Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Examination

Caricato da

Rural Bank Cauayan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

229 visualizzazioni2 pagineBookkeeping

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBookkeeping

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

229 visualizzazioni2 pagineExamination

Caricato da

Rural Bank CauayanBookkeeping

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

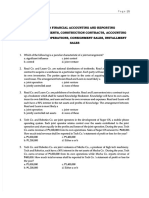

Bookkeeping Questions c.

Money owed by a company to its

1. Which of the following is an item of vendors

working capital? Answers:

a. Fixed assets 1. The correct answer is C.

b. Long-term investments

Explanation: Working capital consists of

c. Accounts receivable

current assets and current liabilities.

d. Bonds payable

2. To which account in the Balance Sheet is

2. The correct answer is A.

the net income or net loss

transferred to at the end of the accounting Explanation: The amount of net income or net

period? loss is transferred to Retained Earnings,

a. Cash which is an equity account.

b. Accounts Receivable 3. The correct answer is B.

c. Inventory

d. Sample Accounts Payable Questions Explanation: Accounts payable is a short-term

3. Accounts Payable is classified as a/an obligation. Hence, it is classified as a current

___________ in the _____________. liability in the Balance Sheet.

a. Current asset; Balance Sheet 4. The correct answer is C.

b. Current liability; Balance Sheet

c. Expense; Income Statement Explanation: A purchase order is a buyer-

d. Revenue; Income Statement generated document that authorizes the

4. Which of the following documents purchase transaction, and when the seller

authorizes the purchase transaction? accepts the terms and conditions indicated

a. Credit memo from supplier therein, it becomes a binding contract

b. Invoice or bill from supplier between the seller and the buyer.

c. Purchase order 5. The correct answer is D.

d. Purchase requisition

Accounts Receivable Questions Explanation: Net sales revenue is the amount

5. Brown Glory Corp. has sales revenue of left after deducting sales discounts and sales

$150,000, sales discounts of returns and allowances from gross sales

$12,000, sales returns allowances of revenue. Cost of goods sold is deducted from

$24,000, and cost of goods sold of net sales revenue to arrive at gross profit.

$60,000. What would be the net sales Gross Sales Revenue – Sales Discounts – Sales

revenue of Brown Glory Corp.? Returns and Allowances

a. $102,000 $150,000 – $12,000 – $24,000 = $114,000.

b. $54,000 6. The correct answer is A.

c. $90,000

Explanation: Accounts receivable is defined

d. $114,000

as money owed to a company by its debtors.

6. What is meant by accounts receivable?

When a company sells goods on credit, it

Money owed to a company by its debtors

creates a current asset by the name of

a. Money owed by a company to its

accounts receivable and books the

creditors

corresponding revenue. When the cash is

b. Money owed to a company by its

received, the asset is reversed.

employees

Potrebbero piacerti anche

- CHAPTER 11 Without AnswerDocumento3 pagineCHAPTER 11 Without Answerlenaka0% (1)

- F9 Financial Management Question BankDocumento248 pagineF9 Financial Management Question BankMuhammad Ahsan100% (1)

- Chapter Exercises DeductionsDocumento11 pagineChapter Exercises DeductionsShaine KeefeNessuna valutazione finora

- Milagro Excel ExhibitsDocumento15 pagineMilagro Excel ExhibitsRazi Ullah0% (1)

- AssignmentDocumento3 pagineAssignmentFrancis Abuyuan100% (1)

- Redico ProjectDocumento94 pagineRedico ProjectAbhishek AgarwalNessuna valutazione finora

- QuestionsDocumento68 pagineQuestionsTrickdady BonyNessuna valutazione finora

- BL AnswerKeyDocumento4 pagineBL AnswerKeyRosalie E. BalhagNessuna valutazione finora

- BLT 2012 Final Pre-Board April 21Documento17 pagineBLT 2012 Final Pre-Board April 21Lester AguinaldoNessuna valutazione finora

- 10 Responsibility Accounting Live DiscussionDocumento4 pagine10 Responsibility Accounting Live DiscussionLee SuarezNessuna valutazione finora

