Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Albatross

Caricato da

indranil biswasTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Albatross

Caricato da

indranil biswasCopyright:

Formati disponibili

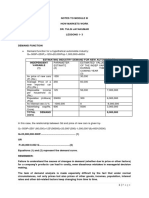

Albatross departmental store is considering re-allocating PoS operation strategy due to new rules for

using payment gateway. The bankers’ association decided that they would charge Rs. 3 per

transaction of value less than Rs. 250 and 2.25% of value over Rs. 250 for payment through credit or

debit card. Albatross is considering charging Rs. 2/- from customers who are paying below Rs. 100/-

and Re. 1/- from their own pocket against customer loyalty for CC and DC payments. However, they

will charge Rs. 3/- to the customer paying amount between Rs. 100/- and Rs. 250/- for CC or DC

payment. Considering the profit percentage, Albatross would have no problem to pay the payment

gateway charges if they increase their prices by 65p for each product in an invoice amounting >250.

The analytics division produced the following joint probability table based on their historical data:

Cash Credit card Debit card

Less than Rs. 100 0.09 0.03 0.04

Rs. 100 – Rs. 250 0.05 0.21 0.18

More than Rs. 250 0.03 0.23 0.14

In our last discussion on this case, we arrived at two alternatives.

i) Increase price of each product by Re .65 for invoices above Rs. 250 (Facility charge)

for CC and DC payments along with other two mentioned policy changes. This would

reduce the revenue loss.

ii) Increase the price across all payment channels. Cash channel would provide extra

revenue but all three channels will face customer churn.

It has been found that the daily number of transactions in the store follows P(1000) distribution.

Further, the following random variables has been identified in order to take a call.

Y= no. of products per transaction

Z=amount in a transaction

The following table details their distribution:

Cash Credit Card Debit Card

< 100 X~P( ) X~P( ) X~P( )

Y~Bin(60, 1/3) Y~Bin(60, 1/3) Y~Bin(60, 2/3)

Z~N(60,2) Z~N(75,3) Z~N(60,2)

100 – 250 X~P(70) X~P( ) X~P( )

Y~Bin(60, 1/3) Y~Bin(60, 2/3) Y~Bin(60, 2/3)

Z~N(230,64) Z~N(230,41) Z~N(200,15)

> 250 X~P( ) X~P( ) X~P( )

Y~Bin(60, 1/3) Y~Bin(60, 2/3) Y~Bin(60, 2/3)

Z~N(800,100) Z~N(1230,900) Z~N(2800,2500)

The speculation is: per Re .5 increment of price/charges, all three X and Z will face a reduction of .5%

for cash channels and 1% for credit and debit card channels.

Are these strategies optimal? What could be your plan A? What could be plan B?

Potrebbero piacerti anche

- 7-Risk and Real Options in Capital BudgetingDocumento38 pagine7-Risk and Real Options in Capital BudgetingSameerbaskarNessuna valutazione finora

- QBM 101 Lecture 10Documento45 pagineQBM 101 Lecture 10Shu HeeNessuna valutazione finora

- Alternative A B C Year 0 1 2 3: Problem 1Documento7 pagineAlternative A B C Year 0 1 2 3: Problem 1fahriihsaniNessuna valutazione finora

- Managerial Eco PaperDocumento6 pagineManagerial Eco PaperTech TricksNessuna valutazione finora

- Demand ElasticityDocumento5 pagineDemand Elasticitykhawaralisher7105100% (3)

- Expected Returns on Investment PortfolioDocumento17 pagineExpected Returns on Investment PortfolioVipulNessuna valutazione finora

- DepreciationDocumento5 pagineDepreciationsofyan samNessuna valutazione finora

- Elasticity and Demand ExerciseDocumento7 pagineElasticity and Demand ExerciseKhairul Bashar Bhuiyan 1635167090Nessuna valutazione finora

- Examples Week1Documento6 pagineExamples Week1sohilamohsen46Nessuna valutazione finora

- Elasticity and Demand ExerciseDocumento7 pagineElasticity and Demand ExerciseAurik IshNessuna valutazione finora

- Elasticity and Demand ExerciseDocumento10 pagineElasticity and Demand ExerciseOmar Faruk 2235292660Nessuna valutazione finora

- CHAPTER 2 (B) - Risk Analysis and Project EvaluationDocumento79 pagineCHAPTER 2 (B) - Risk Analysis and Project EvaluationSarnisha Murugeshwaran (Shazzisha)Nessuna valutazione finora

- TVOM and Equivalent Cash Flow ProblemsDocumento3 pagineTVOM and Equivalent Cash Flow ProblemsAnonymous XybLZfNessuna valutazione finora

