Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting

Caricato da

Rashid W QureshiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accounting

Caricato da

Rashid W QureshiCopyright:

Formati disponibili

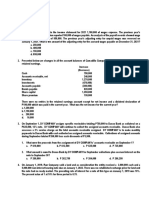

CHAPTER 24

BUDGETARY CONTROL AND

RESPONSIBILITY ACCOUNTING

SUMMARY OF QUESTIONS BY STUDY OBJECTIVES AND BLOOM’S

TAXONOMY

Item SO BT Item SO BT Item SO BT Item SO BT Item SO BT

True-False Statements

sg

1. 1 K 9. 3 C 17. 3 K 25. 4 K 33. 3 K

sg

2. 1 C 10. 3 K 18. 3 K 26. 5 C 34. 4 C

sg

3. 1 K 11. 3 K 19. 4 C 27. 5 K 35. 5 K

sg

4. 2 K 12. 3 C 20. 4 C 28. 6 K 36. 7 K

sg

5. 2 C 13. 3 C 21. 4 C 29. 7 K 37. 7 K

6. 2 C 14. 3 C 22. 4 C 30. 7 K

sg

7. 2 K 15. 3 K 23. 4 C 31. 1 K

sg

8. 2 C 16. 3 K 24. 4 K 32. 2 K

Multiple Choice Questions

38. 1 K 63. 3 K 88. 3 AP 113. 6 C 138. 7 K

39. 1 C 64. 3 C 89. 4 K 114. 6 C 139. 7 C

40. 1 K 65. 3 K 90. 4 AP 115. 6 AP 140. 7 K

41. 1 C 66. 3 C 91. 4 C 116. 6 C 141. 7 AP

42. 1 K 67. 3 C 92. 4 C 117. 6 AP 142. 7 K

43. 1 K 68. 3 K 93. 4 C 118. 6 C 143. 7 K

44. 1 K 69. 3 K 94. 4 K 119. 6 C 144. 7 AP

45. 2 C 70. 3 AP 95. 4 C 120. 6 AP 145. 7 C

46. 2 C 71. 3 C 96. 4 C 121. 7 AP 146. 7 AP

47. 2 C 72. 3 C 97. 4 C 122. 7 AP 147. 7 C

sg

48. 2 C 73. 3 C 98. 4 C 123. 7 AN 148. 1 C

sg

49. 2 C 74. 3 AP 99. 4 K 124. 7 AP 149. 2 K

st

50. 2 C 75. 3 AP 100. 4 C 125. 7 AN 150. 2 K

sg

51. 2 C 76. 3 AP 101. 4 C 126. 7 AP 151. 3 AP

st

52. 2 C 77. 3 AP 102. 4 C 127. 7 AP 152. 3 K

sg

53. 2,3 C 78. 3 AP 103. 4 C 128. 7 AP 153. 3 K

st

54. 3 C 79. 3 AP 104. 4 K 129. 7 AP 154. 3 K

sg

55. 3 AP 80. 3 AP 105. 5 C 130. 7 AP 155. 4 K

st

56. 3 AP 81. 3 AP 106. 5 C 131. 7 AP 156. 4 K

sg

57. 3 AP 82. 3 AP 107. 5 C 132. 7 AP 157. 6 K

st

58. 3 C 83. 3 AP 108. 5 C 133. 7 AN 158. 7 K

sg

59. 3 C 84. 3 AP 109. 5 C 134. 7 AP 159. 7 AP

60. 3 K 85. 3 AP 110. 6 K 135. 7 AP

61. 3 C 86. 3 AP 111. 6 C 136. 7 C

62. 3 C 87. 3 AP 112. 6 K 137. 7 C

Brief Exercises

160. 3 AP 162. 3 AP 164. 4 AP 166. 7 AP 168. 7 AP

161. 3 AP 163. 3 AP 165. 6 AP 167. 7 AP 169. 7 AN

24 - 2 Test Bank for Accounting Principles, Tenth Edition

SUMMARY OF QUESTIONS BY STUDY OBJECTIVES AND BLOOM’S

TAXONOMY

Exercises

170. 2 AP 175. 3 AP 180. 3 AP 185. 6 AN 190. 7 AP

171. 2,3 AP 176. 3 AP 181. 3,6 AP 186. 6 AN 191. 7 AN

172. 3 AP 177. 3 AP 182. 4,5 AP 187. 6,7 AP 192. 7 AN

173. 3 AP 178. 3 AP 183. 5 AN 188. 7 AP 193. 7 AN

174. 3 AP 179. 3 AP 184. 5 AP 189. 7 AP 194. 7 AN

Completion Statements

195. 1 K 198. 3 K 201. 4 K 204. 7 K

196. 1 K 199. 3 K 202. 4 K 205. 7 K

197. 1 K 200. 4 K 203. 4 K 206. 7 K

Matching

207 1 K

Short-Answer Essay

208. 1 K 210. 4 K 212. 7 K

209. 3 K 211. 4 K 213. 7 K

sg

This question also appears in the Study Guide.

st

This question also appears in a self-test at the student companion website.

