Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

GO Ms No 16 13 02 2019

Caricato da

undyingDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

GO Ms No 16 13 02 2019

Caricato da

undyingCopyright:

Formati disponibili

GOVERNMENT OF TELANGANA

ABSTRACT

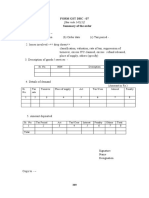

The Telangana Goods and Services Tax Act, 2017 – Waiver of the late fee for

late filing of Form GSTR- 3B for the month of July, 2017 onwards –

Notification - Orders - Issued.

REVENUE (CT.II) DEPARTMENT

G.O.Ms.No. 16 Dated: 13-02-2019

Read:-

From the Commissioner of State Tax, Telangana, Hyderabad, Lr No.

CST’s Ref No. A(1)/103/2017, Dated 21.01.2019.

*****

ORDER:-

The following Notification will be published in an Extra-ordinary issue of

Telangana Gazette Dt. 13.02.2019.

NOTIFCATION

In exercise of the powers conferred by section 128 of the Telangana

Goods and Services Tax Act, 2017 (Act No.23 of 2017), (hereafter in this

notification referred to as the said Act), the State Government, on the

recommendations of the Council , and in supersession of the notification

issued in G.O. Ms No. 214, Revenue (CT-II) Department, Dt. 26-09-2017,

251, Revenue (CT-II) Department, Dt. 22-11-2017 and G.O.Ms No. 292,

Revenue (CT-II) Department, Dt. 20-12-2017, except as respects things done

or omitted to be done before such supersession, hereby waives the amount of

late fee payable by any registered person for failure to furnish the return in

FORM GSTR-3B for the month of July, 2017 onwards by the due date under

section 47 of the said Act, which is in excess of an amount of twenty-five

rupees for every day during which such failure continues:

Provided that where the total amount of state tax payable in the said

return is nil, the amount of late fee payable by such registered person for

failure to furnish the said return for the month of July, 2017 onwards by the

due date under section 47 of the said Act shall stand waived to the extent

which is in excess of an amount of ten rupees for every day during which such

failure continues:

Provided further that the amount of late fee payable under section 47 of

the said Act shall stand waived for the registered persons who failed to furnish

the return in FORM GSTR-3B for the months of July, 2017 to September,

2018 by the due date but furnishes the said return between the period from

22nd December, 2018 to 31st March, 2019.

(BY ORDER AND IN THE NAME OF THE GOVERNOR OF TELANGANA)

SOMESH KUMAR

PRINCIPAL SECRETARY TO GOVERNMENT

To:

The Commissioner of Printing, Stationery and Stores Purchase (Publication Wing) Telangana,

Hyderabad for publication of the Notification (he is requested to supply 50 copies of the

notification to this Department and 300 copies to Commissioner of Commercial Taxes,

Telangana, Hyderabad)

The Commissioner of State Tax, Telangana State, Hyderabad.

The Secretary, GST Council, 5th Floor, Tower II, Jeevan Bharti Building,Janpath Road,

Connaught Place, New Delhi-110 001.

The Principal Chief Commissioner, GST Hyderabad Zone, Kendriya GST,Bhavan, L.B.

Stadium Road, Basheer Bagh, Hyderabad-500 004.

The Accountant General, Telangana State, Hyderabad.

The Law (A) Department

The P.S to Principal Secretary to Hon’ble Chief Minister (NR)

The P.S. to Principal Secretary to Government,

Revenue (CT & Ex) Department

Sf /Sc.

//FORWARDED :: BY ORDER//

SECTION OFFICER.

Potrebbero piacerti anche

- Quotation For Eco-Wooden Structure: Prepared By: Wood Barn India Private LimitedDocumento6 pagineQuotation For Eco-Wooden Structure: Prepared By: Wood Barn India Private LimitedundyingNessuna valutazione finora

- Government of Andhra Pradesh: ST NDDocumento1 paginaGovernment of Andhra Pradesh: ST NDundyingNessuna valutazione finora

- Government of Andhra PradeshDocumento2 pagineGovernment of Andhra PradeshundyingNessuna valutazione finora

- Rigvedic AllDocumento11 pagineRigvedic AllundyingNessuna valutazione finora

- Government of Andhra Pradesh: (RS. in Lakhs)Documento1 paginaGovernment of Andhra Pradesh: (RS. in Lakhs)undyingNessuna valutazione finora

- Vedic Sarasvati-Ganga Civilisation: The Script of Indus Valley Civilisation-16Documento117 pagineVedic Sarasvati-Ganga Civilisation: The Script of Indus Valley Civilisation-16undyingNessuna valutazione finora

- Bhirrana To Mehrgarh and Beyond in The C PDFDocumento33 pagineBhirrana To Mehrgarh and Beyond in The C PDFundying100% (2)

- The Collapse of The Indus-Script Thesis: The Myth of A Literate Harappan CivilizationDocumento39 pagineThe Collapse of The Indus-Script Thesis: The Myth of A Literate Harappan CivilizationundyingNessuna valutazione finora

- Green Grace HyderabadDocumento36 pagineGreen Grace HyderabadundyingNessuna valutazione finora

- Sindhu Is The Vedic SarasvatiDocumento132 pagineSindhu Is The Vedic SarasvatiundyingNessuna valutazione finora

- Telangana Records of Rights (Ror-1B) : Search Through Thousands of Indiafilings Articles and Videos..Documento14 pagineTelangana Records of Rights (Ror-1B) : Search Through Thousands of Indiafilings Articles and Videos..undyingNessuna valutazione finora

- Revised LRS BRS Booklet-2015-2016 PDFDocumento14 pagineRevised LRS BRS Booklet-2015-2016 PDFundyingNessuna valutazione finora

