Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MT101 | Market Timing Introduction for Professionals

Caricato da

VJ QatarTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

MT101 | Market Timing Introduction for Professionals

Caricato da

VJ QatarCopyright:

Formati disponibili

M

UL

AY

C)

(c

MT101 | Market Timing Introduction

M

Market Timing for Professionals

L U

AY

Executive Course Day 1

)C

(c

CHARLES WILLIAM ANG, CFA | MT101 Instructor

PSEi (10 year chart)

M

U

10yr CAGR = 9.0%

L

AY

)C

(c

MT101 | Market Timing Introduction

Two Questions

1. Is this the right place to be investing in?

M

U

2. Is there any way to further improve returns?

L

AY

) C

(c

MT101 | Market Timing Introduction

Real Returns US Markets (1801 – 2001)

M

L U

AY

) C

(c

Source: Stocks for the Long Run 4th edition by Jeremy Siegel

Stocks outperform all asset classes!

MT101 | Market Timing Introduction

Real Returns Developed Markets (1900 – 2006)

M

L U

AY

)C

(c

Stocks outperform all asset classes!

MT101 | Market Timing Introduction

Risk, Return and Holding Period US Markets (1802 – 2006)

M

L U

AY

) C

(c

Source: Stocks for the Long Run 4th edition by Jeremy Siegel

Key is investing over the long term

MT101 | Market Timing Introduction

Improving Returns Through the FTSR Framework

M

L U

AY

)C

(c

MT101 | Market Timing Introduction

Outline for Day 1

AM session:

Improving Returns through the FTSR framework (10-39)

M

Intro to Fundamental Analysis: Classifying Stocks through

U

Growth Rates (40-56)

L

AY

Identifying winners (57-116)

Linking Fundamentals and Technicals (117-136)

) C

(c

PM session: Workshop

MT101 | Market Timing Introduction

Market Timing for Professionals

M

L U

AY

C

IMPROVING RETURNS THROUGH

)

(c

THE FTSR FRAMEWORK

MT101 | Market Timing Introduction

What drives stock price?

(Fair) Price

M

Earnings

L U

AY

) C

(c

In theory, fair price should track earnings trend

MT101 | Market Timing Introduction

What drives stock price?

Price

M

Earnings

L U

AY

) C

(c

In reality, price is also affected by other things –

PERCEPTIONS, EXPECTATIONS and EMOTIONS

MT101 | Market Timing Introduction

Knowing Earnings is not Enough

Knowing earnings trend is important; but not enough

M

L U

One should also understand what the market is

AY

currently thinking and feeling and anticipate what

C

it will most likely think and feel tomorrow

)

(c

MT101 | Market Timing Introduction

Perceptions, Expectations, Emotions – JGS Placement

JGS Placement

M

L U

AY

)C

(c

MT101 | Market Timing Introduction

Perceptions, Expectations, Emotions – JGS Placement

M

L U

AY

)C

(c

MT101 | Market Timing Introduction

Perceptions, Expectations, Emotions – JGS Placement (2015)

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Perceptions, Expectations, Emotions – ALI (2 years)

1Q15: up 19% 1H16: up 16%

M

1H15: up 19% FY16: up 19%

L U

AY

9M16: up 17%

) C

9M15: up 19% 1Q16: up 14%

(c

FY15: up 19%

MT101 | Market Timing Introduction

Fundamentals and Technicals

It is the market (not the fundamentals, nor you) who

M

ultimately moves the share price

L U

AY

Nevertheless, understanding fundamentals gives you

C

an edge over the other players

)

(c

MT101 | Market Timing Introduction

FTSR Framework

M

UL

AY

C)

(c

MT101 | Market Timing Introduction

Fundamentals VS Technicals

Fundamentals Technicals

M

Looks at Business Looks at Price

LU

Long Term Short Term

AY

Searches Value Searches Demand

) C

(c

Impossible to forecast

Price action is sketchy

the future

MT101 | Market Timing Introduction

Fundamentals VS Technicals

Fundamentals Technicals

M

Good Quality Companies Market Confirms

U

Cheap could remain Prices may not be

L

AY

cheap sustainable

C

Long-term outlook, short-term execution

)

(c

Fundamentals is your outlook,

Technicals is your confirmation

MT101 | Market Timing Introduction

FTSR Framework

M

UL

AY

C)

(c

MT101 | Market Timing Introduction

Understanding Market Sentiment

Emotions are inevitable

M

L U

Challenge is to:

AY

1) Learn to control your emotions

C

2) Capitalize on the emotions of the market

)

(c

MT101 | Market Timing Introduction

The Emotional Cycle of Investing: Bull-Bear Cycle

M

L U

AY

) C

(c

Source: Psychological Crowd Profile Analysis by James E. Schildgen

MT101 | Market Timing Introduction

Shanghai Composite Index (2006-2014)

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

US Tech Bubble (2000)

M

LU

AY

) C

(c

MT101 | Market Timing Introduction

Shanghai Composite Index (2014-2017)

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Emotional Cycle of Investing

Cycles are a demonstration of human frailties.

•You can characterize points in the cycle using emotions

M

LU

AY

) C

(c

Source: OptionAlpha.com

MT101 | Market Timing Introduction

Emotional Cycle of Investing

Hope Greed

to cherish a desire a selfish and excessive

with anticipation desire for more

M

UL

AY

Despair Fear

to lose all hope

) C to be afraid of ;

or confidence to expect with alarm

(c

MT101 | Market Timing Introduction

Emotional Cycle of Investing

Knowing where you are in the Stock Market Cycle

holds advantages:

M

• Filtering out noise

U

• Take out emotion

L

• Implement a strategy suitable for current market conditions

AY

1) Looking at the Big Picture

C

2) See corresponding valuations

)

(c

3) Making sense of what the market is telling you

MT101 | Market Timing Introduction

Always Look at the Big Picture

Appraising market conditions

• Always look at the big picture

M

– A rising tide lifts all boats

U

– Immediately, the probabilities are shifted to your favor

L

AY

• By having a long-term outlook, you have a road map.

