Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

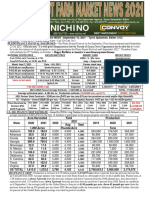

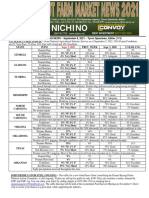

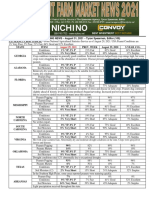

Cotton Marketing News

Caricato da

Brittany EtheridgeDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cotton Marketing News

Caricato da

Brittany EtheridgeCopyright:

Formati disponibili

REPRESENTING COTTON GROWERS THROUGHOUT ALABAMA, FLORIDA, GEORGIA, NORTH CAROLINA, SOUTH CAROLINA, AND VIRGINIA

COTTON MARKETING NEWS

Volume 17, No. 14 August 27, 2019

201919

the market. The US, China, and Germany are all experiencing an

Sponsored by economic slowdown. A global slowdown and recession fears are

also being pushed along by the uncertainties in trade

Now Is Not the Time to Bury Our Heads in the Sand When the trade war with China started, one theory on how it

could impact US cotton was that the US might be able to offset, at

The uncertainties of the US-China trade situation continue to least in part, the loss of exports to China by increasing exports to

weigh heavily on the cotton market. This continues to sometimes other countries. The already occurring expansion of our exports

be a tug-of-war between rumor and fact. The market may react to places like Vietnam and Bangladesh was evidence that it might

positively to rumor or any hint of good news then retreat for lack be possible. The more recent weakening in demand/use,

of follow-through facts or due to subsequent conflicting news. however, and the possibility of a global economic slowdown have

possibly derailed that theory.

In the tit-for-tat battle, over recent weeks and days the US

imposed an additional 10% tariff on $300 billion of Chinese goods USDA’s August monthly projection of World mill use for the 2019

effective September 1 although some have since been delayed to crop marketing year is 123 million bales—almost 3 million bales

December 15; China then retaliated announcing new tariffs on less than its first projection back in May. One half of this reduction

$75 billion of US goods; the US then retaliated by raising existing is accounted for by less use projected for China. As of August 15,

tariff rates on more than $400 billion in Chinese goods; the US and export sales for the 2019 crop year total 8.33 million bales. This

Japan have agreed in principle on a trade deal to be signed in compares to 9.01 million bales at the same time last season.

September; China then said they are willing to resume trade

negotiations; the next rounds of talks is scheduled for September. It is clear, by just looking at what has happened to prices that

farmers are carrying a heavy burden and paying a heavy cost for

During all this, the market has whipsawed up and down based on the ongoing trade dispute. Two years of MFP payments are

trade news and other factors. After falling to 58.4 cents on August certainly a help in terms of mitigating low prices—but that doesn’t

12, prices (Dec futures) “rallied” to 60.13 cents by August 16. help recover lost markets and market share.

Prices maintained around the 59 ½ to 60 cents level for several

days before 3 consecutive losing days (due to trade news) took us The outlook is uncertain, as always. Harvest is upon us or soon

to 57.82 cents—a new low. Prices tried to make a move back will be and growers must decide what to do with the uncommitted

closer to 60 cents today but failed to hold. portion of the crop. What are the alternatives and how do you

evaluate the choices?

Here we are in the 58 cents neighborhood. Given where we are,

what else can you do but assume that prices are going to

eventually somewhere, somehow increase. Now is not the time

to give up and bury our heads in the sand. You have to be positive.

The question is—how do you play the waiting game—it’s not what

to do—we’re going to hope for improvement—the question is

how do we best do that?

The condition of the US crop has deteriorated and we’ve got a

possible hurricane headed for the Southeast. But right now, trade

uncertainty and weakening demand override everything. Let me

SOURCE: DTN, August 27, 2019. just say this in closing—we are close to LDP (or what some still call

a POP payment) territory. If futures stay consistently below 59

cents, an LDP should be in effect. If you take the LDP, and fine if

you do, just remember that the LDP/MLG is your “shock absorber”

It all adds up to an increasingly frustrating time for cotton growers and you no longer have that protection if prices move lower.

as prices just can’t seem to find traction. What is unknown is will

US markets and trade eventually return to “normal” and if so Cotton Economist- Retired

when, or are we in for a longer term complete restructuring of Professor Emeritus of Cotton Economics

how we do business with China.

