Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

OID Tax Diagram-1 - 2019 Update

Caricato da

ricetechTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

OID Tax Diagram-1 - 2019 Update

Caricato da

ricetechCopyright:

Formati disponibili

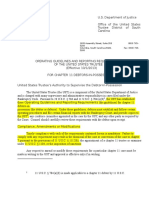

Scenario #1 26 USC 1271; UCC 3-419

IRS Publication 1212, p. 7

For Utilities, Credit Cards, 26 CFR 1.671-5(c) & (d)

Court System

AKA Nominee

1099-A[cquistion] 1099-OID Another 1099-OID by

Tax Return Forms: 1040,

filed on Estate's behalf by received on Estate's Estate receives monthly Nominee for Discharge of

1041, 1120, 706, 709

Nominee behalf to Nominee statements (coupon) from Debt

Nominee requesting

authorization to accept

credits.

FRB is Lender; Transfer credits from Estate accepts and returns Transfers credit from

Refunds credits to Estate

Estate escrow account at for value the statement Nominee's escrow

Estate Bond is the from escrow minus taxes

IRS to Nominee escrow (coupon). account return to Estate's

Borrower rate via a tax return

account escrow account at IRS

Credits are released to

Nominee

Estate is the Payer; Nominee is the Payer;

Nominee is the Recipient Estate is the Recipient

Estate files

1099-A[bandonment]

Check box 5

Estate is Lender Estate must receive

No additional OID needs to be filed since Nominee has Recipient copy of OID for

already filed OIDs on Estate’s behalf. Once Estate receives Nominee is Borrower

Recipient copy of OID, funds can be claimed on a tax return. tax filing

For 1099-OID, see 26 USC 6049

For 1099-A, see 26 USC 6050(j)

Credits used from Autographs Bank For Deposits, Endorsements and

Scenario #2 Accounts, Promissory Notes & Loans Withdrawals Check from Bank

Applications for Homes, Student , Car Account

etc. 26 USC 163, 163(e) & 12 USC 412

26 CFR 1.671-5(c) & (d)

1099-A Request 1099-OID from Banks Tax Forms: 1040, 1041, 1120,

Check Box 5 26 CFR 1.671-5(c) & (d) 706, 709

Transfers credits from the Transfers credit from bank's

Local bank's account to the escrow account at IRS to Refund credits to Estate(YOU) minus

bank's escrow account at the Estate's escrow account at the taxes rate via a tax return

IRS IRS

File a 1099-A and receive 1099-OID for

total credits deposit of check, withdrawals

and endorsed from bank account.

Credit cards are OID-able; ATM withdrawals

Estate is Lender; Bank is the Payer; Includes Digital Autograph

Bank is the Borrower Estate is the Recipient

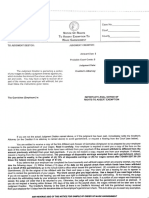

HOW TO CALCULATE OID FOR A LOAN WITH A MATURITY DATE

Scenario #3 (Ex: Mortgage, Car, Student Loan)

(Stated

Redemption Price)

Stated X (Years to

Redemption Price

@ Maturity

Original Issue Price OID Maturity) X

(0.0025). If

less than OID, then

OID=0

OID

Annual

OID Tax Report for Loans with Payments for

a Maturity Date

26 USC 1273 & 26 USC 1275 OIDs on

Mortgage, Car

Loan or Student

Loan

Years

of Term

You can amend your tax return up to

3 years using IRS Forms 1040, 1041.

To file prior to 3 years, use IRS Form

706, 709. Tax Class 5.

Potrebbero piacerti anche

- Nonprofit Law for Religious Organizations: Essential Questions & AnswersDa EverandNonprofit Law for Religious Organizations: Essential Questions & AnswersValutazione: 5 su 5 stelle5/5 (1)

- OID Tax Diagram 3Documento2 pagineOID Tax Diagram 3ricetech100% (14)

- 1099 Oid Puzzle by Myron 7-4-2019Documento2 pagine1099 Oid Puzzle by Myron 7-4-2019ricetech100% (20)

- Request Ltr2Bank For OIDsDocumento2 pagineRequest Ltr2Bank For OIDsricetech96% (48)

- Request Ltr2Bank For OIDsDocumento2 pagineRequest Ltr2Bank For OIDsricetech100% (15)

- Request Ltrs2 3rd Party Collectors For OIDDocumento1 paginaRequest Ltrs2 3rd Party Collectors For OIDricetech100% (3)

- Prisoner ReliefDocumento4 paginePrisoner Reliefricetech100% (16)

- Sample Ltr2 FudiciaryTrustee4 OIDs 3 - 2020Documento3 pagineSample Ltr2 FudiciaryTrustee4 OIDs 3 - 2020ricetech100% (22)

- Request Sample Ltr2CFO - Trustee For OIDs 11 - 2017Documento2 pagineRequest Sample Ltr2CFO - Trustee For OIDs 11 - 2017ricetech92% (13)

- 2 - Oid MethodDocumento2 pagine2 - Oid MethodSovereign62996% (49)

- SampleRequest Ltr2Trustee For OIDs 12 - 2017Documento3 pagineSampleRequest Ltr2Trustee For OIDs 12 - 2017ricetech50% (4)

- Seth Sundberg 1099 OID Indictment, Complaint, Motion To DismissDocumento43 pagineSeth Sundberg 1099 OID Indictment, Complaint, Motion To DismissBob Hurt89% (28)

- Special Deposit PackageDocumento1 paginaSpecial Deposit Packagericetech100% (24)

- Complete Removal of Debt On 3rd Party Debt Collectors 2-28-22Documento2 pagineComplete Removal of Debt On 3rd Party Debt Collectors 2-28-22ricetech100% (6)

- 1099IODDocumento10 pagine1099IODpreston_402003100% (28)

- Debt Removal Complete ProcessDocumento3 pagineDebt Removal Complete Processricetech94% (64)

- Basic Sample Executor Estate Ltr2Creditors 10 - 2017Documento1 paginaBasic Sample Executor Estate Ltr2Creditors 10 - 2017ricetech100% (18)

- 1099 ExplDocumento17 pagine1099 Expldcsshit100% (11)

- 1-8-09 - Patrick - Call - Revisited - Final - Version 1Documento22 pagine1-8-09 - Patrick - Call - Revisited - Final - Version 1api-1973110989% (18)

- 1099-OID and Its HistoryDocumento14 pagine1099-OID and Its Historyjupiterskye81% (16)

- 1099-Oid Interview SanitizedDocumento24 pagine1099-Oid Interview Sanitizedcamwills2100% (6)

- Updated Letter To Escrow Holder 1aDocumento3 pagineUpdated Letter To Escrow Holder 1aapi-19731109100% (7)

- Money Order Keating Style ExampleDocumento2 pagineMoney Order Keating Style Examplekbarn389100% (77)

- 1099 Oid in DepthDocumento29 pagine1099 Oid in Depthpauldawalll75% (8)

- Updated To Stop or Pre - Foreclosure of Real Property - Affidavit & InstructionsDocumento4 pagineUpdated To Stop or Pre - Foreclosure of Real Property - Affidavit & Instructionsricetech100% (7)

- 1099oid ConversationDocumento40 pagine1099oid Conversationsmart5446100% (34)

- InstructionsDocumento6 pagineInstructionslyocco191% (11)

- Definitions in PackageDocumento1 paginaDefinitions in Packagericetech100% (6)

- Request 1099-OID On Court CaseDocumento2 pagineRequest 1099-OID On Court CaseJeromeKmt100% (31)

- Irs Form 1099 OidDocumento43 pagineIrs Form 1099 Oidblcksource98% (44)

- Surrender Cover LetterDocumento1 paginaSurrender Cover Letterricetech93% (15)

- Estate LTRH Notice4express Trust - MCR SanitizedDocumento4 pagineEstate LTRH Notice4express Trust - MCR Sanitizedricetech98% (44)

- 1 - Instructions - Enforcement Process (1) OidDocumento5 pagine1 - Instructions - Enforcement Process (1) Oidchickenlickenhennypenny100% (9)

- Learn The ABCs and Get Your CAP Rev 3Documento9 pagineLearn The ABCs and Get Your CAP Rev 3sc100% (22)

- 1099 OidDocumento40 pagine1099 OidTheeMerovingian98% (50)

- Automobile Certificate of TitleDocumento2 pagineAutomobile Certificate of Titlericetech80% (10)

- GSA Process Overview 4-24-2018Documento12 pagineGSA Process Overview 4-24-2018Tynesha95% (44)

- 709 Form 2005 SampleDocumento4 pagine709 Form 2005 Sample123pratus91% (11)

- Chapter 11 GuidelinesDocumento32 pagineChapter 11 Guidelinesricetech100% (10)

- Updated Letter To Escrow Holder 1Documento3 pagineUpdated Letter To Escrow Holder 1api-19731109100% (25)

- Report 1099Documento9 pagineReport 1099William Smith100% (3)

- f1099 OID 1096 TemplateDocumento3 paginef1099 OID 1096 Templatethenjhomebuyer100% (24)

- Fitl /: How Out Form FnstructionsDocumento7 pagineFitl /: How Out Form Fnstructionslauren5maria100% (14)

- 1099 Oid'sDocumento8 pagine1099 Oid'sNikki Cofield81% (16)

- 1099A Ach PMO Method UnleashedDocumento3 pagine1099A Ach PMO Method UnleashedPeter Moulden86% (7)

- Template Affidavit of Contract For Grant Deed & Filing Transferred InstructionsDocumento2 pagineTemplate Affidavit of Contract For Grant Deed & Filing Transferred Instructionsricetech100% (6)

- ANC Affidavit NotarizedDocumento3 pagineANC Affidavit Notarizedricetech96% (28)

- 001 The ProcessDocumento3 pagine001 The ProcessBhakta Prakash95% (109)

- Rohm Apollo tax refund claim filed out of timeDocumento2 pagineRohm Apollo tax refund claim filed out of timeJosef MacanasNessuna valutazione finora

- Summary Note - EXTINGUISHMENT OF OBLIGATIONSDocumento8 pagineSummary Note - EXTINGUISHMENT OF OBLIGATIONSGiah Mesiona100% (2)

- Banking Law QuestionsDocumento9 pagineBanking Law QuestionsLara De los Santos75% (4)

- NOTESDocumento12 pagineNOTESBhea Irish Joy BuenaflorNessuna valutazione finora

- OID Tax Diagram-1 - 2018Documento3 pagineOID Tax Diagram-1 - 2018ricetech88% (8)

- Class 12 Accounts Notes Chapter 9 Studyguide360Documento19 pagineClass 12 Accounts Notes Chapter 9 Studyguide360Ali ssNessuna valutazione finora

- G.R. No. 189563 April 7, 2014 Gilat Satellite Networks, LTD., Petitioner, United Coconut Planters Bank General Insurance Co., INC., RespondentDocumento5 pagineG.R. No. 189563 April 7, 2014 Gilat Satellite Networks, LTD., Petitioner, United Coconut Planters Bank General Insurance Co., INC., RespondentJasielle Leigh UlangkayaNessuna valutazione finora

- Wage Garnishment FormDocumento6 pagineWage Garnishment FormNeil JonesNessuna valutazione finora

- 2223 Ipp Ws Solicitors Accounts 02 Ce01 GuideDocumento24 pagine2223 Ipp Ws Solicitors Accounts 02 Ce01 GuideGRZRGNessuna valutazione finora

- UCC IRS Form For Discharge of Estate Tax Liens f4422Documento3 pagineUCC IRS Form For Discharge of Estate Tax Liens f4422Anonymous 23VuLx100% (23)

- Cestui Que Vie Indemnity 1935scr0 Key IndemnityDocumento12 pagineCestui Que Vie Indemnity 1935scr0 Key IndemnityHenoAlambreNessuna valutazione finora

- Death of A Taxpayer 2021Documento2 pagineDeath of A Taxpayer 2021Finn Kevin100% (1)

- The Promissory Note As A Substitute For MoneyDocumento30 pagineThe Promissory Note As A Substitute For MoneyricetechNessuna valutazione finora

- Proclamation 2039-Bank Holiday, March 6-9, 1933, InclusiveDocumento2 pagineProclamation 2039-Bank Holiday, March 6-9, 1933, InclusivericetechNessuna valutazione finora

- STOP or PRE - Foreclosure of Real Property Affidavit &instructionsDocumento2 pagineSTOP or PRE - Foreclosure of Real Property Affidavit &instructionsricetech100% (6)

- Surrender Birth CertificateDocumento1 paginaSurrender Birth Certificatericetech82% (11)

- Updated To Stop or Pre - Foreclosure of Real Property - Affidavit & InstructionsDocumento4 pagineUpdated To Stop or Pre - Foreclosure of Real Property - Affidavit & Instructionsricetech100% (7)

- Sample Ltr2 FudiciaryTrustee4 OIDs 3 - 2020Documento3 pagineSample Ltr2 FudiciaryTrustee4 OIDs 3 - 2020ricetech100% (22)

- Template Affidavit of Contract For Grant Deed & Filing Transferred InstructionsDocumento2 pagineTemplate Affidavit of Contract For Grant Deed & Filing Transferred Instructionsricetech100% (6)

- Complete Removal of Debt On 3rd Party Debt Collectors 2-28-22Documento2 pagineComplete Removal of Debt On 3rd Party Debt Collectors 2-28-22ricetech100% (6)

- 2 - Affidavit Sample LTRHD 4 Express Trust Discharge Paymnt - SN - Notary Sanitized Rev 1Documento3 pagine2 - Affidavit Sample LTRHD 4 Express Trust Discharge Paymnt - SN - Notary Sanitized Rev 1ricetech100% (9)

- Wiley 2014 CPAExcel Exam Review Study GuideDocumento4 pagineWiley 2014 CPAExcel Exam Review Study Guidericetech100% (1)

- Time - Table of ContentDocumento1 paginaTime - Table of ContentricetechNessuna valutazione finora

- Sample Affidavit of Negative AvermentDocumento4 pagineSample Affidavit of Negative Avermentricetech100% (5)

- Prisoner ReliefDocumento4 paginePrisoner Reliefricetech100% (16)

- Travel in MichiganDocumento3 pagineTravel in Michiganricetech100% (4)

- Travel in MichiganDocumento3 pagineTravel in Michiganricetech100% (4)

- Sample Mail Wi Foreign AddressesDocumento1 paginaSample Mail Wi Foreign Addressesricetech100% (6)

- Chapter 11 GuidelinesDocumento32 pagineChapter 11 Guidelinesricetech100% (10)

- Redemption ServiceDocumento5 pagineRedemption Servicericetech96% (23)

- Special Deposit PackageDocumento1 paginaSpecial Deposit Packagericetech100% (24)

- You Want OutDocumento2 pagineYou Want Outricetech100% (16)

- Definitions in PackageDocumento1 paginaDefinitions in Packagericetech100% (6)

- 0385 Affidavit of Cert of ID NOTARIZED Sanitized - MCRDocumento1 pagina0385 Affidavit of Cert of ID NOTARIZED Sanitized - MCRricetech86% (7)

- OID Tax Diagram-1 - 2018Documento3 pagineOID Tax Diagram-1 - 2018ricetech88% (8)

- Estate LTRH Notice4express Trust - MCR SanitizedDocumento4 pagineEstate LTRH Notice4express Trust - MCR Sanitizedricetech98% (44)

- Questions About IssuerDocumento1 paginaQuestions About Issuerricetech100% (2)

- Mandatory Notice Fsia & FaraDocumento2 pagineMandatory Notice Fsia & Fararicetech100% (13)

- Guideline, Research WritingDocumento70 pagineGuideline, Research WritingBilal Kemal89% (18)

- Memoir Reflection PaperDocumento4 pagineMemoir Reflection Paperapi-301417439Nessuna valutazione finora

- Trigonometric Ratios: Find The Value of Each Trigonometric RatioDocumento2 pagineTrigonometric Ratios: Find The Value of Each Trigonometric RatioRandom EmailNessuna valutazione finora

- Research 2: First Quarter - Week 5 and 6Documento20 pagineResearch 2: First Quarter - Week 5 and 6Rutchel100% (2)

- Goal Setting - FinalDocumento2 pagineGoal Setting - Finalapi-301796386Nessuna valutazione finora

- The Effect of Peer Pressure To The Grade 10 Students of Colegio San Agustin Makati 2018-2019 That Will Be Choosing Their Respective Strands in The Year 2019-2020Documento5 pagineThe Effect of Peer Pressure To The Grade 10 Students of Colegio San Agustin Makati 2018-2019 That Will Be Choosing Their Respective Strands in The Year 2019-2020Lauren SilvinoNessuna valutazione finora

