Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Is A Construction Company Specializing in Custom Patios

Caricato da

Kailash KumarDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Is A Construction Company Specializing in Custom Patios

Caricato da

Kailash KumarCopyright:

Formati disponibili

(a) (i) Journalize the June transactions for purchase of raw materials, factory labor costs incurred, and

manufacturing overhead

incurred.

Raw Materials Inventory 6,027

Accounts Payable 6,027

Factory Labor 5,905

Cash 5,905

Manufacturing Overhead 1,599

Accumulated Depreciation-Equipment 1,107

Accounts Payable 492

(a) (ii) Journalize the June transactions for the assignment of raw materials, labor, and overhead to production.

Work in Process Inventory 6,027

Manufacturing Overhead 1,845

Raw Materials Inventory 7,872

Work in Process Inventory 4,429

Manufacturing Overhead 1,476

Factory Labor 5,905

Work in Process Inventory ($4,429 × $1.25) 5,536

Manufacturing Overhead 5,536

(a) (iii) Journalize the June transactions for the completion of jobs and sale of goods.

Finished Goods Inventory 18,132

Work in Process Inventory 18,132

Direct Manufacturing

Job Materials Direct Labor Overhead * Total Costs

Rodgers $2,091 $1,920 $2,400 $6,411

Stevens 1,599 1,107 1,384 4,090

Linton 2,706 2,189 2,736 7,631

Mfg Overhd = Direct labor × $1.25 $18,132

Cash 23,247

Sales 23,247

Cost of Goods Sold 18,132

Finished Goods Inventory 18,132

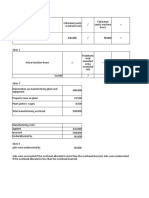

(b) Post the entries to Work in Process Inventory.

430406852.xlsx, Solution P20-3A (2), Page 1 of 8 Page(s), 07/21/201906:41:49

6/1/2012 Balance 6,814 6/30/2012

Direct materials 6,027

Direct labor 4,429

Overhead applied 5,536

6/30/2012 Balance 4,674

430406852.xlsx, Solution P20-3A (2), Page 2 of 8 Page(s), 07/21/201906:41:49

(c) Reconcile the balance in Work in Process Inventory with the costs of unfinished jobs.

Work in process $4,674

Job: Koss

Direct materials $2,460

Direct labor 984

Manufacturing overhead 1,230 $4,674

(d) Prepare a cost of goods manufactured schedule for June.

CASE INC.

Cost of Goods Manufactured Schedule

For the Month Ended June 30, 2017

Work in process, June 1 $6,814

Direct materials used $6,027

Direct labor 4,429

Manufacturing overhead applied 5,536

Total manufacturing costs 15,992

Total cost of work in process 22,806

Less: Work in process, June 30 4,674

Cost of goods manufactured $18,132

430406852.xlsx, Solution P20-3A (2), Page 3 of 8 Page(s), 07/21/201906:41:49

and manufacturing overhead costs

to production.

430406852.xlsx, Solution P20-3A (2), Page 4 of 8 Page(s), 07/21/201906:41:49

18,132

430406852.xlsx, Solution P20-3A (2), Page 5 of 8 Page(s), 07/21/201906:41:49

430406852.xlsx, Solution P20-3A (2), Page 6 of 8 Page(s), 07/21/201906:41:49

Name: Solution Date:

Instructor: Course:

Accounting Principles, Tenth Edition by Weygandt, Kieso, and Kimmel

Primer on Using Excel in Accounting by Rex A Schildhouse

P20-3A,Prepare entries in a job cost system and cost of goods manufactured schedule.

CASE Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber,

depending upon customer preference. On June 1, 2012, the general ledger for CASE Inc. contains the following data.

Raw Materials Inventory $4,200 Manufacturing Overhead Applied $32,640

Work in Process Inventory $5,540 Manufacturing Overhead Incurred $31,650

Subsidiary data for Work in Process Inventory on June 1 are as follows.

Job Cost Sheets

Customer Job

Cost Element Rodgers Stevens Linton

Direct materials $600 $800 $900

Direct labor $320 $540 $580

Manufacturing overhead $400 $675 $725

$1,320 $2,015 $2,205

During June, raw materials purchased on account were $3,900 , and all wages were paid. Additional overhead costs

consisted of depreciation on equipment $700 and miscellaneous costs of $400 incurred on account.