Global recession worries are also contributing to the weakness in

Potrebbero piacerti anche

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Notes For February 18Documento2 pagineNotes For February 18Kate BlackNessuna valutazione finora

- I.predictions For The Economy 2020Documento4 pagineI.predictions For The Economy 2020Jesús Cardiel OliverNessuna valutazione finora

- Breakfast With Dave June 5Documento8 pagineBreakfast With Dave June 5variantperception100% (2)

- Fasanara Capital Investment Outlook - May 3rd 2016Documento17 pagineFasanara Capital Investment Outlook - May 3rd 2016Zerohedge100% (1)

- Trade War Raises Recession Risk (June 2019)Documento20 pagineTrade War Raises Recession Risk (June 2019)WILNessuna valutazione finora

- Jeremy Siegel On The Bear Market, Sky-High Oil Prices and Other Bad NewsDocumento3 pagineJeremy Siegel On The Bear Market, Sky-High Oil Prices and Other Bad Newsmona14lizaNessuna valutazione finora

- Graystone On The MarketsDocumento20 pagineGraystone On The MarketsKarthikNessuna valutazione finora

- AEGO Advisory Board October 2016-10Documento34 pagineAEGO Advisory Board October 2016-10Chatzianagnostou GeorgeNessuna valutazione finora

- Breakfast With Dave 092109Documento8 pagineBreakfast With Dave 092109ejlamasNessuna valutazione finora

- 2018.02 IceCap Global Market OutlookDocumento23 pagine2018.02 IceCap Global Market OutlookZerohedge100% (2)

- The Dilemma of The Grey RhinosDocumento5 pagineThe Dilemma of The Grey RhinosJorge AguirreNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Headlines: Thursday, December 7, 2006Documento10 pagineHeadlines: Thursday, December 7, 2006Andru VolumNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Breakfast With Dave - 052809Documento6 pagineBreakfast With Dave - 052809jobby jobNessuna valutazione finora

- Breakfast With Dave June 12Documento7 pagineBreakfast With Dave June 12variantperception100% (1)

- Bob Chapman Facing A Total Breakdown of Financial Markets 29 10 09Documento4 pagineBob Chapman Facing A Total Breakdown of Financial Markets 29 10 09sankaratNessuna valutazione finora

- Debt, Profits, Canada & More .: Nvestment OmpassDocumento4 pagineDebt, Profits, Canada & More .: Nvestment OmpassPacifica Partners Capital ManagementNessuna valutazione finora

- The Pensford Letter - 1.9.12Documento7 pagineThe Pensford Letter - 1.9.12Pensford FinancialNessuna valutazione finora

- The Great Retail Bifurcation: Why The Retail "Apocalypse" Is Really A RenaissanceDocumento24 pagineThe Great Retail Bifurcation: Why The Retail "Apocalypse" Is Really A RenaissanceTincho PreitiNessuna valutazione finora

- Crashing EconomyDocumento2 pagineCrashing EconomyStanleyNessuna valutazione finora

- Breakfast With Dave 8/9/10Documento12 pagineBreakfast With Dave 8/9/10ctringhamNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Santelli: $4 Gas, $150 Oil Coming This Summer..Documento9 pagineSantelli: $4 Gas, $150 Oil Coming This Summer..Albert L. PeiaNessuna valutazione finora

- A Time For Caution in Global Markets?Documento3 pagineA Time For Caution in Global Markets?tera.secret santaNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- The Great American Credit Collapse Pt2Documento7 pagineThe Great American Credit Collapse Pt2auroradogNessuna valutazione finora

- Financial Wanderings: Why'd It Do What It Did?Documento4 pagineFinancial Wanderings: Why'd It Do What It Did?bblackburn76Nessuna valutazione finora

- Be Careful You Wish ForDocumento5 pagineBe Careful You Wish Foredoardo.pivaNessuna valutazione finora

- Could A Recession Be Just Around The CornerDocumento5 pagineCould A Recession Be Just Around The Cornerey_miscNessuna valutazione finora

- Hidden InflationDocumento7 pagineHidden InflationJose MangualNessuna valutazione finora

- Selling America - A Bears ViewDocumento3 pagineSelling America - A Bears ViewnagstrikesNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- QV Update - 11.04.15Documento2 pagineQV Update - 11.04.15kashmianNessuna valutazione finora

- Week Ending Friday, August 3, 2018: Exchange Yoy MomDocumento13 pagineWeek Ending Friday, August 3, 2018: Exchange Yoy MomsirdquantsNessuna valutazione finora

- Breakfast With Dave - 20101213Documento12 pagineBreakfast With Dave - 20101213marketpanicNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- The - Hyperinflation - Survival.guide - Gerald - Swanson PDFDocumento106 pagineThe - Hyperinflation - Survival.guide - Gerald - Swanson PDFNorisNessuna valutazione finora

