus, the extraordinary VAT must be counted from the date of filing of the

and unusual amounts paid by Aguinaldo to these quarterly VAT return, and that sales to PASAR and

directors in the guise and form of compensation for PHILPOS inside the EPZA are taxed as exports

their supposed services as such, without any relation because these export processing zones are to be

to the measure of their actual services, cannot be managed as a separate customs territory from the rest

regarded as ordinary and necessary expenses within of the Philippines, and thus, for tax purposes, are

the meaning of the law. effectively considered as foreign territory, it still denies

Whenever a controversy arises on the deductibility, for the claims of petitioner corporation for refund of its

purposes of income tax, of certain items for alleged input VAT on its purchases of capital goods and

compensation of officers of the taxpayer, two (2) effectively zero-rated sales during the period claimed

questions become material, namely: (a)Have personal for not being established and substantiated by

services been actually rendered by said officers? (b) In appropriate and sufficient evidence.

the affirmative case, what is the reasonable allowance Tax refunds are in the nature of tax exemptions. It is

therefor. regarded as in derogation of the sovereign authority,

ATLAS CONSOLIDATED MINING DEVT CORP vs. and should be construed in strictissimi juris against the

CIR person or entity claiming the exemption. The taxpayer

who claims for exemption must justify his claim by the

"The taxpayer must justify his claim for tax exemption clearest grant of organic or statute law and should not

or refund by the clearest grant of organic or statute law be permitted to stand on vague implications.

and should not be permitted to stand on vague

implications." ZAMORA VS. COLLECTOR (1963)- ALLOWED TAX

DEDUCTIONS

"Export processing zones (EPZA) are effectively

considered as foreign territory for tax purposes." FACTS:

FACTS: Petitioner corporation, a VAT-registered • Mariano Zamora, owner of the Bay View Hotel and

taxpayer engaged in mining, production, and sale of Farmacia Zamora, Manila, filed his income tax returns

various mineral products, filed claims with the BIR for the years 1951 and 1952. The Collector of Internal

refund/credit of input VAT on its purchases of capital Revenue found that he failed to file his return of the

goods and on its zero-rated sales in the taxable capital gains derived from the sale of certain real

quarters of the years 1990 and 1992. BIR did not properties and claimed deductions which were not

immediately act on the matter prompting the petitioner allowable. The collector required him to pay the sums

to file a petition for review before the CTA. The latter of P43,758.50 and P7,625.00, as deficiency income tax

denied the claims on the grounds that for zero-rating to for the years 1951 and 1952.

apply, 70% of the company's sales must consists of

exports, that the same were not filed within the 2-year

prescriptive period (the claim for 1992 quarterly returns • On appeal by Zamora, the Court of Tax Appeals

were judicially filed only on April 20, 1994), and that modified the decision appealed from and ordered him

petitioner failed to submit substantial evidence to to pay the reduced total sum of P30,258.00

support its claim for refund/credit. (P22,980.00 and P7,278.00, as deficiency income tax

for the years 1951 and 1952.

The petitioner, on the other hand, contends that CTA

failed to consider the following: sales to PASAR and

PHILPOS within the EPZA as zero-rated export sales;

the 2-year prescriptive period should be counted from • Having failed to obtain a reconsideration of the

the date of filing of the last adjustment return which was decision, Mariano Zamora appealed alleging that the

TAXATION ! NOTES [Type here] [Type here]

Court of Tax Appeals erred (amongst other things, this which to ascertain which expense was incurred by her

being the only relevant to the topic) in disallowing in connection with the business of Mariano Zamora and

P10,478.50, as promotion expenses incurred by his which was incurred for her personal benefit, the

wife for the promotion of the Bay View Hotel and Collector and the CTA in their decisions, considered

Farmacia Zamora (which is ½ of P20,957.00, 50% of the said amount of P20,957.00 as business

supposed business expenses). expenses and the other 50%, as her personal

expenses. We hold that said allocation is very fair to

• Note: He contends that the whole amount of Mariano Zamora, there having been no receipt

P20,957.00 as promotion expenses in his 1951 income whatsoever, submitted to explain the alleged business

tax returns, should be allowed and not merely one-half expenses, or proof of the connection which said

of it or P10,478.50, on the ground that, while not all the expenses had to the business or the reasonableness

itemized expenses are supported by receipts, the of the said amount of P20,957.00. While in situations

absence of some supporting receipts has been like the present, absolute certainty is usually not

sufficiently and satisfactorily established. For, as possible, the CTA should make as close an

alleged, the said amount of P20,957.00 was spent by approximation as it can, bearing heavily, if it chooses,

Mrs. Esperanza A. Zamora (wife of Mariano), during upon the taxpayer whose inexactness is of his own

her travel to Japan and the United States to purchase making.

machinery for a new Tiki-Tiki plant, and to observe

hotel management in modern hotels. The CTA,

however, found that for said trip Mrs. Zamora obtained

only the sum of P5,000.00 from the Central Bank and • In the case of Visayan Cebu Terminal Co., Inc. v.

that in her application for dollar allocation, she stated Collector of Int. Rev, it was declared that

that she was going abroad on a combined medical and representation expenses fall under the category of

business trip, which facts were not denied by Mariano business expenses which are allowable deductions

Zamora. No evidence had been submitted as to where from gross income, if they meet the conditions

Mariano had obtained the amount in excess of prescribed by law, particularly section 30 (a) [1], of the

P5,000.00 given to his wife which she spent abroad. Tax Code; that to be deductible, said business

No explanation had been made either that the expenses must be ordinary and necessary expenses

statement contained in Mrs. Zamora's application for paid or incurred in carrying on any trade or business;

dollar allocation that she was going abroad on a that those expenses must also meet the further test of

combined medical and business trip, was not correct. reasonableness in amount; that when some of the

The alleged expenses were not supported by receipts. representation expenses claimed by the taxpayer were

Mrs. Zamora could not even remember how much evidenced by vouchers or chits, but others were

money she had when she left abroad in 1951, and how without vouchers or chits, documents or supporting

the alleged amount of P20,957.00 was spent. papers; that there is no more than oral proof to the

effect that payments have been made for

ISSUE: representation expenses allegedly made by the

taxpayer and about the general nature of such alleged

Whether or not the CTA erred in disallowing expenses; that accordingly, it is not possible to

P10,478.50 as promotion expenses incurred by his determine the actual amount covered by supporting

wife for the promotion of the Bay View Hotel and papers and the amount without supporting papers, the

Farmacia Zamora in the absence of receipts proving court should determine from all available data, the

the same. amount properly deductible as representation

HELD: NO expenses.

