Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Optimal Capital Structure

Caricato da

Scarlet SalongaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Optimal Capital Structure

Caricato da

Scarlet SalongaCopyright:

Formati disponibili

CHAPTER 3

OPTIMAL CAPITAL STRUCTURE

Reported by:

Gonzales, Jade Kristoffer Z.

Lorenzo, Raniel C.

Magat, Jillian C.

Sayde, Joan M.

Sison, Crisanto M.

Presented to:

Prof. Medina F. Orleans

Reporter: Crisanto M. Sison

It is the ultimate goal of the firm to maximize its market value or to maximize the

wealth of its owners. One of the ways in attaining this goal is to minimize the cost of

capital of the firm. We have learned in previous chapters that the weighted average cost

of capital of the firm is affected not only by cost of debt and equity but also by the capital

structure of the firm. Thus, the firm should maintain a capital structure that would result

to the lowest level of WACC and eventually maximize the firm’s stock prize.

Capital Structure – Mix of Debt, Preferred Equity, and Common Equity used to

finance company’s asset.

Optimal Capital Structure – The structure that maximize the market value of the

firm. The sum of Market Value of Debt (MVD) and Market Value of Equity (MVE).

MV-Firm = MVD + MVE

Capital Structure of Unlevered Firm Capital Structure of Levered Firm

(No Debt) (With Debt)

I. DETERMINANTS OF OPTIMAL CAPITAL STRUCTURE

1. Leverage – This is considered as the bridge between the risk of an asset

position and the corresponding risk of its equity.

2. Debt to Equity ratio

Debt ratio – proportion of total assets financed by debt.

Total Debt/Total Asset

Optimal Capital Structure 1

Equity ratio – proportion of total assets financed by equity.

Total Equity/Total Asset

3. Cost of Debt (Kd) – The interest the company must pay on its debt to its

creditors.

4. Resulting Cost of Equity (Ke) – the return required by common or ordinary

shareholders from the firm. May be computed using:

Capital Asset Pricing Model (CAPM)

Ke = rf + β (MRP)

Expected Total Returns

Ke or Rs = [D1/Po] + g

Reporter: Joan M. Sayde

II. EFFECTS OF OPTIMAL CAPITAL STRUCTURE

1. Maximize stock price

Financial Theory supports that capital structure does not have an effect on firm value;

however, in the real world capital markets are largely based on psychology and every

move can have an impact. Raising debt can lower the overall risk of the firm provided that

the firm has not reached the point of financial distress yet. In addition, depending on the

amount of debt raised and how it will be used it may have a positive effect on the stock

price.

Optimal Capital Structure 2

2. Minimizes WACC

The cost of debt is less expensive than equity, because it is less risky. The required

return needed to compensate debt investors is less than the required return needed to

compensate equity investors, because interest payments have priority over dividends and

debt holders receive priority in the event of liquidation. Debt is also cheaper than equity,

because companies get tax relief on interest, while dividend payments are paid out of

after-tax income.

However, there is a limit to the amount of debt a company should have, because an

excessive amount of debt increases interest payments, and the volatility of earnings and

the risk of bankruptcy. This increase in the financial risk to shareholders means that they

will require a greater return to compensate them, which increases the WACC — and

lowers the market value of a business. So, the optimal structure involves using enough

equity to mitigate the risk of being unable to pay back the debt — taking into account the

variability of the business’ cash flow.

3. Earn a high EPS (Earnings Per Share)

Earnings per share (EPS) is the portion of a company's profit allocated to each

outstanding share of common stock. Earnings per share serves as an indicator of a

company's profitability. EPS is calculated as:

EPS = (Net Income - Dividends on Preferred Stock) / Average Outstanding Shares

When the capital structure of a company includes stock options, warrants, restricted

stock units (RSU), etc. these investments, if exercised, could increase the total number

of shares outstanding in the market.

The EPS is an important fundamental used in valuing a company because it breaks

down a firm's profits on a per share basis. This is especially important as the number of

shares outstanding could change, and the total earnings of a company might not be a

real measure of profitability for investors.

