Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

HOBA Problems

Caricato da

Emma Mariz GarciaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

HOBA Problems

Caricato da

Emma Mariz GarciaCopyright:

Formati disponibili

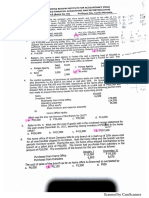

HOME OFFICE, BRANCH & AGENCY ACCOUNTING

Problem 1: The income statement submitted by Bacolod Branch to the HO for the month of

December 31, 2015 follows:

Sales P 600,000

Cost of Sales:

Inventory, Dec. 1, 2015 P 80,000

Shipment from HO 350,000

Purchases locally by branch 30,000

Total P460,000

Inventory, Dec. 31, 2015 100,000 360,000

Gross Margin P 240,000

Operating Expenses 180,000

Net Income for the Month P 60,000

The Branch inventories consisted of:

12/1/2015 12/31/2015

Merchandise Purchase from HO P 70,000 P 84,000

Local Purchase 10,000 16,000

Total P 80,000 P 100,000

After affecting the necessary adjustments, the Home Office ascertained the true income of

the Branch to be P156,000.

What is the balance of the Allowance for overvaluation in the branch inventory at December

31, 2015?

SOLUTION: in solving this, I did a work back:

Sales P 600,000

COGS (264,000)

Gross Profit P 336,000

OPEX (180,000)

True Income P 156,000

Inventory Locally Purchased Total COGS 264,000 360,000

Beg. COGS of LP (24,000) (24,000)

P10,000 P24,000 Sold COGS SFHO 240,000 336,000

Purc.

30,000 Realized All. For Overvaluation = 336T - 240T = 96T

P16,000 End Percentage = 96,0000 / 336,000 = 28.57% or 140%

All. For Overvaluation in Dec. 31, 2015 = P84,000 x 28.57% = 23,999 or 24,000

_________________________________________________________________________________________

Problem 2: Selected information from the trial balances for the home office and the branch

of Jack Sparrow Company at December 31, 2016 is provided. The branch acquires merchandise

from the home office and outside suppliers.

Sales P 60,000 P 30,000

Shipments to branch 8,000

Allowance for Overvaluation of Branch Inv. 3,600

Shipments from home office 10,000

Purchases (outsiders) 35,000 5,500

Merchandise Inventory 12.01.16 20,000 15,000

Expenses 14,000 5,000

Additional Information:

Merchandise inventory, December 31, 2016:

Home Office P 20,000

Branch (7,500 from HO and 2,500 from outsiders) 10,000

The combined net income from Home Office and Branch Operation is:

Solution:

Mark-up % = Shipment from HO - Shipment to Branch

Shipment to Branch

= P10,000 - P8,000 = 25% on

P8,000

Allowance for Overvaluation, End P3,600

Less: Allowance for Overvaluation of P10,000 SHFO 2,000

Allowance for Overvaluation in Beg. Inventory P1,600

Divide by: 25%

SHTB P6,400

Multiply by: 125%

HOME OFFICE, BRANCH & AGENCY ACCOUNTING

Merchandise from HO in the Beginning Inventory P8,000

SHFO OUTSIDERS

Beginning Inventory P 8,000 Beginning Inventory P 7,000

SHFO 10,000 Purchases 5,500

Ending Inventory (7,500) Ending Inventory (2,500)

COGS P10,500 COGS P 10,000

Divide by: 125%

TRUE COGS P 8,400

HOME OFFICE BRANCH

SALES P 60,000 SALES P 30,000

COGS (27,000) COGS (18,400)

GROSS PROFIT P 33,000 GROSS PROFIT P 11,600

OPEX (14,000) OPEX ( 5,000)

INCOME P 19,000 INCOME P 6,600

Combined Net Income = P19,000 + P6,600 = 25,6000

_________________________________________________________________________________________

Problem 3: The following information are taken from the books of Norrington Company and

its branch. The balance are at December 31, 2016, the second year of their operations:

BRANCH NORRINGTON BOOKS

Shipment from Home Office P 888,000

Sales 1,200,000

Expenses 400,000

All. For overvaluation of Branch Inventory P 173,000

The branch acquires all of its merchandise from the HO. The inventories of the branch

at billed prices are as follows:

January 1, 2016 P 150,000

December 31, 2016 168,000

The HO shipments of merchandise to branch are billed at what percent of cost?

