Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

NEGO

Caricato da

Ricarr ChiongCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

NEGO

Caricato da

Ricarr ChiongCopyright:

Formati disponibili

(Sources: The Law on Negotiable Instruments by Hector De Leon & Commercial Law Review by Sundiang & Aquino)

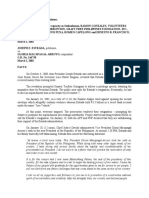

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 1 of 74

WHAT IS A NEGOTIABLE INSTRUMENT? FORMS OF NEGOTIABLE INSTRUMENTS

a. Common forms:

It is a written contract for the payment of money a. Promissory notes — those in

which is intended as a substitute for money and which the issuer has promised

passes from one person to another as money, in to pay. It is an unconditional

such a manner as to give a holder in due course promise in writing made by one

the right to hold the instrument free from person to another, signed by the

defenses available to prior parties. maker, engaging to pay on

demand or at a fixed

determinable future time a sum

FUNCTION & IMPORTANCE OF

certain in money to order or to

NEGOTIABLE INSTRUMENTS

bearer.; and

a. They are used as a substitute for money; b. Bills of exchange — those in

b. They constitute the media of exchange which the issuer has ordered a

for most commercial transactions; and third person to pay. It is an

c. Serves as a medium of credit unconditional order in writing

transaction. addressed by one person to

another, signed by the person

giving it, requiring the person to

CHARACTERISTICS OF NEGOTIABLE

whom it is addressed to pay on

INSTRUMENTS

demand or at a fixed

Negotiable instruments have two important determinable future time a sum

features: certain in money to order or to

a. Negotiability — it is the quality or bearer.

attribute of a bill or note whereby it may b. Special types:

pass from one person to another similar a. Certificates of deposit;

to money, so as to give the holder in due b. Bank notes;

course the right to collect on the c. Due bills;

instrument the sum payable for himself d. Bonds;

free from any defect in the title of any of e. Drafts;

the prior parties or defenses available to f. Trade acceptances; and

them among themselves. g. Banker’s acceptances.

b. Accumulation of secondary contracts —

once an instrument is issued, additional

IN CASE OF DOUBT

parties can become involved. Secondary

parties are picked up and carried along Where the meaning is doubtful, the courts have

with them as they are negotiated from adopted the policy of resolving in favor of the

one person to another, or in the course negotiability of the instrument.

of negotiation of a negotiable

instrument, a series of juridical ties This is so as to encourage the free circulation of

between the parties thereto arise either the negotiable papers because of the admittedly

by law or by privity. indispensable function that they perform in

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 2 of 74

commercial business transactions in any given named therein is the owner of a

country and the world at large. designated number of shares of stock.

g. Warehouse receipt — it is a document of

INSTRUMENTS WITH LIMITED title likewise without an unconditional

NEGOTIABILITY promise or order to pay a sum certain in

money.

a. Letter of credit — it is a letter from a h. Pawn ticket — it is not a negotiable

merchant or bank or banker in one instrument under the Negotiable

place, addressed to another, in another Instruments Law.

place or country, requesting the

addressee to pay money or deliver goods

to a third party therein named, the

writer of the letter undertaking to

provide him the money for the goods or

to repay him.

b. Trust receipt — it is a document of

security pursuant to which a bank

acquires a “security interest” in the

goods under trust receipt. The

transaction involves a loan feature

represented by a letter of credit and a

security feature which is in the covering

trust receipt which secures an

indebtedness. (Lee v. CA, 375 SCRA 579,

2012.)

c. Treasury warrant — it is a government

warrant for the payment of money such

as that issued in favor of a public officer

or employee covering payment or

replenishment of cash advances for

official expenditures; it is payable out of

a specific fund or appropriation.

(Abubakar v. Auditor General, 81 Phil.

359.)

d. Postal money order — it is an order for

the payment of money to the payee

named therein drawn by one post office

upon another under authority of law. It

is subject to the restrictions and

limitations under postal laws and

regulations.

e. Bill of lading — it is without an

unconditional promise or order to pay a

sum certain in money.

f. Certificate of stock — it is a written

instrument signed by a proper officer of

a corporation stating that the person

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 3 of 74

Writing includes not only that which has been

written on paper and with pen or pencil but also

that which is in print or has been typed.

There is no such thing as an oral negotiable

instrument. An oral promise can make it difficult

to determine the liability and create a danger to

fraud.

The instrument must be signed by the maker or

drawer:

FORM OF NEGOTIABLE INSTRUMENTS General Rule: signature of the maker or drawer

is placed at the lower right hand corner of the

An instrument to be negotiable must conform to

instrument, or may appear in any part thereof

the following requirements:

whether at the top, middle, or bottom, or at the

a. It must be in writing and signed by the

margin.

maker or drawer;

b. Must contain an unconditional promise

His signature is prima facie evidence of his

or order to pay a sum certain in money;

intention to be bound as either maker or drawer.

c. Must be payable on demand or at a fixed

However, if the signature is so placed upon the

or determinable future time;

instrument that is is not clear in what capacity

d. Must be payable to bearer or order; and

the person intended to sign, he is deemed an

e. Where the instrument is addressed to a

indorser and not a maker or drawer.

drawee, he must be named or otherwise

indicated therein with reasonable

PROBLEM:

certainty. (Sec. 1, NIL.)

(W-U-P-O-A) Juan Cruz borrowed P1,000.00 from Pedro Santos as

evidenced by a promissory note executed by X as maker.

All other requisites of negotiability are present in the note

FORMAL REQUIREMENTS OF except that Juan Cruz did not affix his usual signature

NEGOTIABILITY, IN GENERAL thereon. As Juan was ailing that time, he was only able to

put “X” in the blank space meant for the signature of the

Form & content: maker. Is the requisite that the instrument must be signed

A negotiable instrument is a contractual by the maker complied with?

obligation to pay money. Yes. The letter “X” is sufficient to comply with the

requirement that the instrument must be signed by the

maker. It appears from the problem that such letter was

Matters to be considered: adopted by Juan Cruz with the intent to authenticate the

In determining the negotiability of an instrument. It is not necessary that the signature is the usual

instrument, the following must be considered: signature of the maker.

a. The whole of the document;

b. Only what appears on the face of the

The instrument must contain an unconditional

instrument; and

promise or order to pay:

c. The provisions of the Negotiable

A commercial paper or instrument involving the

Instruments Law, especially in Sec. 1.

payment of money must contain either a

promise to pay or an order to pay.

FORMAL REQUISITES, EXPLAINED

The instrument must be in writing:

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 4 of 74

Promise or order to pay must be unconditional: PROBLEM:

An unqualified order or promise to pay is The instrument must be payable in a sum certain

unconditional within the meaning of NIL though in money:

coupled with: The promise or order must call for the payment

a. An indication of a particular fund our of of a sum certain in money.

which reimbursement is to be made or a

particular account to be debuted with Money — it is the medium of exchange

the amount, or authorized or adopted by a domestic or foreign

b. A statement of the transaction which government as part of its currency. It includes all

gives rise to the instrument. (Sec. 3, NIL.) legal tender, in which it is that currency which a

debtor can legally compel a creditor to accept in

It is conditional if: payment of a debt in money when tendered by

a. It is an order to promise to pay out of a the debtor in the right amount.

particular fund;

b. An instrument payable upon a If the obligor or the maker is given the option to

contingency. deliver something in lieu of money, the

instrument is not negotiable.

