Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 15: Entry Modes and Strategic Alliances

Caricato da

TIEN NGUYEN THUY100%(1)Il 100% ha trovato utile questo documento (1 voto)

241 visualizzazioni3 pagineTesco's initial international expansion focused on developing nations due to opportunities for rapid growth in emerging markets with few competitors. Tesco creates value internationally by transferring capabilities, hiring local managers, partnering with local companies, and focusing on high-growth markets. In Asia, joint ventures allow Tesco to leverage local knowledge while mitigating risks like nationalization. Entering the US market represents a shift from Tesco's historic focus, and risks include strong competition, but Tesco believes different formats can penetrate different markets.

Descrizione originale:

Critical thinking

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoTesco's initial international expansion focused on developing nations due to opportunities for rapid growth in emerging markets with few competitors. Tesco creates value internationally by transferring capabilities, hiring local managers, partnering with local companies, and focusing on high-growth markets. In Asia, joint ventures allow Tesco to leverage local knowledge while mitigating risks like nationalization. Entering the US market represents a shift from Tesco's historic focus, and risks include strong competition, but Tesco believes different formats can penetrate different markets.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

241 visualizzazioni3 pagineChapter 15: Entry Modes and Strategic Alliances

Caricato da

TIEN NGUYEN THUYTesco's initial international expansion focused on developing nations due to opportunities for rapid growth in emerging markets with few competitors. Tesco creates value internationally by transferring capabilities, hiring local managers, partnering with local companies, and focusing on high-growth markets. In Asia, joint ventures allow Tesco to leverage local knowledge while mitigating risks like nationalization. Entering the US market represents a shift from Tesco's historic focus, and risks include strong competition, but Tesco believes different formats can penetrate different markets.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

Chapter 15: Entry Modes and Strategic Alliances

Critical Thinking and Discussion Questions

1. Review the Management Focus on Tesco.

a) Why did Tesco’s initial international expansion strategy focus on developing

nations?

Tesco was generating strong free cash flows by the early 1990s, and senior

management had to decide using part of that cash on overseas expansion. As

they looked at international markets, they found out the best opportunities

were in the emerging markets of Eastern Europe and Asia where there were few

capable competitors but strong underlying growth trends. Besides, the potential

of rapid revenue growth and supporting host government policies designed to

attract foreign companies are also reasons Tesco’s initial international expansion

strategy focus on developing nations

b) How does Tesco create value in its international operations?

There are factors that create value for Tesco:

- The company devotes considerable attention to transferring its core

capabilities in retailing to its new ventures,

- The company hires local managers and support them with a few operational

experts from the United Kingdom,

- The company’s partnering strategy in Asia has been a great asset because the

companies Tesco has teamed up with are good and have a deep

understanding of the markets in which they are participating,

- The company and its partners bring equally useful assets to the venture

which increases in the probability of success,

- The company focuses on markets with good growth potential but that lacks

strong indigenous competitors.

c) In Asia, Tesco has a long history of entering into joint venture agreements with

local partners. What are the benefits of doing this for Tesco? What are the

risks? How are those risks mitigated?

The benefits for the Tesco are:

- using local knowledge of the Asia’s competitive conditions, culture, language,

political systems, and business systems and;

- sharing the development cost and/or risks of opening foreign market with a

Asia partner;

- facing a low risk of being subject to nationalization or other forms of adverse

government interference.

The risks:

- The technology of Tesco might be stolen because of giving control of its

technology to its partner,

- Tesco does not have the tight control over subsidiaries,

- The share ownership arrangement can lead to conflicts and battles for

control if Tesco’s goal or objectives change or if they take different views as

to what the strategy should be,

- The companies involved could pull out, steal Tesco ideas, of fail and leave

Tesco with debt.

Those risks are mitigated by Tesco just involve 50/50.

d) In March 2006, Tesco announced that it would enter the United States. This

represents a departure from its historic strategy of focusing on developing

nations. Why do you think Tesco made this decision? How is the U.S. market

different from others Tesco has entered? What are the risks here? How do you

think Tesco will do?