• Section 30, of the Tax Code, provides that in C. M. Hoskins & Co. Inc. v Commissioner of Internal

computing net income, there shall be allowed as Revenue

deductions all the ordinary and necessary expenses Facts:

paid or incurred during the taxable year, in carrying on

any trade or business. Since promotion expenses Hoskins, a domestic corporation engaged in the real

constitute one of the deductions in conducting a estate business as broker, managing agents and

business, same must testify these requirements. Claim administrators, filed its income tax return (ITR) showing

for the deduction of promotion expenses or a net income of P92,540.25 and a tax liability of

entertainment expenses must also be substantiated or P18,508 which it paid.

supported by record showing in detail the amount and

nature of the expenses incurred (N.H. Van Socklan, Jr.

v. Comm. of Int. Rev.; 33 BTA 544). Considering, as CIR disallowed 4 items of deductions in the ITR. Court

heretofore stated, that the application of Mrs. Zamora of Tax Appeals upheld the disallowance of an item

for dollar allocation shows that she went abroad on a which was paid to Mr. C. Hoskins representing 50% of

combined medical and business trip, not all of her supervision fees earned and set aside the

expenses came under the category of ordinary and disallowance of the other 3 items.

necessary expenses; part thereof constituted her

personal expenses. There having been no means by

TAXATION ! NOTES [Type here] [Type here]

Issue: The expenditures were rather EXCESSIVE,

considering that the purpose of the law was for a

Whether or not the disallowance of the 4 items were charitable cause.

proper.

Held:

FACTS:

NOT deductible. It did not pass the test of

reasonableness which is: • This case is a petition to review CTA decision

which affirmed the assessment of CIR of amusement

General rule, bonuses to employees made in good tax and surcharge against a boxing and wrestling

faith and as additional compensation for services exhibition held by petitioner Calanoc on 03 Dec 1949

actually rendered by the employees are deductible, at the Rizal Memorial Stadium.

provided such payments, when added to the salaries

do not exceed the compensation for services rendered. • 24 Nov 1949 – Social Welfare Commission

(SCW) issued a solicitation permit, authorizing Calanoc

(petitioner) to solicit and receive contributions for the

The conditions precedent to the deduction of bonuses orphans and destitute children of the Child Welfare

to employees are: Workers Club of the SCW.

· Payment of bonuses is in fact compensation • Such solicitation will be done through a

boxing and wrestling exhibition at the Rizal Memorial

· Must be for personal services actually rendered Stadium. Calanoc financed and promoted the

exhibition.

· Bonuses when added to salaries are reasonable

when measured by the amount and quality of services • BEFORE the exhibition took place, Calanoc

performed with relation to the business of the particular applied with the Collector of Internal Revenue (CIR) for

taxpayer. exemption from the payment of the amusement tax,

based on Sec 260 of the NIRC. CIR says that such

There is no fixed test for determining the exemption will only be granted if Calanoc complies with

reasonableness of a given bonus as compensation. the requirements of the law.

This depends upon many factors.

• AFTER the exhibition, CIR investigated the

tax case of Calanoc. It was shown that the gross sales

amounted to ~26K, expenditures was ~25K, net profit

In the case, Hoskins fails to pass the test. CTA was

was only ~1K. Other items of expenditure included:

correct in holding that the payment of the company to

Mr. Hoskins of the sum P99,977.91 as 50% share of o Police protection

supervision fees received by the company was

inordinately large and could not be treated as an o Gifts

ordinary and necessary expenses allowed for

deduction. o Parties

CF CALANOC vs CIR o Items for representation

(29 Nov 1961) • Only the said net profit was remitted to the

SCW for the said charitable purpose for which the

permit was issued.

Kind of tax involved: AMUSEMENT TAX – Sec 125 of • CIR assessed amount against Calanoc.

the Tax Code provides that amusement tax is collected (around~7K)

from the proprietor, lessee or operator of cockpits,

cabarets, night or day clubs, boxing exhibitions, • Sec of Finance authorized the denial of the

professional basketball games, Jai-Alai, and application for exemption from payment of amusement

racetracks. tax where a) the net proceeds are not substantial OR

b) where the expenses are exorbitant.

DOCTRINE: Payment for police protection given by

Calanoc to the police is ILLEGAL since it is a ISSUE/S: Petitioner Calanoc questions the VALIDITY

consideration given by the petitioner to the police for of the assessment of AMUSEMENT tax against him

the performance by the latter of functions required of (as financer of the exhibition)

them to be rendered by law.

Petitioner’s argument:

TAXATION ! NOTES [Type here] [Type here]

• Denied having received 1K as stadium fee. Vote: En banc. Bengzon, C.J., Padilla, Bautista

Such amount was not included in the receipts; says he Angelo, Labrador, Concepcion, Reyes, J.B.L., Barrera,

cannot be made to pay almost 7 times the amount as Paredes, Dizon and De Leon, JJ., concur.

amusement tax

It is a general rule that `Bonuses to employees made

in good faith and as additional compensation for the

services actually rendered by the employees are

HELD +RATIO: deductible, provided such payments, when added to

the stipulated salaries, do not exceed a reasonable

compensation for the services rendered.