Particular Fund vs. Fund for Reimbursement

INDICATING FUND FOR If the holder is given the election to require

PARTICULAR FUND REIMBURSEMENT something to be done in lieu of payment of

There is only one act 1. The drawee pays money, the instrument is still negotiable.

— the drawee pays the payee from

directly from the his own funds The sum payable is a sum certain, although it is

particular fund afterwards. to be paid (Sec. 2, NIL.):

indicated. 2. The drawee pays a. With interest;

himself from the b. By stated installments;

particular fund i. The dates of each installment

indicated. must be fixed or at least

Particular fund Particular fund determinable and the amount to

indicated is the indicated is not the be paid for each installment

direct source of direct source of must be stated.

payment. payment. c. By stated installments with a provision

that, upon default in payment of any

installment or of interest, the whole

A treasury warrant was issued by Mr. BA in his capacity as

disbursing officer of the Food Administration, a shall become due;

government instrumentality. The warrant states that it is i. Acceleration dependent on

“payable for additional cash advances for the Food maker — negotiable.

Campaign in La Union” and the amount stated therein is ii. Acceleration at option of holder

“payable from the appropriation for Food

Administration.” The warrant is now in the hands of Mr.

— not negotiable.

BA who claims to be a holder in due course. Can BA be d. With exchange, whether at a fixed rate

considered a holder in due course? or at the current rate;

No, he cannot, because he is not even the holder i. If the instrument is an inland or

of the warrant. He cannot be a holder because the warrant

domestic bill, both drawn and

is not even negotiable. The promise to pay is conditional

because the sum is payable out of a particular fund. payable at the same place, there

(Benjamin Abubakar v. The Auditor General, 31 Phil. 359, can be no exchange so that a

July 31, 1948.)

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 5 of 74

stipulation for payment in PROBLEM:

exchange may be disregarded.

e. With costs of collection of an attorney’s Determine if the following instrument is negotiable

fee, in case payment shall not be made “FOR VALUE RECEIVED, I/we jointly and severally promise

at maturity to pay to the ITM Corporation, the sum of ONE MILLION

NINETY THREE THOUSAND SEVEN HUNDRED EIGHTY NINE

PESOS & 71/100 only (P1,093,789.71), Philippine

Currency, the said principal sum, to be payable in 24

The instrument must be payable at a fixed or monthly installments starting July 15, 1978 and every 15th

determinable future time or on demand: of the month thereafter until fully paid…”

An instrument is payable at a determinable The note is not negotiable because it is not

future time, which is expressed to be payable— payable to order or to bearer. It is payable to a specified

person. (Consolidated Plywood Industries, Inc. v. IFC Leasing

a. At a fixed period after date or sight; & Acceptance Corp., 149 SCRA 448, April 30, 1987.)

b. On or before a fixed or determinable

future time specified therein;

c. On or at a fixed period after the The drawee must be named:

occurrence of a specified event which is Where the instrument is addressed to a drawee,

certain to happen, though the time of he must be named or otherwise indicated with

happening be uncertain. (Sec. 4, NIL.) reasonable certainty. The holder must know to

whom he should present it for acceptance

Payable on demand: and/or for payment.

The instrument should be paid the

moment it is presented for payment. A bill may be addressed to more than one

drawee jointly; whether they are partners or not;

Payable at a determinable future time: but not two or more drawees in the alternative

The instrument is payable at a or in succession.

determinable future time if it is expressed to be

payable.

ACTS IN ADDITION TO PAYMENT OF

MONEY

The instrument must be payable to order or to

bearer: General Rule: The instrument is non-negotiable

An instrument that is payable to a specified if it contains a promise or order to do any act in

person or entity is not negotiable because the addition to the payment of money.

NIL requires that the instrument must be

payable to order or to bearer. Exceptions (under Sec. 5, NIL.):

a. Sale of collateral securities

A certificate of time deposit is negotiable when b. Confession of judgment

it is stated: “this is to certify that bearer has c. Waiver of benefit granted by law

deposited xxx, repayable to said depositor.” d. Election of holder to require some other

However, where the said certificates were act.

delivered, but not indorsed as security, there is

no negotiation.

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 6 of 74

PROBLEM: c. In case of P/N, the date of issue, and in

case of bill of exchange, the date of last

The manager & treasurer of MORB Company executed and

delivered to PNB a P/N whereby the company promises to negotiation, for the purpose of

pay to the order of PNB the amount of P61,000.00. The note determining whether a party acted

contains the following stipulations: “Without defalcation, within a reasonable time in making

value received; and do hereby authorize any attorney in the presentment for payment.

Philippines, in case this note be not paid at maturity, to

appear in the name and confess judgment for the above

sum with interest, cost of suit and attorney’s fees of 10% for PROBLEM:

collection, a release of all errors and waiver of rights to

inquisition and appeal, and to the benefit of all laws Can a bill of exchange or a promissory note qualify as a

exempting property, real or personal, from levy or sale.” negotiable instrument if: (a) it a not dated; (b) or the day

MORB claims that the instrument is not negotiable because and month, but not the year of its maturity, is given; (c) or

the above stipulations are invalid. Is MORB correct? it is payable to “cash”; (d) or it names two alternative

The negotiability of the instrument is not affected drawees; (e) or it does not state the place where it is made

by the stipulations. Although MORB is correct in stating that or payable?

the stipulations are void, it is still negotiable if all other (a) Yes. Sec. 6(a) provides that negotiability of an

requirements of Sec. 1 are present. They are in the nature of instrument is not affected if it is not dated.

stipulations authorizing confession of judgment which is (b) No. Absence of the year of maturity affects the

considered void for being against public policy in this negotiability. Time for payment is not

jurisdiction. However under Sec. 5, it provided that the determinable.

negotiable character of an instrument is not affected by a (c) Yes. Sec. 9(d) provides that an instrument is

provision which authorizes confession of judgment if the payable to bearer if the name of the payee

instrument be not paid at maturity. (Phil. National Bank v. does not purport to be the name of any

Manila Oil Refining & By-Products, Co., 43 Phil. 444.) person.

(d) No. Sec. 128 provides that a bill may not be

addressed to 2 or more drawees in the

alternative or succession.

(e) Negotiability of an instrument is not affected

OMISSIONS OF DATE if it does not state the place where it is made

The validity and negotiable character of an or where it is payable.

instrument are not affected by the fact that:

a. It is not dated;

b. Does not specify the value given, or that

OMISSION OF VALUE

any value has been given therefor;

c. Does not specify the place where it is It is usual to state in the instrument that it is

drawn or the place where it is payable; given for “value received” without specifying

d. Bears a seal; what that value is. But it is not even necessary to

e. Designates a particular kind of current state that value has been received for the

money in which payment is to be made. instrument because consideration is presumed.

(Sec. 6, NIL.) (Sec. 24, NIL)

General Rule: The date in a bill or note is not

OMISSION OF PLACE

necessary.

An instrument does not specify the place of

Exceptions: payment is presumed to be payable at the place

a. Where said date is tied to the date of of residence or business of the maker or drawer.

issue;

b. Where interest is stipulated for the

purpose of determining when interest is

to run;

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 7 of 74

e. One or more several payees; or

PRESENCE OF SEAL

f. The holder of an office for the time

The fact that the instrument bears a seal does no being. (Sec. 8, NIL)

destroy its negotiability. There is no difference in

legal effect between sealed and unsealed private PROBLEM:

writings.

Is a certificate of time deposit wherein it is stated: “This is

to certify that bearer has deposited xxx, repayable to said

PAYABLE ON DEMAND depositor” negotiable?

