Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dabur Honey Case Study

Caricato da

Sai Prabhas50%(2)Il 50% ha trovato utile questo documento (2 voti)

556 visualizzazioni4 pagineThe

Copyright

© © All Rights Reserved

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

50%(2)Il 50% ha trovato utile questo documento (2 voti)

556 visualizzazioni4 pagineDabur Honey Case Study

Caricato da

Sai PrabhasThe

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

DABUR HONEY

In its generic form, honey is a wonder product. If in western homes it is a term of

endearment, in India honey is traditionally seen as a health syrup. Through most of India's

produce comes from the concerted hardwork of well-cordinated bees, in far flung villages, the

market belongs largely to the unorganised sector.

No Company in the organised sector had seen business opportunity in honey, till the Rs. 425

crore Dabur India Limited decided to source honey in large volurnes from apiculturalists (bee-

hive formers) and market it: the company introduced branded honey in glass jars to the Indian

market about a decade ago. The only other big organisation selling honey at that time was Khadi

Gramodyog, but it was merely distributing the unbranded produce from villages to the urban

markets.For the company, honey was not an out-of-the way product, considering that Dabur's

product portfolio boasts of a wide array of traditional ayurvedic products which draw inspiration

from Charak Samhita, a treatise on ancient medicine.Available on shop shelves in urban India,

Dabur Honey offered a consistent quality product to the housewife who all along had relied on

the occasional visitor from her village to get some pure honey Naturally; it was a prized

commodity, since it was produced in such tiny volume.

Dabur found that demand was' low.' Honey's usage was restricted to the world of therapy;

used as a cough palliative, a skin conditioner or alternately as a base ingredient for other

ayurvedic formulations. In such a scenario, hard data market estimates were not available.

However, the company saw huge potential. It was reasonably assured that the equity of the

product was deeply engraved in the housewife's mind. With no other company to contend with,

Dabur had the whole field to itself.Although, Dabur made a start of mass marketing of its honey,

it made few efforts to push sales and expand the market in the initial stage. By flowing honey

through its distribution stream, all the company had achieved was planning the product within

the urban consumer's reach. She now expected to see honey at her grocer's shop, but had no new

incentive to buy it.Dabur simply leveraged the strength of its umbrella brand equity to sell the

product. The brand's equity was built overtime through both the buyer's familiarity with the

name, and its consistent delivery of quality.Though there was no competition, and Dabur sold

virtually every jar of honey bought in retail outlets, the company could not ignore one strong

buzz in its bonnet-that the product was not in a mature market, and that it still had a long way to

go. In fact, good marketing could super volumes off take to swell enormously, felt Dabur. This

throught forced the company to take more than just a casual interest in marketing honey.

By the late 1980s, small regional brands had started getting stronger, although they were

confined to small pockets by their lack of a wide distribution mechanism. This posed a danger.

Having to share the spoils of the existing low-volume market could mean having to forego the

benefits of even the organic rate of growth (market expansion aside). Dabur Honey's sales went

from slow to sluggish.

Other brands-Golden Meadows, Allied's and Mehson's among them-had started gaining

recognition in the branded honey market. And some more were off their way in; some with fancy

packaging to target the upmarket buyer. The smaller marketers were selling mainly on price,

which meant trouble for Dabur since there is not enough product differentiation in this category.

This was the time Dabur Honey decided to assert its superiority in the market, and ward off any

threat to its growth.In the year 1991, Dabur Honey took to national level advertising for the first

time, placing the brand on the purity platform. The start of the media explosion gave the brand a

wide choice of vehicles to use in its media mix. The objective was to target the consumer in

towns with population of above one lakh if it could increase its penetration levels in these cities,

felt Dabur, demand for the brand would trickle down to smaller townships and rural areas.

Growth came, Still, at about 20 per cent a year, it was not entirely satisfactory considering that it

was on a small base.The honey that bees make is perhaps the world's purest form of natural

sugar. Refining is the only mechanised process that apiary-drawn honey passes through, so it

made sense at that time to take the purity plank. But this just gave the existing medicine-use

consumer an assurance of quality. It did not either widen the consumer base or raise the per-

family offtake of the product.

