Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Complaint Dsakdl Asdl Kasl PDF

Caricato da

Chokie BamTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Complaint Dsakdl Asdl Kasl PDF

Caricato da

Chokie BamCopyright:

Formati disponibili

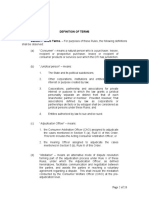

CODE OF COMMERCE COMMERCIAL LAW

CODE OF COMMERCE 3. Absolute Disqualification from Trade

The following cannot engage in commerce nor hold

a. office or have any direct, administrative, or

Merchants and Commercial financial intervention in commercial or industrial

companies:

Transactions a. Persons sentenced to the penalty of civil

(Articles 1-63) interdiction, while they have not served

their sentence or have not been amnestied

1. Definition of Merchants or pardoned

b. Persons who have been declared

bankrupt, while they have not obtained

Merchant- is the middleman between the

their discharge, or been authorized by

consumer and manufacturer; a merchant must do

virtue of an agreement accepted at a

business in his own name

general meeting of creditors and approved

1.1. Natural persons by judicial authority, to continue at the

Those, who having legal capacity to engage in head of their establishments; the discharge

commerce, habitually devote themselves thereto being considered in such cases is limited to

(Art 1) that expressed in the agreement

» Legal capacity to engage in commerce: c. Persons who, on account of laws or

having completed the age of 18 years31 special provisions, may not engage in

» Having free disposition of their property (Art commerce

4)

Legal presumption of habitually engaging in 4. Relative Disqualification from Trade

commerce exists from the moment the person

who intends to engage therein announces The following cannot engage in the commerce,

through circulars, newspapers, handbills, either in person or by proxy, nor can they hold any

posters exhibited to the public, or in any office or have any direct, administrative or financial

manner whatsoever, an establishment which intervention in commercial or industrial companies,

has for its object some commercial operation. within the limits of the districts, provinces or towns

(Art 3) in which they discharge their duties:

A merchant need not devote his full time to a. Justices of the Supreme Court, judges32

commerce and officials of the department of public

prosecutors in active service. This provision

1.2. Foreign entities shall not be applicable to the municipal

Foreigners and companies created abroad may mayors, judges or prosecuting attorneys,

engage in commerce subject to the laws of nor to those who by chance are temporarily

their country with respect to their capacity to discharging the functions of judges or

contract, prosecuting attorneys.

Foreign corporations and partnerships can b. Administrative, economic or military

engage business here, provided they get a heads of districts, provinces or posts

license from the SEC. For insurance companies, c. Employees engaged in the collection

they need a certificate of authority from the and administration of funds of the

Insurance Commission. Banks need a license State, appointed by the Government.

from the Monetary Board. Persons who by contract administer and

Code of Commerce governs: collect temporarily or their representatives

» regards the creation of their establishments are exempted.

in Philippine territory, d. Stock and commercial brokers of

» their mercantile operations, and whatever class they may be.

» the jurisdiction of the courts of the e. Those who by virtue of laws or special

Philippines. provisions, may not engage in

But if there’s a special treaty, the treaty commerce in a determinate territory.

governs. f. Members of Congress (’87 Consti)

g. President, Vice President, Cabinet

2. Applicable Laws members and their deputies or

assistants (’87 Consti)

(whether or not executed by merchants) h. Members of Constitutional Commission

a. Code of Commerce (’87 Consti)

b. If no provision, commercial customs i. President, Vice President, Members of the

c. In the absence of these two, Civil Code Cabinet, Congress, Supreme Court and the

Constitutional Commission, Ombudsman

Customs take precedence over civil law with respect to any loan, guaranty, or

because of the progressive character of other form of financial accommodation

commerce. For centuries, negotiable for any business purpose by any

instruments are governed mostly by customs government-owned or controlled bank to

rather than law. But civil law can also them (Art XI, Sec. 16, ’87 Consti)

supplement the Code of Commerce – the Code

does not contain provisions on extinguishments

of obligations or damages. 32

Judges are no longer disqualified, as per Macariola vs.

Asuncion (114 SCRA 77, 1982). Since the relative

disqualification of judges is political in nature, this was

31 deemed abrogated by change in sovereignty from Spain

The Code of Commerce sets it at 21 years, but RA

6809 lowered the majority age to 18 years to the United States.

100% UP LAW UP BAROPS 2008 Page 255 of 351

CODE OF COMMERCE COMMERCIAL LAW

Absolute Incapacity Relative Incapacity ii. Note that receipt of the acceptance by

Extends throughout the Extends only to the the offeror is immaterial,

Philippines territory where the » Theory of manifestation: in

officer is exercising his commercial transactions, since time

functions is of the essence the contract is

Effect of act is null and Effect is to subject the perfected from the moment the

void violator to disciplinary acceptance is sent, even if it has not

action or punishment yet been received by the offeror. The

offeror can no longer withdraw the

5. Acts of Commerce (Commercial offer or change the terms of his offer.

» Theory of cognition: in civil law, when

Transactions) a contract is entered into by

correspondence, it will be perfected

a. Those acts contained in the Code of only upon receipt by the offeror of

Commerce the unconditional acceptance of the

b. all others of analogous character offeree.

iii. Compare with Art 1319, Civil Code:

The Code of Commerce does not attempt Perfection is only from the time the

anywhere to define what commercial offeror has actual knowledge of

transactions are. It only specifies 2 general acceptance.

classes. iv. BUT different rule when a broker or

An act need not be performed by a merchant in agent intervenes: perfection is when

order that it may be considered an act of the contracting parties shall have

commerce (Cia Agricola de Ultramar vs. Reyes, accepted his offer. (Art 55)

4 Phil 2)

6.4. Indemnification

6. Commercial Contracts i. If the penalty for indemnification is

fixed, the injured party may demand

6.1. Enforceability of Contracts through legal means the fulfillment of

i. Commercial contracts shall be valid, the contract or the penalty stipulated.

whatever the form and language, Recourse to one extinguishes the other

provided their existence is shown by any unless the contrary is stipulated. (Art

means established by the civil law. 56)

EXCEPT when the contract exceeds P300

(the equivalent of 1,500 pesetas), it 6.5. Interpretation

cannot be proved by the testimony of a i. Interpretation and compliance in good

witness alone. There must be some other faith and full enforceability of their

evidence. provisions in their plain, usual and

proper meanings (Art 57)

6.2. Efficacy of Contracts ii. In case of conflicts between copies of the

i. General Rule: Commercial contracts are contract, and an agent intervened in

consensual, so a written instrument is the negotiation, that which appears in

not necessary. the agent’s book shall prevail (Art 58)

Exception: in the ff cases in Art 52 iii. In case of doubt, and the rules cannot

Contracts stated in the Code33 or in resolve the conflict, issues shall be

special laws34 which must be decided in favor of the debtor (Art 59)

reduced to writing or require forms

or formalities necessary for their 6.6. Miscellaneous provisions

efficacy i. Days of grace, courtesy or others which

Contracts executed in a foreign under any name whatsoever defer the

country in which the law requires fulfillment of commercial obligations,

certain instruments, forms or shall not be recognized, except those in

formalities for their validity, which the parties may have previously

although Philippine law does not fixed in contract or which are based on

require them. a definite provision of law. (Art 61).

ii. if these contracts do not satisfy the Ratio: Time is of the essence in

circumstances respectively required, it commercial contracts, so days of grace

shall not give rise to obligations or are prohibited.

causes of action Exception: 30-day grace period in the

Insurance Code to pay premiums

6.3. Perfection of Contracts ii. Debtor is in delay when:

i. Contracts entered into by correspondence » If day of performance is fixed by

shall be perfected from the moment an the parties or by law, debtor is in

answer is made accepting the offer or default on the day following the day

the conditions by which the latter may fixed (art 63)

be modified. (Art 54) » If no period is fixed, 10 days from

execution of contract and on 11th

33 day, debtor in delay without need

The Code requires specific forms for charter parties of demand (Art 62)

and loans on bottomry and respondentia (Arts 267, 578,

» Potestative period (”when debtor

652 and 720).