- US is a big market. In UK, Tesco has consistently outperformed the Asda chain that

is own by Walmart. Tesco had done lots of pre-enter research before they decided

to enter in US market. Tesco believes that each market is unique and requires a

different approach. They found out that no single format can wholly penetrate a

market, after gaining experience in UK market. That is the reason the company has

developed a range of formats from convenience stores to hypermarkets that it

deploys to meet the needs and opportunities. Besides, they initially enter to US

market to increase market share and brand recognition in North America.

- Differences between developing countries and US market:

o United State is the developed country. So, the developed capital market in

US is higher than in others Tesco has entered. US also have high levels of

liquidity.

o Many strong competitors in all of its markets

o Different culture and customers’ tastes

- The risks that they might to face that the United States competitors could be

stronger than Tesco and kick Tesco out of its market.

2. Licensing propriety technology to foreign competitors is the best way to give up a

firm's competitive advantage. Discuss

A licensing agreement is an arrangement whereby a licensor grants the rights to

intangible property, such as patents, inventions, formulas, processes, designs,

copyrights, and trademarks, to another entity (the licensee) for a specified time

period, and in return, the licensor receives a royalty fee from the licensee. Firms are

attracted to licensing because licensing allows them to open a foreign market

without the costs and risks that are associated with the development. Licensing also

allows firms that have intangible property with business applications, in which the

firm itself does not to develop, to take advantage of market opportunities. Licensing

propriety technology to foreign competitors is the best way to give up a firm's

competitive advantage. For the most part, licensing proprietary technology to

foreign competitors raises the risk of a firm losing that technology. Therefore,

licensing should generally be avoided in these situations. Licensing may be a good

thing when the licensing arrangement can be structured in such a way to reduce the

risks of a firm's technological know-how being taken by licensees. A further example

is when a firm perceives its technological advantage as being only transitory, and it

considers rapid imitation of its core technology by competitors to be likely. In such

a case, the firm might want to license its technology as rapidly as possible to foreign

firms in order to gain global acceptance for its technology before imitation occurs.

By licensing its technology to competitors, the firm may deter them from developing

their own, possibly superior, technology, and they may be able to establish its

technology as the dominant design in the industry. However, the attractions of

licensing are probably outweighed by the risks of losing control over technology, and

licensing should be avoided.

3. Discuss how the need for control over foreign operations varies with firms’

strategies and core competencies. What are the implications of the choice of entry

mode?

A company’s core competencies can dictate how they choose to operate overseas

in foreign markets. For instance, no other foreign companies have control over its

exporting entry mode, but wholly owned subsidiaries have 100% control over its

foreign companies. On the other hand, the distinctive competencies will have effect

on which strategies to opt for. For example, if a company's distinctive competency

is based on proprietary technology, entering into a joint venture could be risky due

to losing control over that technology. This type of firm should seek expanding into

foreign countries through wholly owned subsidiary to maintain control over that

technology. In the same way, companies with distinctive management

competencies shouldn’t face a risk of losing their management skills to franchisees

or joint-venture partners. However, it is better for the firms to go for global strategy

at that situation.

Potrebbero piacerti anche

- International Business PDFDocumento2 pagineInternational Business PDFtsoyuli0% (1)

- Activity 2: Case Study: Which Approach Is Best?Documento5 pagineActivity 2: Case Study: Which Approach Is Best?Nina Alyssa OrtegaNessuna valutazione finora

- Sollar Cell ManufacturerDocumento3 pagineSollar Cell ManufacturerGeleen CantosNessuna valutazione finora

- 09 Activity 1Documento2 pagine09 Activity 1Nicola Aika MacasirayNessuna valutazione finora

- 10 Activity 1Documento3 pagine10 Activity 1Lyka DollesinNessuna valutazione finora

- Case Study: Solar Cell Manufacturer: BM1708 Task PerformanceDocumento2 pagineCase Study: Solar Cell Manufacturer: BM1708 Task Performancestella hallare50% (2)

- 11 Task Performance 1Documento2 pagine11 Task Performance 1NhinzKhuletz100% (1)

- Case StudyDocumento3 pagineCase StudySaira VillarNessuna valutazione finora

- 01 Activity 1-Logistics-ManagementDocumento2 pagine01 Activity 1-Logistics-ManagementAngeloNessuna valutazione finora

