Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Standard Chartered

Caricato da

san_sam3Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Standard Chartered

Caricato da

san_sam3Copyright:

Formati disponibili

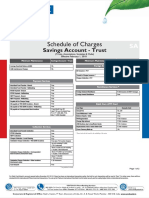

eSaver 10k / 2 in 1 eSaver 10k / 2 in 1

CPS eSaver 10k / Savings CPS eSaver 10k / Savings

10k Savings Account 10k Savings Account

Account Account

MINIMUM BALANCE REQUIREMENT First Year Fee FREE NA

Business Essential Account Monthly Average Balance (MAB)& `10,000 `10,000* Annual Fee (per card) ` 499 NA

Account Maintenance Charges 5% of shortfall** 5% of shortfall** Platinum Rewards Debit Card1

in MAB with in MAB with

First year fee ` 499 ` 499

Max cap of `500 Max cap of `500

Annual fee (per card) ` 499 ` 499

* If Term Deposit > 10,000 then MAB requirement is Nil

** Shortfall is calculated based on difference between required • Lost card re-issuance

minimum MAB & actual MAB in a given month.

ATM Card ` 150 ` 150

*Minimum Average balance (MAB) charges will be applicable to all the accounts.

Where there is no sufficient balance, the charges will be deducted as and when the Shop Smart debit card ` 200 ` 200

account gets funded Platinum Debit Card ` 799 ` 799

&

For Employee Banking account, MAB requirement is Nil

m-Commerce Platinum Debit Card / `499 NA

GENERAL CHARGES Titanium Debit Card

• Account Statements • Cross-currency mark-up charges on cross border 3.5% + 3.5% +

Quarterly Statements FREE FREE transactions on debit card* applicable taxes applicable taxes

SCHEDULE Monthly Statements*

Pass Book*

FREE

FREE

FREE

FREE

*The exchange rate will be the VISA / MasterCard wholesale exchange

rate prevailing at the time of transaction/merchant settlement

• Replacement of PIN FREE FREE

Duplicate passbook issuance* FREE FREE

OF *Available at domicile branch for "Customer-in-Person" (CIP)

• Cheque book

Personalised Cheque Book (Local) FREE FREE

BRANCH TRANSACTION CHARGES$

Cash Deposit / Withdrawal

The above charges will apply in addition to the specific service Charge for the listed

transactions On maintenance of minimum balances (in metro**,balance >=INR 25000;

` 199* ` 199*

Multicity Cheque Book (Personalised) FREE* FREE*

SERVICE

in non metro, balance >= INR 10000), first 4 transactions free in a calendar month,

charges apply from fifth transaction onwards.

*` 50 on accounts where minimum Monthly Average Balance **Metro locations - Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai

(MAB) has not been Maintained in the previous month On non-maintenance of minimum balances, charges apply from first transaction

@ 2 in 1 current account - a total of ` 1,00,000 is to be maintained in all linked term

• ATM Usage1 deposits else an Monthly average balance of ` 50,000 needs to be maintained in the

CHARGES Standard Chartered ATM's in India

Non Standard Chartered ATM's in India

• Branch location - Metro

FREE FREE current account. All other charges will be as per 2 in 1 Savings account.

Transaction limit per month is INR 2,00,000.

Charges on the amount exceeding the limit per month

INR 5 per 1000 on INR 5 per 1000 on

the exceeded

amount*

the exceeded

amount*

(Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai) ^^ Demand Draft/Pay order/Cheque deposit/ Fund Transfer will not be counted as a

transaction

First 3 (Financial & Non Financial^) transactions in a month1 FREE* FREE* @

Cheque deposit/ Fund Transfer will not be counted as a transaction

Above first 3 (Financial & Non Financial^)1 $

Effective November 1, 2013

transactions in a Month (Per Transaction) ` 20* ` 20* * Senior citizens (age>60 years) will not be charged

