Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

TELEGRAM

Caricato da

Nicole SurcaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

TELEGRAM

Caricato da

Nicole SurcaCopyright:

Formati disponibili

jsc notes #3

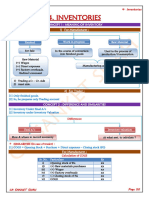

INVENTORIES

Divided into ten (10) sub-topics: (6) Inventory estimation

(1) Composition of Inventory • Gross profit method

• Inclusion and exclusions ü Computation of estimated ending inventory or inventory loss caused

ü Computation of correct inventory balance by calamities

(2) Inventory systems • Retail method

ü Computation of estimated ending inventory (1) FIFO (2)

• Periodic inventory system

Conservative/LCNRV (3) Average

ü Correct journal entry using periodic inventory system

ü Computation of cost of goods sold using (1) FIFO (2)

• Perpetual inventory system

Conservative/LCNRV (3) Average

ü Correct journal entry using perpetual inventory stem

(7) Consignment of goods

(3) Purchase discounts

ü Computation of inventory ending

• Gross method

ü Computation of total cash remittance and receivable from the

ü Correct journal entry using gross method

consignee

• Net method

ü Correct journal entry using net method (8) Inventory error

ü Net effect of errors to (1) net income (2) cost of goods sold (3) ending

(4) Cost flows / cost formulas

inventory balance

• FIFO perpetual / FIFO periodic

ü Computation of ending inventory balance (9) Purchase commitment

ü Computation of cost of goods sold ü Computation of estimated liability on purchase commitment

• Weighted Average ü Computation of loss on purchase commitment

ü Computation of ending inventory balance

(10) Biological asset

ü Computation of cost of goods sold

• Moving Average ü Sariling sikap

ü Computation of ending inventory balance

ü Computation of cost of goods sold

(5) Inventory measurement

• Writedown of inventory to LCNRV

ü Computation of correct inventory account with impairment

ü Computation of NRV (1) raw material (2) work in process (3) finished

goods/merchandise inventory

ü Computation of required allowance for inventory decline

ü Computation of impairment loss and reversal of impairment

ü Computation of cost of goods sold involving writedown

(1) COMPOSITION OF INVENTORY consignee

GOODS IN TRANSIT AND SPECIAL TERMS 9. Insurance in transit (9) Selling and administrative

Term Buyer Seller expenses

FOB shipping point Included Excluded 10. Import duties and non-recoverable (10) Insurance after transit

FOB seller Included Excluded taxes

FOB FAS Included Excluded 11. Commission to brokers / advisers (11) Storage cost after completion

FOB CIF Included Excluded fee / professional fee

FOB place of the seller Included Excluded 12. Normal amount of wasted material (12) Financing expense / interest

Bill and hold arrangement Included Excluded incurred / borrowing cost

Sold on installment Included Excluded (13) VAT

Sale on with high probability of return Included Excluded (14) Abnormal amount of wasted

Goods manufactured at customer’s specification Included Excluded material

Special order Included Excluded

FOB destination Excluded Included (2) INVENTORY SYSTEMS:

FOB buyer Excluded Included Periodic Perpetual

FOB ex-ship Excluded Included dr. Purchases xx dr. Inventory xx

cr. Accounts payable xx cr. Accounts payable xx

FOB place of the buyer Excluded Included

To record purchases on account

Lay away sales Excluded Included dr. Freight in xx dr. Inventory xx

Sale with buyback agreement Excluded Included cr. Cash xx cr. Cash xx

Sale under inventory financing Excluded Included To record payment of freight FOB shipping point

“Hold for shipping instruction” Excluded Included dr. Accounts payable xx dr. Accounts payable xx

Sale on trial / sale on approval Excluded Included cr. Purchase return xx cr. Inventory xx

