Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BGM On GST Audit & Annual Return by CIRC of ICAI Edition July 2019

Caricato da

Sonam GulatiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BGM On GST Audit & Annual Return by CIRC of ICAI Edition July 2019

Caricato da

Sonam GulatiCopyright:

Formati disponibili

Central India Regional Council

The Institute of Chartered Accountants of India

(Set up under Act of Parliament)

Background Materialon

Goods & Service Taxes (GST)

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 1

© Central India Regional Council of The Institute of Chartered Accountants of India All rights

reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted,

in any form or by any means electronic, mechanical, photo-copying, recording, or otherwise, without

the prior permission, in writing, from the publisher. All disputes are subject to Kanpur jurisdiction

only.

DISCLAIMER The views expressed in this Background Material on Annual Return and GST Audit is

being prepared to provide the basic knowledge of Annual Return and GST Audit to our members.

Though the same is being prepared by the experts of the field and we have taken utmost care

regarding authenticity of information, provisions and guidelines mentioned here but still we want to

clarify that the above manual does not haveany legal validity and the only purpose of the manual is

to enhance the knowledge & skill of our members.

Central India Regional Council of The Institute of Chartered Accountants of India may not

necessarily subscribe to the views expressed by the author(s) The information cited in this

Background Material on Annual Return and GST Audithas been drawn primarily from the

http://www.cbic.gov.in/ and other sources. Readers are requested to note Sl. Nos / Table nos etc.,

wherever mentioned refer to the appropriate part / table of the relevant Forms. Names etc., of any

person or entity stated in this book are only for a proper understanding of the discussion and not

for anything else. Assumptions stated are to be understood in the context of the discussion and

cannot be applied to a real time situation, mutatis mutandis. While every effort has been made in

this Book to avoid any kind of errors or omissions. It is likely that errors may have crept in. Any

mistake, error or discrepancy noted by the reader should be brought to the notice Central India

Regional Council of the Institute of Chartered Accountants of India, Kanpur if these are found

helpful, suitable edits / corrections shall be effected in the next edition. It is notified that neither

ICAI nor the Background Material Committee, or publisher or sellers will be responsible for any

damage or loss to anyone of any kind or in any manner whatsoever by the use of this book. It is

suggested that if the context of the Annual Return and GST Audit creates any doubt in the mind of

the reader, s/he should cross-check all the facts, laws and contents of the publication with original

Government / GST Councilpublications or notifications& circulars.

First Edition : July, 2019

Committee/Department : Editorial Board

E-mail : circ@icai.in

Website : www.circ-icai.org

Published by : Central India Regional Council of

Institute of Chartered Accountants of India,

ICAI Bhawan, Plot No.9 ,Block A-1,Lakhanpur, Kanpur - 208024

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 2

Foreword

Goods & Services Tax (GST) was introduced in India on 1st July, 2017.

Introduction of GST has been memorable to our CA Fraternity due to

date of Launch i.e. CA Day. GST was introduced with intent of “One

Nation One Tax” which has replaced multilayred and complex indirect

tax structure within country and made Indirect Tax simplified by removing

cascading effect of tax. GST is the biggest reform in the history of Indirect

Taxation system in India which has made India one unified common market.

It is a single tax on the supply of goods and services, right from the

manufacturer to the consumer. GST integrated the country into a

common market by removing barriers across states and enabling smooth

flow of goods from one state to the other. It subsumed various indirect taxes

levied by the centre and the states to bring in a pan-India uniform indirect

taxation system.

Indirect Tax regime has forced the professionals along with every single individual to be in a learning

mode continuosly. GST Council is coming up with certain circulars and notifications from time to

time with intent to address the grivencess of tax payers and simultaneously by plugging the lanuca

or loop holes in GST Law. However we being the partner in nation's building and the trust shown

by the government and keeping in view the expectations of the society from our profession, we

need to be well versed of the subject matter and represent ourself as best experts in field of

Indirect Taxation. It is mandated that we have a greater responsibility for the same and to

stand firm on the expectation of our fellow citizens. We always proudly say our role as “Partner

in Nation Building” and now as “Partner in GST Knowledge Dissemination”.

We at CIRC is proactively & continuously working towards furtherance of profession and

undertaking several new initiatives to assist the members in discharging their professional

duties in the best possible manner. Recently CIRC has published Background Material on Bank

Audit and this month we are publishing on GST. With the aim of updating the working knowledge of

our members, CIRC has come up with this publication in the form of Background Material on

Annual Return and GST Audit which explains Annual Return and GST Audit with comprehensive

clause by clause analysis of the GST Acts, rules, recent notifications, circulars or orders issued

by the Government from time to time & try to bridge the gap between Acounting termonologies

and Law in a very eloquent and lucid language. I am confident enough that this publication

would be of immense use for our Members, especially the young members, in developing the

working knowledge of Annual Return and GST Audit and understanding various practical aspects

of Annual Return & GST Audit and will work as effective tool for them.

I am thankful to all my seniors in Central Council from CIRC CA Anuj Goyal Ji, CA Kemisa Soni

Ji, CA Manu Agarwal Ji, CA Prakash Sharma Ji, CA Pramod Boob Ji and CA Satish Gupta Ji for

always motivating us and for their continuous support in working of CIRC. I am also thankful

to all my regional council colleagues for their continuous and untiring efforts in bringing out this

Background Material.

I really appreciate the efforts being put in by CA Sachin Kumar Jain, RCM of CIRC and all

the members of the editorial team namely CA Shashank Gupta Ji, CA Arjit Agarwal Ji, CA

Jatin Harjai Ji, CA Yash Daddha Ji, CA Raghav Dangayach Ji for undertaking this tedious

task and bringing out this material in such a short span of time and appreciate their

commitment towards profession.

CA Mukesh Bansal

Chairman CIRC

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 3

Preface

Respected Professional Colleagues,

It is a matter of pleasure and opportunity to serve for the professionas Co-

Editor of this Background material on Annual Returns and GST Audit. It is

indeed a fact that there are historic and rapid changes in Indian Economy.

The Government of India has introduced the system of Goods and Services

Tax(GST) Act. It is no doubt an important step in the field of Indirect Taxes.

The system has been introduced with a view to benefit, the economy by

reduction in overall burden on Goods and Services and to make it competitive

in domestic as well as international markets. The one tax system in place of

various taxes also reduce the compliance burden.

The Government of India has implemented "Free Accounting and Billing Software" to small Tax

payers wherein GSTN as Nodal Office and we are happy to inform that ICAI also helped in

process.

The basic motto behind this Background Material is to enhance skill and knowledge of our

Members and to provide in hand, a ready information on the important related matter to GST

Annual Return and GST Audit. We have tried to keep the language simple. This will be helpful in

conducting the audit and filing Annual Return. We have also tried to explain the various

Technical Terms in GST Act which will be very useful for the esteem Readers of the Manual.

At this juncture, I give a vote of thanks to our worthy and dyanamic CA Mukesh Bansal

Ji, Chairman of CIRC of ICAI to show his confidence in me and give me this prestigious

responsibility to be the Co- Editor of this Background Material.

At the last, I request to be true with the Profession, protect safeguard our common interest of

Professional Development which will enable us to achieve Success. We are committed to do

betterment of performance with Profession and Sincere towards Nation. I wish all very Happy CA

Day and Happy GST Day and we are pleased to release this BGM on CA Day which is also called

GST Day i.e 1st July

Jai Hind ..Jai ICAI !!

Sincerely Yours

CA SachinKumar Jain

Co-Editor of CIRC Background Material on Annual Returns & GST Audit

Regional Council Member CIRC

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 4

Editorial Team

CA Jatin Harjai is a Practicing Chartered Accountant based out of Jaipur. Through his more

than fifteen years of career, he has become recognized for his contribution and expertise as a

knowledgeable professional, advisor and consultant in the field of financial consultancy and tax

advisory. He is consultant in the world bank project for GST Implementation for Govt. of

Rajasthan.