- Taller EconometríaDocumento26 pagineTaller EconometríaDavid GutierrezNessuna valutazione finora

- Inventarios DescuentosDocumento17 pagineInventarios DescuentosLuchoNessuna valutazione finora

- Demand-Supply AnalysisDocumento6 pagineDemand-Supply AnalysisLilla OroviczNessuna valutazione finora

- An Improved Approach To Computing Implied Volatility: FinancialDocumento11 pagineAn Improved Approach To Computing Implied Volatility: Financialharsh guptaNessuna valutazione finora

- Practice Questions For Tutorial 4 Solution - 2020 - Section BDocumento11 paginePractice Questions For Tutorial 4 Solution - 2020 - Section BtanNessuna valutazione finora

- Linear Programming Solution of Ncert ExamplarDocumento16 pagineLinear Programming Solution of Ncert ExamplarKathan PatelNessuna valutazione finora

- FINM2003 - Mid Semester Exam Sem 1 2015 (Suggested Solutions)Documento6 pagineFINM2003 - Mid Semester Exam Sem 1 2015 (Suggested Solutions)JasonNessuna valutazione finora

- Operation Research Assignment Maximizes Farm ProfitsDocumento16 pagineOperation Research Assignment Maximizes Farm Profitseshetu fentaye100% (1)

- Worked Examples For Chapter 3Documento7 pagineWorked Examples For Chapter 3Gaurav KumarNessuna valutazione finora

- Ps 2 SolutionsDocumento4 paginePs 2 SolutionsAdriel IanNessuna valutazione finora

- Complete PastpaperDocumento82 pagineComplete Pastpapersecret studentNessuna valutazione finora

- Mortgage Options: Valuation, Risk Management, & Relative ValueDocumento31 pagineMortgage Options: Valuation, Risk Management, & Relative Value4sainadhNessuna valutazione finora

- Business Statistics - AssignmentDocumento7 pagineBusiness Statistics - AssignmentAkshatNessuna valutazione finora

- SensitivitydddddddDocumento9 pagineSensitivitydddddddOğuz Kaan ÇiçekNessuna valutazione finora

- Regresion Lineal Simple PDFDocumento16 pagineRegresion Lineal Simple PDFCristian Diaz100% (1)

- Tutorial 6 SolutionDocumento5 pagineTutorial 6 Solutionsissy.he.7Nessuna valutazione finora

- 6-Risk and Managerial (Real) Options in Capital Budgeting-Chapter FourteenDocumento17 pagine6-Risk and Managerial (Real) Options in Capital Budgeting-Chapter FourteenSharique KhanNessuna valutazione finora

- BS Atkt QBDocumento13 pagineBS Atkt QBReuben DsouzaNessuna valutazione finora

- Delhi School of EconomicsDocumento26 pagineDelhi School of Economicssinhaanurag21Nessuna valutazione finora

- Demand Analysis Problems and SolutionsDocumento27 pagineDemand Analysis Problems and SolutionsHashma KhanNessuna valutazione finora

- Optimisation TechniquesDocumento32 pagineOptimisation TechniquesAGRAWAL UTKARSHNessuna valutazione finora

- SolutionDocumento8 pagineSolutionArslanNessuna valutazione finora

- Imp Numerical Perfect CompetitionDocumento27 pagineImp Numerical Perfect CompetitionSachin SahooNessuna valutazione finora

- Perfect Competition Problem SetDocumento12 paginePerfect Competition Problem Setguo zhanNessuna valutazione finora

- End of Year Alternative 1 Alternative 2 Income ($) Cost ($) Net Cash Flow ($) Income ($) Cost ($) Net Cash Flow ($) - 3 - 2 - 1 0Documento2 pagineEnd of Year Alternative 1 Alternative 2 Income ($) Cost ($) Net Cash Flow ($) Income ($) Cost ($) Net Cash Flow ($) - 3 - 2 - 1 0Nije AsriNessuna valutazione finora

- 8 or CompilationDocumento121 pagine8 or CompilationadvancedaccountantNessuna valutazione finora

- 1916034_CE1.docDocumento10 pagine1916034_CE1.docGoutam MandalNessuna valutazione finora

- Risk in Capital Budgeting: Sensitivity Technique and Standard DeviationsDocumento13 pagineRisk in Capital Budgeting: Sensitivity Technique and Standard DeviationsSridhar KodaliNessuna valutazione finora

- Benefit Cost RatioDocumento34 pagineBenefit Cost RatioAri WardiantoNessuna valutazione finora