Inventory pledged Excluded Included To record purchase return

dr. Accounts receivable xx dr. Accounts receivable xx

COMPOSITION OF INVENTORY cr. Sales xx cr. Sales xx

Inclusions Exclusions

1. Raw materials (1) Freight out dr. Cost of goods sold xx

2. Work in process (2) Goods held/received on cr. Inventory xx

To record sales on account

consignment

dr. CGS / income summary xx No adjusting entry / closing entry

3. Finished goods (3) Mark up dr. Inventory, end xx

4. Merchandise inventory (4) Gross profit dr. Purchase returns xx

5. Factory supplies (5) Advances to supplier dr. Purchase discounts xx

6. Freight in / transportation / (6) Trading securities/investments in cr. Inventory, beg xx

handling shares/bonds cr. Purchases xx

cr. Freight in xx

7. Goods sent out on consignment (7) Office supplies

To adjust the inventory, recognize cost of sales and close nominal accounts

8. Freight of sending the goods to (8) Marketing supplies

PERPETUAL INVENTORY SYSTEM (2) FIFO perpetual

• No purchases account is used. (3) Weighted average – periodic

• Requires two journal entries to record the sales and sales return. (4) Weighted average – perpetual (moving average)

• Stock cards are maintained under this system (5) Specific identification

• Physical count, is optional and is only use for for internal control to determine the FIFO

accuracy of inventory records. • Computation of (1) Ending inventory in pesos; (2) cost of sales in pesos

• In case the physical count and the perpetual record has discrepancy, the physical • FIFO periodic and FIFO perpetual have different formulas and computation but will

count will prevail. yield to same ending inventory and cost of sales.

• Commonly used for inventories that are relatively high valued. ü Compute the ending inventory first,

ü then compute for the cost of sales.

PERIODIC INVENTORY SYSTEM

Beginning inventory in units xxxx

• Physical count is necessary to determine the amount of inventory to be presented in

Net purchases in units xxxx

the financial statements. Total goods available for sale units TGAS xxxx

• Inventory is updated only upon physical count. Cost of goods sold in units (xxxx)

• Cost of goods sold is a residual amount rather than an account. Ending inventory in units xxxx

Multiply: Unit cost of the last purchases of the period xx

(3) CASH DISCOUNT Ending inventory in pesos xxxx

Gross method Net method

dr. Purchases 100 dr. Purchases 98 Incase the last purchases is lower than the ending inventory:

cr. Accounts payable 100 cr. Accounts payable 98 Ending inventory in units xxxx

Number of units of the last purchases (xxxx)

To record purchases on account

Excess in units xxxx

dr. Accounts payable 100 dr. Accounts payable 98

Multiply: Unit cost of the second to the last purchases of the period xx

cr. Cash 98 cr. Cash 98

Ending inventory coming from the second to the last purchases in pesos xxxx

cr. Purchase discount 2

Total cost of the last purchases in pesos xxxx

To record payment of purchased goods within the discount period

Ending inventory xxxx

dr. Accounts payable 100 dr. Accounts payable 98

cr. Cash 100 dr. Purchase discount forfeited 2 WEIGHTED AVERAGE

cr. Cash 100 • Computation of (1) ending inventory in pesos; (2) cost of sales in pesos

To record payment of purchased goods beyond the discount period ü Compute the ending inventory first,

GROSS METHOD VS. NET METHOD ü then compute for the cost of sales.

• Under gross method, discount lost is included as part of cost of sale & inventory. Total goods available for sale in pesos

Average unit cost

• Under net method, discount lost is included as part of operating expenses. Total goods available for sale in units

• Theoretically, net method is correct and should be followed. Beginning inventory in units xxxx

• Usually, generally, commonly, gross method is used. (silent) Net purchases in units xxxx

Total goods available for sale units TGAS xxxx

(4) COST FORMULAS / COST FLOWS Cost of goods sold in units (xxxx)

• Dividend into (5) different methods: Ending inventory in units xxxx

(1) FIFO periodic Multiply: Average unit cost xx

Ending inventory in pesos xxxx

Total goods available for sale in pesos xxxx (5) INVENTORY MEASUREMENT

Ending inventory in pesos (xxxx) • Inventories are measured at lower of cost or net realizable value (NRV):

Cost of goods sold in pesos xxxx

COMPUTATION OF NRV

Cost of goods sold in units xxxx • For theories purposes, NRV is computed by, estimated selling price minus estimated

Multiply: Average unit cost Xx

cost to complete minus estimated cost to sell.