He has been Special invitee member of National Indirect Tax Committee of ICAI for consecutive

three years. He is Co-opted member of national Indirect Tax Committee of PHD Chamber of

Commerce & Industries for year 2018-19. He is Chairman of Technical Research (Indirect Taxes)

Committee of Tax Consultants Association of Jaipur. Further he is an active member and founder

Convener of the Study Group framed by the ICAI for study, research and recommendations on

GST, whereby all group members are eminent chartered accountants practicing in the field of

Indirect Taxes. He was Co-opted member of Direct Tax Committee of ICSI for the year 2018

CA Shashank Gupta is a practicing Chartered Accountant & is also a Lawyer by qualification.

He has pursued PG.D in tax laws under the aegis of Supreme Court of India where he was the

batch topper and was felicitated by the Law Minister of India in the presence of Hon’ble Chief

Justice of India and four other Supreme Court judges. He is presently a PH.D candidate on the

topic ‘Implementation of GST in India and VAT a cross country analysis’. He is a special invitee to

the IDT committee of ICAI. He is also a member of the Core Advisory Group of ICSI for GST.

Shashank is a prolific speaker and has addressed a range of seminars across the nation on

various issues under the gamut of indirect taxes. He is a regular speaker on the conventions and

seminars conducted by ICAI, ICSI and ICMAI.

He has also conducted sessions for various industry forums.He has several years of experience in

advising clients on a wide range of issues under indirect tax. He is an active litigator and has

argued several matters before adjudication authorities, Commissioner Appeals as well as CESTAT (Indirect tax tribunal)

and has also assisted several leading and multinational clients in dispute resolution, contract review and transaction

structuring.

Shashank carries a perfect blend of a dedicated academic background coupled with years of practical experience.

Presently he is a partner and head of indirect tax practice at Girish Ahuja & Associates. Earlier, Shashank has worked

with Deloitte, BMR Advisors and other leading consultancy organizations.

CA Arjit Agarwal is practicing Chartered Accountant & throughout First Class in Schooling

and Commerce Graduate with over 8 Years of post qualification experience in the areas of Direct

Taxation, Financial Operations, MIS Reporting, Budgeting etc in Multinational Companies.

He is regular contributing articles for CIRC of ICAI for last 7 years and sometimes for NIRC of

ICAI also on Taxation aspects. He has presented papers during his CA course at CA Students

National Conventions and post qualified Speaker at various National Forums of ICAI. He is

actively engaged for the profession and nominated as Co-Opted Member of different Committees

of CIRC ICAI in year 2017-18 , 2018-19 and currently Co-opted Member of Editorial Committee

of CIRC of ICAI for 2019-20. He has received Appreciation Awards at 13th Annual Function and

39th Regional Conference of CIRC of ICAI for his contribution towards profession. Currently he is

elected Managing Committee Member of Moradabad Branch of CIRC of ICAI and Editor in Chief

of Branch Monthly Members E Newsletter.

CA Yash Dadha is a practicing Chartered Accountant and is a fellow member of ICAI. He

has also qualified LLB (Academic). He is having working experience of over 10 years in the

fields of Indirect Taxes with concentration only on GST, Service Tax & Excise matters. He

is currently engaged in handling litigation along with advising clients, structuring

transactions and conducting Due Diligence in given fields of taxation. He was a Special

Invitee to the Indirect Tax Committee of ICAI for the term 2018-19. He is also on panel of CII

as GST, Service Tax & Excise Advisor for Industry Members. He has represented ICAI in

Regional Advisory Committee, Rajasthan under ageis of Chief Commissioner of Excise &

Customs, Jaipur.

CA Raghav Dangayach is a practicing Chartered Accountant and has an experience of Indirect

& Direct Taxation, Company Law Advisory & Auditing.

He specializes in all aspects of Value Added Tax (VAT)/ Central Sales Tax (CST), Central

Excise, Service Tax, Customs, Foreign Trade Policy (FTP), Special Economic Zone (SEZ), Export

Oriented Unit (EOU). Export-Import Laws and well acquainted with the concept and impact of

way forward Goods and Services Tax (GST). He has been a Co-opted Member of STUDENTS

COMMITTEE of CIRC of ICAI for the year 2018-19

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 5

Central India Regional

Council 2019-20

Chairman

CA. Mukesh Bansal

Vice Chairman

CA. Churchill Jain Background Material on Annual

Return & GST Audit

Secretary

CA. Abhisak Pandey Editor in Chief

CA. Mukesh Bansal

Treasurer

CA. Abhishek Sharma Co-Editor

CA. Sachin Kumar Jain

CICASA Chairman

Editorial Members

CA. Devendra Kumar Somani

CA. Jatin Harjai

CA. Shashank Gupta

Members

CA. Arjit Agarwal

CA. Atul Agarwal

CA. Yash Dadha

CA. Atul Mehrotra

CA. Raghav Dangayach

CA. Dinesh Kumar Jain

CA. Nilesh Gupta

CA. Sachin Kumar Jain

CA. Shashikant Chandraker

Ex – Officio Members

CA. Anuj Goyal

CA. Kemisha Soni

CA. Manu Agarwal

CA. Prakash Sharma

CA. Pramod KumarBoob

CA. Satish Kumar Gupta

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 6

Table of Contents

Chapter Chapters & Contents Page No.

No.

1. Introduction

a) Introductionon Annual Return & GST Audit

b) Relevant Provisions of GST Act(s) and Rules

7-10

c) What is the time limit to file Annual Return?

d) Consequences of failure to submit the annual return

e) Conclusion

2. Form GSTR 9 Annual Return

a) Check Points to be considered before filing Form GSTR-9 (Annual Return) 11-12

b) Important amendments having impact on Annual Return

3. Clause wise Analysis – Form GSTR-9 (Annual Return)

a) Part I – Basic Details

b) Part II - Details of Outward and inward supplies made during the financial

year

c) Part – III - Detailsof ITC for the Financial Fear

d) Part IV- Table 9 Details of tax paid as declared in returns filed during the 13-55

financial year

e) Part V - Particulars of the transactions for the previous FY declared in returns

of April to September of current FY or upto date of filing of annual return of

previous FY whichever is earlier

f) Part VI - Other Information

4. Audit under GST: Certification &Scope of GST Audit

a) Introduction

b) Practices to be adopted for GST Audit

c) Certification 56-60

d) Auditors’ Note

e) Vigilant aspects of the Certificate

f) Scope of GST Audit

5. Form GSTR-9C (Reconciliation Statement)

a) Basics - GSTR 9C - Reconciliation Statement

b) Suspicious Issues arising on account of disjunct between Act and Rules 61-64

c) Accounts and Records

d) Consequence of failure to submit annual return and reconciliation statement

6. Clause wise Form Analysis – Form GSTR-9C (Reconciliation

Statement)

a) Part I – Basic Details

b) Part II - Reconciliation of Turnover declared in AuditedAnnual Financial

Statement with Turnover declared in AnnualReturn (GSTR 9) 65-95

c) Part III - Reconciliation of Taxes Paid

d) Part IV - Reconciliation of Input Tax Credit (ITC)

e) Part V - Auditor’s Recommendation on Additional Liability due to non-

reconciliation.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 7

1. Introduction

It is first time that annual compliances (Annual Return and GST Audit) under GST are to be

made by tax payer and auditors. Hence, it is bound to happen that some issues will arise in

filling up and filing of the requisite forms. In cases covered by GST Audit, a certification

from auditor is also required to be filed, along with annual return and reconciliation

statement, which also requires auditor to comment on preparation of books of accounts,

records and other documents as per provisions of GST law. Sec. 35(1) read with Rule 56

prescribes accounts and documents which are to be maintained. Accordingly apart from

reconciliation statement it is necessary for auditor to check and verify sufficiency and

correctness of accounts and documents prepared and maintained by the registered tax payer.

However, this document is being compiled mainly to give ready reference for clauses of form

GSTR 9 & GSTR 9C.

