Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Course Description: Business Finance

Caricato da

Amir Hayat0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni2 pagineBF Outline

Titolo originale

BF Outline

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBF Outline

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni2 pagineCourse Description: Business Finance

Caricato da

Amir HayatBF Outline

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

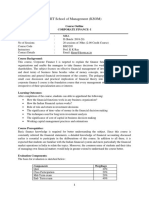

BUSINESS FINANCE

COURSE DESCRIPTION

Business Finance course aims at imparting knowledge about the very basic concepts and tools of

Business Finance. It emphasizes the importance of Business Finance skills to individuals and

enterprises. It deals with the finance function in an organization, the role of the finance manager and

the financial environment in which the firm operates. The financial environment covers the

understanding of financial and capital markets along with the broad orientation of macro-economic

factors affecting the business. The emphasis will remain on developing the skills for planning,

appraising and evaluating the investment, financing and operating decisions.

Learning 1. Functions of business finance and finance manager.

Outcomes 2. The basics of finance theory and its applications to corporate financial decisions.

3. Analysis of financial statements.

4. Tools and techniques of time value of money for investing decisions.

5. Concepts of risk and return for portfolio management.

6. The principles of capital structure.

COURSE CONTENTS

Week 01 An Overview of Business Finance

Finance a quick look.

Business finance and financial manager.

Forms of business organization.

Goals of business finance.

Agency problem.

Week 02 Understanding financial statements and cash flows.

The balance sheet.

The income statement.

Taxes.

Cash flow.

Week 03 Analyzing the financial statements

Standardized financial statements.

Ratio analysis.

The Du-pont identity .

Internal and sustainable growth.

Using financial statement information.

Week 04 & 05 Time Value of Money

The role and perspectives of the TVM concept

Future values

Present values

The relationship between future and present values

Annuities

Future and present values of cash flows under high

compounding frequency

Impact of higher compounding frequency

Inflation and the Time Value of Money

Week 06 Bond and Their Valuation

Definition, types and features of bonds

Valuation of bonds (the basic process)

Basic relationships in bond valuation

Bondholder‟s expected rate of return

Risks associated with bond returns

Week 07 & 08 Stocks and Their Valuation

Shares and their basic features

Benefits from a share investments

Price of ordinary shares

Behaviour of expected dividend growth and share price

Price of shares based on earnings

Expected rate of return

Preferred shares and their characteristics

Price of preferred shared and the expected rate of return

Valuing the entire business

Week 09 & 10 Net present value and other investment Criteria

Net present value.

The payback rule.

The average accounting return.

The internal rate of return.

The profitability index.

The practice of capital budgeting.

Week 11 & 12 Introduction to Islamic Finance.

The concept of:

Mudarba

Musharqa

Murabah

Ijarah

Comparison with the conventional financial system

Week 13-14 Risk and Return

Expected returns and risk defined

Calculating expected return

Calculating risk (Variance and Standard deviation)

Portfolio expected returns

Portfolio variance and standard deviation

Systematic and unsystematic risk

Diversification and portfolio risk

Week 15 & 16 The Cost of Capital

The cost of capital concepts

Individual and weighted average costs of capital

Costs of capital and valuation

Capital structure

Capital structure decision (No taxes or other capital market

imperfections)

Taxation and capital structure decision

Debt equity ratio, cost of capital and the value of the firm (The

MM Propositions)

Optimal capital structure

Evidence on capital structure determinants

RECOMMENDED TEXT BOOKS (Latest available edition)

1. Jemes C. Vanhorne: Fundamentals of Financial Management

2. Eugene F. Brigham: Fundamentals of Financial Management

Potrebbero piacerti anche

- USOnline PayslipDocumento2 pagineUSOnline PayslipTami SariNessuna valutazione finora

- Forces of Fantasy (1ed)Documento127 pagineForces of Fantasy (1ed)Strogg100% (7)

- Investment and Portfolio ManageemntDocumento2 pagineInvestment and Portfolio Manageemntumair aliNessuna valutazione finora

- NYIF Williams Credit Risk Analysis II 2018Documento106 pagineNYIF Williams Credit Risk Analysis II 2018jojozie100% (1)

- Overview of Financial Statement Analysis: Chapter 1. SW Week 1Documento13 pagineOverview of Financial Statement Analysis: Chapter 1. SW Week 1Rama Tri SakriaNessuna valutazione finora