- Mathematical Economics Notes III for V semDocumento6 pagineMathematical Economics Notes III for V semAngad 2K19-PE-012Nessuna valutazione finora

- Take-Home Assignment July 14Documento9 pagineTake-Home Assignment July 14Fazal AbbasNessuna valutazione finora

- Chapter 3 Excercise With SolutionDocumento18 pagineChapter 3 Excercise With SolutionSyed Ali100% (1)

- A Company Manufactures Four Products ADocumento4 pagineA Company Manufactures Four Products AHaile SimachewNessuna valutazione finora

- ML4T 2017fall Exam1 Version BDocumento8 pagineML4T 2017fall Exam1 Version BDavid LiNessuna valutazione finora

- Ugbs 202 Pasco (Lawrence Edinam)Documento27 pagineUgbs 202 Pasco (Lawrence Edinam)Young SmartNessuna valutazione finora

- Mod IIDocumento5 pagineMod IIAmit KumarNessuna valutazione finora

- D AnalysisDocumento1.241 pagineD AnalysisLuqmanhakim XavNessuna valutazione finora

- Mba Econ Midterm Study Prep 11Documento8 pagineMba Econ Midterm Study Prep 11himanshu shuklaNessuna valutazione finora

- P2.6-P3.10 Profit, Cost, Supply, Demand ProblemsDocumento3 pagineP2.6-P3.10 Profit, Cost, Supply, Demand ProblemsOmair NagiNessuna valutazione finora

- Chapter 17Documento31 pagineChapter 17Abdinor Abukar AhmedNessuna valutazione finora

- Financial AccoutingDocumento7 pagineFinancial Accoutingtinale1603Nessuna valutazione finora

- Econ 201 Exam 2 Study GuideDocumento6 pagineEcon 201 Exam 2 Study GuideprojectilelolNessuna valutazione finora

- PROBLEM SET-4 Continuous Probability - SolutionsDocumento8 paginePROBLEM SET-4 Continuous Probability - Solutionsmaxentiuss71% (7)

- Chernobyl Disaster: "Historicizing" ManagementDocumento12 pagineChernobyl Disaster: "Historicizing" Managementindranil biswasNessuna valutazione finora

- Power Verbs List PDFDocumento5 paginePower Verbs List PDFrisheek saiNessuna valutazione finora

- FormulaeDocumento3 pagineFormulaeindranil biswasNessuna valutazione finora

- Y K Mukhoti: Statistical Methods For BusinessDocumento15 pagineY K Mukhoti: Statistical Methods For Businessindranil biswasNessuna valutazione finora

- RV ProbSet 4Documento4 pagineRV ProbSet 4indranil biswasNessuna valutazione finora

- SamplingDistribution NotesDocumento15 pagineSamplingDistribution Notesindranil biswasNessuna valutazione finora

- Agnivesh After MidTermDocumento18 pagineAgnivesh After MidTermindranil biswasNessuna valutazione finora

- OnesampleDocumento14 pagineOnesampleindranil biswasNessuna valutazione finora

- BinPois ProblemSets SolnDocumento3 pagineBinPois ProblemSets Solnindranil biswasNessuna valutazione finora

- National Case Study Competition: Team Name:-Zealous Roker Team Members 1. Indranil Biswas 2. Sumanta Kumar KoleyDocumento6 pagineNational Case Study Competition: Team Name:-Zealous Roker Team Members 1. Indranil Biswas 2. Sumanta Kumar Koleyindranil biswasNessuna valutazione finora

- National Case Study Competition: Team Name:-Zealous Roker Team Members 1. Indranil Biswas 2. Sumanta Kumar KoleyDocumento6 pagineNational Case Study Competition: Team Name:-Zealous Roker Team Members 1. Indranil Biswas 2. Sumanta Kumar Koleyindranil biswasNessuna valutazione finora

- Power Verbs List PDFDocumento5 paginePower Verbs List PDFrisheek saiNessuna valutazione finora

- National Case Study Competition: Team Name:-Zealous Roker Team Members 1. Indranil Biswas 2. Sumanta Kumar KoleyDocumento6 pagineNational Case Study Competition: Team Name:-Zealous Roker Team Members 1. Indranil Biswas 2. Sumanta Kumar Koleyindranil biswasNessuna valutazione finora

- Visa 2013 The Future of TicketingDocumento48 pagineVisa 2013 The Future of TicketingmichaelonlineNessuna valutazione finora

- Transaction Processing Rules PDFDocumento313 pagineTransaction Processing Rules PDFDipanwita BhuyanNessuna valutazione finora

- ATC Schedule of Fees 2021Documento4 pagineATC Schedule of Fees 2021rkseguNessuna valutazione finora