- Chapter 11Documento3 pagineChapter 11Kamran AhmedNessuna valutazione finora

- Finals Exercise 2 - WC Management InventoryDocumento3 pagineFinals Exercise 2 - WC Management Inventorywin win0% (1)

- Financial Management Act1108 Practice SetsDocumento7 pagineFinancial Management Act1108 Practice SetsKaren TaccabanNessuna valutazione finora

- Contract Accounting Journal EntriesDocumento3 pagineContract Accounting Journal Entrieskawasakidude21100% (2)

- Auditing Theory Finals PDF FreeDocumento11 pagineAuditing Theory Finals PDF FreeMichael Brian TorresNessuna valutazione finora

- WRITTEN ACTIVITY 6: Inventory ManagementDocumento4 pagineWRITTEN ACTIVITY 6: Inventory ManagementDaena NicodemusNessuna valutazione finora

- Credit 5Documento7 pagineCredit 5Maria SyNessuna valutazione finora

- PRACTICAL ACCOUNTING 1 Part 2Documento9 paginePRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNessuna valutazione finora

- Mas QuestionsDocumento2 pagineMas QuestionsEll VNessuna valutazione finora

- CRC AceDocumento3 pagineCRC AceNaSheengNessuna valutazione finora

- CH 13Documento15 pagineCH 13alfiNessuna valutazione finora

- Stock Edited PDFDocumento29 pagineStock Edited PDFCzarina PanganibanNessuna valutazione finora

- MAS 7 Exercises For UploadDocumento9 pagineMAS 7 Exercises For UploadChristine Joy Duterte RemorozaNessuna valutazione finora

- MODULE 2 CVP AnalysisDocumento8 pagineMODULE 2 CVP Analysissharielles /Nessuna valutazione finora

- This Study Resource Was: Quiz On Receivable FinancingDocumento3 pagineThis Study Resource Was: Quiz On Receivable FinancingKez MaxNessuna valutazione finora

- CGT Drill Answers and ExplanationsDocumento4 pagineCGT Drill Answers and ExplanationsMarianne Portia SumabatNessuna valutazione finora

- REVIEWer Take Home QuizDocumento3 pagineREVIEWer Take Home QuizNeirish fainsan0% (1)

- Prelims Ms1Documento6 paginePrelims Ms1ALMA MORENANessuna valutazione finora

- PINTO - Razmen R. (MASECO MT EXAM)Documento4 paginePINTO - Razmen R. (MASECO MT EXAM)Razmen Ramirez PintoNessuna valutazione finora

- FAR - Estimating Inventory - StudentDocumento3 pagineFAR - Estimating Inventory - StudentPamelaNessuna valutazione finora

- Q Manacc1 Bep 2019Documento5 pagineQ Manacc1 Bep 2019Deniece RonquilloNessuna valutazione finora

- Which of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Documento3 pagineWhich of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Kath LeynesNessuna valutazione finora

- AFAR Assessment 2Documento5 pagineAFAR Assessment 2JoshelBuenaventuraNessuna valutazione finora

- Tom Schriber A Director of Personnel at Management Resources Inc Is in The Process of Designing A Program That Its Customers Can Use in TheDocumento1 paginaTom Schriber A Director of Personnel at Management Resources Inc Is in The Process of Designing A Program That Its Customers Can Use in TheDoreenNessuna valutazione finora

- Chapter 5 AIS PDFDocumento4 pagineChapter 5 AIS PDFAnne Rose EncinaNessuna valutazione finora

- Prelim Exam PDFDocumento6 paginePrelim Exam PDFPaw VerdilloNessuna valutazione finora

- Introduction To Transaction ProcessingDocumento23 pagineIntroduction To Transaction ProcessingAngel Cauilan100% (1)

- Management Science Assessment 2Documento2 pagineManagement Science Assessment 2Cath KatNessuna valutazione finora

- BLT 2010 Final Pre-Board April 24Documento15 pagineBLT 2010 Final Pre-Board April 24Lester AguinaldoNessuna valutazione finora

- De La Salle Araneta UniversityDocumento7 pagineDe La Salle Araneta UniversityBryent GawNessuna valutazione finora

- TB Chapter12Documento33 pagineTB Chapter12CGNessuna valutazione finora

- Robin Hood CaseDocumento4 pagineRobin Hood CaseRamizNessuna valutazione finora

- Final 2 2Documento3 pagineFinal 2 2RonieOlarteNessuna valutazione finora

- At PDF FreeDocumento15 pagineAt PDF FreemaekaellaNessuna valutazione finora

- Requirement No. 1: PROBLEM NO. 1 - Heats CorporationDocumento1 paginaRequirement No. 1: PROBLEM NO. 1 - Heats CorporationjhobsNessuna valutazione finora

- TX10 - Other Percentage TaxDocumento15 pagineTX10 - Other Percentage TaxKatzkie Montemayor GodinezNessuna valutazione finora

- Acceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting DecisionsDocumento12 pagineAcceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting Decisionsstannis69420Nessuna valutazione finora

- Studet Practical Accounting Ch17 PPE AcquisitionDocumento16 pagineStudet Practical Accounting Ch17 PPE Acquisitionsabina del monteNessuna valutazione finora

- Investment in Equity Securities Intacc1Documento3 pagineInvestment in Equity Securities Intacc1GIRLNessuna valutazione finora

- Grace-AST Module 1Documento12 pagineGrace-AST Module 1Devine Grace A. MaghinayNessuna valutazione finora

- AFAR Question PDFDocumento16 pagineAFAR Question PDFNhel AlvaroNessuna valutazione finora

- Assignment 2Documento4 pagineAssignment 2Ella Davis0% (1)

- Practice ProblemsDocumento3 paginePractice ProblemsSanjeev Ranjan25% (4)

- Assignment Open Ended Questions Revenue Recognition Construction ContractDocumento12 pagineAssignment Open Ended Questions Revenue Recognition Construction ContractBianca AcoymoNessuna valutazione finora

- Lemons Problems Arise in Capital Markets WhenDocumento1 paginaLemons Problems Arise in Capital Markets WhenDipak MondalNessuna valutazione finora

- Managerial Accounting Creating Value in A Dynamic Business Environment Hilton 10th Edition Solutions ManualDocumento11 pagineManagerial Accounting Creating Value in A Dynamic Business Environment Hilton 10th Edition Solutions Manualbarrenlywale1ibn8Nessuna valutazione finora

- This Study Resource Was: SolutionDocumento6 pagineThis Study Resource Was: SolutionChris Jay LatibanNessuna valutazione finora

- Reviewer Incremental Analysis 1Documento5 pagineReviewer Incremental Analysis 1Shaira Rehj RiveraNessuna valutazione finora

- Final Preboard May 08Documento21 pagineFinal Preboard May 08Ray Allen PabiteroNessuna valutazione finora

- Chapter 6 MillanDocumento57 pagineChapter 6 MillanAngelica AllanicNessuna valutazione finora

- Receipt and Disposition of InventoriesDocumento5 pagineReceipt and Disposition of InventoriesWawex DavisNessuna valutazione finora

- Financial AccountingDocumento72 pagineFinancial AccountingChitta LeeNessuna valutazione finora

- Jamb Principles-Of-Accounts Past Question 1994 - 2004Documento38 pagineJamb Principles-Of-Accounts Past Question 1994 - 2004Chukwudinma IkechukwuNessuna valutazione finora

- Principles of AccountsDocumento38 paginePrinciples of AccountsRAMZAN TNessuna valutazione finora

- Practice 5 - Accounting For Merchandising - Theories and Problem SolvingDocumento7 paginePractice 5 - Accounting For Merchandising - Theories and Problem SolvingAeron RamirexNessuna valutazione finora

- Bookkeeping Jobs: Scope of PracticeDocumento4 pagineBookkeeping Jobs: Scope of PracticeRural Bank CauayanNessuna valutazione finora

- Payroll: Explanation Quiz Questions and Answers (Q&A) Crossword PuzzlesDocumento1 paginaPayroll: Explanation Quiz Questions and Answers (Q&A) Crossword PuzzlesRural Bank CauayanNessuna valutazione finora

- Recording Transactions: Accounts PayableDocumento2 pagineRecording Transactions: Accounts PayableRural Bank CauayanNessuna valutazione finora

- Bookkeeping Terms: ..And Basic Accounting DefinitionsDocumento2 pagineBookkeeping Terms: ..And Basic Accounting DefinitionsRural Bank CauayanNessuna valutazione finora

- Branch Manager QualificationsDocumento2 pagineBranch Manager QualificationsRural Bank CauayanNessuna valutazione finora

- Horizantal Verticle NOTESDocumento4 pagineHorizantal Verticle NOTESKrishna TejaNessuna valutazione finora

- Tandon Committee Report On Working Capital: Norms and RecommendationsDocumento20 pagineTandon Committee Report On Working Capital: Norms and RecommendationsPrashant SharmaNessuna valutazione finora

- Project Report On Bharti AxaDocumento41 pagineProject Report On Bharti Axaavenger_guyNessuna valutazione finora

- Financial Management by SaumyaDocumento59 pagineFinancial Management by Saumyasaumyaranjanbiswal92Nessuna valutazione finora

- PP For Chapter 6 - Financial Statement Analysis - FinalDocumento67 paginePP For Chapter 6 - Financial Statement Analysis - FinalSozia TanNessuna valutazione finora

- Acme Laboratories Ltd. - Unsolicited-PtdDocumento13 pagineAcme Laboratories Ltd. - Unsolicited-PtdnasirNessuna valutazione finora

- Distribution Competitiveness GuideDocumento12 pagineDistribution Competitiveness GuideEilyn PimientaNessuna valutazione finora

- IE Chapter 3 - ProjectDocumento56 pagineIE Chapter 3 - Project10-12A1- Nguyễn Chí HiếuNessuna valutazione finora

- Analysis and Interpretation of Financial Statements: What's NewDocumento16 pagineAnalysis and Interpretation of Financial Statements: What's NewJanna Gunio50% (2)

- Marginal AnalysisDocumento10 pagineMarginal AnalysiscompheenaNessuna valutazione finora

- Accell-Group 2021Documento269 pagineAccell-Group 2021chungkiyanNessuna valutazione finora

- MBA-IB 2021-23: Pre-Read MaterialDocumento17 pagineMBA-IB 2021-23: Pre-Read MaterialSIDDHI KANSAL MBA 2021-23 (Delhi)Nessuna valutazione finora

- Financial Statement Analysis ToaDocumento6 pagineFinancial Statement Analysis ToaRampotz Ü EchizenNessuna valutazione finora

- Gujarat Appolo IndustryDocumento68 pagineGujarat Appolo IndustryFarhanNessuna valutazione finora

- FOOT LOCKER Financial AnalysisDocumento4 pagineFOOT LOCKER Financial AnalysisreyesNessuna valutazione finora

- Cash Flow AnalysisDocumento29 pagineCash Flow AnalysisUmer Zaheer100% (1)

- Executive Summary 1.0 Business DescriptionDocumento25 pagineExecutive Summary 1.0 Business DescriptionbonfaceNessuna valutazione finora

- Working Capital Management ReportDocumento51 pagineWorking Capital Management Reportmanojeti89% (9)

- Finance Assisgnment 2 - Princy Priyadarshini JohnDocumento39 pagineFinance Assisgnment 2 - Princy Priyadarshini JohnPrincy JohnNessuna valutazione finora

- 20 Laxmi-ThakurDocumento28 pagine20 Laxmi-ThakurSonu MallickNessuna valutazione finora

- PHD Thesis On Working Capital Management PDFDocumento5 paginePHD Thesis On Working Capital Management PDFBuyCustomPapersCanada100% (2)

- Assessment Task 1Documento47 pagineAssessment Task 1Sandra Lisset BerbesiNessuna valutazione finora

- International Working Capital Management: Dr. Ch. Venkata Krishna Reddy Associate ProfessorDocumento55 pagineInternational Working Capital Management: Dr. Ch. Venkata Krishna Reddy Associate Professorkrishna reddyNessuna valutazione finora

- Financial Analysis of Wipro LTD PDFDocumento101 pagineFinancial Analysis of Wipro LTD PDFAnonymous f7wV1lQKRNessuna valutazione finora

- Final Exam of WCADocumento5 pagineFinal Exam of WCABereket K.ChubetaNessuna valutazione finora