Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fiverrr Asad

Caricato da

Rajib AliCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fiverrr Asad

Caricato da

Rajib AliCopyright:

Formati disponibili

A. Bad Boys, Inc. is evaluating its cost of capital. Under consultation, Bad Boys, Inc.

expects to issue

new debt at par with a coupon rate of 8% and to issue new preferred stock with a $2.50 per share

dividend at $25 a share. The common stock of Bad Boys, Inc. is currently selling for $20.00 a share.

Bad Boys, Inc. expects to pay a dividend of $1.50 per share next year. An equity analyst foresees

a growth in dividends at a rate of 5% per year. Bad Boys, Inc. marginal tax rate is 35%. If Bad Boys,

Inc. raises capital using 45% debt, 5% preferred stock, and 50% common stock, what is Bad Boys

cost of capital?

Answer: As the instructions are given we have to calculate cost of capital or weighted average cost of

capital (WACC) so the formula for calculating the cost of capita is given below;

𝑊𝐴𝐶𝐶 = 𝑟𝑠 ∗ 𝑊𝑠 + 𝑟𝑑 ∗ 𝑊𝑑 ∗ (1 − 𝑇) + 𝑟𝑝 ∗ 𝑊𝑝

Where;

rs is cost of equity

𝑊𝑠 is weight of common stock,

rd is cost of debt,

𝑊𝑑 is weight of common stock

rp is cost of preferred Stock,

𝑊𝑝 is weight of common stock

𝑇 is the marginal tax rate

Data and some necessary calculation

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 1.5

𝑟𝑠 = 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑃𝑟𝑖𝑐𝑒

+ 𝐺𝑟𝑜𝑤𝑡ℎ 𝑟𝑎𝑡𝑒 𝑜𝑓 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 = 20

+ 5% = 12.5. %

𝑊𝑠 = 50%

rd = 8%

𝑊𝑑 = 45%

𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑜𝑛 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑆𝑡𝑜𝑐𝑘 2.5

𝑟𝑝 = = = 10%

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑆𝑡𝑜𝑐𝑘 𝑃𝑟𝑖𝑐𝑒 25

𝑊𝑝 = 5%

𝑇 = 35%

𝑊𝐴𝐶𝐶 = (0.125) ∗ (0.50) + (0.08) ∗ (0.45) ∗ (1 − 0.35) + (0.10) ∗ (0.05)

𝑊𝐴𝐶𝐶 = 0.0625 + 0.0234 + 0.005

𝑊𝐴𝐶𝐶 = 0.0909 = 9.09%

On average, as the cost of total capital raised through a combination of debt, preferred equity and

common equity, Bad boys pays about 9.09% percent per annum. As the some of the date was not given

directly so I have calculated rs and rp first as the requirement of WACC formula by using some formulas

is described above we reached at conclusion. On average Bad boys Inc. uses 9.09% cost for using given

capital structure. Generally company always needs minimum cost to pay on its capital structure.

B. If Bad Boys, Inc. raises capital using 30% debt, 5% preferred stock, and 65% common stock, what

is Bad Boys cost of capital?

Answer:

As in this part all the value are same as in part A except capital structure

𝑊𝑠 = 65%

𝑊𝑑 = 30%

𝑊𝑝 = 5%

rs = 12.5%

rd = 8%

𝑟𝑝 = 10%

𝑇 = 35%

𝑊𝐴𝐶𝐶 = (0.125) ∗ (0.65) + (0.08) ∗ (0.35) ∗ (1 − 0.35) + (0.10) ∗ (0.05)

𝑊𝐴𝐶𝐶 = 0.08125 + 0.0182 + 0.005

𝑊𝐴𝐶𝐶 = 0.1045 = 10.45%

On average, as the cost of total capital raised through a combination of debt, preferred equity and

common equity the weight is 35%, 5% and 65% respectively, Bad boys pays about 9.09% percent per

annum.

C. On page 457, your textbook details the term Cannibalization. In your own words, identify two

corporations that have dealt with cannibalization and what steps were taken to overcome the

cannibalization. Please provide any citations and references. Please be articulate in your

responses.

Answer:

Cannibalize is the process of launching new products, with reference to their own available products.

Cannibalization can be define as when company introduces its new product bases a decline in the sales of

company’s existing product in current market.