It is negotiable being payable to bearer. However,

An instrument is payable on demand— where the CTDs were delivered, but not indorsed as security,

a. Where it is expressed to be payable on there is no negotiation; at most the holder would be a holder

demand, or at sight, or on presentation; for value up to the extent of his lien under Sec. 27 of the NIL

or a pledgee under the Civil Code.

or

b. In which no time for payment is

expressed;

c. Where an instrument is issued, PAYABLE TO BEARER

accepted, or indorsed when overdue, it

The instrument is payable to bearer—

is, as regards the person so issuing,

a. When it is expressed to be so payable; or

accepting, or indorsing it, payable on

b. When it is payable to a person named

demand. (Sec. 7, NIL)

therein or bearer; or

c. When it is payable to the order of a

Par (a): an instrument is payable on demand not

fictitious or non-existing person, and

only as between the immediate parties but also

such fact was known to the person

as to subsequent parties.

making it so payable; or

Par (b): refers only to immediate parties since

d. When the name of the payee does not

between the immediate parties there is no

purport to be the name of any person; or

difference between a holder in due course and a

e. When the only or last indorsement is an

person not a holder in due course.

indorsement in blank. (Sec. 9, NIL)

An instrument payable on demand is due and

Bearer— person in possession of a bill or note

payable immediately after delivery.

which is payable to bearer or legally qualifies as

a bearer instrument.

(NOTE: “on demand” is ordinarily used for

promissory notes; “at sight” is ordinarily used for

When an instrument is payable to bearer,

bills of exchange)

payment to any person in possession thereof in

good faith and without notice that his title is

PAYABLE TO ORDER defective, at or after maturity, discharges the

instrument.

The instrument is payable to order where it is

Fictitious person— one who, though named as

drawn payable to the order of a specified person

payee in an instrument, has no right to it because

or to him or his order. It may be drawn payable

the maker or drawer so intended and it matters

to the order of:

not, whether the name of the payee used by him

a. A payee who is not maker, drawer, or

be that one living or dead, or one who never

drawee;

existed.

b. The drawer or maker; or

c. The drawee; or

d. Two or more payee jointly; or

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 8 of 74

Ante-dating or post-dating an instrument does

CRITERION OF NEGOTIABILITY

not render it invalid or non-negotiable by the

Clear intention of the parties — the substance of fact alone. It may be negotiated before or after

the transaction rather than its form is one of the the date given as long as it is not negotiated after

criterion of negotiability; its maturity. The person to whom the instrument

Use of foreign language — it is still negotiable so date is delivered acquires the title thereto as

even though it is written in a foreign language of the date of delivery.

Mere defect in language or grammatical error —

it does no render an instrument non-negotiable If the ante-dating or post-dating is done for an

illegal or fraudulent purpose, the instrument is

rendered invalid.

PRESUMPTION AS TO DATE

If the instrument bears a date, it is presumed

WHEN DATE MAY BE INSERTED

that said date is the date when it was made by

the maker, drawn by the drawer, accepted by Date may be inserted by the holder—

the drawee, or indorsed by the payee or holder. a. Where an instrument is payable at fixed

period after date but is issued undated;

Generally, a date is not essential to make an and

instrument negotiable. b. Where an instrument is payable at a

fixed period after sight but the

acceptance is undated.

DATE IN INSTRUMENT PAYABLE ON

DEMAND

The insertion of a wrong date does not avoid the

Date of issue or last negotiation — it is required instrument in the hands of a subsequent holder

under Sec. 71 that a promissory note must be in due course; but as to him the date so inserted

presented for payment within a reasonable time is to be regarded as the true date. (Sec. 13, NIL)

after its issue and in case of a bill of exchange,

within a reasonable time after the last

INSERTION OF WRONG DATE

negotiation. Otherwise, persons secondarily

liable may be released from their liability. As to holder with knowledge — insertion of

wrong date in an undated instrument by one

Importance of the date — date of issue of the having knowledge of the true date of issue or

promissory note or the date of the last acceptance will avoid the instrument as to him

negotiation of the bill of exchange is, therefore, but not as to a subsequent holder in due course

essential for the purpose of determining who may enforce the same notwithstanding the

whether a party has acted within a reasonable improper date.

time but not to make the instrument negotiable.

As to subsequent holder in due course —

insertion of wrong date constitutes a material

ANTE-DATED & POST-DATED

alteration; nevertheless, in the hands of a holder

Ante-dated — contains a date earlier than the in due course, the date inserted, even if wrong,

true date of its issuance. is to be regarded as the true date.

Post-dated — contains a date later than the true

date of its issuance.

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 9 of 74

is not available as against a holder in due

STEPS IN ISSUANCE OF NEGOTIABLE

course.

INSTRUMENT

There are 2 steps involved in the issuance of PROBLEM:

every negotiable instrument, namely:

a. The mechanical act of writing the Give the effect of an incomplete but delivered instrument:

instrument completely and in Where the instrument is wanting in any material

accordance with the requirements of particular the person in possession thereof, is prima

Sec. 1; and facie presumed authorized to complete it.

A signature on a blank paper delivered by the person

b. The delivery of the complete instrument

making the signature in order that it may be converted

by the maker or the drawer to the payee into a negotiable instrument operates as prima facie

or holder with the intentions of giving authority to fill it up as such for any amount.

effect to it. In both cases, the instrument must be filled out in

accordance with the authority given and within

reasonable time in order that it may be enforced against

INCOMPLETE INSTRUMENT, DELIVERED any person who became a party thereto prior to its

completion. Persons negotiating after its completion are

liable because of their warranties.

The holder or the person in possession has prima A holder in due course may enforce the instrument as if

it has been filled out strictly in accordance with the

facie authority to complete an incomplete

authority given and within a reasonable time.

instrument by filling out the blanks therein. It is no defense in an action to enforce a negotiable

Material particular — any particular promissory note that it was signed in blank as Sec. 14 of

proper to be inserted in a negotiable the NIL concedes prima facie authority of the person in

instrument to make it complete, and the possession of negotiable instruments to fill in the blanks.

(Quirino Gonzales Logging Concessionaire, et al. V. CA,

power to fill in the blanks extends to every G.R. No. 126568, April 30, 2003.)

complete feature of the instrument.

(Linthlicum v. Bagby, 102 Atl. 997)

The authority to complete is not an authority INCOMPLETE INSTRUMENT,

to alter. The holder has no authority to UNDELIVERED

change the amount after it has been filled The fact that an incomplete instrument,

out, or to insert the words “or order” or “or completed without authority, had not been

bearer” after the name of the payee. delivered, is a defense even against against a

holder in due course.

A signature on a blank paper delivered in

order that may be converted into a The invalidity, therefore, shall only be with

negotiable instrument operates as a prima reference to the parties whose signature appear

facie authority to fill it out as such for any on the instrument before and not after delivery.

amount.

Example:

The instrument may be enforced only against

a party prior to completion if filled out strictly Suppose M makes a note for P10,000 with the

in accordance with the authority given and name of the payee in blank and keeps it in his

within a reasonable time. drawer. P steals the note and inserts his name

as payee and then indorses the note to A, A to

The defense that the instrument had not B, B to C, and C to D, a holder in due course. Can

been filled out in accordance with the D enforce the note against M?

authority given and within a reasonable time

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 10 of 74

No, the law is specific in that the instrument Issue— the first delivery of the

is not a valid contract in the hands of any instrument, complete in form, to a

holder. The phrase “any holder” includes a person who takes it as holder

holder in due course. As the signature of M Holder— payee or indorsee of a bill or

was placed thereon before delivery, he does note who is in possession of it, or the

not assume any responsibility whatsoever. bearer thereof

In this case, a real defense exists. The The delivery of the instrument is the final act

instrument may be considered a forgery essential to its consummation as an

insofar as M is concerned since both the two obligation. Delivery may be made either by

steps in the execution of a negotiable the maker or drawer himself or through a

instrument are not complied with. There is a duly authorized agent.

prima facie presumption of delivery which

M must rebut by proof to the contrary. If a complete instrument is found in the

possession of an immediate party or a remote

The negligence on the part of M may render party other than a holder in due course, there

him liable to a holder in due course. is prima facie presumption of delivery but

subject to rebuttal.