Effective *The maximum cash you can withdraw using your debit card at other bank ATMs PHONE BANKING SERVICE CHARGES$

is INR 10,000 per transaction. However, this limit may vary as per the discretion

1st June 2019 of the other bank. For customers who maintain average monthly

balance >= INR 25000, first 5 transaction per month will be free

• Self Service IVR calls FREE FREE

^Balance Enquiry is considered as Non Financial Transaction • Non IVR calls attended by ` 49* ` 49*

• Branch location - Non metro Phone Banking Officers

$

Effective February 1, 2019

First 5 (Financial & Non Financial^) transactions in a month1 FREE* FREE* *Applicable on non-maintenance of MAB only for those services that are available

Above first 5 (Financial & Non Financial^) transactions in a online but are done through the phone banking executive Senior citizens

(age>60 years) will not be charged.

month1(Per Transaction) ` 20* ` 20*

*The maximum cash you can withdraw using your debit card at other bank BRANCH SERVICE HANDLING CHARGES ` 199* ` 199*

ATMs is INR 10,000 per transaction. However, this limit may vary as per *Applicable on non-maintenance of MAB only for those services that are available

the discretion of the other bank. For customers who maintain average online but are done through branch banking. Senior citizens (age>60 years)

monthly balance >= INR 25000, first 10 transactions per month will be free will not be charged.

^Balance Enquiry is considered as Non Financial Transaction.

OTHER ACCOUNT RELATED CHARGES

• ATM's Outside India1

• Duplicate Statement

Cash withdrawal (Per Transaction) ` 140 ` 140

Statement upto three months old FREE FREE

10k Savings Account Cash withdrawal subject to RBI guidelines.

Balance enquiry (Per Transaction) ` 20 ` 20 Statement more than 3 months old FREE* FREE*

*There will be an applicable fee of INR 99 per month in case the

eSaver 10K Account • ATM Cards

1

First Year Fee ` 150 ` 150

customer opts for a physical statement along with the e statement

w.e.f. 1st January 2019

2 in 1 Savings Account Annual Fee (Per Card) ` 150 ` 150 • Account Closure

• Corporate Platinum Debit Card1 Within 12 months from date of opening ` 500* ` 500*

First Year Fee ` 199 ` 199 *This charge is not applicable, in case the account is closed within

14 days from the date the account is opened

Annual Fee (Per Card) ` 199 ` 199

• Electronic statements (currently for non-consolidated

• ShopSmart Debit Card1 statements only) FREE FREE

First Year Fee ` 200 ` 200 • Electronic statements + Physical statements ` 99* ` 99*

June 2019 Annual Fee (Per Card) ` 200 ` 200 *There will be an applicable fee of INR 99 per month in case the customer opts for a

physical statement along with the e statement w.e.f. 1st January 2019

Platinum Debit Card1

• Stop Payment1

First Year Fee ` 199 ` 199

Single Cheque ` 50 ` 50

Annual Fee (Per Card) ` 199 ` 199

sc.com/in m-Commerce Platinum Debit Card / Titanium Debit Card1

Range of Cheques ` 50 ` 50

eSaver 10k / 2 in 1 eSaver 10k / 2 in 1

CPS eSaver 10k / Savings CPS eSaver 10k / Savings Please Note:

10k Savings Account 10k Savings Account

Account Account Standard Chartered Bank, India, has produced this brochure to keep you informed of our broad range of services. Our

fees and charges reflect our commitment to providing our customers with quality service at competitive prices.

• Cheque Return REMITTANCES The Bank reserves the right to amend the terms, conditions or rate stated in the brochure and to assess charges on

transactions which are not covered by this schedule.

Due to technical reasons FREE FREE • National Electronic Funds Transfer

Safe Deposit Lockers are available at certain branches and can be offered to a customer upon request. Charges for the

Cheque issued by the customer (due to financial reason) Inward FREE FREE same are available at the respective branches.