Meanwhile, big competition began eyeing what Dabur had seen-the enormous potential

in the market if honey were to be sold as a tasty breakfast table food addictive. Transnational

food marketers, Lipton and Nestle, both sell branded honey in markets abroad; and Dabur could

not ignore the chance of their storming markets of urban India with their global honey labels.

In 1994, Dabur gave the brand's ad accounts to Enterprise. At that time, Dabur's ad spend for

honey was a piffling Rs. 10-15 lakh a year.A survey by the agency confirmed Dabur's hunch. It

revealed that the consumption of Dabur Honey was an adjectly-low 26 gm. Per household

annually. Focus group discussions pointed out the reason. Though, the housewife endows honey

with positive and healthful attributes, she does not pull it out of its hiding place till it's needed to

do the job of, say, curing a cough. Relative to other foods, honey is expensive, but this was a

minor consideration for families with lage nourishment outlays. Its own goodness was standing

in its way.And Dabur's umbrella brand values-health through ayurveda-had reinforced the notion

of honey as medicine. In fact. Dabur recommends honey as a base for several ayurvedicmixs.

Also, Dabur Honey's brand Defsonality was dull aid traditional. The agency Worked on the

hypothesis that while health) be the chief attribute by perception. the product's taste did own a

place sonlqwhere in the back of the consumer's mind.The ad spend was hiked to over Rs. 50 lakh

for 1994-95. To make the brand more eciting and to involve the consume, the company even

took to sponsoring recipe and food sections in various women's magazines.

Dabur brought out a 500 gm jar size, priced at Rs. 71, to add to the smaller ones-an indication of

the volumes a household is expected to consume. The package label was changed to include

copy on food values. Simultaneously, Dabur embarked on an elaborate merchandising drive, by

grabbing retail shelf space for product display and by using POP's for added attention. Attractive

incentive schemes were offered to the sales force, besides better terms to the wholesalers.The

drippy Feast It is been just five months since Dabur Honey's relaunch; and the company claims

that sales have already registered a growth of 65 per cent in volumes over last year's figure. The

overall market is displaying a shift from smaller jars to the 500 gms one; consumption per home

appears to be rising.Today, the entire market for honey is estimated at 8,000 tonnes a year,

dominated largely by unorganised players. The leading brand, Dabur commands a market share

of over 10 per cent, while all other branded players together account for around 4 per cent of the

pie. Dabur Honey is Rs. 12 crore brand today, that's double the value it was in 1993-94.

Questions for Discussion

1. What should be the advertising and sales promotion strategies for a new competitive

product entering the branded honey market ?

2. Should the new competitor charge the same price as being charged by Dabur or should it

be different ? Give reasons in support of your answer.

3. Suggest some new sales promotion techniques to Dabur to increase the rate of product

trial by those consumers who have not use4 the product so far.

Potrebbero piacerti anche

- Dabur Honey Case StudyDocumento4 pagineDabur Honey Case StudySai PrabhasNessuna valutazione finora

- Dabur Real JuicesDocumento7 pagineDabur Real Juicestushar jainNessuna valutazione finora

- Himalaya Drug CaseDocumento2 pagineHimalaya Drug CaseAnaMaríaCharryPáezNessuna valutazione finora

- DaburDocumento6 pagineDabursneh pimpalkarNessuna valutazione finora

- Case-Pepsodent Charting Growth in IndiaDocumento1 paginaCase-Pepsodent Charting Growth in IndiaabhishekcheshtaNessuna valutazione finora

- Name: Class: Subject: Professor: Topic: Year:: Guru Nanak Institute of Management StudiesDocumento68 pagineName: Class: Subject: Professor: Topic: Year:: Guru Nanak Institute of Management StudiesAnjan BathiNessuna valutazione finora

- Winter Project Report ON "Comparative Analysis and Market Presence (Agra) of Dabur HajmolaDocumento36 pagineWinter Project Report ON "Comparative Analysis and Market Presence (Agra) of Dabur HajmolaSmit Kumar100% (1)