The adjusted/correct/true profit of the branch?

SOLUTION:

All. For Overvaluation = (Beg. Inventory + SFHO) x markup % on cost

173,000 = (P150,000 + P888,000) x markup % on cost

markup % on cost = 173,000 / 1,038,000

= 0.166666666 or 120% above cost

Sales P 1,200,000

COGS:

Beginning Inventory P 150,000

SFHO 888,000

Less: Ending inventory 168,000

COGS P 870,000

Divide by: 120% (725,000)

Gross Profit P 475,000

OPEX (400,000)

Net Income P 75,000

_________________________________________________________________________________________

Problem 4: The San Miguel Branch of Taiwan Products, Inc. buys merchandise from outsiders

and receive merchandise from the home office for which it is billed at 20% above cost.

Below are excerpts from the trial balances and data on the home office and San Miguel

Branch for the month of April, 2016:

Home Office

Cr. Allowance for overvaluation of Branch Merchandise 462,500

Cr. Shipment to Branch 1,062,500

Branch

Dr. Beginning Inventory 1,800,000

Shipments from home office 1,275,000

Purchases 512,000

Month-end additional data

Ending Inventory of Branch 1,825,000

From Home office, billed price of 1,462,500

From Outsiders, at cost 362,500

The total COGS of the San Miguel Branch at Cost for the month just ended amounted to:

SOLUTION:

Mark-up % = Shipment from HO - Shipment to Branch

HOME OFFICE, BRANCH & AGENCY ACCOUNTING

Shipment to Branch

= P 1,275,000 - P 1,062,500 = 20% above cost

P 1,062,500

Allowance for Overvaluation, End P 462,500

Less: Allowance for Overvaluation of (1,275 - 1,062.5) 212,500

Allowance for Overvaluation in Beg. Inventory P 250,000

Divide by: 20%

SHTB P 1,250,000

Multiply by: 120%

Merchandise from HO in the Beginning Inventory P 1,500,000

SHFO OUTSIDERS

Beginning Inventory P 1,500,000 Beginning Inventory P 300,000

SHFO 1,275,000 Purchases 512,500

Ending Inventory (1,462,500) Ending Inventory (362,500)

COGS P 1,312,500 COGS P 450,000

Divide by: 120%

TRUE COGS P 1,093,750

Total COGS = 1,093,750 + 450,000 = 1,543,750

_________________________________________________________________________________________

Problem 5: The following information are taken from the books and records of Cebu City

Company and its branch. The balances are at December 31, 2016, the second year of the

company’s operations.

Sales P 500,000

Expense 125,000

Shipment to Branch P 250,000

Branch Inventory Allowance 71,875

The branch obtains all its merchandise from the home office. The Home office ships the

merchandise at 125% of its cost. The ending inventory of the branch is P50,000 at billed

price.

The true income of the branch is:

SOLUTION:

SHFO = SHTB x markup on cost

= P250,000 x 125% = P312,500

Branch Inventory Allowance P 71,875

Less: All. For overvaluation (312,500-250,000) 62,500

Beginning Bal. Of All. For overvaluation P 9,375

Divide by: 25%

Shipment to Branch P 37,500

Multiply by: 125%

Shipment from Home Office P 46,875

Sales P 500,000

COGS:

Beginning Inventory P 46,875

SHFO 312,500

Less: Ending Inventory (50,000)

COGS P309,375

Divide by: 125% (247,500)

Gross Profit P 252,500

OPEX (125,000)

Net Income P 127,500

Potrebbero piacerti anche

- ADVACCDocumento6 pagineADVACCangela arcedoNessuna valutazione finora

- Advanced Accounting Part II Quiz 1 Home Office and Branch AccountingDocumento10 pagineAdvanced Accounting Part II Quiz 1 Home Office and Branch AccountingAzyrah Lyren Seguban UlpindoNessuna valutazione finora

- Dayag Chapter 14 Home Office and Branch Accounting Special ProceduresDocumento26 pagineDayag Chapter 14 Home Office and Branch Accounting Special ProceduresLosel CebedaNessuna valutazione finora

- YowDocumento35 pagineYowJane Michelle Eman100% (1)

- OfficeDocumento12 pagineOffice123r12f1100% (1)