- Jeremy Zwinger President: 757 Main Street Colusa, CA 95932 (530) 933-7277Documento54 pagineJeremy Zwinger President: 757 Main Street Colusa, CA 95932 (530) 933-7277Panda Panda TranNessuna valutazione finora

- Breakfast With Dave: David A. RosenbergDocumento7 pagineBreakfast With Dave: David A. RosenbergMitchell SchorrNessuna valutazione finora

- Stocks Surpassing January Highs: Are We Peaking, or Will That Come in Late 2019?Documento8 pagineStocks Surpassing January Highs: Are We Peaking, or Will That Come in Late 2019?kumar.arasu8717Nessuna valutazione finora

- Dinner With Dave 063010Documento7 pagineDinner With Dave 063010BlowmeNessuna valutazione finora

- Breakfast With Dave 082010Documento15 pagineBreakfast With Dave 082010richardck50Nessuna valutazione finora

- Cotton Marketing NewsDocumento2 pagineCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Dave Rosenberg 2018 Economic OutlookDocumento9 pagineDave Rosenberg 2018 Economic OutlooksandipktNessuna valutazione finora

- Macro ResearchDocumento12 pagineMacro ResearchZerohedge100% (2)

- TD Economics: The Weekly Bottom LineDocumento6 pagineTD Economics: The Weekly Bottom LineInternational Business TimesNessuna valutazione finora

- March 112010 PostsDocumento10 pagineMarch 112010 PostsAlbert L. PeiaNessuna valutazione finora

- 20 Rules For Markets and Investing - Compound AdvisorsDocumento27 pagine20 Rules For Markets and Investing - Compound AdvisorsEngin VarolNessuna valutazione finora

- Q12020 ArquitosCapitalManagement LetterDocumento6 pagineQ12020 ArquitosCapitalManagement LetterCamille ManuelNessuna valutazione finora

- Corn Bear ArgumentDocumento11 pagineCorn Bear ArgumentPellucidigmNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- Breakfast With Dave 101310Documento8 pagineBreakfast With Dave 101310fcamargoeNessuna valutazione finora

- The Broyhill Letter: Executive SummaryDocumento4 pagineThe Broyhill Letter: Executive SummaryBroyhill Asset ManagementNessuna valutazione finora

- Said Jeremy Mayes, General Manager For American Peanut Growers IngredientsDocumento1 paginaSaid Jeremy Mayes, General Manager For American Peanut Growers IngredientsBrittany EtheridgeNessuna valutazione finora

- Cotton Marketing NewsDocumento2 pagineCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- October 17, 2021Documento1 paginaOctober 17, 2021Brittany EtheridgeNessuna valutazione finora

- October 24, 2021Documento1 paginaOctober 24, 2021Brittany Etheridge100% (1)

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- U.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Documento1 paginaU.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Brittany EtheridgeNessuna valutazione finora

- 1,000 Acres Pounds/Acre TonsDocumento1 pagina1,000 Acres Pounds/Acre TonsBrittany EtheridgeNessuna valutazione finora

- Sept. 26, 2021Documento1 paginaSept. 26, 2021Brittany EtheridgeNessuna valutazione finora

- Dairy Market Report - September 2021Documento5 pagineDairy Market Report - September 2021Brittany EtheridgeNessuna valutazione finora

- World Agricultural Supply and Demand EstimatesDocumento40 pagineWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNessuna valutazione finora

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocumento1 paginaShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNessuna valutazione finora

- Cotton Marketing NewsDocumento1 paginaCotton Marketing NewsBrittany EtheridgeNessuna valutazione finora

- October 10, 2021Documento1 paginaOctober 10, 2021Brittany EtheridgeNessuna valutazione finora

- Shelled MKT Price Weekly Prices: Same As Last WeekDocumento1 paginaShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeNessuna valutazione finora

- October 3, 2021Documento1 paginaOctober 3, 2021Brittany EtheridgeNessuna valutazione finora

- Sept. 12, 2021Documento1 paginaSept. 12, 2021Brittany EtheridgeNessuna valutazione finora

- YieldDocumento1 paginaYieldBrittany EtheridgeNessuna valutazione finora

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDocumento1 pagina2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeNessuna valutazione finora

- Sept. 19, 2021Documento1 paginaSept. 19, 2021Brittany EtheridgeNessuna valutazione finora

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Documento1 paginaExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Brittany EtheridgeNessuna valutazione finora

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocumento1 paginaShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNessuna valutazione finora

- NicholasDocumento1 paginaNicholasBrittany EtheridgeNessuna valutazione finora

- August 22, 2021Documento1 paginaAugust 22, 2021Brittany EtheridgeNessuna valutazione finora

- Sept. 5, 2021Documento1 paginaSept. 5, 2021Brittany EtheridgeNessuna valutazione finora