C

– Your views are not easily thrown off by short-term volatility

)

(c

– You are set up for bigger opportunities and become less

vulnerable to unwelcome surprises

MT101 | Market Timing Introduction

Philippines Index (2007 – 2017)

M

L U

AY

) C

(c

What do you think are general

conditions doing in the past 5 years?

MT101 | Market Timing Introduction

Always Look at the Big Picture

China (2009 – 2013)

M

What do you think are general

U

conditions doing in the past 5 years?

L

AY

)C

(c

MT101 | Market Timing Introduction

Risk Management

However, some risks will always remain

Diversification

M

U

Position Sizing

L

Cutting losses

AY

C

Always remember: risks first; profits second!

)

(c

MT101 | Market Timing Introduction

Market Timing System and Philosophy

Market Timing: Long-term outlook, short-term execution

Fundamentals: Screening for solid companies

M

Technicals: Understanding what the price is telling you

L U

Sentiment: Identifying where you are in the cycle

AY

Risk: Protecting while maximizing your capital

) C

(c

Overall: Building a system

MT101 | Market Timing Introduction

Market Timing System and Philosophy

Executive course program:

M

U

Goal: Improve yearly returns by 5 to 10%

L

AY

6 to 12 months mindset

)C

(c

MT101 | Market Timing Introduction

Market Timing for Professionals

M

L U

AY

) C INTRODUCTION TO

(c

FUNDAMENTAL ANALYSIS

MT101 | Market Timing Introduction

Essence of Owning a Stock

What does it mean when you own a stock?

M

U

L

AY

)C

(c

MT101 | Market Timing Introduction

Essence of Owning a Stock

The value of a share is determined by how well the

company performs

M

L U

AY

Earnings = Returns

)C

(c

MT101 | Market Timing Introduction

Fundamental Analysis

Fundamental Analysis: study of all factors that affect the

future success (earnings) of a company

M

Competition Economy

U

Efficiency Technology

L

AY

Management Strategy

) C

Product Innovation

Growth Niche

(c

Buying companies should be entrepreneurial

MT101 | Market Timing Introduction

Earnings as Ultimate Driver of Share Price

Share Price

M

L U

Earnings

AY

C

Current Earnings + Future Growth

)

(c

MT101 | Market Timing Introduction

Classification of Stocks

Current Earnings No Growth (Value)

Future Growth

Steady Growth (10-15%)

L U

AY

High Growth (>15%)

)C

(c

Speculative

MT101 | Market Timing Introduction

Classification of Stocks

No Growth (Value)

M

Growth Forecast: 2%

U

L

2016 Earnings: Php20Bil

AY

Market Cap: Php331Bil

) C

P/E: 16.5X

(c

MT101 | Market Timing Introduction

Classification of Stocks

Steady Growth (10-15%)

M

Growth Forecast: 12%

LU

2016 Earnings: Php23.8Bil

AY

Market Cap: Php506Bil

) C

P/E: 21.3X

(c

MT101 | Market Timing Introduction

Classification of Stocks

High Growth (>15%)

M

Growth Forecast: 18%

LU

2016 Earnings: Php6.1Bil

AY

Market Cap: Php209Bil

) C

P/E: 34.3X

(c

MT101 | Market Timing Introduction

Classification of Stocks

Speculative

M

Growth Forecast: 48%??

LU

2016 Earnings: Php1Bil??

AY

Market Cap: Php119Bil

) C

P/E: 119++X

(c

MT101 | Market Timing Introduction

Growth versus Value

Fair Value =

Value of Existing Business + Value of Future Growth

M

U

More uncertainty/

L

Higher risk

AY

)C Higher return

(c

Growth stocks outperform over the long term!

MT101 | Market Timing Introduction

Growth versus Value

Uncertainty in valuing growth stocks

M

LU

AY

)C

(c

MT101 | Market Timing Introduction

Growth versus Value

What about the higher risk?

M

Risk is limited by the FTSR framework

L U

AY

Focusing on growth stocks while executing using FTSR

C

framework allows us to maximize returns

)

(c

MT101 | Market Timing Introduction

Growth versus Value

Growth Value

M

More potential Cheap

Pros

U

Huge interest Predictable

L

AY

Higher premiums Few interest

Cons

More uncertain/volatile )C Limited upside

(c

High expectations

Biggest Value traps

(huge downside if expectations Risk (cheap stocks remain cheap)

fail to materialize)

MT101 | Market Timing Introduction

Growth versus Value

High Expectations – PGOLD (5 Years)

M

L U

AY

C

Announced weaker than

)

(c

expected earnings

MT101 | Market Timing Introduction

Growth versus Value

Value Trap – EDC (5 Years)

Cheap stocks remain cheap for a long time

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Classification of Stocks – 45° vs 90°

No Growth (Value)

M

Steady Growth (10-15%)

L U

45° stock

AY

High Growth (>15%) Earnings driven

) C

(c

Speculative

90° stock

Speculation

MT101 | Market Timing Introduction

Classification of Stocks – 45° vs 90°

45° stock - Earnings driven

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Classification of Stocks – 45° vs 90°

45° stock - Earnings driven

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Classification of Stocks – 45° vs 90°

90° stock - Speculation

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Classification of Stocks – 45° vs 90°

90° stock - Speculation

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Classification of Stocks – 45° vs 90°

90° stock - Speculation

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Conclusion

M

It is possible to make money from all types of stocks

L U

AY

However, market timers (executive course) can

C

maximize their returns by focusing on earnings-

driven, growth stocks

)

(c

MT101 | Market Timing Introduction

Market Timing for Professionals

M

L U

AY

) C IDENTIFYING WINNERS

(c

MT101 | Market Timing Introduction

Steps in Identifying Winners

1. Look for megatrends and identify sectors that benefits

M

2. Classify stocks within the sector

L U

3. Understand the business of the company

AY

4. Visualize the future of the company

C

5. Consider what the market is currently pricing in

)

(c

MT101 | Market Timing Introduction

Spotting Megatrends (Step 1)