SUMMARY OF STUDY OBJECTIVES BY QUESTION TYPE

Item Type Item Type Item Type Item Type Item Type Item Type Item Type

Study Objective 1

1. TF 31. TF 40. MC 43. MC 195. C 207. MA

2. TF 38. MC 41. MC 44. MC 196. C 208. S-A

3. TF 39. MC 42. MC 148. MC 197. C

Study Objective 2

4. TF 7. TF 45. MC 48. MC 51. MC 149. MC 171. Ex

5. TF 8. TF 46. MC 49. MC 52. MC 150. MC

6. TF 32. TF 47. MC 50. MC 53. MC 170. Ex

Study Objective 3

9. TF 33. TF 62. MC 72. MC 82. MC 154. MC 176. Ex

10. TF 53. MC 63. MC 73. MC 83. MC 160. BE 177. Ex

11. TF 54. MC 64. MC 74. MC 84. MC 161. BE 178. Ex

12. TF 55. MC 65. MC 75. MC 85. MC 162. BE 179. Ex

13. TF 56. MC 66. MC 76. MC 86. MC 163. BE 180. Ex

14. TF 57. MC 67. MC 77. MC 87. MC 171. Ex 181. Ex

15. TF 58. MC 68. MC 78. MC 88. MC 172. Ex 198. C

16. TF 59. MC 69. MC 79. MC 151. MC 173. Ex 199. C

17. TF 60. MC 70. MC 80. MC 152. MC 174. Ex 209. S-A

18. TF 61. MC 71. MC 81. MC 153. MC 175. Ex

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 3

Study Objective 4

19. TF 24. TF 91. MC 96. MC 101. MC 156. MC 202. C

20. TF 25. TF 92. MC 97. MC 102. MC 164. BE 203. C

21. TF 34. TF 93. MC 98. MC 103. MC 182. Ex 210. S-A

22. TF 89. MC 94. MC 99. MC 104. MC 200. C 211. S-A

23. TF 90. MC 95. MC 100. MC 155. MC 201. C

Study Objective 5

26. TF 35. TF 106. MC 108. MC 182. Ex 184. Ex

27. TF 105. MC 107. MC 109. MC 183. Ex

Study Objective 6

28. TF 112. MC 115. MC 118. MC 157. MC 183. Ex 186. Ex

110. MC 113. MC 116. MC 119. MC 165. BE 184. Ex 187. Ex

111. MC 114. MC 117. MC 120. MC 181. Ex 185. Ex

Study Objective 7

29. TF 125. MC 133. MC 141. MC 159. MC 190. Ex 212. K

30. TF 126. MC 134. MC 142. MC 166. BE 191. Ex 213. K

36. TF 127. MC 135. MC 143. MC 167. BE 192. Ex

37. TF 128. MC 136. MC 144. MC 168. BE 193. Ex

121. MC 129. MC 137. MC 145. MC 169. BE 194. Ex

122. MC 130. MC 138. MC 146. MC 187. Ex 204. C

123. MC 131. MC 139. MC 147. MC 188. Ex 205. C

124. MC 132. MC 140. MC 158. MC 189. Ex 206. C

Note: TF = True-False BE = Brief Exercise C = Completion

MC = Multiple Choice Ex = Exercise S-A = Short-Answer

CHAPTER STUDY OBJECTIVES

1. Describe the concept of budgetary control. Budgetary control consists of (a) preparing

periodic budget reports that compare actual results with planned objectives, (b) analyzing the

differences to determine their causes, (c) taking appropriate corrective action, and (d)

modifying future plans, if necessary.

2. Evaluate the usefulness of static budget reports. Static budget reports are useful in

evaluating the progress toward planned sales and profit goals. They are also appropriate in

assessing a manager's effectiveness in controlling costs when (a) actual activity closely

approximates the master budget activity level, and/or (b) the behavior of the costs in response

to changes in activity is fixed.

3. Explain the development of flexible budgets and the usefulness of flexible budget

reports. To develop the flexible budget, it is necessary to: (a) Identify the activity index and

the relevant range of activity; (b) Identify the variable costs, and determine the budgeted

variable cost per unit of activity for each cost; (c) Identify the fixed costs, and determine the

budgeted amount for each cost; (d) Prepare the budget for selected increments of activity

within the relevant range. Flexible budget reports permit an evaluation of a manager's

performance in controlling production and costs.

For Instructor Use Only

24 - 4 Test Bank for Accounting Principles, Tenth Edition

4 Describe the concept of responsibility accounting. Responsibility accounting involves

accumulating and reporting revenues and costs on the basis of the individual manager who

has the authority to make the day-to-day decisions about the items. The evaluation of a

manager's performance is based on the matters directly under the manager's control. In

responsibility accounting, it is necessary to distinguish between controllable and

noncontrollable fixed costs and to identify three types of responsibility centers: cost, profit,

and investment.

5. Indicate the features of responsibility reports for cost centers. Responsibility reports for

cost centers compare actual costs with flexible budget data. The reports show only

controllable costs, and no distinction is made between variable and fixed costs.

6. Identify the content of responsibility reports for profit centers. Responsibility reports

show contribution margin, controllable fixed costs, and controllable margin for each profit

center.

7. Explain the basis and formula used in evaluating performance in investment centers.

The primary basis for evaluating performance in investment centers is return on investment

(ROI). The formula for computing ROI for investment centers is: Controllable margin ÷

Average operating assets.

TRUE-FALSE STATEMENTS

1. Budget reports comparing actual results with planned objectives should be prepared only

once a year.

Ans: F, SO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Communication, IMA:

Reporting

2. If actual results are different from planned results, the difference must always be

investigated by management to achieve effective budgetary control.

Ans: F, SO: 1, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

3. Certain budget reports are prepared monthly, whereas others are prepared more

frequently depending on the activities being monitored.

Ans: T, SO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Communication, IMA:

Reporting

4. The master budget is not used in the budgetary control process.

Ans: F, SO: 2, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

5. A master budget is most useful in evaluating a manager's performance in controlling

costs.

Ans: F, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

6. A static budget is one that is geared to one level of activity.

Ans: T, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 5

7. A static budget is changed only when actual activity is different from the level of activity

expected.

Ans: F, SO: 2, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Reporting

8. A static budget is most useful for evaluating a manager's performance in controlling

variable costs.

Ans: F, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Reporting

9. A flexible budget can be prepared for each of the types of budgets included in the master

budget.

Ans: T, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Reporting

10. A flexible budget is a series of static budgets at different levels of activities.

Ans: T, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Reporting

11. Flexible budgeting relies on the assumption that unit variable costs will remain constant

within the relevant range of activity.

Ans: T, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

12. Total budgeted fixed costs appearing on a flexible budget will be the same amount as total

fixed costs on the master budget.

Ans: T, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

13. A flexible budget is prepared before the master budget.

Ans: F, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

14. The activity index used in preparing a flexible budget should not influence the variable

costs that are being budgeted.

Ans: F, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

15. A formula used in developing a flexible budget is: Total budgeted cost = fixed cost + (total

variable cost per unit × activity level).

Ans: T, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

16. Flexible budgets are widely used in production and service departments.

Ans: T, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

17. A flexible budget report will show both actual and budget cost based on the actual activity

level achieved.

Ans: T, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Reporting

18. Management by exception means that management will investigate areas where actual

results differ from planned results if the items are material and controllable.