- Dabur Re Positioning StrategyDocumento23 pagineDabur Re Positioning StrategyVishesh Iyer0% (1)

- Analysis of CavinkareDocumento6 pagineAnalysis of CavinkareGarrima ParakhNessuna valutazione finora

- SWOT Analysis of FoggDocumento3 pagineSWOT Analysis of FoggAzan SandhuNessuna valutazione finora

- Lux Body Wash Final ReportDocumento22 pagineLux Body Wash Final ReportAbhimita GaineNessuna valutazione finora

- Consumer Study of Shampoo.Documento100 pagineConsumer Study of Shampoo.rahulsogani123Nessuna valutazione finora

- Marketing Management Dabur VatikaDocumento3 pagineMarketing Management Dabur Vatikapari50% (2)

- Fair and Lovely b2556Documento6 pagineFair and Lovely b2556nelson vargheseNessuna valutazione finora

- Case Analysisi On Super ShampooDocumento9 pagineCase Analysisi On Super ShampooShiva Krishna PadhiNessuna valutazione finora

- Japan's Economy Abenomics From The Front and Rearview MirrorsDocumento6 pagineJapan's Economy Abenomics From The Front and Rearview MirrorsShubham TapadiyaNessuna valutazione finora

- ChyawanprashDocumento5 pagineChyawanprashBindya ShivaramNessuna valutazione finora

- Bath and Shower in Chile - Analysis: Country Report - Jul 2020Documento3 pagineBath and Shower in Chile - Analysis: Country Report - Jul 2020anonima anonimaNessuna valutazione finora

- P&GDocumento34 pagineP&GPankaj SachanNessuna valutazione finora

- Maya DermDocumento3 pagineMaya DermImran HussainNessuna valutazione finora

- MR SpssDocumento166 pagineMR SpssSumati NarangNessuna valutazione finora

- Dabur IntroDocumento18 pagineDabur IntroDr. GeetaNessuna valutazione finora

- Mismanagement of Fiscal Policy: Greece's Achilles' HeelDocumento9 pagineMismanagement of Fiscal Policy: Greece's Achilles' Heelabhilash191100% (1)

- Dabur India LTD AssgnmntDocumento5 pagineDabur India LTD AssgnmntVipul KumarNessuna valutazione finora

- BorolineDocumento2 pagineBorolineRajaram RajagopalanNessuna valutazione finora

- Thailand-An Imbalance of PaymentsDocumento7 pagineThailand-An Imbalance of PaymentsN MNessuna valutazione finora

- FINALDocumento40 pagineFINALNayanshree JainNessuna valutazione finora

- Group 9 - SDMDocumento50 pagineGroup 9 - SDMPRASHANT KUMARNessuna valutazione finora

- Dabur Sales ManagementDocumento20 pagineDabur Sales Managementrohitpatil222Nessuna valutazione finora

- Competitor Analysis DaburDocumento29 pagineCompetitor Analysis DaburBabasab Patil (Karrisatte)67% (3)

- Positioning As A Strategy-HulDocumento6 paginePositioning As A Strategy-Hulkwin_shah201033% (3)

- Beauty More Than Skin Deep?: Case Study 7Documento15 pagineBeauty More Than Skin Deep?: Case Study 7Trần Hữu Kỳ DuyênNessuna valutazione finora

- OlayDocumento36 pagineOlayrachit.chaudharyNessuna valutazione finora

- Marketing Assignment On Hide and Seek BiscuitDocumento23 pagineMarketing Assignment On Hide and Seek BiscuitShrikant Sahasrabudhe100% (2)

- DaburDocumento27 pagineDaburPriyanka Kale100% (1)

- Dabur ImDocumento21 pagineDabur ImRanak TrivediNessuna valutazione finora

- How Gillette InnovatedDocumento4 pagineHow Gillette Innovatedamul65Nessuna valutazione finora

- Project On Fair&LovelyDocumento15 pagineProject On Fair&LovelyAmar BhavsarNessuna valutazione finora