- Pak Enings HTDocumento15 paginePak Enings HTVincent SampianoNessuna valutazione finora

- Book Value Realizable ValueDocumento4 pagineBook Value Realizable ValueGennia Mae Martinez100% (1)

- P2 AnswerKey PDFDocumento9 pagineP2 AnswerKey PDFJay Mark DimaanoNessuna valutazione finora

- P2 03v2Documento5 pagineP2 03v2Rhegee Irene RosarioNessuna valutazione finora

- Home Office, Branch and Agency Accounting: Acctg 8d 8:30-9:30Documento35 pagineHome Office, Branch and Agency Accounting: Acctg 8d 8:30-9:30Danica100% (1)

- Installment Sales Multiple QuestionsDocumento36 pagineInstallment Sales Multiple QuestionsTrixie CapisosNessuna valutazione finora

- Problems Chapter 6-10Documento15 pagineProblems Chapter 6-10u got no jams0% (1)

- Theory Problem Contracts 2Documento34 pagineTheory Problem Contracts 2Slay SleekNessuna valutazione finora

- 1st Exam Chapter 11Documento9 pagine1st Exam Chapter 11Imma Therese YuNessuna valutazione finora

- Afar PDFDocumento128 pagineAfar PDFMelyn Bustamante100% (1)

- Questions SsDocumento7 pagineQuestions SsAngelli Lamique100% (2)

- Long Quiz 2Documento8 pagineLong Quiz 2CattleyaNessuna valutazione finora

- HO, B & A AcctgDocumento15 pagineHO, B & A AcctgCarolina Fortez Dacanay71% (7)

- Practical Accounting 2 ReviewDocumento42 paginePractical Accounting 2 ReviewJason BautistaNessuna valutazione finora

- This Study Resource Was: Home Office Books Branch BooksDocumento3 pagineThis Study Resource Was: Home Office Books Branch BooksCyrille Keith FranciscoNessuna valutazione finora

- Acctg For Special Transaction - 3rd Lesson PDFDocumento9 pagineAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaNessuna valutazione finora

- Practical Accounting 2Documento4 paginePractical Accounting 2RajkumariNessuna valutazione finora

- Chapter 10Documento9 pagineChapter 10chan.charanchan100% (1)

- Installment, Home-Branch, Liquidation, LT Constn ContractsDocumento47 pagineInstallment, Home-Branch, Liquidation, LT Constn ContractsArianne Llorente83% (6)

- P2 1PB 2nd Sem 1314 With SolDocumento15 pagineP2 1PB 2nd Sem 1314 With SolRhad EstoqueNessuna valutazione finora

- Ad2 1Documento13 pagineAd2 1MarjorieNessuna valutazione finora

- StudyDocumento10 pagineStudyirahQNessuna valutazione finora

- Quizzer Home Office 3Documento11 pagineQuizzer Home Office 3Jamaica David100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocumento5 pagineIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNessuna valutazione finora

- Chapter 11 - Ho Branch - MillanDocumento34 pagineChapter 11 - Ho Branch - MillanAngelica Cerio100% (1)

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Documento12 pagineP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Lesson 4 Accounting For Home OfficeDocumento8 pagineLesson 4 Accounting For Home OfficeheyheyNessuna valutazione finora

- Chapter 3 Multiple ChoicesDocumento16 pagineChapter 3 Multiple ChoicesNayeon LimNessuna valutazione finora

- AFAR Quizzer 3 SolutionsDocumento12 pagineAFAR Quizzer 3 SolutionsHazel Mae Lasay100% (1)

- HOBA - Practice SetDocumento5 pagineHOBA - Practice SetCarl Dhaniel Garcia SalenNessuna valutazione finora

- 08 Home Office Branch Agency AccountingxxDocumento114 pagine08 Home Office Branch Agency AccountingxxRafael Barbin100% (1)

- Big Picture in Focus: Ulob. Account For Branch and Home Office Transactions and Prepare Financial Statements Let'S AnalyzeDocumento3 pagineBig Picture in Focus: Ulob. Account For Branch and Home Office Transactions and Prepare Financial Statements Let'S AnalyzeJean Rose Tabagay BustamanteNessuna valutazione finora

- DocDocumento3 pagineDocWansy Ferrer BallesterosNessuna valutazione finora

- AfarDocumento18 pagineAfarFleo GardivoNessuna valutazione finora

- Total Dividend Income P75,000Documento5 pagineTotal Dividend Income P75,000Danielle100% (1)