Further, the instrument can be enforced

against P, A, B, and C because, as indorsers, An undelivered instrument is inoperative

they warrant that the instrument that the because delivery is a prerequisite to liability.

instrument is genuine and in all respects If the instrument is no longer in the

what it purports to be. As their signatures possession of the person who signed it and it

appear on them instrument after delivery, is complete in its terms, “a valid and

the instrument is valid as to them. intentional delivery him is presumed until the

contrary is proved.”

In the case of P, he is liable not merely Immediate parties— those who are

because he is an indorser but also because immediate in the sense of having or

he is the one responsible for the theft, and being held to know of the conditions

the completion and negotiation of the or limitations placed upon the

instrument. delivery of the instrument.

(Contemplates privity not proximity)

PROBLEM: Remote parties— parties who are not

in direct contractual relation to each

Give the effect of an incomplete undelivered instrument: other

Non-delivery of an incomplete instrument is a real

defense. (Sec. 15, NIL) If delivery was made or authorized, it may

be shown to have been conditional, or for

a special purpose only and not for the

COMPLETE INSTRUMENT, UNDELIVERED

purpose of transferring the property to

Every contract on negotiable instrument even if the instrument.

it is completely written is incomplete and

revocable until its delivery for the purpose of When delivery is made, it is presumed to

giving it effect. be made with the intention to transfer

Delivery— transfer of possession, actual ownership of the instrument to the payee.

or constructive, from one person to If a complete instrument is in the hands of

another. the holder in due course, a valid delivery

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 11 of 74

thereof by all parties prior to him is A signed a blank check and kept it inside the drawer of

conclusively presumed. his desk in his office. B, a janitor of the office, opened

the drawer, got the check and filled out the amount of

P100,000 with B’s name as payee. Thereafter, B

A presumption is said to be conclusive

indorsed the check to C and C indorsed the check to D.

when admission of evidence to the Should the drawee bank dishonor the check? Can D

contrary is not allowed. hold A liable? Would your answer be the same if D was

a holder in due course? How about B and C, are they

PROBLEMS: liable to D?

No, D cannot hold A liable because the instrument is

Give the effect of a complete but undelivered instrument: incomplete and undelivered. Sec. 15, an incomplete

Delivery is essential to the validity of any negotiable and undelivered instrument would not be a valid

instrument. As between immediate parties and those instrument in the hands of any holder as against any

who are similarly situated, delivery must be coupled person whose signature was placed before delivery.

with the intention of transferring title to the Yes, the answer would be the same even if D is a HIDC

instrument. because Sec. 15 says “ANY HOLDER.”

If If the instrument is in the hands of a holder in due Yes, B & C are liable. B was the forger and an

course, valid delivery to him is conclusively indorser, and he warrants that the instrument.

presumed.

T The defense of want of delivery of complete

instrument is only a personal defense..

RULES OF CONSTRUCTION IN CASE OF

Jose Reyes signed a blank check, and in his haste to AMBIGUITY OR OMISSION

attend a party, left the check at the top of his executive

desk in his office. Later, Nazareno forced open the door Where the language of the instrument is

to Reyes’ office, and stole the blank check. Nazareno ambiguous or there are omissions therein,

immediately filled in the amount of P50,000 and a the following rules apply:

fictitious name as payee on the said check. Nazareno

then indorsed the check in the payee’s name and

a. If the sums expressed in words

passed it to Rodan. Thereafter, Roldan indorsed the and figures differ— the amount in

check to Dantes. words must control

(a) Can Dantes enforce the check against Jose (NOTE: By current BSP Circulars,

Reyes?

when a check is defective because

(b) If Dantes is a holder in due course will your

answer to (a) be the same? amount in words and figures

(a) Dantes cannot enforce the instrument against differ, it is automatically returned

Jose Reyes. He can raise the defense that the by the Phil. Clearing House for

incomplete instrument was not delivered since technical deficiencies)

the check was only stolen and filled out by

Nazareno.

b. If words are ambiguous or

(b) Yes, provided that Dantes is a holder in due uncertain— words outweigh

course. If an incomplete instrument has not figures.

been delivered, it will not, if completed and c. If date is not specified for when

negotiated without authority be a valid

interest should run— the interest

contract against any holder, even a holder in

due course. (1985 Bar) runs from the date of the

instrument or if undated from the

date of its issue.

d. If the instrument is undated— it

shall be considered dated as of

the date of its issue

e. If the written and printed words

are in conflict— the written words

should prevail as against printed

words

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 12 of 74

f. If the instrument is either a bill or personal liability, the following requisites

a note— the holder may either at must concur:

his election a. He is duly authorized;

g. If there is doubt in what capacity b. He adds words to his signature

the signatory has signed— he is indicating that he signs as an

deemed to be an indorser. agent, for or on behalf of a

h. If the instrument is signed by two principal, or in representative

or more persons—liability may be capacity; and

either solidary or joint. c. He discloses his principal.

] If the agent signs a note or bill in his own

LIABILITY OF PERSON SIGNING IN TRADE

name and discloses no principal, he is

OR ASSUMED NAME

personally bound, and evidence to the

General Rule: Only persons whose contrary may not be admitted to relieve

signature appear on an instrument are him from personal liability. (Phil. Nat’l

liable thereon. Bank v. Aruego, 102 SCRA 530)

Exceptions: The mere addition of descriptive words

a. Where a person signs in a trade or without disclosing the principal will not

assumed name; relieve the signer from personal liability.

b. The principal is liable if a duly On who signs an instrument in a

authorized agent signs on his own representative capacity but without

behalf; disclosing his principal will still be

c. In case of forgery, the forger is personally liable.

liable even if his signature does

not appear on the instrument;

SIGNATURE BY PROCURATION

d. Where the acceptor makes his

acceptance of a bill on a separate Procuration— act by which a principal gives

paper; and power to another to act in his place as he could

e. Where a person makes a written himself. (Fink v. Scott, 143 S.E. 305.)

promise to accept a bill before it is

drawn. The term gives a warning to that the agent has

but a limited authority, so that is the duty of the

person dealing with him to inquire into the

SIGNATURE BY AN AUTHORIZED AGENT

extent of his authority.

The signature of any party may be made

by a duly authorized agent. No particular

EFFECT OF INDORSEMENT BY

form of appointment is necessary for this

INCAPACITATED PERSONS

purpose and the authority of the agent

may be established as in other cases of Minors:

agency. (Sec. 19, NIL) He is not bound by his indorsement, but he is not

incapacitated to transfer certain rights. It is also

not a personal defense which can be set up by

LIABILITY OF PERSON SIGNING AS AGENT

parties other than the minor; but it is a real

In order that an agent who signs a defense available to the minor. A minor may be

negotiable instrument may escape held bound by his signature in an instrument

where he is found guilty of actual fraud

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 13 of 74

committed by specifically stating that he is of age drawee bank cannot debit the drawer’s account

when, in fact he is not. and that loss shall be borne by the drawee bank.