2. Relevant Provisions of GST Act(s) and Rules

a. Section 35

(5) Every registered person whose turnover during a financial year exceeds the prescribed

limit shall get his accounts audited by a chartered accountant or a cost accountant and shall

submit a copy of the audited annual accounts, the reconciliation statement under sub-

section (2) of section 44 and such other documents in such form and manner as may be

prescribed.

b. Section 44

(1) Every registered person, other than an Input Service Distributor, a person paying tax

under section 51 or section 52, a casual taxable person and a non-resident taxable person,

shall furnish an annual return for every financial year electronically in such form and

manner as may be prescribed on or before the thirty-first day of December following the end

of such financial year.

(2) Every registered person who is required to get his accounts audited in accordance with

the provisions of sub-section (5) of section 35 shall furnish, electronically, the annual return

under sub-section (1) along with a copy of the audited annual accounts and a

reconciliation statement, reconciling the value of supplies declared in the return furnished

for the financial year with the audited annual financial statement, and such other particulars

as may be prescribed.

c. Rule 80

80. Annual return.-

(1) Every registered person, other than an Input Service Distributor, a person paying tax

under section 51 or section 52, a casual taxable person and a nonresident taxable person,

shall furnish an annual return as specified under sub-section (1) of section 44 electronically

in FORM GSTR-9 through the common portal either directly or through a Facilitation

Centre notified by the Commissioner:

Provided that a person paying tax under section 10shall furnish the annual return in FORM

GSTR-9A.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 8

(3) Every registered person whose aggregate turnover during a financial year exceeds two

crore rupees shall get his accounts audited as specified under sub-section (5) of section 35

and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly

certified, in FORM GSTR-9C, electronically through the common portal either directly or

through a Facilitation Centre notified by the Commissioner.

From the above provisions, it is understood that the 2 broad areas inviting attention are:

• Annual Return

• Reconciliation Statement

3. What is the time limit to file Annual Return?

According to Section 44(1) of CGST Act, 2017,every registered person (except persons

excluded as above)have to file annual return on or before 31st December following the end of

financial year.

An explanation was inserted in this section vide Order No. 1/2018-Central Tax dated 11th

December, 2018 to provide that the annual return for the period from the 1st July, 2017 to

the 31st March, 2018 shall be furnished on or before the 31st March, 2019.”

The above provision has been amended again vide Order No.03/2018-Central Tax dated 31st

December 2018 and the due date has been extended to 30th June 2019 which further

extended till 31st August 2019.

4. Consequences of failure to submit the annual return

Late Fee for delayed filing

Section 47(2) of the CGST Act provides for levy of a late fee of Rs. 100/- per day for delay in

furnishing annual return in Form GSTR 9, subject to a maximum amount of quarter percent

(0.25%) of the turnover in the State or Union Territory. Similar provisions for levy of late fee

exist under the State / Union Territory GST Act, 2017.

On a combined reading of Section 47(2) and Section 44 (1) of the CGST Act, 2017 and State

/ Union Territory GST Act, 2017 a late fee of Rs.200/- per day (Rs. 100 under CGST law

+Rs. 100/- under State / Union Territory GST law) could be levied which would be capped to

a maximum amount of 0.5% (0.25% under the CGST Law + 0.25% under the SGST /

UTGST Law) of turnover in the State or Union Territory.

General Penalty for Contravention of Provisions

Any person, who contravenes any of the provisions of this Act or any rules made there under

for which no penalty is separately provided for in this Act, shall be liable to a penalty which

may extend to Rs. 25,000. An equal amount of penalty under the SGST/UTGST Act would

also be applicable. Hence a penalty of up to Rs.50,000/- could be levied.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 9

Notice to defaulters

Section 46 of the CGST Act provides where a registered person fails to furnish a return under

section 39 or section 44 or section 45, a notice shall be issued requiring him to furnish such

return within fifteen days in such form and manner as may be prescribed.

5. Conclusion

Hence understanding the importance of GST Annual Return being a mandatory compliance it

is pertinent to understand the elements of the Form.

Form GSTR-9 (Annual Return) and Form GSTR-9C (Reconciliation Statement)were notified

vide Notification No. 39/2018 – Central Tax dated 4th September, 2018 and Notification No.

49/2018 – Central Tax dated 13th September, 2018 respectively.

The above forms have been substituted with revised forms vide Notification No. 74/2018 –

Central Tax dated 31st December 2018 wherein few changes have made in the forms

already notified.

In this publication, efforts have been directed to carve out a Clause wise analysis and

explanation of the above revised Forms. Since Annual Return is a pre-requisite for

Reconciliation Statement, Annual Return is discussed first and then the Reconciliation

Statement.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 10

FORM GSTR-9 - ANNUAL RETURN

1. Check Points to be considered before filing Form GSTR-9 (Annual Return)

a) It is mandatory to file all FORM GSTR-1 and FORM GSTR-3B for the Financial Year

before filing the annual return. The details for the period between July 2017 to March

2018 are to be provided in this return for Financial Year 2017-18.

b) The instructions of the revised form instruct that through the given form, additional

liability for the FY 2017-18 not declared in FORM GSTR-1 and FORM GSTR-3B may

be declared in this return.

c) Towards the end of the return, taxpayers shall be given an option to pay any additional

liability declared in this form, through FORM DRC-03. Taxpayers shall select ―

“Annual Return” in the drop down provided in FORM DRC-03. It may be noted that such

liability can be paid through electronic cash ledger only.

d) Form GSTR-9should be treated as a document consolidating the monthly summation of

figures punched in periodic GST Returns for a specific Financial Year only which are

duly rectified and tax, if any relating to the Financial Year is paid through GSTR-3B or

DRC-03, as the case may be.

2. Important amendments having impact on Annual Return

Removal of Difficulty Order No. 02/2018 dated 31st December, 2018

(Relevant for Input Tax Credit)

2. In sub-section (4) of section 16 of the said Act, the following proviso shall be inserted,

namely: -

“Provided that the registered person shall be entitled to take input tax credit after the due date

of furnishing of the return under section 39 for the month of September, 2018 till the due date

of furnishing of the return under the said section for the month of March, 2019 in respect of

any invoice or invoice relating to such debit note for supply of goods or services or both

made during the financial year 2017-18, the details of which have been uploaded by the

supplier under sub-section (1) of section 37 till the due date for furnishing the details under

sub-section (1) of said section for the month of March, 2019.”.

This has been discussed in depth later.

(Relevant for Outward Supplies, particularly GSTR-1)

3. In sub-section (3) of section 37 of the said Act, after the existing proviso, the following

proviso shall be inserted, namely: ––

“Provided further that the rectification of error or omission in respect of the details

furnished under sub-section (1) shall be allowed after furnishing of the return under

section 39 for the month of September, 2018 till the due date for furnishing the details

under subsection (1) for the month of March, 2019 or for the quarter January, 2019 to

March, 2019.”

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 11

Analysis:

It should be noted here that a similar proviso imposing time limit for rectification of error or

omission is also provided in Section 39 (i.e. monthly return) but ROD 2 has not added any

such proviso to extend the time limit there under. Hence tax on any outward supply

transaction pertaining to a FY (including FY 17-18) can be paid either up to GSTR-3B of

September of subsequent FY or through DRC-03 thereafter.

Now a careful reading and understanding of ROD 2 and Instructions to Form GSTR-9

discussed further indicate that information to be reported in Form GSTR-9 cannot be reported

in the absence of submission of the relevant details in Form GSTR-1 and Form GSTR-3B for

the financial year 2017-18, the same has been pointed out throughout the form through

instructions to source data on basis of GSTR-1 and GSTR-3B only.

Thus, it appears that one would not be permitted to report any additional liability in Form

GSTR-9 without reporting the same in subsequent GSTR-1 up to March 2019 as per ROD 2

discussed above and payment of such additional tax liability. Since filing of GSTR-1 and

GSTR 3B is a prerequisite, it implies that they must agree with each other by the end of the

last opportunity granted vide ROD 2 reproduced above. However, there may be situations

when they are not in agreement, viz.:

• Where outward supplies for the financial year 2017-18 are correctly reported in Form

GSTR 3B, but the omission or error was occurred in GSTR-1

In such case GSTR-1 (already filed) must be rectified before the due date for filing of

GSTR-1 for March 2019 so that Form GSTR 9 carries the correct turnover.

