Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Rmo 16-2019

Caricato da

Jhenny Ann P. SalemTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Rmo 16-2019

Caricato da

Jhenny Ann P. SalemCopyright:

Formati disponibili

BLIREAU OF INTERN AL REV ENUE

f-Y-r

t-iNF#F+

@

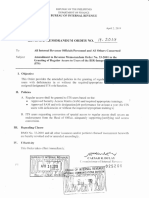

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE APR 1l I,ffit

BUREAU OF INTERNAL REVENUE li( ll faqn

-Ti-TtLD

I

Quezon CitY JILUJZTyiE-ZS AG

RECORDS MGT. DIVISI ON

March 19,2019

tt^ 1f\lt,

O - C/- I.// I

REVENUE MEMORANDUM ORDER NO. I

SUBJECT : Modification of Alphanumeric Tax Code (ATC) for Withholding Taxes in BIR

Form No. 1601-EQ Pursuant to Revenue Regulations (RR) No. 1-2019

IU : AII Collection Agents, Revenue District Officers and Other Internal Revenue

Officers Concerned

I. OBJECTIVE:

To facilitate the proper identification and monitoring of tax collection from withholding taxes

in BIR Form No. 1601-EQ (Quarterly Remittance Return of Creditable Income Taxes Withheld

[Expanded]), pursuant to RR No. 1-20'19, the following ATCs are hereby modified:

MODIFIED/

EXISTING (per ATC Handbook)

NEW

BIR

Tax

ATC Description Form Legal Basis Tax Ratei

Rate

No.

On gross amount of refund given by 1 601 -EQ RR No. 1-2019

MERALCO to customers with active

contracts as classified by MERALCO

WI65O 1 Individual 25% 1

I )lo//O

WC65O 2. Corporate

On gross amount of refund given by

MERALCO to customers with terminated

contracts as classified by MERALCO

w1651 '1. Individual a)o/- 1 t o/

l)/o

WC651 2. Corporate

On gross amount of interest on the

refund of meter deposit whether paid

directly to the customers or applied

agarnst customer's billings of Non-

Residential customers whose monthly

electricity consumption exceeds 200 kwh

as ciassified by MERALCO

wr561 1. Individual 10% 15%

WC661 2. Corporate

MODIFIED/

EXISTING (per ATC Handbook)

NEW

BIR

Tax

ATC Description Form Legal Basis Tax Rate

Rate

No.

On gross amount of interest on the

refund of meter deposit whether paid

directly to the customers or applied

against customer's billings of Non-

Residential customers whose monthly

electricity consumption exceeds 200 kwh

as classified by other electric

Distribution Utilities (DU)

WI663 '1. Individual 20Yo 15o/o

WC663 2. Corporate

Interest income derived from any other

debt instruments not within the

coverage of deposit substitutes and

Revenue Regulations No. 14-20'12

1AO/

wr7'10 1. Individual LV /O 15"/o

WCTiO 2. Corporate

il. REPEALING CLAUSE:

This Revenue Memorandum Order (RMO) revises portions of all other issuances inconsistent

herewith.

ffi. EFFECTIVITY:

This RMO shall take effect immediately.

/Eo+olts-1

CAESAR, R. DULAY

Commissioner of Internal Revenue

025084

ATK 1I

B-3

ffioXos@1vtsto1

Page 2 of 2

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- RMO No.5-2019Documento2 pagineRMO No.5-2019Jhenny Ann P. SalemNessuna valutazione finora

- RMO - No. 26-2019Documento3 pagineRMO - No. 26-2019Jhenny Ann P. SalemNessuna valutazione finora

- Memorandum Circular: InternalDocumento1 paginaMemorandum Circular: InternalJhenny Ann P. SalemNessuna valutazione finora

- RMC 23Documento1 paginaRMC 23Jhenny Ann P. SalemNessuna valutazione finora

- Office Codes AND: Revised Revenue RegionsDocumento2 pagineOffice Codes AND: Revised Revenue RegionsJhenny Ann P. SalemNessuna valutazione finora

- Of in The Act: Modification Nos.2551M12551Q Implementation (RA) For CollectionDocumento2 pagineOf in The Act: Modification Nos.2551M12551Q Implementation (RA) For CollectionJhenny Ann P. SalemNessuna valutazione finora

- I. in II. - ": Revenue Memorai (DumDocumento1 paginaI. in II. - ": Revenue Memorai (DumJhenny Ann P. SalemNessuna valutazione finora

- Rmo - No. 21-2019Documento2 pagineRmo - No. 21-2019Jhenny Ann P. SalemNessuna valutazione finora

- Rmo 13-2019Documento1 paginaRmo 13-2019Jhenny Ann P. SalemNessuna valutazione finora

- Rmo - No. 14-2019Documento21 pagineRmo - No. 14-2019Jhenny Ann P. Salem100% (1)

- RMO No. 25-2019Documento7 pagineRMO No. 25-2019Jhenny Ann P. SalemNessuna valutazione finora

- RMC 1-2019 PDFDocumento1 paginaRMC 1-2019 PDFJhenny Ann P. SalemNessuna valutazione finora

- The Philippines Department of Finance Bureau of Internal Revenue Quezon CityDocumento8 pagineThe Philippines Department of Finance Bureau of Internal Revenue Quezon CityJhenny Ann P. SalemNessuna valutazione finora