- RRL Draft DoveDocumento25 pagineRRL Draft DoveALMIRA LOUISE PALOMARIANessuna valutazione finora

- Dabur Iindia Limited - FinalDocumento37 pagineDabur Iindia Limited - FinalKaashvi HiranandaniNessuna valutazione finora

- Maya DermDocumento3 pagineMaya DermSajal JainNessuna valutazione finora

- Dabur Company Market Over Wive PPT at Bec Bagalkot MbaDocumento65 pagineDabur Company Market Over Wive PPT at Bec Bagalkot MbaBabasab Patil (Karrisatte)Nessuna valutazione finora

- Case Analysis On HimalayasDocumento5 pagineCase Analysis On HimalayasNarendra Shakya100% (1)

- Company Profile Dabur India LTDDocumento7 pagineCompany Profile Dabur India LTDSakshat PuroNessuna valutazione finora

- Khadi Natural Company ProfileDocumento18 pagineKhadi Natural Company ProfileKleiton FontesNessuna valutazione finora

- Nancy Dabur Honey (Repaired)Documento89 pagineNancy Dabur Honey (Repaired)mikkijainNessuna valutazione finora

- Rin Case StudyDocumento4 pagineRin Case StudyReha Nayyar100% (1)

- Godrej ProjectDocumento4 pagineGodrej ProjectPriyanka KhannaNessuna valutazione finora

- Maya DermDocumento8 pagineMaya DermSriharsha VavilalaNessuna valutazione finora

- Hamdard Case StudyDocumento11 pagineHamdard Case StudyPooja SinghNessuna valutazione finora

- Presentation ON Wagh Bakri ChaiDocumento14 paginePresentation ON Wagh Bakri ChaiNIKNISHNessuna valutazione finora

- Maya DermDocumento4 pagineMaya Dermydchou_69100% (1)

- Project Report On Vivels Fairness CreamDocumento47 pagineProject Report On Vivels Fairness CreamDhirender Chauhan0% (1)

- Marketing Plan (Bournvita)Documento36 pagineMarketing Plan (Bournvita)Shailendra GuptaNessuna valutazione finora

- Dabur Case StudyDocumento23 pagineDabur Case Studyankur_ietru100% (7)

- A Case Study On Dabur LTDDocumento3 pagineA Case Study On Dabur LTDgarimaamityNessuna valutazione finora

- Urmila Gidwani CB Brand PositioningDocumento4 pagineUrmila Gidwani CB Brand PositioningPuneet Singh DhaniNessuna valutazione finora

- Case Study - Dabur Over The Years: The Dabur Story'Documento12 pagineCase Study - Dabur Over The Years: The Dabur Story'Shweta NandaNessuna valutazione finora

- Sales Strategy of DaburDocumento5 pagineSales Strategy of DaburRaza MerchantNessuna valutazione finora

- Marketing Strategy Project: Marketing Research On "DABUR Ind LTD"Documento18 pagineMarketing Strategy Project: Marketing Research On "DABUR Ind LTD"Shahbaz ArtsNessuna valutazione finora

- SEBIAnnual ReportDocumento201 pagineSEBIAnnual Reportthexplorer008Nessuna valutazione finora

- Robert D. Strahota, Assistant DirectorDocumento20 pagineRobert D. Strahota, Assistant DirectorSai PrabhasNessuna valutazione finora

- Working Capital of BSNLDocumento55 pagineWorking Capital of BSNLmss_singh_sikarwar86% (7)

- Policies and ProgrammesDocumento59 paginePolicies and ProgrammesrakeshNessuna valutazione finora

- Mentor - JD - Campus PDFDocumento3 pagineMentor - JD - Campus PDFSai PrabhasNessuna valutazione finora

- Business Letters and Logo Samples PDFDocumento31 pagineBusiness Letters and Logo Samples PDFJai Mohammed100% (1)

- ABM Case Study PDFDocumento1 paginaABM Case Study PDFSai PrabhasNessuna valutazione finora

- MBA ResumeDocumento2 pagineMBA Resumevravion63% (8)