Megatrends – Secular or structural changes that

permanently & significantly alter the society/economy

M

U

Possible causes:

L

- Technological advancements

AY

- Demographic changes (age, lifestyle, purchasing power)

C

- Environmental/regulatory changes

)

(c

Usually leads to an inflection point where rapid adoption and

production occurs

MT101 | Market Timing Introduction

Examples of Megatrends

Philippines: Demographic changes

M

U

L

AY

)C

(c

MT101 | Market Timing Introduction

Examples of Megatrends

Philippines: Demographic changes

M

U

L

AY

)C

(c

MT101 | Market Timing Introduction

Examples of Megatrends

Philippines: Young population + BPOs & Remittances

= Rising consumption spending

M

Consumer stocks among top performers

LU

AY

• URC (Rev Growth – 2013:14%; 2014: 14%; 2015: 21%)

C

• JFC (Rev Growth – 2013: 13%; 2014: 13%; 2015: 10%)

)

• DNL (Rev Growth – 2013: -1%; 2014: 50%; 2015: 45%)

(c

MT101 | Market Timing Introduction

Examples of Megatrends

URC, JFC, DNL – 5 Year Chart

M

U

DNL: +404%

L

AY

)C URC: +255%

(c

JFC: +137%

MT101 | Market Timing Introduction

Examples of Megatrends

Other megatrends:

Philippines:

M

– Rising property prices – Motorization

U

L

– Tourism – Infrastructure

AY

Global: ) C

– Mobile internet – Shale revolution

(c

– Cloud storage – China pollution

MT101 | Market Timing Introduction

Steps in Identifying Winners

1. Look for megatrends and identify sectors that benefits

M

2. Classify stocks within the sector

L U

3. Understand the business of the company

AY

4. Visualize the future of the company

C

5. Consider what the market is currently pricing in

)

(c

MT101 | Market Timing Introduction

Classifying Stocks (Step 2)

Different stocks behave differently

M

Can be grouped into the following categories:

U

L

AY

Market leaders Turnaround situations

Top competitors

)C Cyclical stocks

(c

Institutional favorites Past leaders and laggards

MT101 | Market Timing Introduction

Market Leaders

Largest companies with strong earnings growth

M

Sector should be experiencing strong growth

U

Company clearly superior to the other players

L

AY

Strong competitive advantage to sustain position

Can often be seen in the price action of the company

) C

(c

MT101 | Market Timing Introduction

Top Competitors

Niche player with strong earnings growth

M

Relatively smaller compared to market leader

U

While note better overall, it does a certain thing better

L

than everyone else

AY

May eventually overtake the market leader

) C

(c

MT101 | Market Timing Introduction

Market Leaders & Top Competitors

Challenge is almost always about valuations

M

L U

AY

)C

(c

34X P/E 119++X P/E

+137% in 5 yrs over 25X since IPO

MT101 | Market Timing Introduction

Market Leaders & Top Competitors

Key is to look at the future prospects

M

L U

AY

) C

(c

18% annual 4.8Bil guidance by

growth for next 2020

3+ years 25x P/E?

MT101 | Market Timing Introduction

Market Leaders & Top Competitors

2 most important questions:

What is the company’s competitive advantage?

M

Is the business model scalable?

L U

AY

If yes, could potential generate substantial returns over

a long time ) C

(c

Risk is if fails to meet high expectations

MT101 | Market Timing Introduction

Institutional Favorites

Mature and predictable businesses (blue chips)

M

Much less uncertainty compared to other groups

U

Good track record of growth, performance

L

AY

Slow and steady growth; less than market leaders/top

competitors

C

Widely followed; less upside potential

)

(c

MT101 | Market Timing Introduction

Turnaround Situations

Troubled companies that resume growth trajectory

M

Accelerating growth in last 2 or 3 quarters

U

Underlying driver of profit improvement sustainable

L

AY

Significantly exceeding low expectations

Turnaround reflected in strong share price performance

) C

(c

MT101 | Market Timing Introduction

Turnaround Situations

Can provide huge returns as earnings grow and

price rerates

M

U

L

AY

+256%

) C

(c

MT101 | Market Timing Introduction

Turnaround Situations

Sustainability of turnaround is important

M

L U

AY

???

) C

(c

MT101 | Market Timing Introduction

Cyclical Stocks

Companies that are sensitive to economy or

commodity prices

M

U

Business that is greatly affected by economic cycles

L

AY

Inverse P/E cycle: High P/E before a major rally; low

P/E at the top ) C

(c

MT101 | Market Timing Introduction

Cyclical Stocks

Key is to identify the next cycle earlier than others

M

2016 elections:

U

+144%

L

AY

2010 elections:

+367%

C)

(c

MT101 | Market Timing Introduction

Turnaround Situations

Inverse P/E cycle

10X P/E

M

UL

AY

)C

(c

18X P/E

MT101 | Market Timing Introduction

Past Leaders and Laggards

Companies inferior to market leaders

M

Inferior sales and earnings growth

U

Strong performance usually brief and unsustainable

L

AY

Price action lags leaders; rallies usually just to catch up

Usually relatively cheaper than leaders (but cheap for a

reason?)

) C

(c

MT101 | Market Timing Introduction

Past Leaders and Laggards

Try to stay away from laggards

Usually underperforms over the long term

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Summary of Groups

Leaders Competitor Favorites Turnaround Cyclical Laggards

Earnings From weak

Strong Strong Steady Cyclical Weak

growth to strong

M

Industry Strong Strong Steady Any Cyclical Any

L U

Recently

Price action Strong Strong Steady Cyclical Weak

AY

strong

Low to High

Valuation Very high Very high

) C High Low

Avoid

(inverse)

Low

(c

Trading Aggressive Aggressive After Upswings

unless Avoid

strategy (Coils) (Coils) selloffs only

confident

Preferred Preferred

MT101 | Market Timing Introduction

Summary of Groups

Overlaps among the groups are possible

M

Market leader &

U

Institutional favorite

L

AY

Cyclical &

) C

Turnaround story

(c

Companies may change groups in time (but not overnight)