Ans: T, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Risk Analysis, AICPA PC: Problem Solving, IMA:

Internal Controls.

For Instructor Use Only

24 - 6 Test Bank for Accounting Principles, Tenth Edition

19. Policies regarding when a difference between actual and planned results should be

investigated are generally more restrictive for noncontrollable items than for controllable

items.

Ans: F, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Risk Analysis, AICPA PC: Problem Solving, IMA:

Internal Controls

20. A distinction should be made between controllable and noncontrollable costs when

reporting information under responsibility accounting.

Ans: T, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Risk Analysis, AICPA PC: Problem Solving, IMA:

Internal Controls

21. Cost centers, profit centers, and investment centers can all be classified as responsibility

centers.

Ans: T, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

22. More costs become controllable as one moves down to each lower level of managerial

responsibility.

Ans: F, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

23. In a responsibility accounting reporting system, as one moves up each level of

responsibility in an organization, the responsibility reports become more summarized and

show less detailed information.

Ans: T, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

24. Decentralization means that the control of operations is delegated by top management to

many individuals throughout the organization.

Ans: T, SO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: None, IMA: Budget

Preparation

25. A cost item is considered to be controllable if there is not a large difference between

actual cost and budgeted cost for that item.

Ans: F, SO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Reporting

26. A cost center incurs costs and generates revenues and cost center managers are

evaluated on the profitability of their centers.

Ans: F, SO: 5, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

27. The terms "direct fixed costs" and "indirect fixed costs" are synonymous with "traceable

costs" and "common costs," respectively.

Ans: T, SO: 5, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

28. Controllable margin is subtracted from controllable fixed costs to get net income for a

profit center.

Ans: F, SO: 6, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

29. The denominator in the formula for calculating the return on investment includes operating

and nonoperating assets.

Ans: F, SO: 7, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 7

30. The formula for computing return on investment is controllable margin divided by average

operating assets.

Ans: T, SO: 7, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

31. Budget reports provide the feedback needed by management to see whether actual

operations are on course.

Ans: T, SO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

32. A static budget is an effective means to evaluate a manager's ability to control costs,

regardless of the actual activity level.

Ans: F, SO: 2, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

33. The flexible budget report evaluates a manager's performance in two areas: (1)

production and (2) costs.

Ans: T, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

34. The terms controllable costs and noncontrollable costs are synonymous with variable

costs and fixed costs, respectively.

Ans: F, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

35. Most direct fixed costs are not controllable by the profit center manager.

Ans: F, SO: 5, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

36. The manager of an investment center can improve ROI by reducing average operating

assets.

Ans: T, SO: 7, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

37. An advantage of the return on investment ratio is that no judgmental factors are involved.

Ans: F, SO: 7, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

Answers to True-False Statements

Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. Item Ans. Item Ans.

1. F 7. F 13. F 19. F 25. F 31. T 37. F

2. F 8. F 14. F 20. T 26. F 32. F

3. T 9. T 15. T 21. T 27. T 33. T

4. F 10. T 16. T 22. F 28. F 34. F

5. F 11. T 17. T 23. T 29. F 35. F

6. T 12. T 18. T 24. T 30. T 36. T

For Instructor Use Only

24 - 8 Test Bank for Accounting Principles, Tenth Edition

MULTIPLE CHOICE QUESTIONS

38. What is budgetary control?

a. Another name for a flexible budget

b. The degree to which the CFO controls the budget

c. The use of budgets in controlling operations

d. The process of providing information on budget differences to lower level managers

Ans: C, SO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

39. A major element in budgetary control is

a. the preparation of long-term plans.

b. the comparison of actual results with planned objectives.

c. the valuation of inventories.

d. approval of the budget by the stockholders.

Ans: B, SO: 1, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

40. Budget reports should be prepared

a. daily.

b. monthly.

c. weekly.

d. as frequently as needed.

Ans: D, SO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

41. On the basis of the budget reports,

a. management analyzes differences between actual and planned results.

b. management may take corrective action.

c. management may modify the future plans.

d. all of these.

Ans: D, SO: 1, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

42. The purpose of the departmental overhead cost report is to

a. control indirect labor costs.

b. control selling expense.

c. determine the efficient use of materials.

d. control overhead costs.

Ans: D, SO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

43. The purpose of the sales budget report is to

a. control selling expenses.

b. determine whether income objectives are being met.

c. determine whether sales goals are being met.

d. control sales commissions.

Ans: C, SO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 9

44. The comparison of differences between actual and planned results

a. is done by the external auditors.

b. appears on the company's external financial statements.

c. is usually done orally in departmental meetings.

d. appears on periodic budget reports.

Ans: D, SO: 1, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

45. A static budget

a. should not be prepared in a company.

b. is useful in evaluating a manager's performance by comparing actual variable costs

and planned variable costs.

c. shows planned results at the original budgeted activity level.

d. is changed only if the actual level of activity is different than originally budgeted.

Ans: C, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

46. A static budget report

a. shows costs at only 2 or 3 different levels of activity.

b. is appropriate in evaluating a manager's effectiveness in controlling variable costs.

c. should be used when the actual level of activity is materially different from the master

budget activity level.

d. may be appropriate in evaluating a manager's effectiveness in controlling costs when

the behavior of the costs in response to changes in activity is fixed.

Ans: D, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

47. A static budget is appropriate in evaluating a manager's performance if

a. actual activity closely approximates the master budget activity.

b. actual activity is less than the master budget activity.

c. the company prepares reports on an annual basis.

d. the company is a not-for-profit organization

Ans: A, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

48. When budgeted and actual results are not the same amount, there is a budget

a. error.

b. difference.

c. anomaly.

d. by-product.

Ans: B, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

49. Top management's reaction to a difference between budgeted and actual sales often

depends on

a. whether the difference is favorable or unfavorable.

b. whether management anticipated the difference.

c. the materiality of the difference.

d. the personality of the top managers.

Ans: C, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

For Instructor Use Only

24 - 10 Test Bank for Accounting Principles, Tenth Edition

50. If costs are not responsive to changes in activity level, then these costs can be best

described as

a. mixed.

b. flexible.

c. variable.

d. fixed.