AMUSEMENT TAX IS VALID. You cannot pay for

services that are required by law to be performed by The condition precedents to the deduction of bonuses

government officers. Also, the expenditures are to employees are: (1) the payment of the bonuses is in

excessive! fact compensation; (2) it must be for personal services

actually rendered; and (3) bonuses, when added to the

• Evidence showed that while Calanoc did not salaries, are `reasonable ... when measured by the

pay for the stadium fee, said amount was paid by the amount and quality of the services performed with

O-SO Beverages directly to the stadium for relation to the business of the particular taxpayer. Here

advertisement privileges during the exhibition. it is admitted that the bonuses are in fact compensation

and were paid for services actually rendered.

• Since the stadium fee was paid by the

concessionaire, Calanoc had no right to include the KUENZLE AND STREIFF VS CIR

stadium fee among the items of his expenses. Such

amount was unaccounted, and it went into the FACTS:

petitioner’s pocket. 1. Kuenzle & Streiff for the years 1953, 1954 and 1955

• Also, Calanoc cannot justify the other filed its income tax return, declaring losses.

expenses, such as police protection and gifts. 2. CIR filed for deficiency of income taxes against

• SC says that most of the items of Kuenzle & Streiff Inc. for the said years in the amounts

expenditures are either EXORBITANT or were NOT of P40,455.00, P11,248.00 and P16,228.00,

SUPPORTED by receipts. respectively, arising from the disallowance, as

deductible expenses, of the bonuses paid by the

• Payment for police protection given by corporation to its officers, upon the ground that they

Calanoc to the police is ILLEGAL since it is a were not ordinary, nor necessary, nor reasonable

consideration given by the petitioner to the police for expenses within the purview of Section 30(a) (1) of the

the performance by the latter of functions required of National Internal Revenue Code.

them to be rendered by law.

• The expenditures were rather EXCESSIVE,

considering that the purpose of the law was for a

charitable cause.

3. The corporation filed with the Court of Tax Appeals

Dispositive: We have examined the records of the case a petition for review contesting the assessments. CTA

and we agree with the lower court that most of the favored the CIR, however lowered the tax due on 1954.

items of expenditures contained in the statement The corporation moved for reconsideration, but still

submitted to the agent are either exorbitant or not lost.

supported by receipts. We agree with the tax court that

the payment of P461.65 for police protection is illegal

as it is a consideration given by the petitioner to the

police for the performance by the latter of the functions

required of them to be rendered by law. The

expenditures of P460.00 for gifts, P1,880.05 for parties 4. The Corporation contends that the tax court, in

and other items for representation are rather arriving at its conclusion, acted "in a purely arbitrary

excessive, considering that the purpose of the manner", and erred in not considering individually the

exhibition was for a charitable cause. total compensation paid to each of petitioner's officers

WHEREFORE, the decision sought herein to be and staff members in determining the reasonableness

reviewed is hereby affirmed, with costs against the of the bonuses in question, and that it erred likewise in

petitioner. holding that there was nothing in the record indicating

that the actuation of the respondent was unreasonable

or unjust.

TAXATION ! NOTES [Type here] [Type here]

ISSUE: Whether or not the bonuses in question was INTEREST

reasonable and just to be allowed as a deduction?

PAPER INDUSTRIES CORPORATION OF THE

HELD: No. PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R.

Nos. 106949-50 (1995)

RATIO: It is a general rule that `Bonuses to employees

made in good faith and as additional compensation for Facts:

the services actually rendered by the employees are

deductible, provided such payments, when added to Paper Industries Corporation of the Philippines

the stipulated salaries, do not exceed a reasonable (PICOP) is a Philippine corporation registered with the

compensation for the services rendered. The condition Board of Investments (BOI) as a preferred pioneer

precedents to the deduction of bonuses to employees enterprise with respect to its integrated pulp and paper

are: (1) the payment of the bonuses is in fact mill, and as a preferred non-pioneer enterprise with

compensation; (2) it must be for personal services respect to its integrated plywood and veneer mills.

actually rendered; and (3) bonuses, when added to the Petitioner received from the Commissioner of Internal

salaries, are `reasonable ... when measured by the Revenue (CIR) two (2) letters of assessment and

amount and quality of the services performed with demand (a) one for deficiency transaction tax and for

relation to the business of the particular taxpayer. Here documentary and science stamp tax; and (b) the other

it is admitted that the bonuses are in fact compensation for deficiency income tax for 1977, for an aggregate

and were paid for services actually rendered. The only amount of PhP88,763,255.00.

question is whether the payment of said bonuses is PICOP protested the assessment of deficiency

reasonable. transaction tax , the documentary and science stamp

There is no fixed test for determining the taxes, and the deficiency income tax assessment. CIR

reasonableness of a given bonus as compensation. did not formally act upon these protests, but issued a

This depends upon many factors, one of them being warrant of distraint on personal property and a warrant

the amount and quality of the services performed with of levy on real property against PICOP, to enforce

relation to the business. Other tests suggested are: collection of the contested assessments, thereby

payment must be 'made in good faith'; the character of denying PICOP's protests. Thereupon, PICOP went

the taxpayer's business, the volume and amount of its before (CTA) appealing the assessments.

net earnings, its locality, the type and extent of the On 15 August 1989, CTA rendered a decision,

services rendered, the salary policy of the corporation'; modifying the CIR’s findings and holding PICOP liable

'the size of the particular business'; 'the employees' for the reduced aggregate amount of P20,133,762.33.

qualifications and contributions to the business Both parties went to the Supreme Court, which referred

venture'; and 'general economic conditions. However, the case to the Court of Appeals (CA).