One the well-known cannibalization done by Coca-Cola when it introduced different flavored products

against its existing well-known product Coke (Business Insider, 2017). This was done to acquire more

market share in the beverage industry, main reason was to produce different flavored products to give

different taste to its existing customers. When Coca Cola launched different Coke flavors e.g. Diet and the

existing Coke lost market share to Coke Diet. Overall, new product by Coke attracted more share from

Pepsi, therefore Coca-Cola was the winner in the end. Steps taken by Coke are given blow;

Coke first identified its existing customers of their existing product.

Coke then identifies their potential customers for new product.

Then coke launched it new flavored products in the market.

Apple launched iPhone that includes iPod features and then launched its semi-annual product launches

introducing iPhone 4S within one year of iPhone 4 launch (insider, 2015). One of the business rules,

according to Steve Jobs ' interview with Walter Isaacson, “was never to be afraid to cannibalize yourself,

if you don’t cannibalize yourself, someone else will,” he said (Harvard Business Review, 2012). Although

an advanced iPhone 4S could cannibalize an iPhone 4's sales, it didn't dissuade him.

References:

Insider, B. (2017) from https://www.businessinsider.com/apple-on-cannibalization-2015-12

Review, H.B. (2012) from https://hbr.org/2012/04/the-real-leadership-lessons-of-steve-jobs

insider, B. (2015). from https://www.businessinsider.com/apple-on-cannibalization-2015-12

Potrebbero piacerti anche

- Problem Set Capital StructureQADocumento15 pagineProblem Set Capital StructureQAIng Hong100% (1)

- Quarry of Agreement JuliusDocumento2 pagineQuarry of Agreement JuliusLavon Naze50% (2)

- Optimal Capital Structure for Campus DeliDocumento17 pagineOptimal Capital Structure for Campus DeliJoshua Hines100% (1)

- 100 Best Businesses FreeDocumento34 pagine100 Best Businesses Freemally4dNessuna valutazione finora

- Xerox Case StudyDocumento19 pagineXerox Case StudyPrachi Jain100% (2)

- Applied Corporate Finance. What is a Company worth?Da EverandApplied Corporate Finance. What is a Company worth?Valutazione: 3 su 5 stelle3/5 (2)

- Dividend Investing 101 Create Long Term Income from DividendsDa EverandDividend Investing 101 Create Long Term Income from DividendsNessuna valutazione finora

- Final Exam Review AssessmentDocumento14 pagineFinal Exam Review Assessmentbusinessdoctor23Nessuna valutazione finora

- CHAPTER 15—CAPITAL STRUCTURE AND LEVERAGE Multiple ChoiceDocumento22 pagineCHAPTER 15—CAPITAL STRUCTURE AND LEVERAGE Multiple ChoiceDavid LarryNessuna valutazione finora

- Lbo Model PreparationDocumento3 pagineLbo Model PreparationMus Chrifi100% (1)

- Carlyle Model Interview Test - InstructionsDocumento2 pagineCarlyle Model Interview Test - Instructionsjorgeetcheverria100% (1)

- Letter of Appointment ArchitectDocumento4 pagineLetter of Appointment ArchitectPriyankNessuna valutazione finora

- Cost of Capital Calculations ExplainedDocumento7 pagineCost of Capital Calculations ExplainedĐào Thanh Tùng100% (1)

- Bosch Quality CertificationDocumento7 pagineBosch Quality CertificationMoidu ThavottNessuna valutazione finora

- FNCE 203 Practice Final Exam #1 - Answer Key: InstructionsDocumento14 pagineFNCE 203 Practice Final Exam #1 - Answer Key: InstructionsJoel Christian MascariñaNessuna valutazione finora

- Designing A Microsoft SharePoint 2010 Infrastructure Vol 2Documento419 pagineDesigning A Microsoft SharePoint 2010 Infrastructure Vol 2Angel Iulian PopescuNessuna valutazione finora

- Cost of CapitalDocumento45 pagineCost of CapitalG-KaiserNessuna valutazione finora

- Advanced Accounting Fischer11e - SMChap21Documento24 pagineAdvanced Accounting Fischer11e - SMChap21sellertbsm2014Nessuna valutazione finora

- A Case Study On Engro FertilizersDocumento17 pagineA Case Study On Engro FertilizersManzoor Ahmed Memon100% (2)

- Cost of CapitalDocumento44 pagineCost of CapitalnewaznahianNessuna valutazione finora