- Arabic Letters Practice WorksheetsDocumento3 pagineArabic Letters Practice Worksheetsvinsensius soneyNessuna valutazione finora

- Fs 6 Learning-EpisodesDocumento11 pagineFs 6 Learning-EpisodesMichelleNessuna valutazione finora

- Dilg MC 2013-61Documento14 pagineDilg MC 2013-61florianjuniorNessuna valutazione finora

- Cfas Chapter 2Documento55 pagineCfas Chapter 2Lance Lenard Divinagracia Calimpos100% (1)

- Pakistani Companies and Their CSR ActivitiesDocumento15 paginePakistani Companies and Their CSR ActivitiesTayyaba Ehtisham100% (1)

- Chapter 2: The Conceptual Framework: Fundamentals of Intermediate Accounting Weygandt, Kieso, and WarfieldDocumento36 pagineChapter 2: The Conceptual Framework: Fundamentals of Intermediate Accounting Weygandt, Kieso, and WarfieldAppu KhanNessuna valutazione finora

- Chapter 1 Capstone Case: New Century Wellness GroupDocumento4 pagineChapter 1 Capstone Case: New Century Wellness GroupJC100% (7)

- Airport Solutions Brochure Web 20170303Documento6 pagineAirport Solutions Brochure Web 20170303zhreniNessuna valutazione finora

- Valuation of Finacial Statment PDFDocumento50 pagineValuation of Finacial Statment PDFhindustani888Nessuna valutazione finora

- Finance CourseDocumento18 pagineFinance Coursegourav patwekar100% (1)

- ACCCOB2-Introduction To Financial Accounting PDFDocumento34 pagineACCCOB2-Introduction To Financial Accounting PDFJose GuerreroNessuna valutazione finora

- 3.FINA211 Financial ManagementDocumento5 pagine3.FINA211 Financial ManagementIqtidar Khan0% (1)

- ThangkaDocumento8 pagineThangkasifuadrian100% (1)

- MGT 215 Fundamentals of Financial ManagementDocumento4 pagineMGT 215 Fundamentals of Financial ManagementRajkishor PanditNessuna valutazione finora

- Credit Analysis and Distress PredictionDocumento57 pagineCredit Analysis and Distress Predictionrizki nurNessuna valutazione finora

- School Form 10 SF10 Learners Permanent Academic Record For Elementary SchoolDocumento10 pagineSchool Form 10 SF10 Learners Permanent Academic Record For Elementary SchoolRene ManansalaNessuna valutazione finora

- GC Women University Sialkot: Course Outline Business FinanceDocumento4 pagineGC Women University Sialkot: Course Outline Business FinanceTajalli FatimaNessuna valutazione finora

- Advance Corporate Finance Course OverviewDocumento2 pagineAdvance Corporate Finance Course Overviewumair aliNessuna valutazione finora

- CF - CO Section - BDocumento31 pagineCF - CO Section - BAditya SinghNessuna valutazione finora

- FM NotesDocumento36 pagineFM NotesFaye DalhagNessuna valutazione finora

- Principles of FinanceDocumento2 paginePrinciples of FinanceolmezestNessuna valutazione finora

- Financial Management Course Handout at BITS PilaniDocumento5 pagineFinancial Management Course Handout at BITS PilaniArun PadmanabhanNessuna valutazione finora

- Jamila Mufazzal - Syllabus Principles of Business Finance (BF)Documento4 pagineJamila Mufazzal - Syllabus Principles of Business Finance (BF)jamila mufazzalNessuna valutazione finora

- JAIPURIA INSTITUTE OF MANAGEMENT POST GRADUATE DIPLOMA IN MANAGEMENT (MARKETING) 2020-22 CORPORATE FINANCE COURSEDocumento32 pagineJAIPURIA INSTITUTE OF MANAGEMENT POST GRADUATE DIPLOMA IN MANAGEMENT (MARKETING) 2020-22 CORPORATE FINANCE COURSEANKIT GUPTANessuna valutazione finora

- Course Outline - Fin 223Documento3 pagineCourse Outline - Fin 223DenisNessuna valutazione finora

- Financial ManagementDocumento7 pagineFinancial Managementisamad820Nessuna valutazione finora

- Investment Management: CAFTA WebinarDocumento38 pagineInvestment Management: CAFTA WebinarAryan PandeyNessuna valutazione finora

- Corporate FinanceDocumento2 pagineCorporate Financeumair aliNessuna valutazione finora