'in determining whether the particular salary or

compensation payment is reasonable, the situation CA denied the appeal of the CIR and modified the

must be considered as a whole. judgment against PICOP holding it liable for

transaction tax and absolved it from payment of

It seems clear from the record that, in arriving at its documentary and science stamp tax and compromise

main conclusion, the tax court considered, inter alia, penalty. It also held PICOP liable for deficiency of

the following factors: income tax.

1) The paid officers, in the absence of evidence to the Issues:

contrary, that they were competent, on the other the

record discloses no evidence nor has petitioner ever 1. Whether PICOP is liable for transaction tax

made the claim that all or some of them were gifted

with some special talent, or had undergone some 2. Whether PICOP is liable for documentary and

extraordinary training, or had accomplished any science stamp tax

particular task, that contributed materially to the

3. Whether PICOP is liable for deficiency income tax

success of petitioner's business during the taxable

years in question. Held:

2) All the other employees received no pay increase in 1. YES. PICOP reiterates that it is exempt from the

the said years. payment of the transaction tax by virtue of its tax

exemption under R.A. No. 5186, as amended, known

3) The bonuses were paid despite the fact that it had

as the Investment Incentives Act, which in the form it

suffered net losses for 3 years. Furthermore the

existed in 1977-1978, read in relevant part as follows:

corporation cannot use the excuse that it is 'salary paid'

"SECTION 8. Incentives to a Pioneer Enterprise. — In

to an employee because the CIR does not question the

addition to the incentives provided in the preceding

basic salaries paid by petitioner to the officers and

section, pioneer enterprises shall be granted the

employees, but disallowed only the bonuses paid to

following incentive benefits: (a) Tax Exemption.

petitioner's top officers at the end of the taxable years

Exemption from all taxes under the National Internal

in question.

Revenue Code, except income tax, from the date of

TAXATION ! NOTES [Type here] [Type here]

investment is included in the Investment Priorities Plan 3. YES. PICOP did not deny the existence of

x x x”. The Supreme Court holds that that PICOP's tax discrepancy in their Income Tax Return and Books of

exemption under R.A. No. 5186, as amended, does not Account owing to their procedure of recording its export

include exemption from the thirty-five percent (35%) sales (reckoned in U.S. dollars) on the basis of a fixed

transaction tax. In the first place, the thirty-five percent rate, day to day and month to month, regardless of the

(35%) transaction tax is an income tax, a tax on the actual exchange rate and without waiting when the

interest income of the lenders or creditors as held by actual proceeds are received. In other words, PICOP

the Supreme Court in the case of Western Minolco recorded its export sales at a pre-determined fixed

Corporation v. Commissioner of Internal Revenue. The exchange rate. That pre-determined rate was decided

35% transaction tax is an income tax on interest upon at the beginning of the year and continued to be

earnings to the lenders or placers. The latter are used throughout the year. Because of this, the CIR has

actually the taxpayers. Therefore, the tax cannot be a made out at least a prima facie case that PICOP had

tax imposed upon the petitioner. In other words, the understated its sales and overstated its cost of sales

petitioner who borrowed funds from several financial as set out in its Income Tax Return. For the CIR has a

institutions by issuing commercial papers merely right to assume that PICOP's Books of Accounts speak

withheld the 35% transaction tax before paying to the the truth in this case since, as already noted, they

financial institutions the interest earned by them and embody what must appear to be admissions against

later remitted the same to the respondent CIR. The tax PICOP's own interest.

could have been collected by a different procedure but

the statute chose this method. Whatever collecting CASE: THE COMMISSIONER OF INTERNAL

procedure is adopted does not change the nature of REVENUE, petitioner, vs. CONSUELO L. VDA. DE

the tax. It is thus clear that the transaction tax is an PRIETO, respondent. G.R. No. L-13912 September

income tax and as such, in any event, falls outside the 30, 1960

scope of the tax exemption granted to registered

pioneer enterprises by Section 8 of R.A. No. 5186, as

amended. PICOP was the withholding agent, obliged

to withhold thirty-five percent (35%) of the interest FACTS:

payable to its lenders and to remit the amounts so

Respondent Vda. de Prieto conveyed by way of

withheld to the Bureau of Internal Revenue ("BIR"). As

a withholding, agent, PICOP is made personally liable gifts a real property to her children. The Commissioner

for the thirty-five percent (35%) transaction tax 10 and of Internal Revenue appraised the property donated at

if it did not actually withhold thirty-five percent (35%) of P1,231,268.00, and assessed the total sum of

the interest monies it had paid to its lenders, PICOP P117,706.50 as donor's gift tax, interest and

had only itself to blame. compromises due thereon. Of the total sum of

P117,706.50 paid by respondent on April 29, 1954, the

sum of P55,978.65 represents the total interest on

2. NO. The CIR assessed documentary and science account of deliquency. Said sum was claimed as

stamp taxes, amounting to PhP300,000.00, on the deduction, among others, by respondent in her 1954

issuance of PICOP's debenture bonds. Tax income tax return. Petitioner disallowed the claim and

exemptions are, to be sure, to be "strictly construed," as a consequence of such disallowance assessed

that is, they are not to be extended beyond the ordinary respondent for 1954 deficiency income tax due on the

and reasonable intendment of the language actually aforesaid P55,978.65, including interest 1957,

used by the legislative authority in granting the surcharge and compromise for the late payment.

exemption. The issuance of debenture bonds is

certainly conceptually distinct from pulping and paper

manufacturing operations. But no one contends that

issuance of bonds was a principal or regular business ISSUE:

activity of PICOP; only banks or other financial

institutions are in the regular business of raising money Whether or not interest paid for the late

by issuing bonds or other instruments to the general payment of tax is deductible from gross income.

