Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Value Added Tax

Caricato da

emierry claveCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Value Added Tax

Caricato da

emierry claveCopyright:

Formati disponibili

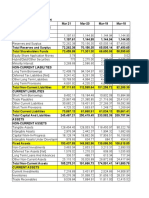

J.S. International Shipping Corp.

Tax Profile- Value Added Tax

Taxable Year 2018

1st Quarter 2nd Quarter

Particulars Tax Base Tax Due Tax Base

Vatable Sales 911,042.25 109,325.07 486,651.16

Sales to Government

Zero rated sales 4,415,964.80 - 3,840,096.00

Exempt sales

Total sales 5,327,007.05 109,325.07 4,326,747.16

Less : Allowable Input Tax

Input Tax Carried Over From Previous Period 6,410,337.27

Input Tax Deffered On Capital Goods Exceeding P1M From Previous Quarter

Transitional Input Tax

Presupmtive Input Tax

Others

Total 6,410,337.27

Current Transaction

Purchase of Capital Goods not Exceeding P1M

Purchase of Capital Goods not Exceeding P1M

Domestic Purchases Of Goods Others Than Capital 917,783.61 110,134.03 879,519.85

Importation Of Goods Other than Capital Goods -

Domestic Purchase Of service 8,091,801.47 971,016.18 9,844,320.59

Service rendered By Non - residents

Purchase Not Qualified For input Tax

Others

Total Current Purchases 9,009,585.08 10,723,840.44

Total Available Inputv Tax 7,491,487.48

Less : Deduction Of From Input tax

Input Tax On Purchases Of capital Goods Exceeding P1m Deffered For The Succeeding Period

Input tax On Sale To Govt. Closed To Expense

Input Tax Allocable To Exempt Sales

Vat Return / Tcc Claimed

Others

Total

Total Allowable Input Tax 7,491,487.48

Net Vat Payable 7,491,487.48

Less : Tax Credits / Payment

Monthly Vat Payments

Creditable Value - Added Tax

Advance Payment For Sugar And Flour Industries

Vat witheld On Sales To Government

Vat Paid In Return Previously Filed. If This Is An Amended Return

Advance Payment Made

Others

Total Tax Credits Payments

Tax Still payable 7,491,487.48

Add Penaties

Total Amount payable 7,491,487.48

2nd Quarter 3rd Quarter 4th Quarter TOTAL

Tax Due Tax Base Tax Due Tax Base Tax Due Tax Base

58,398.14 1,011,192.15 121,343.06 556,881.38 66,825.77 2,965,766.94

6,963,597.60 8,057,404.47 23,277,062.87

58,398.14 7,974,789.75 121,343.06 8,614,285.85 66,825.77 26,598,721.84

7,382,162.41 8,610,625.12 8,317,056.37 6,410,337.27

7,382,162.41 8,610,625.12 8,317,056.37 6,410,337.27

105,542.38 769,869.50 92,384.34 587,269.82 70,472.38 3,154,442.78

-

1,181,318.47 7,880,313.70 945,637.64 8,657,957.13 1,038,954.86 34,474,392.89

8,650,183.20 9,245,226.95 37,628,835.67

8,669,023.26 9,648,647.10 9,426,483.60 35,235,641.44

1,210,247.67 1,210,247.67

1,210,247.67 1,210,247.67

8,669,023.26 8,438,399.43 9,426,483.60 34,025,393.77

- 8,610,625.12 8,317,056.37 - 9,359,657.83 - 2,161,739.10

- 8,610,625.12 - 8,317,056.37 - 9,359,657.83 - 18,795,851.84

- 8,610,625.12 - 8,317,056.37 - 9,436,194.01

TOTAL

Tax Due

355,892.03

2,793,247.54

378,533.13

4,136,927.15

Potrebbero piacerti anche

- Florentino, Romeo GaaDocumento6 pagineFlorentino, Romeo GaaRosevie Anne GabayNessuna valutazione finora

- Final Cookies FsDocumento8 pagineFinal Cookies FsDanah Jane GarciaNessuna valutazione finora

- BSBFIM601 Assessment 1: Sales and Profit BudgetsDocumento8 pagineBSBFIM601 Assessment 1: Sales and Profit Budgetsprasannareddy9989100% (1)