- 13 Activity 1Documento2 pagine13 Activity 1•MUSIC MOOD•Nessuna valutazione finora

- Bermudo Hazel 1Documento1 paginaBermudo Hazel 1Hazel BermudoNessuna valutazione finora

- Name: Date: Score:: Quiz I. Problem Solving (8 Items X 5 Points)Documento2 pagineName: Date: Score:: Quiz I. Problem Solving (8 Items X 5 Points)Raiza Cartago0% (1)

- In Order To Succeed in The Initiative?Documento3 pagineIn Order To Succeed in The Initiative?Alleya mae MinguezNessuna valutazione finora

- 11 Task Performance 2 PDFDocumento2 pagine11 Task Performance 2 PDFCristopher Rico DelgadoNessuna valutazione finora

- Sample Problems On Financial RatiosDocumento2 pagineSample Problems On Financial RatiosJaJe PHNessuna valutazione finora

- 03 Task Performance 1 (3) ENVDocumento2 pagine03 Task Performance 1 (3) ENVRalph Louise PoncianoNessuna valutazione finora

- CaseDocumento3 pagineCaseJessa GaloNessuna valutazione finora

- 05 Quiz 1Documento1 pagina05 Quiz 1juan linyaNessuna valutazione finora

- Week 11Documento1 paginaWeek 11Cindy Catulay TupalNessuna valutazione finora

- 11 Activity 1 TQMDocumento2 pagine11 Activity 1 TQMBea Catherine LaguitaoNessuna valutazione finora

- In Partial Fulfillment of Requirements To The Subject Operations Management EntitledDocumento6 pagineIn Partial Fulfillment of Requirements To The Subject Operations Management EntitledAyen MarquezNessuna valutazione finora

- SM 2021 S2 Topic 1 and 2 Learning ActivityDocumento2 pagineSM 2021 S2 Topic 1 and 2 Learning ActivityBùi Thị Thu HồngNessuna valutazione finora

- 06 eLMS Quiz 1 - ARGDocumento1 pagina06 eLMS Quiz 1 - ARGLacorte Jr MeranoNessuna valutazione finora

- Louie Anne Lim - 09 Quiz 1Documento1 paginaLouie Anne Lim - 09 Quiz 1Louie Anne LimNessuna valutazione finora

- 05 Activity 1 13 AnswerDocumento7 pagine05 Activity 1 13 AnswerAllyza RenoballesNessuna valutazione finora

- Dahunan, Ken Alvin H. BSBA 311 FACIMAN Activity 9Documento1 paginaDahunan, Ken Alvin H. BSBA 311 FACIMAN Activity 9ken dahunanNessuna valutazione finora

- 05 - Journal - 1 - TQMDocumento1 pagina05 - Journal - 1 - TQMjoan maganadNessuna valutazione finora

- 03 Review 1 TQMDocumento1 pagina03 Review 1 TQMNicole ReyesNessuna valutazione finora

- 07 Activity 1Documento3 pagine07 Activity 1Angel BinlayoNessuna valutazione finora

- 01 Online Activity 1Documento1 pagina01 Online Activity 1Venjo SanchezNessuna valutazione finora

- Business ResearchDocumento2 pagineBusiness ResearchGeleen CantosNessuna valutazione finora

- 11 Activity 2 OMDocumento1 pagina11 Activity 2 OMBea Catherine Laguitao0% (1)

- 10 LeDocumento5 pagine10 LearisuNessuna valutazione finora

- Entrep-10 Journal 1Documento1 paginaEntrep-10 Journal 1marjorie ArroyoNessuna valutazione finora

- Innovative MCI Units Finds Culture Shock in Colorado SpringDocumento3 pagineInnovative MCI Units Finds Culture Shock in Colorado SpringKervin AlubNessuna valutazione finora

- 10-Assigment-1 PQTDocumento8 pagine10-Assigment-1 PQTsamanthaNessuna valutazione finora

- ActivityDocumento2 pagineActivityDaniela AvelinoNessuna valutazione finora

- Group 3 Task Performance in TQMDocumento6 pagineGroup 3 Task Performance in TQMchristine joice bataanNessuna valutazione finora