public. The actual dedication of the proceeds of the

bonds to the carrying out of PICOP's registered

operations constituted a sufficient nexus with such

HELD:

registered operations so as to exempt PICOP from

taxes ordinarily imposed upon or in connection with YES. For interest to be deductible, it must be

issuance of such bonds. The Supreme Court agrees

shown that: (1) there be an indebtedness, (2) there

with the Court of Appeals on this matter that the CTA

should be interest upon it, and (3) what is claimed as

and the CIR had erred in rejecting PICOP's claim for

exemption from stamp taxes an interest deduction should have been paid or

accrued within the year. In this case, the last two

requirements are undisputed. The only question is if

interest on account of late payments of taxes be

TAXATION ! NOTES [Type here] [Type here]

considered as indebtedness. Indebtedness has been Section 30 of the NIRC, Gross Income “Par. C (3):

defined as an unconditional and legally enforceable Credits against tax per taxes of foreign countries.

obligation for the payment of money. Within the

meaning of that definition, it is apparent that a tax may If the taxpayer signifies in his return his desire to have

be considered indebtedness. Although taxes already the benefits of this paragraph, the tax imposed by this

due have not, strictly speaking, the same concept as shall be credited with: Paragraph (B), Alien resident of

debts, they are, however, obligations that may be the Philippines; and, Paragraph C (4), Limitation on

considered as such. Where statute imposes a personal credit.”

liability for a tax, the tax becomes, at least in a board

An alien resident not entitled to tax credit for foreign

sense, a debt. It follows that the interest paid by herein

income taxes paid when his income is derived wholly

respondent for the late payment of her donor's tax is

from sources within the Philippines.

deductible from her gross income.

In conclusion, interest payment for delinquent taxes is

not deductible as tax but the taxpayer is not precluded Double taxation becomes obnoxious only where the

thereby from claiming said payment as deduction on taxpayer is taxed twice for the benefit of the same

account of interest. governmental entity. In the present case, although the

taxpayer would have to pay two taxes on the same

TAXES

income but the Philippine government only receives

Commissioner of Internal Revenue vs W.E. the proceeds of one tax, there is no obnoxious double

Lednicky and Maria Lednicky taxation.

FACTS: TAMBUNTING PAWNSHOP, INC. v.

COMMISSIONER OF INTERNAL REVENUE. G.R.

Spouses are both American citizens residing in the No. 179085. January 21, 2010

Philippines and have derived all their income from

Philippine sources for taxable years in question. FACTS:

Petitioner was issued an assessment for deficiency

VAT for the taxable year of 1999. Petitioner, after his

On March, 1957, filed their ITR for 1956, reporting protest with the CIR merited no response, it filed a

gross income of P1,017,287.65 and a net income of P Petition for Review with the CTA raising that

733,809.44. On March 1959, file an amended claimed pawnshops are not subject to VAT under the NIRC and

deduction of P 205,939.24 paid in 1956 to the United that pawn tickers are not subject to documentary stamp

States government as federal income tax of 1956. tax.

The CTA ruled that petitioner is liable for the deficiency

VAT and the documentary stamp tax.

The petitioner argues that a pawnshop is not

ISSUE: enumerated as one of those engaged in sale or

exchange of services in Section 108 of the National

Whether a citizen of the United States residing in the

Internal Revenue Code and citing the case of

Philippines, who derives wholly from sources within the

Commissioner of Internal Revenue v. Michel J. Lhuillier

Philippines, may deduct his gross income from the

Pawnshops, Inc. as basis.

income taxes he has paid to the United States

government for the said taxable year? ISSUE: Whether petitioner is liable for the deficiency

VAT.

Whether the petitioner is liable for the documentary

stamp tax.

HELD:

RULING:

An alien resident who derives income wholly from

YES. The Court cited the case of First Planters

sources within the Philippines may not deduct from

Pawnshop, Inc. v. Commissioner of Internal Revenue.

gross income the income taxes he paid to his home

In the foregoing case, since the imposition of VAT on

country for the taxable year. The right to deduct foreign

pawnshops, which are non-bank financial

income taxes paid given only where alternative right to

intermediaries, was deferred for the tax years 1996 to

tax credit exists.

TAXATION ! NOTES [Type here] [Type here]

2002, petitioner is not liable for VAT for the tax year government function, the State is not bound by the

1999. neglect of its agents and officers. It must be stressed

that the same is not a valid reason for the non-payment

NO. Sections 195 of the NIRC provides that on the of its tax liabilities.

pledge of personal property, there shall be collected a

documentary stamp tax. The Court held in Michel J. Refining Company v. CA

Lhuillier Pawnshop, Inc. v. Commissioner of Internal G.R. No. 118794 May 8, 1996

Revenue that the documentary stamp tax is an excise REGALADO, J.

tax on the exercise of a right or privilege and that

pledge is among the privileges, the exercise of which

Lessons Applicable: deductibility of bad debts,

is subject to documentary stamp taxes. For purposes

penalties of 25% surcharge, interest of 20, civil

of taxation, pawn tickets are proof of an exercise of a

penalties are compensatory (not penal), civil penalties

taxable privilege of concluding a contract of pledge.

and interest are automatic

BAD DEBTS

Laws Applicable:

Philex Mining Corporation v CIR GR No 125704,

FACTS:

August 28, 1998

Petitioner Philippine Refining Company (PRC) was

FACTS:

assessed by respondent Commissioner of Internal

BIR sent a letter to Philex asking it to settle its tax Revenue (Commissioner) to pay a deficiency tax for

liabilities amounting to P124 million. Philex protested the year 1985 in the amount of P1,892,584

the demand for payment stating that it has pending

PRC protested that the amounts are bad debts and

claims for VAT input credit/refund amounting to P120

interest expense which are allowable and legl

million. Therefore, these claims for tax credit/refund

deductions. But, CIR ignored it and issued a warrant

should be applied against the tax liabilities.

of garnishment against PRC's deposits at City Trust

In reply the BIR found no merit in Philex’s position. On Bank.

appeal, the CTA reduced the tax liability of Philex.