- Net Sales Less: Cost of Goods Sold: Projected Income Statement Five Year PeriodDocumento17 pagineNet Sales Less: Cost of Goods Sold: Projected Income Statement Five Year PeriodAdrian Rodriguez PangilinanNessuna valutazione finora

- Final Ma Jud Ni FinancialsDocumento78 pagineFinal Ma Jud Ni FinancialsMichael A. BerturanNessuna valutazione finora

- FS SquashDocumento10 pagineFS SquashDanah Jane GarciaNessuna valutazione finora

- Part-2 Cash Flow Apex Footwear Limited Growth RateDocumento11 paginePart-2 Cash Flow Apex Footwear Limited Growth RateRizwanul Islam 1912111630Nessuna valutazione finora

- Verana Exhibit and SchedsDocumento45 pagineVerana Exhibit and SchedsPrincess Dianne MaitelNessuna valutazione finora

- BreakdownDocumento2 pagineBreakdownquenguyen9866Nessuna valutazione finora

- Pronatural Food Corp. Financial Statement AnalysisDocumento29 paginePronatural Food Corp. Financial Statement AnalysisZejkeara ImperialNessuna valutazione finora

- Financial Projections GymDocumento4 pagineFinancial Projections GymMark Joseph OlinoNessuna valutazione finora

- Comparative Analysis of Filinvest Land Inc. and Subsidiaries' Statement of Financial Position from 2017-2021Documento28 pagineComparative Analysis of Filinvest Land Inc. and Subsidiaries' Statement of Financial Position from 2017-2021Kris MacuhaNessuna valutazione finora

- Profit&LossDocumento1 paginaProfit&LossVivek SonuNessuna valutazione finora

- Tata Steel FinancialsDocumento8 pagineTata Steel FinancialsManan GuptaNessuna valutazione finora

- Fs Squash CookiesDocumento10 pagineFs Squash CookiesDanah Jane GarciaNessuna valutazione finora

- Tedros Genene Bakery Income Statement For The Year 2013 - 2018Documento30 pagineTedros Genene Bakery Income Statement For The Year 2013 - 2018Samuel GirmaNessuna valutazione finora

- I. Assets: 2018 2019Documento7 pagineI. Assets: 2018 2019Kean DeeNessuna valutazione finora

- Standard-Ceramic-Limited NewDocumento10 pagineStandard-Ceramic-Limited NewTahmid ShovonNessuna valutazione finora

- Laporan Keuangan PT KoyakiDocumento2 pagineLaporan Keuangan PT Koyakinurul azizahNessuna valutazione finora

- Business PlanDocumento10 pagineBusiness PlanDanah Jane GarciaNessuna valutazione finora

- Projection Summary Isargas Group For Investor Oct 2019Documento4 pagineProjection Summary Isargas Group For Investor Oct 2019Anton CastilloNessuna valutazione finora

- WiproDocumento9 pagineWiprorastehertaNessuna valutazione finora

- RBSMI Achieves Over P1 Billion in Total Assets in 2021Documento14 pagineRBSMI Achieves Over P1 Billion in Total Assets in 2021Vicxie Fae CupatanNessuna valutazione finora

- 1233 NeheteKushal BAV Assignment1Documento12 pagine1233 NeheteKushal BAV Assignment1Anjali BhatiaNessuna valutazione finora

- FS Gas StationDocumento25 pagineFS Gas StationKathlyn JambalosNessuna valutazione finora

- Laporan Keuangan GGRM (2014 S.D. 2016)Documento4 pagineLaporan Keuangan GGRM (2014 S.D. 2016)Eriko Timothy GintingNessuna valutazione finora

- Chevron Holdings Vs CIRDocumento47 pagineChevron Holdings Vs CIRFaye TabadaNessuna valutazione finora

- Beximco Pharmaceuticals Ltd. Income Statement and Financial Position AnalysisDocumento14 pagineBeximco Pharmaceuticals Ltd. Income Statement and Financial Position AnalysisIftekar Hasan SajibNessuna valutazione finora

- Tax Revenue Collection Statistics - 2021 22 Financial YearDocumento6 pagineTax Revenue Collection Statistics - 2021 22 Financial YearHashim MohamedNessuna valutazione finora

- Exhibit 1Documento9 pagineExhibit 1jeffblake1216Nessuna valutazione finora

- Total Projected CostDocumento15 pagineTotal Projected CostElla AbelardoNessuna valutazione finora