- 02 Activity 2 CARMENDocumento2 pagine02 Activity 2 CARMENreighnaNessuna valutazione finora

- GAYETA, Robert Kyle P. MMW Weeks 11-12 Uses and AbusesDocumento4 pagineGAYETA, Robert Kyle P. MMW Weeks 11-12 Uses and AbusesKyle GayetaNessuna valutazione finora

- Task Performance Research Paper Outline I. BackgroundDocumento6 pagineTask Performance Research Paper Outline I. BackgroundmichaelabatraloNessuna valutazione finora

- Task Performance Instructions:: Criteria Description PointsDocumento1 paginaTask Performance Instructions:: Criteria Description PointsJong-suk OppxrNessuna valutazione finora

- Idea Builder CATILO, AlexisDocumento2 pagineIdea Builder CATILO, AlexisPercy Jason BustamanteNessuna valutazione finora

- Facilities 05 Review 1Documento2 pagineFacilities 05 Review 1zelestaireNessuna valutazione finora

- 03 Task Performance 1Documento6 pagine03 Task Performance 1Princess ParasNessuna valutazione finora

- VALERIO STEPHANIE DANIELLE M. 05 - Performance - Task - 1Documento1 paginaVALERIO STEPHANIE DANIELLE M. 05 - Performance - Task - 1Pen MartijaNessuna valutazione finora

- Pop Culture 04 Worksheet 3 RolunaDocumento2 paginePop Culture 04 Worksheet 3 RolunaShane Xavier Palma RolunaNessuna valutazione finora

- Behavioral Theory With Reference To Coca Cola CompanyDocumento1 paginaBehavioral Theory With Reference To Coca Cola CompanyRąheel HùssąinNessuna valutazione finora

- 06 Journal 1Documento1 pagina06 Journal 1GTABORADA,JOVELITA S.Nessuna valutazione finora

- 03 - Activity - 1 (1) SlazarrrjayboDocumento2 pagine03 - Activity - 1 (1) SlazarrrjayboJaybo SalazarNessuna valutazione finora

- Case Study Building Quality and Operational Excellence in ABBBDocumento1 paginaCase Study Building Quality and Operational Excellence in ABBBAnne Lorraine LeonenNessuna valutazione finora

- RAGASA 07 Activity 1Documento2 pagineRAGASA 07 Activity 1EMILY M. RAGASANessuna valutazione finora

- 1Documento4 pagine1joemarieNessuna valutazione finora

- 04 TP FinancialDocumento4 pagine04 TP Financialbless erika lendroNessuna valutazione finora

- The Life of An Iphone (Antonia, 2020) : Names Vless Butista Section Date ActivityDocumento4 pagineThe Life of An Iphone (Antonia, 2020) : Names Vless Butista Section Date ActivityJanine CalditoNessuna valutazione finora

- VaradDocumento4 pagineVaradvirat kohliNessuna valutazione finora

- Procter & Gamble (P&G) : ActivityDocumento1 paginaProcter & Gamble (P&G) : ActivityJean OrlinaNessuna valutazione finora

- Joennel M. Semilla Ms. Rowena Garcia The Entrepreneurial Mind Sample Problems On Financial RatiosDocumento2 pagineJoennel M. Semilla Ms. Rowena Garcia The Entrepreneurial Mind Sample Problems On Financial RatiosJoennel SemillaNessuna valutazione finora

- Tesco'S Case: International Business ManagementDocumento4 pagineTesco'S Case: International Business ManagementVân ĐàoNessuna valutazione finora

- Critical Thinking and Discussion QuestionsDocumento2 pagineCritical Thinking and Discussion QuestionsAlejandra NicolNessuna valutazione finora

- Network of Global Corporate Control. Swiss Federal Institute of Technology in ZurichDocumento36 pagineNetwork of Global Corporate Control. Swiss Federal Institute of Technology in Zurichvirtualminded100% (2)

- Comparative Analysis of Ulips and Mutual FundsDocumento58 pagineComparative Analysis of Ulips and Mutual FundsSami Zama100% (1)

- Accounting Standard 1 PDFDocumento4 pagineAccounting Standard 1 PDFChristopher Jacob MurmuNessuna valutazione finora