PRC filed a Petition for Review with the CTA who

ISSUES: reversed the interest expense disallowance but

maintained the 13 bad debts disallowance.

Whether legal compensation can properly take place

between the VAT input credit/refund and the excise tax PRC elevated the case to CA who dismissed the case

liabilities of for failing to satisfy the requirements of worthlessness

of a debt:

Philex Mining Corp;

(1) there is a valid and subsisting debt

Whether the BIR has violated the NIRC which requires

the refund of input taxes within 60 days (2) debt must be actually ascertained to be worthless

and uncollectible during the taxable year

Whether the violation by BIR is sufficient to justify non-

payment by Philex (3) debt must be charged off during the taxable year

RULING: (4) debt must arise from the business or trade of the

taxpayer

No, legal compensation cannot take place. The

government and the taxpayer are not creditors and (5) uncollectible even in the future

debtors of each other.

(6) exerted diligent effort to collect

Yes, the BIR has violated the NIRC. It took five years

ISSUES:

for the BIR to grant its claim for VAT input credit.

Obviously, had the 1. W/N bad debts requirements are met to be

deductible as assessed by the CA

BIR been more diligent and judicious with their duty, it

could have granted the refund 2. W/N PRC should be liable for penalties and interests

No, despite the lethargic manner by which the BIR

handled Philex’s tax claim, it is a settled rule that in the

performance of HELD: petition at bar is DENIED

TAXATION ! NOTES [Type here] [Type here]

1. NO. That the circumstances are such that the method does

not reflect the taxpayer ’ s income with reasonable

Furthermore, there are steps outlined to be undertaken accuracy and certainty and proper and just additions of

by the taxpayer to prove that he exerted diligent efforts personal expenses and other non-deductible

to collect the debts, viz: (1) sending of statement of expenditures were made and correct , fair and

accounts; (2) sending of collection letters; (3) giving the equitable credit adjustments were given by way of

account to a lawyer for collection; and (4) filing a eliminating non- taxable items.

collection case in court.

FERNANDEZ HERMANOS INC VS. CIR

The only evidentiary support given by PRC for its

aforesaid claimed deductions was the explanation or FACTS:

justification posited by its financial adviser or

accountant. Not a single document was offered to • Four cases involve two decisions of the Court of Tax

show that the Remoblas Store and CM Variety Store Appeal s determining the taxpayer ' s income tax

were burned, even just a police report or an affidavit liability for the years 1950 to 1954 and for the year

attesting to such loss by fire. The account of Tomas 1957. Both the taxpayer and the Commissioner of

Store in the amount of P16,842.79 is uncollectible, Internal Revenue, as petitioner and respondent in the

claims petitioner PRC, since the owner thereof was cases a quo respectively , appealed from the Tax

murdered and left no visible assets which could satisfy Court's decisions , insofar as their respective

the debt. Withal, just like the accounts of the two other contentions on particular tax items were therein

stores just mentioned, petitioner again failed to present resolved against them. Since the issues raised are

proof of the efforts exerted to collect the debt, other inter related, the Court resolves the four appeals in this

than the aforestated asseverations of its financial joint decision.

adviser. The accounts of Aboitiz Shipping Corporation

• The taxpayer , Fernandez Hermanos, Inc. , is a

and J. Ruiz Trucking in the amounts of P89,483.40 and

domestic corporation organized for the principal

P69,640.34, respectively, both of which allegedly arose

purpose of engaging in business as an " investment

from the hijacking of their cargo and for which they

company " wi th main office at Manila. Upon verification

were given 30% rebates by PRC, are claimed to be

of the taxpayer's income tax returns for the period in

uncollectible. Again, petitioner failed to present an iota

quest ion, the Commissioner of Internal Revenue

of proof, not even a copy of the supposed policy

assessed against the taxpayer the sums of

regulation of PRC that it gives rebates to clients in case

P13,414.00, P119,613.00, P11,698.00, P6,887.00 and

of loss arising from fortuitous events or force majeure,

P14,451.00 as alleged deficiency income taxes for the

which rebates it now passes off as uncollectible debts.

year s 1950, 1951, 1952, 1953 and 1954, respectively.

Findings of the CTA having recognized expertise will Said assessments were the result of alleged

not ordinarily be reviewed absent a showing of gross discrepancies found upon the examination and

error or abuse on its part. verification of the taxpayer's income tax returns for the

said years, summarized by the Tax Court in its decision

2. YES. of June 10, 1963 in CTA Case No. 787, as follows:

Sec. 248 and 249 of the tax code clearly provides that

civil penalty is imposed in case of failure to pay the tax

within the prescribed time for its payment and

deficiency tax or any surcharge or interest on the due

date appearing in the notice and demand of the

commissioner. Thus, penalties of 25% surcharge and ISSUE: The correctness of the Tax Court's rulings with

interest of 20% shall accrue from April 11, 1989. respect to the disputed items of disallowances

enumerated in the Tax Court's summary reproduced

Tax laws imposing penalties for delinquencies, so we

have long held, are intended to hasten tax payments HELD:

by punishing evasions or neglect of duty in respect

thereof. If penalties could be condoned for flimsy That the circumstances are such that the method does

reasons, the law imposing penalties for delinquencies not reflect the taxpayer’s income with reasonable

would be rendered nugatory, and the maintenance of accuracy and certainty and proper and just additions of

the Government and its multifarious activities will be personal expenses and other non-deductible

adversely affected. expenditures were made and correct , fair and

equitable credit adjustments were given by way of

eliminating non-taxable items.