- PPTC 153Documento7 paginePPTC 153filipamaltezNessuna valutazione finora

- The Current Status and The Prospect of E-Banking in BangladeshDocumento42 pagineThe Current Status and The Prospect of E-Banking in BangladeshFayaza Rahman Eva85% (20)

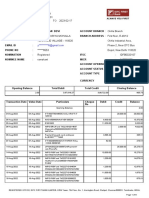

- Account Usage and Recharge Statement From 12-Jul-2020 To 18-Jul-2020Documento1 paginaAccount Usage and Recharge Statement From 12-Jul-2020 To 18-Jul-2020MONISH NAYARNessuna valutazione finora

- BRM ProjectDocumento58 pagineBRM ProjectKirti BafnaNessuna valutazione finora

- IDFCFIRSTBankstatement 10027354401 154032854Documento6 pagineIDFCFIRSTBankstatement 10027354401 154032854SAGAR YADAVNessuna valutazione finora

- Mobile Banking Presentation on BOB ServicesDocumento12 pagineMobile Banking Presentation on BOB ServicesAkesh GuptaNessuna valutazione finora

- American Express Serve Statement SummaryDocumento6 pagineAmerican Express Serve Statement SummaryJohn Bean0% (1)

- My Card Place.3Documento3 pagineMy Card Place.3DIGITAL PATRIOTSNessuna valutazione finora

- Banking Insurance and Financial Services: Unit 1: Introduction To BANKING (25%)Documento13 pagineBanking Insurance and Financial Services: Unit 1: Introduction To BANKING (25%)sunगीत मजे्seNessuna valutazione finora

- PESTEL Analysis of Landbank of the PhilippinesDocumento4 paginePESTEL Analysis of Landbank of the PhilippinesEmmanuel EsmerNessuna valutazione finora

- Bank Alfalah 1Documento36 pagineBank Alfalah 1smartahmedNessuna valutazione finora

- Airpay Proposal DetailDocumento10 pagineAirpay Proposal DetailSooday JhaveriNessuna valutazione finora

- Bank of America - Online Banking - Service AgreementDocumento24 pagineBank of America - Online Banking - Service AgreementMarija Mijuskovic 0207974787818Nessuna valutazione finora

- 8 IsicpDocumento195 pagine8 Isicpwyc199806Nessuna valutazione finora

- Parktown Girls High School Fees 2022 05 24 - 14 02 54 - 889807Documento1 paginaParktown Girls High School Fees 2022 05 24 - 14 02 54 - 889807mpilolonxumaloNessuna valutazione finora

- DD Rules V 4 19 Rulebook Nov 2011 FinalDocumento68 pagineDD Rules V 4 19 Rulebook Nov 2011 Finalimesimaging100% (1)

- How to Fill Out the Policy Change Request FormDocumento14 pagineHow to Fill Out the Policy Change Request FormJulienne Mhae ReyesNessuna valutazione finora

- Kelas XI Sem IIDocumento4 pagineKelas XI Sem IINURMAINAHNessuna valutazione finora

- Base 24Documento254 pagineBase 24sjayaraman79Nessuna valutazione finora

- Credit and Debit Card Differentiation Assignment ResearchDocumento9 pagineCredit and Debit Card Differentiation Assignment ResearchZubaidahNessuna valutazione finora

- DB Elavon Application V0222 ENGDocumento6 pagineDB Elavon Application V0222 ENGsrmmontgomery srmmontgomerytelus.netNessuna valutazione finora

- Statement of Account: Total Payment Due PHP 7,492.80Documento4 pagineStatement of Account: Total Payment Due PHP 7,492.80Kristelle Anne TamolinNessuna valutazione finora

- Issue 50Documento24 pagineIssue 50The Indian NewsNessuna valutazione finora

- Upgrade MID Non HNW Classic Customer VersionDocumento3 pagineUpgrade MID Non HNW Classic Customer VersionSanju GirijaNessuna valutazione finora

- Baliopan - The Ultimate Beginner and Advanced Guide To Carding 2018 Baliopan (2018)Documento96 pagineBaliopan - The Ultimate Beginner and Advanced Guide To Carding 2018 Baliopan (2018)drako12345678993% (14)

- Nairawise Mass MRKT Tier3: First City Monument Bank LimitedDocumento3 pagineNairawise Mass MRKT Tier3: First City Monument Bank LimitedJoshua Akorewaye ArigbedeNessuna valutazione finora

- Mobile Wallet Payments Recent Potential Threats AnDocumento8 pagineMobile Wallet Payments Recent Potential Threats AnAisha SinghNessuna valutazione finora