• Where outward supplies for the financial year 2017-18 reported by the supplier are

correctly uploaded in Form GSTR-1 during financial year 2018-19 (on availing the

benefit provided by Order 2) but correction not made in GSTR-3B

The additional tax liability unpaid must be paid through Form DRC 3 so that Form GSTR

9 would carry the correct information regarding outward supplies and taxes duly paid

(partly through GSTR 3B and rest through DRC 3).

Hence Removal of Difficulty Order No. 2 and the amendments in the Form have now enabled

reporting of rectified details in GSTR-9 so that correct figures are carried in GSTR-9 and

GSTR-9C for reconciliation.

Another view indicated and supported by Instruction No. 3 is that additional liability for the

FY 2017-18 not declared in FORM GSTR-1 and FORM GSTR-3B may be declared in this

return.

As per Press Release dated 04.06.2019 it is clarified as that payments made through FORM

DRC-03 for any supplies relating to period between July 2017 to March 2018 will not be

accounted for in FORM GSTR-9 but shall be reported during reconciliation in FORM GSTR-

9C.

(Clarification is sought from government in this regard.)

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 12

Clause wise Analysis – Form GSTR-9 (Annual Return)

1. Part I – Basic Details

This part requires the basic details of the registered person and the relevant Financial Year for

which Annual Return is filed. All the details in the given Part of the Form will be auto-

populated and Financial Year has to be opted from a drop-down available at the return

dashboard.

Although the form uses the term ‘Financial Year’, Instruction No. 2 to the Form provide that

the details for the period between July 2017 to March 2018 are to be provided in this return.

2. Part II - Details of Outward and inward supplies made during the financial year

The heading of this part has been substituted from “Details of Outward and inward supplies

declared during the financial year” to “Details of Outward and inward supplies made during

the financial year”.

Analysis:

Instruction 4 of the Form for Part II provide that all supplies for which tax payment has

been made through FORM GSTR-3B between July 2017 to March 2018 shall be declared

in this part.

The values in the given part will be auto-populated in the system drafted GSTR-9 on the basis

of GSTR-1 filed by the Registered Person and the same can be verified with the GSTR-1

summary available for the Financial Year on GSTR-9 Dashboard only.

The given part of the Form is divided in two Tables:

Table 4 (Turnover and Liability Table)

Details of advances, inward and outward supplies made during the financial year on

which tax is payable

a. Table 4A and 4B

Clause 4A: Supplies made to un-registered persons (B2C)

Clause 4B: Supplies made to registered persons (B2B)

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 13

Clause 4A Clause 4B

Instruction Aggregate value of supplies Aggregate value of supplies made to

made to consumers and registered persons (including supplies

unregistered personson which made to UINs) on which tax has been

tax has been paid paid

Inclusions • Supplies made through E- • Supplies made through E-

Commerce operators Commerce operators

• Net of credit notes or debit

notes

Reference Tables Table 5, Table 7, Table 9 and Table 4A and Table 4C

of GSTR-1 Table 10

Exclusion • Supplies on which tax is to be paid

by the recipient on reverse charge

basis

• Details of debit and credit notes (to

be mentioned separately)

b. Clause 4C

Zero rated supply (Export) on payment of tax (except supplies to SEZs)

Instruction: Aggregate value of exports(except supplies to SEZs) on which tax has been paid

Reference Table of GSTR-1:Table 6A of FORM GSTR-1

Remarks:

Table 6A of FORM GSTR-1 includes two types of export invoices:

1. Exports with payment of tax

2. Exports without payment of tax under Letter of Undertaking

Table 6A in summary of GSTR-1 (PDF) will only show the total amount of exports and

hence the amount of exports with payment of tax can only be verified through invoice level

summary of GSTR-1 available for download on GST portal in Json format.

c. Clause 4D

Supply to SEZs on payment of tax

Instruction: Aggregate value of supplies to SEZs on which tax has been paid

Reference Table of GSTR-1:Table 6B of FORM GSTR-1

Remarks:

Table 6B of FORM GSTR-1 includes two types of SEZ supplies:

1. SEZ supplies with payment of tax

2. SEZ supplies without payment of tax under Letter of Undertaking

Table 6B in summary of GSTR-1 (PDF) is available as part of total amount B2B invoices as

per Table 4A, 4B, 4C, 6B and 6C. Hence the amount of SEZ supplies with payment of tax

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 14

can only be verified through invoice level summary of GSTR-1 available for download on

GST portal in Json format.

d. Clause 4E

Deemed Exports

Instruction:

Aggregate value of supplies in the nature of deemed exports on which tax has been paid

Reference Table of GSTR-1:Table 6C of FORM GSTR-1

Remarks:

Table 6C is available as part of total amount of B2B invoices in Table 4A, 4B, 4C, 6B and

6Cin GSTR-1. Hence the amount of deemed exports can only be verified through invoice

level summary of GSTR-1 available for download on GST portal in Json format.

e. Clause 4F

Advances on which tax has been paid but invoice has not been issued (not covered

under (A) to (E) above)

Instruction: Details of all unadjusted advances i.e. advance has been received and tax has

been paid but invoice has not been issued in the current year.

Reference Table of GSTR-1:Table 11A of FORM GSTR-1

Remarks:

Only Table 11A will give the total amount of advances received in the relevant Financial

Year. The unadjusted advances should be calculated as follows:

Table Information

Table 11A Advances received

(-)Table 11B Advances adjusted

= Value for Clause 4F of FORM GSTR-9 Net unadjusted advances

The auto populated figures in Clause 4F of GSTR-9 are correctly reflected as per above

calculation.

f. Clause 4G

Inward supplies on which tax is to be paid on reverse charge basis

Instruction:

Aggregate value of all inward supplies (including advances and net of credit and debit notes)

on which tax is to be paid by the recipient (i.e.by the person filing the annual return) on

reverse charge basis.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 15

Inclusions:

• Supplies received from registered persons, unregistered persons on which tax is levied on

reverse charge basis. Illustrative List of supplies leviable to tax under RCM when

received from following suppliers:

o Goods Transport Agencies

o Advocates

o Arbitral Tribunal

o Sponsorship Services

o Government or Local Authority

o Director (not an employee of company)

o Insurance Agent

o Recovery Agent

o Transportation of Vessel

o Transfer or permitting right to use copyright

o Cab Services by E-Commerce Operator

(Reference: Section 9(3) of CGST Act, 2017 and Sec. 5(3) of IGST Act, 2017)

• Inward supplies received from unregistered persons on which tax is levied under RCM

upto 12th October 2017. (Reference: Section 9(4) of CGST Act, 2017 and Sec. 5(4) of

IGST Act, 2017)

• Import of services.

Aggregate value of all above inward supplies should be taken including advances and net of

credit and debit notes.

Reference Table of GSTR-3B: Table 3.1(d) of FORM GSTR-3B

Analysis:

This detail will be auto-populated in the system drafted GSTR-9 on the basis of GSTR-3B

filed and the same can be verified with the GSTR-3B summary available for the Financial

Year on GSTR-9 Dashboard only.

Although the auto populated details in this clause will be on the basis of RCM liability on

inward supplies reported in GSTR-3B for July 2017 to March 2018 only, the instruction

provide for all inward supplies on which tax is to be paid and hence a call needs to be taken

to declare any additional liability under reverse charge either paid in subsequent GSTR-3B or

not paid till filing of Annual Return. If any such liability under reverse charge has been

identified, it can be declared in this clause only. Rectification of amount of inward supplies in

GST returns in the next financial year should be reported in table 10 or 11 accordingly.

g. Table 4 – Clause I and Clause J

Credit Notes and Debit Notes issued in respect of transactions specified in (B) to (E)

above (-)

Instruction:Aggregate value of credit notes/debit notes issued in respect of B to B supplies

(4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E).

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 16

Reference Table of GSTR-1: Table 9B

Analysis:

• The auto-populated values in this clause of GSTR-9 are net value of Debit notes and

Credit notes reported in Table 9B of GSTR-1 filed for the financial year.