34 desires”), debtor is in delay from

Negotiable Instruments Law requires negotiable

demand

instruments to be in writing. Insurance Code requires

payment of premium for a fire insurance contract to exist.

iii. Art. 50. Commercial contracts. They

are governed by:

100% UP LAW UP BAROPS 2008 Page 256 of 351

CODE OF COMMERCE COMMERCIAL LAW

a) Code of Commerce » If one merchant does not present his

b) Special law – if it’s the appropriate books, while the other presents his and are

law like the Insurance Code kept in accordance with law, the one who

c) Civil Code – to be applied in a presents will prevail, unless the reason for

suppletory manner to other special failure to produce is caused by a fortuitous

laws. event.

(This is not the same as in Art. 2. If what is » If both books are kept in accordance with

involved is an act of commerce, apply Art. law and they conflict, the court will decide

2. But if it is a commercial contract, apply on the basis of the rules of preponderance

Art. 50.) of evidence by taking into consideration the

totality of the evidence presented by both

7. Commercial Registry sides.

a. A book where entries are made of merchants 8. Cuentas en Participacion

and of documents affecting their commercial

transactions, or A partnership the existence of which was

b. An office established for the purpose of copying only known to those who had an interest in

and recording verbatim certain classes of the same, being no mutual agreements

documents of commercial nature between the partners and without a

corporate name indicating to the public in

7.1. Nature of registration: some way that there were other people

» by individual merchants – optional besides the one who ostensibly managed

» by corporation – compulsory, as it is the fact and conducted the business, is exactly the

of registration which creates the corporation accidental partnership of cuentas en

» partnerships with a capital of P3000 or more participacion defined in article 239 of the

or where the contributions consists of real Code of Commerce.

estate properties – compulsory, per Art.

1772, Civil Code Those who contract with the person under

» Philippine vessels whose name the business of such

with more than 3 tons gross – partnership of cuentas en participacion is

compulsory conducted, shall have only a right of action

with gross tonnage of 3 tons or less – against such person and not against the

optional (Bar Review Materials in other persons interested, and the latter, on

Commercial Law – J. Miravite, 2005 ed.) the other hand, shall have no right of

action against the third person who

7.2. Effect of failure to register contracted with the manager unless such

» an individual merchant who fails to register manager formally transfers his right to

cannot request the inscription of any them. (Art 242 of the code Of Commerce.)

document in the mercantile registry, nor (Bourns vs Carman, 1906)

take advantage of its effects (Art. 18, Code

of Commerce) Joint Account Partnership

» failure to register the articles of

No firm name Has a firm name

incorporation will not create the corporation

No common fund Has common fund

» failure to register the partnership does not

No juridical personality Has juridical personality

affect the existence of juridical personality,

Only ostensible partner All general partners

whether or not it has P3000 or more or real

liable to 3rd persons liable to 3rd persons

estate properties in contributions by the

partners (Bar Review Materials in Only ostensible partner All general partners

Commercial Law – J. Miravite, 2005 ed.) manages manage

Liquidation done by Liquidation entrusted to

7.3. Bookkeeping of Commerce ostensible partner any partner/s

National Internal Revenue Code: a taxpayer

must keep a journal and a ledger. But if his

gross quarterly receipts do not exceed P5000,

he can keep a simplified set of books. In the

case of corporations and partnerships, if their

gross income exceed P25,000 quarterly, their

books must be audited by an independent CPA.

NIRC also requires that the books must be kept

for 3 years. In case of corporations, the

Corporation Code requires them to keep record

of all business transactions, minutes of meeting

of BOD and stockholder, and stock and transfer

book.

Art. 48 lays down certain evidentiary rules

regarding keeping of books:

» This is an admission against interest. The

entries in the books of merchants may be

used as evidence against them.

» If the books of 2 merchants conflict where

1 book is kept in accordance with law while

the other is not, the former will prevail.

100% UP LAW UP BAROPS 2008 Page 257 of 351

CODE OF COMMERCE COMMERCIAL LAW

b.

4. How it works:

Letters of Credit

(Articles 567-572)

1. Definition Buyer procures LoC and obliges himself to

reimburse the issuing bank upon receipt of the

documents of title

An engagement by a bank or other person

made at the request of a customer that the

issuer (bank) will honor a draft or other

demands for payment or other complaints with Issuing bank issues LoC in favor of seller

the conditions specified in the credit.

(Prudential Bank vs. IAC, 1992).

An instrument issued by a bank in behalf of a

customer authorizing a beneficiary to draw a

draft or drafts which will be honored on Issuing bank opens a LoC

presentation to the bank if drawn in accordance with a correspondent bank

with the terms and conditions specified in the abroad (bank-to-bank

letter of credit. transaction

Art. 567, Code of Commerce: those issued by

one merchant to another or for the purpose of

attending to a commercial transaction.

2. Purpose

Seller ships goods to the buyer and delivers

To satisfy the seemingly irreconcilable interests

documents of title and draft to the issuing (or

of a seller, who refuses to part with his goods negotiating) bank to recover payment

before he is paid, and a buyer, who wants to

have control of the goods before paying. (Bank

of America vs. CA, 1993)

The primary purpose of the LoC is to substitute 5. Perfection of the LoC

for and support the agreement of the

buyer/importer to pay money under a contract From the time the correspondent bank makes

or other arrangement. It creates in the payment to persons in whose favor the LoC has

seller/exporter a secure expectation of been opened (Belman Inc. vs. Central Bank,

payment. 1958)

Take note: The opening of a LoC is only a mode

3. Nature of payment, which is not an essential requisite

of a contract (Johannes Schuback & Sons vs.

The buyer may be required to contract a bank to CA, 1993). A contract can still be perfected,

issue a letter of credit in favor of the seller so even without the perfection of a LoC.

that the issuing bank can authorize the seller to

draw drafts and engage to pay them upon their 6. Rules on LoC

presentment simultaneously with the tender of

documents required by the letter of credit. The Bank of America vs. CA (1993)

seller gets paid only if he delivers the documents

of title over the goods, while the buyer gets the If there is no provision in the Code of

goods only after reimbursing the bank. Commerce, follow Uniform Customs and

Basic principle: bank deals with documents only. Practice or generally observed usages and

As such, they are not qualified to deal with customs

goods. They will act on the basis of documents Rule of Strict Conformity/Compliance:

only. Documents tendered must strictly conform to

3 distinct and separate contracts in the LoC: the terms of the LoC. The tender of documents

» One links the party applying for the LoC by the beneficiary (seller) must include all

(buyer) and the party for whose benefit the documents required by the letter. A

LoC is issued (seller). correspondent bank which departs from what

» Between the account party (buyer) and the has been stipulated under the letter of credit,

issuing bank. Under this contract, as when it accepts a faulty tender, acts on its

(sometimes called the "Application and own risks and it may not thereafter be able to

Agreement" or the "Reimbursement recover from the buyer or the issuing bank, as

Agreement"), the account party applies to the case may be, the money thus paid to the

the issuing bank for a specified LoC and beneficiary

agrees to reimburse the bank for amounts

paid by that bank Feati Bank vs CA (1991)

» Between the issuing bank and the

beneficiary (seller), in order to support the An advising or notifying bank does not incur

contract. It is the LoC proper in which the any obligation by the notification. Its only

bank promises to pay the seller pursuant to obligation is to check the apparent authenticity

the terms and conditions stated therein of the LoC

Independent contracts involved in a LoC: Negotiating bank has a right of recourse

» contract of sale between buyer and seller against the issuer bank. Until the negotiating

» contract of the issuing bank

» LoC

100% UP LAW UP BAROPS 2008 Page 258 of 351

CODE OF COMMERCE COMMERCIAL LAW

bank is reimbursed, drawer of the draft is still 9. Letter of Credit-Trust Receipt

contingently liable.