• First cheque return in the last 12 months ` 500 ` 500 Outward FREE FREE Charges in this document are exclusive of applicable taxes

• More than one cheque return in the ` 750 ` 750 • Real Time Gross Settlement Transfer 1

For Employee Banking accounts, please contact phone-banking for service charges applicable to your relationship.

last 12 months (per return) Inward FREE FREE Employee Banking variants include: CPS eSaver 10k, Smart Banking Howzzat

Cheque deposited by customer (due to financial reason) ` 150 ` 150 Outward FREE FREE 2

Charges for Smart Banking Howzzat, CPS eSaver 10k, Howzzat Account will be as per schedule of charges for 10k Savings

Account variant.

Foreign Currency Cheque ` 181* ` 181* • Immediate Payment Service (IMPS)1

*Other Bank's charges additional - <= INR 1000 FREE FREE GST NOTE:

• Electronic Clearing Service return - > INR 1000 and <= INR 100,000 `5 `5 GST will be levied at the applicable rates in force on all taxable supplies with effect from a date to be notified by the Government.

ECS debit instructions issued by customer and returned unpaid - > INR 100,000 and <= INR 200,000 ` 15 ` 15 Once GST is implemented, it will be levied at the applicable rates in force on foreign currency conversion. For the purpose of

determination of value of in relation to supply of foreign currency, including money changing, the following table (as provided in

• First ECS return in the last 12 months ` 500 ` 500 • Pay orders / Demand Draft drawn on 0.15% Free Upto the draft rules) should be used:

• More than one ECS return in the last 12 months (per return) ` 750 ` 750 our branches1 2 per month*

• SMS TRANSACTION ALERTS*1 Min. fee ` 50, Max. ` 1,500 Value of Service on which GST to be paid.

*Charges @ 0.15% to apply thereafter Less than or equal to INR 1,00,000 1% of the transaction amount, subject to minimum of INR 250/-

<=5 SMS sent per month ` 2.5 per month ` 2.5 per month

>5 SMS sent per month ` 5 per month ` 5 per month • Demand Drafts drawn on 0.25% 0.25% Greater than INR 1,00,000 and less

INR 1000 + 0.5% of the transaction amount

* SMS transaction alert charges will apply only if the MAB is less than or equal to INR 10,00,000

correspondent banks1 (specified Locations*)

than INR 25,000. This is irrespective of the account level MAB Greater than 10,00,000 INR 5,500 + 0.1% of the transaction amount, subject to maximum of

requirement" *List available at all our branches INR 60,000/-

Min. fee ` 250, Max. ` 5,000. max. fee will not apply to certain locations.

SPECIAL SERVICES For other locations, correspondent bank charges will apply additionally The GST at applicable rates would be levied on the value calculated as per above table.

• Foreign Inward Remittance Certificate / Form 10H ` 100 ` 100

Foreign Currency Draft ` 776 ` 776

• Certificate of Balance / Certificate of Interest (draft in EURO - ` 1,025)

Certificate upto 12 months old FREE FREE

• Cancellation / Revalidation

Certificate more than 12 months FREE FREE

Demand Draft / Pay Order ` 100 ` 100

• Retrieval of Documents

• Lost / Duplicate instrument FREE* FREE*

Document upto 6 months old* ` 150 ` 150

*Correspondent bank's charges additional

Document more than 6 months old* ` 150 ` 150

*Retrieval pertaining to cheque and Debit instructions will not be • Funds Transfer

charged upto one year old

Transmission in Foreign Currency ` 250* ` 250*

• Standing instructions (Telex transfer)

Setting up charges FREE FREE *Other Bank's charges additional

Execution fee FREE FREE

• Remittances from abroad ` 250 ` 250

Charges / commission on transaction additional FREE FREE

DOORSTEP BANKING@1 On call

Amendment FREE FREE

• Banker's report FREE FREE Cash Pick up / Delivery < ` 3,00,000 ` 200# ` 200#

• Signature Verification FREE FREE Cash Pick up / Delivery >= ` 3,00,000 and ` 350# ` 350#