Optimal Capital Structure 3

III. CONSIDERATIONS IN THE DETERMINE OF THE OPTIMAL CAPITAL

STRUCTURE

1. Capital Structure Theory

In financial management, capital structure theory refers to a systematic approach

to financing business activities through a combination of equities and liabilities.

Competing capital structure theories explore the relationship between debt financing,

equity financing and the market value of the firm.

2. Trade-off Theory

The trade-off theory states that the optimal capital structure is a trade-off between

interest tax shields and cost of financial distress:

Value of firm = Value if all-equity financed + PV (tax shield) - PV (cost of financial

distress)

In summary, the trade-off theory states that capital structure is based on a trade-

off between tax savings and distress costs of debt. Firms with safe, tangible assets

and plenty of taxable income to shield should have high target debt ratios. The theory

is capable of explaining why capital structures differ between industries, whereas it

cannot explain why profitable companies within the industry have lower debt ratios

(trade-off theory predicts the opposite as profitable firms have a larger scope for tax

shields and therefore subsequently should have higher debt levels).

3. Pecking Order Theory

The pecking order theory focuses on asymmetrical information costs. This

approach assumes that companies prioritize their financing strategy based on the path

of least resistance. Internal financing (retained earnings) is the first preferred method,

followed by debt and external equity financing (debt and issuance of new shares) as

a last resort.

Optimal Capital Structure 4

4. Asymmetry of Information

This believes that the management has more information on the firm’s position and

is more likely to decide the method of financing on the basis of this information. When

the company believes it will undertake a profitable project, it will opt to finance with

debt so as to “concentrate” the profits to the current shareholders. When the company

believes it will undertake a risky project, it will opt to finance with equity so as to

“spread” the possible loss to both the old and new shareholders.

5. Management Empire-Building

Empire building is typically seen as unhealthy for a corporation, as managers will

often become more concerned with acquiring greater resource control than with

optimally allocating resources. Corporate controls imposed by a company's board and

upper-level management are supposed to prevent empire building within a

corporation's ranks. On a larger scale, it may lead to acquisitions or other decisions

that do not ultimately benefit shareholders, increase the corporation's financial health,

or bolster the company's long-term viability. The failure to screen out empire builders

can lead to corporate actions that do not necessarily provide the best growth

opportunities for a corporation and its shareholders, such as acquisitions made to

boost the control of the company's executives.

Reporter: Jade Kristoffer Z. Gonzales

IV. IN DETERMINING THE OPTIMAL CAPITAL STRUCTURE, IT MAY BE

BASED ON THE:

1. Lowest weighted average cost of capital, and/or

2. Highest Stock Price

To illustrate the determination of Optimal Capital Structure through the minimization of

weighted average cost of capital (WACC), we assume the following debt to equity ratio

with their corresponding cost of debt:

Optimal Capital Structure 5

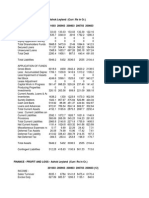

Debt-to-Total Equity-to-Total Debt-to-Equity Before-tax-

Assets Ratio Assets Ratio Ratio cost of debt

(wd) (we) (D/E) (kd)

0.10 0.90 0.11 7.0%

0.20 0.80 0.25 7.2%

0.30 0.70 0.43 8.0%

0.40 0.60 0.67 8.8%

0.50 0.50 1.00 9.6%

Additional information:

The tax rate (T) is 40%.

The risk-free premium (rf) is 5%.

The market risk premium (MRP) is 6%.

The unlevered beta (βU) is 1.0.

REQUIREMENTS:

1. Using the Hamada Equation, compute for the Beta coefficient for each capital

structure.

2. Using CAPM, compute for cost of equity.

3. Compute the WACC for each capital structure.

4. Determine the debt ratio and equity ratio at optimal capital structure.

5. Determine the WACC at the optimal capital structure.

SOLUTION:

This problem uses a trial and error method to determine which capital structure is optimal

which shows the lowest WACC.

