Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BOC Updated Bank Fees and Charges

Caricato da

Mac Manalo Ebora0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni2 pagineBOC BANK FEES

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBOC BANK FEES

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni2 pagineBOC Updated Bank Fees and Charges

Caricato da

Mac Manalo EboraBOC BANK FEES

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

BANK OF COMMERCE FEES AND CHARGES – DEPOSIT ACCOUNTS

As of April 27, 2017

PESO DEPOSIT ACCOUNTS FEE PESO CHECKING ACCOUNT FEE

Falling below minimum ADB for 2 consecutive

P200 monthly Returned Check

months

under Check Protection Facility additional P200 Presenting Bank P1,000

account is dormant P30 (see Note1) Drawee Bank P1,000

Closing of new account w/in first 30 days P200 P200 for every P40,000 or

DAUD/DAIF handling fee

Replacement Fee for Lost ATM card P100 fraction thereof/day/check

Replace Lost Passbook (same for FCY-SA) P200 Stop Payment Order (SPO) P200 per check

Over-the-Counter (OTC) Funds Transfer Counter Check Issuance P50

1st transaction FREE Personal Corporate

Succeeding account P30/beneficiary Checkbook re-order per booklet P175 P350

Specially designed check Personal Corporate

FOREIGN CURRENCY (FCDU) FEE PCHC Processing Fee P53 P111

US Dollar Printing Cost actual actual

Falling below minimum ADB US$ 5 DST P75 P150

Closing of new account w/in first 30 days US$ 5 Physical check retrieval P100

Dormant Fee for Accounts falling below min.

US$ 5 monthly Bank Statement of Account (SOA)

ADB

Deposit of DD or check drawn outside USA (please inquire) Interim P30

Returned checks via Cash Letter Service US$ 21 Reprinting w/o check image P30

Euro P100 for 1st 5 pages

Reprinting with check image

Cable and commission charge for telegraphic transfer plus P10/succeeding page

For deposit (incoming) EUR 5 check images only (OTC & P50/check (front or dorsal

For withdrawal (payment) EUR 10 inward) side, or both)

TIME DEPOSIT (PESO AND FCDU)

Pre-termination – Applicable interest rate

Within 1st half of term 25% of agreed interest rate or savings account rate, whichever is higher

Within 2nd half of term 50% of agreed interest rate or savings account rate, whichever is higher.

Note : If pre-terminated - the Documentary Stamps Tax (DST) is for the account of the depositor

Notarial Fee on Affidavit of Loss of Certificate Cable and commission

P200 For deposit (incoming) EUR 5

of Time Deposit charge for telegraphic

For withdrawal (payment) EUR 10

Lost 1PIA passbook replacement P200 transfer

Note 1: Effective April 27, 2017, the new BSP rules on dormant accounts (BSP Circ. 928) shall apply. Dormant accounts

shall be charged a dormancy fee of THIRTY PESOS (PHP30.00) per month five (5) years after the last activity if the account falls below the required

minimum maintaining Average Daily Balance (ADB).

BANK OF COMMERCE FEES AND CHARGES – LOANS, REMITTANCE AND ATM

As of April 27, 2017

LOANS (Time, Term and FCDU) FEE Small Business Loan (Term Loan) FEE

Penalty fee on payment default 12% p.a. Appraisal fee

Processing fee (Term and SBL) P5,000 Metro Manila P3,500

Provincial P4,000

Late payment charge 18% p.a.

REMITTANCE SERVICES FEES

Correspondent

Outgoing Remittances Cable charge Commission DST

bank (OUR)

Local

US$ 11.50 US$ 5

RTGS P1.50

(Peso equivalent) (Peso equivalent)

EPCS P6.60 or US$ 11.50 P1.50

PDDTS US$ 11.50 US$ 5

Foreign / Outward Money Transfer

Telegraphic Transfer - US Dollar US$ 15

US$ 11.50 US$ 5

Telegraphic Transfer - Other currencies US$ 30

Incoming Remittances Credit to Peso Account Credit to US$ Account

Local Commission DST Commission

RTGS P150 P1.50

EPCS P100 P1.50

PDDTS – Online GSRT via

- Online Gross Settlement Real Time (GSRT) via

P350 US$ 7.50

Philippine Depository and Trust Corporation (PDTC) P0.30 for every P200

- Batch Transfer/End of Day Netting under PCHC P350 or a fraction thereof US$ 5

Foreign – via SWIFT P350 US$ 7.50

ATM TRANSACTIONS FEE

Balance inquiry using other bank’s ATM P2

Withdrawal using other bank’s ATM P13

Lost ATM card replacement P100

Card replacement for Crediting Service Facility & Payroll Plus P50

Taxes, as may be applicable:

Withholding Tax on interest: DST on Time Deposit and Loans

Peso – 20% <1 Year Term = Principal÷ P200 x P1 x no. of days÷ 365 days

Foreign Currency – 7.5% 1 Year Term and above = Principal÷P200 x P1

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Business Plan SampleDocumento14 pagineBusiness Plan SampleGwyneth MuegaNessuna valutazione finora

- Kennedy 11 Day Pre GeneralDocumento16 pagineKennedy 11 Day Pre GeneralRiverheadLOCALNessuna valutazione finora

- Cfa - Technical Analysis ExplainedDocumento32 pagineCfa - Technical Analysis Explainedshare757592% (13)

- CBN Rule Book Volume 5Documento687 pagineCBN Rule Book Volume 5Justus OhakanuNessuna valutazione finora

- Clerks 2013Documento12 pagineClerks 2013Kumar KumarNessuna valutazione finora

- Deductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocumento12 pagineDeductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersMichael Reyes75% (4)

- Modern Money and Banking BookDocumento870 pagineModern Money and Banking BookRao Abdur Rehman100% (6)

- Request BADACODocumento1 paginaRequest BADACOJoseph HernandezNessuna valutazione finora

- Manual Goldfinger EA MT4Documento6 pagineManual Goldfinger EA MT4Mr. ZaiNessuna valutazione finora

- Belt and Road InitiativeDocumento17 pagineBelt and Road Initiativetahi69100% (2)

- TIPS As An Asset Class: Final ApprovalDocumento9 pagineTIPS As An Asset Class: Final ApprovalMJTerrienNessuna valutazione finora

- Approaches To Industrial RelationsDocumento39 pagineApproaches To Industrial Relationslovebassi86% (14)

- Chap014 Solution Manual Financial Institutions Management A Risk Management ApproachDocumento19 pagineChap014 Solution Manual Financial Institutions Management A Risk Management ApproachFami FamzNessuna valutazione finora

- The Global Interstate System Pt. 3Documento4 pagineThe Global Interstate System Pt. 3Mia AstilloNessuna valutazione finora

- Oil Opportunities in SudanDocumento16 pagineOil Opportunities in SudanEssam Eldin Metwally AhmedNessuna valutazione finora

- Dhiratara Pradipta Narendra (1506790210)Documento4 pagineDhiratara Pradipta Narendra (1506790210)Pradipta NarendraNessuna valutazione finora

- Industry Analysis: Liquidity RatioDocumento10 pagineIndustry Analysis: Liquidity RatioTayyaub khalidNessuna valutazione finora

- Asiawide Franchise Consultant (AFC)Documento8 pagineAsiawide Franchise Consultant (AFC)strawberryktNessuna valutazione finora

- Rental AgreementDocumento1 paginaRental AgreementrampartnersbusinessllcNessuna valutazione finora

- Revenue Procedure 2014-11Documento10 pagineRevenue Procedure 2014-11Leonard E Sienko JrNessuna valutazione finora

- Trade Confirmation: Pt. Danareksa SekuritasDocumento1 paginaTrade Confirmation: Pt. Danareksa SekuritashendricNessuna valutazione finora

- Stock-Trak Project 2013Documento4 pagineStock-Trak Project 2013viettuan91Nessuna valutazione finora

- Latihan Soal PT CahayaDocumento20 pagineLatihan Soal PT CahayaAisyah Sakinah PutriNessuna valutazione finora

- Modified Jominy Test For Determining The Critical Cooling Rate For Intercritically Annealed Dual Phase SteelsDocumento18 pagineModified Jominy Test For Determining The Critical Cooling Rate For Intercritically Annealed Dual Phase Steelsbmcpitt0% (1)

- Change Control Procedure: Yogendra GhanwatkarDocumento19 pagineChange Control Procedure: Yogendra GhanwatkaryogendraNessuna valutazione finora

- Pune HNIDocumento9 paginePune HNIAvik Sarkar0% (1)

- Designing For Adaptation: Mia Lehrer + AssociatesDocumento55 pagineDesigning For Adaptation: Mia Lehrer + Associatesapi-145663568Nessuna valutazione finora

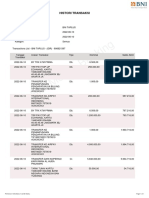

- BNI Mobile Banking: Histori TransaksiDocumento1 paginaBNI Mobile Banking: Histori TransaksiWebi SuprayogiNessuna valutazione finora

- What Is Zoning?Documento6 pagineWhat Is Zoning?M-NCPPCNessuna valutazione finora

- GL July KoreksiDocumento115 pagineGL July KoreksihartiniNessuna valutazione finora