Ans: D, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

51. Assume that actual sales results exceed the planned results for the second quarter. This

favorable difference is greater than the unfavorable difference reported for the first quarter

sales. Which of the following statements about the sales budget report on June 30 is true?

a. The year-to-date results will show a favorable difference.

b. The year-to-date results will show an unfavorable difference.

c. The difference for the first quarter can be ignored.

d. The sales report is not useful if it shows a favorable and unfavorable difference for the

two quarters.

Ans: A, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

52. A static budget is appropriate for

a. variable overhead costs.

b. direct materials costs.

c. fixed overhead costs.

d. none of these.

Ans: C, SO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

53. What is the primary difference between a static budget and a flexible budget?

a. The static budget contains only fixed costs, while the flexible budget contains only

variable costs.

b. The static budget is prepared for a single level of activity, while a flexible budget is

adjusted for different activity levels.

c. The static budget is constructed using input from only upper level management, while

a flexible budget obtains input from all levels of management.

d. The static budget is prepared only for units produced, while a flexible budget reflects

the number of units sold.

Ans: B, SO: 2,3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

54. A flexible budget

a. is prepared when management cannot agree on objectives for the company.

b. projects budget data for various levels of activity.

c. is only useful in controlling fixed costs.

d. cannot be used for evaluation purposes because budgeted data are adjusted to reflect

actual results.

Ans: B, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 11

55. The master budget of Carpenter Company shows that the planned activity level for next

year is expected to be 100,000 machine hours. At this level of activity, the following

manufacturing overhead costs are expected:

Indirect labor $480,000

Machine supplies 120,000

Indirect materials 140,000

Depreciation on factory building 100,000

Total manufacturing overhead $840,000

A flexible budget for a level of activity of 120,000 machine hours would show total

manufacturing overhead costs of

a. $988,000.

b. $840,000.

c. $1,008,000.

d. $908,000.

Ans: A, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

56. Cartee, Inc. prepared a 2012 budget for 120,000 units of product. Actual production in

2012 was 130,000 units. To be most useful, what amounts should a performance report

for this company compare?

a. The actual results for 130,000 units with the original budget for 120,000 units

b. The actual results for 130,000 units with a new budget for 130,000 units.

c. The actual results for 130,000 units with last year's actual results for 134,000 units

d. It doesn't matter. All of these choices are equally useful.

Ans: B, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

57. A department has budgeted monthly manufacturing overhead cost of $540,000 plus $3

per direct labor hour. If a flexible budget report reflects $1,044,000 for total budgeted

manufacturing cost for the month, the actual level of activity achieved during the month

was

a. 528,000 direct labor hours.

b. 168,000 direct labor hours.

c. 348,000 direct labor hours.

d. Cannot be determined from the information provided.

Ans: B, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

58. Which one of the following would be the same total amount on a flexible budget and a

static budget if the activity level is different for the two types of budgets?

a. Direct materials cost

b. Direct labor cost

c. Variable manufacturing overhead

d. Fixed manufacturing overhead

Ans: D, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Quantitative Methods

For Instructor Use Only

24 - 12 Test Bank for Accounting Principles, Tenth Edition

59. In developing a flexible budget within a relevant range of activity,

a. only fixed costs are included.

b. it is necessary to relate variable cost data to the activity index chosen.

c. it is necessary to prepare a budget at 1,000 unit increments.

d. variable and fixed costs are combined and are reported as a total cost.

Ans: B, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

60. What budgeted amounts appear on the flexible budget?

a. Original budgeted amounts at the static budget activity level

b. Actual costs for the budgeted activity level

c. Budgeted amounts for the actual activity level achieved

d. Actual costs for the estimated activity level

Ans: C, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

61. The flexible budget

a. is prepared before the master budget.

b. is relevant both within and outside the relevant range.

c. eliminates the need for a master budget.

d. is a series of static budgets at different levels of activity.

Ans: D, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

62. A flexible budget can be prepared for which of the following budgets comprising the

master budget?

a. Sales

b. Overhead

c. Direct materials

d. All of these

Ans: D, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

63. Another name for the static budget is

a. master budget.

b. overhead budget.

c. permanent budget.

d. flexible budget.

Ans: A, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

64. If a company plans to sell 48,000 units of product but sells 60,000, the most appropriate

comparison of the cost data associated with the sales will be by a budget based on

a. the original planned level of activity.

b. 54,000 units of activity.

c. 60,000 units of activity.

d. 48,000 units of activity.

Ans: C, SO: 3, Bloom: C, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 13

65. Within the relevant range of activity, the behavior of total costs is assumed to be

a. linear and upward sloping.

b. linear and downward sloping.

c. curvilinear and upward sloping.

d. linear to a point and then level off.

Ans: A, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

66. Sales results that are evaluated by a static budget might show

1. favorable differences that are not justified.

2. unfavorable differences that are not justified.

a. 1

b. 2

c. both 1 and 2.

d. neither 1 nor 2.

Ans: C, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

67. The selection of levels of activity to depict a flexible budget

1. will be within the relevant range.

2. is largely a matter of expediency.

3. is governed by generally accepted accounting principles.

a. 1

b. 2

c. 3

d. 1 and 2

Ans: D, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

FSA

68. Management by exception

a. causes managers to be buried under voluminous paperwork.

b. means that all differences will be investigated.

c. means that only unfavorable differences will be investigated.

d. means that material differences will be investigated.

Ans: D, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

69. Under management by exception, which differences between planned and actual results

should be investigated?

a. Material and noncontrollable

b. Controllable and noncontrollable

c. Material and controllable

d. All differences should be investigated

Ans: C, SO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

For Instructor Use Only

24 - 14 Test Bank for Accounting Principles, Tenth Edition

70. Anthony Roofing's budgeted manufacturing costs for 50,000 squares of shingles are:

Fixed manufacturing costs $30,000

Variable manufacturing costs $20.00 per square

Anthony produced 40,000 squares of shingles during March. How much are budgeted

total manufacturing costs in March?

a. $800,000

b. $1,030,000

c. $1,000,000

d. $830,000

Ans: D, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

71. A flexible budget depicted graphically

a. is identical to a CVP graph.

b. differs from a CVP graph in the way that fixed costs are shown.

c. differs from a CVP graph in the way that variable costs are shown.

d. differs from a CVP graph in that sales revenue is not shown.

