Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1.impact of Corporate

Caricato da

shovonDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

1.impact of Corporate

Caricato da

shovonCopyright:

Formati disponibili

Impact of Corporate Governance on

Audit Fees and Audit Quality:

A Study in the Insurance Industry of Bangladesh

Tanzina Haque FCMA Sadia Afroze

Associate Professor Associate Professor

Department of Accounting & Information Systems Department of Accounting & Information Systems

University of Dhaka University of Dhaka

tzh86@yahoo.com safroze@gmail.com

Fatema-Tuz-Zohra

Assistant Professor

Department of Accounting & Information Systems

University of Dhaka

Fatema.tuz.zohra.du@gmail.com

Abstract

Corporate Governance, audit fee and Audit quality are very important components for any organization to

ensure internal control and financial reporting procedures.This study is primarily done to measure the impact

of corporate governance on audit fee and audit quality in the insurance sector of Bangladesh considering

the growing importance of insurance industry for economic development. Though more than 63 insurance

companies are working now in Bangladesh covering life and general insurance, for the analysis of the scenario,

information was collected about 40 insurance companies out of 47 listed insurance companies in Dhaka

Stock Exchange. Among them 8 are life insurance company and other 32 are general insurance company of

Bangladesh. All the annual report of Insurance Company has been selected for 2017. It is evident that the

audit fee of insurance companies of Bangladesh is too much lower than that is proposed in minimum audit

fee schedule by the Institute of Chartered Accountants of Bangladesh (ICAB). Therefore, the contemporary

study targets to assess the relationship between corporate governance, audit fee and audit quality in the

insurance sector of Bangladesh. For this motive panel regression is used to analyze the relationship, and the

results showed that Corporate Governance (CG), Farm Size(FS) and leverage have a positive relationship

with audit fee and CG, FS and audit fee have a positive relationship with audit quality.

4 THE COST AND MANAGEMENT

ISSN 1817-5090,VOLUME-47, NUMBER-02, MARCH-APRIL 2019

Securities and Exchange Commission (BSEC) that,

Introduction:

the audit fee is the fees that must be paid for annual

Insurance sector is now one of the largest

audits, assurance and review of financial statements

contributory sectors in the total economy of

for every fiscal year. The amount of audit fee is not

Bangladesh. This sector generally signals the

fixed.Audit fee varies depending on these factors like

prospect and probability of other sectors too, as

assignment risk, the complexity of service, the level

insurance sector assists other sectors to be safe

of expertise required, the cost structure of client’s

from disasters. Insurance industry particularly has

firm, and other professional considerations, terms

special social interest because of its various functions

and conditions. Members of Public Accounting Firm

in society. The main aim of the modern insurance

are not allowed to have clients by offering a fee that

industry is to minimize the risk by association of the

could spoil the image of the auditing profession. So,

insured into the institutionalized risk communities,

all the considerations must be concluded to provide

i.e., insurance companies and to ensure direct

certainty to public accounting members and clients

economic protection against negative effects of

that audit fee will reflect the responsibility and risk

risk actuation through indemnity (Njegomir and

of public accounting.

Tepavac, 2014). In addition to the primary function,

insurance companies are also involved in exchange Audit Fee and Corporate Governance

and trade, credit improvement, mobilization of funds, Several researches have been conducted to take a

effective capital allocation and other activities that look at the relationship between the audit fee and

contribute directly to the society. So the successful CG. Study of Chow(1982), discovered the positive

management of this industry is very crucial for all and significant relationship between audit fee & CG.

stakeholders and for entire community. And that is Griffin, et al. (2010) mentioned that CG has both

only possible through good corporate governance the positive (increasing) & bad (decreasing) affect

which confirm a better quality audit and also have over the audit fee. Arshad,et al., (2011), examined

an impact on the determination of appropriate audit the positive impact of Audit committee over the

fees. So Corporate Governance, audit fee and Audit profitability of firm. According to Hamza (2018),

quality are very important components for any there is a significant impact of corporate governance

organization to ensure internal control and financial principles on auditor’s independence and audit fees.

reporting procedures. Governance in corporation

and its effectiveness can lead to organizational Firm Size

success. Reputed audit firms are consistently trying A plethora of research supplies the evidence

to improve the corporate governance mechanism between firm size and audit fee and determines the

(Abdullah,2008). On the other hand, failure or in- positive relationship between them. Study of Francis

effectiveness of corporate governance can lead to and Wang (2005), located the positive relationship

financial distress. Corporate governance practices of Audit fee with firm size. They analyzed that audit

ensure that audit quality is properly maintained. fee is related to total property of company. Similarly,

Audit quality ensures the accountability of the firm. Hay,et al. (2006), relates the audit fee with audit

Empirical evidence also shows that poor corporate quality and found the positive relationship between

governance decreases the audit quality of financial them. Moreover their study also concluded that

reporting (Cercello et al., 2002). The purpose of audit fee determines the audit quality.

this research is to observe the relationship between

Firms Leverage

corporate governance, audit fee and audit quality;

Highly leveraged corporations have more chances

and measure the impacts of corporate governance

of becoming bankrupt, that will lead to positive

on audit fee and audit quality.

relationship between the companies’ leverage and

audit fee because greater audit efforts are required

Literature review

for evaluation of leveraged company. Lu and Sapara

Audit and Audit fee (2009), mention that larger business risk association

According to Iskak(1999) (cited in Suharli, Michell will increase customer’s pressure for higher auditing

&Nurlaelah, 2008), audit fee is charged by a public quality, which in turn results in increase of audit fee.

accountant to the respective client for the financial Similarly, Bedard and Johnstone (2004), observed

audit services.This matches the opinion of Bangladesh the positive relationship between the company’s

leverage and audit fee.