Other incapacitated persons PROBLEMS:

Their incapacity is a real defense available even

M, maker, prepared a P/N payable to the order of A,

against a holder in due course. but he did not sign the same and left it inside his

drawer. X, a thief, stole the instrument, forged M’s

signature and delivered the same to A. A indorsed the

FORGERY instrument to B, B in turn indorsed it to C, then C to D,

the present holder.

Forgery— the counterfeit-making or fraudulent

(a) Against whom can D enforce payment?

alteration of any writing, and may consist in the (b) Will your answer be the same it were a bearer

signing of another’s name or the alteration of an instrument?

instrument in the name, amount, description of (a) D can enforce payment from X, A, B, & C but

the person with intent to defraud. not against M. Sec. 23, the forged signature of

M is wholly inoperative and no right to enforce

payment was acquired against M by virtue of

When a signature if forged or made without the the forged signature.

authority of the person whose signature it However, the indorsers are liable because they

purports to be, it is wholly inoperative, and no are parties after the forgery and are therefore

precluded from setting up such forgery against

right to retain the instrument, or to give a

the present holder. When they indorsed the

discharge, or to enforce payment against any instrument, they warranted that the

party, can be acquired through or under such instrument is genuine and in all respects what

signature, unless the party against whom it is it purports to be.

sought to enforce such right is precluded from (b) The answer would be the same even if it were

a bearer instrument.

setting up the forgery or want of authority.

Fernando forged the name of Daniel, manager of a

In case forgery of an instrument payable to trading company, as drawer of a check. BPI, the drawee

order, it is not only the person whose signature bank, did not detect the forgery and paid the amount.

was forged who would not be liable but also the May the bank charge the amount paid against the

parties prior to such person. account of the alleged drawer?

No. The drawee may not charge the account of the

trading company. A bank is charged with the

In case forgery of an instrument payable to knowledge of the signature of its customer and it

bearer, the party whose indorsement is forged is should not honor any check bearing a forged

liable to a holder in due course, but not to one signature of the drawer. (1977 Bar)

who is not a holder in due course.

Juan de la Cruz signs a P/N payable to Pedro or bearer,

Despite forgery of the signature, there may be and delivers it personally to Pedro. The latter somehow

misplaces the note and Carlos finds the note lying

parties who shall be precluded from setting up around the corridor of the building. Carlos indorses P/N

forgery or want of authority: to Juana, for value, by forging the signature of Pedro.

a. Those who warrants like the indorsers or May Juana hold Juan liable on the note?

acceptors; Yes. The P/N is payable to bearer hence title is

transferred thru negotiation by mere delivery of the

b. Those who ratified the forgery, express note. Juana may obtain title even if there is no

or implied; and indorsement.

c. Those who were negligent.

The general rule is that in case of forgery of the

indorsement of the payee of the check and the If the

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 14 of 74

Hernan issued a check payable to the order of Fernando signature appears thereon has become a party

in the sum of P12,000, and drawn on X Bank. The check thereto for value.

was delivered to Matilde by Adriano for encashment.

At that time, the check had the indorsements of

Fernando and Rosa. When Matilde encashed it with X WHAT CONSTITUTES VALUE

Bank, she affixed her signature on the check. Upon

Matilde’s receipt of the cash proceeds of the check she Value is any consideration sufficient to support a

turned over the amount to Adriano. X Bank was simple contract. An antecedent or pre-existing

informed that the alleged indorsement of the payee debt constitutes value; and is deemed such

Fernando was a forgery, since the latter had died 2

years ago. X Bank having refunded the amount to

whether the instrument is payable on demand or

Hernan, sued Matilde, who refused to return the at a future time.

money.

(a) Was X Bank correct in paying Hernan? A valuable consideration does not have to be

(b) Does X Bank have a cause of action against

adequate; it is sufficient if it is a valuable one.

Matilde?

(a) Yes. X Bank was correct in paying Hernan. The

forged signature of the payee is wholly

inoperative and no right to give discharge to HOLDER FOR VALUE

the instrument was acquired by X Bank thru the Holder for value— one who has given a valuable

forged signature. When X Bank paid Matilde, it

did not comply with the order of its client.

consideration for the instrument issued or

Hence, it is the bank’s duty to reimburse negotiated to him.

Hernan.

(b) Yes. Matilde is a general indorser and as such The holder is deemed as such not only as regards

she warrants that she has good title to the

the party to whom value has been given by him

instrument. Having breached such warranty,

she is no responsible to the collecting bank. but also in respect to all those who become

Even if she encashed the check for Adriano as parties prior to the time when value was given.

an accommodation party, her liability as an

indorser remains. A holder of a negotiable instrument is presumed

to be a holder for value until the contrary be

shown by any party who claims otherwise.

The holder is a holder for value only to the extent

that the consideration agreed upon has been

paid, delivered, or performed. Non-performance

of the obligation will give rise to partial or full

defense of failure of consideration as the case

may be.

PRESUMPTION OF CONSIDERATION One who has taken a negotiable instrument as

Consideration— the immediate, direct, or collateral security for a debt has a lien on the

essential reason which induces a party to enter instrument.

into a contract

If the amount of the instrument is more than the

It is not necessary that the consideration be debt secured by such instrument, the pledgee is

expressly stated in the instrument. Presumption a holder for value to the extent of his lien.

is that it has been issued for a valuable

consideration and tat every person whose If the amount of the instrument is less than or

the same as the debt secured by such

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 15 of 74

instrument, the pledgee is a holder for value for After making payment to the holder, the

the full amount and may recover all. accommodation party may recover from the

accommodated party for reimbursement.

WANT OF CONSIDERATION

ACCOMMODATION

REGULAR PARTY

Absence of consideration— a total lack of any PARTY

valid consideration for the contract, Signs an instrument Signs the instrument for

inconsequence of which the alleged contract without receiving value value

must fail. therefor

Signs an instrument for Does not sign for the

Failure of consideration— failure or refusal of the purpose of lending purpose of lending his

one of the parties to do, perform or comply with his name to some other name

the consideration agreed upon. person

May always show by Cannot disclaim or limit

parol evidence that he is his personal liability as

LIABILITY OF ACCOMMODATION PARTY

only an accommodation appearing on the

Accommodation note or bill— one to which the party instrument by parol

accommodation party has put his name, without evidence

consideration, for the purpose of Cannot avail of the May avail of the defense

accommodating some other party who is to use defense of absence or of absence or failure of

it, and is expected to pay it. (Loan of one’s credit failure of consideration consideration against a

line) against a holder in due holder not in due course

course

Accommodation party— one who has signed the After paying the holder, Ay not sue any

instrument as maker, drawer, acceptor, or may sue for subsequent party for

indorser, without consideration, for the purpose reimbursement the reimbursement

of lending his name to another party. accommodated party,

although a subsequent

Accommodated party— one in whose favor a party

person, without consideration, signs an

instrument for the purpose of lending his credit

and enabling said party to raise money upon it.

The accommodation party is liable on the

instrument to a holder for value notwithstanding

such holder at the time of taking the instrument

knew him to be only an accommodation party.

The absence of consideration between the

accommodation party and the accommodated

party does not itself constitute a valid defense

against a holder for value even though he knew

of it when he became a holder. (Ang Tiong v.

Lorenzo Ting, 22 SCRA 713)

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 16 of 74

subject to all defense available against

the latter.

b. Transferee does not become holder of

instrument.

c. When indorsement is subsequently

obtained, the transfer operates as a

negotiation only as of the time the

indorsement is actually made.