Ans: D, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

72. The activity index used in preparing the flexible budget

a. is prescribed by generally accepted accounting principles.

b. is only applicable to fixed manufacturing costs.

c. is the same for all departments.

d. should significantly influence the costs that are being budgeted.

Ans: D, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

73. A static budget is not appropriate in evaluating a manager's effectiveness if a company

has

a. substantial fixed costs.

b. substantial variable costs.

c. planned activity levels that match actual activity levels.

d. no variable costs.

Ans: B, SO: 3, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

74. Cunningham Manufacturing Company prepared a fixed budget of 80,000 direct labor

hours, with estimated overhead costs of $400,000 for variable overhead and $120,000 for

fixed overhead. Cunningham then prepared a flexible budget at 76,000 labor hours. How

much is total overhead costs at this level of activity?

a. $380,000

b. $500,000

c. $494,000

d. $520,000

Ans: B, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 15

75. For June, Devin Manufacturing estimated sales revenue at $400,000. It pays sales

commissions that are 4% of sales. The sales manager's salary is $190,000, estimated

shipping expenses total 1% of sales, and miscellaneous selling expenses are $10,000.

How much are budgeted selling expenses for the month of July if sales are expected to be

$360,000?

a. $28,000

b. $218,000

c. $18,000

d. $220,000

Ans: B, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

76. Edward Industries budgeted manufacturing costs for 50,000 sip-its are:

Fixed manufacturing costs $50,000 per month

Variable manufacturing costs $12.00 per sip-it

Edward produced 40,000 sip-its during March. How much is the flexible budget for total

manufacturing costs for March?

a. $520,000

b. $650,000

c. $480,000

d. $530,000

Ans: D, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

77. Crowell Manufacturing budgeted costs for 50,000 linear feet of block are:

Fixed manufacturing costs $24,000 per month

Variable manufacturing costs $16.00 per linear

Crowell installed 40,000 linear feet of block during March. How much is budgeted total

manufacturing costs in March?

a. $640,000

b. $824,000

c. $800,000

d. $664,000

Ans: D, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

78. In the Patrick Company, indirect labor is budgeted for $72,000 and factory supervision is

budgeted for $24,000 at normal capacity of 160,000 direct labor hours. If 180,000 direct

labor hours are worked, flexible budget total for these costs is

a. $96,000.

b. $108,000.

c. $105,000.

d. $99,000.

Ans: C, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

For Instructor Use Only

24 - 16 Test Bank for Accounting Principles, Tenth Edition

79. Groom Company uses flexible budgets. At normal capacity of 16,000 units, budgeted

manufacturing overhead is: $48,000 variable and $270,000 fixed. If Groom had actual

overhead costs of $321,000 for 18,000 units produced, what is the difference between

actual and budgeted costs?

a. $3,000 unfavorable

b. $3,000 favorable

c. $9,000 unfavorable

d. $12,000 favorable

Ans: B, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

80. A company's planned activity level for next year is expected to be 200,000 machine hours.

At this level of activity, the company budgeted the following manufacturing overhead

costs:

Variable Fixed

Indirect materials $280,000 Depreciation $120,000

Indirect labor 400,000 Taxes 20,000

Factory supplies 40,000 Supervision 100,000

A flexible budget prepared at the 160,000 machine hours level of activity would show total

manufacturing overhead costs of

a. $576,000.

b. $720,000.

c. $768,000.

d. $816,000.

Ans: D, SO: 3, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

81. In the Shrub Company, indirect labor is budgeted for $108,000 and factory supervision is

budgeted for $36,000 at normal capacity of 160,000 direct labor hours. If 180,000 direct

labor hours are worked, flexible budget total for these costs is:

a. $144,000.

b. $162,000.

c. $157,500.

d. $148,500.

Ans: C, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

82. Kessler Company uses flexible budgets. At normal capacity of 16,000 units, budgeted

manufacturing overhead is: $64,000 variable and $180,000 fixed. If Kessler had actual

overhead costs of $250,000 for 18,000 units produced, what is the difference between

actual and budgeted costs?

a. $2,000 unfavorable.

b. $2,000 favorable.

c. $6,000 unfavorable.

d. $8,000 favorable.

Ans: B, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 17

83. A company's planned activity level for next year is expected to be 200,000 machine hours.

At this level of activity, the company budgeted the following manufacturing overhead

costs:

Variable Fixed

Indirect materials $240,000 Depreciation $100,000

Indirect labor 320,000 Taxes 20,000

Factory supplies 40,000 Supervision 80,000

A flexible budget prepared at the 180,000 machine hours level of activity would show total

manufacturing overhead costs of

a. $540,000.

b. $720,000.

c. $740,000.

d. $600,000.

Ans: C, SO: 3, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

84. Carly Industries produced 256,000 units in 120,000 direct labor hours. Production for the

period was estimated at 264,000 units and 132,000 direct labor hours. A flexible budget

would compare budgeted costs and actual costs, respectively, at

a. 128,000 hours and 132,000 hours.

b. 132,000 hours and 120,000 hours.

c. 128,000 hours and 120,000 hours.

d. 120,000 hours and 120,000 hours.

Ans: D, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

85. A company's planned activity level for next year is expected to be 200,000 machine hours.

At this level of activity, the company budgeted the following manufacturing overhead

costs:

Variable Fixed

Indirect materials $180,000 Depreciation $75,000

Indirect labor 240,000 Taxes 15,000

Factory supplies 30,000 Supervision 60,000

A flexible budget prepared at the 180,000 machine hours level of activity would show total

manufacturing overhead costs of

a. $405,000.

b. $540,000.

c. $555,000.

d. $450,000.

Ans: C, SO: 3, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

86. Limpia Industries produced 320,000 units in 150,000 direct labor hours. Production for the

period was estimated at 330,000 units and 165,000 direct labor hours. A flexible budget

would compare budgeted costs and actual costs, respectively, at

a. 160,000 hours and 165,000 hours.

b. 165,000 hours and 150,000 hours.

c. 160,000 hours and 150,000 hours.

d. 150,000 hours and 150,000 hours.