- A Study On Customer Perception Towards Royal Enfield With Special Reference To Malappuram DistrictDocumento13 pagineA Study On Customer Perception Towards Royal Enfield With Special Reference To Malappuram DistrictPiyush Aggarwal100% (1)

- Curriculum Vitae: ObjectiveDocumento2 pagineCurriculum Vitae: ObjectiveSai PrabhasNessuna valutazione finora

- Sai Siva ShankarDocumento2 pagineSai Siva ShankarSai PrabhasNessuna valutazione finora

- SaisivashankarDocumento2 pagineSaisivashankarSai PrabhasNessuna valutazione finora

- Business - Letter - Handout - Major RevDocumento5 pagineBusiness - Letter - Handout - Major RevnurulstorwNessuna valutazione finora

- Fresher MBA Resume Formats - 1Documento2 pagineFresher MBA Resume Formats - 1Samaan Gouse100% (1)

- Teja Satyanarayana Reddy Manda: Academic QualificationsDocumento2 pagineTeja Satyanarayana Reddy Manda: Academic QualificationsSai PrabhasNessuna valutazione finora

- Questionnaire FlipkartDocumento2 pagineQuestionnaire FlipkartSudheender Srinivasan79% (28)

- Project Flipkart PDFDocumento91 pagineProject Flipkart PDFSai PrabhasNessuna valutazione finora

- Online Shopping Questionnaire PDFDocumento7 pagineOnline Shopping Questionnaire PDFSai PrabhasNessuna valutazione finora

- Project FlipkartDocumento91 pagineProject Flipkartnikhincc77% (98)

- A Study On Customer Perception Towards Royal Enfield With Special Reference To Malappuram DistrictDocumento13 pagineA Study On Customer Perception Towards Royal Enfield With Special Reference To Malappuram DistrictPiyush Aggarwal100% (1)

- Royal Enfield Project ReportDocumento68 pagineRoyal Enfield Project ReportSai PrabhasNessuna valutazione finora

- QUESTIONNAIRE Internet MarketingDocumento3 pagineQUESTIONNAIRE Internet MarketinghericsNessuna valutazione finora

- Royal Enfield Project ReportDocumento146 pagineRoyal Enfield Project ReportVenu S88% (175)

- Concept:: Unit - Iv Wage and Salary AdministrationDocumento27 pagineConcept:: Unit - Iv Wage and Salary AdministrationSai PrabhasNessuna valutazione finora

- Scet HRM Mid Ii QBDocumento5 pagineScet HRM Mid Ii QBSai PrabhasNessuna valutazione finora

- Mentor - JD - Campus PDFDocumento3 pagineMentor - JD - Campus PDFSai PrabhasNessuna valutazione finora

- Mentor - JD - Campus PDFDocumento3 pagineMentor - JD - Campus PDFSai PrabhasNessuna valutazione finora

- Principles of Management PDFDocumento292 paginePrinciples of Management PDFSai Prabhas100% (1)

- Industrial Relation Means The Relationship Between Employers and Employees in Course ofDocumento22 pagineIndustrial Relation Means The Relationship Between Employers and Employees in Course ofSai PrabhasNessuna valutazione finora

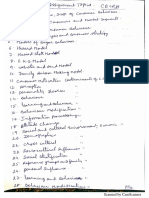

- CBCRM Seminar Topics PDFDocumento2 pagineCBCRM Seminar Topics PDFSai PrabhasNessuna valutazione finora

- GSM Radio ConceptsDocumento3 pagineGSM Radio ConceptsMD SahidNessuna valutazione finora

- Letter of Acceptfor TDocumento3 pagineLetter of Acceptfor TCCSNessuna valutazione finora

- Unit: 1: Newton's Laws of Motion & Principle of Transmissibility of ForceDocumento5 pagineUnit: 1: Newton's Laws of Motion & Principle of Transmissibility of ForceKunal SinghNessuna valutazione finora

- AREMA Shoring GuidelinesDocumento25 pagineAREMA Shoring GuidelinesKCHESTER367% (3)

- 12 Constructor and DistructorDocumento15 pagine12 Constructor and DistructorJatin BhasinNessuna valutazione finora