- Rak Ceramics: Income StatementDocumento27 pagineRak Ceramics: Income StatementRafsan JahangirNessuna valutazione finora

- M.I. Cement Factory Limited (MICEMENT) : Income StatementDocumento15 pagineM.I. Cement Factory Limited (MICEMENT) : Income StatementWasif KhanNessuna valutazione finora

- Financial Ratios v3Documento18 pagineFinancial Ratios v3Amichai GravesNessuna valutazione finora

- Ten Year Financial Summary PDFDocumento2 pagineTen Year Financial Summary PDFTushar GoelNessuna valutazione finora

- New ExcelDocumento25 pagineNew Excelred8blue8Nessuna valutazione finora

- E. Sensitivities and ScenariosDocumento3 pagineE. Sensitivities and ScenariosDadangNessuna valutazione finora

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingDocumento4 paginePeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorNessuna valutazione finora

- Comparitive Profit and Loss Statement of Unitech Group For The Year Ended 2008Documento4 pagineComparitive Profit and Loss Statement of Unitech Group For The Year Ended 2008mukulpharmNessuna valutazione finora

- FIN254 Project NSU (Excel File)Documento6 pagineFIN254 Project NSU (Excel File)Sirazum SaadNessuna valutazione finora

- Group 4 - TATA PowerDocumento26 pagineGroup 4 - TATA PowerSaMyak JAinNessuna valutazione finora

- P and L PDFDocumento2 pagineP and L PDFjigar jainNessuna valutazione finora

- Wipro Statement of Profit and Loss and Balance Sheet 2012-2021Documento6 pagineWipro Statement of Profit and Loss and Balance Sheet 2012-2021SatishNessuna valutazione finora

- New Manoj Grill UdhyogDocumento24 pagineNew Manoj Grill UdhyoggpdharanNessuna valutazione finora

- Tata Steel Profit and Loss Annual ReportDocumento8 pagineTata Steel Profit and Loss Annual ReportReshma ShahNessuna valutazione finora

- 2019 Proposed BudgetDocumento91 pagine2019 Proposed Budgetcharmaine vegaNessuna valutazione finora

- Bharat Petroleum Corporation Limited: Company's ProfileDocumento7 pagineBharat Petroleum Corporation Limited: Company's ProfileTanushree LamareNessuna valutazione finora

- Comparitive Financial Statement of Reliance Industries For Last 5 YearsDocumento33 pagineComparitive Financial Statement of Reliance Industries For Last 5 YearsPushkraj TalwadkarNessuna valutazione finora

- RMG Sales Forecast - QueenieDocumento31 pagineRMG Sales Forecast - QueenieQueenie Amor AstilloNessuna valutazione finora

- Marta's Financial AspectDocumento20 pagineMarta's Financial AspectMarvin GamboaNessuna valutazione finora

- Bajaj Auto Ratio AnalysisDocumento2 pagineBajaj Auto Ratio AnalysisATANU GANGULYNessuna valutazione finora

- Bajaj Aut1Documento2 pagineBajaj Aut1Rinku RajpootNessuna valutazione finora

- Shree Cement DCF ValuationDocumento71 pagineShree Cement DCF ValuationPrabhdeep DadyalNessuna valutazione finora

- Tata Motors DCFDocumento11 pagineTata Motors DCFChirag SharmaNessuna valutazione finora

- Excel - 13132110014 - Draft Paper Individu - FNT 4A-1Documento53 pagineExcel - 13132110014 - Draft Paper Individu - FNT 4A-1Ferian PhungkyNessuna valutazione finora

- Summary of VAT Returns - 2013Documento3 pagineSummary of VAT Returns - 2013Argie Capuli RapisuraNessuna valutazione finora

- ITC Profit AnalysisDocumento16 pagineITC Profit AnalysisAnimesh GuptaNessuna valutazione finora

- Pran Group MIS ReportDocumento14 paginePran Group MIS ReportNazer HossainNessuna valutazione finora

- Bsbfim601 Manage Finances Prepare BudgetsDocumento9 pagineBsbfim601 Manage Finances Prepare BudgetsAli Butt100% (4)

- Wipro Annual Report 2011 12Documento244 pagineWipro Annual Report 2011 12Hariharasudan HariNessuna valutazione finora