• Credit Notes and Debit Notes issued during the financial year in respect of outward

supplies made during the financial year are required to be reported here.

• However, total amount of Table 9B cannot be borrowed for computation of the amount

under this clause because Table 9B may also include credit notes issued against supplies

wherein no tax was payable. Such credit notes would be reported under clause 5H and not

4I.

• Any commercial/accounting credit notes without GST should not be considered for the

calculation of taxable value and tax amount in GSTR-9.

h. Table 4 – Clause K and Clause L

Supplies / tax declared or reduced through Amendments

Instruction:

Details of amendments made to B to B supplies (4B), exports (4C), supplies to SEZs (4D)

and deemed exports (4E), credit notes (4I), debit notes (4J) and refund vouchers.

Reference Table of GSTR-1: Table 9A and 9C

Analysis:

In the auto-populated draft at portal, amendments are correctly considered at differential

amount increased/reduced through such amendments.

For example, an invoice of taxable value Rs. 100,000 and 18% tax thereon was reported Rs.

10,000 and applicable tax and an amendment was made later to declare correct values, then

the values in this clause will be correctly reflected as Rs. 90,000 and applicable tax.

i. Table 4 – Clause N

Supplies and advances on which tax is to be paid (H + M) above

The aggregate values computed in this Clause include Supplies and advances on which tax is

to be paid (net of Credit/Debit notes and amendments) made during the Financial Year.

Remarks:

The value in Clause 4N of FORM GSTR-9 (excluding Clause 4G)plus amendments reported

in Table 10 and 11 in Part V of GSTR-9 will be the final value of taxable turnover carried

forward to FORM GSTR-9C in Clause 7F for reconciliation with taxable turnover as per

books computed thereof.

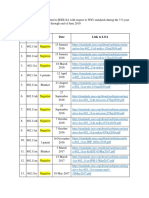

Clause-wise Cross referencing of GSTR-9 and GSTR-1

(For Table 4 and Table 5)

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 17

GSTR-9

GSTR-1 4A 4B 4C 4D 4E 4F 4I 4J 4K/ 5 5 5 5D 5 5 5

4L A B C , H I J/

5E 5

, K

5F

Table 4A, 4B,4C,

6B, 6C – B2B

Invoices

Table 5A, 5B –

B2C (Large)

Invoices

Table 9B –

Debit/Credit

Notes

(Registered)

Table 9B –

Debit/Credit

Notes (Un -

registered)

Table 6A –

Export Invoices

Table 7 – B2C

(Others)

Table 8 – Nil

rated, exempted

and non GST

outward supplies

Table 11A(1),

11A(2) - Tax

Liability

(Advances

Received)

11B(1), 11B(2) -

Adjustment of

Advances

12 - HSN-wise

summary of

outward supplies

9A - Amended

B2B Invoices

9A - Amended

B2C (Large)

Invoices

9C - Amended

Credit/Debit

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 18

Notes

(Registered)

9C - Amended

Credit/Debit

Notes

(Unregistered)

9A - Amended

Exports Invoices

10 - Amended

B2C(Others)

11A - Amended

Tax Liability

(Advance

Received)

11B -Amendment

of Adjustment of

Advances

Notes to consider:

Source of GSTR-9 – GSTR-3B or GSTR-1?

3B 1

Instruction 4 of the Form for Heading of Table 4 of GSTR-9 is as under:

Part II provide that all supplies Details of advances, inward and outward supplies made during the

for which tax payment has financial year on which tax is payable.

been made through FORM

GSTR-3B between July 2017 to Clause wise instructions direct that relevant data for the clauses may

March 2018 shall be declared in be sourced from Tables of GSTR-1 and hence the auto populated

this part. figures are generated on the basis of GSTR-1 only.

Clause wise instructions for Also, Instruction to Clause 5N, i.e., the total of Table 4 and 5 provide

Part-II provide that ‘Aggregate that ‘Total turnover including the sum of all the supplies (with

value of supplies made to on additional supplies and amendments) on which tax is payable and tax

which tax has been paid shall is not payable shall be declared here.’

be declared here’.

Hence it is evident that the headings and instructions of the Form are contrary and hence a

call is needed to be taken on case to case basis

Issues:

1. Reporting of additional liability – A dichotomy between Instructions

Comparison of Instructions:

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 19

Can be declared Only tax paid transactions

Instruction No. 3 states Instruction No. 4 provide as under:

that additional liability

for the FY 2017-18 not Part II consists of the details of all outward supplies & advances received

declared in FORM during the financial year for which the annual return is filed. It may be

GSTR-1 and FORM noted that all the supplies for which payment has been made through

GSTR-3B may be FORM GSTR-3B between July 2017 to March 2018 shall be declared

declared in this return. in this part.

Further, Instruction 7 provides that Part V consists of particulars of

transactions for the previous financial year but paid in the FORM GSTR-

3B of April to September of current FY or date of filing of Annual

Return for previous financial year.

It is evident from a careful reading thatthe above instructions are contrary where on one side

Instruction No. 3 proposes that the liability for FY 2017-18 missed while reporting in GSTR-

1 and GSTR-3B can be reported in GSTR-9 whereas Instruction 4 and 7 restricts the details

in Part II and Part V to only such transactions for which tax has been paid through GSTR-3B

in respective periods.

In this regard, a recent clarification has been issued wherein it has been clarified that

irrespective of when the supply was declared in FORM GSTR-1, the principle of declaring a

supply in Pt. II or Pt. V is essentially driven by when was tax paid through FORM GSTR-3B

in respect of such supplies. If the tax on such supply was paid through FORM GSTR-3B

between July 2017 to March 2018 then such supply shall be declared in Pt. II and if the tax

was paid through FORM GSTR3B between April 2018 to March 2019 then such supply shall

be declared in Pt. V of FORM GSTR-9.

It has been clarified by GST council that“any additional outward supply which was not

declared by the registered person inFORM GSTR-1 and FORM GSTR-3B shall be

declared in Pt.II of the FORM GSTR-9. Such additional liability shall be computed in

Pt.IV and the gap between the “tax payable” and “Paid through cash” column of

FORM GSTR-9 shall be paidthrough FORM DRC-03”.

2. Red Alert on variation in auto-populated figures more than 20%

It has to be kept in mind that although the auto-populated values in Form GSTR-9 are

editable, where such values are modified by more/less than 20%, the same will be highlighted

in red for attention.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 20

The authorities may also seek explanation such variance in system generated figures.

Clarified by council that it may be noted that auto-population is a functionality provided to

taxpayers for facilitation purposes, taxpayers shall report the data as per their books of

account or returns filed during the financial year

3. Disjunct between GSTR-1 and GSTR-3B – Impact on reporting in GSTR-9

In the prevalent return structure, there is a disjunct between GSTR-1 and GSTR-3B and tax is

paid as per transactions declared in GSTR-3B which may be at a variance from GSTR-1.

j. Table 5 (Turnover without liability)

Details of Outward supplies on which tax is not payable as declared in returns filed

during the financial year

The values in the clauses of this Table will be auto-populated on basis of GSTR-1 filed for

the Financial Year.

Clause 5A - Zero rated supply (Export) without payment of tax

Clause 5B - Supply to SEZs without payment of tax

5A 5B

Instruction Aggregate value of exports (except Aggregate value of supplies

supplies to SEZs) on which tax has not to SEZs on which tax has not

been paid shall be declared here. been paid shall be declared

here.

GSTR-1 Table 6A Table 6B

Reference Table

Remarks:

The auto-populated values for exports or SEZ supplies without payment of tax can be verified

from invoice level GSTR-1 summary only.

k. Clause 5C

Supplies on which tax is to be paid by recipient on reverse charge basis

Instruction:

Aggregate value of supplies made to registered persons on which tax is payable by the

recipient on reverse charge basis. Details of debit and credit notes are to be mentioned

separately. Table 4B of FORM GSTR-1 may be used for filling up these details.