Debt-to-Equity Resulting Beta Resulting Cost of WACC

Ratio (a) Equity (b) (c)

A 0.10/0.90 = 0.11 1.0667 11.4% 10.68%

B 0.20/0.80 = 0.25 1.1500 11.9% 10.38%

C 0.30/0.70 = 0.43 1.2571 12.54% 10.22%

D 0.40/0.60 = 0.67 1.4000 13.4% 10.15%

E 0.50/0.50 = 1.00 1.6000 14.6% 10.18%

A. At Debt-Equity ratio of 10%:90%.

a. New (levered) beta

𝐷

βL = βU [ 1 + (1 – T) (𝐸 )]

10%

= 1[1 + (1 – 40%) (90%)]

βL = 1.0667

Optimal Capital Structure 6

b. Current Cost of Equity

Ke = rf + β(MRP)

= 5% + 1.0667(6%)

Ke = 11.4%

c. Weighted Cost of Capital

WACC = [kd(1 – T)(DR)] + [ke (ER)]

= [7%(1 – 0.4)(10%)] + [11.4%(90%)]

WACC = 10.68%

B. At Debt-Equity ratio of 20%:80%.

a. New (levered) Beta

𝐷

βL = βU [1 + (1 – T)(𝐸 )]

20%

= 1[1 + (1 – 40%)(80%)]

βL = 1.15

b. Current Cost of Equity

Ke = rf + β(MRP)

= 5% + 1.15(6%)

Ke = 11.9%

c. Weighted Average Cost of Capital

WACC = [kd(1 – T)(DR)] + [ke(ER)]

= [7.2%(1 – 0.4)(20%)] + [11.9%(80%)]

WACC = 10.38%

Optimal Capital Structure 7

Reporter: Jillian C. Magat

C. At Debt-Equity ratio of 30%:70%.

a. New (levered) Beta

𝐷

βL = βU[1 + (1 – T) (𝐸 )]

30%

= 1[1 + (1 – 40%)(70%)]

βL = 1.2571

b. Current Cost of Equity

Ke = rf + β(MRP)

= 5% + 1.2571(6%)

Ke = 12.54%

c. Weighted Average Cost of Capital

WACC = [kd(1 – T)(DR)] + [ke(ER)]

= [8%(1 – 0.4)(30%)] + [12.54%(70%)]

WACC = 10.22%

D. At Debt-Equity ratio of 40%:60%.

a. New (levered) Beta

𝐷

βL = βU[1 + (1 – T) (𝐸 )]

40%

= 1[1 + (1 – 40%)(60%)]

βL = 1.4

b. Current Cost of Equity

Ke = rf + β(MRP)

= 5% + 1.4(6%)

Ke = 13.4%

c. Weighted Average Cost of Capital

WACC = [kd(1 – T)(DR)] + [ke(ER)]

= [8.8%(1 – 0.4)(40%)] + [13.4%(60%)]

WACC = 10.15%

Optimal Capital Structure 8

E. At Debt-Equity ratio of 50%:50%.

a. NEW (LEVERED) BETA

𝐷

βL = βU[1 + (1 – T)(𝐸 )]

50%

= 1[1 + (1 – 40%)(50%)]

βL = 1.6

b. CURRENT COST OF EQUITY

Ke = rf + β(MRP)

= 5% + 1.6(6%)

Ke = 14.6%

c. WEIGHTED AVERAGE COST OF CAPITAL

WACC = [kd(1 – T)(DR)] + [ke(ER)]

= [9.6%(1 – 0.4)(50%)] + [14.6%(50%)]

WACC = 10.18%

Reporter: Raniel C. Lorenzo

To illustrate the determination of Optimal Structure through the Stock Price Optimization,

we assume the following debt ratio with their corresponding dividend per share cost of

debt:

Debt Ratio Dividend per Share (Div1) Cost of Equity (Ke)

0% ₱ 5.50 11.5%

25% ₱ 6.00 12.0%

40% ₱ 6.50 13.0%

50% ₱ 7.00 14.0%

75% ₱ 7.50 15.0%

Optimal Capital Structure 9

Additional information:

Assume that the company’s growth rate is 2%.

REQUIREMENTS:

1. What is the debt ratio at the optimal capital structure?

2. What is the equity ratio at the optimal capital structure?

SOLUTION:

To determine the optimal capital structure, the stock price (Po) must be computed. The

capital structure with the highest stock price is the optimal capital structure.