Cost of goods sold in pesos xxxxx

• For problems purposes, NRV is computed by

(1) Raw material, current replacement cost

MOVING AVERAGE

• In weighted average, you will compute for the average unit cost once at the end of the (2) Work in process, estimated selling price minus estimated cost to complete minus

period, in moving average you will compute for the average unit cost every time estimated cost to sell.

purchases are made. (3) Finished goods or merchandise inventory, estimated selling price minus estimated

cost to repair, if any, minus estimated cost to sell.

• Moving average is a long computation problem and there is no shortcut for it.

• Solve it slowly and carefully by preparing five (5) column computation:

COMPUTATION OF ALLOWANCE FOR INVENTORY IMPAIRMENT / INVENTORY

Date Transaction Units Unit cost Total Cost WRITEDWON

Feb. 1 -- 100 3 300 • Observe the following formula to compute allowance:

Feb. 3 Purchases 200 2.5 500 Historical cost / cost xxxx

Total Compute new unit cost 300 2.67* 800 Lower of cost or NRV (item by item basis) (xxxx)

Feb. 5 Sold 50 2.67 (133.5) Allowance for inventory decline, ending xxxx

* Computed by dividing total cost by the number of units

* the basis of the cost of unit sold is the latest average unit cost. COMPUTATION OF IMPAIRMENT LOSS AND REVERSAL OF IMPAIRMENT

• Impairment should be squeeze in the credit side of the allowance account, reversal

FIFO vs. LIFO vs. AVERAGE should be squeezed in the debit side of the allowance account

• In times of inflation (increasing prices)

Allowance for inventory writedown

(1) FIFO will yield highest income, highest inventory balance, lowest cost of sales xx Beginning balance

(2) LIFO will yield lowest income, lowest inventory balance, highest cost of sales Reversal of impairment during the year xx xx Impairment / writedown during the year

(3) Average will yield higher income than LIFO but lower income than FIFO, higher Xx Ending balance

inventory balance than LIFO but lower inventory balance than FIFO, lower cost of

sales than LIFO but higher cost of sales than FIFO. Alternative computation

kaya mo yan Allowance for inventory decline, beg xxxx

Allowance for inventory decline, ending (xxxx)

• In times of deflation (decreasing prices) Impairment loss (if increase) reversal of impairment (if decrease) xxxx

(1) FIFO will yield lowest income, lowest inventory balance, highest cost of sales

(2) LIFO will yield highest income, highest inventory balance, higher cost of sales

(3) Average will yield lower income than LIFO but higher income than FIFO, lower

inventory balance than LIFO but higher inventory balance than FIFO, higher cost of

sales than LIFO but lower cost of sales than FIFO.

COMPUTATION OF COST OF GOODS SOLD W/ ALLOWANCES ü Sixth, compute for the estimated ending inventory

Allowance method ü Seventh, compute the fire loss \

Inventory, beg @ cost xxxx

Purchases, xxxx COMPUTATION OF NET PURCHASES (a)

Inventory, end @ cost (xxxx) To compute for the net purchases, use the T-account of accounts payable then squeeze

Cost of sales before writedown xxxx gross purchases.

plus: Inventory writedown / impairment or minus: reversal of impairment xxxx/(xxxx) Accounts payable – trade

(a) Payment made to supplier Beginning balance

Cost of sales adjusted xxxx

(b) Purchase discount (a) Gross purchases

Direct method

(c) Purchase return (b) Freight, shipping point, prepaid

Inventory, beg @ nrv xxxx

Ending balance

Purchases, xxxx

Inventory, end @ nrv (xxxx) Gross purchases xxxx

Cost of sales adjusted xxxx minus: purchase discount (xxxx)

minus: purchase returns (xxxx)

