Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

M.Sc. Actuarial Sciences Mid Term Examination 2019

Caricato da

Ghulam NabiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

M.Sc. Actuarial Sciences Mid Term Examination 2019

Caricato da

Ghulam NabiCopyright:

Formati disponibili

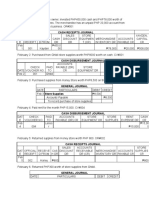

College of Statistical and Actuarial Sciences

University of the Punjab, Q.A. Campus, Lahore

M.Sc. Actuarial Sciences

Mid Term Examination 2019

Paper: Employee Benefits Management Semester: VI

Marks: 35 Time Allowed: 1.5 hour

There will be no use of Mobile phone as Calculator. Mobile phone not allowed. There will be no transformation of calculators.

Q.1 A pension scheme provides a pension of 1/45 of final pensionable salary for each year of service, with a

maximum of 2/3 of final pensionable salary, upon retirement at age 65.

Final pensionable salary is defined as average annual salary over the 3 years immediately preceding

retirement. A member is now aged exactly 47 and has 14 years of past service. He earned £40,000 in the

previous 12 months. Calculate the expected present value now of this member’s total pension on

retirement, using the symbols defined in, and assumptions underlying, the Formulae and Tables for

Actuarial Examinations. (7)

Q.2 Calculate the expected present value of a disability benefit of £5,000 pa payable weekly to a healthy life

now aged 45. Assume that interest, mortality, sickness rates and recovery rates are consistent with those

given in the Tables. (7)

Q3 A pension scheme provides a pension of 1/60th of career average salary in respect of each year of

service upon age retirement between the ages of 60 and 65, and a proportionate amount in respect of any

incomplete years of service. Fiona, aged 48, has 13 years of past service, total past salary of £290,570

and expects to receive a salary of £30,000 over the coming year. Derive formulae for the expected

present values of Fiona’s past and future service pensions. Calculate these expected present values using

the values given in the Tables. (7)

Q.4 A pension fund offers the following benefit to its members: upon age retirement at any age, a member

will receive an annual pension equal to 1/60th of final pensionable salary for each year of service, up to

a maximum of two thirds of final salary. The pension fund is due to be valued on 1 July 2005. Salaries

are increased each year on 1 July. Final pensionable salary is defined to be the average salary earned

over the three years preceding retirement. Normal pension age is 65. At the valuation date, one member

is aged 40 exactly, has 18 years of past service and earned £32,000 over the last year. Calculate the

expected present value of the past and future service benefits for this member assuming that mortality,

retirement, interest and salary scale are as given in the Tables. (7)

Q.5 A pension scheme provides a pension of n/ 60 ths of final average salary payable from the normal

retirement age of 65. However, n is limited to a maximum of 40 years. Write down a commutation

function formula for calculating the total service liability for members with a whole number of years’

past service who joined the scheme:

(a) After age 25, and

(b) Before age 25. (7)

Potrebbero piacerti anche

- Know Your Retirement BookletDocumento21 pagineKnow Your Retirement BookletPushparajan GunasekaranNessuna valutazione finora

- Bc2010-1 Budget CircularDocumento6 pagineBc2010-1 Budget CircularLecel LlamedoNessuna valutazione finora

- Iii. Hours of Work and Remuneration: REPUBLIC ACT NO. 4670 June 18, 1966 The Magna Carta For Public School TeachersDocumento21 pagineIii. Hours of Work and Remuneration: REPUBLIC ACT NO. 4670 June 18, 1966 The Magna Carta For Public School TeachersCharmae CabanagNessuna valutazione finora

- AM2 - Tutorial 6Documento11 pagineAM2 - Tutorial 6Chinh KiềuNessuna valutazione finora

- InstructionsDocumento8 pagineInstructionssathyanarayana medaNessuna valutazione finora

- Atal Pension Yojana: Page 1 of 4Documento4 pagineAtal Pension Yojana: Page 1 of 4Bhanu Satya SaiNessuna valutazione finora

- Institute and Faculty of Actuaries: Subject CT5 - Contingencies Core TechnicalDocumento20 pagineInstitute and Faculty of Actuaries: Subject CT5 - Contingencies Core TechnicalKashif KhalidNessuna valutazione finora

- Details of Retirement BenefitsDocumento17 pagineDetails of Retirement BenefitsDharini GanesanNessuna valutazione finora