Ans: D, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

For Instructor Use Only

24 - 18 Test Bank for Accounting Principles, Tenth Edition

87. At zero direct labor hours in a flexible budget graph, the total budgeted cost line intersects

the vertical axis at $40,000. At 20,000 direct labor hours, a horizontal line drawn from the

total budgeted cost line intersects the vertical axis at $120,000. Fixed and variable costs

may be expressed as:

a. $40,000 fixed plus $4 per direct labor hour variable.

b. $40,000 fixed plus $6 per direct labor hour variable.

c. $80,000 fixed plus $2 per direct labor hour variable.

d. $80,000 fixed plus $4 per direct labor hour variable.

Ans: A, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

88. At 18,000 direct labor hours, the flexible budget for indirect materials is $36,000. If

$37,400 are incurred at 18,400 direct labor hours, the flexible budget report should show

the following difference for indirect materials:

a. $1,400 unfavorable.

b. $1,400 favorable.

c. $600 favorable.

d. $600 unfavorable.

Ans: D, SO: 3, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

89. The accumulation of accounting data on the basis of the individual manager who has the

authority to make day-to-day decisions about activities in an area is called

a. static reporting.

b. flexible accounting.

c. responsibility accounting.

d. master budgeting.

Ans: C, SO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

90. Thomas Company recorded operating data for its shoe division for the year.

Sales $1,500,000

Contribution margin 300,000

Controllable fixed costs 180,000

Average total operating assets 600,000

How much is controllable margin for the year?

a. 20%

b. 50%

c. $300,000

d. $120,000

Ans: D, SO: 4, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Quantitative Methods

91. A cost is considered controllable at a given level of managerial responsibility if

a. the manager has the power to incur the cost within a given time period.

b. the cost has not exceeded the budget amount in the master budget.

c. it is a variable cost, but it is uncontrollable if it is a fixed cost.

d. it changes in magnitude in a flexible budget.

Ans: A, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 19

92. As one moves up to each higher level of managerial responsibility,

a. fewer costs are controllable.

b. the responsibility for cost incurrence diminishes.

c. a greater number of costs are controllable.

d. performance evaluation becomes less important.

Ans: C, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

93. A responsibility report should

a. be prepared in accordance with generally accepted accounting principles.

b. show only those costs that a manager can control.

c. only show variable costs.

d. only be prepared at the highest level of managerial responsibility.

Ans: B, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

94. Top management can control

a. only controllable costs.

b. only noncontrollable costs.

c. all costs.

d. some noncontrollable costs and all controllable costs.

Ans: C, SO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

95. Not-for-profit entities

a. do not use responsibility accounting.

b. utilize responsibility accounting in trying to maximize net income.

c. utilize responsibility accounting in trying to minimize the cost of providing services.

d. have only noncontrollable costs.

Ans: C, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

96. Which of the following is not a true statement?

a. All costs are controllable at some level within a company.

b. Responsibility accounting applies to both profit and not-for-profit entities.

c. Fewer costs are controllable as one moves up to each higher level of managerial

responsibility.

d. The term segment is sometimes used to identify areas of responsibility in

decentralized operations.

Ans: C, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

97. Costs incurred indirectly and allocated to a responsibility level are considered to be

a. nonmaterial.

b. mixed.

c. controllable.

d. noncontrollable.

Ans: D, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

For Instructor Use Only

24 - 20 Test Bank for Accounting Principles, Tenth Edition

98. Management by exception

a. is most effective at top levels of management.

b. can be implemented at each level of responsibility within an organization.

c. can only be applied when comparing actual results with the master budget.

d. is the opposite of goal congruence.

Ans: B, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

99. Which responsibility centers generate both revenues and costs?

a. Investment and profit centers

b. Profit and cost centers

c. Cost and investment centers

d. Only profit centers

Ans: A, SO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

100. The linens department of a large department store is

a. not a responsibility center.

b. a profit center.

c. a cost center.

d. an investment center.

Ans: B, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

101. The foreign subsidiary of a large corporation is

a. not a responsibility center.

b. a profit center.

c. a cost center.

d. an investment center.

Ans: D, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

102. The maintenance department of a manufacturing company is a(n)

a. segment.

b. profit center.

c. cost center.

d. investment center.

Ans: C, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

103. Which of the following is not a correct match?

1. Incurs costs

2. Generates revenue

3. Controls investment funds

a. Investment Center 1, 2, 3

b. Cost Center 1

c. Profit Center 1, 2, 3

d. All are correct matches.

Ans: C, SO: 4, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 21

104. A cost center

a. only incurs costs and does not directly generate revenues.

b. incurs costs and generates revenues.

c. is a responsibility center of a company which incurs losses.

d. is a responsibility center which generates profits and evaluates the investment cost of

earning the profit.

Ans: A, SO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

105. A manager of a cost center is evaluated mainly on

a. the profit that the center generates.

b. his or her ability to control costs.

c. the amount of investment it takes to support the cost center.

d. the amount of revenue that can be generated.

Ans: B, SO: 5, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

106. Performance reports for cost centers compare actual

a. total costs with static budget data.

b. total costs with flexible budget data.

c. controllable costs with static budget data.

d. controllable costs with flexible budget data.

Ans: D, SO: 5, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

107. In the performance report for cost centers,

a. controllable and noncontrollable costs are reported.

b. fixed costs are not reported.

c. no distinction is made between fixed and variable costs.

d. only materials and controllable costs are reported.

Ans: C, SO: 5, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

108. Of the following choices, which contain both a traceable fixed cost and a common fixed

cost?

a. Profit center manager's salary and timekeeping costs for a responsibility center's

employees.

b. Company president's salary and company personnel department costs.

c. Company personnel department costs and timekeeping costs for a responsibility

center's employees.

d. Depreciation on a responsibility center's equipment and supervisory salaries for the

center.

Ans: C, SO: 5, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

109. Which of the following is not an indirect fixed cost?

a. Company president's salary

b. Depreciation on the company building housing several profit centers

c. Company personnel department costs

d. Profit center supervisory salaries

Ans: D, SO: 5, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

For Instructor Use Only

24 - 22 Test Bank for Accounting Principles, Tenth Edition

110. A profit center is

a. a responsibility center that always reports a profit.

b. a responsibility center that incurs costs and generates revenues.

c. evaluated by the rate of return earned on the investment allocated to the center.

d. referred to as a loss center when operations do not meet the company's objectives.