TAXATION ! NOTES [Type here] [Type here]

Proper adjustments to conform to the income tax laws. deduction over and above such cost cannot be claimed

Proper adjustments for non-deductible items must be and allowed. The reason is that deductions from gross

made. The following non-deductibles , as the case may income are privileges, not matters of right. They are not

be, must be created by implication but upon clear expression in the

law.

added to the increase of decrease in the net worth:

Facts:

1. Personal living or family expenses

Basilan Estates, Inc. claimed deductions for the

2. Premiums paid on any life insurance policy depreciation of its assets on the basis of their

acquisition cost. As of January 1, 1950 it changed the

3. Losses from sales or exchanges of property

depreciable value of said assets by increasing it to

between members of the family

conform with the increase in cost for their replacement.

4. Income taxes paid Accordingly, from 1950 to 1953 it deducted from gross

income the value of depreciation computed on the

5. Other non-deductible taxes reappraised value.

6. Election expenses and other expense against public CIR disallowed the deductions claimed by petitioner,

policy consequently assessing the latter of deficiency income

taxes.

7. Non-deductible contributions

Issue:

8. Gifts to others

Whether or not the depreciation shall be determined on

9. Estate inheritance and gift taxes

the acquisition cost rather than the reappraised value

10. Net Capital Loss of the assets

Held:

Yes. The following tax law provision allows a deduction

from gross income for depreciation but limits the

On the other hand, non- taxable items should be recovery to the capital invested in the asset being

deducted therefrom. These items are necessary depreciated:

adjustments to avoid the inclusion of what otherwise

are non-taxable receipts. They are:

1. inheritance gifts and bequests received (1)In general. — A reasonable allowance for

deterioration of property arising out of its use or

2. non- taxable gains employment in the business or trade, or out of its not

being used: Provided, That when the allowance

3. compensation for injuries or sickness authorized under this subsection shall equal the capital

invested by the taxpayer . . . no further allowance shall

4. proceeds of life insurance policies

be made. . . .

5. sweepstakes

The income tax law does not authorize the depreciation

6. winnings of an asset beyond its acquisition cost. Hence, a

deduction over and above such cost cannot be claimed

7. interest on government securities and increase in and allowed. The reason is that deductions from gross

net worth are not taxable if they are shown not to be income are privileges, not matters of right. They are not

the result of unreported income but to be the result of created by implication but upon clear expression in the

the correction of errors in the taxpayer’s entries in the law [Gutierrez v. Collector of Internal Revenue, L-

books relating to indebtedness 19537, May 20, 1965].

BASILAN ESTATES, INC. v. CIR Depreciation is the gradual diminution in the useful

G.R. No. L-22492 September 5, 1967 value of tangible property resulting from wear and tear

Bengzon, J.P., J. and normal obsolescense. It commences with the

acquisition of the property and its owner is not bound

Doctrine: to see his property gradually waste, without making

provision out of earnings for its replacement.

The income tax law does not authorize the depreciation

of an asset beyond its acquisition cost. Hence, a

TAXATION ! NOTES [Type here] [Type here]

The recovery, free of income tax, of an amount more constructively received said rents. The non-collection

than the invested capital in an asset will transgress the was the petitioner’s fault since it refused to refused to

underlying purpose of a depreciation allowance. For accept the rent, and not due to nonpayment of lessees.

then what the taxpayer would recover will be, not only Hence, although the corporation did not actually

the acquisition cost, but also some profit. Recovery in receive the rent, it is deemed to have constructively

due time thru depreciation of investment made is the received them.

philosophy behind depreciation allowance; the idea of

profit on the investment made has never been the DEPLETION

underlying reason for the allowance of a deduction for Consolidated Mines, Inc. v. CTA (Aug. 29, 1974)

depreciation

FACTS:

LIMPAN INVESTMENT VS. CIR- ACTUAL VS

CONSTRUCTIVE RECEIPT • The Company, a domestic corporation

engaged in mining, had filed its income tax returns for

FACTS:

1951, 1952, 1953 and 1956. In 1957 examiners of the

• BIR assessed deficiency taxes on Limpan Corp, a BIR investigated the income tax returns filed by the

company that leases real property, for under-declaring Company because its auditor, Felipe Ollada, claimed

its rental income for years 1956-57 by around P20K the refund of the sum of P107,472.00 representing

and P81K respectively. alleged overpayments of income taxes for the year

1951.

• Petitioner appeals on the ground that portions of

these underdeclared rents are yet to be collected by • After the investigation the examiners reported

the previous owners and turned over or received by the that:

corporation.

(A) For the years 1951 to 1954:

• Petitioner cited that some rents were deposited with

• The Company had not accrued as an

the court, such that the corporation does not have

expense the share in the company profits of Benguet

actual nor constructive control over them.

Consolidated Mines as operator of the Company's

• The sole witness for the petitioner, Solis (Corporate mines, although for income tax purposes the Company

Secretary- Treasurer) admitted to some undeclared had reported income and expenses on the accrual

rents in 1956 and1957, and that some balances were basis;

not collected by the corporation in 1956 because the

• Depletion and depreciation expenses had

lessees refused to recognize and pay rent to the new

been overcharged; and

owners and that the corp’s president Isabelo Lim

collected some rent and reported it in his personal • The claims for audit and legal fees and

income statement, but did not turn over the rent to the miscellaneous expenses for 1953 and 1954 had not

corporation. been properly substantiated

• He also cites lack of actual or constructive control (B) For the year 1956:

over rents deposited with the court.

• The Company had overstated its claim for

depletion; and

ISSUE: • Certain claims for miscellaneous expenses

were not duly supported by evidence.