(6) INVENTORY ESTIMATION

add: freight in xxxx

• Use to when / as

net purchases on account xxxx

(1) Inventory destroyed by major fire incident or other casualties

cash purchases xxxx

(2) Proof of the reasonableness and accuracy of the physical count

net purchases xxxx

(3) External and internal interim financial reporting

Alternative computation

(4) Rough test of the validity of an inventory cost determined under either periodic or

accounts payable, end xxxx

perpetual system

payment made to supplier xxxx

GROSS PROFIT METHOD accounts payable, beg (xxxx)

• Computation of estimated inventory loss caused by casualties or theft. net purchases on account xxxx

Inventory, beg xxxx

COMPUTATION OF NET SALES

Purchases, net (a) xxxx

• To compute for the net sales, use the T-account of accounts receivable then squeeze

Cost of sales [sales x (100-GPR] or [sales / (1+GPR)] (xxxx)

gross credit sales.

Estimated ending inventory xxxx

Trade Receivable – trade

Remaining inventory after fire (NRV of the remaining goods + goods in (xxxx) Beginning balance (a) Collection of AR

owned but in transit) (a) Sale on account (b) Collection of recovery

Fire loss xxxx (b) Recovery of written of AR (c) Write off of AR

(c) Freight FOB ship pt., prepaid (d) Discount taken

ü First, Inventory, beg is usually given.

ü Second, compute for the net purchases. (e) Sales actually returned

ü Third, compute for the net sales. (f) Other form of payment

ü Fourth, compute for the cost ratio Ending balance

ü Fifth, compute for the cost of sales *you can’t simply, collection made + AR, end – AR, beg = net sales you will arrive at

wrong net sales sometimes if the company has recovery and writeoffs

Gross sales xxxx COMPUTATION OF COST RATIO

minus: sales returns only (xxxx) Cost ratio under average approach

net sales on account xxxx TGAS @ cost

xx%

TGAS @ retail

cash sales xxxx

net sales xxxx

Cost ratio under LCNRV / conservative approach

COMPUTATION OF COST RATIO TGAS @ cost

xx%

Based on sale (gross profit) Based on cost (mark up) TGAS @ retail + markdown – markdown cancellation

Selling price 100% Selling price 100% + GP%

Cost ratio under FIFO approach

Cost of goods (CR%) Cost of goods (100%)

TGAS @ cost – inventory, beg @ cost

Gross profit GP% Gross profit GP% xx%

TGAS @ retail – inventory, beg @ retail

CGS Net sales x (100 – GPR) CGS Net sales / (1+GPR)

COMPUTATION OF NET SALES

RETAIL METHOD

To answer carefully the questions involving retail, need to follow the steps: Sales xxxx

Sales return (xxxx)

(1) Compute for the total goods available for sale (TGAS);

Employee discounts xxxx

(2) Compute for the cost to retail ratio; Normal losses from shoplifting xxxx

(3) Compute for the net sales; Normal losses from theft xxxx

(4) Compute for the cost of sales; Normal losses from shrinkage xxxx

(5) Compute for the ending inventory; Net sales xxxx

If the problem is silent, assume losses are normal.

COMPUTATION OF TGAS COST AND RETAIL “sales discount”; “sales allowance” and “freight out” should be ignored.

Cost Retail

Inventory, beg + + COMPUTATION OF COST OF SALES

Purchases + + Net sales xxxx

Purchase return – – Cost ratio xx%

Cost of sales xxxx

Purchase discount –

Purchase allowance –

COMPUTATION OF ENDING INVENTORY

Freight-in + TGAS at cost xxxx

Departmental trans-in + + Cost of sales (see computation above) (xxxx)

Departmental trans-out – – Inventory, end @ cost xxxx

Abnormal loss – – Alternative computation

TGAS at retail xxxx

Mark up +

Net sales (xxxx)