Debt Ratio Dividends per share Cost of Equity (Ke) Stock price

0% ₱ 5.50 11.5% ₱ 57.89

25% ₱ 6.00 12.0% ₱ 60.00

40% ₱ 6.50 13.0% ₱ 59.09

50% ₱ 7.00 14.0% ₱ 58.33

75% ₱ 7.50 15.0% ₱ 57.69

A. At zero debt ratio (Unlevered): B. At 25% debt ratio:

(OPTIMAL CAPITAL STRUCTURE)

P0 = _D1_

P0 = _ D1

r-g

r-g

_₱ 5.5__

_₱ 6.0__

11.5% – 2%

12.0%– 2%

P0 = ₱ 57.89

P0 = ₱ 60.00

Optimal Capital Structure 10

C. At 40% debt ratio: D. At 50% debt ratio:

P0 = _ D1_ P0 = _ D1_

r–g r–g

₱ 6.5__ _₱ 7.0__

13.0%– 2% 14.0% – 2%

P0 = ₱ 58.33

P0 = ₱ 59.09

E. At 75% debt ratio:

P0 = _ D1_

r-g

_₱ 7.5__

15.0%– 2%

P0 = ₱ 57.69

The optimal capital structure provides the highest stock price aside from lowest

WACC. From the given expected dividends and cost of debt, the optimal capital

structure that results to highest stock price is at 25%:75% debt to equity ratio.

The firm from zero debt level (unlevered) may welcome risk through issuance of debt

securities and become a levered firm. However, the said firm should maintain

acceptable level of financial risk because high debt ratio increases not only cost of debt

but also cost of equity, thereby increasing WACC.

In addition, the firm, thru the BOD, may issue debt or equity securities to change the

capital structure. However, their decision should be in line with their goal of maximizing

the market value of the firm.

Therefore, the firm should focus on maintaining the optimal capital structure that would

result to the minimization of WACC or maximization of stock price.

Optimal Capital Structure 11

QUIZ

Name: ___________________________________ Date: __________ Score: _____________

DIRECTIONS: Write TRUE if the statement is incorrect, and FALSE if the statement is correct. 5 pts.

1. The Optimal Capital Structure is one which is purely composed of debt.

2. The market value of an unlevered firm is equal to the market value of its debt.

3. A levered firm benefits from the tax shield effect of interest expense brought about by debt.

4. A capital structure is optimal if a company is paying lesser tax and providing lower market value of the firm.

5. Cost of equity is that portion of total assets financed by equity.

DIRECTIONS: Identify what is being asked / described in the following items. 5 pts.

_____________ 1. It believes that capital structure is relevant and that financing should be done in an order.

_____________ 2. It is one that maximizes the market value of a firm.

_____________ 3. The portion of the total asset that is financed by debt.

_____________ 4. It is considered as the bridge between asset risk position and its corresponding risk on equity.

_____________ 5. The overall cost of utilizing the money supplied by creditors and/or owners.

DIRECTIONS: Complete the table using the given information and identify, in sentence form, which among the capital

structures is optimal based on WACC and Stock price, individually. (Show your solution) 2 pts. each

Debt- Before- Dividend

to- tax- Stock

Debt per Resulting Cost of

Equity cost of WACC

Ratio Beta Equity price

Ratio debt Share

(D/E) (kd)

15% 0.18 7.0% ₱ 5.30

28% 0.39 7.5% ₱ 6.20

12% 0.14 7.8% ₱ 6.75

Additional information:

The risk-free premium is 4%

The market risk premium is 8%

The tax rate is 32%

The unlevered beta is 1.78

There is no dividend growth rate.