Whether or not the BIR was correct in assessing

deficiency taxes against Limpan Corp. for undeclared • In view of said reports the CIR sent the

rental income Company a letter of demand requiring it to pay certain

deficiency income taxes for the years 1951 to 1954,

HELD:

inclusive, and for the year 1956. Deficiency income tax

Yes. Petitioner admitted that it indeed had undeclared assessment notices for said years were also sent to the

income (although only a part and not the full amount Company. The Company requested a reconsideration

assessed by BIR). Thus, it has become incumbent of the assessment, but the Commissioner refused to

upon them to prove their excuses by clear and reconsider, hence the Company appealed to the CTA

convincing evidence, which it has failed to do. When is

• On May 6, 1961 the Tax Court rendered

there constructive receipt of rent? With regard to 1957

judgment ordering the Company to pay the amounts of

rents deposited with the court, and withdrawn only in

P107,846.56, P134,033.01 and P71,392.82 as

1958, the court viewed the corporation as having

TAXATION ! NOTES [Type here] [Type here]

deficiency income taxes for the years 1953, 1954 and 2. The estimated total recoverable units in the

1956, respectively. property; and

• However, on August 7, 1961, upon motion of 3. The no. of units recovered during the taxable

the Company, the Tax Court reconsidered its decision year in question.

and further reduced the deficiency income tax liabilities

of the Company to P79,812.93, P51,528.24 and RESEARCH AND DEVELOPMENT

P71,382.82 for the years 1953, 1954 and 1956,

3M Philippines, Inc. vs. Commissioner of Internal

respectively.

Revenue (26 September 1988)

• Both the Company and the Commissioner Facts:

appealed to this Court. The Company questions the

rate of mine depletion adopted by the Court of Tax • 3M Philippines, Inc., a subsidiary of 3M-St.

Appeals and the disallowance of depreciation charges Paul, is a non-resident foreign corporation with

and certain miscellaneous. principal office in St. Paul, Minnesota, USA.

ISSUE: • It is the exclusive importer, manufacturer,

wholesaler, and distributor in the Philippines of all

• Whether the CTA erred with respect to the

products of the latter.

rate of mine depletion

• To enable it to manufacture, package,

RULING:

promote, market, sell and install the highly specialized

• The Tax Code provides that in computing net products of its parent company, and render the

income there shall be allowed as deduction, in the case necessary post-sales service and maintenance to its

of mines, a reasonable allowance for depletion thereof customers, petitioner entered into a "Service

not to exceed the market value in the mine of the Information and Technical Assistance Agreement" and

product thereof which has been mined and sold during a "Patent and Trademark License Agreement" with the

the year for which the return is made. (Sec. 30(g) (1) latter under which the petitioner agreed to pay to 3M-

(B). St. Paul a technical service fee of 3% and a royalty of

2% of its net sales.

• As an income tax concept, depletion is wholly

a creation of the statue – solely a matter of legislative • Both agreements were submitted to, and

grace. Hence, the taxpayer has the burden of justifying approved by, the Central Bank of the Philippines.

the allowance of any deduction claimed. As in

• In its income tax return for the fiscal year

connection with all other tax controversies, the burden

ended October 31, 1974, the petitioner claimed the

of proof to show that a disallowance of depletion by the

following deductions as business expenses:

Commissioner is incorrect or that an allowance made

is inadequate is upon the taxpayer, and this is true with (a) royalties and technical service fees of P

respect to the value of the property constituting the 3,050,646.00; and

basis of the deduction. This burden-of-proof rule has

been frequently applied and a value claimed has been (b) Pre-operational cost of tape coater of P97,

disallowed for lack of evidence. 485.08.

• Here, SC considered the evidence presented

(testimony of Eligio Garcia) and the Report to

• On the first item, the respondent

Stockholders which includes the Balance Sheet as of

Commissioner of Internal Revenue allowed a

1946), geological report on the estimated amount of

deduction of ₱797,046.09 only as technical service fee

ore in the claims, etc.) it set forth a very detailed

and royalty for locally manufactured products, but

computation of the depletion rate, determining the

disallowed the sum of ₱2,323,599.02 alleged to have

value of each component of the formula of depletion,

been paid by the petitioner to 3M-St. Paul as technical

viz: Rate of Depletion Per Unit=Cost of Mine

service fee and royalty on ₱46,471,998.00 worth of

Property/Estimated Ore Deposit of product Mined and

finished products imported by the petitioner from the

sold – depletion is different from depreciation.

parent company, on the ground that the fee and royalty

• In determining the amount of cost depletion should be based only on locally manufactured goods.

allowable the following three facts are essential: The improper deduction was treated by respondent as

a disguised dividend or income.

1. The basis of the property;

TAXATION ! NOTES [Type here] [Type here]

• On the second item, respondent allowed payments required to be made as a condition to the

₱19,544.77 or one-fifth (1/5) of petitioner's capital continued use or possession, for the purpose of the

expenditure of ₱97,046.09 for its tape coater which trade, profession or business, for property to which the

was installed in 1973 because such expenditure should taxpayer has not taken or is not taking title or in which

be amortized for a period of five (5) years, hence, he has no equity.

payment of the disallowed balance of ₱77,740.38

should be spread over the next four (4) years. Petitioner points out that the Central bank

Respondent ordered petitioner to pay ₱840,540 as "has no say in the assessment and collection of internal

deficiency income tax on its 1974 return, plus revenue taxes as such power is lodged in the Bureau

₱353,026.80 as 14% interest per annum from February of Internal Revenue," that the Tax Code "never

15, 1975 to February 15, 1976, or a total of mentions Circular 393 and there is no law or regulation

₱1,193,566.80. governing deduction of business expenses that refers

to said circular." The argument is specious, for,

• Petitioner protested the assessment in a letter although the Tax Code allows payments of royalty to

dated March 7, 1980. The respondent Commissioner be deducted from gross income as business expenses,

did not answer the protest. Instead, he issued warrants it is CB Circular No. 393 that defines what royalty

of distraint and levy on October 1, 1984. On October payments are proper. Hence, improper payments of

23, 1984, petitioner appealed to the Court of Tax royalty are not deductible as legitimate business

Appeals by petition for review with a prayer for the expenses.

issuance of a writ of preliminary injunction to stop the

enforcement of the warrants of distraint and levy. The NO DEDUCTIBLE EXPENSES