OUTSTATION CHEQUE COLLECTION < ` 10,00,000

#

In case MAB is not maintained charges @`600

• Cheque drawn on any of our branches FREE FREE per request shall apply

• Cheque drawn on another bank FREE FREE

Cheque Pick-up / DD & PO Delivery (Per request) ` 100 ` 100

(Our branch locations)

1

• Speed Clearing Location Fixed Schedule Services

Cheque amount <= ` 1,00,000 FREE FREE Frequency - Daily (Cash Pickup & Delivery) ` 3,000 ` 3,000

< ` 3,00,000 per month per month

Cheque amount > ` 1,00,000 FREE FREE

Frequency - Daily (Cash Pickup & Delivery) ` 8,000 ` 8,000 PHONE BANKING NUMBERS

• Other Locations

>= ` 3,00,000 and < ` 10,00,000 per month per month

Cheque amount <= ` 5,000 FREE FREE Allahabad, Amritsar, Bhopal, Bhubaneshwar, Chandigarh, 6601444 / 3940444

Frequency - Weekly (Cash Pickup & Delivery) ` 700 ` 700 Cochin / Ernakulam, Coimbatore,Indore, Jaipur, Jalandhar, Kanpur,

Cheque amount > ` 5,000 and <= ` 10,000 FREE FREE < ` 3,00,000 per month per month Lucknow, Ludhiana, Nagpur, Patna, Rajkot, Surat, Vadodara

Cheque amount > ` 10,000 and <= ` 1,00,000 FREE FREE Frequency - Weekly (Cash Pickup & Delivery) ` 1,300 ` 1,300

Ahmedabad, Bangalore, Chennai, Delhi, Hyderabad, Kolkata, 66014444 / 39404444

Cheque amount > ` 1,00,000 FREE FREE >= ` 3,00,000 and < ` 10,00,000 per month per month

Mumbai, Pune

• Foreign Currency Cheque Frequency - Daily Cheque Pickup FREE once a day FREE once a day

Gurgaon, Noida 011 - 66014444

• Cheque Collection (USD) Frequency - Weekly (Cheque Pickup) FREE FREE

011 - 39404444 /

for cheque <= 50000 USD USD 35 USD 35 Fee on delivery on Sunday, Public Holidays and

for cheque > 50000 USD USD 55 USD 55 Banking Holidays will be twice the listed price. Jalgaon, Guwahati, Cuttack, Mysore, Thiruvananthpuram, 1800 345 1000 /

Cleared Overseas - Reject USD 15 USD 15 @ In select cities only, list available with branches. Vishakhapatnam, Proddatur, Dehradun, Mathura, Saharanpur,

Cleared Overseas - Investigation charges USD 50 USD 50

Siliguri 1800 345 5000

• Cheque collection (currencies other than USD) 0.28%* 0.28%*

*Min INR 121

Potrebbero piacerti anche

- Schedule of Service Charges: Basic Savings Bank Deposit Account Aasaan Savings AccountDocumento2 pagineSchedule of Service Charges: Basic Savings Bank Deposit Account Aasaan Savings AccountArvind Reddy4.0Nessuna valutazione finora

- In Bsbda Sosc Sep17Documento2 pagineIn Bsbda Sosc Sep17shekharsap284Nessuna valutazione finora

- Documents Required For Title TransferDocumento2 pagineDocuments Required For Title TransferChaitanya Chaitu CANessuna valutazione finora

- Deposit Accounts GCo Key Fact Statement EnglishDocumento5 pagineDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNessuna valutazione finora

- Indus Online Savings Account SocDocumento4 pagineIndus Online Savings Account Socrushi44Nessuna valutazione finora