- Corporate Finance Course OutlineDocumento4 pagineCorporate Finance Course OutlineMD Rifat Zahir0% (1)

- Financial Management Course OutlineDocumento2 pagineFinancial Management Course OutlineMadiha ZamanNessuna valutazione finora

- Course Outline All in OneDocumento50 pagineCourse Outline All in OneMillionNessuna valutazione finora

- Managing The Finance FunctionDocumento12 pagineManaging The Finance FunctionDumplings DumborNessuna valutazione finora

- Company Specific Financial PerformanceDocumento22 pagineCompany Specific Financial PerformanceJorge NANessuna valutazione finora

- 01 FM Introduction To FM 01012021Documento33 pagine01 FM Introduction To FM 01012021Prasad GharatNessuna valutazione finora

- Financial Management Course OutlineDocumento2 pagineFinancial Management Course OutlineRosenna99Nessuna valutazione finora

- Required Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate FinanceDocumento2 pagineRequired Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate Financegenius_2Nessuna valutazione finora

- Sillabusu: Azərbaycan Respublikasi Təhsil Nazirliyi Azərbaycan Respublikasi İqtisad Universiteti (Unec)Documento10 pagineSillabusu: Azərbaycan Respublikasi Təhsil Nazirliyi Azərbaycan Respublikasi İqtisad Universiteti (Unec)Emiraslan MhrrovNessuna valutazione finora

- FFM Class Outline 2018 - 2019Documento5 pagineFFM Class Outline 2018 - 2019Juan SanguinetiNessuna valutazione finora

- Valuation Principles and Practices: Analysis of Financial StatementsDocumento50 pagineValuation Principles and Practices: Analysis of Financial StatementsRohn J JacksonNessuna valutazione finora

- Advanced Financial Accounting and Reporting: Management and Advisory ServicesDocumento4 pagineAdvanced Financial Accounting and Reporting: Management and Advisory ServicesCj SernaNessuna valutazione finora

- Afin209 FPD 1 2017 1Documento3 pagineAfin209 FPD 1 2017 1Daniel Daka100% (1)

- Managing Cash & Investment (EY)Documento12 pagineManaging Cash & Investment (EY)Anil KumarNessuna valutazione finora

- BabeDocumento16 pagineBabeNathan FellixNessuna valutazione finora

- Ratio Analysis GuideDocumento43 pagineRatio Analysis Guideraghavendra_20835414Nessuna valutazione finora

- FM - 1Documento15 pagineFM - 1akesingsNessuna valutazione finora

- FM Course Outline & Materials-Thappar UnivDocumento74 pagineFM Course Outline & Materials-Thappar Univharsimranjitsidhu661Nessuna valutazione finora

- CAMELS and PEARLS Applied To Financial Management of Commercial Bank in VietnamDocumento44 pagineCAMELS and PEARLS Applied To Financial Management of Commercial Bank in VietnamDan LinhNessuna valutazione finora

- Intel College: Course Name: Business Finance and EconomicsDocumento2 pagineIntel College: Course Name: Business Finance and EconomicsRocky Kaur100% (1)

- Southern University Bangladesh Department of Business Administration Program: Undergraduate-BBADocumento2 pagineSouthern University Bangladesh Department of Business Administration Program: Undergraduate-BBAmaquesurat ferdousNessuna valutazione finora

- AD1101 AY15 - 16 Sem 1 Lecture 1Documento21 pagineAD1101 AY15 - 16 Sem 1 Lecture 1weeeeeshNessuna valutazione finora

- IFRS On Banking SectorDocumento6 pagineIFRS On Banking SectorSiddhi MirnaalNessuna valutazione finora

- Corporate Finance ManagementDocumento9 pagineCorporate Finance Managementtrustmakamba23Nessuna valutazione finora

- Financial Accounting For The Lending BankerDocumento3 pagineFinancial Accounting For The Lending BankerRobert NzulwaNessuna valutazione finora

- TextBook BusinessFinanceDocumento7 pagineTextBook BusinessFinanceJot BawaNessuna valutazione finora

- KSOM Corporate Finance Course OutlineDocumento3 pagineKSOM Corporate Finance Course OutlineAkankshya PanigrahiNessuna valutazione finora

- CityU - Chapter 1 Intro To CF - STDDocumento34 pagineCityU - Chapter 1 Intro To CF - STDNguyễn Đăng HiếuNessuna valutazione finora

- Scope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnDocumento4 pagineScope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnPrabhjeet KalsiNessuna valutazione finora