- Acctg 10 Midterm Lesson Part .1Documento21 pagineAcctg 10 Midterm Lesson Part .1NANNessuna valutazione finora

- C Par First Pre Board 2008 ADocumento17 pagineC Par First Pre Board 2008 AJaylord Pido100% (1)

- Construction Contracts PAS 11 Afar Michael B.Bongalonta, Cpa, Micb, MbaDocumento3 pagineConstruction Contracts PAS 11 Afar Michael B.Bongalonta, Cpa, Micb, MbaTine GriegoNessuna valutazione finora

- CPA Board Examination Operation - Advance Accounting: Page 1 of 11Documento11 pagineCPA Board Examination Operation - Advance Accounting: Page 1 of 11Janella Patrizia0% (1)

- Csa 9Documento1 paginaCsa 9Von Andrei MedinaNessuna valutazione finora

- Solution Chapter 9Documento15 pagineSolution Chapter 9BobslaneLlenos0% (2)

- Prelim Exam - Doc2Documento16 paginePrelim Exam - Doc2alellie100% (1)

- Solution Chapter 13Documento31 pagineSolution Chapter 13ClarisaJoy Sy100% (3)

- Prelim Quiz 001 - Joint Arrangements: Contributions Profit andDocumento3 paginePrelim Quiz 001 - Joint Arrangements: Contributions Profit andJashim Usop100% (1)

- Questions On ALOBIDocumento3 pagineQuestions On ALOBIALIX V. LIMNessuna valutazione finora

- Questions On ALOBIDocumento3 pagineQuestions On ALOBIGlory Nicol OrapaNessuna valutazione finora

- Dayag Chapter 14 Home Office and Branch Accounting Special ProceduresDocumento31 pagineDayag Chapter 14 Home Office and Branch Accounting Special ProceduresPaula De Rueda100% (4)

- Home Office and Branch AccountingDocumento12 pagineHome Office and Branch AccountingKrizia Mae FloresNessuna valutazione finora

- Removal Adv. 2Documento2 pagineRemoval Adv. 2Cattleya0% (1)

- Home Office and Branch Accounting Special ProblemsDocumento27 pagineHome Office and Branch Accounting Special ProblemsAnna Marie Alferez80% (5)

- Home Office and Branch Accounting ProblemsDocumento3 pagineHome Office and Branch Accounting ProblemsJerah TorrejosNessuna valutazione finora

- Ho BRDocumento3 pagineHo BRSummer Star33% (3)

- Dokumen - Tips Branch Accounting TestbankDocumento5 pagineDokumen - Tips Branch Accounting TestbankJessa Mae DuhaylongsodNessuna valutazione finora

- Cash To Accrual ProblemsDocumento10 pagineCash To Accrual ProblemsAmethystNessuna valutazione finora

- Questionnaires BSA SubjectsDocumento27 pagineQuestionnaires BSA SubjectsJamila Mae FabiaNessuna valutazione finora

- Business CombinationDocumento7 pagineBusiness CombinationEmma Mariz GarciaNessuna valutazione finora

- Prelim Post Test 1Documento4 paginePrelim Post Test 1Emma Mariz GarciaNessuna valutazione finora

- Module 2 - Methods of Segregating Mixed CostDocumento4 pagineModule 2 - Methods of Segregating Mixed CostEmma Mariz GarciaNessuna valutazione finora

- Module 3 - CVP AnalysisDocumento4 pagineModule 3 - CVP AnalysisEmma Mariz GarciaNessuna valutazione finora

- Afar FormulasDocumento53 pagineAfar FormulasEmma Mariz GarciaNessuna valutazione finora

- Module 3 - Activity Based CostingDocumento5 pagineModule 3 - Activity Based CostingEmma Mariz GarciaNessuna valutazione finora

- Advance Financial Accounting and ReportingDocumento25 pagineAdvance Financial Accounting and ReportingEmma Mariz GarciaNessuna valutazione finora

- Depreciated Separately.: Property, Plant and EquipmentDocumento5 pagineDepreciated Separately.: Property, Plant and EquipmentEmma Mariz GarciaNessuna valutazione finora