- FINC3015 Final Exam Sample QuestionsDocumento5 pagineFINC3015 Final Exam Sample QuestionsTecwyn LimNessuna valutazione finora

- Answers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalDocumento220 pagineAnswers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalJoel Christian MascariñaNessuna valutazione finora

- Enterprise Architecture DesignerDocumento22 pagineEnterprise Architecture DesignerVENKATNessuna valutazione finora

- AsadDocumento2 pagineAsadRajib Ali100% (2)

- BUS 635 Quiz3 Sum15 AnswersDocumento5 pagineBUS 635 Quiz3 Sum15 AnswershnoamanNessuna valutazione finora

- Calculate Cost of Capital and WACCDocumento4 pagineCalculate Cost of Capital and WACCshazlina_liNessuna valutazione finora

- Meseleler 100Documento9 pagineMeseleler 100Elgun ElgunNessuna valutazione finora

- 2 SDocumento12 pagine2 SRohith ThatchanNessuna valutazione finora

- FINA 4383 Quiz 2Documento9 pagineFINA 4383 Quiz 2Samantha LunaNessuna valutazione finora

- CFR Sample QuestionsDocumento10 pagineCFR Sample Questionsisgigles157Nessuna valutazione finora

- QUALITY MANAGEMENT SYSTEM COST OF CAPITALDocumento18 pagineQUALITY MANAGEMENT SYSTEM COST OF CAPITALMarium ShabbirNessuna valutazione finora

- Corpfin HW 7Documento2 pagineCorpfin HW 7notanaccount0% (1)

- Practice Questions Before The Final Fall 2014Documento4 paginePractice Questions Before The Final Fall 2014rheg3070Nessuna valutazione finora

- Financial leverage and capital structure fundamentalsDocumento13 pagineFinancial leverage and capital structure fundamentalsMichelle LamNessuna valutazione finora

- Financial Objectives and Credit RatingsDocumento36 pagineFinancial Objectives and Credit RatingsMuhammad MujtabaNessuna valutazione finora

- I. Using The Capital Asset Pricing Model II. Estimating K For Comparable Dividend-Paying Stocks in Their IndustryDocumento6 pagineI. Using The Capital Asset Pricing Model II. Estimating K For Comparable Dividend-Paying Stocks in Their IndustryAhad SultanNessuna valutazione finora

- FIN674 - Final - Sample 1 - QuestionsDocumento8 pagineFIN674 - Final - Sample 1 - QuestionsFabricio Cifuentes EspinosaNessuna valutazione finora

- Shapiro CHAPTER 6 SolutionsDocumento10 pagineShapiro CHAPTER 6 SolutionsjzdoogNessuna valutazione finora

- Week 6 Capital Cost and Capital StructureDocumento51 pagineWeek 6 Capital Cost and Capital StructureKarthik RamanathanNessuna valutazione finora

- Valuing StocksDocumento39 pagineValuing StocksANITAAZHARNED0% (3)

- Coc Practice Questions Lyst4584Documento6 pagineCoc Practice Questions Lyst4584ramNessuna valutazione finora

- Chapter 15 Q&PDocumento49 pagineChapter 15 Q&PYakamoMutsuNessuna valutazione finora

- FM PQDocumento3 pagineFM PQOmer Zahid100% (1)

- Final Review Session SPR12RปDocumento10 pagineFinal Review Session SPR12RปFight FionaNessuna valutazione finora

- Compre BAV Sol 2019-20 1Documento9 pagineCompre BAV Sol 2019-20 1f20211062Nessuna valutazione finora

- Question and Answer - 52Documento31 pagineQuestion and Answer - 52acc-expertNessuna valutazione finora

- Jun18l1cfi-C01 Qa PDFDocumento3 pagineJun18l1cfi-C01 Qa PDFJuan Pablo Flores QuirozNessuna valutazione finora

- Jun18l1cfi-C01 QaDocumento3 pagineJun18l1cfi-C01 QaJuan Pablo Flores QuirozNessuna valutazione finora

- Lecture15 PDFDocumento24 pagineLecture15 PDFkate ngNessuna valutazione finora

- Nanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)Documento3 pagineNanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)asdsadsaNessuna valutazione finora

- MAN 321 Corporate Finance Final Examination: Fall 2001Documento8 pagineMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginNessuna valutazione finora

- Finance Re-Exam 3Documento4 pagineFinance Re-Exam 3mrdirriminNessuna valutazione finora