- 224 23 BS BF 224Documento3 pagine224 23 BS BF 224D'zite JereNessuna valutazione finora

- Chapter 06Documento25 pagineChapter 06Farjana Hossain DharaNessuna valutazione finora

- Course Outline Financial Management NTUDocumento6 pagineCourse Outline Financial Management NTUHassaanNessuna valutazione finora

- Module 2 - Intrinsic ValuationDocumento11 pagineModule 2 - Intrinsic ValuationLara Camille CelestialNessuna valutazione finora

- PAM Outlines 07012021 042154pmDocumento7 paginePAM Outlines 07012021 042154pmzainabNessuna valutazione finora

- The Pursuit of Conceptual FrameworkDocumento24 pagineThe Pursuit of Conceptual FrameworkbananaNessuna valutazione finora

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceDa EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNessuna valutazione finora

- Custodio 2014Documento30 pagineCustodio 2014Amir HayatNessuna valutazione finora

- KingWhat's in An EducationDocumento58 pagineKingWhat's in An EducationAmir HayatNessuna valutazione finora

- Guidance To Evaluate A Research Proposal Please Answer The Following QuestionsDocumento1 paginaGuidance To Evaluate A Research Proposal Please Answer The Following QuestionsAmir HayatNessuna valutazione finora

- 2019Documento4 pagine2019Amir HayatNessuna valutazione finora

- Promoting Access To Finance by Empowering Consumers - Financial Literacy in Developing CountriesDocumento8 paginePromoting Access To Finance by Empowering Consumers - Financial Literacy in Developing CountriesAmir HayatNessuna valutazione finora

- House of Science & Commerce: Admission FormDocumento2 pagineHouse of Science & Commerce: Admission FormAmir HayatNessuna valutazione finora

- Guidance To Evaluate A Research Proposal Please Answer The Following QuestionsDocumento1 paginaGuidance To Evaluate A Research Proposal Please Answer The Following QuestionsAmir HayatNessuna valutazione finora

- MFG en Paper Access To Finance 2004Documento79 pagineMFG en Paper Access To Finance 2004Amir HayatNessuna valutazione finora

- The Role of Financial Literacy in Resource Acquisition and Financial Performance Moderating Role of Government SupportDocumento11 pagineThe Role of Financial Literacy in Resource Acquisition and Financial Performance Moderating Role of Government SupportAmir HayatNessuna valutazione finora

- Liquidity and Market EfficiencyDocumento20 pagineLiquidity and Market EfficiencyAmir HayatNessuna valutazione finora

- 001 Image File 1Documento22 pagine001 Image File 1Amir HayatNessuna valutazione finora

- Gareth Jones 2008Documento2 pagineGareth Jones 2008Amir HayatNessuna valutazione finora

- PH: 5519388, 5566614, 5519377 Fax: 051-5513059: Peas Pullao or Yakhni PullaoDocumento6 paginePH: 5519388, 5566614, 5519377 Fax: 051-5513059: Peas Pullao or Yakhni PullaoAmir HayatNessuna valutazione finora

- Samplesizeformula PDFDocumento1 paginaSamplesizeformula PDFRaffy PangilinanNessuna valutazione finora

- Bachelor of Arts Sciences Private Late College Annual System1Documento10 pagineBachelor of Arts Sciences Private Late College Annual System1Muzammil HasnainNessuna valutazione finora

- Course Contents & Class Schedule: Mid-TermDocumento2 pagineCourse Contents & Class Schedule: Mid-TermAmir HayatNessuna valutazione finora

- Public Selection DR 637Documento6 paginePublic Selection DR 637Amir HayatNessuna valutazione finora

- Course Contents & Class Schedule: Mid-TermDocumento2 pagineCourse Contents & Class Schedule: Mid-TermAmir HayatNessuna valutazione finora

- PhD in Finance at EDHEC Business SchoolDocumento26 paginePhD in Finance at EDHEC Business SchoolAmir HayatNessuna valutazione finora

- Determination of Volatile Compounds in Apple Pomace by SBSE-GC-MSDocumento9 pagineDetermination of Volatile Compounds in Apple Pomace by SBSE-GC-MSAmir HayatNessuna valutazione finora

- Thyroid-Stimulating Hormone (TSH) Level in Nutritionally Obese Children and Metabolic Co-MorbidityDocumento6 pagineThyroid-Stimulating Hormone (TSH) Level in Nutritionally Obese Children and Metabolic Co-MorbidityAmir HayatNessuna valutazione finora