Analysis:

Instruction 4 for Part II of the Form will not be relevant while reporting values in this clause

because no tax has been paid through GSTR-3B on such outward supplies where tax is

payable by recipient.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 21

It is important to note that where the registered person is engaged only in making outward

supplies which are taxable under reverse charge mechanism, he would have not been able to

report these supplies in GSTR-3B since it is a taxable supply under GST but Column 3.1(a)

of GSTR-3B does not accept taxable value without tax liability in respective IGST, CGST

and SGST columns.

It has also been observed that taxpayers do not report their outward supplies on which tax is

payable under RCM in GSTR-1 or they only mention the taxable value and declare the same

in tax columns with 0% tax rates. This is not the correct approach to declare such transactions

in GSTR-1. Instructions to FORM GSTR-1 provide that Table 4 capturing information

relating to B to B supplies should be captured in Table 4B for supplies attracting reverse

charge, rate-wise;

If the registered person has not reported the details in GSTR-1, the auto-populated figures

would not be correct and in such case a call has to be taken to report the actual values of

outward supplies taxable under RCM as per financials in Clause 5C of GSTR-9.

l. Clause 5D, 5E and 5F

Exempted, Nil Rated and Non-GST supply

Instruction:

Aggregate value of exempted, Nil Rated and Non-GST supplies shall be declared here. Table

8 of FORM GSTR-1 may be used for filling up these details.

The value of no supply shall be declared under Non-GST supply (5F).

Analysis:

The term exempt supply has been defined under Section 2(47) of CGST Act, 2017 as under:

(47) “exempt supply” means supply of any goods or services or both which attracts nil rate

of tax or which may be wholly exempt from tax under section 11, or under section 6 of the

Integrated Goods and Services Tax Act, and includes non-taxable supply;

The term non-taxable supply is defined under Section 2(78) of CGST Act, 2017 as:

(78) “non-taxable supply” means a supply of goods or services or both which is not leviable

to tax under this Act or under the Integrated Goods and Services Tax Act.

Remarks:

1. As per the definition, nil rated supplies are exempt supplies only but to the contrary,

GSTR-9 provides two different clauses for exempted and nil rated supplies. Now it poses

a question as to which supplies should be reported as exempted and which ones as nil

rated.

In clause5D, the taxpayer is expected to furnish information in relation to supplies on

which goods and services wholly exempted from tax under Notification 2/2017- CT(Rate)

for goods and 12/2017-CT(Rate) for services during the financial year 2017-18.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 22

In clause 5E, the taxpayer is expected to furnish information in relation to supplies on

which NIL rate of duty is chargeable as per section 9 read with Notification No. 1/2017-

CT (Rate) for goods and Notification No. 11/2017- CT (Rate) for services during the

financial year 2017-18.

2. Value of “No supply” is not required to be declared in any of the returns filed during the

Financial Year but it is required to be declared in Annual Return Part-II. It gives rise to an

ambiguity where such values should be fetched from, since it has not been declared in

returns filed.

The intention is to capture such details which are part of Schedule-III to Section 7 of the

CGST Act 2017 (i.e. Activities which are neither treated as supply of goods and nor treated

as supply of services). Since there was no column in period GST Returns to capture no

supply details, hence it has been specified here. Since no GST can be levied on “no supplies”

hence they are being reported here so that while reconciling the turnover with books of

accounts an unnecessary reconciliation item which shall have no tax impact shall not arise.

Instances of transactions which can be categorized as no supply on the basis of general

meaning of the words are illustrated as under:

• Services by employee to employer in course of employment

• Sale of Land or completed Building

• Transaction of Actionable Claim (other than lottery, betting and gambling)

• High Seas Sales before filing of BOE for Home Consumption

• Bonded Warehouse Sales before filing of BOE for Home Consumption

m. Clause 5H and 5I

Credit Notes issued in respect of transactions specified in A to F above (-)

Debit Notes issued in respect of transactions specified in A to F above (+)

Instruction:

Aggregate value of credit notes/debit notes issued in respect of supplies declared in 5A, 5B,

5C, 5D, 5E and 5F shall be declared here. Table 9B of FORM GSTR-1 may be used for

filling up these details.

Remarks:

Out of referred clauses, value of credit/debit notes in respect of following can only be

reported:

• Exports without payment of tax

• SEZ supplies without payment of Tax

• Supplies attracting tax on reverse charge basis

In relation of Clause D, E and F of Table 5, there is no specific field for Credit/Debit Notes.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 23

n. Clause 5J and 5K

Supplies declared through Amendments (+)

Supplies reduced through Amendments (-)

Instruction:

Details of amendments made to exports (except supplies to SEZs) and supplies to SEZs on

which tax has not been paid shall be declared here. Table 9A and Table 9C of FORM GSTR-

1 may be used for filling up these details.

o. Clause 5N

Total Turnover (including advances) (4N + 5M - 4G above)

Instruction:

Total turnover including the sum of all the supplies (with additional supplies and

amendments) on which tax is payable and tax is not payable shall be declared here. This shall

also include amount of advances on which tax is paid but invoices have not been issued in the

current year. However, this shall not include the aggregate value of inward supplies on which

tax is paid by the recipient (i.e. by the person filing the annual return) on reverse charge basis.

Remarks:

The value computed in Clause 5N of FORM GSTR-9 above, along with amendments

declared in April to September of current Financial Year for the previous Financial Year as

declared in Table 10 and 11 of GSTR-9, will be carried forward to FORM GSTR-9C in

Clause 5Q as Turnover as declared in Annual Return (GSTR-9). Such aggregate value taken

from GSTR-9 will be reconciled with Annual turnover as per Financial Statements in GSTR-

9C and reasons of un-reconciled differences will have to be reported.

3. Part – III - Details of ITC for the Financial Year

A. Preliminary Discussion

i. Whether extension of time limit for claiming ITC vide Removal of Difficulty Order

No. 2/2018 has any nexus with the changes made in Form GSTR-9?

It has now, been clarified that Input tax credit on inward supplies pertaining to FY 2017-18

but availed during the period April 2018 to March 2019 shall be declared in Table 8C of

FORM GSTR-9.

Part III has been broadly divided into three tables: Table 6, 7 and 8.

Part – III - DETAILS OF ITC FOR THE FINANCIAL YEAR

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 24

I. TABLE-6 - DETAILS OF ITC AVAILED DURING THE FINANCIAL YEAR

This table shall contain the information relating to ITC claimed on all inward supplies

received from registered persons, unregistered persons (RCM), registered persons (RCM),

import of goods, import of services, ISD credit, ITC reclaimed , transitional credits during the

FY 2017-18 i.e. in the GSTR-3B and TRAN-1, filed for the tax periods July-March 2018.

Tables 6, 7 and 8 are now being discussed in detail one by one.

a. Table -6A - Total amount of input tax credit availed through FORM GSTR-3B

Instruction:

Analysis:

Table - 4A of GSTR-3B contains the information relating to ITC claimed on:

• import of goods,

• import of services,

• inward supplies liable to RCM u/s 9(3) and 9(4),

• inward supplies from ISD

• All other input tax credit.

Remark:

Since the data in this table is auto populated from the returns filed during the FY 2017-18,

hence the same cannot be edited.

b. Table -6B - Inward supplies (other than imports and inward supplies liable to reverse

charge but includes services received from SEZs)

Instruction:

Source: Table 4(A)(5) of Form GSTR-3B.

Analysis:

Details of all inward supplies other than those listed below and the ITC on which has been

claimed in Table 4(A)(5) of Form GSTR-3B to be declared here.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 25

List of inward supplies not required to be reported in this table:

a) Inward supplies on which tax is payable under RCM

b) ITC claimed on import of goods

c) ITC claimed on import of services

d) ITC claimed on inward supplies from ISD

e) ITC which was availed, reversed and then reclaimed in the ITC ledger

Remarks:

a) The amount of ITC reclaimed (after availment and reversal) is required to be disclosed

separately in Table 6H. However, in form GSTR-3B, the said information (ITC reclaimed

after reversal) shall always be a part of ITC claimed in Table-4(A)(5) of Form GSTR-3B.