Important to regularly monitor the companies

MT101 | Market Timing Introduction

Steps in Identifying Winners

1. Look for megatrends and identify sectors that benefits

M

2. Classify stocks within the sector

L U

3. Understand the business of the company

AY

4. Visualize the future of the company

C

5. Consider what the market is currently pricing in

)

(c

MT101 | Market Timing Introduction

Understanding the Business (Step 3)

Analyzing stocks should be entrepreneurial

M

Main goals:

U

1. Identifying the company’s competitive advantage

L

AY

help determine the sustainability of business

C

2. Understanding the drivers of earnings

)

help project the growth outlook going forward

(c

MT101 | Market Timing Introduction

Understanding the Business

M

LU

AY

)C

(c

MT101 | Market Timing Introduction

Determining Competitive Advantage

Competitive Advantage – any attribute that allows a

company to outperform its competitors

M

U

Differentiation (branding)

L

Management/ manpower

AY

Operational effectiveness

Cost leadership

) C

(c

Technology/ innovation

Distribution network

MT101 | Market Timing Introduction

Determining Competitive Advantage

M

L U

AY

)C

(c

MT101 | Market Timing Introduction

Determining Competitive Advantage

Should be verified by high and rising margins

‒ Net margins for established businesses

M

‒ Gross margins for young businesses

L U

Net Margins

AY

2010 2011 2012 2013 2014 2015

ALI

GLO

15.4

15.7

17.3

)

14.5

C 18.1

12.4

15.4

5.5

16.6

13.5

15.5

12.8

(c

MWC 36.1 35.5 37.4 37.6 35.5 38.6

CEB 23.8 10.7 10.2 1.2 1.6 12.0

MT101 | Market Timing Introduction

Determining Competitive Advantage

ALI is the only stock that

outperformed the index

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

Understanding Revenue and Growth Drivers

Sales Price x Quantity

– Cost of Goods (Variable) Input cost; scale

M

U

Gross Profit Gross margin

L

AY

– Operating Expenses (Var&Fixed) Cost efficiencies, scale

Profit before Tax

) C Operating margin

(c

– Taxes

Net Income Net margin

MT101 | Market Timing Introduction

Understanding Revenue and Growth Drivers

Sales = Price X Quantity

M

U

Price: Pricing power of company

L

AY

C

Quantity: Product demand; Capacity

)

(c

MT101 | Market Timing Introduction

Understanding Revenue and Growth Drivers

Cost of Goods = Cost X Quantity

M

U

Cost: Economies of scale; Input costs

L

AY

C

Pricing power, economies of scale, and input costs are

)

(c

all reflected in Gross Margin

MT101 | Market Timing Introduction

Understanding Revenue and Growth Drivers

Operating Expenses

M

U

Cost efficiencies either through

L

AY

cost cutting or scale

) C

Scale (leverage): The higher the % of fixed costs, the

(c

slower the growth/decline in operating expenses

MT101 | Market Timing Introduction

M

UL

AY

C)

(c

MT101 | Market Timing Introduction

M

UL

AY

C)

(c

MT101 | Market Timing Introduction

Understanding Revenue and Growth Drivers

Preference

Volume

M

Scale

L U

Price

AY

Input Cost

) C

Operating Cost

(c

Not all growth are created equal

MT101 | Market Timing Introduction

Steps in Identifying Winners

1. Look for megatrends and identify sectors that benefits

M

2. Classify stocks within the sector

L U

3. Understand the business of the company

AY

4. Visualize the future of the company

C

5. Consider what the market is currently pricing in

)

(c

MT101 | Market Timing Introduction

Visualizing the Future of the Company (Step 4)

Easiest way to beat the “experts” is by always being

aware of the BIG PICTURE

M

U

Investors and traders tend to have a short time horizon

L

AY

Human nature

Investment goals ) C

(c

“What will the company look like in 5 years? 10 years?”

MT101 | Market Timing Introduction

Emperador Case Study

Sept 2013, EMP sold 1.8Bil shares (Php16.2Bil) in its IPO

M

At that time, it was expected to earn Php6.2Bil for 2013

U

(24% y/y growth; 55% 3 yr CAGR from 2010 to 2013)

L

AY

Key points: Best selling brandy in world with 31Mil cases/year

C

Banking on rising purchasing power to boost sales

)

(c

MT101 | Market Timing Introduction

Emperador Case Study

Some other important points:

1. 96% of EMP’s sales come from brandy segment; 86% from

M

Emperador Light

U

2. EMP already market leader in brandy sales in Phil,

L

accounting for 96% market share; albeit with “only” a 48%

AY

share in overall spirits

C

3. Philippine spirits industry has been growing by 6% annually

)

(c

MT101 | Market Timing Introduction

Emperador Case Study

“What will the company look like in 5 years?”

M

U

“Will it be able to sustain its strong growth historically?”

L

AY

) C

(c

MT101 | Market Timing Introduction

Emperador Case Study

M

L U

AY

) C

(c

Ironically, sometimes it is easier to predict

what will happen in 5 years time

MT101 | Market Timing Introduction

Steps in Identifying Winners

1. Look for megatrends and identify sectors that benefits

M

2. Classify stocks within the sector

L U

3. Understand the business of the company

AY

4. Visualize the future of the company

C

5. Consider what the market is currently pricing in

)

(c

MT101 | Market Timing Introduction

Consider what the Market is Pricing In (Step 5)

Ultimately, EVERYTHING is relative to EXPECTATIONS

M

U

“Happiness is equal to REALITY minus EXPECTATIONS”

L

AY

)C

(c

MT101 | Market Timing Introduction

Consider what the Market is Pricing In (Step 5)

Ultimately, EVERYTHING is relative to EXPECTATIONS

M

Ways to gauge market expectations:

L U

1. Broker reports

AY

2. Assumptions; earnings forecasts; target prices

3. Company guidance

)C

4. Current valuations

(c

5. Price action (technical analysis)

MT101 | Market Timing Introduction

Valuation Basics

M

UL

AY

C)

VALUING COMPANIES

(c

MT101 | Market Timing Introduction

Valuation Basics

Estimate of the value of a stock

– Not an exact science

M

– Relies heavily on both explicit & implicit assumptions

U

– More as guides rather than as absolutes

L

AY

) C

Nothing is 100% certain!

