Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Coral Vs Cir

Caricato da

stargazer0732Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Coral Vs Cir

Caricato da

stargazer0732Copyright:

Formati disponibili

1/17/2019 CentralBooks:Reader

Close Reader

SUPREME COURT REPORTS ANNOTATED VOLUME 793

Information | Reference

Copy Selection

Case Title: Select some text within a

CORAL BAY NICKEL paragraph and click here to

CORPORATION, petitioner, vs. copy the selected text. Citation

COMMISSIONER OF INTERNAL included.

REVENUE, respondent.

Citation: 793 SCRA 190

More...

Search Result

G.R. No. 190506. June 13, 2016.*

CORAL BAY NICKEL CORPORATION,

petitioner, vs. COMMISSIONER OF

INTERNAL REVENUE, respondent.

Taxation; Tax Refund; Tax Credit; As

pronounced in Silicon Philippines, Inc. v.

Commissioner of Internal Revenue, 754 SCRA

279 (2015), the exception to the mandatory

and jurisdictional compliance with the

120+30-day period is when the claim for the

tax refund or credit was filed in the period

between December 10, 2003 and October 5,

2010 during which Bureau of Intenal Revenue

(BIR) Ruling No. DA-489-03 was still in effect.

—As pronounced in Silicon Philippines, Inc. v.

Commissioner of Internal Revenue, 754 SCRA

279 (2015), the exception to the mandatory

and jurisdictional compliance with the

120+30-day period is when the claim for the

tax refund or credit was filed in the period

between December 10, 2003 and October 5,

2010 during which BIR Ruling No. DA-489-03

was still in effect. Accordingly, the premature

filing of the judicial claim was allowed, giving

to the CTA jurisdiction over the appeal.

Same; Cross Border Doctrine; Destination

Principle; With the issuance of Revenue

Memorandum Circular (RMC) No. 74-99, the

distinction under the old rule was disregarded

and the new circular took into consideration

the two (2) important principles of the

Philippine Value-Added Tax (VAT) system: the

Cross Border Doctrine and the Destination

Principle.—With the issuance of RMC 74-99,

the distinction under the old rule was

disregarded and the new circular took into

consideration the two important principles of

the Philippine VAT system: the Cross Border

Doctrine and the Destination Principle.

Same; Value-Added Tax; No Value-Added

Tax (VAT) shall be imposed to form part of the

cost of goods destined for consumption outside

© Copyright 2019 Central Book Supply, Inc. All rights reserved.

http://www.central.com.ph/sfsreader/session/00000168591641add3cddec1003600fb002c009e/t/?o=False 1/1

Potrebbero piacerti anche

- California Supreme Court Petition: S173448 – Denied Without OpinionDa EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionValutazione: 4 su 5 stelle4/5 (1)

- The Letters of Gracchus on the East India QuestionDa EverandThe Letters of Gracchus on the East India QuestionNessuna valutazione finora

- MTD - No Jurisdiction Over The Subject MatterDocumento9 pagineMTD - No Jurisdiction Over The Subject MatteradeeNessuna valutazione finora

- 2018 - TeevesvsICCS NOTDocumento21 pagine2018 - TeevesvsICCS NOTDeborah PalacioNessuna valutazione finora

- 47 SPOUSES TEVES Vs INTEGRATED CREDIT CORPORATIONDocumento24 pagine47 SPOUSES TEVES Vs INTEGRATED CREDIT CORPORATIONLuelle PacquingNessuna valutazione finora

- Theory and Basis of TaxationDocumento3 pagineTheory and Basis of TaxationBai Johara SinsuatNessuna valutazione finora

- National Power Corporation vs. Municipal Government of NavotasDocumento11 pagineNational Power Corporation vs. Municipal Government of NavotasEvelyn TocgongnaNessuna valutazione finora

- MCC Industrial vs. Ssangyong Corp.Documento65 pagineMCC Industrial vs. Ssangyong Corp.NewbieNessuna valutazione finora

- MCC Industrial Sales Corporation vs. SsangyongDocumento65 pagineMCC Industrial Sales Corporation vs. SsangyongYeu GihNessuna valutazione finora

- Case Digest GR l-12518 L-66160 105208Documento2 pagineCase Digest GR l-12518 L-66160 105208Gian Paula MonghitNessuna valutazione finora

- Taxation Law Ii: Rights and Remedies of TaxpayersDocumento15 pagineTaxation Law Ii: Rights and Remedies of TaxpayersdoraemoanNessuna valutazione finora

- Administrative Decisions As Res JudicataDocumento6 pagineAdministrative Decisions As Res JudicataFatima Sarpina HinayNessuna valutazione finora

- Rule 2-Rule 3 CasesDocumento131 pagineRule 2-Rule 3 CasesCharisse MunezNessuna valutazione finora