- Business Combination - Stock AcquisitionDocumento6 pagineBusiness Combination - Stock AcquisitionEmma Mariz GarciaNessuna valutazione finora

- Necessary Condition For Control.: PAS 38 Intangible AssetsDocumento2 pagineNecessary Condition For Control.: PAS 38 Intangible AssetsEmma Mariz GarciaNessuna valutazione finora

- Proof of CashDocumento1 paginaProof of CashEmma Mariz GarciaNessuna valutazione finora

- Branch Accounting TestbankDocumento5 pagineBranch Accounting TestbankCyanLouiseM.Ellixir100% (6)

- The Purpose Driven LifeDocumento17 pagineThe Purpose Driven LifeEmma Mariz GarciaNessuna valutazione finora

- Audit of CashDocumento9 pagineAudit of CashEmma Mariz Garcia25% (8)

- Deduction From The Gross EstateDocumento6 pagineDeduction From The Gross EstateEmma Mariz GarciaNessuna valutazione finora

- If Deductions Are Claimed:, The Burden of Proving The Legality of The Deductions Rests Upon The TaxpayerDocumento7 pagineIf Deductions Are Claimed:, The Burden of Proving The Legality of The Deductions Rests Upon The TaxpayerEmma Mariz GarciaNessuna valutazione finora

- Branch Accounting TestbankDocumento5 pagineBranch Accounting TestbankCyanLouiseM.Ellixir100% (6)

- DonationDocumento3 pagineDonationEmma Mariz GarciaNessuna valutazione finora

- Payment Form: Under Tax Compliance Verification Drive/Tax MappingDocumento2 paginePayment Form: Under Tax Compliance Verification Drive/Tax MappingtristanjohnmagrareNessuna valutazione finora

- Vat Exempt SalesDocumento4 pagineVat Exempt SalesEmma Mariz GarciaNessuna valutazione finora

- Deduction From The Gross EstateDocumento6 pagineDeduction From The Gross EstateEmma Mariz GarciaNessuna valutazione finora

- Pas 12: Income Taxes Accounting Income Taxable IncomeDocumento5 paginePas 12: Income Taxes Accounting Income Taxable IncomeEmma Mariz GarciaNessuna valutazione finora

- Share-Based Sample ProblemsDocumento4 pagineShare-Based Sample ProblemsEmma Mariz Garcia100% (1)

- Value-Added Tax FinalDocumento5 pagineValue-Added Tax FinalEmma Mariz GarciaNessuna valutazione finora

- Correction of ErrorsDocumento15 pagineCorrection of ErrorsEmma Mariz GarciaNessuna valutazione finora

- Pfrs For Small EntitiesDocumento3 paginePfrs For Small EntitiesEmma Mariz Garcia100% (2)

- Estate TaxDocumento7 pagineEstate TaxEmma Mariz GarciaNessuna valutazione finora

- AFAR Mastery Part5Documento7 pagineAFAR Mastery Part5Emma Mariz GarciaNessuna valutazione finora

- Bir UpdatesDocumento2 pagineBir UpdatesEmma Mariz GarciaNessuna valutazione finora

- Laurel VS GarciaDocumento2 pagineLaurel VS GarciaRon AceNessuna valutazione finora

- Midterm Exam (Regulatory Framework and Legal Issues in Business Law) 2021 - Prof. Gerald SuarezDocumento4 pagineMidterm Exam (Regulatory Framework and Legal Issues in Business Law) 2021 - Prof. Gerald SuarezAlexandrea Bella Guillermo67% (3)

- Persuasive SpeechDocumento2 paginePersuasive SpeechAngel Zachary RayyanNessuna valutazione finora

- PM-KISAN: Details of Eligible and Ineligible FarmersDocumento2 paginePM-KISAN: Details of Eligible and Ineligible Farmerspoun kumarNessuna valutazione finora

- Summary of All Sequences For 4MS 2021Documento8 pagineSummary of All Sequences For 4MS 2021rohanZorba100% (3)

- 1 Relative Maxima, Relative Minima and Saddle PointsDocumento3 pagine1 Relative Maxima, Relative Minima and Saddle PointsRoy VeseyNessuna valutazione finora

- CR Injector Repair Kits 2016Documento32 pagineCR Injector Repair Kits 2016Euro Diesel100% (2)