Transaction

Relationship between the seller and the

negotiating bank is like that between drawer

and purchaser of drafts, ie. the involved bank Bank extends loan to borrower. Loan is covered

deals only with documents and not on the by a LoC, and the security for the loan is a

goods described in the documents. trust receipt.

7. Obligations of Parties in Letter of Credit 10. Kinds of LoC

Independence Principle: Negotiating bank has 10.1. Commercial LoC

no duty to verify if what is described in the LoC 10.2. Traveller’s LoC

or shipping documents actually tallies with that

loaded aboard a ship. Banks do not deal with Note: No protest is required in case of

the property to be exported or shipped to the dishonor. LoCs are issued to definite persons

importer, but deal only with documents. and not to order, thus non-negotiable.

International custom negates any duty on the

part of a bank to verify whether what has been 10.3. Other kinds: (Sundiang Reviewer)

described in letters of credits or drafts or » Confirmed LoC - whenever the

shipping documents actually tallies with what beneficiary stipulates that the

was loaded aboard ship obligation of the opening bank shall

also be made the obligation of

BPI vs De Reny Fabrics (1970) another bank to himself

» Irrevocable LoC- a definite

LoC is a primary obligation of the bank. It is undertaking on the part of the

separate from the underlying contract it may issuing bank and constitutes the

support, and is not merely an accessory engagement of that bank to the

contract. beneficiary and bona fide holders of

drafts drawn and/or documents

presented thereunder, that the

8. Parties

provisions for payment, acceptance

or negotiation contained in the

8.1. Buyer credit will be duly fulfilled, provided

- procures the LoC and obliges himself to that all terms and conditions of the

reimburse the issuing bank upon receipt of the credit are complied with.

document’s title - Issuing bank cannot revoke

without consent of beneficiary and

8.2. Issuing bank applicant (Without such consent, it

- undertakes to pay the seller upon receipt cannot be cancelled even by a court

of the draft and proper documents of titles and to order)

surrender the documents to the buyer upon » Revolving LoC - one that provides

reimbursement for renewed credit to become

available as soon as the opening

8.3. Seller bank has advised that the

- who, in compliance with the contract of negotiating or paying that the

sale, ships the goods to the buyer and delivers the drafts already drawn by the

documents of title and draft to the issuing bank to beneficiary have been reimburse to

recover payment. the opening bank by the buyer

» Back-to-Back LoC - a credit with

8.4. Other parties may include: identical documentary requirements

» Advising (notifying) bank and covering the same

- may be utilized to convey to the merchandise as another LoC,

seller the existence of the credit except for a difference in the price

» Confirming bank of the merchandise as shown by

- will lend credence to the LoC the invoice and the draft. The

issued by a lesser known issuing second letter can be negotiated

bank. The confirming bank is only after the first is negotiated.

directly liable to pay the seller- » Standby LoC - a security

beneficiary arrangement for the performance

» Paying bank of certain obligations. It can be

- undertakes to encash the drafts drawn against only if another

drawn by the exporter/seller business transaction is not

» Instead of going to the place of the performed. It may be issued in lieu

issuing bank to claim payment, the of a performance bond.

buyer may approach another bank - an absolute undertaking to

(termed the negotiating bank) to have pay the money advanced or the

the draft discounted (Charles Lee vs amount for which credit is given on

CA, 2002) the faith of the instrument. They

are primary obligations and not

accessory contracts. But while they

are a security arrangement, they

are not converted thereby into

contracts of guaranty. (IBAA vs

IAC, 1988)

100% UP LAW UP BAROPS 2008 Page 259 of 351

CODE OF COMMERCE COMMERCIAL LAW

11. Sight Drafts the fixtures and equipment used in and about

the business (Sec 2)

No presentment required before

acceptance. Exempt Transactions:

» Sale or mortgage is made in the ordinary

course of business

12. Margin Fee » When accompanied with a written waiver

by all the seller/mortgagor’s creditors (Sec.

Tax on sale of foreign exchange. Since the 2)

contract of sale is consensual, it falls due » Sale by virtue of a judicial order (Sec. 8)

as soon as the local bank opens the LoC » Sale by assignee in insolvency or those

(Pacific Oxygen Company vs. Central Bank, beyond the reach of creditors

1968). » Sale of properties exempt from attachment

or execution (Rule 39, Sec. 13, Rules of

Court)

1.I. Creditors contemplated:

Bulk Sales Law » Creditor at the time of the sale/mortgage

» Need not be judgment creditors

(Act 3952, as amended) » Claim need not be due

1. Purpose Fraudulent conveyance under the Bulk Sales

Law as against transfer in fraud of creditors

under the CC:

To regulate the sale, transfer, mortgage or

» The former is null and void while the latter

assignment of goods, wares, merchandise,

(under Arts. 1381-1389) is rescissible and

provisions or materials in bulk, and

is valid until set aside by a competent court

prescribing penalties for the violation of the

» When the law is duly complied with, the

provisions thereof.

creditors may not object to the transaction,

but it may be rescinded if it is shown that it

To prevent the defrauding of creditors by

was, in fact, made in fraud of creditors

the secret sale or disposal or mortgage in

(Pandect of Commercial Law and

bulk of all or substantially all of a

Jurisprudence - Justice Vitug, 1997 ed.)

merchant’s stock of goods bulk until the

creditor of the seller shall have been paid in

The law covers all transactions, whether done

full.

in good faith or not, or whether the seller is in

a state of insolvency or not, as long as the

The law is penal in nature. Thus, its

transaction falls within the description of what

provisions must be strictly construed

is a “bulk sale”. Neither the motive nor the

against the government and liberally in

intention of the seller, nor the resulting

favor of the accused.

consequence thereof to his estate, constitutes

an element of what is a bulk sale; nor is the

The general scheme of the law is to declare

proof thereof relevant in determining whether

such bulk sales fraudulent and void as to

the said transaction falls within the coverage of

creditors of the vendor, or presumptively

the law.

so, unless specified formalities are

observed, such as the demanding and the

Albercht vs Cudikee (79 Pac. 628)

giving of a list of creditors, the giving of

actual or constructive notice to such

The common use of the term stock when applied to

creditors, by the record or otherwise, and

goods in a mercantile house refers to that which

the making of an inventory. (Comments

are kept for sale.

and Cases on Sales – De Leon, 2005 ed.)

Boise Credit Men’s Assoc. vs Ellis (133 Pac. 6)

Justification: police power of the state

(Liwanag vs Mengraj)

Merchandise must be construed to mean such

things as are usually bought and sold in trade by

2. Types of Sales in Bulk 35

merchants. (People’s Savings Bank vs Ben

Allsburg, 131 N.W. 101) It means something that is

Not in the ordinary course of trade or business sold everyday, and is constantly going out of the

Any sale, transfer, mortgage or assignment of store and being replaced by other goods.

a stock of goods, wares, merchandise,

provisions, or materials (Sec 2) Brown vs Quigley (130 N.W. 690)

In the course of trade or business The term (fixtures) refers to such articles of

Sale, transfer, mortgage or assignment of all, merchandise usually possessed and annexed to the

or substantially all, of the business or trade premises occupied by merchants to enable them

conducted or of all, or substantially all, of better to store, handle, and display their wares

although removable without material injury to the

35

This topic came out in 2007, 2006, 2005, 2001, 2000, premises at or before the end of tenancy.

1997, 1995, 1994, 1993, 1988. Specific questions were

asked of sec. 2 and sec. 5. In 1982 questions on the Comments ad Cases on Sales – De Leon, 2000 ed.

rights and liabilities of parties were asked, these are

covered in sections 3, 4, 5 and 9. Lands and buildings are not “goods, merchandise

and fixtures” therefore not covered by the BSL.