Ans: B, SO: 6, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

111. The best measure of the performance of the manager of a profit center is the

a. rate of return on investment.

b. success in meeting budgeted goals for controllable costs.

c. amount of controllable margin generated by the profit center.

d. amount of contribution margin generated by the profit center.

Ans: C, SO: 6, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

112. Controllable margin is defined as

a. sales minus variable costs.

b. sales minus contribution margin.

c. contribution margin less controllable fixed costs.

d. contribution margin less noncontrollable fixed costs.

Ans: C, SO: 6, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

113. Controllable margin is most useful for

a. external financial reporting.

b. preparing the master budget.

c. performance evaluation of profit centers.

d. break-even analysis.

Ans: C, SO: 6, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

114. Which of the following will not result in an unfavorable controllable margin difference?

a. Sales exceeding budget; costs under budget

b. Sales exceeding budget; costs over budget

c. Sales under budget; costs under budget

d. Sales under budget; costs over budget

Ans: A, SO: 6, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

115. Given below is an excerpt from a management performance report:

Budget Actual Difference

Contribution margin $2,000,000 $2,100,000 $100,000

Controllable fixed costs $1,000,000 $ 900,000 $100,000

The manager's overall performance

a. is 20% below expectations.

b. is 20% above expectations.

c. is equal to expectations.

d. cannot be determined from information given.

Ans: B, SO: 6, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 23

116. Which of the following are financial measures of performance?

1. Controllable margin

2. Product quality

3. Labor productivity

a. 1

b. 2

c. 3

d. 1 and 3

Ans: A, SO: 6, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

117. Given below is an excerpt from a management performance report:

Budget Actual Difference

Contribution margin $1,200,000 $1,160,000 $40,000 U

Controllable fixed costs $400,000 $440,000 $40,000 U

The manager's overall performance

a. is 10% above expectations.

b. is 10% below expectations.

c. is equal to expectations.

d. cannot be determined from the information provided.

Ans: B, SO: 6, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

118. A responsibility report for a profit center will

a. not show controllable fixed costs.

b. not show indirect fixed costs.

c. show noncontrollable fixed costs.

d. not show cumulative year-to-date results.

Ans: B, SO: 6, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

119. The dollar amount of the controllable margin

a. is usually higher than the contribution margin.

b. is usually lower than the contribution margin.

c. is always equal to the contribution margin.

d. cannot be a negative figure.

Ans: B, SO: 6, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA:

Reporting

120. Gilbert Company recorded operating data for its shoe division for the year. The company’s

desired return is 5%.

Sales $1,000,000

Contribution margin 200,000

Total direct fixed costs 120,000

Average total operating assets 400,000

Which one of the following reflects the controllable margin for the year?

a. 20%

b. 50%

c. $60,000

d. $80,000

Ans: D, SO: 6, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

For Instructor Use Only

24 - 24 Test Bank for Accounting Principles, Tenth Edition

121. Center Industries had average operating assets of $4,000,000 and sales of $2,000,000 in

2012. If the controllable margin was $600,000, the ROI was

a. 60%

b. 50%

c. 30%

d. 15%

Ans: D, SO: 7, Bloom: A, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

122. Lundquist Manufacturing had average operating assets of $8,000,000 and sales of

$4,000,000 in 2012. If the controllable margin was $800,000, the ROI was

a. 50%

b. 40%

c. 20%

d. 10%

Ans: D, SO: 7, Bloom: A, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

123. The area manager of the Nandos Restaurants is considering two possible expansion

alternatives. The required investments, expected controllable margins, and the ROIs of

each are as follows:

Project Investment Controllable Margin ROI

Portland $240,000 $60,000 25%

Seattle $1,080,000 $100,000 9.25%

The Nandos segment has currently $4,000,000 in invested capital and a controllable

margin of $500,000. Which one of following projects will increase Nandos division’s ROI?

a. Both the Portland and Seattle options

b. Only the Portland option

c. Only the Seattle option

d. Neither the Portland nor the Seattle options

Ans: B, SO: 7, Bloom: AN, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

124. Higley Industries recorded operating data for its Southern division for the year. Higley

requires its return to be 10%.

Sales $1,400,000

Controllable margin 160,000

Total average assets 4,000,000

Fixed costs 100,000

What is the ROI for the year?

a. 4%

b. 35%

c. –6%

d. 1.5%

Ans: A, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 25

125. Noel Division’s operating results include: controllable margin of $300,000, sales totaling

$2,400,000, and average operating assets of $1,000,000. Noel is considering a project

with sales of $200,000, expenses of $172,000, and an investment of average operating

assets of $400,000. Noel’s required rate of return is 9%. Should Noel accept this project?

a. Yes, ROI will drop by 6.6% which is still above the required rate of return.

b. No, the return is less than the required rate of 9%.

c. Yes, ROI still exceeds the cost of capital.

d. No, ROI will decrease to 7%.

Ans: B, SO: 7, Bloom: AN, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

126. Cooper Industries reported the following items for 2012:

Income tax expense $ 60,000

Contribution margin 200,000

Controllable fixed costs 80,000

Interest expense 40,000

Total operating assets 650,000

How much is controllable margin?

a. $200,000

b. $120,000

c. $60,000

d. $20,000

Ans: B, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

127. Kessler Industries is evaluating its Mountain division, an investment center. The division

has a $90,000 controllable margin and $600,000 of sales. How much will Kessler’s

average operating assets be when its return on investment is 10%?

a. $900,000

b. $990,000

c. $600,000

d. $510,000

Ans: A, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

128. An investment center generated a contribution margin of $400,000, fixed costs of

$200,000 and sales of $2,000,000. The center’s average operating assets were $800,000.

