Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Kauai Property Home Exmption Form - Sept 30 Deadline

Caricato da

kauaiskyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Kauai Property Home Exmption Form - Sept 30 Deadline

Caricato da

kauaiskyCopyright:

Formati disponibili

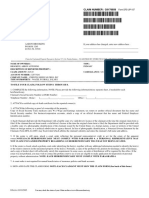

REAL PROPERTY ASSESSMENT DIVISION PRINT RESET

DEPARTMENT OF FINANCE, COUNTY OF KAUA'I FILING TAX MAP KEY (TMK)

DF-RP P-3 4444 RICE ST, SUITE 454, LIHUE, HI 96766-1326 DEADLINE

Phone 808-241 -4224 ZONE SECTION PLAT PARCEL CPR

Rev 05-13-2019

SEPTEMBER

CLAIM FOR HOME EXEMPTION

(Chap. 5A-11.1, 5A-I 1.4, 5A-11.5, KCC: 514A-6, HRS) 30TH

I. Home exemption is hereby claimed from Real Property Tax by:

____________________________________________________________ __________________________ _____________________________

(PRINT OWNER’S NAME) (SOCIAL SECURITY NUMBER) (DATE OF BIRTH)

____________________________________________________________ __________________________ _____________________________

(PRINT OWNER’S NAME) (SOCIAL SECURITY NUMBER) (DATE OF BIRTH)

Home Address ___________________________________________________________________________________________________________

Mailing Address__________________________________________________________________________________________________________

A. Is any portion of the property you reside on, used as a rental or business? Yes–Sq ft ______ Approx. days of the year _____ No

B. How many dwellings are located on this parcel? ______ Total number of living units on this parcel ____________

C. If more than one dwelling, indicate the approximate year built of the dwelling you occupy: _________

D. Do you or your spouse have a home exemption on any other property? Yes No

If Yes, indicate tax key / parcel identification no. ________________________________________

This is an authorization to cancel my previous exemption and apply it to this new parcel; applicable to Kaua‘i Island exemption only.

E. Have you filed a State of Hawai‘i resident income tax return (N-11 or N-13) within the last 12 months? Yes No

If NO, I am requesting a waiver from this requirement for the following reason: (INITIAL BELOW THE APPLICABLE OPTION.)

______ I/We am/are a new resident(s) to the State of Hawai‘i and will file a State of Hawai‘i resident income tax return (N-11 or N-13) not

(Initial) later than April 30th the year following this application. FAILURE TO FILE MAY RESULT IN A ROLLBACK OF ANY BENEFITS GRANTED.

______ I/We am/are not required to file under State of Hawai‘i Income Tax Law AND am not required to file income tax in any other

(Initial) judrisdiction other than at the U. S. Federal level. I/We agree to sign, in the presence of a notary under penalty of law, an Affidavit

certifying my income tax status.

II. Submit this Claim with proof of age. Acceptable proof are valid State of Hawai'i driver’s license, state registration card, birth

certificate, and government or legal documents. (Copies of above documents will be accepted with mail-submitted claims.)

III. CERTIFICATION

• I/We own and occupy this property as my/our principal home as of the assessment date;

Claiming the property as owned and occupied as your principal home, certifies that you are not claiming any other home

on Kaua‘i, in the state of Hawai‘i, in another state or in another country. The property is not used for secondary, temporary or vacation

purposes and is my true, fixed permanent home and principal residence.

• My/Our ownership is recorded at the Bureau of Conveyances in Honolulu on or before SEPT 30TH preceding the tax year for

which the exemption is claimed; AND

• I/We am/are filing a claim for the home exemption and submit it to the Real Property Assessment Division on or before

SEPT 30TH preceding the tax year for which the exemption is claimed.

Any person who has been allowed an exemption has a duty to report to the assessor within 30 days after he ceases to qualify for such exemption.

Failure to submit such a report shall be cause for disqualification and penalty of up to $200 for each year.

Any individual who intentionally misleads the Real Property Assessment Division by knowingly submitting false statments in this application may

be prosecuted for Unsworn Falsification to Authorities in violation of Section 710-1063 of the Hawaii Revised Statutes. Unsworn falsification is a

misdmemeanor and violations may result in imprisonment of up to one year and a $2,000 fine.