100% UP LAW UP BAROPS 2008 Page 260 of 351

CODE OF COMMERCE COMMERCIAL LAW

included in the sale, transfer or

Philippine Law on Sales – Villanueva, 1998 ed. mortgage

iii. notify every creditor whose name

The qualification “in the normal course of and address is set forth in the

business” applies only to the first type of verified statement personally or by

bulk sale defined by law. registered mail, of the price, terms

Fraud and insolvency is not an element of conditions of the sale, transfer,

what constitutes “Bulk Sales”. mortgage, or assignment.

The law covers all transactions, whether

done in good faith or bad faith. 3.3. Transfer for Consideration

It shall be unlawful for vendor to transfer title

3. Duties of Persons Selling in Bulk without consideration or for a nominal

consideration only. (Sec 7)

3.1. Statement of Creditors

4. Consequences of Non-compliance

Vendor must, before receiving from the

vendee, mortgagee, or agent any part of the Any person violating any provision of this Act shall,

purchase price, or any promissory note, be punished by imprisonment not less than six

memorandum, or other evidence therefore months, nor more than five years, or fined in sum

deliver a written statement of creditors with the not exceeding five thousand pesos, or both. (Sec

following information: 11)

i. names and addresses of all 4.1. Incomplete or false or untrue sworn

creditors to whom said vendor or written statement is a violation

mortgagor may be indebted

ii. amount of indebtedness due or 4.2. Effects of false statements in the

owing, or to become due or owing schedule of creditors

to each of said creditors (Sec 3) » Without knowledge of the buyer: if the

statement is fair upon its face he will

The sworn statement shall be registered in the be protected

Bureau of Commerce. For the registration of » With knowledge or imputed knowledge

each such sworn statement a fee of five pesos of buyer: the vendee accepts it at his

shall be charged. (Sec 9) peril. The sale is valid between the

vendor and the vendee but void as the

If the vendor/mortgagor receives any part of against the creditors

the purchase price, or any promissory note, or » With names of certain creditors without

other evidence of indebtedness without having notice: the sale is void as to such

first delivered the sworn statement and without creditors, whether that omission was

applying the purchase or mortgage money of fraudulent or not

the said property to the pro rata payment of » With respect to an innocent purchaser

the bona fide claims of the creditors of the for value from the original purchaser:

vendor or mortgagor, he shall be deemed to purchaser shall be protected

have violated this Act, and any such sale,

transfer or mortgage shall be fraudulent and 4.3. Effects of violation of law on transfer

void. (Sec 4) » As between the parties: valid contract

» As between persons other than the

If the vendor / mortgagor shall knowingly or creditors: valid

willfully make, deliver or cause to be made or » As to affected creditors of the

delivered, a statement which shall not include seller/mortgagor: void

the names of all such creditors, w/ the correct » Criminal liability, if expressly provided

amount due and to become due to each of

them, or shall contain any false or untrue

statement, shall be deemed to have violated

the provisions of this Act. (Sec 6) 1.II

Warehouse

The vendor, mortgagor, transferor or assignor

must apply the purchase money to the pro-rata Receipts Law

payment of bona fide claims of the creditors as (Act 2137)

shown in the verified statement.

3.2. Inventory and Notification 1. Purpose and Coverage

Vendor / mortgagor must, at least ten days To regulate the status, rights and liabilities of

before the sale, transfer or execution of a the parties in a warehousing contract

mortgage To protect those who, in good faith and for

value, acquire negotiable warehouse receipts

i. make a full detailed inventory by negotiation

ii. preserve the same showing the To render the title to, and the right of

quantity and, so far as is possible possession of, property stored in warehouses

with the exercise of reasonable more easily convertible

diligence, the cost price to the To facilitate the use of warehouse receipts as

vendor, transferor, mortgagor or documents of title

assignor of each article to be

100% UP LAW UP BAROPS 2008 Page 261 of 351

CODE OF COMMERCE COMMERCIAL LAW

In order to accomplish these, to place a much Where a warehouse receipt or quedan is

greater responsibility on the warehouseman transferred or endorsed to a creditor only to secure

Covers negotiable warehouse receipts, which the payment of a loan or debt, the transferee or

can only be issued by a warehouseman in the endorsee does not automatically become the owner

business of receiving commodities on deposit of the goods covered by the warehouse receipt or

for storage. In all other cases where receipts quedan but he merely retains the right to keep,

are not issued by a warehouseman, Art. 1507- and with the consent of the owner to sell, them so

1520 of the Civil Code applies as to satisfy the obligation from the proceeds of the

For public and private warehouses sale, this for the simple reason that the transaction

Bills of lading and quedans are governed by Art involved is not a sale but only a mortgage or

1507-1520 and 1636 of the Civil Code (Ratio: pledge, and if the property covered by the quedans

Sugar centrals that issue quedans are not or warehouse receipts is lost later without the fault

warehousemen) or negligence of the mortgagee or pledgee or the

But note: a warehouse receipt is also cited in transferee or endorsee of the warehouse receipt or

Art 1636 as a document of title quedan, then said goods are to be regarded as lost

All other negotiable receipts are covered by the on account of the real owner, mortgagor or

law on negotiable instruments pledgor.

2. Definitions 3.2. Form of Warehouse Receipt

2.1. Warehouseman Sec 2. Warehouse receipts need not be in any

» Person lawfully engaged in the business of particular form but every such receipt must

storing goods for profit (Sec. 58a) embody within its written or printed terms:

» Duly authorized officer/agent of a

warehouseman may validly issue a i. The location of the warehouse

warehouse receipt (National Bank vs where the goods are stored

Producer’s Warehouse Association, 42 Phil ii. The date of the issue of the

609) receipt

iii. The consecutive number of the

2.2. Warehouse receipt

» Building or place where goods are iv. A statement whether the goods

deposited and stored for profit received will be delivered to the

bearer, to a specified person, or

2.3. Warehouse receipt to a specified person in his

» Written acknowledgment by a order

warehouseman that he has received and v. The rate of storage charges

holds certain goods therein described in vi. A description of the goods or of

store for the person to whom it is issued the packages containing them

» Simple written contract between the owner vii. The signature of the

of the goods and the warehouseman to pay warehouseman or his authorized

the compensation for that service agent

» Bilateral contract; imports that goods are in viii. If the receipt is issued for goods of

the house of the warehouseman and is a which the warehouseman is owner,

symbolical representation of the property either solely or in common with

itself. others, the fact of such

» Not a negotiable instrument although it is ownership, and

negotiable as provided by the act. ix. A statement of the amount of

advances made and of liabilities

incurred for which the

warehouseman claims a lien. If

3. Nature/Characteristics of Warehouse the precise amount of such

Receipts36 advances made or of such liabilities

incurred is, at the time of the issue

3.1. Function of Warehouse Receipt of, unknown to the warehouseman

or to his agent who issues it, a

Negotiation carries with it transfer of title over statement of the fact that advances

the commodity covered by the receipt (thus, it have been made or liabilities

has the same function as a negotiable bill of incurred and the purpose thereof is

lading) sufficient.

Except: Where a negotiable warehouse The date of issue appearing in the receipt

receipt is indorsed and delivered to a indicates prima facie the date when the

creditor as a collateral for a loan contract of deposit is perfected and when the

storage charges shall begin to run against the

If commodity covered by receipt is lost through depositor.

a fortuitous event, the debtor will bear loss

The mere fact that the goods deposited are

incorrectly described does not make ineffective

Martinez vs PNB (1953) the receipt when the identity of the goods is

fully established by evidence. Thus, its

endorsement and delivery shall constitute a

36 sufficient transfer of the title of the goods

The negotiation and transfer of receipts was ask in

(American Foreign Banking Corp. vs Herridge,

2007, 2005, 1993 and 1979.