5 THE COST AND MANAGEMENT

ISSN 1817-5090,VOLUME-47, NUMBER-02, MARCH-APRIL 2019

Audit Firm’s Size in the insurance industry than in different industries

Big 4 Audit firms in Bangladesh considered in that have been addressed by prior research. Audit

this study are: 1. Rahman Rahman Huq, KPMG in fees (Lin and Hwang, 2010), auditor size (Boone

Bangladesh; 2. A. Qasem& Co., Ernst & Young Global et al., 2010), and auditor recognition (Hope at al.,

Limited; 3. Deloitte Bangladesh Limited, Nurul Faruk 2008) are the most commonly listed indications of

Hasan & Co. (Nufhas); 4.PWC Bangladesh Private audit quality. These indicators are all conveniently

Ltd. relevant to the Big 4 (or 5 or 6) auditors. These Big

4 auditors are not only the biggest auditors in the

There are several reasons for charging high fees by world, but are also generally the auditors with the

large audit firms; Such as: best reputations and highest prices. According to

• Large audit firms charge higher fee due to the fact Hay et al. (2006), a Big 4 binary variable is the most

of its monopoly or oligopoly in market. commonly used indicator of audit quality. Hope

• Large audit firms charge a premium due to the fact et al., (2008), propose that the capacity to detect

of their audit quality services as in contrast to the material error in the financial statement is a function

services provided through their competitors. of auditor’s competence, whilst the propensity to

correct or reveal the material error is a function

DeAngelo (1981) suggests that large audit firms

of audit committee independence from the Board.

have high level of reputational risk so provides a

Based on the overwhelming proof that the use of

quality service to their customers & charges higher

Big 4 auditors is strongly associated to audit quality

amount for that.

measures, this study uses Big 4 auditing as a proxy

Audit Quality variable for audit quality.

According to American Accounting Association’s

Corporate Governance and Audit quality

(AAA) Financial Accounting Standard Committee

(2001), audit quality is determined by the professional Board Size

competence and sufficient independence.Widiastuty According to Lipton and Lorsch (1992),the dimension

and Febrianto (2010) said that audit quality is an audit of the board is associated with board’s controlling

operated by a competent, expertise and independent and monitoring ability. However, the literature on

person. All audit must meet the required auditing the effectiveness of board measurement on its

standards and quality control standards, because monitoring efficiency is mixed. Some argue that

one of the most essential objectives of external companies with smaller board are better governed.

financial reporting is to decrease company conflicts For example, Ozkan (2007) states that smaller

between the association and its various stakeholders boards are more effective in monitoring activities

(Healy and Palepu,2001; Hope et al.,2008). However, due to the fact they enjoy higher interaction and

in addition to the direct effects of audit quality on communication. However Lipton & Lorsch (1992)

accounting trustworthiness, oblique consequences and Jensen (1993) argue that larger boards are

of audit excellency are additionally observed; these related with the board monitoring capability because

effects are mediated by way of the associations companies with larger board enjoyextra expertise

between audit excellency and different mechanisms and experience. In alignment with these arguments

of corporate governance (O’Sullivan,2000; Carcello and findings, we assume that the board size provides

et al., 2002; Abbott et al., 2003; Knechel and toward the board high-quality and such board will

Willekens, 2006). Broye and Weill (2008) through an demand high quality audit, leading to enlarge in audit

empirical study examined an effect of audit quality on fees.

economic debt holders and document the existence Board Independence

of a fantastic affiliation between audit first-class and It is the primary obligation of the independent

leverage. Numerous researches have reported that directors to monitor the movements and decisions

audit quality is generally applicable to the funding of top managers to guard the shareholders’ interest

decisions that are made through investors and other from the managers’ opportunistic behavior. Prior

participants in capital markets. Because Insurance research found that the independent directors are

Companies are regularly collecting funds from thought about as sound governance mechanism

external shareholders, there is no reason to anticipate due to their monitoring function, because they

that audit quality possessing much less significance

6 THE COST AND MANAGEMENT

ISSN 1817-5090,VOLUME-47, NUMBER-02, MARCH-APRIL 2019

are not under the any hierarchal authority and do They documented a high-quality relationship

not face the issue of retaliation. Moreover, Beatty between audit committee independence and audit

and Zajac (1994) also stated that the independent fee.

directors are regarded to be really useful for the Based on the valid arguments and empirical studies

organization, because they are much less conciliatory shown by the literature we can develop the following

for top management. In alignment with the above hypothesis which will be tested by the research

argument, preceding research suggested that board model:

independence is positively related with audit fees,

Hypothesis formulation: -

because the independent directors demand high-

quality audit. H1: There is positive relationship between audit fee

and audit quality.

Audit Committee

The Blue RibbonCommittee’s (BRC) (1999) gives H2: Audit quality is positively related with firm size.

a strong suggestion concerning theexistence of H3:In case of better corporate governance audit

an audit committee and its characteristics like quality will be better.

audit committee size, independence and financial H4: More the leveraged company, higher will be their

information of the audit committee which results audit fee.

in strong audit committee oversight of financial

H5:In case of better corporate governance audit fee

statement disclosures. According to McMullen and

will be higher.

Roghurandan (1996), the internal audit committee

of a company helps reliable financial reporting and H6: Larger the firm size the audit fee will be higher.

reduces the incidence of errors, irregularities and H7:The larger the audit firm, the higher the audit fee

every other such indicator of unreliable reporting. will be charged.

Their finding assists that the presence of an audit

committee will lead to high corporatedisclosures. Research Methodology

Similarly, Bangladesh Code of Corporate Governance The research paper is carried out on the basis

(2012) also ensures the existence of internal audit of secondary data found in the listed insurance

committee and expects a better financial reporting companies of Dhaka Stock Exchange (DSE) in

as an effect of a presence of audit committee. Bangladesh.There are 47 listed insurance companies

in DSE of which 12 are life and 35 are non-life

Audit Committee Size

(general) insurance company. For the purpose of

BRC report (1999) suggests that in order to

this study 40 listed insurance companies were

be effective an audit committee must consist of

taken out of which 8 are Life Insurance Company

adequate members with greater independence.

and 32 are general insurance companies.The Dhaka

According to Braiotta (2000), suggestions

Stock Exchange (DSE) website and Lanka Bangla

involving audit committee size are to improve its

investment portal have been used to collect the

organizational status. Correspondingly,large sized

necessary data.

audit committee is legitimized by way of a meaningful

organizational guidance from the board and regarded An essential purpose of this study is to observe the

as an authoritative body, not only by internal audit relationship of CG and Audit Fee. And the analysis

function, but also by way of an external auditor. consists of total 5 variables: Audit Fee (dependent

variable), G-score (Independent variable) and Firm

Audit Committee Independence

size, Audit firm size and Leverage (three controlled

According to Abbott et al., (2003), the improved

variables).

percentage of non-executive directors on audit

committee strengthens oversight of financial The other essential purpose of the study is to observe

reporting, which leads to lower probabilities the relationship of CG and Audit Quality for which

of unreliable financial reporting. Therefore, 4 variables are selected: Audit Quality (dependent

nonexecutive directors dominated audit committee variable), G- Score (independent variable) and Firm

facilitate excessive high-quality of financial reporting Size and Audit Fee (controlled variables).

and improves the objectivity of the audit committee. Tables 1, 2 and 3 provide the operational definitions

of these variables.