- World Agricultural Supply and Demand EstimatesDocumento40 pagineWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNessuna valutazione finora

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocumento1 paginaShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNessuna valutazione finora

- FPAC Honeybee Brochure August2021Documento4 pagineFPAC Honeybee Brochure August2021Brittany EtheridgeNessuna valutazione finora

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbDocumento1 paginaShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbBrittany EtheridgeNessuna valutazione finora

- August 29, 2021Documento1 paginaAugust 29, 2021Brittany EtheridgeNessuna valutazione finora

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Documento1 paginaExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Brittany EtheridgeNessuna valutazione finora

- Logiq v12 SM PDFDocumento267 pagineLogiq v12 SM PDFpriyaNessuna valutazione finora

- EGurukul - RetinaDocumento23 pagineEGurukul - RetinaOscar Daniel Mendez100% (1)

- Chapter 1Documento6 pagineChapter 1Grandmaster MeowNessuna valutazione finora

- Poetry UnitDocumento212 paginePoetry Unittrovatore48100% (2)

- Hazardous Locations: C.E.C. ClassificationsDocumento4 pagineHazardous Locations: C.E.C. ClassificationsThananuwat SuksaroNessuna valutazione finora

- P 348Documento196 pagineP 348a123456978Nessuna valutazione finora

- Myanmar 1Documento3 pagineMyanmar 1Shenee Kate BalciaNessuna valutazione finora

- Arduino Uno CNC ShieldDocumento11 pagineArduino Uno CNC ShieldMărian IoanNessuna valutazione finora

- Retail Banking Black BookDocumento95 pagineRetail Banking Black Bookomprakash shindeNessuna valutazione finora

- BARUDocumento53 pagineBARUhueuaNessuna valutazione finora

- HRMDocumento118 pagineHRMKarthic KasiliaNessuna valutazione finora

- DMIT - Midbrain - DMIT SoftwareDocumento16 pagineDMIT - Midbrain - DMIT SoftwarevinNessuna valutazione finora

- Chapter 4 - Basic ProbabilityDocumento37 pagineChapter 4 - Basic Probabilitynadya shafirahNessuna valutazione finora

- Resume 1Documento2 pagineResume 1Aidie HerreraNessuna valutazione finora

- BLP#1 - Assessment of Community Initiative (3 Files Merged)Documento10 pagineBLP#1 - Assessment of Community Initiative (3 Files Merged)John Gladhimer CanlasNessuna valutazione finora

- Adjective & VerbsDocumento3 pagineAdjective & VerbsDennis BerkNessuna valutazione finora

- Babe Ruth Saves BaseballDocumento49 pagineBabe Ruth Saves BaseballYijun PengNessuna valutazione finora

- Final WMS2023 HairdressingDocumento15 pagineFinal WMS2023 HairdressingMIRAWATI SAHIBNessuna valutazione finora

- Jee MainsDocumento32 pagineJee Mainsjhaayushbhardwaj9632Nessuna valutazione finora

- Amendments To The PPDA Law: Execution of Works by Force AccountDocumento2 pagineAmendments To The PPDA Law: Execution of Works by Force AccountIsmail A Ismail100% (1)

- DION IMPACT 9102 SeriesDocumento5 pagineDION IMPACT 9102 SeriesLENEEVERSONNessuna valutazione finora

- Introduction To Atomistic Simulation Through Density Functional TheoryDocumento21 pagineIntroduction To Atomistic Simulation Through Density Functional TheoryTarang AgrawalNessuna valutazione finora

- BMGT 200 Assignment 2 Answer KeysDocumento3 pagineBMGT 200 Assignment 2 Answer Keysharout keshishianNessuna valutazione finora

- 5066452Documento53 pagine5066452jlcheefei9258Nessuna valutazione finora

- Эквивалентная Схема Мотра Теслы с Thomas2020Documento7 pagineЭквивалентная Схема Мотра Теслы с Thomas2020Алексей ЯмаNessuna valutazione finora

- Math Review CompilationDocumento9 pagineMath Review CompilationJessa Laika CastardoNessuna valutazione finora

- CAA Safety Plan 2011 To 2013Documento46 pagineCAA Safety Plan 2011 To 2013cookie01543Nessuna valutazione finora

- 24 DPC-422 Maintenance ManualDocumento26 pagine24 DPC-422 Maintenance ManualalternativblueNessuna valutazione finora

- Bacacay South Hris1Documento7.327 pagineBacacay South Hris1Lito ObstaculoNessuna valutazione finora

- Solubility Product ConstantsDocumento6 pagineSolubility Product ConstantsBilal AhmedNessuna valutazione finora