Mark up cancellation – Ending inventory @ retail xxxx

Mark down – Cost ratio xx%

Mark down cancellation + Inventory, end @ cost xxxx

TGAS xx xx

MANUFACTURING ENTITY CONSIGNMENT OF GOODS

• Computation of inventory balances and cost of goods sold under manufacturing • Receivable and sale is recognized upon selling of goods by the consignor.

companies: • Computation of ending inventory sent out on consignment:

Raw materials, beg xxxx Historical cost of inventory xxxx

Net purchases: Freight in to consignor xxxx

Gross purchases xxxx Total cost of goods sent out xxxx

Purchase discount (xxxx) Prorate of the remaining goods xx/xx

Purchase returns (xxxx) Inventory, end xxxx

Freight in xxxx xxxx

Raw materials, available for use xxxx • Computation of cash remittance from consignee or receivable from the consignee:

Raw materials, end (xxxx) Number of goods sent out on consignee xxxx

Raw materials, used xxxx Number of goods remaining in the hands out consignee (xxxx)

Direct labor xxxx Goods sold on consignment in units xxxx

OH % of direct labor (normal costing)/actual overhead (actual costing) Selling price of each goods xxxx

Indirect material xxxx Commission of the consignee (xxxx)

Indirect labor xxxx Total cash to be remitted xxxx

Factory supplies xxxx Cash remitted (xxxx)

Supervision xxxx Receivable form consignee xxxx

Depreciation of factory warehouse, equipment, machineries xxxx INVENTORY ERRORS

Factory real property taxes xxxx • Determine the inventory system that the company is using, it is important in

Factory rentals xxxx determining the effect of errors. If the problem is silent, assume periodic system is

Light, power and water xxxx being used.

Cost of factory management xxxx

PERIODIC SYSTEM

Maintenance / repair of factory equipment xxxx xxxx

Error Asset / WC Liability Cost of sale Net income

Manufacturing cost xxxx

Inventory, beg No effect No effect Same effect Opposite effect

Work in process, beg xxxx Purchase No effect Same effect Same effect Opposite effect

Total goods put in process xxxx Sale Same effect No effect No effect Same effect

Work in process, end (xxxx) Inventory, end Same effect No effect Opposite effect Same effect

Cost of goods manufactured xxxx PERPETUAL SYSTEM

Finished goods, beg xxxx Error Asset Liability Cost of sale Net income

Total goods available for sale xxxx Inventory, beg* No effect No effect No effect No effect

Finished goods, end (xxxx) Purchase Same effect Same effect No effect No effect

Cost of goods sold xxxx Sale Same effect No effect Same effect Same effect

Inventory, end* No effect No effect No effect No effect

*if not based on physical count or silent.

END OF JSC.NOTE_03

Potrebbero piacerti anche

- Equity Valuation: Models from Leading Investment BanksDa EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNessuna valutazione finora

- Financial Accounting and Reporting - Inventories (Recognition, Measurement, Estimation and Valuation)Documento5 pagineFinancial Accounting and Reporting - Inventories (Recognition, Measurement, Estimation and Valuation)LuisitoNessuna valutazione finora

- Far 05 InventoriesDocumento10 pagineFar 05 InventoriesRefinej WickerNessuna valutazione finora

- C3 - Accounting For InventoriesDocumento95 pagineC3 - Accounting For InventoriesHồ ThảoNessuna valutazione finora

- Inventory Reviewer PDFDocumento2 pagineInventory Reviewer PDFAina AguirreNessuna valutazione finora

- CH 07Documento10 pagineCH 07Gaurav KarkiNessuna valutazione finora

- TOPIC 1 Accounting For InventoryDocumento9 pagineTOPIC 1 Accounting For Inventorykirah raraNessuna valutazione finora

- Slide Chapter 2 PDFDocumento23 pagineSlide Chapter 2 PDFLinh meniNessuna valutazione finora

- Wiley Online Notes For Inventory FinalDocumento14 pagineWiley Online Notes For Inventory FinalsukoorNessuna valutazione finora