Assignment— the transfer of the title to an

instrument, with the assignee generally taking

METHODS OF TRANSFER OF A only such title or rights as his assignor has,

NEGOTIABLE INSTRUMENT subject to all defenses available against his

a. Issue — first delivery of the instrument assignor.

complete in form, to a person who takes

it as holder. An instrument’s legal life NEGOTIATION ASSIGNMENT

does not begin until it is issued by the Refers only to Refers generally to an

maker or drawer to the first holder; negotiable ordinary contract

b. Negotiation — operate to make the instruments

transferee of a negotiable instrument Transferee is a holder Transferee is an

the holder thereof. It ordinarily involves assignee

indorsement; A holder in due An assignee is subject

c. Assignment — involves a transfer of course is subject only to both real and

rights under a contract. to real defenses personal defenses

A holder in due An assignee merely

Negotiation — the transfer of a negotiable course may acquire a steps into the shoes

instrument from one person to another made in better title or greater of the assignor

such a manner as to constitute the transferee rights under the

the holder thereof. instrument than

those possessed by

METHODS OF NEGOTIATION the transferor or prior

party

If the instrument is payable to bearer, it is A general indorser An assignor does no

negotiated by mere delivery alone without warrant the solvency warrant the solvency

indorsement. of prior parties of prior parties unless

expressly stipulated

If the instrument is payable to order, it is or the insolvency is

negotiated by the indorsement of the holder known to him

completed by delivery. An indorser is not An assignor is liable

liable unless there be even without notice

Delivery if an order instrument without presentment and of dishonor

indorsement: notice of dishonor

a. Transfer operates as an ordinary Governed by the Governed by Articles

assignment and the assignee is merely Negotiable 1624 to 1635 of the

placed in the position of the assignor, Instruments Law Civil Code

the former acquiring the instrument

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 17 of 74

1. One that

INDORSEMENT

specifies the

Indorsement— the writing of the name of the person to

payee on the instrument with the intent either whom the

to transfer title to the same, or to strengthen the instrument is to

security of the holder by assuming a contingent be paid; and

liability for its future payment, or both. 2. One that

specifies the

An indorsement is a mode of transfer and it person to

involves a new contract and an obligation on the whose order

part of the indorser— an implied guaranty that the instrument

the instrument will be duly paid according to the is to be payable.

terms thereof. b. Blank — no indorsee is specified

and it is done by affixing the

Necessity of Indorsement indorser’s signature

a. Indorsement is essential to the ii. As to the kind of title transferred

execution of an instrument payable to a. Restrictive

the order of the maker or drawer. i. When considered a

b. It is essential to the negotiation of an restrictive indorsement:

order instrument, not if a bearer 1. Prohibits the

instrument. further

c. It is not necessary to a mere assignment negotiation of

of a negotiable or non-negotiable the instrument;

instrument. or

2. Constitutes the

Form of Indorsement indorsee the

The NIL does not require an exclusive form by agent of the

which an indorsement may be accomplished. It indorser; or

only needs to be in writing. 3. Vest the title in

the indorsee in

Place of Indorsement trust for or to

a. On the instrument itself; or the use of some

b. On a separate piece of paper attached to other persons

the instrument (allonge) ii. Rights of restrictive

indorsee

General Rule: Indorsement must be of the entire 1. To receive

instrument. payment of the

instrument;

Exception: When there was previous partial 2. To bring any

payment. action thereon

that the

Kinds of Indorsement indorser could

i. As to the methods of negotiation bring;

a. Special — designates the 3. To transfer his

indorsee rights as such

i. Forms of special indorsee, where

indorsement: the form of the

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 18 of 74

indorsement bank or corporation, it is deemed prima facie to

authorizes him be payable to the bank or corporation of which

to do so. he is such officer, and may be negotiated by

b. Non-restrictive either the indorsement of the bank or

iii. As to scope of liability of indorser corporation or the indorsement of the officer.

a. Qualified — constitutes the (Sec. 42, NIL)

indorser a mere assignor of the

title to the instrument. It may be Where the name of a payee or indorsee is

made by adding to the wrongly designated or misspelled, he may

indorser’s signature the words indorse the instrument as therein described

“without recourse” adding, if he thinks fit, his proper signature. (Sec.

b. Unqualified or General 43, NIL)

iv. As to presence or absence of limitations

a. Conditional — party required to Where any person is under obligation to indorse

pay the instrument may in a representative capacity, he may indorse in

disregard the condition and such terms as to negative personal liability. (Sec.

make payment fo the indorsee 44, NIL)

or his transferee whether the

condition has been fulfilled or Except where an indorsement bears date after

not. the maturity of the instrument, every

b. Unconditional negotiation is deemed prima facie to have been

v. Other kinds of indorsements effected before the instrument was overdue.

a. Joint (Sec. 45, NIL)

b. Successive

c. Irregular or Anomalous Except where the contrary appears, every

d. Facultative indorsement is presumed prima facie to have

been made at the place where the instrument is

If the instrument is originally payable to order, dated. (Sec. 46, NIL)

and it is negotiated by the payee by special

indorsement, the indorsement of the indorsee is General Rule: An instrument negotiable in origin

necessary to the further negotiation of the is always negotiable.

instrument.

Exceptions:

If the instrument is originally payable to bearer, a. When the instrument has been

it may be negotiated by mere delivery even if the restrictively indorsed; or

original bearer indorsed it specially but the b. When it has been discharged by

special indorser is liable to only such holders as payment or otherwise.

make title through his indorsement.

Striking out of Indorsement

Where an instrument is payable to the order of

two or more payees or indorsees who are not The holder may at any time strike out any

partners, all must indorse unless the one indorsement which is not necessary to his title.

indorsing has authority to indorse for the others. The indorser whose indorsement is struck out,

(Sec. 41, NIL) and all indorsers subsequent to him, are thereby

relieved from liability on the instrument. (Sec.

Where an instrument is drawn or indorsed to a 48, NIL)

person as “cashier” or other fiscal officer of a

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 19 of 74

If the instrument is payable to bearer, it may be If a prior party reacquires an instrument before

negotiated by mere delivery without maturity, he may negotiate the same further. But

indorsement. In case it is indorsed, it remains a after paying the holder, he may not claim

bearer instrument and may be further payment from any of the intervening parties.

negotiated by mere delivery. The holder may

strike out all intervening indorsements or any of Limits on renegotiation of instruments:

them for none of them is necessary to his title. b. Where it is payable to the order of third

person, and has been paid by the

If the instrument is payable to order, it may be drawer;

negotiated only by the indorsement of the payee c. Where it was made or accepted for

completed by delivery. accommodation and has been paid by

a. When the indorsement is special, the the party accommodated; and

indorsement of the special indorsee is d. In other cases, where the instrument is

necessary to the further negotiation of discharged when acquired by a prior

the instrument. If the indorsement is in party.

blank, the instrument becomes payable

to bearer and may be negotiated by

mere delivery.

Where the holder of an instrument payable to

his order transfers it for value without indorsing

it, the transfer vests in the transferee such title

as the transferor had therein, and the transferee

acquires, in addition, the right to have the

indorsement of the transferor. But for the HOLDER IN DUE COURSE

purpose of determining whether the transferee Classes of holders

is a hold in due course, the negotiation takes a. Holders simply;

effect as of the time when the indorsement is b. Holders for value; and

actually made. (Sec. 49, NIL) c. Holders in due course.