- Criteria For Non - TeachingDocumento5 pagineCriteria For Non - TeachingMayur ThombreNessuna valutazione finora

- Behra Berk DeMarzo Problem 5-3 StartDocumento2 pagineBehra Berk DeMarzo Problem 5-3 StarttomNessuna valutazione finora

- 114 008 1 ct5Documento8 pagine114 008 1 ct5Wei SeongNessuna valutazione finora

- TSC Notes - RETIREMENTDocumento3 pagineTSC Notes - RETIREMENTNgunguru SecondaryNessuna valutazione finora

- Bharat Pensioners HandbookDocumento72 pagineBharat Pensioners Handbookbhupesh420Nessuna valutazione finora

- 2.1q Classwork Questions On Financial PlanningDocumento4 pagine2.1q Classwork Questions On Financial PlanningARYA SHETHNessuna valutazione finora

- EPF India Higher Pension With Employee Pension Scheme (EPS), Conditions, Formula, Calculation at Various Stages For RetirementDocumento9 pagineEPF India Higher Pension With Employee Pension Scheme (EPS), Conditions, Formula, Calculation at Various Stages For RetirementMegastar IQNessuna valutazione finora

- Advt No 1 2015Documento10 pagineAdvt No 1 2015sapna24Nessuna valutazione finora

- EmpBen Practice SetDocumento1 paginaEmpBen Practice SetCassyNessuna valutazione finora

- 9a.investment Adviser Level 1 Retirement Planning Ppt4 1 AutosavedDocumento114 pagine9a.investment Adviser Level 1 Retirement Planning Ppt4 1 AutosavedIshaNessuna valutazione finora

- Excerpts From EPF Scheme of 1995Documento4 pagineExcerpts From EPF Scheme of 1995askarnabNessuna valutazione finora

- CalSTRS AB 340 Fact SheetDocumento2 pagineCalSTRS AB 340 Fact Sheetjon_ortizNessuna valutazione finora

- 2009 08 18 MHRD NotificationDocumento5 pagine2009 08 18 MHRD Notificationyashwant1299523Nessuna valutazione finora

- Media To Upload1674896573Documento5 pagineMedia To Upload1674896573ramanjaneiahNessuna valutazione finora

- CPP EI IT CalculationDocumento4 pagineCPP EI IT CalculationirfanNessuna valutazione finora

- Reflection #1: 1. Describe The Nature of HRM in Your OrganizationDocumento21 pagineReflection #1: 1. Describe The Nature of HRM in Your OrganizationJONATHAN TABBUNNessuna valutazione finora

- Guidelines For Half Yearly IncentivesDocumento1 paginaGuidelines For Half Yearly IncentivesAnupam BaliNessuna valutazione finora

- Members Briefing Document 3.3Documento8 pagineMembers Briefing Document 3.3Candice HurstNessuna valutazione finora

- 7th CPC Common MemorandumDocumento5 pagine7th CPC Common Memorandumshannbaby22Nessuna valutazione finora

- CFA L1 Scholarship Exam 15aug TVM PaperDocumento26 pagineCFA L1 Scholarship Exam 15aug TVM PaperMadhavNessuna valutazione finora

- PERC Actuarial Note May 2014Documento138 paginePERC Actuarial Note May 2014Jim PawelczykNessuna valutazione finora

- Retirement BenefitsDocumento8 pagineRetirement Benefitsramineedi6Nessuna valutazione finora

- Atal Pension Yojana (APY) - Details of The Scheme 1.: Annexure IIIDocumento9 pagineAtal Pension Yojana (APY) - Details of The Scheme 1.: Annexure IIIvenkateshNessuna valutazione finora

- Module MASEDocumento9 pagineModule MASEJONATHAN TABBUNNessuna valutazione finora

- FD 03 SRP 2020 Dtd-23-03-2020 PDFDocumento4 pagineFD 03 SRP 2020 Dtd-23-03-2020 PDFLokesh G NNessuna valutazione finora

- Bull2014 9 PDFDocumento1 paginaBull2014 9 PDFjspectorNessuna valutazione finora

- PersonnelDocumento28 paginePersonnelTejdeepSomaguttaNessuna valutazione finora

- A-Teaching Assistant B-Lecturer C-Assistant Professor D-Associate Professor E-ProfessorDocumento2 pagineA-Teaching Assistant B-Lecturer C-Assistant Professor D-Associate Professor E-Professorمحمد الباذرNessuna valutazione finora