- Civ Wave 1Documento4 pagineCiv Wave 1Psychelynne Maggay NicolasNessuna valutazione finora

- 2006 Republic v. GingoyonDocumento14 pagine2006 Republic v. Gingoyonmaria tanNessuna valutazione finora

- Janine Karla ADocumento11 pagineJanine Karla AJappy AranasNessuna valutazione finora

- CIR vs. CTADocumento2 pagineCIR vs. CTARhea CagueteNessuna valutazione finora

- Malcaba vs. ProHealth Pharma Philippines, Inc., 864 SCRA 518, G.R. No. 209085 June 6, 2018Documento34 pagineMalcaba vs. ProHealth Pharma Philippines, Inc., 864 SCRA 518, G.R. No. 209085 June 6, 2018Rogelio Jr. AdlawanNessuna valutazione finora

- Rule 2 FTDocumento175 pagineRule 2 FTNicole BlancheNessuna valutazione finora

- Ii. MCC v. Ssangyong CorpDocumento49 pagineIi. MCC v. Ssangyong CorpJoanne CamacamNessuna valutazione finora

- 07 209448-2017-Power Sector Assets and Liabilities20210424-14-1slvzybDocumento40 pagine07 209448-2017-Power Sector Assets and Liabilities20210424-14-1slvzybJustine GervacioNessuna valutazione finora

- Gonzales vs. Climax Mining LTD.: VOL. 452, FEBRUARY 28, 2005 607Documento13 pagineGonzales vs. Climax Mining LTD.: VOL. 452, FEBRUARY 28, 2005 607Angelie FloresNessuna valutazione finora

- Sps. Perez v. HermanoDocumento4 pagineSps. Perez v. HermanoJenny Mary Dagun100% (2)

- Villaflor vs. Court of AppealsDocumento1 paginaVillaflor vs. Court of AppealsKenneth Ray TagleNessuna valutazione finora

- ADR Digests - Week 2Documento17 pagineADR Digests - Week 2Hannah HernandoNessuna valutazione finora

- 23 NPC vs. Antero Bongbong PDFDocumento20 pagine23 NPC vs. Antero Bongbong PDFnette PagulayanNessuna valutazione finora

- 43 - Tejada Vs Homestead Property Corp.Documento6 pagine43 - Tejada Vs Homestead Property Corp.Jane MaribojoNessuna valutazione finora

- Gonzales v. Climax Mining LTD., 452 SCRA 607 (2005)Documento29 pagineGonzales v. Climax Mining LTD., 452 SCRA 607 (2005)inno KalNessuna valutazione finora

- PDF Apo Fruits Corporation V Land Bank of The Philippines - CompressDocumento4 paginePDF Apo Fruits Corporation V Land Bank of The Philippines - CompressEdwino Nudo Barbosa Jr.Nessuna valutazione finora

- Republic vs. Marsman Development CompanyDocumento14 pagineRepublic vs. Marsman Development CompanyFbarrsNessuna valutazione finora

- 3 ESSO Vs CIRDocumento2 pagine3 ESSO Vs CIRAlex FranciscoNessuna valutazione finora

- Kepco v. CIRDocumento8 pagineKepco v. CIRKhian JamerNessuna valutazione finora

- Turner Vlorenzo ShippingDocumento11 pagineTurner Vlorenzo ShippingJose Warven IlalimNessuna valutazione finora

- 2 Metro Pacific Corporation v. Commissioner of Internal Revenue, CTA Case No. 8318 (Second Division), 11 June 2014Documento3 pagine2 Metro Pacific Corporation v. Commissioner of Internal Revenue, CTA Case No. 8318 (Second Division), 11 June 2014Anonymous eqJkcbhHNessuna valutazione finora

- G.R. No. 111080 April 5, 2000 Orosa Vs CA HeldDocumento5 pagineG.R. No. 111080 April 5, 2000 Orosa Vs CA Heldrosario orda-caiseNessuna valutazione finora

- Corporation Law - Republic Planter Bank v. AganaDocumento5 pagineCorporation Law - Republic Planter Bank v. AganaNikko ParNessuna valutazione finora

- G.R. No. L-33580 February 6, 1931 Sancho vs. LizarragaDocumento15 pagineG.R. No. L-33580 February 6, 1931 Sancho vs. LizarragaRaymart L. MaralitNessuna valutazione finora

- Pasco vs. Pison-Arceo Agri DevelopmentDocumento7 paginePasco vs. Pison-Arceo Agri DevelopmentFatzie MendozaNessuna valutazione finora

- MITSUBISHI MOTORS v. BOCDocumento2 pagineMITSUBISHI MOTORS v. BOCRuby ReyesNessuna valutazione finora

- G.R. No. 190590 San Jose Vs Ma. Ozamis Controversy Test Intracorporate DisputeDocumento17 pagineG.R. No. 190590 San Jose Vs Ma. Ozamis Controversy Test Intracorporate DisputeChatNessuna valutazione finora