7 THE COST AND MANAGEMENT

ISSN 1817-5090,VOLUME-47, NUMBER-02, MARCH-APRIL 2019

Table1: Operational Definitions of Study Table3: Definitions of four Dichotomous

Variables Variables used for G-Score

Name of Name of

Symbol Definitions Symbol Definitions

Variable Variable

Dependent Audit Natural log of audit fee Board Size B Size If the company board size less

Variable: Fee than the sample median value

Independent G-Score It is measured by summing up takes the value 1 or otherwise

Variable: the four variables, i.e., Board takes the value 0.

Governance Size, Board Independence, Board B If the company percentage of

score Remuneration & Audit Independence Independence independent outside directors

Committee and Audit is greater than sample

Committee Independence. median value takes value 1 or

It indicates maximum otherwisetakes the value 0.

governance quality 4 and Remuneration REM_Audit If the company have both

minimum governance quality 0. & audit the remuneration and audit

Control Variables Firm size is calculated by taking committee committees takes value 1 or If

: natural log of firm's total asset. the company doesn't have both

Firm size F Size Big 4 audit firms of Bangladesh. the remuneration and audit

If it is related to one of the big committees takes value 0

Auditor firm size Big 4 4 audit firms of Bangladesh, Audit Aud If the company percentage of

variable takes the value 1, or committee Independence independent outside directors

if it is not related to one of

Independence on the audit committee is

the big four audit firms of

greater than sample median

Bangladesh,variable takes the

value takes value 1 or

value 0.

otherwise takes the value 0.

Calculated as total debt/ total This research study is a quantitative analysis (using

assets of the

Leverage Leverage company. STATA software)to determine the impact of CG on

audit fee and audit quality in the insurance sector of

Bangladesh, thus retaining the operational definitions

Table2: Operational Definitions of Study

of the variables and hypotheses of the study, the

Variables

research models are produced as follows:

Name of

Symbol Definitions

Variable Model 1: Audit Fee =β0 + β1 G-Score + β2 FS + β3

Dependent It is measured by summing up Big4 + β4 Lev + ε

Variable: the three variables, i.e., Big 4

Audit Quality Audit audit firms, Audit Committee Model 2: Audit Quality =β0 + β1 G-Score + β2 FS +

Quality Independence and Presence of

board-reporting internal

β3 Audit Fee + ε

Auditors

Independent It is measured by summing up Findings

Variable: the four variables, i.e., Board

Governance G-Score Size, Board Independence, Descriptive Statistics of four Dichotomous

score Remuneration & Audit Variables:

Committee and Audit

Committee Independence. It Table 4 shows the descriptive statistics of four

indicates maximum governance dichotomous variables.The table shows that

quality 4 and minimum

governance quality 0. the median value of board size (BS) is 17 for

Control Variables : board independence, the median value is 12% for

Firm Size F Size Firm size is calculated by taking independent directors in board structures. Moreover,

natural log of firm's total asset.

Audit Fee Audit Natural log of audit fee median value of remuneration & audit committee

Fee is 1. Finally, for audit committee independence, the

median value is 25% independent directors in Audit

committee.

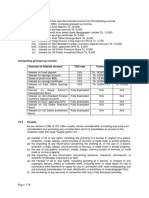

Table 4: Descriptive Statistics of Four Dichotomous Variables

Obser. Mean Median Maxi. Mini Std. Dev

Board Size 40 16.2 17 20 5 3.53

Board Independence 40 0.15 0.12 .40 .05 0.07

REM_Audit Committee 40 1 1 1 1 1

Audit Committee Independence 40 0.30 .25 .67 .11 0.15

8 THE COST AND MANAGEMENT

ISSN 1817-5090,VOLUME-47, NUMBER-02, MARCH-APRIL 2019

Descriptive Statistics of Study Variables median value 2 & standard deviation 1.07. Moreover,

for Model 1: log value total assets of sample firms to represent

Table 5 shows the results for descriptive statistics the firm size ranges from maximum value 10.64

of all the 5 variables. Results shows the log value to minimum value 8.79, having a mean value of F.

of audit fee ranges from 6.09 to 4.70 having Size is 9.39, median value 9.16 & standard deviation

mean value of 5.35, median value 5.38 & standard 0.52. However, maximum leverage value is 0.16 and

deviation 0.30. Similarly, governance score (G-Score) minimum value of leverage is 0 with mean value

of sample firms ranges from maximum value 4 to of 0.02 & median value of 0. Big 4 being a dummy

minimum value 1, mean value of G-Score is 2.3, variable have maximum value of 1and the minimum

value of 0.

Table 5: Descriptive Statistics of Study Variables for Model 1

Obser. Mean Median Maxi. Mini Std. Dev.

AuditFee 40 5.35 5.38 6.09 4.70 0.30

GScore 40 2.3 2 4 1 1.07

F.Size 40 9.39 9.16 10.64 8.79 0.52

Big 4 40 0.1 0 1 0 0.30

Lev 40 0.02 0 0.16 0 0.04

Descriptive Statistics of Study Variables minimum value 1, mean value of G-Score is 2.3,

for Model 2: median value 2 & standard deviation 1.07. Moreover,

Table 6 shows the results for descriptive statistics log value total assets of sample firms to represent

of all the 4 variables. Results shows the log value the firm size ranges from maximum value 10.64

of audit quality ranges from 2.4 to 1.11 having to minimum value 8.79 , having a mean value of F.

mean value of 1.34, median value 1.25 & standard Size is 9.39, median value 9.16 & standard deviation

deviation 0.26. Similarly, governance score (G-Score) 0.52. However, maximum audit fee value is 6.09 and

of sample firms ranges from maximum value 4 to minimum value of audit fee is 4.70 with mean value

of 5.35 & median value of 5.39.

Table 6: Descriptive Statistics of Study Variables for Model 2

Obser. Mean Median Maxi. Mini Std. Dev.