- Wiley Online Notes For Inventory FinalDocumento14 pagineWiley Online Notes For Inventory FinalsukoorNessuna valutazione finora

- ea2e5ecc-fa8e-46c7-891a-a70d7ab7fc6fDocumento13 pagineea2e5ecc-fa8e-46c7-891a-a70d7ab7fc6fKajal SharmaNessuna valutazione finora

- Chapter 5 InventoriesDocumento12 pagineChapter 5 InventoriesMelvin OngNessuna valutazione finora

- Chapter 06 v0Documento43 pagineChapter 06 v0Diệp Diệu ĐồngNessuna valutazione finora

- As 2Documento4 pagineAs 2abhishekkapse654Nessuna valutazione finora

- Chapter 3 - InventoriesDocumento44 pagineChapter 3 - Inventorieslorenpham2010.03Nessuna valutazione finora

- Inventories NotesDocumento2 pagineInventories NotesMikaela LacabaNessuna valutazione finora

- FAR 214 Inventory ConceptsDocumento17 pagineFAR 214 Inventory ConceptsJai BacalsoNessuna valutazione finora

- Week Five:: Reporting andDocumento38 pagineWeek Five:: Reporting andIzham ShabdeanNessuna valutazione finora

- Universal College of Parañaque: Inventories Related Standards: Pas 2 - InventoriesDocumento26 pagineUniversal College of Parañaque: Inventories Related Standards: Pas 2 - InventoriesTeresaNessuna valutazione finora

- As - 2: Valuation of InventoriesDocumento18 pagineAs - 2: Valuation of InventoriesrajuNessuna valutazione finora

- ACCT1111 Chapter 6 Lecture (Revised)Documento63 pagineACCT1111 Chapter 6 Lecture (Revised)Wky JimNessuna valutazione finora

- Integartion OBYC SAP FI MMCCDocumento57 pagineIntegartion OBYC SAP FI MMCCAriba TestingNessuna valutazione finora

- MOD 07 Inventory BasicsDocumento17 pagineMOD 07 Inventory BasicsKhen HannaNessuna valutazione finora

- 08 Ias 2Documento3 pagine08 Ias 2Irtiza AbbasNessuna valutazione finora

- Assignment 1571213755 SmsDocumento15 pagineAssignment 1571213755 SmsRahul Kumar Sharma 17Nessuna valutazione finora

- Cagayan - Batch 2Documento22 pagineCagayan - Batch 2Sarah BalisacanNessuna valutazione finora

- Acc Prin 2 CH 1Documento12 pagineAcc Prin 2 CH 1Bona MisbaNessuna valutazione finora

- Inventory Lecture NotesDocumento7 pagineInventory Lecture NotesRena Lyn ManzanoNessuna valutazione finora

- PAS 2 InventoriesDocumento16 paginePAS 2 Inventoriesjan petosilNessuna valutazione finora

- Module 6 - IAS 2 Inventory SlidesDocumento58 pagineModule 6 - IAS 2 Inventory SlidesGiven RefilweNessuna valutazione finora

- Ind As 2: Inventories: (I) MeaningDocumento6 pagineInd As 2: Inventories: (I) MeaningDinesh KumarNessuna valutazione finora

- Accounting Grade 11 Term 3 Week 4 - 2020Documento6 pagineAccounting Grade 11 Term 3 Week 4 - 2020adriana espinoza de los monterosNessuna valutazione finora

- Acc 441 Draft CompressDocumento13 pagineAcc 441 Draft CompressDeviane CalabriaNessuna valutazione finora

- Module 7 13 No 11Documento6 pagineModule 7 13 No 11LEIGHANNE ZYRIL SANTOSNessuna valutazione finora

- Financial Reporting Standards (Pas # 2) : Inventory Accounting Recognition, Measurement and DisclosuresDocumento51 pagineFinancial Reporting Standards (Pas # 2) : Inventory Accounting Recognition, Measurement and DisclosuresKylieNessuna valutazione finora