Sec. 49 is applicable only to an instrument that Ordinary holder (or mere holder) — a person who

is payable to order. qualifies as a holder but does not meet all the

conditions to qualify as a holder in due course.

i. The transaction operates as an equitable

assignment and the transferee acquires In the hands of any holder other than a holder in

the instrument for value without due course, a negotiable instrument is subject to

indorsing it. any and every defense or defect in the

ii. He cannot negotiate it. instrument, whether real or personal, as it it

iii. If the transferor had legal title, the were non-negotiable.

transferee acquires such title and, in

addition, the right to have the Rights of a holder in general

indorsement of the transferor. a. He may sue on the instrument in his

name; and

Reacquirer — a holder who negotiates an b. He may receive payment and if the

instrument and then subsequently reacquires it. payment is in due course, the instrument is

discharged.

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 20 of 74

What constitutes a holder in due course (HIDC) receives notice of infirmity in the instrument or

(COV-N) defect in the title of the holder, he is relieved

a. That it is complete and regular upon its from the obligation to make payment.

face;

b. That he became the holder of it before it Where the instrument has been transferred to

was overdue, and without notice that it him in consideration of his promise to make

has been previously dishonored, if such future payments to his transferor, he is under

was the fact; no legal obligation to pay the balance of the

c. That he took it in good faith and for amount he has agreed to pay on discovering the

value; infirmity or defect.

d. That at the time it was negotiated to

him, he had no notice of any infirmity in The title of a person who negotiates an

the instrument or defect in the title of instrument is defective in two ways:

the person negotiating it. a. In the acquisition

o He obtained the instrument or

All four conditions must concur in order to any signature by fraud, duress,

qualify a person as a holder in due course. If any or force and fear, or any

one of them is absent, the holder cannot be unlawful means, or for illegal

considered a holder in due course. consideration.

b. In the negotiation

There is a presumption that every holder is o He negotiated the instrument in

generally a holder in due course; but he who breach of faith, or under such

shall claim otherwise, shall have the burden of circumstances as amount to a

proof. fraud.

A holder of a non-negotiable instrument cannot In order to constitute notice of defect, the

attain the status of a holder in due course. He is transferee must have actual knowledge of the

a mere assignee subject to defenses, acquiring infirmity or defect; or knowledge of such facts

no better rights under the contract than those (which don’t appear on the face of the

possessed by the assignor. instrument) that his action in taking the

instrument amounts to bad faith. (Sec. 56, NIL)

A transferee who receives an instrument other

than by issue or negotiation cannot acquire the Rights of a holder in due course

status of a holder in due course regardless of the a. He may sue on the instrument in his own

other circumstances under which his acquisition name;

of the instrument took place. b. He may receive payment and if the

payment is in due course, the instrument

Where the transferee receives notice of any is discharged;

infirmity in the instrument or defect in the title c. He holds the instrument free from any

of the person negotiating the same before he defect of title of prior parties;

had paid te full amount agreed to be paid d. He holds the instrument free from

therefor, he will be deemed a holder in due defenses available to prior parties

course only to the extent of the amount therefor among themselves; and

paid by him. (Sec. 54, NIL) e. He may enforce payment of the

instrument for the full amount thereof

Where an instrument has been taken but the against all parties liable thereon.

purchaser has not yet paid anything, and he

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 21 of 74

Personal defenses cannot be set up against a Juan, intending to buy a car, saw an old friend, Pedro, who

holder in due course. is an agent to sell the car belonging to XYZ Clinic. After

negotiation, Juan decided to buy the said car. He drew upon

Real defenses attach to the instrument itself, request of Pedro, a crossed check for P1,000.00, payable to

hence, they would be available against all XYZ Clinic as evidence of good faith but which was merely

meant to be shown to XYZ Clinic by Pedro who received the

persons even as against a holder in due course. said check. The check would then be returned when Pedro

brings the car and its registration certificate for Juan’s

A holder, who is not a holder in due course, inspection. For failure of Pedro to bring the car and its

acquires the instrument subject to ALL certificate of registration, and to return the check, Juan

issued a “stop payment order” to the drawee bank. In the

DEFENSES, whether real or personal, because he meantime, Pedro paid the check to XYZ Clinic for the

is treated as a mere assignee of a non-negotiable hospital bill of his wife and was given P132.00 as change.

paper. May XYZ Clinic be considered a holder in due course, hence

entitled to recover?

PROBLEMS: XYZ Clinic may not be considered a holder in due course,

hence, not entitled to recover. Even though XYZ Clinic was

A is indebted to B in the amount of P100,000.00. In order to unaware of the circumstances with respect to the

raise funds to pay for his obligation, A sold his old car to C delivery of the check to Pedro, there are circumstances

on Jan. 25, 2019. A agreed to deliver the car to C on Jan. 30, that should have put him on inquiry. It should have been

2019. However, A convinced C to immediately issue a check noted that Juan had no relation with it; that the amount

and to make the check payable to B. A informed C that the of the check did not correspond exactly with the

check will be issued to B because of A’s outstanding obligation of Pedro to the clinic; and that the check is a

obligation. Hence, C issued a check to B to pay for the loan crossed check, meaning that it should only be deposited

of A payable on Jan. 30, 2019. The check was delivered to and may not be encashed should have put the clinic to

B thru A. B and C were not aware at that time that the car inquiry as to the possession of the check by Pedro, and

was sold, it was already destroyed by fire. A fraudulently why he used it to pay his account.

hid such fact in order to convince C to issue the check and

to convince B to accept the check. Can B, the payee of the Larry issued a negotiable P/N to Evelyn and authorized the

check, be considered a holder in due course? latter to fill out the amount in blank with his loan account

Yes. There is a presumption that he is a holder in in the sum of P1,000.00. However, Evelyn inserted

due course because there is nothing stated in the P5,000.00 in violation of the instruction. She negotiated the

facts which shows otherwise. Moreover, all the note to Julie who had knowledge of the infirmity. Julie in

requisites of Sec. 52 of the NIL are present in the turn negotiated said note to Devi for value and who had no

case because it appears that B is a holder of the knowledge of the infirmity. Supposing Devi indorses the

instrument who has taken the instrument complete note to Baby for value but who has knowledge of the

and regular in its face, he took it before it was infirmity, can the latter enforce the note against Larry?

overdue, it was not previously dishonored, he took Yes. The problems indicates that Baby is not a holder in

it in good faith and for value, and he had no notice due course. When she took the instrument, she had

of any infirmity in the instrument or a defect of the knowledge of the breach of trust committed by Evelyn

title of a prior party. against Larry. However, she has all the rights of a holder

in due course because she took the instrument from Devi,

who was a holder in due course. Although Baby is not a

holder in due course, she did not participate in the breach

of trust committed by Evelyn. Hence, Larry cannot set up

the defense that the instrument was completed in breach

of trust against Baby because such defense is a personal

defense. (1993 Bar)

DEFENSES

Defenses — grounds or reasons pleaded or

offered by the defendant in a case, showing why

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 22 of 74

the plaintiff as a matter of law or fact, should not Ultra vires act of Fraud in inducement

be given the relief he seeks. corporation

Fraud in factum or in Filling out blanks not

Kinds of Defenses esse contractus within authority

a. Real Defenses (Absolute or Universal) —

Illegality — if Duress or

those assertable against all parties,

declared void for any intimidation

including holders in due course; they

purpose

attach to the instrument itself; and they

Vicious force or Filling out blanks

challenge the validity of the instrument

violence beyond reasonable

itself.