A summary of materials requisition slips and time tickets for June shows the following.

Customer Job Materials Requisition Slips Time Tickets

Rodgers $800 $450

Koss 2,000 800

Stevens 500 360

Linton 1,300 1,600

Rodgers 300 390

4,900 3,600

General use 1,500 1,200

$6,400 $4,800

Overhead was charged to jobs at the same rate of $1.25 per dollar of direct labor cost. The patios for customers Rodgers,

Stevens, and Linton were completed during June and sold for a total of $18,900 Each customer paid in full.

Instructions

(a) (i) Journalize the June transactions for purchase of raw materials, factory labor costs incurred, and manufacturing overhead costs

incurred.

Raw Materials Inventory 3,900

Accounts Payable 3,900

Factory Labor 4,800

Cash 4,800

Manufacturing Overhead 1,100

Accumulated Depreciation-Equipment 700

Accounts Payable 400

(a) (ii) Journalize the June transactions for the assignment of raw materials, labor, and overhead to production.

Work in Process Inventory 4,900

Manufacturing Overhead 1,500

Raw Materials Inventory 6,400

430406852.xlsx, Solution P20-3A, Page 7 of 8 Page(s), 07/21/201906:41:49

Name: Solution Date:

Instructor: Course:

Work in Process Inventory 3,600

Manufacturing Overhead 1,200

Factory Labor 4,800

Work in Process Inventory ($3,600 × $1.25) 4,500

Manufacturing Overhead 4,500

(a) (iii) Journalize the June transactions for the completion of jobs and sale of goods.

Finished Goods Inventory 14,740

Work in Process Inventory 14,740

Direct Manufacturing

Job Materials Direct Labor Overhead * Total Costs

Rodgers $1,700 $1,160 $1,450 $4,310

Stevens 1,300 900 1,125 3,325

Linton 2,200 2,180 2,725 7,105

Mfg Overhd = Direct labor × $1.25 $14,740

Cash 18,900

Sales 18,900

Cost of Goods Sold 14,740

Finished Goods Inventory 14,740

(b) Post the entries to Work in Process Inventory.

6/1/2012 Balance 5,540 6/30/2012 14,740

Direct materials 4,900

Direct labor 3,600

Overhead applied 4,500

6/30/2012 Balance 3,800

(c) Reconcile the balance in Work in Process Inventory with the costs of unfinished jobs.

Work in process $3,800

Job: Koss

Direct materials $2,000

Direct labor 800

Manufacturing overhead 1,000 $3,800

(d) Prepare a cost of goods manufactured schedule for June.

CASE INC.

Cost of Goods Manufactured Schedule

For the Month Ended June 30, 2012

Work in process, June 1 $5,540

Direct materials used $4,900

Direct labor 3,600

Manufacturing overhead applied 4,500

Total manufacturing costs 13,000

Total cost of work in process 18,540

Less: Work in process, June 30 3,800

Cost of goods manufactured $14,740

430406852.xlsx, Solution P20-3A, Page 8 of 8 Page(s), 07/21/201906:41:50

Potrebbero piacerti anche

- Economic and Financial TermsDocumento10 pagineEconomic and Financial Termsvica3_100% (4)

- Perform of Cost Audit Report - PharmaceuticalDocumento46 paginePerform of Cost Audit Report - PharmaceuticalShami KantNessuna valutazione finora

- Market Rate AnalysisDocumento106 pagineMarket Rate AnalysisnkureshiNessuna valutazione finora

- Helipad Plan 1:200 Scale: Float Finished Margins To Helipad Brushed Concrete With 100MmDocumento1 paginaHelipad Plan 1:200 Scale: Float Finished Margins To Helipad Brushed Concrete With 100MmAhmed AsimNessuna valutazione finora

- Case StudyDocumento22 pagineCase StudyM Zain Ul AbedeenNessuna valutazione finora

- ACCPA Conference 2017 - IFC PresentationDocumento23 pagineACCPA Conference 2017 - IFC PresentationGodsonNessuna valutazione finora

- IRR Toyo Dies2Documento54 pagineIRR Toyo Dies2desty windy utamiNessuna valutazione finora

- Profit Planning and Activity Based BudgetingDocumento50 pagineProfit Planning and Activity Based BudgetingcahyatiNessuna valutazione finora

- Unit Cost Analysis As of April 2003: Sub Total (Materials)Documento15 pagineUnit Cost Analysis As of April 2003: Sub Total (Materials)Abdul Q HannanNessuna valutazione finora

- PGPM 33 - Material and Logistics Management M57Documento30 paginePGPM 33 - Material and Logistics Management M57Ashutosh Kumar0% (1)

- Financial Analysis of Nestle LTDDocumento43 pagineFinancial Analysis of Nestle LTDShahbaz AliNessuna valutazione finora

- (040420) Developing Business Case PPT GroupDocumento22 pagine(040420) Developing Business Case PPT GroupAndi Yusuf MasalanNessuna valutazione finora

- Gail India LTD ReferenceDocumento46 pagineGail India LTD Referencesharadkulloli100% (1)

- Simulasi: No. Keterangan Vol Sat Harga Satuan Jumlah Harga SatDocumento13 pagineSimulasi: No. Keterangan Vol Sat Harga Satuan Jumlah Harga SatagungNessuna valutazione finora

- PROBLEM 2-45:: Particulars Case A Case B Case CDocumento6 paginePROBLEM 2-45:: Particulars Case A Case B Case CSrihari KumarNessuna valutazione finora

- Furnish Details in A Separate Sheet)Documento4 pagineFurnish Details in A Separate Sheet)Parasuram BonangiNessuna valutazione finora

- Rent Vs Buy Calculator - AssetyogiDocumento16 pagineRent Vs Buy Calculator - AssetyogiAkhlaqur RahmanNessuna valutazione finora

- Importance of Measurement of Labour Productivity in Construction by Pravin Minde & Prachi GhateDocumento5 pagineImportance of Measurement of Labour Productivity in Construction by Pravin Minde & Prachi GhatePravin MindeNessuna valutazione finora

- Product CostingDocumento8 pagineProduct CostingHitesh RawatNessuna valutazione finora

- Quotation - Services: Not in UseDocumento4 pagineQuotation - Services: Not in UseAnilKalwaniyaNessuna valutazione finora

- Contract Package Schedule: Average Foreign Currency RateDocumento23 pagineContract Package Schedule: Average Foreign Currency RateThon Marvine Dionisio UrbanoNessuna valutazione finora

- 2-Capital Budgeting TechniquesDocumento31 pagine2-Capital Budgeting TechniquesSafdar BNC cjk IqbalNessuna valutazione finora

- Shamita Nandi: Key Skills Profile SummaryDocumento3 pagineShamita Nandi: Key Skills Profile SummaryHRD CORP CONSULTANCYNessuna valutazione finora

- VP Operations Job DescriptionDocumento2 pagineVP Operations Job DescriptionAmol Ghemud100% (1)

- Arctic Insultion Case Study - Rashik GuptaDocumento12 pagineArctic Insultion Case Study - Rashik GuptaRashik Gupta50% (2)

- Valuation of Tata SteelDocumento3 pagineValuation of Tata SteelNishtha Mehra100% (1)

- FM Assignment - Prashant KhombhadiaDocumento3 pagineFM Assignment - Prashant Khombhadiavicky54321inNessuna valutazione finora

- Planned / Actual & Forecast Quantities: Major Boq ItemsDocumento1 paginaPlanned / Actual & Forecast Quantities: Major Boq Itemsburerey100% (1)

- Financial Feasibility of Product ADocumento4 pagineFinancial Feasibility of Product AMuhammad AsadNessuna valutazione finora

- Total Project Cost Analysis Excel TemplateDocumento16 pagineTotal Project Cost Analysis Excel TemplateOumeyma HamlauiNessuna valutazione finora

- Project Estimate Using Area Methd No Elements Qty Unit RateDocumento3 pagineProject Estimate Using Area Methd No Elements Qty Unit RateGishan Nadeera GunadasaNessuna valutazione finora

- Progress Billing 032818Documento8 pagineProgress Billing 032818Francis F. RivamonteNessuna valutazione finora

- The Project Management Process Groups: A Case StudyDocumento24 pagineThe Project Management Process Groups: A Case StudyjpatanoNessuna valutazione finora

- PMP Notes Rajesh Thallam v1.0Documento194 paginePMP Notes Rajesh Thallam v1.0Sudheep Chandran C PNessuna valutazione finora

- Seminar Earth Work Volume Area CalculationDocumento384 pagineSeminar Earth Work Volume Area CalculationRonald Cario SeguinNessuna valutazione finora

- ROI TecnologiasDocumento27 pagineROI TecnologiasDiego SornozaNessuna valutazione finora

- Target Costing: Ludwigsburg VMDocumento11 pagineTarget Costing: Ludwigsburg VMkashi3027Nessuna valutazione finora

- Cumulative Cost Curve Percent TemplateDocumento10 pagineCumulative Cost Curve Percent TemplatensadnanNessuna valutazione finora

- Balance CTC - Lily Lilac Tulip 19 20 - SWF - 08.01.2022Documento51 pagineBalance CTC - Lily Lilac Tulip 19 20 - SWF - 08.01.2022UTTAL RAY100% (1)

- Mind Map Job Order CostingDocumento1 paginaMind Map Job Order CostingAndhika Bella PrawitasariNessuna valutazione finora

- Competitiveness, Strategy and ProductivityDocumento67 pagineCompetitiveness, Strategy and ProductivityQWERTYNessuna valutazione finora

- 2013 - DSSA - DSSA - Annual Report - 2013 PDFDocumento292 pagine2013 - DSSA - DSSA - Annual Report - 2013 PDFPak Ngah LebayNessuna valutazione finora

- Balance Sheet - in Rs. Cr.Documento72 pagineBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Financial Slide For ReportDocumento6 pagineFinancial Slide For ReportTuan Noridham Tuan LahNessuna valutazione finora

- Is A Construction Company Specializing in Custom PatiosDocumento8 pagineIs A Construction Company Specializing in Custom Patioslaale dijaanNessuna valutazione finora

- Ch02 Job Order Costing1Documento8 pagineCh02 Job Order Costing1Laika Mico MotasNessuna valutazione finora

- Chapter 5 Assignment Cost AccountingDocumento3 pagineChapter 5 Assignment Cost AccountingSydnei HaywoodNessuna valutazione finora

- Cost Accounting Chapter 2 Assignment #3Documento5 pagineCost Accounting Chapter 2 Assignment #3Tawan VihokratanaNessuna valutazione finora

- Midterm Managerial Fall-2020 SolutionDocumento8 pagineMidterm Managerial Fall-2020 SolutionEmna NegrichiNessuna valutazione finora

- Management AccountingDocumento6 pagineManagement AccountingJohn Allen Cruz Caballa100% (2)

- Manufacturing AccountDocumento1 paginaManufacturing AccountJingyiNessuna valutazione finora

- L1-Practice Problem-Process Costing-Single Department Cost of Production ReportDocumento2 pagineL1-Practice Problem-Process Costing-Single Department Cost of Production ReportlalalalaNessuna valutazione finora

- Cost Accounting Chapter 2 Assignment #5Documento4 pagineCost Accounting Chapter 2 Assignment #5Tawan Vihokratana100% (1)

- Cost Accounting Mid PaperDocumento3 pagineCost Accounting Mid Paperpalwasha100% (1)

- BACOSTMX Module 3 Self-ReviewerDocumento5 pagineBACOSTMX Module 3 Self-ReviewerlcNessuna valutazione finora

- Zakaria Ch1Documento8 pagineZakaria Ch1Zakaria HasaneenNessuna valutazione finora

- Ch.2 Book Exercise + AnswerDocumento13 pagineCh.2 Book Exercise + Answertomsuen63Nessuna valutazione finora

- Exercise Job CostingDocumento8 pagineExercise Job Costingrkailashinie50% (2)

- Job Order Costing Problems and SolutionsDocumento14 pagineJob Order Costing Problems and SolutionsErika GuillermoNessuna valutazione finora

- Job Order CostingDocumento3 pagineJob Order CostingGayzelle MirandaNessuna valutazione finora

- Fernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Documento3 pagineFernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Kailash KumarNessuna valutazione finora

- Jennys FroyoDocumento16 pagineJennys FroyoKailash Kumar100% (2)

- Silven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsDocumento5 pagineSilven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsKailash KumarNessuna valutazione finora

- (Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Documento4 pagine(Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Kailash KumarNessuna valutazione finora

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocumento4 pagineThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNessuna valutazione finora

- Thompson Industrial Products Inc Is A DiversifiedDocumento4 pagineThompson Industrial Products Inc Is A DiversifiedKailash KumarNessuna valutazione finora

- Pastore Drycleaners Has Capacity To Clean UpDocumento4 paginePastore Drycleaners Has Capacity To Clean UpKailash KumarNessuna valutazione finora

- Prince Corporation Acquired 100 Percent of Sword CompanyDocumento2 paginePrince Corporation Acquired 100 Percent of Sword CompanyKailash Kumar50% (2)

- O-Level Accounting Paper 2 Topical and yDocumento343 pagineO-Level Accounting Paper 2 Topical and yKailash Kumar100% (3)

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocumento2 pagineCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNessuna valutazione finora

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADocumento17 pagineOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarNessuna valutazione finora

- Bracey Company Manufactures and Sells One ProductDocumento2 pagineBracey Company Manufactures and Sells One ProductKailash KumarNessuna valutazione finora

- Paragraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Documento2 pagineParagraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Kailash KumarNessuna valutazione finora

- Bethany's Bicycle CorporationDocumento15 pagineBethany's Bicycle CorporationKailash Kumar100% (2)

- James Kimberley President of National Motors Receives A BonusDocumento1 paginaJames Kimberley President of National Motors Receives A BonusKailash KumarNessuna valutazione finora

- Kristen Lu Purchased A Used Automobile ForDocumento1 paginaKristen Lu Purchased A Used Automobile ForKailash KumarNessuna valutazione finora

- Diamond Hardware Uses The Periodic Inventory SystemDocumento7 pagineDiamond Hardware Uses The Periodic Inventory SystemKailash KumarNessuna valutazione finora

- 2-13 White Company Has Two Departments Cutting and Finishing. The Company Uses A Job-OrderDocumento2 pagine2-13 White Company Has Two Departments Cutting and Finishing. The Company Uses A Job-OrderKailash KumarNessuna valutazione finora

- Tristar Production Company Began Operations On SeptemberDocumento2 pagineTristar Production Company Began Operations On SeptemberKailash KumarNessuna valutazione finora

- La Femme Accessories Inc Produces Womens HandbagsDocumento1 paginaLa Femme Accessories Inc Produces Womens HandbagsKailash KumarNessuna valutazione finora

- The Balance Sheet at December 31, 2018, For Nevada Harvester Corporation Includes The Liabilities Listed BelowDocumento4 pagineThe Balance Sheet at December 31, 2018, For Nevada Harvester Corporation Includes The Liabilities Listed BelowKailash KumarNessuna valutazione finora

- Smith Foundry in Colomus Ohio Uses A PredeterminedDocumento2 pagineSmith Foundry in Colomus Ohio Uses A PredeterminedKailash KumarNessuna valutazione finora

- The Risk Register PDFDocumento8 pagineThe Risk Register PDFdddibalNessuna valutazione finora

- Accounting For Environmental Remediation CostsDocumento18 pagineAccounting For Environmental Remediation CostsAnanya DeshpandeNessuna valutazione finora

- Top 20 Accounting Assistant Interview Questions & Answers 20Documento36 pagineTop 20 Accounting Assistant Interview Questions & Answers 20Anesu ChibweNessuna valutazione finora

- Maher Ghneim: Operation Manager (Approved and Licensed by The SCA)Documento4 pagineMaher Ghneim: Operation Manager (Approved and Licensed by The SCA)maher1974Nessuna valutazione finora

- Plan Training Session Final 3Documento36 paginePlan Training Session Final 3Niel Ivan Alliosada Quimbo100% (1)

- Bilal Kahlid Cv..Documento2 pagineBilal Kahlid Cv..SaadNessuna valutazione finora

- The Burden On The Accountants Caused by The Covid-19 PandemicDocumento15 pagineThe Burden On The Accountants Caused by The Covid-19 PandemicSean VillacortaNessuna valutazione finora

- Cima f2 2012 NotesDocumento18 pagineCima f2 2012 NotesThe ExP GroupNessuna valutazione finora

- Test Bank For Government and Not For Profit Accounting 8th by GranofDocumento20 pagineTest Bank For Government and Not For Profit Accounting 8th by GranofHorace Renfroe100% (40)

- Part I. Sem. I Business Ethics and Corporate Social Responsibility PDFDocumento9 paginePart I. Sem. I Business Ethics and Corporate Social Responsibility PDFIqra farooqNessuna valutazione finora

- Riya Thakkar (4181) MaDocumento50 pagineRiya Thakkar (4181) MaRiya ThakkarNessuna valutazione finora

- Acc 1 - Financial Accounting and Reporting DRILL NO. 5 - Adjusting EntriesDocumento1 paginaAcc 1 - Financial Accounting and Reporting DRILL NO. 5 - Adjusting Entriesnicole bancoroNessuna valutazione finora

- Test Bank For Auditing A Business Risk Approach 8th Edition by RittenburgDocumento12 pagineTest Bank For Auditing A Business Risk Approach 8th Edition by RittenburgfredeksdiiNessuna valutazione finora

- Chapter Two: Accounting Cycle For Service-Giving BusinessesDocumento128 pagineChapter Two: Accounting Cycle For Service-Giving BusinessesMikias BekeleNessuna valutazione finora

- ENG - Soal Mojakoe Pengantar Akuntansi UTS Ganjil 2022 - 2023Documento9 pagineENG - Soal Mojakoe Pengantar Akuntansi UTS Ganjil 2022 - 2023Akun AnonNessuna valutazione finora

- Indofood CBP Sukses Makmur - Bilingual - 31 - Mar - 21Documento129 pagineIndofood CBP Sukses Makmur - Bilingual - 31 - Mar - 21NicoleNessuna valutazione finora

- For Filing - Emp 1h 2022 Complete SetDocumento45 pagineFor Filing - Emp 1h 2022 Complete SetBORDALLO JAYMHARKNessuna valutazione finora

- SKS Accounting ServicesDocumento13 pagineSKS Accounting ServicesSKS Business ServiceNessuna valutazione finora

- SAP FICO T-CODE - XLSX FINAL 2021Documento23 pagineSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- Chapter OneDocumento56 pagineChapter OneKamal MoyerNessuna valutazione finora

- What Are Accounting PrinciplesDocumento3 pagineWhat Are Accounting PrinciplesMarie MirallesNessuna valutazione finora

- Project Report of Financial and Ratio Analysis of Small Pharmaceutical ComapnyDocumento102 pagineProject Report of Financial and Ratio Analysis of Small Pharmaceutical ComapnyAviral Tripathi50% (6)

- Accounting For Managerial Decision (6th Sem Notes)Documento36 pagineAccounting For Managerial Decision (6th Sem Notes)Kamal Sachdev67% (3)

- Journal & LedgerDocumento36 pagineJournal & Ledgerapi-373125733% (3)

- Elements of Financial Statements & The Recognition Criteria For Assets & LiabilitiesDocumento13 pagineElements of Financial Statements & The Recognition Criteria For Assets & LiabilitiesdeepshrmNessuna valutazione finora

- Accounting Guide For Non-ProfitsDocumento152 pagineAccounting Guide For Non-ProfitsAilene Camacho100% (3)

- Adv. Aud. CH 6 Auditor Resp.Documento5 pagineAdv. Aud. CH 6 Auditor Resp.HagarMahmoudNessuna valutazione finora

- Cambridge, 2nd Ed. - Depreciation and DisposalDocumento3 pagineCambridge, 2nd Ed. - Depreciation and DisposalShannen LyeNessuna valutazione finora

- Chapter 4 Adjusting EntriesDocumento43 pagineChapter 4 Adjusting EntriesCamille Gene Solidum100% (1)

- Akuntansi Manajaemen Chapter 15Documento15 pagineAkuntansi Manajaemen Chapter 15lullasangadNessuna valutazione finora