- RMC 10-2019 PDFDocumento1 paginaRMC 10-2019 PDFJhenny Ann P. SalemNessuna valutazione finora

- REVENUE MEMORANDUM CIRCULAR NO. 6-2019 Issued On January 17, 2019Documento1 paginaREVENUE MEMORANDUM CIRCULAR NO. 6-2019 Issued On January 17, 2019Jhenny Ann P. SalemNessuna valutazione finora

- Rmo 27-2019Documento1 paginaRmo 27-2019Jhenny Ann P. SalemNessuna valutazione finora

- FF'B 2e20ig: InternalDocumento1 paginaFF'B 2e20ig: InternalJhenny Ann P. SalemNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Insolvency and Bankruptcy Board of India NCLT - ChennaiDocumento2 pagineInsolvency and Bankruptcy Board of India NCLT - ChennaiGuna KrishNessuna valutazione finora

- 9706 s10 Ms 22 PDFDocumento7 pagine9706 s10 Ms 22 PDFYousaf GillaniNessuna valutazione finora

- Case-Study - Laura Ashley.Documento16 pagineCase-Study - Laura Ashley.inesvilafanhaNessuna valutazione finora

- Appendix 74 IIRUPDocumento2 pagineAppendix 74 IIRUPKaren Balisacan Segundo RuizNessuna valutazione finora

- Green REIT PLC Annual Report 2016Documento176 pagineGreen REIT PLC Annual Report 2016Mihir JoshiNessuna valutazione finora

- q3. Fs QuizzerDocumento13 pagineq3. Fs QuizzerClaudine DuhapaNessuna valutazione finora

- Ruma GhoshDocumento26 pagineRuma GhoshhritamgemsNessuna valutazione finora

- General Accounting Plan Local Government Units: Table 1Documento1 paginaGeneral Accounting Plan Local Government Units: Table 1Pee-Jay Inigo UlitaNessuna valutazione finora

- The Role of Private Equity Firms - RizwanDocumento17 pagineThe Role of Private Equity Firms - RizwangizmorizNessuna valutazione finora

- UN-Habitat, Slum Upgrading Facility. 2009Documento70 pagineUN-Habitat, Slum Upgrading Facility. 2009Marcos BurgosNessuna valutazione finora

- Chap. 5 Variable CostingDocumento8 pagineChap. 5 Variable CostingAnand DubeyNessuna valutazione finora

- Assignment On Time Value of MoneyDocumento2 pagineAssignment On Time Value of MoneyVijay NathaniNessuna valutazione finora

- Perhitungan Excel 2018Documento28 paginePerhitungan Excel 2018Nemy Kholidatul FitroNessuna valutazione finora

- Ia 3 Chapter 4 DraftDocumento32 pagineIa 3 Chapter 4 DraftRuiz, CherryjaneNessuna valutazione finora

- AssignmentDocumento8 pagineAssignmentEdna MingNessuna valutazione finora

- Unit 2 Tutorial Worksheet AnswersDocumento15 pagineUnit 2 Tutorial Worksheet AnswersHhvvgg BbbbNessuna valutazione finora

- Reviewer in TaxationDocumento9 pagineReviewer in TaxationMerlyn M. Casibang Jr.Nessuna valutazione finora

- United States Court of Appeals, Eleventh CircuitDocumento18 pagineUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNessuna valutazione finora

- State of Microfinance in BhutanDocumento45 pagineState of Microfinance in BhutanasianingenevaNessuna valutazione finora

- A Study On Imapct of Behavioural Biases On Retail InvestorsDocumento60 pagineA Study On Imapct of Behavioural Biases On Retail InvestorsNisha DhanasekaranNessuna valutazione finora

- Expected Questions of InterviewDocumento4 pagineExpected Questions of InterviewAmit RanjanNessuna valutazione finora

- HDFC Bank QuestionnaireDocumento25 pagineHDFC Bank QuestionnaireIesha GuptaNessuna valutazione finora

- Bank of The Philippine Islands Green Finance FrameworkDocumento7 pagineBank of The Philippine Islands Green Finance FrameworkMarilyn CailaoNessuna valutazione finora

- Complying With Ohio Consumer Law - A Guide For BusinessesDocumento32 pagineComplying With Ohio Consumer Law - A Guide For BusinessesMike DeWineNessuna valutazione finora

- How To Use Ichimoku Charts in Forex TradingDocumento14 pagineHow To Use Ichimoku Charts in Forex Tradinghenrykayode4Nessuna valutazione finora

- OPPT IntroductionDocumento5 pagineOPPT IntroductionP2P FoundationNessuna valutazione finora

- MAC2601-OCT NOV 2013eDocumento11 pagineMAC2601-OCT NOV 2013eDINEO PRUDENCE NONGNessuna valutazione finora

- Classic Pen Case CMADocumento2 pagineClassic Pen Case CMARheaPradhanNessuna valutazione finora

- Project IRIS PresentationDocumento11 pagineProject IRIS PresentationRadha MadhuriNessuna valutazione finora

- ASHMEAD-BARTLETT, E. - The Passing of The Shereefian Empire PDFDocumento618 pagineASHMEAD-BARTLETT, E. - The Passing of The Shereefian Empire PDFbenshys100% (2)