(c

MT101 | Market Timing Introduction

Valuation Methods

Absolute valuation

M

– Discounted cash flow

U

– Net asset value

L

– Intrinsic multiples (matrix)

AY

Relative valuation

C)

(c

– Relative multiples

MT101 | Market Timing Introduction

Relative Valuation

Relative valuation: valuations comparing the price of an

asset to similar or comparable assets

M

L U

AY

Use relative multiples as a way of standardizing prices

standardized

)C

– For prices to be comparable, it has to be first

(c

MT101 | Market Timing Introduction

Relative Valuation

Standardizing prices

Lot A Lot B

M

U

Php2,000,000 Price Php10,000,000

L

AY

20 sqm Size 200 sqm

Php100,000 C) Price/sqm Php50,000

(c

Implicit assumption: Lots A & B are comparable

MT101 | Market Timing Introduction

Relative Valuation

Standardizing prices

Stock A Stock B

M

U

Php40/sh Price Php2400/sh

L

AY

Php2/sh Earnings Php160/sh

20X C) P/E 15X

(c

Implicit assumption: Stocks A & B are comparable

MT101 | Market Timing Introduction

Relative Valuation

Standardizing prices

Lot A Lot B

M

U

Php2,000,000 Price Php10,000,000

L

AY

20 sqm Size 200 sqm

Php100,000 C) Price/sqm Php50,000

(c

Fort Location Cavite

MT101 | Market Timing Introduction

Relative Valuation

Standardizing prices

Stocks A & B are both priced at Php100/sh

M

L U

2016 EPS 2017 2018 2019 2020 2021

AY

Stock A 5 10 20 40 80 160

Stock B 10

C

)12 14 17 21 25

(c

P/E Stock A = 20X

Stock B = 10X

MT101 | Market Timing Introduction

Relative Valuation

Standardizing prices

Stock A Stock B

M

U

Php40/sh Price Php2400/sh

L

AY

Php2/sh Earnings Php160/sh

20X C) P/E 15X

(c

25% Growth 12%

MT101 | Market Timing Introduction

Valuation Summary

Absolute valuation: COL rating and target prices

M

Note that valuations are just estimates

U

– Buy below prices should be used

L

AY

Note that the higher the growth, the more uncertainty

C

– Qualitative factors and TA become more important

)

(c

MT101 | Market Timing Introduction

Valuation Summary

2 sides of Fundamental Analysis

1. Quantitative (Numbers)

M

2. Qualitative (Story)

L U

AY

Ideally, numbers & story go hand in hand.

However, stories usually come first

)C

(c

While analysts/investors wait for numbers to confirm, the

market is already pricing it in

MT101 | Market Timing Introduction

Fundamentals and Technicals

M

L U

AY

C

LINKING FUNDAMENTALS AND

)

(c

TECHNICALS

MT101 | Market Timing Introduction

Price Action and Fundamentals

Fundamentals and the long term price action are

always interrelated

M

U

1. Fundamentals can guide you on how the share price

L

would most likely behave

AY

C

2. Price action can indicate the quality of the

)

fundamentals of a company

(c

MT101 | Market Timing Introduction

200-Day Moving Average

Computed as the average closing price over last 200

trading days (roughly 1 year)

M

U

General indication of the overall health of the prices

L

AY

Overlaps with the annual cycle of earnings

) C

(c

Prices below 200-day could mean that there is

something fundamentally wrong

MT101 | Market Timing Introduction

200-Day Moving Average - PGOLD

M

L U

AY

) C

(c

MT101 | Market Timing Introduction

200-Day Moving Average - PGOLD

M

L U

AY

C

Announced weaker than

)

expected earnings

(c

MT101 | Market Timing Introduction

200-Day Moving Average - DNL

M

L U

AY

)C

(c

MT101 | Market Timing Introduction

200-Day Moving Average - DNL

M

Earnings starting to miss

U

estimates

L

AY

) C

(c

MT101 | Market Timing Introduction

200-Day Moving Average - ICT

M

L U

AY

)C

(c

MT101 | Market Timing Introduction

200-Day Moving Average - ICT

M

L U

Slight miss in estimates

AY

C

China devalues currency

)

(c

Poor numbers come out

MT101 | Market Timing Introduction

Understanding Disappointments

Sometimes, good companies can also go through

difficult times

M

- solid long term outlook but with temporary issues

L U

AY

Important to identify and understand the reason for

the weakness

) C

- key question: “How long will the issue last?”

(c

MT101 | Market Timing Introduction

Understanding Disappointments - CHP

M

L U

AY

) C Reports weak earnings

4Q revs down 13% on 8% drop

(c

in volume and 5% drop in price

MT101 | Market Timing Introduction

Understanding Disappointments - JFC

M

L U

AY

)C Reports sharp increase in

(c

operating expenses

MT101 | Market Timing Introduction

M

Thank you.

LU

AY

C)

(c

CHARLES WILLIAM ANG, CFA | MT101 Instructor

Potrebbero piacerti anche

- Understanding Market Behaviour and Timing OpportunitiesDocumento118 pagineUnderstanding Market Behaviour and Timing Opportunitiesnon Gam3rNessuna valutazione finora

- Business Review Q3FY17Documento31 pagineBusiness Review Q3FY17ranjansolanki13Nessuna valutazione finora

- Business Environment QPDocumento7 pagineBusiness Environment QPAarnav SharmaNessuna valutazione finora

- Mba1 Me Dec07Documento2 pagineMba1 Me Dec07Surbhi SofatNessuna valutazione finora

- Accepted Manuscript: J. of Multi. Fin. ManagDocumento56 pagineAccepted Manuscript: J. of Multi. Fin. ManagWati MehraNessuna valutazione finora

- Topic 1 Introduction Macroeconomics MasterDocumento41 pagineTopic 1 Introduction Macroeconomics MastermoonladymoonNessuna valutazione finora