Hence, caution would be required in cases where the ITC has been reclaimed in GSTR-

3B to ensure that it doesn’t get reported in this table.

b) It is relevant to note if the Registered Person has disclosed gross total ITC [including

blocked ITC u/s 17(5)] in Table 4A of GSTR 3B and reduced the ineligible ITC in Table

4B (2) of GSTR 3B, the Registered Person should disclose the gross total ITC [including

ineligible ITC u/s 17(5)] in Table 6B of GSTR 9. The ineligible ITC u/s 17(5)will be

disclosed in Table 7E of GSTR 9. However, where the amount of blocked credit has been

declared only in Table 4(D) of the Form GSTR-3B and not included in Table 4(A), then

the same need not be reported here also.

c) The most complex information in Tables 6 is the bifurcation of the ITC availed into

inputs, input services and capital goods. The breakup of ITC into inputs, input services

and capital goods was originally required in GSTR-2. Therefore, the taxpayers were

originally required and expected to maintain such information for every ITC. Since Form

GSTR-2 has been suspended since inception (barring for July 2017), hence most of the

tax payers might have not maintained such information at the time of claiming ITC in

monthly returns. Therefore, collecting such information might prove to be a tedious task

for those taxpayers. Further, GST law requires to maintain the details of the inputs and

input services used in the manufacture of goods or provision of service along with a

register of input tax credit vide Section 35 when read with Rule 56.

So, this leads to an apprehension that the tax payer is required to maintain the details of

the ITC claimed into ITC on inputs, inputs services and capital goods.

d) In cases where the classification of ITC into Input, Input Services and Capital Goods is

not available in the records as discussed above, following basic approach may be adopted:

• Take Purchase Register, from the books of accounts and get the monthly figure of ITC. It

shall be ITC on inputs

• Take Fixed Assets Register, identify the addition to assets and ITC on such assets can be

tracked from there. In case Tax Audit under Income Tax is applicable, then invoice wise/

date wise additions in fixed assets can be taken from Form 3CD and ITC on capital goods

can be derived accordingly.

• From Total ITC, deduct ITC derived on inputs and capital goods as above.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 26

• The balance ITC should be related to expense which is to be apportioned as Input/Input

Services.

c. Table -6C - Inward supplies received from unregistered persons liable to reverse charge

(other than B above) on which tax is paid & ITC availed

Instruction:

6C Aggregate value of input tax credit availed on all inward supplies received

from unregistered persons (other than import of services) on which tax is

payable on reverse charge basis shall be declared here. It may be noted that

the total ITC availed is to be classified as ITC on inputs, capital goods and

input services. Table 4(A)(3) of FORM GSTR-3B may be used forfilling

up these details.

Source: Table 4(A)(3) of FORM GSTR-3B

Analysis:

a) This table contains the aggregate value of input tax credit availed on all inward supplies

received from unregistered Person (other than import of services) on which tax is payable

on reverse charge basis. Tax paid on supplies received from unregistered person and on

which input tax credit has not been availed, will not be reported under this clause.

b) Only the aggregate value of GST paid under reverse charge u/s 9(3) and 9(4) on supplies

procured from unregistered persons shall be disclosed here.

c) Notification No. 38/2017 – CT(R) dated 13.10.2017 was issued by the Government to

provide exemption from payment of tax under reverse charge for supplies received from

unregistered Persons. Therefore, clause 6C of GSTR 9 will contain data relating to inward

supplies received from unregistered Persons liableto GST u/s 9(4) from 1stJuly 2017 to

12thOctober 2017 only. However, the data related to the inward supplies received from

unregistered Persons liable to GST u/s 9(3) shall be for the entire period to be reported.

d) GST paid on import of services should not be reported here. It is required to be reported

in Table 6F.

e) Inward supplied received from Registered Persons liable to reverse charge u/s 9(3) should

not be disclosed under this Table.

Remarks:

a) Data disclosed in Table 6C and 6D should not exceed the data disclosed in Table 4G of

GSTR 9.

b) Inward supplies received from unregistered persons on which GST is paid under section

9(3) but subsequently where such supplies are being reflected in Form GSTR-2A, then

the same is required to be reported in Table 6D instead of this table.

For example, where GST is paid on GTA services u/s 9(3) on the presumption that the

supplier is unregistered because the supplier did not raise the tax invoice at time of supply

and subsequently such transactions are being reflected in GSTR-2A, then the same is not

required to be reported here. It shall be reported in next table.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 27

d. Table – 6D - Inward supplies received from registered persons liable to reverse charge

(other than B above) on which tax is paid and ITC availed

Instruction:

Source: Table 4(A)(3) of FORM GSTR-3B.

Analysis:

a) This clause requires reporting of the aggregate value of input tax credit availed on all

inward supplies (of input, input services and capital goods) as received from registered

persons on which tax is payable under reverse charge as per section 9(3) of CGST Act.

b) The list of goods liable to GST under reverse charge u/s 9(3) is notified in Notification

No. 4/2017-Central Tax (Rate), dated 28.06.2017. Further, in respect ofservices, the list

of services has been notified in Notification No. 13/2017- CT(R) dated 28.06.2017and

Notification No. 10/2017- IT(R) dated 28.06.2017.

c) GST paid on import of services should not be reported here. It is required to be reported

in Table 6F.

d) Inward supplied received from unregistered persons should notbe disclosed under this

Table.

Remarks:

a) Data disclosed in Table 6C and 6D should not exceed the data disclosed in Table 4G of

GSTR 9.

b) Data disclosed in Table 6C and 6D should also not exceed the data disclosed in Table –

4(A)(2) and 4(A)(3) of GSTR-3B filed for the period 2017-18.

c) Inward supplies received from registered persons on which GST is payable under section

9(3), then the eligibility of ITC on such supplies is subject to fulfilment of the invoice

details required in accordance with Rules 46 to 55A read with Rule 36(2).

d) Inward supplies received from unregistered persons on which GST in paid under section

9(3) but subsequently where such supplies are being reflected in Form GSTR-2A, then

the same is required to be reported in Table 6D instead of this table. Further the eligibility

of ITC on such supplies is subject to fulfilment of the invoice details required in

accordance with Rules 46 to 55A read with Rule 36(2).

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 28

e. Table – 6E- Imports of goods (Including supplies from SEZ)

Instruction:

6E Details of input tax credit availed on import of goods including supply of

goods received from SEZs shall be declared here. It may be noted that the

total ITC availed is to be classified as ITC on inputs and capital goods.

Table 4(A)(1) of FORM GSTR-3B may be used for filling up these details.

Source: Table 4(A)(1) of FORM GSTR-3B

Analysis:

a) This table requires reporting of the aggregate value of input tax credit availed on all

imports (for inputs and capital goods) from outside India or SEZ units.

b) Such data can also be validated from the bill of entry or other similar document

prescribed under the Customs Act, Customs Tariff Act or rules made there under for the

assessment of Integrated tax on imports.

As per clarification issued, Table 8 has no row to fill in credit of IGST paid at the time of

import of goods but availed in the return of April 2018 to March 2019. Due to this, there are

apprehensions that credit which was availed between April 2018 to March 2019 but not

reported in the annual return may lapse. For this particular entry, taxpayers are advised to fill

the entire credit availed on import of goods from July 2017 to March 2019 in Table 6(E) of

FORM GSTR-9 itself.

f. Table – 6F- Import of services (excluding inward supply from SEZ)

Instruction:

6F Details of input tax credit availed on import of services (excluding inward

supplies from SEZs) shall be declared here. Table 4(A)(2) of FORM GSTR-3B

Source: Table 4(A)(2) of FORM GSTR-3B

Analysis:

a) Aggregate value of input tax credit availed on all import of services received from outside

India needs to be reported here.

b) Data for this clause can also be corroborated with the details disclosed in the notes to

accounts in the Financial Statements.

c) ITC claimed on services received from SEZ unit need not be reported here.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 29

g. Table – 6G- Input Tax received from ISD

Instruction:

Source: Table 4(A)(4) of FORM GSTR-3B

Analysis:

In this Table, the Registered Person should report aggregate value of input tax credit availed

on all invoices raised by ISD. The Registered Person should be in possession of invoice

issued by ISD u/r 54(1) of CGST Rules. It is also relevant to note that the ineligible portion

of ITC distributed should not be availed as ITC.

h. Table – 6H- Amount of ITC reclaimed (other than B above) under the provision of the act.