Audit quality 40 1.34 1.25 2.4 1.11 0.26

G-Score 40 2.3 2 4 1 1.07

F. Size 40 9.39 9.16 10.64 8.79 0.52

Audit Fee 40 5.35 5.39 6.09 4.70 0.30

Regression Analysis for Model 1:

Regression analysis was performed to find out relationship between the audit fee and corporate

whether corporate governance (CG), firm size governance (CG). Again, the results show that there

(FS), auditor firm size (Big 4) and leverage are is a positive and significant impact of firm size (FS)

the predictors of audit fee. Major findings of the on audit fee (= .2348427). This result additionally

regression analysis in form of estimated relationships supports the hypothesis (H6) of the study that there

are shown in the Table 7. Table 7 provides “beta” is positive relationship between the audit fee and

value for every variable as well as its standard error firm size (FS). Similarly, there is a positive impact of

in parenthesis. In order to estimate the relationship, Leverage on audit fee (=.0025096) supported (H4)

audit fee was regressed on the corporate governance and auditor firm size (Big 4) on audit fee (=.3147481)

(CG), firm size (FS), leverage and auditor firm size (H7). Moreover, outcomes of the regression analysis

(Big 4). The results illustrate that there is a positive also show that independent variables, (Corporate

impact of corporate governance (CG) on audit governance(CG), firm size(FS), leverage & audit firm

fee (=.0232464). This statistically significant result size(Big 4),account for 29.70% significant variance in

supports the hypothesis (H5) that there is positive

9 THE COST AND MANAGEMENT

ISSN 1817-5090,VOLUME-47, NUMBER-02, MARCH-APRIL 2019

audit fee (R = .2970).Thus, hypotheses of the study are established and these outcomes are in consistent with

preceding studies.

Table 7: Regression Results for Model 1

*(5 variables, 40 observations pasted into data editor)

Regressauditfeegscore fs bigfour lev

Source SS df MS Number of obs = 40

Model 1.07546081 4 .268865202 F( 4, 35) = 3.70

Residual 2.54550823 35 .072728807 Prob> F = 0.0130

R-squared = 0.2970

Adj R-squared = 0.2167

Root MSE = .26968

Auditfee Coef. Std. Err. T P>|t| [95% Conf. Interval]

Gscore .0232464 .0405698 0.57 0.570 -.0591147 .1056075

Fs .2348427 .0837198 2.81 0.008 .0648824 .4048031

Bigfour .3147481 .143463 2.19 0.035 .0235027 .6059934

Lev .0025096 1.028139 0.00 0.998 -2.084724 2.089744

3.064438 .7915812 3.87 0.000 1.457442 4.671433

Regression Analysis for Model 2:

Regression analysis was performed to find out corporate governance (CG). Again, the results show

whether corporate governance (CG), firm size (FS) that there is a positive and significant impact of firm

and audit fee are the predictors of audit quality. size (FS) on audit quality (= .0086045). So the result

Major findings of the regression analysis in form of supports the hypothesis (H2)of the study that there

estimated relationships are shown in the Table 8. is a positive relationship between the audit quality

Table 8 provides ''beta'' value for every variable as and firm size (FS).Similarly, there is a positive impact

well as its standard error in parenthesis. In order to of audit fee on audit quality (=.3059354) which

estimate the relationship, audit quality was regressed support hypothesis (H1). Moreover, outcomes of

on the corporate governance (CG), firm size (FS) the regression analysis also show that independent

and audit fee. The results illustrate that there is a variables (Corporate governance (CG), firm size

positive impact of corporate governance (CG)on (FS), audit fee account for 38.18% and significant

audit quality (=.1107733). This statistically significant variance in audit fee(R = .3818). Thus, hypotheses of

result supports the hypothesis (H3) that there is a the study are established and these outcomes are in

positive relationship between the audit quality and consistent with preceding studies.

Table 8: Regression Results for Model 2

*(4 variables, 40 observations pasted into data editor)

regress audit quality g score fs auditfee

Source SS Df MS Number of obs = 40

Model .99595376 3 .331984587 F( 3, 36) = 7.41

Residual 1.61250316 36 .044791755 Prob> F = 0.0005

R-squared = 0.3818

Adj R-squared = 0.3303

Total 2.60845692 39 .066883511 Root MSE = .21164

Auditquality Coef. Std. Err. t P>|t| [95% Conf. Interval]

Gscore .1107733 .0319726 3.46 0.001 .0459298 .1756167

Fs .0086045 .0721966 0.12 0.906 -.137817 .155026

Auditfee .3059354 .1243375 2.46 0.019 .0537673 .5581034

_cons -.6337465 .7123869 -0.89 0.380 -2.078534 .8110411

Conclusion

Throughout this extensive study, it becomes clearly that there exists a positive relationship between the

evident that corporate governance, audit fee and G-Score and Audit Fee. Moreover, the effects also

audit quality are not isolated from each other. The showed that there exists a positive relationship

results of the study through Model 1 demonstrate between Audit Fee and Firm Size. Further, the results

10 THE COST AND MANAGEMENT

ISSN 1817-5090,VOLUME-47, NUMBER-02, MARCH-APRIL 2019

showed that there is positive relationship of Audit Bedard, J. and K. Johnstone, 2004. Earnings manipulation risk, corporate

governance risk and auditors' planning and pricing decisions. The

Fee with Leverage. Finally, the relationship between Accounting Review,Vol 79(2),pp. 277-304.

Audit Fee and Audit Firm Size is positive. Thus, the Blue Ribbon Committee (BRC) (1999). Report and Recommendations

of the Blue Ribbon Committee on Improving the Effectiveness of

outcomes of the present study prove that audit fee Corporate Audit Committees. New York Stock Exchange, New York,

is a function of corporate governance (CG), firm USA.

size (FS), audit firm size (big 4) and leverage. Similarly Boone, J. P., Khurana, I. K., & Raman, K. K. (2010). Do the Big 4 and

the Second- tier firms provide audits of similar quality.Journal of

Model 2 demonstrate that there exists a positive Accounting & Public Policy,Vol 29, pp. 330-352.

relationship between the G-Score and Audit Quality. Braiotta, L. (2000). The Audit Committee Handbook, New York: Wiley,

USA.

Moreover, the results also showed that there exists

Broye, G. and Weill, L. (2008). Does leverage influence auditor choice?

a positive relationship between Audit Quality and A cross-country analysis. Applied Financial Economics, Vol. 18, issue

9, pp. 715-731.