- Aggregate Demand: Applying The IS-LM Model: MACROECONOMICS, 8th EditionDocumento28 pagineAggregate Demand: Applying The IS-LM Model: MACROECONOMICS, 8th EditionDiego PalmiereNessuna valutazione finora

- Managerial Economics Exam QuestionsDocumento2 pagineManagerial Economics Exam QuestionsSurbhi SofatNessuna valutazione finora

- LP in UAE FinancialsDocumento8 pagineLP in UAE FinancialsKavitha Reddy GurrralaNessuna valutazione finora

- Chapter 7Documento32 pagineChapter 7zulfikriNessuna valutazione finora

- College: Diploma Management/Commercial CapitalDocumento2 pagineCollege: Diploma Management/Commercial CapitalKP VIPINNessuna valutazione finora

- Plunges BSEDocumento13 paginePlunges BSEAnindita DesarkarNessuna valutazione finora

- MBA (Sem. - 1") Managerial Economics Sub - Iect Code: Mb-1O5 Paper ID: (CO105)Documento2 pagineMBA (Sem. - 1") Managerial Economics Sub - Iect Code: Mb-1O5 Paper ID: (CO105)Surbhi SofatNessuna valutazione finora

- 8.products IRS (1206)Documento36 pagine8.products IRS (1206)Luca DiboNessuna valutazione finora

- Pres On TIOsDocumento22 paginePres On TIOssaifullahbukharisaifNessuna valutazione finora

- Financial ManagementDocumento5 pagineFinancial ManagementHTB MoviesNessuna valutazione finora

- Fo MM3 Sli 04Documento73 pagineFo MM3 Sli 04ShahidNessuna valutazione finora

- Quant Teck Fund PresentationDocumento28 pagineQuant Teck Fund PresentationRavishankarNessuna valutazione finora

- LMEprecious UpdateDocumento31 pagineLMEprecious UpdateAnonymous wze4zUNessuna valutazione finora

- Is-Lm and Fiscal & Monetary Policies: Session 11 - 15Documento34 pagineIs-Lm and Fiscal & Monetary Policies: Session 11 - 15Raj PatelNessuna valutazione finora

- H1 2010 NCM Market Report - Proshare - 020710Documento169 pagineH1 2010 NCM Market Report - Proshare - 020710ProshareNessuna valutazione finora

- Isc Econ BudgetDocumento5 pagineIsc Econ BudgetanuhyaextraNessuna valutazione finora

- Benjamin Tal MBABC VancouverDocumento26 pagineBenjamin Tal MBABC VancouverScott DawsonNessuna valutazione finora

- Angel One: Leaner, Stronger, Faster - A Transformed Broker!Documento36 pagineAngel One: Leaner, Stronger, Faster - A Transformed Broker!Ravi KumarNessuna valutazione finora

- L&T Technology Services LTDDocumento40 pagineL&T Technology Services LTDCatAsticNessuna valutazione finora

- Tata Consultancy Services - Q1FY20 - Result Update - 10072019 - 12-07-2019 - 09Documento7 pagineTata Consultancy Services - Q1FY20 - Result Update - 10072019 - 12-07-2019 - 09tejNessuna valutazione finora

- Bba 203Documento2 pagineBba 203api-3782519Nessuna valutazione finora

- China's Business Cycles and Early Warning Indicators: Jcer Discussion PaperDocumento30 pagineChina's Business Cycles and Early Warning Indicators: Jcer Discussion PaperIves LeeNessuna valutazione finora

- Tata Consultancy Services: Good 3QFY06 Reinforcing Offshore Traction, Remains One of Our Top PicksDocumento14 pagineTata Consultancy Services: Good 3QFY06 Reinforcing Offshore Traction, Remains One of Our Top Pickstdog66Nessuna valutazione finora

- Macro WK 9Documento2 pagineMacro WK 9Cedric Shi Han SimNessuna valutazione finora

- Economics II881 0Ph5UNVbG9Documento2 pagineEconomics II881 0Ph5UNVbG9Nell CrastoNessuna valutazione finora

- NBF Company Report 10-25-2023Documento6 pagineNBF Company Report 10-25-2023ysxujupjpcrdediagzNessuna valutazione finora

- InterestRateBasics (Preliminary)Documento48 pagineInterestRateBasics (Preliminary)Imad RouguiNessuna valutazione finora

- Growth of Service Sector in IndiaDocumento41 pagineGrowth of Service Sector in Indiasantosh75% (8)

- BS (2nd) May2018 PDFDocumento2 pagineBS (2nd) May2018 PDFAman VermaNessuna valutazione finora

- Eco Sem IV ImpDocumento2 pagineEco Sem IV Impatharva1760Nessuna valutazione finora

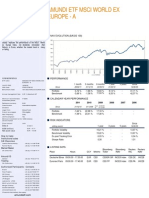

- Amundi ETF Tracks World ex Europe StocksDocumento2 pagineAmundi ETF Tracks World ex Europe Stockshp24714303Nessuna valutazione finora

- TNPSC PDFDocumento33 pagineTNPSC PDFமுத்துக்குமார் சிவகாமிNessuna valutazione finora

- Bba 705Documento2 pagineBba 705api-3782519Nessuna valutazione finora

- The Dynamics of Manufacturing Industry and The ResDocumento34 pagineThe Dynamics of Manufacturing Industry and The ResRaphael OgangNessuna valutazione finora

- Way2wealth Derivatives 10jan18Documento2 pagineWay2wealth Derivatives 10jan18kasNessuna valutazione finora

- Chapter 6 Theory of Firm and Market Structure - PART 1Documento36 pagineChapter 6 Theory of Firm and Market Structure - PART 1hidayatul raihanNessuna valutazione finora

- 07 Capital Budgeting IIIDocumento56 pagine07 Capital Budgeting IIISEO SHU HUINessuna valutazione finora

- ECO101 Week9 PerfectCompetitionDocumento29 pagineECO101 Week9 PerfectCompetitionShawn MaNessuna valutazione finora

- FM QP 2008-20Documento18 pagineFM QP 2008-20Jubin JacobNessuna valutazione finora

- MCX Note Edelweiss - 20feb-2015Documento17 pagineMCX Note Edelweiss - 20feb-2015Om PrakashNessuna valutazione finora

- Square root law for price impact: Empirical evidence and theoryDocumento39 pagineSquare root law for price impact: Empirical evidence and theoryedyaccNessuna valutazione finora

- India sneak peek jul 21Documento8 pagineIndia sneak peek jul 21nikhilNessuna valutazione finora

- Impact of Fundamentals On IP O ValuationDocumento21 pagineImpact of Fundamentals On IP O ValuationirfantanwarNessuna valutazione finora

- The Investment Clock - Trevor GreethamDocumento28 pagineThe Investment Clock - Trevor Greethamcherrera73Nessuna valutazione finora

- 11 Business Cycles and Aggregate DemandDocumento7 pagine11 Business Cycles and Aggregate DemandChristian Cedrick OlmonNessuna valutazione finora

- Chapter13 PDFDocumento34 pagineChapter13 PDFOruc MeherremliNessuna valutazione finora

- EconomicsDocumento8 pagineEconomicsmanthansaini8923Nessuna valutazione finora

- Introducing Advanced Macroeconomics:: Growth and Business Cycles CyclesDocumento28 pagineIntroducing Advanced Macroeconomics:: Growth and Business Cycles CyclesIzzat MushtaqNessuna valutazione finora

- MI CH 11.investment Apprisal Techniques PDFDocumento6 pagineMI CH 11.investment Apprisal Techniques PDFPonkoj Sarker TutulNessuna valutazione finora

- UNASAM Investig Etmclipie IED PIE EHBDocumento42 pagineUNASAM Investig Etmclipie IED PIE EHBEnrique Huerta BerríosNessuna valutazione finora

- E.bs 3rd-Unit 7 Sectors of EconomyDocumento34 pagineE.bs 3rd-Unit 7 Sectors of EconomyBảo YếnNessuna valutazione finora

- AMZN Q3 2009 Earnings PresentationDocumento21 pagineAMZN Q3 2009 Earnings PresentationychartsNessuna valutazione finora

- Exercises EPA1222 MOT1421 Micro NR 4Documento2 pagineExercises EPA1222 MOT1421 Micro NR 4mentalistpatrickNessuna valutazione finora

- Perspectives on Nigeria's Economic Development Volume IDa EverandPerspectives on Nigeria's Economic Development Volume INessuna valutazione finora

- Fosroc Nitocote SN502: Constructive SolutionsDocumento2 pagineFosroc Nitocote SN502: Constructive SolutionsVJ QatarNessuna valutazione finora

- Nitocote PE135 PDFDocumento2 pagineNitocote PE135 PDFSuresh BabuNessuna valutazione finora

- Fosroc Dekguard Filler: Acrylic, Intercoat Pin Hole FillerDocumento2 pagineFosroc Dekguard Filler: Acrylic, Intercoat Pin Hole FillerVincent JavateNessuna valutazione finora

- Fosroc Nitocote NT402: Constructive SolutionsDocumento4 pagineFosroc Nitocote NT402: Constructive SolutionsVJ QatarNessuna valutazione finora

- Fosroc Nitocote NT550: Constructive SolutionsDocumento4 pagineFosroc Nitocote NT550: Constructive SolutionsVincent JavateNessuna valutazione finora

- Nitocote sr3000Documento4 pagineNitocote sr3000VJ QatarNessuna valutazione finora

- Fosroc Nitocote EPS Protective CoatingDocumento4 pagineFosroc Nitocote EPS Protective CoatingmangjitNessuna valutazione finora

- Fosroc Dekguard S: Constructive SolutionsDocumento4 pagineFosroc Dekguard S: Constructive SolutionsshazibNessuna valutazione finora

- Nitocote Primer SealerDocumento2 pagineNitocote Primer SealerVJ QatarNessuna valutazione finora

- Fosroc Nitocote HT120: Constructive SolutionsDocumento4 pagineFosroc Nitocote HT120: Constructive SolutionsVincent JavateNessuna valutazione finora

- Fosroc Nitocote SN522: Non Staining Water RepellentDocumento2 pagineFosroc Nitocote SN522: Non Staining Water RepellentDasha DosftNessuna valutazione finora

- Fosroc Nitocote EP410: Constructive SolutionsDocumento4 pagineFosroc Nitocote EP410: Constructive SolutionsVJ QatarNessuna valutazione finora

- Nitocote CM210Documento4 pagineNitocote CM210sivakumar ramaiahNessuna valutazione finora

- MNVTFRDF 0UDocumento4 pagineMNVTFRDF 0UTarek TarekNessuna valutazione finora

- Fosroc Dekguard PU: Constructive SolutionsDocumento4 pagineFosroc Dekguard PU: Constructive SolutionsVJ QatarNessuna valutazione finora

- Galva FroidDocumento2 pagineGalva FroidChrill DsilvaNessuna valutazione finora

- Fosroc Nitocote HEX: Constructive SolutionsDocumento4 pagineFosroc Nitocote HEX: Constructive SolutionsVJ QatarNessuna valutazione finora

- Brushbond TGP crystalline waterproofingDocumento2 pagineBrushbond TGP crystalline waterproofingMahesh SavandappaNessuna valutazione finora

- Fosroc Nitocote EP403: Constructive SolutionsDocumento4 pagineFosroc Nitocote EP403: Constructive SolutionsVJ QatarNessuna valutazione finora

- Nitocote EP405Documento4 pagineNitocote EP405mangjitNessuna valutazione finora

- Fosroc Dekguard EP302: Water Based, Epoxy Resin Primer For Dekguard PUDocumento2 pagineFosroc Dekguard EP302: Water Based, Epoxy Resin Primer For Dekguard PUVJ QatarNessuna valutazione finora

- Fosroc Nitocote EN901 High Chemical Resistant Protective LiningDocumento4 pagineFosroc Nitocote EN901 High Chemical Resistant Protective LiningVincent JavateNessuna valutazione finora