- APY Scheme DetailsDocumento9 pagineAPY Scheme DetailsGARUAV RAHINessuna valutazione finora

- Likely Scales of Pay For University Teachers in The Light of 7CPC RecommendationsDocumento6 pagineLikely Scales of Pay For University Teachers in The Light of 7CPC RecommendationsGurkirpal Singh SekhonNessuna valutazione finora

- FPSB India - Retirement Module Sample Paper - Simplified Solution Using Calculator - March 2013Documento9 pagineFPSB India - Retirement Module Sample Paper - Simplified Solution Using Calculator - March 2013Krupa VoraNessuna valutazione finora

- CH 7 QuestionsDocumento2 pagineCH 7 Questionswiljae90Nessuna valutazione finora

- IandF CT5 201604 ExamDocumento7 pagineIandF CT5 201604 ExamPatrick MugoNessuna valutazione finora

- Presentation On Contributory Provident FundDocumento4 paginePresentation On Contributory Provident FundAli HaiderNessuna valutazione finora

- Employee Pension SchemeDocumento6 pagineEmployee Pension SchemeAarthi PadmanabhanNessuna valutazione finora

- 2.1 Casswork Questions On Financial PlanningDocumento3 pagine2.1 Casswork Questions On Financial PlanningYash DedhiaNessuna valutazione finora

- Ministry of FinanceDocumento12 pagineMinistry of FinanceNikhil DhokeNessuna valutazione finora

- Probable Solution For Questions Asked - Current Batch - March 2015Documento30 pagineProbable Solution For Questions Asked - Current Batch - March 2015aditiNessuna valutazione finora

- The Employees Provident Fund and Miscellaneous Provisions Act, 1952Documento2 pagineThe Employees Provident Fund and Miscellaneous Provisions Act, 1952tarkdeepڪNessuna valutazione finora

- UPDATED Bloomberg NYC Pension Tier Reform PlanDocumento4 pagineUPDATED Bloomberg NYC Pension Tier Reform PlanCeleste KatzNessuna valutazione finora

- Frs 119 Employee BenefitDocumento54 pagineFrs 119 Employee BenefitNahar SabirahNessuna valutazione finora

- Chris Adams Superintendent ContractDocumento7 pagineChris Adams Superintendent ContractLancasterOnlineNessuna valutazione finora

- TestfileDocumento8 pagineTestfileAnonymous XbAMoqjmGmNessuna valutazione finora

- Hedu e 111 2010Documento33 pagineHedu e 111 2010Modi MitulkumarNessuna valutazione finora

- Calculation of PensionDocumento2 pagineCalculation of Pensionramki240Nessuna valutazione finora

- Submitted By:-Arun Kumar Ramanujan College (University of Delhi)Documento20 pagineSubmitted By:-Arun Kumar Ramanujan College (University of Delhi)GUNAL VNessuna valutazione finora

- Payment of Bonus Act 1965Documento21 paginePayment of Bonus Act 1965Praful Kambe100% (1)

- Who Are Covered Under The Social Security System?Documento6 pagineWho Are Covered Under The Social Security System?Mervic Al Tuble-NialaNessuna valutazione finora

- C.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMDa EverandC.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMNessuna valutazione finora

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionDa EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNessuna valutazione finora

- Population Structure AssetDocumento28 paginePopulation Structure AssetGhulam NabiNessuna valutazione finora

- Life Contingencies and Life Table 6 - AprilDocumento17 pagineLife Contingencies and Life Table 6 - AprilGhulam Nabi100% (1)

- CorporategovernanceDocumento16 pagineCorporategovernanceGhulam NabiNessuna valutazione finora

- Asian Economic and Financial Review: Neeraj K. Sehrawat Amit Kumar Nandita Lohia Satvik Bansal Tanya AgarwalDocumento11 pagineAsian Economic and Financial Review: Neeraj K. Sehrawat Amit Kumar Nandita Lohia Satvik Bansal Tanya AgarwalGhulam NabiNessuna valutazione finora

- Practice Exam 1Documento19 paginePractice Exam 1Ghulam NabiNessuna valutazione finora

- Financial Mathemati CS: Ghulam NabiDocumento8 pagineFinancial Mathemati CS: Ghulam NabiGhulam NabiNessuna valutazione finora

- Life Contingencies and Life Table - Lecture 3Documento14 pagineLife Contingencies and Life Table - Lecture 3Ghulam NabiNessuna valutazione finora