- SJS vs. AtienzaDocumento2 pagineSJS vs. AtienzaLance LagmanNessuna valutazione finora

- 8 Sherwill Vs Sitio Sto NinoDocumento7 pagine8 Sherwill Vs Sitio Sto NinoJonathan Vargas NograNessuna valutazione finora

- Fortich vs. CoronaDocumento33 pagineFortich vs. CoronaJane MaribojoNessuna valutazione finora

- Supreme Court: de La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocumento4 pagineSupreme Court: de La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsMarielNessuna valutazione finora

- Case GR 157479Documento7 pagineCase GR 157479MeeJeeNessuna valutazione finora

- 5 Republic Vs Salud HizonDocumento11 pagine5 Republic Vs Salud HizonJeanne CalalinNessuna valutazione finora

- 164 Supreme Court Reports Annotated: Tejada vs. Homestead Property CorporationDocumento7 pagine164 Supreme Court Reports Annotated: Tejada vs. Homestead Property CorporationJAMNessuna valutazione finora

- Chang Yung Fa vs. GianzonDocumento5 pagineChang Yung Fa vs. GianzonDax MonteclarNessuna valutazione finora

- Cases Reported: Supreme Court Reports AnnotatedDocumento16 pagineCases Reported: Supreme Court Reports AnnotatedPrincess Janine SyNessuna valutazione finora

- GR NO. 138248 - September 7 2005: Piapi Vs TalipDocumento4 pagineGR NO. 138248 - September 7 2005: Piapi Vs TalipGennard Michael Angelo AngelesNessuna valutazione finora

- Carantes vs. Court of AppealsDocumento16 pagineCarantes vs. Court of AppealsArnold BagalanteNessuna valutazione finora

- 22 Malonzo v. PrincipeDocumento19 pagine22 Malonzo v. PrincipeTon RiveraNessuna valutazione finora

- Republic Vs Ker & CompanyDocumento17 pagineRepublic Vs Ker & Companycode4saleNessuna valutazione finora

- CIR vs. SantosDocumento1 paginaCIR vs. Santosdanexrainier100% (1)

- G.R. No. 166429 PDFDocumento4 pagineG.R. No. 166429 PDFAnonymous 1tHH45nENessuna valutazione finora

- 034 Bautista Vs UnangstDocumento2 pagine034 Bautista Vs UnangstKikoy IlaganNessuna valutazione finora

- Badillo v. TayagDocumento17 pagineBadillo v. TayagHannah HernandoNessuna valutazione finora

- Intramuros vs. OffshoreDocumento43 pagineIntramuros vs. OffshoreMP ManliclicNessuna valutazione finora

- Giron V OchoaDocumento14 pagineGiron V Ochoaanne6louise6panagaNessuna valutazione finora

- A.M. No. RTJ 16 2443Documento7 pagineA.M. No. RTJ 16 2443stargazer0732Nessuna valutazione finora

- Takenaka Vs CirDocumento1 paginaTakenaka Vs Cirstargazer0732Nessuna valutazione finora

- Techniques in Answering Bar QuestionsDocumento15 pagineTechniques in Answering Bar Questionsstargazer0732Nessuna valutazione finora

- Silicon Phil Vs CirDocumento1 paginaSilicon Phil Vs Cirstargazer0732Nessuna valutazione finora

- Cir VS Sony PDFDocumento1 paginaCir VS Sony PDFstargazer0732Nessuna valutazione finora

- Special ProceedingsDocumento21 pagineSpecial Proceedingsstargazer0732Nessuna valutazione finora

- Gelano Vs Ca (Corporation Law)Documento3 pagineGelano Vs Ca (Corporation Law)stargazer0732Nessuna valutazione finora

- Sample Complaint Unlawful DetainerDocumento6 pagineSample Complaint Unlawful Detainerstargazer0732100% (1)

- 91 - Northern Motors vs. Coquia - TanDocumento332 pagine91 - Northern Motors vs. Coquia - Tanstargazer0732Nessuna valutazione finora

- Plaintiff-Appellee Vs Vs Defendant Petitioner-Appellant. Laurel, Del Rosario & Sabido Solicitor-General HiladoDocumento7 paginePlaintiff-Appellee Vs Vs Defendant Petitioner-Appellant. Laurel, Del Rosario & Sabido Solicitor-General Hiladostargazer0732Nessuna valutazione finora

- Docshare - Tips Credit TransactionDocumento23 pagineDocshare - Tips Credit Transactionstargazer0732Nessuna valutazione finora

- Digest of Tuanda V An G R No 110544Documento1 paginaDigest of Tuanda V An G R No 110544stargazer0732Nessuna valutazione finora