How much is the return on investment?

a. 25%

b. 175%

c. 50%

d. 75%

Ans: A, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

For Instructor Use Only

24 - 26 Test Bank for Accounting Principles, Tenth Edition

129. Alma Manufacturing recorded operating data for its auto accessories division for the year.

Sales $750,000

Contribution margin 150,000

Total direct fixed costs 90,000

Average total operating assets 400,000

How much is ROI for the year if management is able to identify a way to improve the

contribution margin by $30,000, assuming fixed costs are held constant?

a. 45.0%

b. 22.5%

c. 15.0%

d. 12.0%

Ans: B, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

130. The current controllable margin for Stern Division is $124,000. Its current operating assets

are $400,000. The division is considering purchasing equipment for $120,000 that will

increase annual controllable margin by an estimated $20,000. If the equipment is

purchased, what will happen to the return on investment for Stern Division?

a. An increase of 16.1%

b. A decrease of 13.3%

c. A decrease of 3.3%

d. A decrease of 7.2%

Ans: C, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

131. Ashton Industries recorded operating data for its Leather division for the year. Ashton

requires its return to be 9%.

Sales $1,000,000

Controllable margin 180,000

Total average assets 600,000

Fixed costs 60,000

How much is ROI for the year?

a. 10%

b. 16.7%

c. 20%

d. 30%

Ans: D, SO: 7, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

132. Casey Stetson is the Bottle Division manager and her performance is evaluated by

executive management based on Division ROI. The current controllable margin for Bottle

Division is $92,000. Its current operating assets total $420,000. The division is considering

purchasing equipment for $80,000 that will increase sales by an estimated $20,000, with

annual depreciation of $20,000. If the equipment is purchased, what will happen to the

return on investment for the division?

a. An increase of 0.5%

b. A decrease of 0.5%

c. A decrease of 3.5%

d. It will remain unchanged.

Ans: C, SO: 7, Bloom: AP, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 27

133. Sloot Division of Taylor Company’s operating results include: controllable margin,

$400,000; sales $4,400,000; and operating assets, $1,600,000. The Sloot Division’s ROI

is 25%. Management is considering a project with sales of $200,000, variable expenses of

$120,000, fixed costs of $80,000; and an asset investment of $300,000. Should

management accept this new project?

a. No, since ROI will be lowered.

b. Yes, since ROI will increase.

c. Yes, since additional sales always mean more customers.

d. No, since a loss will be incurred.

Ans: A, SO: 7, Bloom: AN, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

134. The City Division of Worldwide Industries had an ROI of 25% when sales were $2 million

and controllable margin was $400,000. What were the average operating assets?

a. $100,000

b. $500,000

c. $1,600,000

d. $8,000

Ans: C, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

135. Cocoa Industries recorded operating data for its chocolate division for the year.

Sales $1,000,000

Contribution margin 180,000

Total fixed costs 120,000

Average total operating assets 400,000

How much is ROI for the year if management is able to identify a way to improve the

contribution margin by $40,000, assuming fixed costs are held constant?

a. 25%

b. 18%

c. 45%

d. 12%

Ans: A, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

136. A distinguishing characteristic of an investment center is that

a. revenues are generated by selling and buying stocks and bonds.

b. interest revenue is the major source of revenues.

c. the profitability of the center is related to the funds invested in the center.

d. it is a responsibility center which only generates revenues.

Ans: C, SO: 7, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Reporting,

AICPA PC: None, IMA: Budget Preparation

137. A measure frequently used to evaluate the performance of the manager of an investment

center is

a. the amount of profit generated.

b. the rate of return on funds invested in the center.

c. the percentage increase in profit over the previous year.

d. departmental gross profit.

Ans: B, SO: 7, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: None, IMA: Budget

Preparation

For Instructor Use Only

24 - 28 Test Bank for Accounting Principles, Tenth Edition

138. Return on investment is calculated by dividing

a. contribution margin by sales.

b. controllable margin by sales.

c. contribution margin by average operating assets.

d. controllable margin by average operating assets.

Ans: D, SO: 7, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

139. Which one of the following will not increase return on investment?

a. Variable costs are increased

b. An increase in sales

c. Average operating assets are decreased

d. Variable costs are decreased

Ans: A, SO: 7, Bloom: C, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

140. If an investment center has generated a controllable margin of $150,000 and sales of

$600,000, what is the return on investment for the investment center if average operating

assets were $1,000,000 during the period?

a. 15%

b. 25%

c. 45%

d. 60%

Ans: A, SO: 7, Bloom: K, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

141. Which statement is true?

a. An investment center is responsible for revenues and expenses, as well as earning a

return on assets.

b. An investment center is only responsible for its investments.

c. An investment center is only responsible for revenues and expenses.

d. A profit center is evaluated using contribution margin, while an investment center is

evaluated using ROI.

Ans: A, SO: 7, Bloom: AP, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: None, IMA: Budget

Preparation

142. The denominator in the formula for return on investment calculation is

a. investment center controllable margin.

b. dependent on the specific type of profit center.

c. average investment center operating assets.

d. sales for the period.

Ans: C, SO: 7, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

143. In the formula for ROI, idle plant assets are

a. included in the calculation of controllable margin.

b. included in the calculation of operating assets.

c. excluded in the calculation of operating assets.

d. excluded from total assets.

Ans: C, SO: 7, Bloom: K, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

For Instructor Use Only

Budgetary Control and Responsibility Accounting 24 - 29

144. In computing ROI, land held for future use

a. will hurt the performance measurement of an investment center's manager.

b. is important in evaluating the performance of a profit center manager.

c. is included in the calculation of operating assets.

d. is considered a nonoperating asset.

Ans: D, SO: 7, Bloom: AP, Difficulty: Easy, Min: 1, AACSB: None, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA:

Budget Preparation

145. Stetson Parts has a current return on investment of 10% and the company has

established an 8% minimum rate of return for the division. The division manager has two

investment projects available, for which the following estimates have been made:

Project A - Annual controllable margin = $48,000, operating assets = $800,000

Project B - Annual controllable margin = $120,000, operating assets = $1,100,000

Which project should be funded?

a. Both projects

b. Project A

c. Project B

d. Neither project

Ans: C, SO: 7, Bloom: C, Difficulty: Hard, Min: 5, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

146. If an investment center has a $90,000 controllable margin and $1,200,000 of sales, what

average operating assets are needed to have a return on investment of 10%?

a. $120,000

b. $210,000

c. $900,000

d. $1,200,000

Ans: C, SO: 7, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector, AICPA FN: Measurement, AICPA PC: Problem Solving,

IMA: Budget Preparation

147. Which of the following valuations of operating assets is not readily available from the

accounting records?

a. Cost

b. Book value

c. Market value

d. Both cost and market value