Firm Size and also have a positive relationship of

Carcello, J. V., Hermanson, D. R., Neal, T. L., & Riley Jr, R. A. (2002). Board

Audit Quality with Audit Fee. Thus the outcomes Characteristics and Audit Fees,Contemporary Accounting Research,

of the present study prove that audit quality is a Vol 19, pp. 365-384.

Chow, C.W., (1982). The demand for external auditing: size, debt and

function of corporate governance (CG), firm size ownership influences. The Auditing Review,Vol 57(2): pp. 272-291.

(FS) and the size of the audit firm. Actually basic DeAngelo, L. (1981). Auditor independence, low-balling and disclosure

corporate governance ensures high audit quality regulation. Journal of Accounting and Economics,Vol 3, pp. 113-27.

Francis, J.R. and D. Wang, 2005, Impact of the SEC’s public fee disclosure

and in that relationship audit fee plays its role. To requirement on subsequent period fees and implications for market

ensure better and more applicable audit quality, efficiency.Auditing: A Journal of Practice and Theory, 24(supplement),pp.

145-60.

corporate governance and its proper practices

Griffin, P. A., Lont, D. H., and Sun,Y. (2010). Agency problems and audit fees:

within and outside the organization needs to be further tests of the free cash flow hypothesis. Accounting and Finance,

addressed. Audit fee needs to be reasonably good so Vol50, Issue2, June 2010, pp. 321-350.

Hamza, M. (2018). The Impact of Corporate Governance on Auditor’s

that it doesn’t distract corporate governance. Other Independence and Audit Fees: An Empirical Study of Jordanian

issues that might come into equation like Broad size, Insurance Companies Listed on Amman Stock Exchange. International

Journal of Economics and Finance,Vol 10, p171.

Leverage, Firm size needs to be reviewed to reduce

Hay, D., W. Knechel and N. Wong, 2006. Audit fees: a meta-analysis of the

the gap that ultimately be beneficial for corporations. effect of supply and demand attributes. Contemporary Accounting

Research,Vol 23(1): pp. 141- 191.

The insurance companies are now facing extreme Healy, P.M. and Palepu, K. G. 2001. Information asymmetry, corporate

competition due to contemporary forces of disclosure, and the capital markets: A review of the empirical

disclosure literature. Journal of Accounting and Economics, vol. 31, issue

globalization, changing customer’s demands and 1-3, pp. 405-440

technological changes for better quality. To survive Hope, O.K., Kang, T., Thomas, W., &Yoo, Y. K. (2008). Culture and auditor

choice: A test of the secrecy hypothesis. Journal of Accounting & Public

in this turbulent environment, organizations Policy,Vol 27, pp. 357-373.

not only have to encourage good corporate Jensen, M. C. (1993).The modern industrial revolution, exit, and the failure

governance practices, but also have to improve of internal control systems. Journal of Finance,Vol 48(3), pp. 831-880.

Knechel, W. &Willekens, M. (2006). The Role of Risk Management and

their performance for transparency of financial Governance in Determining Audit Demand. Journal of Business Finance

statements and assurance of fairness. In order to & Accounting.Vol 33. Pp. 1344-1367.

refrain management from the activities detrimental Lin, J.W., & Hwang, M. I. (2010). Audit Quality, Corporate Governance, and

Earnings Management: A Meta-Analysis. International Journal of Auditing,

to the welfare of the company, audit fee structure, Vol 14, pp.57- 77.

good corporate governance and audit independence Lipton, M. and Lorsch, J. (1992). A modest proposal for improved

corporate governance. The Business Lawyer,Vol 48(1), pp.59-77.

should get the highest importance.

Lu, T. and H. Sapra, 2009.Auditor conservatism and investment efficiency.

References: The Accounting Review,Vol 84(6), pp. 1933-1958

AAA Financial Accounting Standards Committee. (2001). Commentary: Mcmullen, D.A. &Roghurandan, K. (1996). Enhancing audit committee

SEC auditor independence requirements. Accounting Horizons, Vol effectiveness. Journal of Accountancy,Vol 182, pp. 79-81.

15(4), pp. 373-386 Njegomir, V. and Tepavac, R. (2014). Corporate Governance in Insurance

Abbott, L. J., Parker, S., Peters, G. F. and Raghunandan, K. (2003). The Companies. Management,Vol, 19. pp. 81-95.

association between audit committee characteristics and audit fees. O’Sullivan, N. (2000).The impact of board composition and ownership on

Auditing: A Journal of Practice &Theory,Vol 22 (2), pp. 17-32. audit quality: evidence from large UK companies. British Accounting

Abdullah, W.Z.W. (2008), The Impact of Board Composition, Ownership Review,Vol, 32(4), 397-414.

and CEO Duality on Audit Quality: The Malaysian Evidence. Malaysian Ozkan, N. (2007). Do Corporate Governance Mechanisms Influence

Accounting Review,Vol.7, No. 2, PP. 17-28 CEO Compensation? An Empirical Investigation of UK Companies.

Arshad,A.M., Satar, R.A., Hussain, M., and Naseem,A. (2011). Effect of audit Journal of Multinational Financial Management,Vol, 17. 349-364.

on profitability: a study of cement listed firms, Pakistan. Global Journal Suharli, Michell &Nurlaelah. (2008). The concentration of the auditor and

of Management and Business Research,Vol 11(9). the audit fee determination: Investigation on SOEs. Jurnal Akuntansidan

Beatty, R. P., and Zajac, E. J. (1994). Managerial incentives, monitoring, Auditing Indonesia, Vol 12. Issue (2). pp. 133-148

and risk bearing: A study of executive compensation, ownership, Widiastuty, E. &Febrianto, R. (2010). The measurement of audit quality: an

and board structure in initial public offerings. Administrative Science essay. Scientific Journal of Accounting and Business,Vol 2.

Quarterly,Vol 39(2), pp. 313-315.