- Indus College of Science & Commerce: Send UpsDocumento3 pagineIndus College of Science & Commerce: Send UpsAmir HayatNessuna valutazione finora

- Clothing-Related Motorcycle Injuries in Pakistan: Findings From A Surveillance StudyDocumento7 pagineClothing-Related Motorcycle Injuries in Pakistan: Findings From A Surveillance StudyAmir HayatNessuna valutazione finora

- Corruption in PakistanDocumento28 pagineCorruption in PakistanAli FarooquiNessuna valutazione finora

- Khan 2016Documento37 pagineKhan 2016Amir HayatNessuna valutazione finora

- Adua Yi 2016Documento7 pagineAdua Yi 2016Amir HayatNessuna valutazione finora

- Lattice Valued Intuitionistic Fuzzy Sets: Tadeusz Gerstenkorn, Andreja Tepav Cevi CDocumento11 pagineLattice Valued Intuitionistic Fuzzy Sets: Tadeusz Gerstenkorn, Andreja Tepav Cevi CAmir HayatNessuna valutazione finora

- Ars Laner 2017Documento23 pagineArs Laner 2017Amir HayatNessuna valutazione finora

- Application Optimization in Mobile Cloud Computing: A ReviewDocumento17 pagineApplication Optimization in Mobile Cloud Computing: A ReviewAmir HayatNessuna valutazione finora

- Entrance English Test for Graduate Management StudiesDocumento6 pagineEntrance English Test for Graduate Management StudiesPhương Linh TrươngNessuna valutazione finora

- List LaguDocumento13 pagineList LaguLuthfi AlbanjariNessuna valutazione finora

- Flowserve Corp Case StudyDocumento3 pagineFlowserve Corp Case Studytexwan_Nessuna valutazione finora

- MKT201 Term PaperDocumento8 pagineMKT201 Term PaperSumaiyaNoorNessuna valutazione finora

- 2024 JanuaryDocumento9 pagine2024 Januaryedgardo61taurusNessuna valutazione finora

- IiuyiuDocumento2 pagineIiuyiuLudriderm ChapStickNessuna valutazione finora

- Florida SUS Matrix Guide 2020Documento3 pagineFlorida SUS Matrix Guide 2020mortensenkNessuna valutazione finora

- KSDL RameshDocumento10 pagineKSDL RameshRamesh KumarNessuna valutazione finora

- Building Security in Maturity Model: (Bsimm)Documento2 pagineBuilding Security in Maturity Model: (Bsimm)cristiano.vs6661Nessuna valutazione finora

- Tos Survey of Philippine LiteratureDocumento1 paginaTos Survey of Philippine LiteratureBernadette Barro GomezNessuna valutazione finora

- Sunway Berhad (F) Part 2 (Page 97-189)Documento93 pagineSunway Berhad (F) Part 2 (Page 97-189)qeylazatiey93_598514100% (1)

- Cartagena PresentationDocumento20 pagineCartagena PresentationPaula SimóNessuna valutazione finora

- Daddy's ChairDocumento29 pagineDaddy's Chairambrosial_nectarNessuna valutazione finora

- Introduction To The Appian PlatformDocumento13 pagineIntroduction To The Appian PlatformbolillapalidaNessuna valutazione finora

- Summary of Kamban's RamayanaDocumento4 pagineSummary of Kamban's RamayanaRaj VenugopalNessuna valutazione finora

- Solution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFDocumento24 pagineSolution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFsusan.lemke155100% (11)

- Senate Hearing, 110TH Congress - The Employee Free Choice Act: Restoring Economic Opportunity For Working FamiliesDocumento83 pagineSenate Hearing, 110TH Congress - The Employee Free Choice Act: Restoring Economic Opportunity For Working FamiliesScribd Government DocsNessuna valutazione finora

- Far East Bank (FEBTC) Vs Pacilan, Jr. (465 SCRA 372)Documento9 pagineFar East Bank (FEBTC) Vs Pacilan, Jr. (465 SCRA 372)CJ N PiNessuna valutazione finora

- MG6863 - ENGINEERING ECONOMICS - Question BankDocumento19 pagineMG6863 - ENGINEERING ECONOMICS - Question BankSRMBALAANessuna valutazione finora

- Lancaster University: January 2014 ExaminationsDocumento6 pagineLancaster University: January 2014 Examinationswhaza7890% (1)