Optimal Capital Structure 12

Potrebbero piacerti anche

- Levered Vs Unlevered Cost of Capital.Documento7 pagineLevered Vs Unlevered Cost of Capital.Zeeshan ShafiqueNessuna valutazione finora

- Royal Mail CaseDocumento5 pagineRoyal Mail Casedf0% (1)

- Negative Rates The Bank of Japan ExperienceDocumento8 pagineNegative Rates The Bank of Japan ExperienceYash BhasinNessuna valutazione finora

- Oasis Hong Kong Case FinalDocumento58 pagineOasis Hong Kong Case FinalAtika Siti AminahNessuna valutazione finora

- FM16 Ch21 Tool KitDocumento41 pagineFM16 Ch21 Tool KitAdamNessuna valutazione finora

- Deutsche Bank and The Road To Basel - IIIDocumento20 pagineDeutsche Bank and The Road To Basel - IIISHASHANK CHOUDHARY 22Nessuna valutazione finora

- CS-10 UBS - A Pattern of Ethics ScandalsDocumento3 pagineCS-10 UBS - A Pattern of Ethics ScandalsUlin Noor RahmaniNessuna valutazione finora

- Dollarization in Vietnam (Complete)Documento15 pagineDollarization in Vietnam (Complete)Thuy Duong DuongNessuna valutazione finora

- Project Finance: Aditya Agarwal Sandeep KaulDocumento96 pagineProject Finance: Aditya Agarwal Sandeep Kaulsguha123Nessuna valutazione finora

- Syndicate 1 Nike Cost of Capital FinalDocumento2 pagineSyndicate 1 Nike Cost of Capital FinalirfanmuafiNessuna valutazione finora

- Waterfall Chart: Total Revenues - Company Total Revenues - CategoryDocumento10 pagineWaterfall Chart: Total Revenues - Company Total Revenues - CategoryEvert TrochNessuna valutazione finora

- LBO Model Algeco - For StudentsDocumento5 pagineLBO Model Algeco - For StudentsZexi WUNessuna valutazione finora

- Semi-Annual Debt in A Quarterly ModelDocumento2 pagineSemi-Annual Debt in A Quarterly ModelSyed Muhammad Ali SadiqNessuna valutazione finora

- Arcadian Business CaseDocumento20 pagineArcadian Business CaseHeniNessuna valutazione finora

- Case 16 Group 56 AnannaDocumento44 pagineCase 16 Group 56 AnannaSayeedMdAzaharulIslamNessuna valutazione finora

- Mini Case Chapter 3 Final VersionDocumento14 pagineMini Case Chapter 3 Final VersionAlberto MariñoNessuna valutazione finora

- Shapiro Chapter 20 SolutionsDocumento13 pagineShapiro Chapter 20 SolutionsRuiting ChenNessuna valutazione finora

- Optimum Capital StructureDocumento7 pagineOptimum Capital StructureOwenNessuna valutazione finora

- CFADS Calculation & Application PDFDocumento2 pagineCFADS Calculation & Application PDFJORGE PUENTESNessuna valutazione finora

- ITT - Group Assignment - 3DDocumento5 pagineITT - Group Assignment - 3DRitvik DineshNessuna valutazione finora

- Optimal Capital StructureDocumento9 pagineOptimal Capital StructureRamesh PantNessuna valutazione finora

- Valuation Bermuda Triangle A I MRDocumento59 pagineValuation Bermuda Triangle A I MRCarlos Jesús Ponce AranedaNessuna valutazione finora

- Finance Compendium Club ChanakyaDocumento60 pagineFinance Compendium Club ChanakyaAmresh YadavNessuna valutazione finora

- Project FinanceDocumento9 pagineProject FinanceAditi AggarwalNessuna valutazione finora

- Facebook IPO caseHBRDocumento29 pagineFacebook IPO caseHBRCrazy Imaginations100% (1)

- Chapter 13 MK 2Documento5 pagineChapter 13 MK 2Novelda100% (1)

- Kota SolutionDocumento59 pagineKota SolutionAlvaro M. JimenezNessuna valutazione finora

- Alibaba IPODocumento56 pagineAlibaba IPOsushilNessuna valutazione finora

- Kelompok 5 Soal TerjemahanDocumento1 paginaKelompok 5 Soal TerjemahanElgaNurhikmahNessuna valutazione finora

- Gensol Engg Initial (JP Morgan)Documento14 pagineGensol Engg Initial (JP Morgan)beza manojNessuna valutazione finora

- Chapter 09 Im 10th EdDocumento24 pagineChapter 09 Im 10th Edsri rahayu desraNessuna valutazione finora