- YaalDocumento25 pagineYaalruseenyNessuna valutazione finora

- 02 - Nature and Role of Science in SocietyDocumento10 pagine02 - Nature and Role of Science in SocietyMarcos Jose AveNessuna valutazione finora

- Fouts Federal LawsuitDocumento28 pagineFouts Federal LawsuitWXYZ-TV DetroitNessuna valutazione finora

- Types of Non Verbal CommunicationDocumento7 pagineTypes of Non Verbal Communicationgaurav gharat100% (1)

- WhatsApp Chat With MiniSoDocumento28 pagineWhatsApp Chat With MiniSoShivam KumarNessuna valutazione finora

- Lee. Building Balanced Scorecard With SWOT Analysis, and Implementing "Sun Tzu's The Art of Business Management Strategies" On QFD Methodology PDFDocumento13 pagineLee. Building Balanced Scorecard With SWOT Analysis, and Implementing "Sun Tzu's The Art of Business Management Strategies" On QFD Methodology PDFSekar Ayu ParamitaNessuna valutazione finora

- Abcs Booklet Kidney-Stones PDFDocumento20 pagineAbcs Booklet Kidney-Stones PDFDendhy Dwi Handana SagitaNessuna valutazione finora

- Manonmaniam Sundaranar University: B.Sc. Psychology - Ii YearDocumento129 pagineManonmaniam Sundaranar University: B.Sc. Psychology - Ii YearAnanta ChaliseNessuna valutazione finora

- Marriage and Divorce Conflicts in The International PerspectiveDocumento33 pagineMarriage and Divorce Conflicts in The International PerspectiveAnjani kumarNessuna valutazione finora

- Anxiety DisordersDocumento10 pagineAnxiety DisordersAhmed AntarNessuna valutazione finora

- Why I Want To Be An Army OfficerDocumento1 paginaWhy I Want To Be An Army OfficercmphalanNessuna valutazione finora

- Chapter 11 Waiting Line ModelsDocumento46 pagineChapter 11 Waiting Line ModelsLara FloresNessuna valutazione finora

- BTCTL 17Documento5 pagineBTCTL 17Alvin BenaventeNessuna valutazione finora

- How To Read A Research PaperDocumento16 pagineHow To Read A Research PaperHena Afridi100% (1)

- Never Can Say Goodbye Katherine JacksonDocumento73 pagineNever Can Say Goodbye Katherine Jacksonalina28sept100% (5)

- PREETI and RahulDocumento22 paginePREETI and Rahulnitinkhandelwal2911Nessuna valutazione finora

- TSH TestDocumento5 pagineTSH TestdenalynNessuna valutazione finora

- Perception On The Impact of New Learning Tools in Humss StudentDocumento6 paginePerception On The Impact of New Learning Tools in Humss StudentElyza Marielle BiasonNessuna valutazione finora

- File 000011Documento25 pagineFile 000011Jf LarongNessuna valutazione finora

- FP010CALL Trabajo CO Ardila Jaime Molina PiñeyroDocumento12 pagineFP010CALL Trabajo CO Ardila Jaime Molina PiñeyroRomina Paola PiñeyroNessuna valutazione finora

- Chapter 7: Identifying and Understanding ConsumersDocumento3 pagineChapter 7: Identifying and Understanding ConsumersDyla RafarNessuna valutazione finora

- The Saving Cross of The Suffering Christ: Benjamin R. WilsonDocumento228 pagineThe Saving Cross of The Suffering Christ: Benjamin R. WilsonTri YaniNessuna valutazione finora

- The Flowers of May by Francisco ArcellanaDocumento5 pagineThe Flowers of May by Francisco ArcellanaMarkNicoleAnicas75% (4)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyDa EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyValutazione: 4.5 su 5 stelle4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceDa EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNessuna valutazione finora

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDa EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyValutazione: 5 su 5 stelle5/5 (1)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesDa EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesValutazione: 5 su 5 stelle5/5 (4)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageDa EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageValutazione: 4.5 su 5 stelle4.5/5 (109)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Da EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Valutazione: 4.5 su 5 stelle4.5/5 (24)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsDa EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsValutazione: 4 su 5 stelle4/5 (4)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Da EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeDa EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeValutazione: 4 su 5 stelle4/5 (21)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessDa EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessValutazione: 4.5 su 5 stelle4.5/5 (28)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora