Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Documentary Stamp Tax Rates

Caricato da

Lalaine Reyes0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

21 visualizzazioni2 pagineBusiness Taxation summary of rates

Lalaine Reyes

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBusiness Taxation summary of rates

Lalaine Reyes

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

21 visualizzazioni2 pagineDocumentary Stamp Tax Rates

Caricato da

Lalaine ReyesBusiness Taxation summary of rates

Lalaine Reyes

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

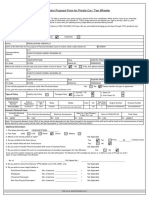

Documentary Stamp Taxes

Of the par value of such shares of stock; or

Original issue of shares of stock P2.00 on each P200

On actual consideration if without par value

Stock dividends P2.00 on each P200 Of the actual value represented by each share

Of the par value of such due-bill, certificate

Sales, agreements to sell, memoranda of of obligation or stock; or

sales, deliveries or transfer of shares or P1.50 on each P200 50% of documentary stamp tax paid upon the

certificates of stock original issue of said stock if without par

value

Bonds, debentures, certificate of stock

or indebtedness issued in foreign Same as tax required by law on similar instruments when issued, sold or transferred in the PH

countries

Certificates of profits or interest in Of the face value of such certificate or

P1.00 on each P200

property or accumulations memorandum

On each bank check, draft or certificate of

Bank checks, drafts, certificate of

deposit not drawing interest, or order for

deposit not bearing interest and other P3.00

payment of any sum of money drawn upon

instruments

or issued at sight or on demand

Of the issue price of any such debt

instrument;

All debt instruments P1.50 on each P200

Proportional with the ratio of number of days

to 365 days if term is less than one year.

Of the face value of any such bill of

All bills of exchange or drafts P0.60 on each P200

exchange or draft

Of the face value of any such bill of

Acceptance of bills of exchange and

P0.60 on each P200 exchange, or order, or the Philippine

others

equivalent (drawn out, payable in)

Of the face value of any such bill of

Foreign bills of exchange, and letters of

P0.60 on each P200 exchange or letter of credit, or the Philippine

credit

equivalent (drawn in, payable out)

Exempt if ≤ P100,000;

P20.00 if >100,000 but ≤ P300,000;

P50.00 if > P300,000 but ≤ P500,000;

Life insurance policies Of the amount of insurance

P100.00 if > 500,000 but ≤ P750,000;

P150.00 if > P750,000 but ≤ P1,000,000;

P200.00 if < P1,000,000

Policies of insurance upon property P0.50 on each P4.00 Of the amount of premium charged

Fidelity bonds and other insurance

P0.50 on each P4.00 Of the amount of premium charged

policies

Of the premium or installment payment or

Policies of annuities P1.00 on each P200

contract price collected

Pre-need plans P0.40 on P200 Of the premium or contribution collected

Indemnity bonds P0.30 on each P4.00 Of the premium charged

Certificates P30.00 On each certificate

On each warehouse receipt (exempt in any

Warehouse receipts P30.00 one calendar month covering property of

which does not exceed P200)

Jai-alai, horse racing tickets, lotto and P0.20 + P0.20 on every P1.00 in excess of

On each ticket

other authorized number games P1.00

P2.00 if > P100 but ≤ P1,000 On each set of bills of lading or receipts

Bills of lading or receipts

P20.00 if ≤ P1,000 (except charter party)

On each proxy for voting at any election for

Proxies P30.00

officers

Powers of Attorney P10.00 On each power of attorney

P6.00 for the first P2,000 + P2.00 for every On each lease, agreement, memorandum, or

Leases and other hiring agreements

P1,000 in excess of P2,000 contract for hire

P40 if ≤ P5,000

Mortgages, pledges and deeds of trust Of the amount secured

+ P20.00 on each P5,000 in excess thereof

On consideration contracted to be paid or on

Deeds of sale, conveyances, and P15.00 if ≤ P1,000 + its fair market value, whichever is higher;

donation of real property P15.00 on each P1,000 in excess thereof On actual consideration if one of the parties

is the Government

P1,000 if ≤ 1,000 tons, ≤ 6 months + P100.00

on each month in excess thereof;

P2,000 if > 1,000 tons, ≤ 10,000 tons, ≤ 6 On the registered gross tonnage of the ship,

Charter parties and similar instruments

months + P200.00 on each months in excess; vessel, or streamer

P3,000 if >10,000, ≤ 6 months + P300 on

each month in excess thereof

Documentary Stamp Taxes

Assignments and renewals of certain

Same rate as that imposed on the original instrument

instruments

Potrebbero piacerti anche

- 02 - Notes On Statement of Comprehensive IncomeDocumento2 pagine02 - Notes On Statement of Comprehensive IncomeLalaine ReyesNessuna valutazione finora

- 05 - Notes On Noncurrent Asset Held For SaleDocumento3 pagine05 - Notes On Noncurrent Asset Held For SaleLalaine ReyesNessuna valutazione finora

- 06 - Notes On Discontinued OperationsDocumento3 pagine06 - Notes On Discontinued OperationsLalaine ReyesNessuna valutazione finora

- 00 - Notes On Accounting ProcessDocumento7 pagine00 - Notes On Accounting ProcessLalaine ReyesNessuna valutazione finora

- 02 - Notes On Statement of Comprehensive IncomeDocumento2 pagine02 - Notes On Statement of Comprehensive IncomeLalaine ReyesNessuna valutazione finora

- Audit of The Revenue and Collection CycleDocumento5 pagineAudit of The Revenue and Collection CycleLalaine ReyesNessuna valutazione finora

- 04 - Notes On Interim ReportingDocumento2 pagine04 - Notes On Interim ReportingLalaine ReyesNessuna valutazione finora

- Classroom Notes On LBTDocumento5 pagineClassroom Notes On LBTLalaine ReyesNessuna valutazione finora

- Reflection Paper 1Documento2 pagineReflection Paper 1Lalaine ReyesNessuna valutazione finora

- Notes On Excise TaxesDocumento19 pagineNotes On Excise TaxesLalaine ReyesNessuna valutazione finora

- Reyes - Lalaine - Cost - CVP AnalysisDocumento5 pagineReyes - Lalaine - Cost - CVP AnalysisLalaine ReyesNessuna valutazione finora

- Classroom Notes On DSTDocumento6 pagineClassroom Notes On DSTLalaine ReyesNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Investment Manager - S Insurance (IMI) - Product BrochureDocumento5 pagineInvestment Manager - S Insurance (IMI) - Product BrochureHARMAN SINGHNessuna valutazione finora

- Metamorphosis of Modern Management - Financial ServicesDocumento12 pagineMetamorphosis of Modern Management - Financial ServicesSiva BalajiNessuna valutazione finora

- Motor Proposal Form For Private Car / Two Wheeler: Customer Type: Insured DetailsDocumento2 pagineMotor Proposal Form For Private Car / Two Wheeler: Customer Type: Insured DetailssrinadhNessuna valutazione finora

- Takaful MaybankDocumento4 pagineTakaful MaybankSHANessuna valutazione finora

- B.G.Patki Motor' Risk Management & Automobile Accident Technology Consultant B.G.PatkiDocumento123 pagineB.G.Patki Motor' Risk Management & Automobile Accident Technology Consultant B.G.PatkiYuvarani LoganathanNessuna valutazione finora

- Mashoo 1ST ASSIGNMENT OF Financial RegulatryDocumento40 pagineMashoo 1ST ASSIGNMENT OF Financial RegulatryAhsan khanNessuna valutazione finora

- Insurance Regulatory & Development Authority of India (IRDAI)Documento10 pagineInsurance Regulatory & Development Authority of India (IRDAI)Deeptangshu KarNessuna valutazione finora

- Political RISK IN INTERNATIONAL MARKETINGDocumento7 paginePolitical RISK IN INTERNATIONAL MARKETINGShubhajit Nandi75% (4)

- NEW Health Insurance Rate Press ReleaseDocumento2 pagineNEW Health Insurance Rate Press ReleaseRob PortNessuna valutazione finora

- Proposal Form - Corona Kavach Policy, Star Health and Allied Insurance Co LTD - V.1 - WebDocumento4 pagineProposal Form - Corona Kavach Policy, Star Health and Allied Insurance Co LTD - V.1 - WebPanduranga reddyNessuna valutazione finora

- Taxation CasesDocumento3 pagineTaxation CasesalmsypayosNessuna valutazione finora

- Murat Balamir Seismic Master Plan Istanbul 009005Documento22 pagineMurat Balamir Seismic Master Plan Istanbul 009005irene_plopeanuNessuna valutazione finora

- Levy v. PeruDocumento184 pagineLevy v. PeruDana MardelliNessuna valutazione finora

- Indian Ministry of Shipping, Guidelines On Deployment of Armed Security Guards On Merchant Ships, August 2011Documento9 pagineIndian Ministry of Shipping, Guidelines On Deployment of Armed Security Guards On Merchant Ships, August 2011Feral JundiNessuna valutazione finora

- Exhibit 2 Wilshire Due Diligence Questionnaire (EME)Documento23 pagineExhibit 2 Wilshire Due Diligence Questionnaire (EME)Anonymous qAegy6GNessuna valutazione finora

- Bouvier's Law Revised 6th Edition - Sec. ADocumento151 pagineBouvier's Law Revised 6th Edition - Sec. Ageoraw9588Nessuna valutazione finora

- Kidnap and Ransom Proposal Form-1Documento3 pagineKidnap and Ransom Proposal Form-1gargramNessuna valutazione finora

- Student Nov 1st 2022 DataDocumento2 pagineStudent Nov 1st 2022 DataSanjana VakkundNessuna valutazione finora

- 3-Gmc Claim Form HDFC ErgoDocumento3 pagine3-Gmc Claim Form HDFC ErgoDT worldNessuna valutazione finora

- Multi State Cooprative Societies ActDocumento72 pagineMulti State Cooprative Societies ActarvindkrajuNessuna valutazione finora

- Pioneer Insurance vs. CADocumento5 paginePioneer Insurance vs. CAaftb321Nessuna valutazione finora

- Fire InsuranceDocumento1 paginaFire InsuranceRoche AltizoNessuna valutazione finora

- Classification of Hindu PropertyDocumento24 pagineClassification of Hindu PropertySrishti PunjNessuna valutazione finora

- Finance For Everyone Assignment 2 ROHAN 1099Documento10 pagineFinance For Everyone Assignment 2 ROHAN 1099NathoNessuna valutazione finora

- CambertfordDocumento2 pagineCambertfordEnrique AlonsoNessuna valutazione finora

- Aviva PoliciesDocumento14 pagineAviva PoliciesKirtan ShahNessuna valutazione finora

- Consignment AccountDocumento15 pagineConsignment AccountMahmudul Mahmud100% (1)

- Common Stock Cash Note Payable Cash Cash Services Cash Note Payable Services A/P Services A/R A/P A/R Cash CashDocumento3 pagineCommon Stock Cash Note Payable Cash Cash Services Cash Note Payable Services A/P Services A/R A/P A/R Cash CashĐàm Quang Thanh TúNessuna valutazione finora

- Invitation To Submit Offer To PurchaseDocumento39 pagineInvitation To Submit Offer To PurchaseCamille LachicaNessuna valutazione finora

- FI PPT Sec 1 Chapter 5 RMDocumento8 pagineFI PPT Sec 1 Chapter 5 RMOusman SeidNessuna valutazione finora