- PPA 4 InventoriesDocumento8 paginePPA 4 Inventoriesbullalulla840Nessuna valutazione finora

- RQB QsDocumento76 pagineRQB QsOlha LNessuna valutazione finora

- FR Shield - Ind As 2 - InventoriesDocumento4 pagineFR Shield - Ind As 2 - InventoriesTanvi jain100% (1)

- FINACC1 Inventories PDFDocumento6 pagineFINACC1 Inventories PDFJerico DungcaNessuna valutazione finora

- Stevenson Inv MGMT Spring 2013Documento132 pagineStevenson Inv MGMT Spring 2013Gurunathan MariayyahNessuna valutazione finora

- Inventory Management and ControlDocumento111 pagineInventory Management and ControlkaranNessuna valutazione finora

- Management Accounting NotesDocumento212 pagineManagement Accounting NotesFrank Chinguwo100% (1)

- Inventories Lkas 2Documento12 pagineInventories Lkas 2kavindyatharaki2002Nessuna valutazione finora

- P1.001 InventoriesDocumento5 pagineP1.001 InventoriesPatrick Kyle AgraviadorNessuna valutazione finora

- Inventories: Iv. (Cost Below P15,000 Capitalization Threshold For PPE)Documento4 pagineInventories: Iv. (Cost Below P15,000 Capitalization Threshold For PPE)Alelie Joy dela CruzNessuna valutazione finora

- Philippine Accounting Standards: InvetoriesDocumento21 paginePhilippine Accounting Standards: InvetoriesCASTILLO JOSIAH ANDREI V.Nessuna valutazione finora

- Far Notes For QualiDocumento10 pagineFar Notes For QualiMergierose DalgoNessuna valutazione finora

- Accounting StandardsDocumento56 pagineAccounting StandardsAkshay KumarNessuna valutazione finora

- Cheat SheetDocumento15 pagineCheat SheetJason wonwonNessuna valutazione finora

- IE6404 - Chapter 3: Inventory ManagementDocumento18 pagineIE6404 - Chapter 3: Inventory ManagementJosé Manuel Slater CarrascoNessuna valutazione finora

- INVENTORIESDocumento28 pagineINVENTORIESLourdios EdullantesNessuna valutazione finora

- Inventories 2Documento19 pagineInventories 2anna paulaNessuna valutazione finora

- Inventorymanagement 1242Documento80 pagineInventorymanagement 1242rajesh goyalNessuna valutazione finora

- Persediaan (Inventories) : AccountingDocumento66 paginePersediaan (Inventories) : AccountingMuhammad IrsyadNessuna valutazione finora

- Inventory Part 1Documento32 pagineInventory Part 1Leddie Bergs Villanueva VelascoNessuna valutazione finora

- Review - IV: Nature of Inventory and Cost of Goods SoldDocumento10 pagineReview - IV: Nature of Inventory and Cost of Goods SoldAmrutaNessuna valutazione finora

- Inventory ManagementDocumento39 pagineInventory ManagementNaomi KangNessuna valutazione finora

- Cfas Lesson 3 Pas 2 (Activity)Documento3 pagineCfas Lesson 3 Pas 2 (Activity)Michelle CabezoNessuna valutazione finora

- ACC 111 Inventories AutosavedDocumento19 pagineACC 111 Inventories AutosavedGiner Mabale Steven100% (1)

- Macro Enterprise: Republic of The Philippines Province of Negros Oriental City of DumagueteDocumento1 paginaMacro Enterprise: Republic of The Philippines Province of Negros Oriental City of DumagueteMyla Oira CaneteNessuna valutazione finora

- Project Report On Coca Cola Market StrategiesDocumento24 pagineProject Report On Coca Cola Market StrategiesAnonymous 2ywVRjTy3Nessuna valutazione finora

- FEMA E-74 Reducing The Risks of Nonstructural Earthquake DamageDocumento885 pagineFEMA E-74 Reducing The Risks of Nonstructural Earthquake DamageManolis Michelakis100% (1)