- Tax Reform in India Achievements and Challenges PDFDocumento17 pagineTax Reform in India Achievements and Challenges PDFrudra learning institute be the best100% (1)

- CTI-Paper-1-GK-Question-Paper-pdf-07-01-2024Documento34 pagineCTI-Paper-1-GK-Question-Paper-pdf-07-01-2024Kridl smgNessuna valutazione finora

- Chapter 13: Current Liabilities and ContingenciesDocumento25 pagineChapter 13: Current Liabilities and ContingenciesMohammed Akhtab Ul HudaNessuna valutazione finora

- G.R. No. 163345 July 4, 2008 Commissioner of Internal Revenue, Petitioners, vs. PERF REALTY CORPORATION, Respondent. FactsDocumento2 pagineG.R. No. 163345 July 4, 2008 Commissioner of Internal Revenue, Petitioners, vs. PERF REALTY CORPORATION, Respondent. FactsJoshua Erik MadriaNessuna valutazione finora

- The+Cloud9+Dominus+Company Profit+and+LossDocumento2 pagineThe+Cloud9+Dominus+Company Profit+and+LossMaria del Pilar GarayNessuna valutazione finora

- Inter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)Documento176 pagineInter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)pradeep ozaNessuna valutazione finora

- MR Eb Direct InvoiceDocumento2 pagineMR Eb Direct InvoiceHIMANSHU BHARDWAJNessuna valutazione finora

- 1099 ReportingDocumento24 pagine1099 ReportingAtif JavaidNessuna valutazione finora

- Antonio Morales Reyes T183 2023-03-30Documento1 paginaAntonio Morales Reyes T183 2023-03-30Antonio MoralesNessuna valutazione finora

- Cash Credits LLB Notes Income Tax Act Gen Law CollegeDocumento8 pagineCash Credits LLB Notes Income Tax Act Gen Law CollegeJohn WickNessuna valutazione finora

- Form For House Loan in Joint NameDocumento1 paginaForm For House Loan in Joint Namemk_valiantNessuna valutazione finora

- Case #2 - The Mba Decision - QuestionsDocumento1 paginaCase #2 - The Mba Decision - QuestionsGarrett Singer0% (1)

- Bangalore & Your Probation Period Would Be 1 Year From The Date of Joining. During ProbationDocumento2 pagineBangalore & Your Probation Period Would Be 1 Year From The Date of Joining. During ProbationBhavya Shetty100% (1)

- Revised Dissertation ReportDocumento61 pagineRevised Dissertation Reportparv guptaNessuna valutazione finora

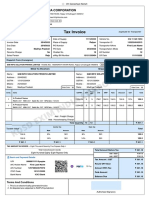

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Gadde Niharika ChowdaryNessuna valutazione finora

- ACT400 - Mastery ExerciseDocumento125 pagineACT400 - Mastery ExerciseKrystal FabianNessuna valutazione finora

- Irish Capital Gains FormDocumento4 pagineIrish Capital Gains FormGragory NyauchiNessuna valutazione finora

- SMP 15 Year 1 LAKHDocumento3 pagineSMP 15 Year 1 LAKHTamil Vanan NNessuna valutazione finora

- Introduction To The Real Property Tax Administration FinalDocumento7 pagineIntroduction To The Real Property Tax Administration FinalNeil Mervyn LisondraNessuna valutazione finora

- AcadsDocumento3 pagineAcadsReid PaladNessuna valutazione finora

- GaneshDocumento1 paginaGaneshganeshtambre747Nessuna valutazione finora

- A5 InvoiceDocumento1 paginaA5 InvoiceVaibhav PritwaniNessuna valutazione finora

- GST Impact On Restaurants in IndiaDocumento19 pagineGST Impact On Restaurants in IndiaVarun RimmalapudiNessuna valutazione finora

- PartnershipDocumento330 paginePartnershipAbby Sta Ana100% (2)

- CHAPTER 1 & 2 Power and Limitations of TaxationDocumento47 pagineCHAPTER 1 & 2 Power and Limitations of TaxationCeej DalipeNessuna valutazione finora

- Taxation ProjectDocumento23 pagineTaxation ProjectAkshata MasurkarNessuna valutazione finora

- Income Statement Analysis of Vitarich CorporationDocumento11 pagineIncome Statement Analysis of Vitarich CorporationLynnie Jane JauculanNessuna valutazione finora

- Jim Turin & Sons, Inc., v. Commissioner of Internal Revenue Case AnalysisDocumento5 pagineJim Turin & Sons, Inc., v. Commissioner of Internal Revenue Case AnalysisFloyd SeremNessuna valutazione finora

- TaxDocuments 20221231D 1680486197406 0Documento10 pagineTaxDocuments 20221231D 1680486197406 0J CNessuna valutazione finora

- TAX Withholding TaxesDocumento6 pagineTAX Withholding TaxesRae WorksNessuna valutazione finora