49 Phil 975).

100% UP LAW UP BAROPS 2008 Page 262 of 351

CODE OF COMMERCE COMMERCIAL LAW

bearer or to the order of any person named

3.3. Effect of Non-compliance: in such receipt

No provision shall be inserted in a

» Sec. 2. A warehouseman shall be liable to negotiable receipt that it is non-negotiable.

any person injured thereby for all damages Such provision shall be void.

caused by the omission from a negotiable

receipt of any of the terms herein required. It is negotiated either by delivery or

» If any of these requisites in Sec 2 are indorsement

absent, it becomes a deposit only When negotiable receipt not required to be

surrendered

3.4. Effect of omission of any of the essential

terms: Estrada vs CAR (1961)

» Validity of receipt is not affected

» Warehouseman is liable for damages (No surrender needed if ordered by court) The SC

» Negotiability of receipt is not affected ordered the manager of Moncada Bonded

» The issuance of a warehouse receipt in Warehouse to release shares in palay without the

the form provided by the law is merely necessity of producing and surrendering the

permissive and directory and not original of the warehouse receipts issued. The SC

mandatory in the sense that if the stated “our order must be carried out in the

requirements are not observed, then the meantime that this cases have not been finally

goods delivered for storage become decided in order to ameliorate the precarious

ordinary deposits situation in which said petitioners find themselves.”

3.5. Terms that cannot be included Duplicate Receipts

» Those contrary to the provisions of the

Warehouse Receipts Law Sec. 6. When more than one negotiable

» Those which may impair his obligation receipt is issued for the same goods, the

to exercise that degree of care in the word “duplicate” shall be plainly placed

safekeeping of the goods entrusted to upon the face of every such receipt, except

him which a reasonably careful man would the first one issued. A warehouseman shall

exercise in regard to similar goods of his be liable for all damages caused by his

own failure to do so to any one who purchased

» Those contrary to law, morals, public the subsequent receipt for value supposing

customs, public order or public policy it to be an original, even though the

» Those exempting the warehouseman purchase be after the delivery of the goods

from liability for misdelivery by the warehouseman to the holder of the

» Those exempting the warehouseman original receipt.

from liability for negligence

37

Negotiable vs Non-negotiable receipts

3.6. Kinds of Warehouse Receipts

i. Non-negotiable Non-Negotiable Negotiable

If goods are sold by As long as the goods

Sec. 4. A receipt in which it is stated that assignment, assignee must covered by a

the goods received will be delivered to the advise warehouseman. negotiable

depositor or to any other specified person Until he does, his rights warehouse receipt,

may be defeated by a these goods may not

Sec. 7. A non-negotiable receipt shall have subsequent attaching be attached etc.

plainly placed upon its face by the creditor, or a subsequent

warehouseman issuing it “non-negotiable” levy on execution, or a

or “not negotiable.” In case of the vendor’s lien or stoppage in

warehouseman’s failure so to do, a holder transitu that could be

of the receipt who purchased it for value enforced against the

supposing it to be negotiable, may, at his assignor

option, treat such receipt as imposing upon Rights of the transferee: Rights of the person

the warehouseman the same liabilities he 1. Title of the goods, as to whom it is

would have incurred had the receipt been against the transferor negotiated (holder):

negotiable. (merely steps into the 1. Title to the goods

This section shall not apply to letters, shoes) of the person

memoranda, or written acknowledgement 2. Right to notify the negotiating the

of an informal character. warehouseman of the receipt and title of

transfer and acquire the the person to whose

It is transferred by its delivery to the direct obligation of the order the goods were

transferee accompanied by a deed of warehouseman to hold the to be delivered

assignment, donation or other form of goods for him 2. Direct obligation of

transfer the warehouseman

Effect of failure to mark “negotiable”: does to hold possession of

not render it non-negotiable if it contains the goods for him, as

words of negotiability if the warehouseman

directly contracted

ii. Negotiable

37

The comparison between negotiable versus non-

Sec. 5. A receipt in which it is stated that negotiable warehouse receipts was asked in 2007, 1988,

the goods received will be delivered to the 1984, 1983 and 1982.

100% UP LAW UP BAROPS 2008 Page 263 of 351

CODE OF COMMERCE COMMERCIAL LAW

Non-Negotiable Negotiable

with him Note: Negotiable Warehouse Receipt is different

Negotiation defeats from a Negotiable Instrument

the lien of the seller

of the goods (sec. 9) Note: Negotiation takes effect as of the time when

Goods represented can be Goods represented the indorsement is actually made.

subject to attachment or cannot be subject to

levy by execution (Sec. 42) attachment or levy Negotiable Negotiable Warehouse

by execution, unless Instruments Receipts

in proper Allow negotiation

circumstances (Sec. If deliberately altered, If altered, it is still valid,

38

25) it becomes null and but can be enforced only

void accdg to its original tenor

» Deliver to X – this is non-negotiable. To

sell the goods, the warehouse receipt Subject is money Subject is merchandise

must be assigned

» Deliver to X or order - this is

negotiable. The goods can be sold by Object of value is the Object of value is the

special endorsement and delivery instrument itself goods deposited

» Deliver to X or bearer- this is

Liability of Liability of intermediate

negotiable because it is deliverable to

intermediate parties is parties is none (for failure

bearer. The goods can be sold by

secondary (NIL) to deliver goods)

delivery.

If originally payable to If originally payable to

Lost/destroyed receipts

bearer, it will always bearer but is endorsed

remain so even if it is specially, it will become

Sec. 14. Lost / destroyed receipts

endorsed specially or deliverable to order and

Where a negotiable receipt has been lost /

in blank can only be negotiated by

destroyed, a court may order the delivery

indorsement and delivery

of the goods upon

Holder in due course Endorsee, even if a holder

» satisfactory proof of loss/

may obtain a title in due course, obtains

destruction

better than that which only such title as the

» giving of a bond with sufficient

the party negotiating person negotiating had

sureties to be approved by the

to him had over the goods

court to protect the warehouseman

from any liability or expense, which

he or any person injured by such Who may negotiate a warehouse receipt:

delivery may incur by reason of the

» its owner

original receipt remaining

» any person to whom the possession

outstanding or custody of the receipt has been

A court may also order payment of entrusted by the owner, if, by the

warehouseman’s reasonable costs and terms of the receipt, the goods are

counsel fees. deliverable to the person to whom the

possession or custody of receipt has

The delivery of goods shall not relieve the

been entrusted or in such a form that it

warehouseman from liability to a person to

may be negotiated by delivery (Sec.

whom the negotiable receipt has been/shall 40)

be negotiated for value without notice of Warranties:

the proceedings/delivery of goods. » that receipt is genuine

» legal right to negotiate

4. Assignment and Negotiation » no knowledge of defects that may

impair receipt

Sec 41. A person to whom a negotiable receipt has » right of transfer to title over goods

been duly negotiated acquires thereby: and that the goods are merchantable

The indorser does not guarantee that the

a. Such title to the goods as the person warehouseman will comply with his

negotiating the receipt to him had or had duties (Sec. 45)

ability to convey to a purchaser in good Creditor receiving the warehouse receipt

faith for value, and also such title to the which is given as a collateral makes no

goods as the depositor or person to whose warranty (Sec. 46)

order the goods were to be delivered by the

terms of the receipt had or had ability to 5. Rights and Duties of a Warehouseman39

convey to a purchaser in good faith for

value, and 5.1. Rights

b. The direct obligation of the warehouseman » Degree of Care

to hold possession of the goods for him

according to the terms of the receipt as

fully as if the warehouseman and

39

contracted directly with him. The obligation and liabilities of a warehouseman was

asked in 200, 1999, 1998, 1993, 1991, 1984, 1989,

38

1980, 1978 and 1977.