- Metallgesellschaft: Hedging Gone Awry: Presented By: Suvendu Kumar Bishoyi JKPS/PGDM/09/50Documento10 pagineMetallgesellschaft: Hedging Gone Awry: Presented By: Suvendu Kumar Bishoyi JKPS/PGDM/09/50Suvendu Bishoyi100% (1)

- PF Group 11 AquasureDocumento13 paginePF Group 11 Aquasuresiby13172Nessuna valutazione finora

- Tata MotorsDocumento2 pagineTata MotorsTanvi SharmaNessuna valutazione finora

- Fixed Income Instruments in IndiaDocumento90 pagineFixed Income Instruments in Indiaapi-19459467100% (11)

- Shapiro CHAPTER 3 Altered SolutionsDocumento17 pagineShapiro CHAPTER 3 Altered Solutionsjimmy_chou1314100% (1)

- Long Term Capital ManagementDocumento49 pagineLong Term Capital ManagementLiu Shuang100% (2)

- OM AssignmentDocumento6 pagineOM AssignmentNøør E SeharNessuna valutazione finora

- Optimal Capital StructureDocumento8 pagineOptimal Capital StructureKatenkaNessuna valutazione finora

- LeasingDocumento14 pagineLeasingFelix SwarnaNessuna valutazione finora

- Sustainable Finance: The Imperative and The OpportunityDocumento70 pagineSustainable Finance: The Imperative and The OpportunityNidia Liliana TovarNessuna valutazione finora

- WhiteMonk HEG Equity Research ReportDocumento15 pagineWhiteMonk HEG Equity Research ReportgirishamrNessuna valutazione finora

- Worldwide Paper CompanyDocumento1 paginaWorldwide Paper CompanyendiaoNessuna valutazione finora

- Investment Detective SG8Documento11 pagineInvestment Detective SG8Mr SecretNessuna valutazione finora

- Fixed Line Telecom: Wateen Telecom Limited - Going For The ListingDocumento4 pagineFixed Line Telecom: Wateen Telecom Limited - Going For The ListingjawadataNessuna valutazione finora

- q2 Valuation Insights Second 2020 PDFDocumento20 pagineq2 Valuation Insights Second 2020 PDFKojiro FuumaNessuna valutazione finora

- Case 19 NotesDocumento5 pagineCase 19 NotesFLODOHANessuna valutazione finora

- Q&E Micro Week 1Documento1 paginaQ&E Micro Week 1Aisha IslamadinaNessuna valutazione finora

- Bank Risk Management Is Used Mostly in The FinancialDocumento9 pagineBank Risk Management Is Used Mostly in The FinancialYash PratapNessuna valutazione finora

- Data: Fazio Pump Corporation - CurrentDocumento8 pagineData: Fazio Pump Corporation - CurrentTubagus Donny SyafardanNessuna valutazione finora

- 13 Capital Structure (Slides) by Zubair Arshad PDFDocumento34 pagine13 Capital Structure (Slides) by Zubair Arshad PDFZubair ArshadNessuna valutazione finora

- Module 1 Task 1 VceDocumento10 pagineModule 1 Task 1 VcevedantNessuna valutazione finora

- Investment - LeasingDocumento5 pagineInvestment - LeasingNadya RizkitaNessuna valutazione finora

- 5 Macroeconomics PDFDocumento31 pagine5 Macroeconomics PDFKing is KingNessuna valutazione finora

- Capital StructureDocumento28 pagineCapital Structureluvnica6348Nessuna valutazione finora

- Our ProjectDocumento7 pagineOur ProjectYoussef samirNessuna valutazione finora

- Chapter 2 - CompleteDocumento29 pagineChapter 2 - Completemohsin razaNessuna valutazione finora

- (Lecture 10 & 11) - Gearing & Capital StructureDocumento18 pagine(Lecture 10 & 11) - Gearing & Capital StructureAjay Kumar TakiarNessuna valutazione finora

- RelianceDocumento9 pagineRelianceIshpreet SinghNessuna valutazione finora

- Capital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmDocumento11 pagineCapital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmArun NairNessuna valutazione finora

- LMT: Dimaampao / Riano Negotiable InstrumentsDocumento14 pagineLMT: Dimaampao / Riano Negotiable InstrumentsMark MartinezNessuna valutazione finora