- Fosroc Nitocote ET402: Constructive SolutionsDocumento4 pagineFosroc Nitocote ET402: Constructive SolutionsVJ QatarNessuna valutazione finora

- Fosroc Dekguard AC: Constructive SolutionsDocumento4 pagineFosroc Dekguard AC: Constructive SolutionsVJ QatarNessuna valutazione finora

- Fosroc Dekguard PU100: Constructive SolutionsDocumento4 pagineFosroc Dekguard PU100: Constructive SolutionsVJ QatarNessuna valutazione finora

- Specification For Painting & External Coating of Metal Pipes & StructuresDocumento23 pagineSpecification For Painting & External Coating of Metal Pipes & StructuresVJ QatarNessuna valutazione finora

- Fosroc Dekguard E2000: (Also Known As Nitocote FBC)Documento4 pagineFosroc Dekguard E2000: (Also Known As Nitocote FBC)Tejinder KumarNessuna valutazione finora

- Specification For FencingDocumento13 pagineSpecification For FencingVJ QatarNessuna valutazione finora

- Specification For Non Toxicity Requirements For Paints and CoatingsDocumento5 pagineSpecification For Non Toxicity Requirements For Paints and CoatingsVJ QatarNessuna valutazione finora

- W C Ss 011 (Water Dranage)Documento14 pagineW C Ss 011 (Water Dranage)zfrlNessuna valutazione finora

- Subsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationDocumento16 pagineSubsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationAnzas Rustamaji PratamaNessuna valutazione finora

- Illustration KK Co. Perpetual ClosingDocumento9 pagineIllustration KK Co. Perpetual ClosingNAOL BIFTUNessuna valutazione finora

- MTP 1 Suggested Answers AADocumento9 pagineMTP 1 Suggested Answers AAYash RankaNessuna valutazione finora

- E StatementDocumento10 pagineE Statementsheheryar khanNessuna valutazione finora

- S4 HANA Finance Q&ADocumento8 pagineS4 HANA Finance Q&AleilamortezaNessuna valutazione finora

- Chapter 14 Solutions ManualDocumento55 pagineChapter 14 Solutions ManualAkash M Shahzad100% (1)

- BPP F3 KitbjDocumento5 pagineBPP F3 KitbjMuhammad Ubaid UllahNessuna valutazione finora

- Clwtaxn - Lecture Week4Documento17 pagineClwtaxn - Lecture Week4Maria Angelika ArcillaNessuna valutazione finora

- Auditing Equity and Debt SecuritiesDocumento5 pagineAuditing Equity and Debt SecuritiesElisha Batalla80% (5)

- Chapter 7 DepreciationDocumento50 pagineChapter 7 Depreciationpriyam.200409Nessuna valutazione finora

- Assignment of Fundamental of Accounting IDocumento12 pagineAssignment of Fundamental of Accounting IibsaashekaNessuna valutazione finora

- Acc 108 Current LiabilitiesDocumento5 pagineAcc 108 Current Liabilitiesmkrisnaharq99Nessuna valutazione finora

- Memo Myanmar - Compliance Private Company May 2020Documento21 pagineMemo Myanmar - Compliance Private Company May 2020Phyu PhyuNessuna valutazione finora

- MUTUAL FUND-MCQ-Final-25-1Documento1 paginaMUTUAL FUND-MCQ-Final-25-1HetviNessuna valutazione finora

- My Watchlist - Value ResearchDocumento1 paginaMy Watchlist - Value ResearchpksNessuna valutazione finora

- BulanMangestutyWijaya - PT TRI BANYAN TIRTA, TBKDocumento123 pagineBulanMangestutyWijaya - PT TRI BANYAN TIRTA, TBKw5btddpnpcNessuna valutazione finora

- Cash & ReceivablesDocumento53 pagineCash & Receivablesnati100% (1)

- Annual Report 2013Documento232 pagineAnnual Report 2013BETTY ELIZABETH JUI�A QUILACHAMINNessuna valutazione finora

- Chapter-1 INTRODUCTION TO FINANCIAL ACCOUNTINGDocumento15 pagineChapter-1 INTRODUCTION TO FINANCIAL ACCOUNTINGWoldeNessuna valutazione finora

- Finals - II. Deductions & ExemptionsDocumento13 pagineFinals - II. Deductions & ExemptionsJovince Daño DoceNessuna valutazione finora

- Group Assignment Cafes Monte Bianco Final V2Documento13 pagineGroup Assignment Cafes Monte Bianco Final V2Linh Chi Trịnh T.Nessuna valutazione finora

- Acctg 105 QuizDocumento5 pagineAcctg 105 Quizshin shinNessuna valutazione finora

- LCCI L3 Certificate in Accounting ASE20104 July 2017Documento16 pagineLCCI L3 Certificate in Accounting ASE20104 July 2017Aung Zaw HtweNessuna valutazione finora

- Topic 1 - Introduction To Venture Capital and Private EquityDocumento79 pagineTopic 1 - Introduction To Venture Capital and Private EquityerilNessuna valutazione finora

- Solved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFDocumento1 paginaSolved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFAnbu jaromiaNessuna valutazione finora

- Determining The Optimal Working Capital Management (Case Study: PT Ultrajaya Milk Industry & Trading Company TBK)Documento16 pagineDetermining The Optimal Working Capital Management (Case Study: PT Ultrajaya Milk Industry & Trading Company TBK)Ayub AlansoriNessuna valutazione finora

- Chap 2 Financial Analysis & PlanningDocumento108 pagineChap 2 Financial Analysis & PlanningmedrekNessuna valutazione finora

- SCB - Fund I To Fund II - 30.3.23Documento2 pagineSCB - Fund I To Fund II - 30.3.23ester sriayuNessuna valutazione finora

- 12 Business Combination Pt2 PDFDocumento1 pagina12 Business Combination Pt2 PDFRiselle Ann SanchezNessuna valutazione finora

- Voith DCF Excel FileDocumento80 pagineVoith DCF Excel FileVenkat RamanNessuna valutazione finora