Sec. 25 was asked in 1999 and 1981.

100% UP LAW UP BAROPS 2008 Page 264 of 351

CODE OF COMMERCE COMMERCIAL LAW

Sec 3. A warehouseman may insert in a receipt 1. the person lawfully entitled to the

issued by him any other terms and conditions possession of the goods, or his agent;

provided that such terms and conditions shall 2. a person who is either himself entitled

not: to delivery by the terms of a non-

xxx negotiable receipt issued for the goods,

a) in any wise impair his obligation to exercise or who has written authority from the

that degree of care which a reasonably person so entitled either indorsed upon

careful man would exercise in regard to the receipt or written upon another

similar goods of his own paper; or

3. a person in possession of a negotiable

General Rule: Warehouseman is required receipt by the terms of which the goods

to exercise such degree of care which a are deliverable to him or order, or to

reasonable careful owner would exercise bearer, or which has been indorsed to

over similar goods of his own. He shall be him or in blank by the person to whom

liable for any loss or injury to the goods delivery was promised by the terms of

caused by his failure to exercise such care. the receipt or by his mediate or

immediate indorser.

Exception: He shall not be liable for any

loss or injury which could not have been Sec. 10. When a warehouseman delivers the

avoided by the exercise of such care. goods to one who is not in fact lawfully entitled

to the possession of them, the warehouseman

Exception to the exception: He may limit shall be liable as for conversion to all having a

his liability to an agreed value of the right of property or possession in the goods if

property received in case of loss. He he delivered the goods otherwise than as

cannot stipulate that he will not be authorized by (b) and (c) of Sec 9

responsible for any loss caused by his

negligence. Though he delivered the goods as authorized

by said subdivisions he shall be so liable, if

» To be paid prior to such delivery he had either:

» In case of non-payment, to exercise his lien 1. been requested, by or on behalf of the

on the goods deposited person lawfully entitled, not to make

such delivery or

» To refuse delivery in proper legal 2. had information that the delivery about

circumstances to be made was to one not lawfully

entitled

5.2. Duties

» Issue a warehouse receipt in the Conversion

required form for goods received - an unauthorized assumption and exercise

of the right of ownership over goods belonging

» Obligation to Deliver Goods to another through the alteration of their

condition or the exclusion of the owner’s right

Sec 8. A warehouseman, in the absence of (Bouvier’s Law Dictionary)

some lawful excuse provided by this Act, is

bound to deliver the goods upon a demand 40

Sec. 17. If more than one person claims the

made either by the holder of a receipt for the

title/possession of the goods, the

goods or by the depositor; if such demand is

warehouseman may, either as a defense to an

accompanied with:

action or as an original suit, require all known

1. an offer to satisfy the warehouse man’s

claimants to interplead.

lien

2. an offer to surrender the receipt, if

Sec. 18. If:

negotiable, with such indorsements as

1. someone other than the depositor or

would be necessary for the negotiation

person claiming under him has a claim

of the receipt; and

to the title or possession of goods AND

3. a readiness and willingness to sign,

2. the warehouseman has information of

when the goods are delivered, an

such claim

acknowledgement that they have been

the warehouseman shall be excused from

delivered, if such signature is requested

liability for refusing to deliver the goods until

by the warehouseman.

he has had:

The burden shall be upon the warehouseman to

2. reasonable time to ascertain the

establish the existence of a lawful excuse for

validity of the adverse claim OR

such refusal.

3. bring legal proceedings to compel

claimants to interplead

General Rule: a demand should be made

on the warehouseman in order that the

Sec. 18 not applicable to cases where the

duty to deliver the goods will arise

warehouseman himself makes a claim to

the goods (67 C.J. 536)

Exception: when the warehouseman has

In case there are adverse claimants, the

rendered it beyond his power to deliver the

warehouseman can refuse to deliver the

goods, demand may be dispensed with

goods to anyone of them until he has had

[Art. 1169(3), Civil Code]

40

Sec 9. A warehouseman is justified in This topic on adverse claimants was asked in 2005 and

delivering the goods to one who is: 1975.

100% UP LAW UP BAROPS 2008 Page 265 of 351

CODE OF COMMERCE COMMERCIAL LAW

reasonable time to ascertain the validity of circumstances as if the goods had been

the various claims; he is not excused from kept separate.

liability in case he makes a mistake

(Comments and Cases on Credit » To insure the goods in proper

Transactions – De Leon, 2002 ed.) circumstances

Original action or counterclaim for Where the law provides

interpleader, whichever is appropriate. In Where it was an inducement for the

such case, the warehouseman will be depositor to enter into the contract

relieved from liability in delivering the Established practice

goods to the person found by the court to Where the warehouse receipt

have a better right (Comments and Cases contains a representation to that

on Credit Transactions – De Leon, 2002 effect

ed.)

Other instances when the warehouseman » To mark a non-negotiable warehouse

may refuse to deliver: receipt as such

» when the holder of the receipt does

not satisfy the conditions » To mark as such the duplicates of a

prescribed in Sec. 8 negotiable warehouse receipt

» when the warehouseman has legal

title in himself on the goods, such » To give the proper notice in case of

title or right being derived directly sale of the goods as provided in the law

or indirectly from the transfer made

by the depositor at the time or » To take up and cancel the warehouse

subsequent to the deposit for receipt when the goods are delivered

storage, or from the

warehouseman’s lien (Sec. 16) » Other Duties

If warehouseman fails to cancel receipt

General rule: The warehouseman cannot when he delivers goods, he is liable if

refuse to deliver on the ground that he owns receipt should turn up again (Sec 11)

the goods (bailee cannot assert title to the Warehouseman should record partial

goods entrusted to him). delivery on receipt, or else he is liable

Exceptions: In the 2 cases mentioned above on entire receipt (Sec 12)

If alteration is authorized,

» Where the goods have already been warehouseman is liable as altered. If

lawfully sold to third persons to not authorized, warehouseman is liable

satisfy the warehouseman’s lien or as originally issued (Sec 13)

disposed of because of their

perishable nature (Sec. 36) Effects of alteration:

» In the valid exercise of the

warehouseman’s lien (Sec. 31) Alteration immaterial (WON fraudulent; WON

» The warehouseman will not be (tenor of receipt not authorized)

required to deliver the goods if such changed) warehouseman is liable

had been lost. But this is without on the altered receipt

prejudice to liabilities which may be accdg to its original

incurred by him due to such loss. tenor

Alteration material but Warehouseman is liable

» On commingling of Goods authorized accdg to its terms as

altered

General Rule : Material alteration Liable accdg to its

Sec. 22 A warehouseman shall keep the goods so innocently made original tenor

far separate from Material alteration Liable accdg to the

1. the goods of other depositors and fraudulently made original tenor to a

2. from other goods of the same purchaser of receipt for

depositor for which a separate value without notice and

receipt has been issued even to the alterer and

as to permit at all times the identification and subsequent purchasers

redelivery of the goods deposited. with notice (except that

liability is limited only to

Exception: delivery as he is

Sec. 23. excused from any

1. If authorized by agreement or custom and liability)

2. Goods are fungible

the warehouseman may mingle with other goods of A fraudulent alteration cannot divest

the same kind and grade. the title of the owner of the stored

goods and the warehouseman is liable

The various depositors shall own the entire mass to return them to the owner

and each shall be entitled to such portion as the A bona fide holder acquires no right to

amount deposited by him bears to the whole. the goods under a lost or stolen

negotiable receipt or to which the

The warehouseman shall be severally indorsemant of the depositor has been

liable to each depositor for the care and forged

redelivery of his share of such mass to

the same extent and under the same

100% UP LAW UP BAROPS 2008 Page 266 of 351

CODE OF COMMERCE COMMERCIAL LAW

Warehouseman is liable for issuing receipt Sec. 31. A warehouseman having a valid lien

for non-existing goods or misdescribed against the person demanding the goods may

goods (Sec. 20) refuse to deliver the goods until the lien is satisfied.