11 THE COST AND MANAGEMENT

ISSN 1817-5090,VOLUME-47, NUMBER-02, MARCH-APRIL 2019

Potrebbero piacerti anche

- Yu 2020Documento7 pagineYu 2020Rusli RusliNessuna valutazione finora

- 01 IRMM8341alhajayaokeyDocumento9 pagine01 IRMM8341alhajayaokeyajNessuna valutazione finora

- D. I. PurnamasariDocumento5 pagineD. I. PurnamasariBella TansilNessuna valutazione finora

- Factors Affecting Audit Firms Rotation Jordanian CaseDocumento20 pagineFactors Affecting Audit Firms Rotation Jordanian CaseSarah FawazNessuna valutazione finora

- Audit Quality - The IAASB's FrameworkDocumento5 pagineAudit Quality - The IAASB's FrameworkSadia 55Nessuna valutazione finora

- Bai Nghien Cuu 4Documento15 pagineBai Nghien Cuu 4Ưng Nguyễn Thị KimNessuna valutazione finora

- The Impact of Audit Committee Characteristics On Audit Fees Evidence From GhanaDocumento21 pagineThe Impact of Audit Committee Characteristics On Audit Fees Evidence From Ghanachavala allen kadamsNessuna valutazione finora

- Risk Management Committee, Auditor Choice and Audit Fees: ArticleDocumento16 pagineRisk Management Committee, Auditor Choice and Audit Fees: ArticleKahfi PrasetyoNessuna valutazione finora

- Audit Quality and Audit Firm ReputationDocumento10 pagineAudit Quality and Audit Firm ReputationEdosa Joshua AronmwanNessuna valutazione finora

- Does Audit Fees and Non-Audit Fees Matters in Audit Quality?Documento11 pagineDoes Audit Fees and Non-Audit Fees Matters in Audit Quality?Addoula TOUNSINessuna valutazione finora

- Risks: Risk Management Committee, Auditor Choice and Audit FeesDocumento15 pagineRisks: Risk Management Committee, Auditor Choice and Audit FeesYulianti RaharjoNessuna valutazione finora

- Effective Factors On The Determination of Audit Fees in IranDocumento8 pagineEffective Factors On The Determination of Audit Fees in IranIzz NaimiNessuna valutazione finora

- Term Paper Insurance CompanyDocumento24 pagineTerm Paper Insurance CompanyartusharNessuna valutazione finora

- Impact of Audit Failures and Internal Control On Performance of Public Companies in OmanDocumento9 pagineImpact of Audit Failures and Internal Control On Performance of Public Companies in OmanBOHR International Journal of Business Ethics and Corporate GovernanceNessuna valutazione finora

- Ilechukwu, Felix UbakaDocumento8 pagineIlechukwu, Felix UbakaMariaa IvannaNessuna valutazione finora

- Quality of Internal Control Over Financial Reporting, Corporate Governance and Credit RatingsDocumento63 pagineQuality of Internal Control Over Financial Reporting, Corporate Governance and Credit RatingsFouad KaakiNessuna valutazione finora

- Bai Nghien Cuu 5Documento12 pagineBai Nghien Cuu 5Ưng Nguyễn Thị KimNessuna valutazione finora

- Agency Theory - 84391Documento9 pagineAgency Theory - 8439101022682327001Nessuna valutazione finora

- Conceptual Relationship Between Corporate Governance and Audit Quality in Shari'ah Compliant Companies Listed On Bursa MalaysiaDocumento9 pagineConceptual Relationship Between Corporate Governance and Audit Quality in Shari'ah Compliant Companies Listed On Bursa MalaysiaRecca DamayantiNessuna valutazione finora

- The Effects of Audit LagDocumento16 pagineThe Effects of Audit LagAfrizar PaneNessuna valutazione finora

- The Effect of Audit Quality On Firm Performance: A Panel Data ApproachDocumento16 pagineThe Effect of Audit Quality On Firm Performance: A Panel Data ApproachFaraz Khoso BalochNessuna valutazione finora

- Corporate Social Responsibility Risk and Auditor-Client RetentionDocumento27 pagineCorporate Social Responsibility Risk and Auditor-Client RetentionNanang AgussaputraNessuna valutazione finora

- Corporate Governance and Financial LeverDocumento9 pagineCorporate Governance and Financial LeverRika Ircivy Agita YanguNessuna valutazione finora

- Integration of Audit Quality Practices and The Determinants of Strategic Decision-Making Ability To Enhance Business PerformanceDocumento7 pagineIntegration of Audit Quality Practices and The Determinants of Strategic Decision-Making Ability To Enhance Business PerformanceInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Corporate Governanceand Firm ValueDocumento19 pagineCorporate Governanceand Firm ValueAbinash MNessuna valutazione finora

- Ijsar 6048 PDFDocumento10 pagineIjsar 6048 PDFInsyiraah Oxaichiko ArissintaNessuna valutazione finora

- GCG - 3Documento6 pagineGCG - 3Amelia Wahyuni DewiNessuna valutazione finora

- THESIS Measures Taken by SMEs in Bacolod City For Financial Audit Quality EnhancementDocumento46 pagineTHESIS Measures Taken by SMEs in Bacolod City For Financial Audit Quality EnhancementVon Ianelle AguilaNessuna valutazione finora

- Fea76paper 4Documento16 pagineFea76paper 4Chai ChaiNessuna valutazione finora

- Audit Committee Effectiveness and Corporate Sustainable GrowthDocumento34 pagineAudit Committee Effectiveness and Corporate Sustainable GrowthReni Mustika SariNessuna valutazione finora

- Yewande's Revisd c1Documento29 pagineYewande's Revisd c1adewale abiodunNessuna valutazione finora

- The Impact of Audit Committee Effectiveness On Audit Quality: Evidence From The Middle EastDocumento8 pagineThe Impact of Audit Committee Effectiveness On Audit Quality: Evidence From The Middle EastAbdul Jaihudin AnwarNessuna valutazione finora

- MTA & Fadhillah. Published in JAATDocumento8 pagineMTA & Fadhillah. Published in JAATMuhammad TaufikNessuna valutazione finora

- UntitledDocumento3 pagineUntitledNUR FARAH ALIAH RAMLANNessuna valutazione finora

- Audit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaDocumento15 pagineAudit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaIdorenyin Okon100% (1)

- Khudhair - The Effect of Board Characteristics and Audit Committee Characteristics On Audit QualityDocumento12 pagineKhudhair - The Effect of Board Characteristics and Audit Committee Characteristics On Audit QualityyaiyalahNessuna valutazione finora

- Disclosure in BanksDocumento18 pagineDisclosure in BanksDina AlfawalNessuna valutazione finora

- 40 Corporate GovernanceDocumento34 pagine40 Corporate GovernanceNicolas Ernesto100% (1)

- YaDocumento18 pagineYaAnnisya KaruniawatiNessuna valutazione finora

- Impact of Ownership Characteristics On Modified Audit Opinion in JordanDocumento13 pagineImpact of Ownership Characteristics On Modified Audit Opinion in JordankesianaNessuna valutazione finora