- Research Methodology: 1st SemesterDocumento11 pagineResearch Methodology: 1st SemesterMohammed Khaled Al-ThobhaniNessuna valutazione finora

- An Analysis of Extrinsic Elements in The Freedom Writers MovieDocumento3 pagineAn Analysis of Extrinsic Elements in The Freedom Writers MovieNinda AlfiaNessuna valutazione finora

- The Babysitters Club Book ListDocumento5 pagineThe Babysitters Club Book ListLaura92% (12)

- Childhood and Growing UpDocumento108 pagineChildhood and Growing UpJules Exequiel Pescante SuicoNessuna valutazione finora

- Newsletter 3.1Documento12 pagineNewsletter 3.1mrifenburgNessuna valutazione finora

- Chapter 1-5 Teacher-Attributes (Full Research)Documento26 pagineChapter 1-5 Teacher-Attributes (Full Research)Honeyvel Marasigan BalmesNessuna valutazione finora

- Music in Movies Lesson PlanDocumento2 pagineMusic in Movies Lesson Planapi-448118853Nessuna valutazione finora

- EN5VC IIIf 3.8 - 2023 2024 - Day2Documento3 pagineEN5VC IIIf 3.8 - 2023 2024 - Day2Ma. Feliza Saligan100% (1)

- Dapat na Pagtuturo sa Buhangin Central Elementary SchoolDocumento14 pagineDapat na Pagtuturo sa Buhangin Central Elementary SchoolKATHLEEN CRYSTYL LONGAKITNessuna valutazione finora

- Child Labour PPT PresentationDocumento20 pagineChild Labour PPT Presentationsubhamaybiswas73% (41)

- GR 12 Term 1 2019 Ps TrackerDocumento104 pagineGR 12 Term 1 2019 Ps TrackerAlfred NdlovuNessuna valutazione finora

- (ACV-S06) Week 06 - Pre-Task - Quiz - Weekly Quiz (PA) - INGLES IV (36824)Documento5 pagine(ACV-S06) Week 06 - Pre-Task - Quiz - Weekly Quiz (PA) - INGLES IV (36824)Gianfranco Riega galarzaNessuna valutazione finora

- .Ukmedia3349ican DLD Guide Final Aug4 PDFDocumento44 pagine.Ukmedia3349ican DLD Guide Final Aug4 PDFraneemghandour28Nessuna valutazione finora

- FEDERAL PUBLIC SERVICE COMMISSION SCREENING/PROFESSIONAL TESTSDocumento36 pagineFEDERAL PUBLIC SERVICE COMMISSION SCREENING/PROFESSIONAL TESTSCh Hassan TajNessuna valutazione finora

- Flirt English (2. Staffel): 1. Welcome to BrightonDocumento3 pagineFlirt English (2. Staffel): 1. Welcome to BrightonFamilyGangNessuna valutazione finora

- Role of Educational Resource Centre in Teaching MathematicsDocumento17 pagineRole of Educational Resource Centre in Teaching MathematicsVrinthaNessuna valutazione finora

- Senior High School: Introduction To The Human PhilosophyDocumento28 pagineSenior High School: Introduction To The Human PhilosophyAvelina SantosNessuna valutazione finora

- Class X-BookDocumento16 pagineClass X-BookPratyakshNessuna valutazione finora

- Differianted Math Lesson Plan Triangular Prisms - Diego MenjivarDocumento4 pagineDifferianted Math Lesson Plan Triangular Prisms - Diego Menjivarapi-491433072Nessuna valutazione finora

- DLL WEEK 1 health 9 4TH QUARTERDocumento3 pagineDLL WEEK 1 health 9 4TH QUARTERAdhing ManolisNessuna valutazione finora

- F18Documento4 pagineF18Aayush ShahNessuna valutazione finora

- Unit 5 MCQDocumento44 pagineUnit 5 MCQcreepycreepergaming4Nessuna valutazione finora

- Attitudes of student teachers towards teaching professionDocumento6 pagineAttitudes of student teachers towards teaching professionHuma Malik100% (1)

- InTech-A Review of Childhood Abuse Questionnaires and Suggested Treatment ApproachesDocumento19 pagineInTech-A Review of Childhood Abuse Questionnaires and Suggested Treatment ApproacheskiraburgoNessuna valutazione finora