Effect of misdescription of goods: The warehouseman’s lien is possessory in

Warehouseman is under the obligation nature (PNB vs Judge Se)

to deliver the identical property Involuntary parting with possession of goods

stored with him and if he fails to do ordinarily does not result in loss of his lien by a

so, he is liable directly to the owner. warehouseman (93 C.J.S. 59)

As against a bona fide purchaser of a A warehouseman who has released his lien by

warehouse receipt, the warehouseman the surrender of the goods may not thereafter

is estopped from denying that he claim a lien on other goods of the same

has received the goods described in depositor for unpaid charges on the goods if

the receipt the goods were delivered to him under different

If the description consists merely of bailments

marks or label upon the goods or upon The loss of the warehouseman’s lien does not

the packages containing them, the necessarily mean the extinguishments of the

warehouseman is not liable even if depositor’s obligation to pay the warehousing

the goods are not of the kind as fees and charges which subsists to be a

indicated in the marks or labels. personal liability

Remedies discussed in PNB vs. Sajo, 292 SCRA

Warehouseman is estopped to set up title 202 (1998)

in himself (Sec 16) » To refuse to deliver the goods until

Non-delivery or goods do not correspond to his lien is satisfied (Sec 31)

description => warehouseman is liable » To sell the goods by public auction

and apply the proceeds to the value

6. Warehouseman’s Lien of the lien (Sec 33 and 34)

Effects:

Sec. 27. A warehouseman shall have a lien on the the warehouseman is not

goods deposited or on the proceeds thereof for liable for non-delivery even if

1. all lawful charges for storage and the receipt given for the

preservation of goods goods were negotiated (Sec.

2. all lawful claims for money 36)

advanced, interest, insurance, where the sale was made

transportation, labor, weighing, without the publication

coopering, and other charges in relation required and before the time

to such goods provided by law, such sale is

3. all reasonable charges for notice void and the purchaser of the

and advertisements of sale goods acquires no title in

4. sale of goods where default has been them (Eastern Paper Mills

made in satisfying the warehouseman’s Co., Inc. vs Republic

lien Warehousing Corp, 170 SCRA

595)

In case of a negotiable receipt, the charges » By other means allowed by law to a

that are present at the time of the issuance of creditor against his debtor, to collect

the receipt must be so stated in the receipt from the depositor all charges and

with the amounts thereof specified. If the advances which the depositor

existing charges are not stated, the expressly or impliedly contracted with

warehouseman shall have no lien thereon, the warehouseman to pay (Sec 32)

except only for charges for storage of those » Other remedies allowed by law to

goods subsequent to the date of the receipt. enforce a lien against personal

property (Sec 35)

Sec. 28. A warehouseman’s lien may be enforced:

1. against all goods belonging to the The warehouseman may refuse to deliver

person who is liable as debtor for the goods to any holder of the receipt when the

claims storage fee stipulated in the receipt has not yet

2. against all goods belonging to others been paid

which have been deposited at any time

by the person who is liable as debtor for PNB vs. Se (1996)

the claims

If such person had been so While the PNB is entitled to the stocks of sugar as

entrusted with the possession of the endorsee of the quedans, delivery to it shall be

goods such that a pledge by him at effected only upon payment of the storage fees.

the time of the deposit to one who Imperative is the right of the warehouseman to

took the goods in good faith for demand payment of his lien at this juncture,

value would have been valid. because in accordance with Section 29 of the

Warehouse Receipts Law, the warehouseman loses

Sec. 29. A warehouseman loses his lien: his lien upon goods by surrendering possession

1. by surrendering possession of the goods thereof. In other words, the lien may be lost where

2. by refusing to deliver the goods when a the warehouseman surrenders the possession of

demand is made with which he is bound to the goods without requiring payment of his lien,

comply because a warehouseman's lien is possessory in

nature.

100% UP LAW UP BAROPS 2008 Page 267 of 351

CODE OF COMMERCE COMMERCIAL LAW

But the warehouseman cannot refuse to deliver Civil liabilities Criminal

the goods because of an adverse claim of liabilities

ownership [PNB vs. Sayo, 292 SCRA 202 a negotiable

(1998)] warehouse

receipt for

Rules on attachment/execution of goods goods of

deposited: which he is an

» In case of negotiable receipt, the goods owner without

cannot be attached or levied in execution stating such

unless: fact of

receipt is first surrendered ownership

its negotiation is enjoined (Sec. 51)

receipt is impounded by the court (Sec. 5. delivery of

25) goods without

Creditor’s remedies: seek for the obtaining

attachment of the receipt or seek aid from negotiable

courts to compel the debtor to satisfy warehouse

claims by means allowed by law in regard receipt (Sec.

to property which cannot readily be 54)

attached or levied upon by ordinary process 3rd persons Negotiation of

(Sec. 26) warehouse

receipt issued

Not applicable: for mortgaged

If the depositor is not the owner of the goods with

goods (thief) or one who has no right intent to

to convey title to the goods binding deceive

upon the owner

Actions for recovery or manual delivery

of goods by the real owner

Where attachment is made prior to the

issuance of receipt General Bonded Warehouse Act

(Act 3893 as amended by RA 247)

Rights acquired by attaching creditors

cannot be defeated by the issuance of a

negotiable receipt of title thereafter 1. Purpose

(International Breeding Co. vs Terminal

Warehouse Co., 126 Atl. 902)

An act to regulate the business of receiving

commodities for storage, giving the director

» In case of a non-negotiable receipt, the

of Commerce and Industry the duty to

goods can be attached, provided it is done

enforce if, providing penalties for violation

prior to the notification of the

of the provisions, exempting cooperative

warehouseman of the transfer (Sec. 42);

marketing associations of commodity

reason: absent such notice, both the

producers from application thereof.

warehouseman and the sheriff have a right

To protect depositors by giving them a

to assume that the goods are still owned by

direct recourse against the bond filed by

the person whose name appears in the

the warehouseman in case of the latter’s

receipt

insolvency

To encourage the establishment of more

7. Liabilities41 warehouses

Civil liabilities Criminal 2. Definition of Terms

liabilities

Warehouseman For damages 1. issuance of

2.1. Warehouse

or his agent suffered for receipts for

failure to goods not Every building, structure, or other protected

comply with received (Sec. enclosure in which commodities are kept for

legal duties 50) storage.

2. issuance of

receipt 2.2. Warehouseman

containing A person engaged in the business receiving

false commodities for storage

statement

(Sec. 51) 2.3. Receipt

3. issuance of

Any receipt issued by a warehouseman for

duplicate

commodities delivered to him.

negotiable

warehouse

Gonzales vs Go Tiong (1958)

receipt not

marked as

The kind or nature of the receipts issued by

such (Sec. 52)

him for the deposits is not very material, much

4. issuance of

less decisive. Though it is desirable that

receipts issued by a bonded warehouseman

41

Please read footnote 6. should conform to the provisions of the

100% UP LAW UP BAROPS 2008 Page 268 of 351

CODE OF COMMERCE COMMERCIAL LAW

Warehouseman Receipts Law, said provisions No person shall engage in the business of receiving

are not mandatory. Under Section 1 of the commodities for storage without first securing a

Warehouse Receipts Act, the issuance of a license therefore from the Director of the Bureau of

warehouse receipt in the form provided by it is Commerce and Industry. Said license shall be

merely permissive and directory and not annual and shall expire on the thirty-first day of

obligatory. December.

Commodities Any person applying for a license shall set forth in

» Any farm, agricultural or horticultural the application

product; the place or places where the business

» animal and animal husbandry or and warehouse are to be established or

livestock, dairy or poultry product; located and

» water, marine or fish product; the maximum quantity of commodities

» mineral, chemical, drug or medicinal to be received.

product;

» forestry product; and any raw, There shall be imposed an annual license fee of:

processed, manufactured or finished P50 for the first 1000 square meters of

product or by-product protected enclosure or 1000 cubic meters

» good, article, or merchandise, either of of storage space, or any fraction of such

domestic or of foreign production or enclosure or space, and

origin, which may be traded or dealt in 2 ½ centavos for each additional square

openly and legally. meter or cubic meter.

3. Business of Receiving Commodities for 5. Requirement of Bond

Storage

The application shall be accompanied by a cash

The business of receiving commodities for storage bond or a bond secured by real estate or signed by

shall include any contract or transaction wherein a duly authorized bonding company at not less

1. the warehouseman is obligated to than 33 1/3% of the market value of the maximum

return the very same commodities quantity or commodities to be received.

delivered to him or pay its value; Said bond shall be so conditioned as to respond for

2. the commodities delivered is to be the market value of the commodities actually

milled for and on account of the delivered and received at any time the

owner thereof; warehouseman is unable to return the commodities

3. the commodities delivered is or to pay its value.

commingled with the commodities The bond shall be approved by the Director of the

delivered by or belonging to other Bureau of Commerce and Industry before issuing a

persons and the warehouseman is license under this Act.

obligated to return the commodities of Whenever the Director shall determine that a bond

the same kind or pay its value. approved by him has become insufficient, he may

require an additional bond or bonds to be given by

The kinds of commodity to be deposited must the warehouseman concerned.

be those, which may be traded or dealt in Any person injured by the breach of any obligation

openly and legally. Thus, illegal and prohibited to secure which a bond is given, shall be entitled to

goods may not be validly received (Sec. 2) sue on the bond in his own name in any court of

The warehouseman is not covered by law if the competent jurisdiction to recover the damages he

owner merely rents space to a certain group of may have sustained by such breach.

persons because the law covers warehouse that

accepts goods: (a) storage, (b) milling and Nothing contained herein shall except any property

commingling with the obligation to return the of assets of any warehouseman from being sued on

same quantity or to pay their value. in case the bond given is not sufficient to respond

for the full market value of the commodities

Limjoco vs Director of Commerce (1965) received by such warehouseman.

Any contract or transaction wherein the palay 6. Requirement of Insurance

delivered is to be milled for and on account of the

owner shall be deemed included in the business of Every person licensed to engage in the business of

receiving rice for storage. In other words, it is receiving commodities for storage shall insure the

enough that the palay is delivered, even if only to commodities so received and stored against fire.

have it milled.

In this case it is a fact that palay is delivered to For palay and corn license, a bond with the

appellant and sometimes piled inside her "camalig" National Grains Authority is required; also an

in appreciable quantities, to wait for its turn in the insurance cover is required

milling process. This is precisely the situation

covered by the statute. 7. Duties of Bonded Warehouseman

The main intention of the law-maker is to give

protection to the owner of the commodity against

7.1. Storage of Commodities

possible abuses (and we might add negligence) of

the person to whom the physical control of his

properties is delivered. Every warehouseman shall receive for storage,

so far as his license and the capacity of his

4. Requirement of License warehouse permit, any commodities, of the

kind customarily stored therein by him, which

100% UP LAW UP BAROPS 2008 Page 269 of 351

CODE OF COMMERCE COMMERCIAL LAW

may be tendered to him in a suitable condition

for warehousing, in the usual manner and in 1.III

the ordinary and usual course of business,

without making any discrimination between Trust Receipts Law

persons desiring to avail themselves of (PD 115)

warehouse facilities.

7.2. Give the necessary bond 1. Definition of Trust Receipt

7.3. Insure against fire the commodity As a document, it is a written or printed

received (Sec. 6) document signed by the entrustee in favor of

the entruster whereby the latter releases the

7.4. Record-Keeping and Reporting goods to the possession of the former upon the

Requirements entrustee’s promise to hold said goods in trust

for the entruster, to sell or dispose of the

Every warehouseman shall keep a complete goods, and to return the proceeds thereof to

record of: the extent of what is owing to the entruster;

OR to return the goods, if unsold or not

the commodities received by him, otherwise dispose of (Sec. 4)

the receipts issued therefor of the Trust Receipt transaction – a separate and

withdrawals, independent security transaction intended to

the liquidations and all receipts returned to aid in financing importers and retail dealers

and cancelled by him. who do not have sufficient funds to finance the

importation/purchases and who may not be

He shall make reports to the Director of Bureau able to acquire credit except through

of Commerce and Industry concerning his utilization, as collateral, of the merchandise

warehouse and the conditions, contents, imported/purchased (Nacu vs. CA; South City

operations, and business. Home vs. BA Finance)

Goods are owned by the bank, and are only

7.5. Observe rules and regulations of the released to the importer in trust after the grant

Bureau of Domestic Trade (Sec. 9) of the loan. The bank acquires a security

interest in the goods as holder of a security

A person injured by the breach of the title for the advances it made to the entrustee.

warehouseman may sue on the bond put Entrustee must deliver money or return unsold

up by the warehouseman to recover goods to entrustor

damages he may have sustained on count Bank is preferred over other creditors.

of such breach. In case the bond is Bank is also not liable to buyer of goods as

insufficient to cover full market value of the vendor

commodity stored, he may sue on any Purchaser from entrustee gets good title.

property or assets of the warehouseman No particular form is required for trust receipt,

not exempt by law from attachment and but it must substantially contain:

execution (Sec. 7) » Description of the goods, documents or

instruments subject of the TR

8. Warehouse Receipts Law vs. General » Total invoice value of the goods and the

amount of the draft to be paid by the

Bonded Warehouse Act

entrustee

» Undertaking or a commitment of the

Warehouse Receipts General Bonded entrustee

Law Warehouse Act to hold in trust for the entruster

Prescribes the mutual Regulates and the goods, documents or

duties and rights of a supervises warehouses instruments therein described

warehouseman who which put up a bond to dispose of them in the

issues warehouse manner provided for in the trust

receipts, and his receipt

depositor, and covers all to turn over the proceeds of the

warehouses whether sale of the goods, documents or

bonded or not instruments to the entruster to the

*Bar Review Materials in Commercial Law - Jorge extent of the amount owing to the

Miravite, 2002 ed. entruster or as appears in the trust

receipt or to return the goods,

9. Liabilities documents or instruments in the

event of their non-sale within the

a. civil: breach of obligations secured by the bond period specified therein (Sec. 5)

b. criminal: » the trust receipt may contain other terms

i. engaging in business covered by the Act in and conditions agreed upon by the parties

violation of the license requirement (Sec. in addition to those hereinabove

11) enumerated provided that such terms and

ii. receiving a quantity of commodity greater conditions shall not be contrary to

than its capacity or that specified in the provisions of this Decree, any existing laws,

license, if the goods deposited are lost or public policy or morals, public order or

destroyed (Sec. 12) good customs (Sec. 5)

iii. connivance with a warehouseman for the » trust receipts are denominated in Philippine

purpose of evading the license requirement currency or acceptable and eligible foreign

(Sec. 13) currency

100% UP LAW UP BAROPS 2008 Page 270 of 351

CODE OF COMMERCE COMMERCIAL LAW

to effect their presentation,

2. Purposes of the Law collection or renewal

To encourage the use of and promote The sale of goods/documents/instruments by a

transactions based on trust receipts; regulate person in the business of selling such for profit

the use of trust receipts; encourage and who, at the outset of the transaction, has, as

promote the use of trust receipts as an against the buyer,

additional and convenient aid to commerce and general property rights in such goods/

trade documents/instruments, or

To regulate trust receipt transactions in order who sells the same to the buyer on credit,

to assure the protection of the rights and the retaining title or other interest as security

enforcement of the obligations of the parties for the payment of the purchase price