- 45 ..Islamic BankingDocumento47 pagine45 ..Islamic BankingShaguftaNessuna valutazione finora

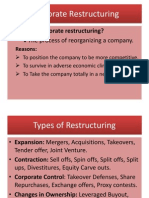

- Corporate RestructuringDocumento27 pagineCorporate RestructuringAkash Bafna100% (1)

- Global Disclosure of Economics and Business (GDEB)Documento160 pagineGlobal Disclosure of Economics and Business (GDEB)Asian Business ConsortiumNessuna valutazione finora

- Home Savings & Loan Bank v. Dailo DigestDocumento1 paginaHome Savings & Loan Bank v. Dailo DigestAce DiamondNessuna valutazione finora

- Specialists Trading Practices by Richard NeyDocumento2 pagineSpecialists Trading Practices by Richard Neyaddqdaddqd100% (2)

- 59 IpcccostingDocumento5 pagine59 Ipcccostingapi-206947225Nessuna valutazione finora

- 21 Sian Tuan Avenue ReportDocumento21 pagine21 Sian Tuan Avenue ReportJames YuNessuna valutazione finora

- Behavioural FinanceDocumento14 pagineBehavioural FinanceRadhakrishna MishraNessuna valutazione finora

- Chapter 12 (Income Tax On Corporations)Documento10 pagineChapter 12 (Income Tax On Corporations)libraolrackNessuna valutazione finora

- Spectra Foods & Beverages PVT LTD 2006 29697Documento10 pagineSpectra Foods & Beverages PVT LTD 2006 29697Bhavana PrettyNessuna valutazione finora

- Economies of Scale HandoutDocumento2 pagineEconomies of Scale HandoutrobtriniNessuna valutazione finora

- KW 4Documento50 pagineKW 4Roshan NanjundaiahNessuna valutazione finora

- Moodys KMV MaualDocumento226 pagineMoodys KMV MaualPuneet MishraNessuna valutazione finora

- Canpac Trends Private Limited: Instrument Amount Rated Rating ActionDocumento3 pagineCanpac Trends Private Limited: Instrument Amount Rated Rating ActionSaurabh JainNessuna valutazione finora

- Dprbidar Solar Power PVT LTD - Project Information MemorandumDocumento4 pagineDprbidar Solar Power PVT LTD - Project Information MemorandumCh YedukondaluNessuna valutazione finora

- Global Term Structure ModellingDocumento13 pagineGlobal Term Structure ModellingduffiekanNessuna valutazione finora

- Insurance Broking BusinessDocumento70 pagineInsurance Broking BusinessNevinJoy100% (3)

- The Stoic Investor: Possessed by Your PossessionsDocumento6 pagineThe Stoic Investor: Possessed by Your PossessionspadmaniaNessuna valutazione finora

- Financial Ratio Analysis Gp1 by Professor & Lawyer Puttu Guru PrasadDocumento56 pagineFinancial Ratio Analysis Gp1 by Professor & Lawyer Puttu Guru PrasadPUTTU GURU PRASAD SENGUNTHA MUDALIARNessuna valutazione finora

- Hbs Case - Ust Inc.Documento4 pagineHbs Case - Ust Inc.Lau See YangNessuna valutazione finora

- Question Paper International Finance and TradeDocumento12 pagineQuestion Paper International Finance and TradeRaghavendra Rajendra Basvan33% (3)

- Financial Statement Analysis OmfedDocumento65 pagineFinancial Statement Analysis OmfedJack RiderNessuna valutazione finora

- Credit Risk Management at State Bank of India Project Report Mba FinanceDocumento104 pagineCredit Risk Management at State Bank of India Project Report Mba FinanceNilam Pawar67% (3)

- Financial Ratio Calculator: Income StatementDocumento18 pagineFinancial Ratio Calculator: Income StatementPriyal ShahNessuna valutazione finora

- Aarti ProjectDocumento52 pagineAarti Projectsimran kumariNessuna valutazione finora

- Principle of ManagementDocumento6 paginePrinciple of ManagementWaqar AhmadNessuna valutazione finora

- What You Should Know About PMP FormulasDocumento23 pagineWhat You Should Know About PMP FormulasNicole MartinezNessuna valutazione finora