- Sologenic OnepagerDocumento1 paginaSologenic OnepagerzhullkhadriansyaNessuna valutazione finora

- Chuck LeBeau - Trailing Stops - Chandelier StrategyDocumento2 pagineChuck LeBeau - Trailing Stops - Chandelier Strategyasvc8536Nessuna valutazione finora

- Acc 231 CH 1 Flash CardsDocumento4 pagineAcc 231 CH 1 Flash CardsAnonymous Ax1gYcVnyHNessuna valutazione finora

- Cost IM - CH 14Documento23 pagineCost IM - CH 14Mr. FoxNessuna valutazione finora

- PV Crossovers - Parallax Financial ResearchDocumento8 paginePV Crossovers - Parallax Financial Researchalexbernal0Nessuna valutazione finora

- 5 Year Financial PlanDocumento26 pagine5 Year Financial PlanNaimul KaderNessuna valutazione finora

- Advanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoiceDocumento15 pagineAdvanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoicepallaviNessuna valutazione finora

- Capital Market in IndiaDocumento12 pagineCapital Market in IndiaKetaki BodheNessuna valutazione finora

- 2014 Nvca Yearbook PDFDocumento127 pagine2014 Nvca Yearbook PDFDeepa DevanathanNessuna valutazione finora

- Pak Electron LimitedDocumento22 paginePak Electron LimitedSaad AnwarNessuna valutazione finora

- Dissertation 2Documento64 pagineDissertation 2Nikos Karakaisis0% (1)

- Caf 1 IaDocumento4 pagineCaf 1 IaaskermanNessuna valutazione finora

- Ebook IOP PDFDocumento125 pagineEbook IOP PDFamruta ayurvedalayaNessuna valutazione finora

- Literature ReviewDocumento8 pagineLiterature ReviewKEDARANATHA PADHY100% (1)

- Introduction To Derivatives: Susan Thomas Ajay ShahDocumento56 pagineIntroduction To Derivatives: Susan Thomas Ajay ShahMazhar FaizNessuna valutazione finora

- Lecture 6 - Additional Note On CAPM DerivationDocumento5 pagineLecture 6 - Additional Note On CAPM DerivationJohnNessuna valutazione finora

- Day Trading For DummiesDocumento17 pagineDay Trading For DummiesJeffNessuna valutazione finora

- The Effect of Macroeconomic Variables On Stock Market Performance: A Case Study of GhanaDocumento102 pagineThe Effect of Macroeconomic Variables On Stock Market Performance: A Case Study of Ghanasamdagdivine0% (1)

- ZACKS Screening PDFDocumento53 pagineZACKS Screening PDFraviraviravi1100% (1)

- Wells NVDADocumento7 pagineWells NVDAResearch ReportsNessuna valutazione finora

- Football Field MYOR-2Documento27 pagineFootball Field MYOR-2Nusan TravellerNessuna valutazione finora

- Ratio Analysis of Eastern Bank LTD.: Bus 635 (Managerial Finance)Documento19 pagineRatio Analysis of Eastern Bank LTD.: Bus 635 (Managerial Finance)shadmanNessuna valutazione finora

- Principals of Risk Interest Rate ScenariosDocumento38 paginePrincipals of Risk Interest Rate ScenariosBob TaylorNessuna valutazione finora

- Occidental Petrolium CorporationDocumento10 pagineOccidental Petrolium CorporationblockeisuNessuna valutazione finora

- A Trending Walk Rather Than A Random Walk?time-Series Momentum in AustraliaDocumento40 pagineA Trending Walk Rather Than A Random Walk?time-Series Momentum in AustraliaFaisal MahboobNessuna valutazione finora

- 5 Advanced Counter Trend Trading TechniquesDocumento29 pagine5 Advanced Counter Trend Trading Techniqueschandra369100% (2)

- Ashok LeylandDocumento6 pagineAshok Leylandkaaviya6Nessuna valutazione finora

- Distributor Empanelment FormDocumento6 pagineDistributor Empanelment FormManu KumarNessuna valutazione finora

- Question Bank SAPMDocumento7 pagineQuestion Bank SAPMN Rakesh92% (12)