- Sell Your SongsDocumento82 pagineSell Your Songsapi-3697728100% (2)

- Bulk Water Supply Sample ContractDocumento119 pagineBulk Water Supply Sample Contractdemosrea100% (1)

- Pawlowski T. Breuer C. Hovemann A. 2010 PDFDocumento23 paginePawlowski T. Breuer C. Hovemann A. 2010 PDFMatheus EvaldtNessuna valutazione finora

- Energy Resource ReportDocumento127 pagineEnergy Resource ReportKhishigbayar PurevdavgaNessuna valutazione finora

- Reduce Late Filing Penalty InterestDocumento2 pagineReduce Late Filing Penalty InterestIndia Tax Made Simple (taxworry.com)50% (2)

- 006 Endencia V DavidDocumento3 pagine006 Endencia V DavidannamariepagtabunanNessuna valutazione finora

- De Barreto, Et. Al. V. Villanueva, Et. Al., (1961) : Daniel Carlo M. Benipayo 11685352Documento24 pagineDe Barreto, Et. Al. V. Villanueva, Et. Al., (1961) : Daniel Carlo M. Benipayo 11685352Edu FajardoNessuna valutazione finora

- Oracle HCM Cloud v13 PDFDocumento258 pagineOracle HCM Cloud v13 PDFDennisNessuna valutazione finora

- REO-Local-Taxation As of May 2020 REO-Local-Taxation As of May 2020Documento20 pagineREO-Local-Taxation As of May 2020 REO-Local-Taxation As of May 2020Refinej WickerNessuna valutazione finora

- 20230225DSLG2088Documento33 pagine20230225DSLG2088Tubai BhattacharjeeNessuna valutazione finora

- Income tax filing deadline reminderDocumento2 pagineIncome tax filing deadline remindermakamkkumarNessuna valutazione finora

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocumento4 pagineEmployer's Annual Federal Unemployment (FUTA) Tax ReturnPatriciaNessuna valutazione finora

- Customs Guide For Crew MembersDocumento9 pagineCustoms Guide For Crew MembersAlex YewNessuna valutazione finora

- FR - Study - Guide 2020 PDFDocumento560 pagineFR - Study - Guide 2020 PDFAndre LisboaNessuna valutazione finora

- Cash Flow Analysis For Nestle India LTDDocumento2 pagineCash Flow Analysis For Nestle India LTDVinayak Arun SahiNessuna valutazione finora

- G.R. No. 203754 June 16 2015Documento2 pagineG.R. No. 203754 June 16 2015Titus EdisonNessuna valutazione finora

- CHP 3 Pad370 MDM SarehanDocumento8 pagineCHP 3 Pad370 MDM SarehanPaikuna sumoNessuna valutazione finora

- Pando v. Gimenez AntichresisDocumento1 paginaPando v. Gimenez AntichresisMariel QuinesNessuna valutazione finora

- CIR V FMFDocumento21 pagineCIR V FMFPatatas SayoteNessuna valutazione finora

- Project Report On Fixed Deposit in Devgiri BankDocumento78 pagineProject Report On Fixed Deposit in Devgiri BankKamlakar Avhad69% (16)

- Week 7 FABM 2Documento9 pagineWeek 7 FABM 2WeighingSwing 35Nessuna valutazione finora

- Zemen Bank Annual Report 2010Documento21 pagineZemen Bank Annual Report 2010leunamaa100% (1)

- RMC No. 73-2019 - Annex ADocumento1 paginaRMC No. 73-2019 - Annex ALeo R.Nessuna valutazione finora

- Income Taxation On Individuals ModuleDocumento18 pagineIncome Taxation On Individuals ModuleCza PeñaNessuna valutazione finora

- GST & Charge of GST PaperDocumento3 pagineGST & Charge of GST PaperDevendra AryaNessuna valutazione finora

- Book AnswersDocumento138 pagineBook AnswersMartina Vassallo100% (1)

- Chapter 4Documento12 pagineChapter 4jeo beduaNessuna valutazione finora

- Budget 2015-16: Le Discours de Vishnu Lutchmeenaraidoo Dans Son IntégralitéDocumento71 pagineBudget 2015-16: Le Discours de Vishnu Lutchmeenaraidoo Dans Son IntégralitéDefimediagroup LdmgNessuna valutazione finora