- Calculating WACC and Project NPV with Changing Floatation CostsDocumento18 pagineCalculating WACC and Project NPV with Changing Floatation CostsYoga Pratama Rizki FNessuna valutazione finora

- Solutions Class Examples AFM2015Documento36 pagineSolutions Class Examples AFM2015SherelleJiaxinLiNessuna valutazione finora

- Optimal Financing Mix Approach Adjusted Present ValueDocumento16 pagineOptimal Financing Mix Approach Adjusted Present ValueAnshik BansalNessuna valutazione finora

- Capital Budgeting Under UncertaintyDocumento30 pagineCapital Budgeting Under UncertaintyJyoti YadavNessuna valutazione finora

- Tutorial 7 - Cost of Debt + WACCDocumento2 pagineTutorial 7 - Cost of Debt + WACCAmy LimnaNessuna valutazione finora

- Cost of Capital - FinalDocumento51 pagineCost of Capital - FinalthinkestanNessuna valutazione finora

- ACC00152 Business Finance Topic 6 Tutorial AnswersDocumento2 pagineACC00152 Business Finance Topic 6 Tutorial AnswersPaul TianNessuna valutazione finora

- Corporate Finance Cost of Capital: Dr. Avinash Ghalke, CFADocumento20 pagineCorporate Finance Cost of Capital: Dr. Avinash Ghalke, CFAmansi agrawalNessuna valutazione finora

- Can One Size Fit All?Documento21 pagineCan One Size Fit All?Abhimanyu ChoudharyNessuna valutazione finora

- Capital Structure Theories ExplainedDocumento33 pagineCapital Structure Theories ExplainedNaman LadhaNessuna valutazione finora

- Exam 2 PracticeDocumento4 pagineExam 2 PracticeRaunak KoiralaNessuna valutazione finora

- Capital Structure DecisionsDocumento84 pagineCapital Structure DecisionsWasimNessuna valutazione finora

- Cost of CapitalDocumento35 pagineCost of CapitalgagafikNessuna valutazione finora

- CFA I QBank, Cost of CapitalDocumento15 pagineCFA I QBank, Cost of CapitalGasimovskyNessuna valutazione finora

- Ninth Edition: Political Economy of TradeDocumento18 pagineNinth Edition: Political Economy of Tradeprokophailaanh100% (1)

- Class 6-Supply Chain Management PDFDocumento29 pagineClass 6-Supply Chain Management PDFRajib AliNessuna valutazione finora

- International Business: The Challenges of Globalization: Ninth EditionDocumento26 pagineInternational Business: The Challenges of Globalization: Ninth EditionRajib AliNessuna valutazione finora

- Class 5-Product and Service DesignDocumento58 pagineClass 5-Product and Service DesignRajib AliNessuna valutazione finora

- Ninth Edition: Political Economy of TradeDocumento18 pagineNinth Edition: Political Economy of Tradeprokophailaanh100% (1)

- Class 5-Product and Service DesignDocumento58 pagineClass 5-Product and Service DesignRajib AliNessuna valutazione finora

- International Business: The Challenges of Globalization: Ninth EditionDocumento26 pagineInternational Business: The Challenges of Globalization: Ninth EditionRajib AliNessuna valutazione finora

- Five RRRRRR RRRRRRR RRRRRRRDocumento13 pagineFive RRRRRR RRRRRRR RRRRRRRRajib AliNessuna valutazione finora

- PakDocumento8 paginePakRajib AliNessuna valutazione finora

- Assessment of Outlier....................Documento8 pagineAssessment of Outlier....................Rajib AliNessuna valutazione finora

- E Form..... Tristar....Documento13 pagineE Form..... Tristar....Rajib AliNessuna valutazione finora

- CF ReportDocumento11 pagineCF ReportRajib AliNessuna valutazione finora

- Norway Netherland: Graph of Each Country GDP Growth RateDocumento4 pagineNorway Netherland: Graph of Each Country GDP Growth RateRajib AliNessuna valutazione finora

- AbstractDocumento11 pagineAbstractRajib AliNessuna valutazione finora

- No DoubtDocumento1 paginaNo DoubtRajib AliNessuna valutazione finora

- Millennium Development Goals in BhutanDocumento2 pagineMillennium Development Goals in BhutanRajib Ali100% (1)