- MCB Young Key Fact SheetDocumento3 pagineMCB Young Key Fact SheetFahad MagsiNessuna valutazione finora

- Class Notes BB9143Documento4 pagineClass Notes BB9143BBNessuna valutazione finora

- Key Facts Sheet Asaan Digital Account (Ada) Islamic CurrentDocumento3 pagineKey Facts Sheet Asaan Digital Account (Ada) Islamic CurrentAmira AslamNessuna valutazione finora

- Cardholder Agreement MITCDocumento54 pagineCardholder Agreement MITCNihit SharmaNessuna valutazione finora

- Tariff List: Category Tariff Products Category TariffDocumento1 paginaTariff List: Category Tariff Products Category TariffsrajkrishnaNessuna valutazione finora

- Most Important Terms & Conditions: Kotak Mahindra Bank Limited ADocumento53 pagineMost Important Terms & Conditions: Kotak Mahindra Bank Limited AJaackson SabastianNessuna valutazione finora

- Most Important Terms & ConditionsDocumento58 pagineMost Important Terms & Conditionsanshul630Nessuna valutazione finora

- Credit Card Tandc PDFDocumento58 pagineCredit Card Tandc PDFniharikarllameddy.kaNessuna valutazione finora

- Fino Merchant - Brochure - Eng - Feb - 2024Documento9 pagineFino Merchant - Brochure - Eng - Feb - 2024uti.softpanNessuna valutazione finora

- Key Fact Statement For Deposit Products: Account Types & Salient FeaturesDocumento3 pagineKey Fact Statement For Deposit Products: Account Types & Salient FeaturesHassan AhmadNessuna valutazione finora

- NMB Tariff Guide 2021Documento2 pagineNMB Tariff Guide 2021Adul MahmoudNessuna valutazione finora

- Mahana MunafaDocumento2 pagineMahana Munafaalimurtaza6582Nessuna valutazione finora

- In Mid Savings AccountDocumento4 pagineIn Mid Savings Accountjb6c8h4rnmNessuna valutazione finora

- 7716pe2 Cafm May06Documento24 pagine7716pe2 Cafm May06harshrathore17579Nessuna valutazione finora

- Merchant Brochure Eng December 2023Documento8 pagineMerchant Brochure Eng December 2023Nasiruddin AhmedNessuna valutazione finora

- Merchant Brouchure Eng August 2023Documento8 pagineMerchant Brouchure Eng August 2023ARJUN HALDARNessuna valutazione finora

- Cardholder Agreement MITCDocumento53 pagineCardholder Agreement MITCVishal PandeyNessuna valutazione finora

- AIB Visa Corporate Business Card Additional UserDocumento18 pagineAIB Visa Corporate Business Card Additional UserRafay HussainNessuna valutazione finora

- MITC Premium 15 6 2016Documento6 pagineMITC Premium 15 6 2016raop3651Nessuna valutazione finora

- Schedule of Charges Current AccountDocumento8 pagineSchedule of Charges Current AccountAshif RejaNessuna valutazione finora

- 1119 PDFDocumento5 pagine1119 PDFMusafir AdamNessuna valutazione finora

- Nri SocDocumento1 paginaNri SocRavi AhujaNessuna valutazione finora

- SOB Indus PartnerDocumento2 pagineSOB Indus Partnerrajprince26460Nessuna valutazione finora

- NMB Tariff Guide 2023Documento2 pagineNMB Tariff Guide 2023MabulaNessuna valutazione finora

- English CCDocumento6 pagineEnglish CCdsouzan071Nessuna valutazione finora

- Changes in Upcoming Schedule of Charges (Jul-Dec-2022)Documento1 paginaChanges in Upcoming Schedule of Charges (Jul-Dec-2022)Nasir MuhmoodNessuna valutazione finora

- Key Fact Sheet (HBL FreedomAccount) - July To DecemberDocumento1 paginaKey Fact Sheet (HBL FreedomAccount) - July To DecemberAftab AhmedNessuna valutazione finora

- KFS HBL Islamic Basic Banking Account - Jul 19Documento1 paginaKFS HBL Islamic Basic Banking Account - Jul 19M-Waseem AnsariNessuna valutazione finora

- Key Fact Sheet For Islamic Digital AccountDocumento7 pagineKey Fact Sheet For Islamic Digital Accountwaqas wattooNessuna valutazione finora

- NMB Tariff Guide - 2022Documento2 pagineNMB Tariff Guide - 2022doplapesa dpNessuna valutazione finora

- Dgyhbdbkud Buf JyDocumento3 pagineDgyhbdbkud Buf JySai Raavan Chowdary KakaniNessuna valutazione finora

- KFS HBL Al-Irtifa Account - Jul 19Documento1 paginaKFS HBL Al-Irtifa Account - Jul 19M-Waseem AnsariNessuna valutazione finora

- Key Services: CSO & Corporate Office: Regd Office: Angel Broking Limited (Formerly Known As Angel Broking Pvt. LTD.)Documento2 pagineKey Services: CSO & Corporate Office: Regd Office: Angel Broking Limited (Formerly Known As Angel Broking Pvt. LTD.)sivagaaneshNessuna valutazione finora

- MITC Document CustomerDocumento19 pagineMITC Document CustomerKamal GauravNessuna valutazione finora

- ICICI Bank Credit Card Important DetailsDocumento11 pagineICICI Bank Credit Card Important DetailsAdvaitNessuna valutazione finora

- Key Fact Sheet (HBL ConventionalCurrentAccount) - July To DecemberDocumento1 paginaKey Fact Sheet (HBL ConventionalCurrentAccount) - July To DecemberRaja AdeelNessuna valutazione finora

- Indus Online Savings Account SOCDocumento8 pagineIndus Online Savings Account SOCrajprince26460Nessuna valutazione finora

- Kotak Zen Credit Card BrochureDocumento8 pagineKotak Zen Credit Card BrochureSaksham Goel100% (1)

- Financial Accounting Chapter 1 - 3: By: Stefanie (125180444) Angela (125180447) Yuvina (125180464)Documento20 pagineFinancial Accounting Chapter 1 - 3: By: Stefanie (125180444) Angela (125180447) Yuvina (125180464)Elafan storeNessuna valutazione finora

- 8888 - Amex - Corp Fees-6pp - 2019 - V3Documento2 pagine8888 - Amex - Corp Fees-6pp - 2019 - V3Tina MichaelNessuna valutazione finora

- Abw2209 003 MW Priceupdate Web-99 PDFDocumento1 paginaAbw2209 003 MW Priceupdate Web-99 PDFBenny BerniceNessuna valutazione finora

- CreditCardStatement PDFDocumento3 pagineCreditCardStatement PDFInnocentRabbitNessuna valutazione finora

- FC EliteDocumento1 paginaFC Elitejpdeleon20Nessuna valutazione finora

- Equity Bank Tarrif and ChargesDocumento1 paginaEquity Bank Tarrif and Chargesedward mpangile0% (1)

- KFS HBL Al-Mukhtar Account - Jul 19Documento1 paginaKFS HBL Al-Mukhtar Account - Jul 19M-Waseem AnsariNessuna valutazione finora

- Chapter 2 ActivityDocumento10 pagineChapter 2 ActivityBELARMINO LOUIE A.Nessuna valutazione finora

- I B C C M I T & C: Ndusind ANK Redit ARD OST Mportant Erms OnditionsDocumento6 pagineI B C C M I T & C: Ndusind ANK Redit ARD OST Mportant Erms Onditionsmohitagarwal13Nessuna valutazione finora

- HBL Conventional CurrentAccount (Key Fact Sheet) - Jul - Dec 2020Documento1 paginaHBL Conventional CurrentAccount (Key Fact Sheet) - Jul - Dec 2020Hamza AbidNessuna valutazione finora