- Gothic ArchitectureDocumento6 pagineGothic ArchitectureleeNessuna valutazione finora

- Overview of Incorporation in CambodiaDocumento3 pagineOverview of Incorporation in CambodiaDavid MNessuna valutazione finora

- Daily Plankton Agrabinta CianjurDocumento141 pagineDaily Plankton Agrabinta CianjurPutra Cahya GemilangNessuna valutazione finora

- Operation of A CRT MonitorDocumento8 pagineOperation of A CRT MonitorHarry W. HadelichNessuna valutazione finora

- Bofa Turkish Banks-Back On The RadarDocumento15 pagineBofa Turkish Banks-Back On The RadarexperhtmNessuna valutazione finora

- Journal Articles: Types of JournalsDocumento4 pagineJournal Articles: Types of JournalsOtieno SteveNessuna valutazione finora

- Industry and Community Project: Jacobs - Creating A Smart Systems Approach To Future Cities Project OutlineDocumento14 pagineIndustry and Community Project: Jacobs - Creating A Smart Systems Approach To Future Cities Project OutlineCalebNessuna valutazione finora

- Model Contract FreelanceDocumento3 pagineModel Contract FreelancemarcosfreyervinnorskNessuna valutazione finora

- Book Review Fiction New HereDocumento7 pagineBook Review Fiction New HereFILZAH SYAUQINA BINTI SUBLY Pelajar KPTM IpohNessuna valutazione finora

- Javascript NotesDocumento5 pagineJavascript NotesRajashekar PrasadNessuna valutazione finora

- Ch04Exp PDFDocumento17 pagineCh04Exp PDFConstantin PopescuNessuna valutazione finora

- Teaching Plan - Math 8 Week 1-8 PDFDocumento8 pagineTeaching Plan - Math 8 Week 1-8 PDFRYAN C. ENRIQUEZNessuna valutazione finora

- Zkp8006 Posperu Inc SacDocumento2 pagineZkp8006 Posperu Inc SacANDREA BRUNO SOLANONessuna valutazione finora

- Capital Structure and Leverage: Multiple Choice: ConceptualDocumento53 pagineCapital Structure and Leverage: Multiple Choice: ConceptualArya StarkNessuna valutazione finora

- CSCU Module 08 Securing Online Transactions PDFDocumento29 pagineCSCU Module 08 Securing Online Transactions PDFdkdkaNessuna valutazione finora

- FT FocusDocumento19 pagineFT Focusobi1kenobyNessuna valutazione finora

- Microbial Diseases of The Different Organ System and Epidem.Documento36 pagineMicrobial Diseases of The Different Organ System and Epidem.Ysabelle GutierrezNessuna valutazione finora

- QuerySurge Models Mappings DocumentDocumento28 pagineQuerySurge Models Mappings Documentchiranjeev mishra100% (1)

- Space Saving, Tight AccessibilityDocumento4 pagineSpace Saving, Tight AccessibilityTran HuyNessuna valutazione finora

- T10 - PointersDocumento3 pagineT10 - PointersGlory of Billy's Empire Jorton KnightNessuna valutazione finora

- Previous Year Questions Tnusrb S. I - 2010: Part - A': General KnowledgeDocumento21 paginePrevious Year Questions Tnusrb S. I - 2010: Part - A': General Knowledgemohamed AzathNessuna valutazione finora

- Computer in Community Pharmacy by Adnan Sarwar ChaudharyDocumento10 pagineComputer in Community Pharmacy by Adnan Sarwar ChaudharyDr-Adnan Sarwar Chaudhary100% (1)

- Modular ResumeDocumento1 paginaModular ResumeedisontNessuna valutazione finora

- BBO2020Documento41 pagineBBO2020qiuNessuna valutazione finora

- Florida Gov. Ron DeSantis Provides Update As Hurricane Ian Prompts EvDocumento1 paginaFlorida Gov. Ron DeSantis Provides Update As Hurricane Ian Prompts Evedwinbramosmac.comNessuna valutazione finora