- JRFM 15 00577 v2Documento22 pagineJRFM 15 00577 v2Zubaria BashirNessuna valutazione finora

- ALJALEXU Volume 6 Issue 2 Pages 41-84Documento43 pagineALJALEXU Volume 6 Issue 2 Pages 41-84Abdikani KhaLiifaNessuna valutazione finora

- Audit Services and Financial Reporting Quality The Role of Accounting Expertise AuditorsDocumento26 pagineAudit Services and Financial Reporting Quality The Role of Accounting Expertise AuditorsS GNessuna valutazione finora

- Question 2 PPTDocumento14 pagineQuestion 2 PPTBasit SattarNessuna valutazione finora

- 20.0102.0019 - Afla A.P - Riset Akuntansi - TUGAS TOPIK-TOPIK AUDIT QUALITY BDocumento3 pagine20.0102.0019 - Afla A.P - Riset Akuntansi - TUGAS TOPIK-TOPIK AUDIT QUALITY BAfla Azzahra PutriNessuna valutazione finora

- 2023 - Aisyah-Firman-Pratiwi - The Effect of Audit Quality and Capital Intensity Ratio On Earning Management in Sharia Listed CompaniesDocumento22 pagine2023 - Aisyah-Firman-Pratiwi - The Effect of Audit Quality and Capital Intensity Ratio On Earning Management in Sharia Listed CompaniesasmeldiNessuna valutazione finora

- The Impact of Corporate Governance On Financial Distress Likelihood An Empirical EvidenceDocumento21 pagineThe Impact of Corporate Governance On Financial Distress Likelihood An Empirical EvidenceTrần Đức TàiNessuna valutazione finora

- The Effects of Corporate Governance On Financial Performance and Financial Distress - Evidence From EgyptDocumento23 pagineThe Effects of Corporate Governance On Financial Performance and Financial Distress - Evidence From EgyptTrần Đức TàiNessuna valutazione finora

- Audit Committee, Internal Audit Function and Earnings Management: Evidence From JordanDocumento19 pagineAudit Committee, Internal Audit Function and Earnings Management: Evidence From JordanNadeem TahaNessuna valutazione finora

- Ado 2020Documento7 pagineAdo 2020arielNessuna valutazione finora

- Do Audit Tenure and Firm Size Contribute To Audit Quality Empirical Evidence From Jordan PDFDocumento18 pagineDo Audit Tenure and Firm Size Contribute To Audit Quality Empirical Evidence From Jordan PDFMuhammad AkbarNessuna valutazione finora

- The Impact of Audit Quality On The Financial Performance of Listed Companies NigeriaDocumento6 pagineThe Impact of Audit Quality On The Financial Performance of Listed Companies NigeriaKathlyn BrawleyNessuna valutazione finora

- 309-Article Text-1894-6-10-20220429Documento10 pagine309-Article Text-1894-6-10-20220429Bryan GPNessuna valutazione finora

- Artikel Audit 6Documento21 pagineArtikel Audit 6Almi HafizNessuna valutazione finora

- The Impact of Financial Restatement On Auditor Changes: Iranian EvidenceDocumento25 pagineThe Impact of Financial Restatement On Auditor Changes: Iranian EvidencehiasintaNessuna valutazione finora

- 7642 27051 1 PBDocumento19 pagine7642 27051 1 PBn t ahamedNessuna valutazione finora

- Corporate Governance and Audit FeesDocumento32 pagineCorporate Governance and Audit FeesElena DobreNessuna valutazione finora

- Audit LagDocumento16 pagineAudit Lagtito mohamedNessuna valutazione finora

- Thesis Auditor IndependenceDocumento5 pagineThesis Auditor IndependenceYasmine Anino100% (2)

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveDa EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNessuna valutazione finora

- Class Synopsis - 015Documento1 paginaClass Synopsis - 015shovonNessuna valutazione finora

- Organization Chart: Board of DirectorsDocumento1 paginaOrganization Chart: Board of DirectorsshovonNessuna valutazione finora

- Reading Materials - Audit & AssuranceDocumento1 paginaReading Materials - Audit & AssuranceshovonNessuna valutazione finora

- Notification Issued by Financial Reporting Council (FRC)Documento1 paginaNotification Issued by Financial Reporting Council (FRC)shovonNessuna valutazione finora

- Audit & Assurance Module Syllabus Area - Audit & Assurance Particulars Weighting (Indicative %) RemarksDocumento1 paginaAudit & Assurance Module Syllabus Area - Audit & Assurance Particulars Weighting (Indicative %) RemarksshovonNessuna valutazione finora

- Class Synopsis - 01Documento1 paginaClass Synopsis - 01shovonNessuna valutazione finora

- Assurance Sheet A Combination of Manual & Suggested Answers Up To Nov-Dec, 2020Documento117 pagineAssurance Sheet A Combination of Manual & Suggested Answers Up To Nov-Dec, 2020shovonNessuna valutazione finora

- Advantages and Disadvantages of Appraisal Methods: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocumento1 paginaAdvantages and Disadvantages of Appraisal Methods: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNessuna valutazione finora

- Problem ONE: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocumento1 paginaProblem ONE: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNessuna valutazione finora

- Tax Compliance 03Documento1 paginaTax Compliance 03shovonNessuna valutazione finora

- Tax Compliance 04Documento1 paginaTax Compliance 04shovonNessuna valutazione finora

- International Standard Book Number-IsBN TDocumento9 pagineInternational Standard Book Number-IsBN TshovonNessuna valutazione finora

- Required:: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocumento1 paginaRequired:: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNessuna valutazione finora

- Tax Compliance 01Documento1 paginaTax Compliance 01shovonNessuna valutazione finora

- Affiliation LetterDocumento7 pagineAffiliation LettershovonNessuna valutazione finora

- Strategic Management Accounting - M30304: Description 2018 2019Documento4 pagineStrategic Management Accounting - M30304: Description 2018 2019shovonNessuna valutazione finora

- P1 PerfomanceDocumento1 paginaP1 PerfomanceshovonNessuna valutazione finora

- ICAB - Certificate Level TaxationDocumento2 pagineICAB - Certificate Level TaxationshovonNessuna valutazione finora

- 7 - IT - GOVERNANCE May June 2019Documento2 pagine7 - IT - GOVERNANCE May June 2019Abdullah al MahmudNessuna valutazione finora