- Chapter 1 Solutions: Solution 1.1Documento2 pagineChapter 1 Solutions: Solution 1.1Ghulam NabiNessuna valutazione finora

- Information Asymmetry, Mutual Funds and Earnings Management: Evidence From ChinaDocumento23 pagineInformation Asymmetry, Mutual Funds and Earnings Management: Evidence From ChinaGhulam NabiNessuna valutazione finora

- Guidelines For Government Employees and Organizations in The Wake of COVID-19 EpidemicDocumento4 pagineGuidelines For Government Employees and Organizations in The Wake of COVID-19 EpidemicGhulam NabiNessuna valutazione finora

- Paper SpaltDocumento70 paginePaper SpaltGhulam NabiNessuna valutazione finora

- Interest Rates and Dsicount RateDocumento20 pagineInterest Rates and Dsicount RateGhulam NabiNessuna valutazione finora

- Time ValueDocumento11 pagineTime ValueGhulam NabiNessuna valutazione finora

- Financial Mathemati CS: Ghulam NabiDocumento15 pagineFinancial Mathemati CS: Ghulam NabiGhulam NabiNessuna valutazione finora

- Special Paper, 2019 BSAS, S-III Replica Statistics IIIDocumento1 paginaSpecial Paper, 2019 BSAS, S-III Replica Statistics IIIGhulam NabiNessuna valutazione finora

- Financial Math SOA (12 Edition) - Ch.1: by Mr. Ghulam Nabi Lecturer College of Statistical and Actuarial Sciences, PUDocumento14 pagineFinancial Math SOA (12 Edition) - Ch.1: by Mr. Ghulam Nabi Lecturer College of Statistical and Actuarial Sciences, PUGhulam NabiNessuna valutazione finora

- Interest Rates and Dsicount RateDocumento20 pagineInterest Rates and Dsicount RateGhulam NabiNessuna valutazione finora

- Financial Mathemati CS: Ghulam NabiDocumento16 pagineFinancial Mathemati CS: Ghulam NabiGhulam NabiNessuna valutazione finora

- The Effects of Shariah Board Composition On Islamic Equity Indices ' PerformanceDocumento12 pagineThe Effects of Shariah Board Composition On Islamic Equity Indices ' PerformanceGhulam NabiNessuna valutazione finora

- DGT Conflicts of Interest FMADocumento60 pagineDGT Conflicts of Interest FMAGhulam NabiNessuna valutazione finora

- Some Clarity On Mutual Fund Fees: Stewart Brown Steven PomerantzDocumento28 pagineSome Clarity On Mutual Fund Fees: Stewart Brown Steven PomerantzGhulam NabiNessuna valutazione finora

- Learning About Mutual Fund Managers: Darwin Choi, Bige Kahraman, and Abhiroop MukherjeeDocumento75 pagineLearning About Mutual Fund Managers: Darwin Choi, Bige Kahraman, and Abhiroop MukherjeeGhulam NabiNessuna valutazione finora

- Journal of Financial Economics: David Hunter, Eugene Kandel, Shmuel Kandel, Russ WermersDocumento29 pagineJournal of Financial Economics: David Hunter, Eugene Kandel, Shmuel Kandel, Russ WermersGhulam NabiNessuna valutazione finora

- Working and Organization of Mutual Fund Company: Roshan Shukla and Shikha GuptaDocumento9 pagineWorking and Organization of Mutual Fund Company: Roshan Shukla and Shikha GuptaGhulam NabiNessuna valutazione finora

- Objective Type Questions For Business Statistics I.com Part 2Documento9 pagineObjective Type Questions For Business Statistics I.com Part 2Ghulam NabiNessuna valutazione finora

- Journal of Financial Economics: David Moreno, Rosa Rodríguez, Rafael ZambranaDocumento21 pagineJournal of Financial Economics: David Moreno, Rosa Rodríguez, Rafael ZambranaGhulam NabiNessuna valutazione finora

- No Date Day Topic-P-Paper (ASM Book) Topic-CT3 (Acted Book) TestDocumento3 pagineNo Date Day Topic-P-Paper (ASM Book) Topic-CT3 (Acted Book) TestGhulam NabiNessuna valutazione finora

- International Review of Financial Analysis: Jason Foran, Niall O'SullivanDocumento12 pagineInternational Review of Financial Analysis: Jason Foran, Niall O'SullivanGhulam NabiNessuna valutazione finora

- Q 8.2 Solution With WorkingsDocumento8 pagineQ 8.2 Solution With WorkingsGhulam NabiNessuna valutazione finora

- 1 - Contribution Margin AnalysisDocumento28 pagine1 - Contribution Margin AnalysisMahmoud TrezeguetNessuna valutazione finora

- Sec Form Auf-002-R: Securities and Exchange CommissionDocumento3 pagineSec Form Auf-002-R: Securities and Exchange CommissionRodolfo KhiaNessuna valutazione finora

- Apy ChartDocumento1 paginaApy ChartJai mishraNessuna valutazione finora

- Company AuditDocumento30 pagineCompany AuditChutmaarika GoteNessuna valutazione finora

- Port Folio Management of Banking SectorDocumento45 paginePort Folio Management of Banking SectorNitinAgnihotriNessuna valutazione finora

- Cash Receipts Journal: Accounts PayableDocumento6 pagineCash Receipts Journal: Accounts PayableThomas EsguerraNessuna valutazione finora

- Financial System Scope and FunctionDocumento2 pagineFinancial System Scope and FunctionvivekNessuna valutazione finora

- Commerehensive Project Report On MSMEDocumento121 pagineCommerehensive Project Report On MSMEKirronMehttaNessuna valutazione finora

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Documento8 pagineFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNessuna valutazione finora

- PPFAS Monthly Portfolio Report February 28 2023Documento44 paginePPFAS Monthly Portfolio Report February 28 2023DevendraNessuna valutazione finora

- Đề 2022 2023Documento11 pagineĐề 2022 2023buitrantuuyen2003Nessuna valutazione finora

- Barcoma-Acce 412 (11435) - Reaction PaperDocumento2 pagineBarcoma-Acce 412 (11435) - Reaction PaperDiana Mae BarcomaNessuna valutazione finora

- Acps 4 Complete SolutionsDocumento2 pagineAcps 4 Complete SolutionsLuna ShiNessuna valutazione finora

- ETF Quarterly 4Q09Documento4 pagineETF Quarterly 4Q09Vladimir KreindelNessuna valutazione finora

- Lecture Note 10 - Mortgage and Mortgage-Backed SecuritiesDocumento58 pagineLecture Note 10 - Mortgage and Mortgage-Backed Securitiesben tenNessuna valutazione finora

- Marketing of Financial ServicesDocumento10 pagineMarketing of Financial ServicesRohit SoniNessuna valutazione finora

- Banking Management Chapter 01Documento8 pagineBanking Management Chapter 01AsitSinghNessuna valutazione finora

- Questions For ESP2Documento35 pagineQuestions For ESP2Wabi SabiNessuna valutazione finora

- Essentials of Managerial Finance 14th Edition Besley Solutions ManualDocumento31 pagineEssentials of Managerial Finance 14th Edition Besley Solutions Manualmichaelstokes21121999xsb100% (31)

- Fins2624 Problem Set 5 Tutorial QuestionDocumento5 pagineFins2624 Problem Set 5 Tutorial QuestionPhebieon MukwenhaNessuna valutazione finora

- Topic 4 - Quiz Types of Major Accounts PDFDocumento4 pagineTopic 4 - Quiz Types of Major Accounts PDFSarah Santos33% (3)

- Tabel Bunga Ekonomi TeknikDocumento32 pagineTabel Bunga Ekonomi TeknikTdaNessuna valutazione finora

- Real vs. Nominal Interest RateDocumento15 pagineReal vs. Nominal Interest RateDebarshi GhoshNessuna valutazione finora

- A Summer Internship Presentation ON "Banking Operations" inDocumento16 pagineA Summer Internship Presentation ON "Banking Operations" insweetashusNessuna valutazione finora

- NACH ModifiedDocumento1 paginaNACH ModifiederbgawdweNessuna valutazione finora

- Credit AppraisalsssDocumento4 pagineCredit AppraisalsssVikram ShettyNessuna valutazione finora

- Phases in BankingDocumento2 paginePhases in BankingAnkur TyagiNessuna valutazione finora

- Auditing Unit 1Documento39 pagineAuditing Unit 1Haseeb AhmedNessuna valutazione finora

- Account StatementDocumento1 paginaAccount StatementИван ИвановNessuna valutazione finora

- Assignment 1-IFRSDocumento14 pagineAssignment 1-IFRSZahidNessuna valutazione finora