- Please Pay by Total Due: Contact UsDocumento5 paginePlease Pay by Total Due: Contact Usnguyen tung100% (1)

- Mercantile Bank Consolidated Pricing Guide - 11march2022Documento5 pagineMercantile Bank Consolidated Pricing Guide - 11march2022sipho5mlnNessuna valutazione finora

- Midxx New and Other Products Sbkri Sbpen and SBSDF FormsDocumento2 pagineMidxx New and Other Products Sbkri Sbpen and SBSDF Formsankitshinde1Nessuna valutazione finora

- Kina Bank Fees Charges ScheduleDocumento15 pagineKina Bank Fees Charges SchedulemarcialitovivaresNessuna valutazione finora

- Yuvaraj Resume UPDATEDocumento3 pagineYuvaraj Resume UPDATEsan_sam3Nessuna valutazione finora

- Zest MoneyDocumento9 pagineZest Moneysan_sam3Nessuna valutazione finora

- 174 1913 1687264227Documento2 pagine174 1913 1687264227san_sam3Nessuna valutazione finora

- Course: Leadership, Engagement, and People Performance Case Study: The Team That Wasn'T GIO Project Submission Template Student Name (Full Name)Documento8 pagineCourse: Leadership, Engagement, and People Performance Case Study: The Team That Wasn'T GIO Project Submission Template Student Name (Full Name)san_sam3Nessuna valutazione finora

- Transaction Successful: Hi SangiahDocumento1 paginaTransaction Successful: Hi Sangiahsan_sam3Nessuna valutazione finora

- Importance of EnglishDocumento1 paginaImportance of Englishsan_sam3Nessuna valutazione finora

- Repayment Schedule PDFDocumento3 pagineRepayment Schedule PDFsan_sam3Nessuna valutazione finora

- Sangiah Muthu Vairam - Project Submission - LeadershipDocumento14 pagineSangiah Muthu Vairam - Project Submission - Leadershipsan_sam3Nessuna valutazione finora

- Banks Policy On Covid Related Reschedulement of Dues PDFDocumento6 pagineBanks Policy On Covid Related Reschedulement of Dues PDFYuva KonapalliNessuna valutazione finora

- Body PartsDocumento2 pagineBody Partssan_sam3Nessuna valutazione finora

- Adakamana Marunmagal. She Boasted How Acceptive She Was of Her Son's Relationship With A VellakariDocumento1 paginaAdakamana Marunmagal. She Boasted How Acceptive She Was of Her Son's Relationship With A Vellakarisan_sam3Nessuna valutazione finora

- CASHe-Doc Smandate PDFDocumento1 paginaCASHe-Doc Smandate PDFsan_sam3Nessuna valutazione finora

- ConversaSpain Application Form 2019Documento3 pagineConversaSpain Application Form 2019san_sam3100% (1)

- F-Engine S2200ME-B Carrier Ethernet Switch CLI Manual (V3.0)Documento295 pagineF-Engine S2200ME-B Carrier Ethernet Switch CLI Manual (V3.0)Francisco Moraga75% (4)

- Room Rental AgreementDocumento3 pagineRoom Rental AgreementgrandoverallNessuna valutazione finora

- Airbus Defence and Space EWISA - AthensDocumento21 pagineAirbus Defence and Space EWISA - AthensCORAL ALONSONessuna valutazione finora

- Basics JavaDocumento27 pagineBasics JavaSabari NathanNessuna valutazione finora

- Accord - DA-XDocumento95 pagineAccord - DA-XPeter TurnšekNessuna valutazione finora

- MAX1204 5V, 8-Channel, Serial, 10-Bit ADC With 3V Digital InterfaceDocumento24 pagineMAX1204 5V, 8-Channel, Serial, 10-Bit ADC With 3V Digital InterfaceGeorge BintarchasNessuna valutazione finora