- P1 Class Notes by Sir Rafiqul Islam FCMADocumento91 pagineP1 Class Notes by Sir Rafiqul Islam FCMAAsmaNessuna valutazione finora

- Affiliation LetterDocumento7 pagineAffiliation LettershovonNessuna valutazione finora

- Subject: Letter of Cake & Desert Sponsorship For AIS 21 Graduation Completion CeremonyDocumento2 pagineSubject: Letter of Cake & Desert Sponsorship For AIS 21 Graduation Completion CeremonyshovonNessuna valutazione finora

- 7th Merit List Circular C Unit 2018-2019Documento1 pagina7th Merit List Circular C Unit 2018-2019shovonNessuna valutazione finora

- Print Receipt CmaDocumento1 paginaPrint Receipt CmashovonNessuna valutazione finora

- Britt PagesDocumento16 pagineBritt PagesshovonNessuna valutazione finora

- 0485c6e71cda08e995c857504fa1d86fDocumento3 pagine0485c6e71cda08e995c857504fa1d86fshovonNessuna valutazione finora

- Device InfoDocumento1 paginaDevice InfoshovonNessuna valutazione finora

- Dhaka University Day 2018Documento16 pagineDhaka University Day 2018shovonNessuna valutazione finora

- DateDocumento2 pagineDateshovonNessuna valutazione finora

- Dhaka University Day 2018Documento16 pagineDhaka University Day 2018shovonNessuna valutazione finora

- Knowledge Horizons The Present and Promise of KnowDocumento365 pagineKnowledge Horizons The Present and Promise of KnowSantiAm OfficialNessuna valutazione finora

- Thesis Presentation FormatDocumento4 pagineThesis Presentation FormatCollegePaperWriterUK100% (1)

- 3 Step Interview in Teaching SpeakingDocumento26 pagine3 Step Interview in Teaching SpeakingThao PhamvuhuongNessuna valutazione finora

- Remote Audit ProcessDocumento2 pagineRemote Audit Processsandeepkumar2311100% (1)

- Izracunat Moment Inercije T Profila 175x90x30Documento1 paginaIzracunat Moment Inercije T Profila 175x90x30cakizemunac4577Nessuna valutazione finora

- SimulationDocumento18 pagineSimulationSadiaAslamNessuna valutazione finora

- Caring For Critically Ill Patients With The ABCDEF Bundle Results of The ICU Liberation Collaborative in Over 15,000 Adults Pun2018Documento12 pagineCaring For Critically Ill Patients With The ABCDEF Bundle Results of The ICU Liberation Collaborative in Over 15,000 Adults Pun2018sarintiNessuna valutazione finora

- Mr. Narasareddy P B I Year M.Sc. Nursing, Child Health Nursing Akshaya College of Nursing, 2 Cross, Ashok Nagar, TumkurDocumento15 pagineMr. Narasareddy P B I Year M.Sc. Nursing, Child Health Nursing Akshaya College of Nursing, 2 Cross, Ashok Nagar, TumkurAsha JiluNessuna valutazione finora

- Textbook Economic Development 12Th Edition Full ChapterDocumento41 pagineTextbook Economic Development 12Th Edition Full Chaptervirginia.carmona601100% (25)

- CM5 - Mathematics As A ToolDocumento17 pagineCM5 - Mathematics As A ToolLoeynahcNessuna valutazione finora

- Curs How To WriteDocumento68 pagineCurs How To WriteIMARIANA23O6Nessuna valutazione finora

- A Study On Human Resources Management Based On System DynamicsDocumento6 pagineA Study On Human Resources Management Based On System DynamicsOlimpia RaduNessuna valutazione finora

- APA 8TH EditionDocumento2 pagineAPA 8TH EditionEunice Candelario86% (14)

- Jawaban QnaDocumento2 pagineJawaban QnaIvana YustitiaNessuna valutazione finora

- Grade 12 Holiday HWDocumento19 pagineGrade 12 Holiday HWVed PanickerNessuna valutazione finora

- San Rafael, Zaragoza, Nueva Ecija Junior High SchoolDocumento55 pagineSan Rafael, Zaragoza, Nueva Ecija Junior High SchoolNica Mae SiblagNessuna valutazione finora

- Iron Ore TalingsDocumento8 pagineIron Ore TalingsUday BoddepalliNessuna valutazione finora

- S02 - S03 - 1 - The Dominant Logic Retrospective and Extension - Bettis N CKP 1995Documento11 pagineS02 - S03 - 1 - The Dominant Logic Retrospective and Extension - Bettis N CKP 1995Ravi JosephNessuna valutazione finora

- 2015 Al Science Course of StudyDocumento83 pagine2015 Al Science Course of Studyapi-272657519Nessuna valutazione finora

- Program Schedule Phase 2Documento2 pagineProgram Schedule Phase 2priya dharshiniNessuna valutazione finora

- H570B104 Final Exam PreparationDocumento3 pagineH570B104 Final Exam PreparationyuliiaNessuna valutazione finora

- Enrico Resume 1Documento2 pagineEnrico Resume 1antz12345Nessuna valutazione finora

- College and Career Readiness Lesson Plan 1Documento4 pagineCollege and Career Readiness Lesson Plan 1api-453647158Nessuna valutazione finora

- WSN 118 2019 164 180Documento18 pagineWSN 118 2019 164 180Aldrin GarciaNessuna valutazione finora

- GCSE Practical Guide Biology Food TestsDocumento9 pagineGCSE Practical Guide Biology Food TestsOyasor Ikhapo AnthonyNessuna valutazione finora

- Tips For Structuring Better Brainstorming Sessions - InspireUXDocumento7 pagineTips For Structuring Better Brainstorming Sessions - InspireUXJonathan Bates0% (1)

- Quality Gurus - AmericanDocumento6 pagineQuality Gurus - AmericanMeghan PivaneNessuna valutazione finora

- Rosca Ciprian Application Form EB 11-12Documento20 pagineRosca Ciprian Application Form EB 11-12Ciprian RoscaNessuna valutazione finora

- Mla in Text CitationsDocumento8 pagineMla in Text Citationsapi-35588255Nessuna valutazione finora

- Strosahl ACBS ACT Brief Intervention WorkshopDocumento17 pagineStrosahl ACBS ACT Brief Intervention WorkshopJay MikeNessuna valutazione finora