Instruction:

Source: Table-4(A)(5) of FORM GSTR-3B

Analysis:

Details of all ITC claimed, reversed and reclaimed during the FY 2017-18 needs to be

reported in this table.

Illustration – ITC reversed on account of non-payment to vendor within one hundred and

eighty days. When payment is made, the registered person is eligible to reclaim thecredit.

Such credits are to be reported in Table 6H.

Remarks:

a) Only those ITC which has been reclaimed till March 2018 needs to be reported here.

Where any ITC pertaining to FY 2017-18 becomes eligible to be reclaimed after March

2018, then the same need not be reported in this form being filed for the FY 2017-18.

Same would then be reported in the annual return of FY 2018-19.

b) Any ITC which was required to be reclaimed till March 2018 but the same has been

reclaimed in subsequent period, then the same needs to be reported in Table 8C and 13

respectively.

c) ITC disclosed in Table 6B and 6H should be equal to the data disclosed in Table 4(A)(5)

of GSTR 3B.

d) Any ITC which has been reclaimed is required to be claimed in GSTR-3B in Table

4(A)(5) along with all other ITC which have been claimed for the very first time. So, the

ITC which has been reclaimed in the said table need to be recognized from the said table

which suggests that there is a necessity to have a pinpoint working of the ITC claimed in

GSTR-3B for all the tax periods. In the absence of such working papers, spotting the ITC

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 30

which has been reclaimed in the returns might prove to be a challenge. Precaution on

given point should be kept.

i. Table – 6I- Sub-total (6B to 6H above)

The said table auto-calculates the summation of the details declared in table 6B to 6H above.

j. Table – 6J- Difference (I-A above)

Instruction:

Analysis:

This table auto-calculates the difference between the ITC auto populated in Table 6A above

from Table-4(A) of GSTR-3B for the entire period and the aggregate of ITC being auto-

populated in the Table 6I above.

Remark:

a) The figure in this table should always be equal to zero as Tables 6B to 6H above requires

exactly to punch the data filed in GSTR-3B and therefore there appears to be no reason as

to there would be any difference in this table.

b) This table is a cross check for the taxpayers to ensure that they have declared all the

details filed in GSTR-3B for the period for which such annual return is being filed.

k. Table – 6K- Transition credit through TRAN-I (including revision if any)

Instruction:

Source: Credit entry appearing in the Electronic Credit ledger with the description

“Transition Cenvat Credit/VAT credit”.

Analysis:

Amount of credit received in the Electronic credit ledger through Form GST Tran-1 should

be reported here. Where the registered tax payer has revised GSTTRAN-1, the credit claimed

in the revised TRAN-1 should be disclosed in this Table.

l. Table – 6L-Transition credit through TRAN-II

Instruction:

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 31

Source: Electronic Credit ledger under the head of Transition cenvat credit/vat credit

Analysis:

This table shall contain the aggregate value of credit availed by the registered person through

TRAN-II. The credits availed through Form TRAN-II are credited directly into the Electronic

credit ledger of the Registered Person.

Remark:

GSTN is auto-populating the details of transitional credit received in the ECL after March

2018 in this table. But since the said credit was not available for utilization during the FY

2017-18, whether the same should be reported in this table is a debatable issue. Hence the

registered person and the auditor need to take the necessary caution.

m. Table – 6M - Any other ITC availed but not specified above

Instruction:

Source: Credit entry in Electronic Credit Ledger pertaining to ITC-01 or ITC-02 during the

period for which the annual return is being filed.

Analysis:

This table contains the details of the ITC availed but not covered in any of heads specified

under 6B to 6L above. ITC availed on the basis of section 18(1) or 18(3) through ITC-01 or

ITC-03 should be reported here.

n. Table – 6N-Sub-total (K to M above)

The said table auto-calculates the summation of the details declared in table 6K to 6M above

i.e. other than the ITC availed in GSTR-3B.

o. Table – 6O-Total ITC availed (I+N above)

This table is the summation table 6I and 6N above i.e. the ITC availed in GSTR-3B (Tables

6B to 6H) and other ITC not claimed in GSTR-3B (Tables 6K to 6M)

B. TABLE-7 - Details of ITC reversed and ineligible ITC for the Financial Year

This table shall contain the information relating to ITC reversed in the monthly returns

(GSTR-3B) for the FY 2017-18 i.e. July-March 2018, be it under Rule 37 or Rule 39 or

Rule 42 or Rule 43. This table also requires reversing blocked credits u/s 17(5) of the CGST

Act along with reversals of ineligible transitional credits.

One important point to be noted here is that this table contains the details of only those

reversals which have been made in the monthly returns (GSTR-3B) of July-March 2018.

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 32

Any reversal of ITC availed during FY 2017-18 done after 31st March 2018 i.e. during

the monthly returns of April-March 2019 shall be reported in a separate table (Table-

12) and not under this table.

Instruction:

7A, 7B, Details of input tax credit reversed due to ineligibility or reversals required

7C, 7D, under rule 37, 39, 42 and 43 of the CGST Rules, 2017 shall be declared

7E, 7F, here. This column should also contain details of any input tax credit

7G and reversed under section 17(5) of the CGST Act, 2017 and details of ineligible

7H transition credit claimed under FORM GST TRAN-I or FORM GST TRAN-

II and then subsequently reversed. Table 4(B) of FORM GSTR-3B may be

used for filling up these details. Any ITC reversed through FORM ITC -03

shall be declared in 7H. If the amount stated in Table 4D of FORM GSTR-

3B was not included in table 4A of FORM GSTR-3B, then no entry should

be made intable 7E of FORM GSTR-9. However, if amount mentioned in

table 4D of FORM GSTR-3B was included in table 4A of FORM GSTR-

3B, then entry will come in 7E of FORM GSTR-9.

II. CLAUSE WISE ANALYSIS OF TABLE 7:

a. Table – 7A – As per Rule 37

Source: Table 4(B)(2) of GSTR-3B

Analysis:

a) Reversal of ITC done case of failure in payment of consideration within 180 days from

the date of issue of invoice by the supplier is required to be reported in this table.

b) Such condition of 180 days is required to seen on 31st March 2018. If any ITC appears

liable to be reversed on the said date which has actually been reversed till GSTR-3B of

March 2018 should be reported here.

c) ITC which was reversed in 2018-19 pertaining to FY 2017-18 should be reported in Table

12.

b. Table -7B – As per Rule 39

Source: Table 4(B)(2) of GSTR-3B

Analysis:

a) Rule 39 deals with the procedure for distribution of input tax credit (ITC) by Input Service

Distributor (ISD). ISD is required to distribute ITC in the manner prescribed in the sub

rule 39(1). The ISD shall as per rules 39(1)(d), separately distribute the amount of

ineligible input tax credit as per section 17(5) of the Act.

b) If any supplier gives credit note to the ISD then input tax credit is required to be reduced

and shall be apportioned to each recipient in the same ratio in which the input tax credit

contained in the original invoice was distributed in terms of clause (d).

Background Material on Annual Return & GST Audit http://www.circ-icai.org/ Page 33

c) Consequently, ISD is required to issue a credit note to give effect to the above adjustment

to each of the recipient of the original invoice. Recipient of such credit notes is required to

reverse the credit received from ISD in GSTR-3B in Table 4(B)(2) which is required to be

reported in this table.

d) Another instance for reversal of ISD credit may arise when the credit is distributed by the

ISD either to the wrong unit or in wrong proportion.

c. Table – 7C & 7D – Reversal as per Rule 42 & 43

Source: Table 4(B)(1) of GSTR-3B

Analysis:

a) Reversal of ITC pertaining to FY 2017-18 done under Rule 42 & 43 in Form GSTR-

3B filed for the said period is required to be done in this table.