- Amjad & Co.Documento19 pagineAmjad & Co.Rajib AliNessuna valutazione finora

- Group ADocumento1 paginaGroup ARajib AliNessuna valutazione finora

- Career Objective: Curriculum Vitae of Muzzamil HussainDocumento2 pagineCareer Objective: Curriculum Vitae of Muzzamil HussainRajib AliNessuna valutazione finora

- FisheriaaDocumento12 pagineFisheriaaRajib AliNessuna valutazione finora

- Case StudyDocumento5 pagineCase StudyRajib AliNessuna valutazione finora

- Engro Fertilizers LimitedDocumento10 pagineEngro Fertilizers LimitedRajib AliNessuna valutazione finora

- Bob's Bike & Cafe Case StudyDocumento6 pagineBob's Bike & Cafe Case StudyRajib AliNessuna valutazione finora

- SummaryDocumento8 pagineSummaryRajib AliNessuna valutazione finora

- Capital BudgetingDocumento83 pagineCapital BudgetingKaran SharmaNessuna valutazione finora

- Chap14-Firms Competitive Nov2018Documento16 pagineChap14-Firms Competitive Nov2018Algerien MadinNessuna valutazione finora

- Designorate Business Model Canvas1qDocumento1 paginaDesignorate Business Model Canvas1qMunkhsoyol GanbatNessuna valutazione finora

- Survey of Current Business Documents Convergence in State Per Capita IncomesDocumento13 pagineSurvey of Current Business Documents Convergence in State Per Capita IncomesViverNessuna valutazione finora

- Problems On DepreciationDocumento13 pagineProblems On DepreciationEkansh DwivediNessuna valutazione finora

- P - Issn: 2503-4413 E - Issn: 2654-5837, Hal 78 - 85 Studi Brand Positioning Toko Kopi Kekinian Di IndonesiaDocumento8 pagineP - Issn: 2503-4413 E - Issn: 2654-5837, Hal 78 - 85 Studi Brand Positioning Toko Kopi Kekinian Di IndonesiaNurul SyafitriiNessuna valutazione finora

- Chapter 3 - Food ProductionDocumento14 pagineChapter 3 - Food ProductionjohanNessuna valutazione finora

- JDF Procurement Expenditure Policy (G4 & QM)Documento27 pagineJDF Procurement Expenditure Policy (G4 & QM)Jez MusikNessuna valutazione finora

- South Indian Bank Result UpdatedDocumento13 pagineSouth Indian Bank Result UpdatedAngel BrokingNessuna valutazione finora

- Chapter 1-7Documento54 pagineChapter 1-7Sheila Tugade Dela CruzNessuna valutazione finora

- PRESENTATION Criticisms Strategic Management AccountingDocumento38 paginePRESENTATION Criticisms Strategic Management AccountingAzri Mohamed YusofNessuna valutazione finora

- TRACKING#:89761187821: BluedartDocumento2 pagineTRACKING#:89761187821: BluedartStone ColdNessuna valutazione finora

- Conversation Questions English For Business 1516Documento22 pagineConversation Questions English For Business 1516Alex PetriciNessuna valutazione finora

- Diagnosing and Changing Organizational CultureDocumento2 pagineDiagnosing and Changing Organizational CultureJohnyDoeNessuna valutazione finora

- Investors PerceptionDocumento30 pagineInvestors PerceptionAmanNagaliaNessuna valutazione finora

- Business Practices of CommunitiesDocumento11 pagineBusiness Practices of CommunitiesKanishk VermaNessuna valutazione finora

- Configure MSS (WDA) Settings in SAP NetWeaver BCDocumento6 pagineConfigure MSS (WDA) Settings in SAP NetWeaver BCThandile FikeniNessuna valutazione finora

- Valuation of Colgate-PalmoliveDocumento9 pagineValuation of Colgate-PalmoliveMichael JohnsonNessuna valutazione finora

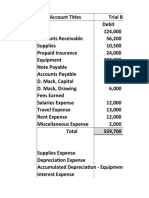

- Trial Balance Accounting RecordsDocumento8 pagineTrial Balance Accounting RecordsKevin Espiritu100% (1)

- Global Trust in Advertising Report Sept 2015Documento22 pagineGlobal Trust in Advertising Report Sept 2015Jaime CubasNessuna valutazione finora

- Importance of Accounting and Finance For IndustryDocumento16 pagineImportance of Accounting and Finance For IndustryDragosNessuna valutazione finora

- Chapter 01Documento15 pagineChapter 01Alan Wong100% (1)