- Caw 5-5Documento2 pagineCaw 5-5api-490406210Nessuna valutazione finora

- Fallling Objects TBT - FinalDocumento2 pagineFallling Objects TBT - FinalAhmed EssaNessuna valutazione finora

- Swiss ArabianDocumento101 pagineSwiss ArabianKiran MoreNessuna valutazione finora

- Gap Analysis: Dr. N. BhaskaranDocumento4 pagineGap Analysis: Dr. N. BhaskaranNagarajan BhaskaranNessuna valutazione finora

- Center Mount Unit Coolers: Technical GuideDocumento8 pagineCenter Mount Unit Coolers: Technical GuideJay PatelNessuna valutazione finora

- Ebook Setup - Ea Padu Viral v.100Documento50 pagineEbook Setup - Ea Padu Viral v.100Keyboard KrazyNessuna valutazione finora

- IBM 'Selectric Composer' Fonts CatalogDocumento60 pagineIBM 'Selectric Composer' Fonts CatalogAnthony M75% (4)

- Paper Bridge CompetitionDocumento5 paginePaper Bridge Competitionzia.mudassir2Nessuna valutazione finora

- Collective MarketingDocumento13 pagineCollective MarketingMart RuralNessuna valutazione finora

- Workshop On Prospects For Start Ups in Solar Energy TechnologiesDocumento5 pagineWorkshop On Prospects For Start Ups in Solar Energy TechnologiesmayankragarwalNessuna valutazione finora

- Credit Hours: 3 Lecture Hours: 2 Laboratory Hours: 2 Prerequisites: CSC 227Documento2 pagineCredit Hours: 3 Lecture Hours: 2 Laboratory Hours: 2 Prerequisites: CSC 227Zerihun BekeleNessuna valutazione finora

- Nokia's FailureDocumento11 pagineNokia's FailureRohith ThampiNessuna valutazione finora

- Final Year Project "Addressing Marketing and Growth Issues of Chattha's Pakistani Street Food" BBA-8Documento143 pagineFinal Year Project "Addressing Marketing and Growth Issues of Chattha's Pakistani Street Food" BBA-8Muhammad Humayun KhanNessuna valutazione finora

- HTML Cheat SheetDocumento53 pagineHTML Cheat SheetmszsohailNessuna valutazione finora

- Sign Language To Text ConverterDocumento2 pagineSign Language To Text ConverterAditya RajNessuna valutazione finora

- Top 10 Hottest Female Anchors 2018: 1. Julie BanderasDocumento3 pagineTop 10 Hottest Female Anchors 2018: 1. Julie BanderasUzair SoomroNessuna valutazione finora

- Renault 12 SDocumento17 pagineRenault 12 STadeusz Antoni ChudzikNessuna valutazione finora

- 911 (996), 1998 - 2005 PDFDocumento777 pagine911 (996), 1998 - 2005 PDFRadovan NikolcicNessuna valutazione finora

- Logistics Notes From Ex9-11Documento157 pagineLogistics Notes From Ex9-11nsadnan100% (1)

- Terra Et Aqua 153 CompleteDocumento44 pagineTerra Et Aqua 153 CompleteCarlos PicalugaNessuna valutazione finora

- Proglaze® SSG: Single-Component, Neutral-Cure, Silicone Sealant For Structural GlazingDocumento2 pagineProglaze® SSG: Single-Component, Neutral-Cure, Silicone Sealant For Structural GlazingTung ThanhNessuna valutazione finora

- Database Design ConceptDocumento4 pagineDatabase Design ConceptChiranSJ100% (1)

- Rubric For Human Impact Ecuadorian EcosystemDocumento3 pagineRubric For Human Impact Ecuadorian EcosystemJohn OsborneNessuna valutazione finora

- The Technical University of KenyaDocumento5 pagineThe Technical University of KenyaEng Stephen ArendeNessuna valutazione finora