- Report On Gladiolus Exposure Visit To Islamabad 26 Aug 2016Documento10 pagineReport On Gladiolus Exposure Visit To Islamabad 26 Aug 2016Akhtar AliNessuna valutazione finora

- DB'sDocumento3 pagineDB'sOpalyn Mina GonzagaNessuna valutazione finora

- ForFrom InditexDocumento24 pagineForFrom InditexPaula LópezNessuna valutazione finora

- HYPERMARKET Tesco/ Aeon/ SpeedmartDocumento4 pagineHYPERMARKET Tesco/ Aeon/ SpeedmartBatrisha AliaNessuna valutazione finora

- VineethaDocumento48 pagineVineethaShareena FarooqueNessuna valutazione finora

- Filipino Entrepreneurs in The Philippines and Their Contribution To Economic Developmen1Documento8 pagineFilipino Entrepreneurs in The Philippines and Their Contribution To Economic Developmen1Arissa Viray Adina100% (1)

- KurkureDocumento8 pagineKurkurekushal agrawalNessuna valutazione finora

- Pub - Goblin Markets Changeling The Lost PDFDocumento49 paginePub - Goblin Markets Changeling The Lost PDFMadmen quill100% (2)

- Conept of RetailingDocumento13 pagineConept of RetailingAniSh ThapaNessuna valutazione finora

- Seneca's Gymnastics Team Thriving: Such Sweet SoundsDocumento12 pagineSeneca's Gymnastics Team Thriving: Such Sweet SoundselauwitNessuna valutazione finora

- P&GDocumento16 pagineP&GGanesh AdityaNessuna valutazione finora

- Splash Corporation Background: Early BeginningsDocumento9 pagineSplash Corporation Background: Early BeginningsTelle MarieNessuna valutazione finora

- Romania Country Commercial Guide 2008Documento120 pagineRomania Country Commercial Guide 2008Sorin MoiseNessuna valutazione finora

- 1lecture 1 Applied Marketing ManagementDocumento33 pagine1lecture 1 Applied Marketing ManagementglamomNessuna valutazione finora

- Group 4 - Metro Cash and CarryDocumento7 pagineGroup 4 - Metro Cash and CarryRehan TyagiNessuna valutazione finora

- Ramakrishna Sangam Milk Parlour ProjectDocumento9 pagineRamakrishna Sangam Milk Parlour ProjectABHISHEK KUMARNessuna valutazione finora

- Managing Early Growth of The New VentureDocumento24 pagineManaging Early Growth of The New VentureZaryab Qurashi Xabi100% (1)

- Costco201407us DLDocumento101 pagineCostco201407us DLsudeepk_sapNessuna valutazione finora

- Kuliah - 2 - Channel StructureDocumento44 pagineKuliah - 2 - Channel StructureWildan HakimNessuna valutazione finora

- Lobster Pot Closes 1975Documento1 paginaLobster Pot Closes 1975droshkyNessuna valutazione finora

- Big Bazaar Location StrategyDocumento60 pagineBig Bazaar Location Strategyshafia ahmadNessuna valutazione finora

- Amul SIP ReportDocumento29 pagineAmul SIP ReportAshish KumarNessuna valutazione finora

- Economics of Gaming Consoles - A Study On XboxDocumento22 pagineEconomics of Gaming Consoles - A Study On XboxKalyan Mukhopadhyay100% (1)

- Consignment Daily Sales Report PT. Matahari Department Store TBK by SupplierDocumento106 pagineConsignment Daily Sales Report PT. Matahari Department Store TBK by SupplierMaharani Amalia PutriNessuna valutazione finora

- INTRODUCTION Advertising Is Only One Element of The Promotion MixDocumento10 pagineINTRODUCTION Advertising Is Only One Element of The Promotion MixstudybasedNessuna valutazione finora

- The 7 Beautiful Things Excellent Leaders Do: by Robin SharmaDocumento12 pagineThe 7 Beautiful Things Excellent Leaders Do: by Robin SharmaswarajchaNessuna valutazione finora