- Revised LRS BRS Booklet-2015-2016Documento14 pagineRevised LRS BRS Booklet-2015-2016undyingNessuna valutazione finora

- Deaddiction For PornDocumento21 pagineDeaddiction For PornundyingNessuna valutazione finora

- Center For The Study of Language and InformationDocumento12 pagineCenter For The Study of Language and InformationundyingNessuna valutazione finora

- List of Commodity Which Comes Under @5%Documento2 pagineList of Commodity Which Comes Under @5%undyingNessuna valutazione finora

- GO Ms No 17 13 02 2019Documento1 paginaGO Ms No 17 13 02 2019undyingNessuna valutazione finora

- 11 - Chapter 3Documento28 pagine11 - Chapter 3undyingNessuna valutazione finora

- (See Rule 142 (5) ) : Sr. No. HSN DescriptionDocumento1 pagina(See Rule 142 (5) ) : Sr. No. HSN DescriptionundyingNessuna valutazione finora

- GST DRC 07 PDFDocumento1 paginaGST DRC 07 PDFundyingNessuna valutazione finora

- 10 Filing of ReturnDocumento16 pagine10 Filing of ReturnundyingNessuna valutazione finora

- BSNL Vat Good VatDocumento21 pagineBSNL Vat Good VatundyingNessuna valutazione finora

- Rigved & Indus-Saraswati Valley Civilization: Inking The LinkDocumento27 pagineRigved & Indus-Saraswati Valley Civilization: Inking The LinkundyingNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Name: Piyush Pradeep Kolte PRN: 20180302037 Subject: GST LawDocumento11 pagineName: Piyush Pradeep Kolte PRN: 20180302037 Subject: GST LawPîyûsh KôltêNessuna valutazione finora

- Bobby & BettyDocumento6 pagineBobby & BettySimon KingNessuna valutazione finora

- GSTR-2A Data Entry Instructions Worksheet Name GSTR-2A Table Reference Field NameDocumento39 pagineGSTR-2A Data Entry Instructions Worksheet Name GSTR-2A Table Reference Field NameSanjay kumarNessuna valutazione finora

- Invoice 1279626839Documento2 pagineInvoice 1279626839Abhik Kumar MajiNessuna valutazione finora

- CH 2Documento29 pagineCH 2syahirahNessuna valutazione finora

- Paystub 202102Documento1 paginaPaystub 202102dsnreddyNessuna valutazione finora

- Chapter 11Documento5 pagineChapter 11张心怡Nessuna valutazione finora

- Blue Minimalist Management Strategic PresentationDocumento14 pagineBlue Minimalist Management Strategic PresentationTheRealNessuna valutazione finora

- Cir vs. FilinvestDocumento4 pagineCir vs. FilinvestAlphaZuluNessuna valutazione finora

- Zimbabwe 2012 Tax TablesDocumento1 paginaZimbabwe 2012 Tax TablesnheksNessuna valutazione finora

- Practice Problems - Transfer TaxesDocumento2 paginePractice Problems - Transfer TaxesuchishaiNessuna valutazione finora

- Midwest Office ProductsDocumento2 pagineMidwest Office Productsgaurav_ajmani80% (5)

- 2009 Tax Table 1040 1040NR For H1B, F1, J1, OPTDocumento13 pagine2009 Tax Table 1040 1040NR For H1B, F1, J1, OPTusvisataxesNessuna valutazione finora

- Hotel Bills OCRDocumento1 paginaHotel Bills OCRNishantNessuna valutazione finora

- HRA at Capital CostDocumento1 paginaHRA at Capital Costsudhir mishraNessuna valutazione finora

- Payslip Month of December 2022Documento1 paginaPayslip Month of December 2022Amir SohailNessuna valutazione finora

- L A S T P A y C e R T I F I C A T eDocumento7 pagineL A S T P A y C e R T I F I C A T eapi-3710215Nessuna valutazione finora

- Reverse Charge MechanismDocumento19 pagineReverse Charge MechanismSayyadNessuna valutazione finora

- FIFO LIFO PracticalDocumento16 pagineFIFO LIFO Practicalkrishna aroraNessuna valutazione finora

- AEROCON E-Way Bill SystemDocumento1 paginaAEROCON E-Way Bill SystemCHANDRATAN HALDARNessuna valutazione finora

- PGBPDocumento9 paginePGBPYandex PrithuNessuna valutazione finora

- US Internal Revenue Service: f941sb AccessibleDocumento1 paginaUS Internal Revenue Service: f941sb AccessibleIRSNessuna valutazione finora

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Documento1 paginaSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONessuna valutazione finora

- Income Tax Fundamentals 2014 Whittenburg 32nd Edition Test Bank Chapters 1 5-7-12Documento27 pagineIncome Tax Fundamentals 2014 Whittenburg 32nd Edition Test Bank Chapters 1 5-7-12KimberlyThomasknwy100% (40)

- A Donor's Guide: Vehicle DonationDocumento10 pagineA Donor's Guide: Vehicle Donationriki187Nessuna valutazione finora

- PIS ReportDocumento1 paginaPIS ReportSamar ahmedNessuna valutazione finora

- Sarath Salary SlipDocumento5 pagineSarath Salary Slipbindu mathaiNessuna valutazione finora

- Affidavit Declaration FormDocumento1 paginaAffidavit Declaration FormGolden LightphNessuna valutazione finora

- TATA 1mg Healthcare Solutions Private Limited: Barmer, Barmer, 344702, INDocumento1 paginaTATA 1mg Healthcare Solutions Private Limited: Barmer, Barmer, 344702, INNehru LalNessuna valutazione finora

- May 3 Iesco Online BillDocumento1 paginaMay 3 Iesco Online BillShehzad hasnainiNessuna valutazione finora