Dated: _____________________ 20_____

____________________________________ ______________________ __________________________________________________________________

OWNER’S SIGNATURE OWNER’S SIGNATURE

____________________________________ ____________________________________ ___________________________________________

Cell Phone Home Phone Email Address

(For Official Use)

Pitt #______ Bldg #______ Bldg #______ Bldg %______ Land %______

Approval pending: Recordation Building Appraiser review Other: __________________________________

Received by ________________________________________ ______________ 20_______ Effective _______________Tax Year

County of Kaua’i Documentation No: RPA 004

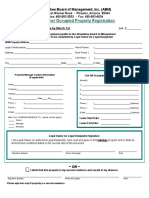

Real Property Administration

Home Exemption Administrative Rules & Policy Revision Level: 06-09-2010

Scope/Purpose

To promote and provide for a uniform and consistently applied response to all Claim for Home Exemption Filings.

Eligibility

Section 5A-11.4 of the Kaua'i County Code establishes the basis for eligibility of Home Use Exemption, whereas Section

5A-8.1(c)(4) sets forth the determining factors for Homestead tax classification. Administrative Rules were promulgated

and certified on June 9, 2010 to further clarify what factors may be considered in determining eligibility for both Home

Use Exemption and Homestead tax classification. These "Factors" are enumerated in Administrative Rules RP-10.3

Eligibility for Home Exemption and RP-10.4 Criteria for determination of “principal” home or residence Under these

Administrative Rule, the director may rely on the following criteria to determine whether real property is being used as the

owner’s “principal” home or residence:

Listed in order of Importance.

1. Amount of time used at this residence, which shall be based on a minimum of 181 calendar days per year;

2. Place of employment;

3. Where other family members reside;

4. The address used for tax returns, driver’s license, car and voter registration, bills and correspondence;

5. The location of the owner’s banks, religious organizations or recreational clubs;

6. Other uses of property, such as commercial activities, leasing or renting.

In addition, an owner who has temporarily moved into a care home may have his property deemed a “principal” home

or residence provided he does not rent the property or permit new individuals (other than immediate family members)

to reside at the property and meets all other applicable requirements of K.C.C. Sec. 5A-11.4.

Further, per K.C.C. Sec. 5A-11.4(a)(1)(E), the home exemption shall be applied only to the portion of the property

being used exclusively as a home. Should the entire property be rented or used for commercial activities for any

amount of time, the property shall not be considered an owner’s “principal” home or residence.

It should be noted that a property owner must obtain a Home Use Exemption to become eligible for the Homestead

tax classification; however merely obtaining a Home Use Exemption does not necessarily entitle that owner to the

Homestead tax class. Homestead tax classification is reserved solely for properties that are used exclusively

(emphasis added) as the owner’s principal home or residence. Uses that would preclude owner-occupants from

being considered Homestead properties include second dwellings, commercial use, transient vacation rental use,

home offices, bed-and-breakfast operations, and any other uses that may generate income, monetary gain or

economic benefit.

SOCIAL SECURITY NUMBER – The applicant's social security number is required for the purpose of establishing the

identity of the applicant for home exemption and maintaining a record of home exemption claims. The request is

authorized under the federal Social Security Act (42 U.S.C.A. Sec. 405(c)(2)(C). Disclosure is voluntary and will not

affect the allowance of a claim for exemption but failure to disclose may result in delay in verifying eligibility for the

claim. If disclosed, social security numbers will not be subject to public access.

Potrebbero piacerti anche

- Application Form For License To OperateDocumento2 pagineApplication Form For License To OperateARLASCO SECURITY AGENCY, INC.100% (4)

- Rental ApplicationDocumento4 pagineRental ApplicationMus MNessuna valutazione finora

- APPLICATION Purchase Residential Lot/Housing UnitDocumento1 paginaAPPLICATION Purchase Residential Lot/Housing UnitHana Park80% (5)

- PDFDocumento2 paginePDFAntonio BrookinsNessuna valutazione finora

- Re-KYC and operationalize inactive NRI accountDocumento4 pagineRe-KYC and operationalize inactive NRI accountranjit12345Nessuna valutazione finora

- PNP Es Housing FormDocumento3 paginePNP Es Housing FormSan Narciso Qppo PcadNessuna valutazione finora

- Application To Rent/Screening FeeDocumento2 pagineApplication To Rent/Screening FeeAna CastroNessuna valutazione finora

- Lot Links Application PDFDocumento4 pagineLot Links Application PDFAnthony Juice Gaston BeyNessuna valutazione finora

- AFFIDAVITDocumento2 pagineAFFIDAVITatty.elmanotarypublicNessuna valutazione finora

- Request For Converting Resident Indian' Savings Bank (SB) Account Into NRO SB AccountDocumento4 pagineRequest For Converting Resident Indian' Savings Bank (SB) Account Into NRO SB AccountSrinivasan DeviNessuna valutazione finora

- Form No.92-Affidavit of LossDocumento2 pagineForm No.92-Affidavit of LossMaica PinedaNessuna valutazione finora

- Iowa Rental Application FormDocumento5 pagineIowa Rental Application FormNeuro TonyNessuna valutazione finora

- Homestead Application 2018Documento7 pagineHomestead Application 2018Korey FrasNessuna valutazione finora

- NRI Account Conversion Request FormDocumento9 pagineNRI Account Conversion Request FormTusharNessuna valutazione finora

- Request For Converting Resident Indian' Savings Bank (SB) Account Into NRO SB AccountDocumento9 pagineRequest For Converting Resident Indian' Savings Bank (SB) Account Into NRO SB AccountnevinkoshyNessuna valutazione finora

- Property Tax Relief - Homestead and Farmstead Exclusion ApplicationDocumento3 pagineProperty Tax Relief - Homestead and Farmstead Exclusion ApplicationPAHouseGOPNessuna valutazione finora

- Utah Rental ApplicationDocumento2 pagineUtah Rental Applicationjbscribd123321Nessuna valutazione finora

- Apply for Tenancy at Arnold PropertyDocumento2 pagineApply for Tenancy at Arnold PropertyRebecca TeeNessuna valutazione finora

- PEZA Accreditation Application FormDocumento7 paginePEZA Accreditation Application FormEd CabreraNessuna valutazione finora

- GSIS Property Insurance Form1Documento1 paginaGSIS Property Insurance Form1metro midsayap water districtNessuna valutazione finora

- Re-KYC Diligence of NRE or NRO or FCNR (B) AccountDocumento4 pagineRe-KYC Diligence of NRE or NRO or FCNR (B) AccountMahendran KuppusamyNessuna valutazione finora

- NHA Application Form 1Documento1 paginaNHA Application Form 1TindusNiobetoNessuna valutazione finora

- NooprDocumento2 pagineNooprapi-254004364Nessuna valutazione finora

- FS Form 5188Documento3 pagineFS Form 51882Plus100% (4)

- Application For Demolition Certificate of Compliance FormsDocumento9 pagineApplication For Demolition Certificate of Compliance FormsJoeuardee PedoyNessuna valutazione finora

- Gove Company ApplicationDocumento4 pagineGove Company ApplicationhwuppstcyslofrseveNessuna valutazione finora

- Fidelity Foreign Tax Certification Form GuideDocumento2 pagineFidelity Foreign Tax Certification Form GuidemiscribeNessuna valutazione finora

- Rental FormDocumento5 pagineRental FormJorge LuissNessuna valutazione finora

- (Please Fill Out One Form Per Applicant) : Continued On BackDocumento2 pagine(Please Fill Out One Form Per Applicant) : Continued On BackSara BurkettNessuna valutazione finora

- HOUSING LOAN NRIDocumento4 pagineHOUSING LOAN NRIJatin ParmarNessuna valutazione finora

- Sav 5188Documento3 pagineSav 5188sopor,es painNessuna valutazione finora

- Application Form: Loan Requested Purpose of Loan DateDocumento2 pagineApplication Form: Loan Requested Purpose of Loan DateZulueta Jing MjNessuna valutazione finora

- Colorado Rental Application FormDocumento5 pagineColorado Rental Application FormMichelle TaylorNessuna valutazione finora

- APPLICATIONDocumento19 pagineAPPLICATIONSuranjan BhattacharyyaNessuna valutazione finora

- D&S Management Application AgreementDocumento4 pagineD&S Management Application AgreementshellshockincNessuna valutazione finora

- University Heights Contractor Registration FormDocumento5 pagineUniversity Heights Contractor Registration FormgarbagepatchNessuna valutazione finora

- Application To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramDocumento2 pagineApplication To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramCrislyne ItaliaNessuna valutazione finora

- TdcappDocumento1 paginaTdcappHitalo MariottoNessuna valutazione finora

- SEC Form IHU-ADocumento14 pagineSEC Form IHU-APatrick HarrisNessuna valutazione finora

- Applying for a Business PermitDocumento2 pagineApplying for a Business PermitJessel Recelestino-EsculturaNessuna valutazione finora

- Diplomatic Motor Vehicle ProgramDocumento11 pagineDiplomatic Motor Vehicle Programtafilli54Nessuna valutazione finora

- CONDITONAL DEED of SALE Template (With Rent-To-own) FormattedDocumento3 pagineCONDITONAL DEED of SALE Template (With Rent-To-own) FormattedRogelio CaratingNessuna valutazione finora

- vHUNGBYVmgVdSlqyCiSXnmuQ0eJ91OGhusTj1 ELz6zp0 RXMHdRtmuCJOlNRy Lo4jJxrNYjj6Documento1 paginavHUNGBYVmgVdSlqyCiSXnmuQ0eJ91OGhusTj1 ELz6zp0 RXMHdRtmuCJOlNRy Lo4jJxrNYjj6Reynald TayagNessuna valutazione finora

- Haryana Vidyut Prasaran Nigam LimitedDocumento10 pagineHaryana Vidyut Prasaran Nigam Limitedaloo leoNessuna valutazione finora

- Rental Application Template 02Documento3 pagineRental Application Template 02Lorena LongcopNessuna valutazione finora

- Auto-Offer PSBANKDocumento3 pagineAuto-Offer PSBANKAnna KristinaNessuna valutazione finora

- SAL FormDocumento4 pagineSAL FormMark Kevin Plasencia DobleNessuna valutazione finora

- Pacifico Kyc 2020 UpdateDocumento4 paginePacifico Kyc 2020 UpdateHamad FalahNessuna valutazione finora

- (10.2022) Simplified Appl Form For Home2u BAU AAsDocumento2 pagine(10.2022) Simplified Appl Form For Home2u BAU AAsazrulhakim1010Nessuna valutazione finora

- Application Form CorpDocumento3 pagineApplication Form CorpFort Nico Fajardo BuensucesoNessuna valutazione finora

- GPF FinalpmtDocumento4 pagineGPF FinalpmtFayaz KhanNessuna valutazione finora

- Housing Loan Application Form Schedule ADocumento1 paginaHousing Loan Application Form Schedule AMadster RobertsNessuna valutazione finora

- Application For Property Tax Abatement Exemption: Texas Comptroller of Public AccountsDocumento3 pagineApplication For Property Tax Abatement Exemption: Texas Comptroller of Public AccountsNnamdi AzikeNessuna valutazione finora

- 30-Day Notice To VacateDocumento1 pagina30-Day Notice To VacateNormal MixtaNessuna valutazione finora

- Affidavit (TT) PDFDocumento1 paginaAffidavit (TT) PDFLOUNGE HOMENessuna valutazione finora

- GPF Advance, Withdrawal & Final Payment FormDocumento7 pagineGPF Advance, Withdrawal & Final Payment Formabhityg1812Nessuna valutazione finora

- SLF002 CalamityLoanApplication V05-2Documento2 pagineSLF002 CalamityLoanApplication V05-2LouiseNessuna valutazione finora

- For Re-KYC Nredocument NRI - 18.5Documento4 pagineFor Re-KYC Nredocument NRI - 18.5rajucbit_2000Nessuna valutazione finora

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Da EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Nessuna valutazione finora

- How to Avoid Foreclosure in California, 2012 EditionDa EverandHow to Avoid Foreclosure in California, 2012 EditionNessuna valutazione finora

- Loosening Lending Restrictions Make It Easier For Hawaii Condominium Buyers To Get Mortgages - Pacific Business NewsDocumento2 pagineLoosening Lending Restrictions Make It Easier For Hawaii Condominium Buyers To Get Mortgages - Pacific Business NewskauaiskyNessuna valutazione finora

- Tim Mira 2018 Top 20 Real Estate SalesDocumento1 paginaTim Mira 2018 Top 20 Real Estate SaleskauaiskyNessuna valutazione finora

- Koloa Plantation Days 2016 Event ScheduleDocumento1 paginaKoloa Plantation Days 2016 Event SchedulekauaiskyNessuna valutazione finora

- MIRA Kauai Statistics September 2017Documento4 pagineMIRA Kauai Statistics September 2017kauaiskyNessuna valutazione finora

- MIRA Kauai Statistics - September 2016Documento4 pagineMIRA Kauai Statistics - September 2016kauaiskyNessuna valutazione finora

- Kauai County Surcharge On General Excise Tax As of Jan 2019Documento2 pagineKauai County Surcharge On General Excise Tax As of Jan 2019kauaiskyNessuna valutazione finora

- KoloaPlantationDays2017 EventScheduleDocumento1 paginaKoloaPlantationDays2017 EventSchedulekauaiskyNessuna valutazione finora

- 2016 Kauai Farm Fair ScheduleDocumento4 pagine2016 Kauai Farm Fair SchedulekauaiskyNessuna valutazione finora

- Kauai Farm Fair Schedule 2015Documento2 pagineKauai Farm Fair Schedule 2015kauaiskyNessuna valutazione finora

- Waiver Form 2015Documento2 pagineWaiver Form 2015kauaiskyNessuna valutazione finora

- KoloaPlantationDays2015 EventScheduleDocumento1 paginaKoloaPlantationDays2015 EventSchedulekauaiskyNessuna valutazione finora

- 2015 Kauai Okinawan FestivalDocumento1 pagina2015 Kauai Okinawan FestivalkauaiskyNessuna valutazione finora

- Kauai Jr. Lifeguard 2015Documento1 paginaKauai Jr. Lifeguard 2015kauaiskyNessuna valutazione finora

- FlavorsOfKukuiula March2015Documento1 paginaFlavorsOfKukuiula March2015kauaiskyNessuna valutazione finora

- Kauai Keiki Jr. Lifeguard 2015Documento1 paginaKauai Keiki Jr. Lifeguard 2015kauaiskyNessuna valutazione finora

- KoloaPlantationDays2013 EventScheduleDocumento1 paginaKoloaPlantationDays2013 EventSchedulekauaiskyNessuna valutazione finora

- HARPTA FAQsDocumento8 pagineHARPTA FAQskauaiskyNessuna valutazione finora

- Koloa Bus Shuttle ScheduleDocumento1 paginaKoloa Bus Shuttle SchedulekauaiskyNessuna valutazione finora

- KBR Scholarship Application 2013Documento2 pagineKBR Scholarship Application 2013kauaiskyNessuna valutazione finora

- KVMH GOLF Tournament Flyer ThanksgivingDocumento1 paginaKVMH GOLF Tournament Flyer ThanksgivingkauaiskyNessuna valutazione finora

- Kauai Musuem Christmas Craft Fair - Dec 7, 2012Documento1 paginaKauai Musuem Christmas Craft Fair - Dec 7, 2012kauaiskyNessuna valutazione finora

- 2012 Dine Out For Hunger FlyerDocumento1 pagina2012 Dine Out For Hunger FlyerkauaiskyNessuna valutazione finora

- 2009 2010 Waimea To KoloaDocumento4 pagine2009 2010 Waimea To KoloakauaiskyNessuna valutazione finora

- KVMH Golf Brochure Proof Changes EmailDocumento1 paginaKVMH Golf Brochure Proof Changes EmailkauaiskyNessuna valutazione finora

- KVMH GOLF Flyer FinalDocumento1 paginaKVMH GOLF Flyer FinalkauaiskyNessuna valutazione finora

- Kauai Farm Fair Schedule 2011Documento2 pagineKauai Farm Fair Schedule 2011kauaiskyNessuna valutazione finora

- GST Registration CertificateDocumento3 pagineGST Registration CertificateAccounts West India GlobalNessuna valutazione finora

- UST Faculty Union v. BitonioDocumento5 pagineUST Faculty Union v. BitonioEmir Mendoza100% (1)

- Overtime Pay for 12-Hour WorkdayDocumento15 pagineOvertime Pay for 12-Hour Workdayphilip_galeon100% (1)

- Deed of Extra Judicial Settlemnt With Sale Mariquita Linda M. Sumilang Et Al NewDocumento2 pagineDeed of Extra Judicial Settlemnt With Sale Mariquita Linda M. Sumilang Et Al Newjhonny braavooNessuna valutazione finora

- MOA BulSU-Northcast constructionDocumento7 pagineMOA BulSU-Northcast constructionRuiz JimNessuna valutazione finora

- BDCDocumento3 pagineBDCemily100% (2)

- Consumer Protection Act 2019Documento27 pagineConsumer Protection Act 2019Anav Aggarwal0% (1)

- DEED OF ABSOLUTE SALeDocumento2 pagineDEED OF ABSOLUTE SALeGeraldine Galicia-AmarNessuna valutazione finora

- Before The Hon'Ble District Court of Ranchi Jharkhand Under Section 20 of Civil Procedure Court, 1908Documento11 pagineBefore The Hon'Ble District Court of Ranchi Jharkhand Under Section 20 of Civil Procedure Court, 1908Kabir JaiswalNessuna valutazione finora

- Sample Notice of Lawsuit and Request For Waiver of Service of SummonsDocumento5 pagineSample Notice of Lawsuit and Request For Waiver of Service of SummonsStan Burman100% (2)

- Spouses Yu V Ngo Yee Te GR No. 155868Documento26 pagineSpouses Yu V Ngo Yee Te GR No. 155868Kaye Miranda LaurenteNessuna valutazione finora

- Consignment AgreementDocumento3 pagineConsignment AgreementPranav JainNessuna valutazione finora

- List of Accomodation Near TISS (2011-12)Documento6 pagineList of Accomodation Near TISS (2011-12)kopaljsNessuna valutazione finora

- PracCourtPrelims - ComplaintDocumento3 paginePracCourtPrelims - ComplaintPaoloTrinidadNessuna valutazione finora

- Youth Development Budget ActDocumento3 pagineYouth Development Budget ActPraisah Marjorey Casila-Forrosuelo PicotNessuna valutazione finora

- Material Transfer Agreement (Mta)Documento2 pagineMaterial Transfer Agreement (Mta)Ali BousadiaNessuna valutazione finora

- OBLICONDocumento60 pagineOBLICONanonymousgurll100% (6)

- LTD Digest 3Documento3 pagineLTD Digest 3Fernando BayadNessuna valutazione finora

- Daily Routines Esl Vocabulary Game Cards For KidsDocumento7 pagineDaily Routines Esl Vocabulary Game Cards For KidsIsabella IsaBellaNessuna valutazione finora

- Sample Lease Termination AgreementDocumento2 pagineSample Lease Termination AgreementIvy Audrey TelegatosNessuna valutazione finora

- 7a Initial PetitionDocumento105 pagine7a Initial PetitionAnna Burnham100% (1)

- Fausto Barredo, Petitioner, Vs - Severino Garcia and Timotea Almario, Respondents.Documento2 pagineFausto Barredo, Petitioner, Vs - Severino Garcia and Timotea Almario, Respondents.Innah Agito-RamosNessuna valutazione finora

- Review Estate and Business Tax ExemptionsDocumento2 pagineReview Estate and Business Tax ExemptionsAndre CarrerasNessuna valutazione finora

- Lista de Responsables de Las Firmas Bolivianas Vinculadas Con El Caso Panamá PapersDocumento3 pagineLista de Responsables de Las Firmas Bolivianas Vinculadas Con El Caso Panamá PapersLos Tiempos DigitalNessuna valutazione finora

- Adr CaseDocumento17 pagineAdr Caseshilpasingh1297Nessuna valutazione finora

- Individual Assignment Analyzes Breach of Contract IssuesDocumento4 pagineIndividual Assignment Analyzes Breach of Contract IssuesAlan LauNessuna valutazione finora

- 2 Introduction To ContractDocumento5 pagine2 Introduction To ContractMax TanNessuna valutazione finora

- PACU v Secretary of Education ruling upholds regulation of private schoolsDocumento3 paginePACU v Secretary of Education ruling upholds regulation of private schoolsAnonymous hS0s2moNessuna valutazione finora

- Rera 1Documento4 pagineRera 1flyingiq servicesNessuna valutazione finora