time

o It does not render the

Want of authority Transfer in breach of

instrument valueless, it is only

faith

unenforceable against the party

entitled to set up the defense Prescription Mistake

but not against those to whom Discharge in Insertion of wrong

such a defense is not available. insolvency date

b. Personal Defenses (Limited or Equitable) Ante-dating or post-

— those available to prior parties among dating for illegal or

themselves but which are not good fraudulent purpose

against a holder in due course; includes

every defense available in actions under Kinds of Fraud

ordinary contract law; and they a. Fraud in the execution (fraud in factum)

challenge the validity of the agreement — present when a person is induced to

for which the instrument was issued. sign an instrument not knowing its

o They are available only against character as a note or bill

that person or subsequent o Exists in cases in where a person,

holder who stands in privity with without negligence, has signed

the party seeking to enforce it. an instrument which was a

o They can be used only between negotiable instrument, but was

original parties or immediate deceived as to the character of

parties or against one who is not the instrument and without

a holder in due course. knowledge of it.

o This kind of fraud is a real

defense because there is no

REAL DEFENSES PERSONAL DEFENSES contract.

o Example: When a person is

Minority (available Failure or absence of made to sign a document which

only to the minor) consideration he believes is an application for

Forgery Illegal consideration a credit card, but was in fact a

Non-delivery of Non-delivery of promissory note.

incomplete complete instrument b. Fraud in inducement (simple fraud) —

instrument the person who signs the instrument

Material alteration Conditional delivery intends to sign the same as a negotiable

of complete instrument but was induced to do so

instrument only through fraud.

o In this case, the consent was

vitiated by fraud

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 23 of 74

o This kind of fraud is a personal authority to draw the

defense because it does not instrument

prevent a contract. o Admits the existence of the

payee and his capacity to

PROBLEM: indorse

c. Certifier of a check

A induced B by fraud to make a P/N payable on demand

to the order of A in the sum of P50,000,000.00.

(a) Can A file an action successfully against the

maker, B, for the amount of the note?

(b) Further, A transfers the note to C who pays Secondarily liable parties

P50,000,000.00 therefor and acquires the

note under circumstances that make him a

a. Drawer of a bill of exchange

holder in due course. Can C file an action o Admits the existence of payee

successfully against B for the amount of the and his capacity to indorse

note? o Engages that the instrument

(a) No. B may raise the defense of fraud in

will be accepted or paid by the

inducement against A who is not a holder in

due course. party primarily liable

(b) Yes. Since C is presumed to be a holder in due o Engages that if the instrument

course. is dishonored and proper

proceedings are brought, he

will pay to the party entitled to

be paid

b. Indorser of a note or a bill

PRIMARILY LIABLE SECONDARILY LIABLE

Unconditionally bound Conditionally bound

PRIMARY AND SECONDARY LIABILITIES Absolutely required to Undertakes to pay the

Liability — obligation of a party to a negotiable pay the instrument instrument only after

instrument to pay the same according to its upon maturity certain conditions have

terms. been fulfilled

Primarily liable parties A person placing his signature upon an

a. Maker of a promissory note instrument otherwise than as maker, drawer, or

o Engages to pay according to acceptor is deemed to be an indorser, unless he

the tenor of the instrument clearly indicates by appropriate words his

o Admits the existence of the intention to be bound in some other capacity.

payee and his capacity to (Sec. 63, NIL)

indorse

b. Acceptor of a bill of exchange General Indorser — a person who signs his name

o Engages to pay according to on the back of an instrument

the tenor of his acceptance

o Admits the existence of the Irregular or Anomalous Indorsement — an

drawer indorsement for some purpose other than to

o Admits the genuineness of his transfer the instrument, or an indorsement by a

signature and his capacity and stranger to the instrument or by one not in the

actual or apparent chain of title, especially an

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 24 of 74

indorsement made prior to the delivery of the

instrument to the payee. Purpose is usually to

INDORSER DRAWER

add the signer’s credit to the instrument.

A party to either a note or Party only to a bill

An irregular or anomalous indorser is a person a bill

who: Does not make any Makes the admission

a. Not otherwise a party to an instrument, admission regarding the regarding the existence of

b. Places thereon his signature in blank, existence of the payee the payee and his then

c. Before delivery and his then capacity to capacity to indorse

indorse

Usually, an irregular or anomalous indorser is an Has warranties Makes no warranties

accommodation indorser.

WARRANTIES

IRREGULAR

Warranties of Qualified Indorser & Persons GENERAL INDORSER

INDORSER

negotiating by mere delivery Makes either a blank Always makes a blank

a. That the instrument is genuine and in all or special indorsement

respects what it purports to be; indorsement

b. That he has good title to it; Indorses the Indorses the

c. That all prior parties had capacity to instrument after its instrument before its

contract; delivery to the payee delivery to the payee

d. That he has no knowledge of any fact Liable only to parties Liable to the payee

which would impair the validity of the subsequent to him and subsequent

instrument or render it valueless parties unless he

The warranty of persons negotiating by mere signs for the

delivery extends to the immediate transferees accommodation of

only. the payee in which

case he is liable only

The liability of the one who negotiates by mere to all parties

delivery extends in favor only of his immediate subsequent to the

transferee. payee

The liability of the one who is a qualified indorser

extends to all subsequent holders who make title ENFORCEMENT OF LIABILITY

through his indorsement for a breach of any of Primarily liable parties

his warranties. a. Maker

o Liable the moment he makes the

Warranties of a General Indorser instrument

a. That the instrument is genuine and in all b. Drawee (Acceptor)

respects what it purports to be; o Liable the moment he accepts

b. That he has good title to it; the instrument

c. That all prior parties had capacity to

contract; Secondarily liable parties

d. That the instrument is, at the time of his a. Steps to Charge Secondary Parties in

indorsement, valid and subsisting. Promissory Note

The unqualified indorser also warrants that the

instrument will be honored.

NEGOTIABLE INSTRUMENTS LAW JUDGE E. BONGHANOY

Page 25 of 74

o Presentment for payment must

be made within the required

period to the maker

o Notice of dishonor should be

given, if P/N is dishonored by

non-payment by the maker.

b. Steps to Charge Secondary Parties in Bill

of Exchange

o Presentment for acceptance or

negotiation within a reasonable RULES ON PRESENTMENT FOR PAYMENT

time after it was acquired

o If dishonored by non- Presentment for payment — the presentation of

acceptance an instrument to the person primarily liable for

i. Notice of dishonor the purpose of demanding and receiving

should be given to the payment

indorsers and drawer

ii. If the bill is a foreign bill, When presentment for payment not necessary

there must be protest Presentment for payment is not necessary to

for dishonor by non- charge persons primarily liable. But it is

acceptance necessary to charge persons secondarily liable,

o If the bill is accepted except:

i. Presentment for a. As to drawer, where he has no right to

payment to the expect or require that the drawee or

acceptor should be acceptor will pay the instrument;

made b. As to indorser, where the instrument

1. If the bill is was made or accepted for his

dishonored accommodation and he has no reason to

upon expect that the instrument will be paid if

presentment presented;

for payment c. When dispensed with:

2. Notice of i. Where, after the exercise of

dishonor must reasonable diligence,

be given to presentment cannot be made

persons ii. Where the drawee is a fictitious

secondarily person

liable iii. By waiver of presentment,

ii. If the bill is a foreign bill, express or implied

protest for dishonor by d. Where the instrument has been

non-payment must be dishonored by non-acceptance.

made

c. Steps to Charge Acceptor for Honor and Requisites of Presentment for Payment

Referee in case of Need a. Must be made by the holder, or by some