Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tata Steel: Performance Highlights

Caricato da

sunnysmvduTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tata Steel: Performance Highlights

Caricato da

sunnysmvduCopyright:

Formati disponibili

1QFY2011 Result Update | Steel

August 13, 2010

Tata Steel BUY

CMP Rs527

Performance highlights Target Price Rs702

(Rs cr) 1QFY11(S) 1QFY10(S) chg (%) 1QFY11(C) 1QFY10(C) chg(%) Investment Period 12 months

Net revenue 6,471 5,554 16.5 27,195 23,292 16.8

EBITDA 2,836 1,681 68.8 4,433 (30) - Stock Info

EBITDA Sector Steel

43.8 30.3 1,357bp 16.3 - -

margin(%) Market Cap (Rs cr) 46,734

Rep. PAT 1,579 790 100.0 1,825 (2,209) - Beta 1.7

Source: Company, Angel Research 52 Week High / Low 737/409

Avg. Daily Volume 2163450

For 1QFY2011, Tata Steel reported consolidated net revenue of Rs27,195cr and

Face Value (Rs) 10

net profit of Rs1,825cr. Going forward, we expect Tata Steel Europe (TSE) to

BSE Sensex 18,167

report weaker performance on a sequential basis in 2QFY2011 due to lower

product prices, higher raw-material cost and lower volumes. On the other hand, Nifty 5,452

the company’s Indian operations are expected to remain strong because of higher Reuters Code TISC.BO

integration levels. We maintain our Buy rating on the stock. Bloomberg Code TATA@IN

Standalone performance impacted by lower volumes: During 1QFY2011, Tata

Steel’s net revenue declined 13.3% qoq to Rs6,471cr on account of lower

Shareholding Pattern (%)

production due to maintenance shutdown and power failure at Jamshedpur plant.

Promoters 31.3

Sales volumes were flat on a yearly basis but declined 17.7% qoq to 1.4mn

MF / Banks / Indian Fls 26.5

tonnes. Average realisation increased by 16.8% yoy and 8.3% qoq to

Rs42,871/tonne. EBITDA margin expanded by 1,357bp to 43.8% because of FII / NRIs / OCBs 15.5

cost-reduction initiatives and higher realisations. Indian Public / Others 26.7

Consolidated operations on a recovery: Net revenue increased by 16.8% yoy to

Rs27,195cr but was down 1.1% qoq. Group deliveries increased by 8.9% yoy to Abs. (%) 3m 1yr 3yr

6mn tonnes, declining 7.5% qoq. Capacity utilisation in Europe was 90% during Sensex 5.2 17.1 21.0

the quarter. In Europe, deliveries increased to 3.7mn tonnes as compared to Tata Steel (8.4) 12.0 (7.4)

3.3mn tonnes in 1QFY2010 but were down sequentially from 3.9mn tonnes in

4QFY2010. EBITDA/tonne for European operations increased to US $79 as

compared to a loss of US $117 in 1QFY2010. Adjusted EBITDA/tonne for the

quarter stood at US $105.

Key financials (Consolidated)

Y/E March (Rs cr) FY2009 FY2010E FY2011E FY2012E

Net sales 147,329 102,393 115,961 121,410

% chg 12.4 (30.5) 13.3 4.7

Net profit 4,951 (2,009) 6,483 7,158

% chg (59.9) - - 10.4

EPS (Rs) 59.0 (25.0) 73.1 80.7

EBITDA margin (%) 12.3 7.9 13.8 14.3

P/E (x) 8.9 - 7.2 6.5 Paresh Jain

P/BV (x) 1.6 1.7 1.4 1.2 Tel: 022-40403800 Ext: 348

RoE (%) 16.0 - 21.2 19.7 pareshn.jain@angeltrade.com

RoCE (%) 15.4 5.2 13.2 14.1

Pooja Jain

EV/Sales (x) 0.7 0.9 0.8 0.4

Tel: 022-40403800 Ext: 311

EV/EBITDA (x) 5.4 12.0 5.9 5.2 pooja.j@angeltrade.com

Source: Company, Angel Research

Please refer to important disclosures at the end of this report 1

Tata Steel | 1QFY2011 Result Update

Exhibit 1: 1QFY2011 standalone performance

Y/E March (Rs cr) 1QFY11 1QFY10 yoy % FY10 FY09 yoy %

Net Sales 6,471 5,554 16.5 25,022 24,316 2.9

Consumption of Raw Material 965 1,606 (39.9) 5,799 5,780 0.3

(% of Net Sales) 14.9 28.9 23.2 23.8

Power& Fuel 355 328 8.1 1,268 1,091 16.2

(% of Net Sales) 5.5 5.9 5.1 4.5

Staff Costs 578 506 14.2 2,361 2,306 2.4

(% of Net Sales) 8.9 9.1 9.4 9.5

Freight & Handling 352 315 11.7 1,357 1,251 8.5

(% of Net Sales) 5.4 5.7 5.4 5.1

Other expenses 1,385 1,118 23.9 5,284 4,754 11.1

(% of Net Sales) 21.4 20.1 21.1 19.6

Total Expenditure 3,635 3,873 (6.2) 16,070 15,182 5.8

Operating Profit 2,836 1,681 68.8 8,952 9,133 (2.0)

OPM (%) 43.8 30.3 35.8 37.6

Interest 328 342 (4.2) 1,508 1,153 30.9

Depreciation 280 253 10.7 1,083 973 11.3

Other Income 129 108 19.3 854 308 177.0

Exceptional Items 0 0 0 0

Profit before Tax 2,357 1,193 97.5 7,214 7,316 (1.4)

(% of Net Sales) 36 21 29 30

Tax 778 403 92.8 2,168 2,114 2.5

(% of PBT) 33.0 33.8 30.0 28.9

Profit after Tax 1,579 790 100.0 5,047 5,202 (3.0)

Source: Company, Angel Research

Exhibit 2: 1QFY2011 standalone – Actual vs. Angel estimates

(Rs cr) Actual Estimate Variation (%)

Net sales 6,471 6,906 (6.3)

EBITDA 2,836 3,096 (8.4)

EBITDA margin (%) 43.8 44.8 (100bp)

PBT 2,357 2,786 (15.4)

PAT 1,579 1,866 (15.4)

Source: Company, Angel Research

August 13, 2010 2

Tata Steel | 1QFY2011 Result Update

Exhibit 3: 1QFY2011 consolidated performance

Y/E March (Rs cr) 1QFY11 1QFY10 yoy % FY10 FY09 yoy %

Net Sales 27,195 23,292 16.8 102,393 147,329 (30.5)

Consumption of Raw Material 10,348 11,885 (12.9) 44,752 74,914 (40.3)

(% of Net Sales) 38.1 51.0 43.7 50.8

Power& Fuel 971 966 0.5 4,052 5,957 (32.0)

(% of Net Sales) 3.6 4.1 4.0 4.0

Staff Costs 3,777 3,963 (4.7) 16,463 17,975 (8.4)

(% of Net Sales) 13.9 17.0 16.1 12.2

Freight & Handling 1,586 1,156 37.2 5,549 6,025 (7.9)

(% of Net Sales) 5.8 5.0 5.4 4.1

Other expenses 6,080 5,352 13.6 23,535 24,331 (3.3)

(% of Net Sales) 22.4 23.0 23.0 16.5

Total Expenditure 22,762 23,322 (2.4) 94,350 129,202 (27.0)

Operating Profit 4,433 (30) - 8,043 18,128 (55.6)

OPM (%) 16.3 - 7.9 12.3

Interest 598 882 (32.2) 3,022 3,290 (8.1)

Depreciation 1,044 1,089 (4.1) 4,492 4,265 5.3

Other Income 59 204 (70.8) 1,186 266 346.4

Exceptional Items (60) (219) - (1,684) (4,095) -

Profit before Tax 2,791 (2,016) - 31 6,743 (99.5)

(% of Net Sales) 10.3 - 0.0 4.6

Tax 1,000 223 348.8 2,152 1,894 13.6

(% of PBT) 35.9 - - 28.1

Profit after Tax 1,790 (2,239) - (2,121) 4,849 -

Share of profit 42 9 127 61

Minority interest (6) 21 (15) 41

Net Income 1,825 (2,209) - (2,009) 4,951 -

(% of Net Sales) 6.7 - - 3.4

Source: Company, Angel Research

August 13, 2010 3

Tata Steel | 1QFY2011 Result Update

Key analyst meet takeaways

Production at Indian operations was affected by maintenance shutdown and

power failures at the Jamshedpur plant.

The ferro chrome segment was slightly affected by lower volumes in the low

value-added segment (Dolomite). However, average ferro realisation stood at

US $1,437/tonne as compared to US $847/tonne in 1QFY2010 and

US $1,152/tonne in 4QFY2010. The company reported EBITDA of

US $44mn in 1QFY2011 as against US $4mn in 1QFY2010.

Production at TSE was also affected by the shutdown of blast furnace and fire

incident at Ijmuiden.

In Thailand, despite political problems, performance was healthy as the

company sold products in new export markets. During 1QFY2011, the

Thailand subsidiary reported EBITDA of US $12mn as compared to US $1mn

in 1QFY2010. Operations at NatSteel benefited from strong construction

activity. As a result, NatSteel reported EBITDA of US $20mn in 1QFY2011 as

compared to US $9mn in 1QFY2010.

The rationalisation process at Corus is complete and currently the workforce

stands at 35,000 employees.

The 3mn tonne expansion in India is on track and expected to come on stream

by October–December 2011.

The raw-material projects in Mozambique and Canada are on track and

expected to be commissioned by 1QFY2012E. The total spending remaining

for the Mozambique project is US $100mn–150mn, while the Canadian

project will involve a capex of CAD350mn.

Net debt at the end of 1QFY2011 stood at US $9.2bn. During the quarter, the

company raised US $230mn through preferential allotment of shares and

warrants.

August 13, 2010 4

Tata Steel | 1QFY2011 Result Update

Result highlights

Standalone performance affected by lower volumes

Tata Steel’s standalone 1QFY2011 net revenue grew by 16.5% yoy to Rs6,471cr

but was down 13.3% qoq. During the quarter, production was lower on a

sequential basis due to maintenance shutdown and power failure at Jamshedpur

plant. Sales volumes were flat on a yearly basis, declining 17.7% qoq to 1.4mn

tonnes. Average realisation increased by 16.8% yoy and 8.3% qoq to

Rs42,871/tonne. EBITDA margin expanded by 1,357bp to 43.8% on account of

cost-reduction initiatives and higher realisations. Consequently, EBITDA grew by

68.8% yoy to Rs2,836cr. During the quarter, while interest expense declined by

4.2% yoy to Rs328cr, other income increased by 19.3% yoy to Rs129cr. As a result,

net profit came in at Rs1,579cr, registering growth 100% yoy.

Deliveries in Europe down sequentially

On a consolidated basis, 1QFY2011’s net revenue increased by 16.8% yoy, down

1.1% qoq, to Rs27,195cr. Group deliveries increased by 8.9% yoy to 6mn tonnes;

however, they declined by 7.5% on a sequential basis. In Europe, deliveries

increased to 3.7mn tonnes as compared to 3.3mn tonnes in 1QFY2010 but were

down sequentially from 3.9mn tonnes in 4QFY2010. EBITDA/tonne for TSE

increased to US $79 as compared to a loss of US $117 in 1QFY2010. Adjusted

EBITDA/tonne stood at US $105 for the quarter. Capacity utilisation in Europe was

90% during the quarter. Consolidated EBITDA stood at Rs4,433cr as compared to

a loss of Rs30cr in 1QFY2010. Consolidated net profit stood at Rs1,825cr as

compared to a loss of 2,209cr in 1QFY2010.

Exhibit 4: Subsidiaries’ performance

EBITDA/tonne trend (US $mn) 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11

Tata Steel India

Steel deliveries (mn tonnes) 1.4 1.5 1.6 1.7 1.4

EBITDA (US $/tonne) 244 264 290 410 444

Tata Steel Europe

Steel deliveries (mn tonnes) 3.3 3.9 3.8 3.9 3.7

EBITDA (US $/tonne) (117) (96) 37 94 79

NatSteel

Steel deliveries (mn tonnes) 0.5 0.7 0.6 0.6 0.6

EBITDA (US $/tonne) 17 29 25 18 33

Thailand

Steel deliveries (mn tonnes) 0.3 0.3 0.3 0.3 0.3

EBITDA (US $/tonne) 4 57 27 10 40

Source: Company, Angel Research

August 13, 2010 5

Tata Steel | 1QFY2011 Result Update

Investment rationale

Brownfield expansion on track

Tata Steel’s 3mn tonne brownfield expansion plan is on track and is expected to be

commissioned by October–December 2011. We believe the company’s profitability

would be further supported by higher volumes from FY2013E.

Higher integration level for TSE to boost earnings

Tata Steel is in the process of developing a coking coal mine in Mozambique and

an iron ore mine in Canada to increase the integration levels of TSE. The projects

are expected to be commissioned by 1QFY2012E. The total spending remaining

for the Mozambique project is US $100mn–150mn, while the Canadian project

will involve a capex of CAD350mn. We expect the company’s backward

integration projects in Mozambique and Canada to translate into significant

earnings improvement for TSE.

Outlook and valuation

At the CMP of Rs527, the stock is trading at 5.9x FY2011E and 5.2x FY2012E

EV/EBITDA. Going forward, we expect TSE to report weaker performance on a

sequential basis in 2QFY2011 due to lower product prices, higher raw-material

cost and lower volumes. However, the company’s Indian operations are expected

to remain strong because of higher integration levels. We maintain a Buy view on

the stock with an SOTP-based Target Price of Rs702.

Exhibit 5: SOTP valuation

FY2012 EBIDTA (Rs) EV/EBIDTA (x) EV (Rs)

Tata Steel 11,592 7.0 81,141

TSE 4,622 5.0 23,112

Asia 1,114 5.0 5,568

Total EV 109,820

Net Debt 47,541

Market cap 62,279

Target Price 702

Source: Angel Research

Exhibit 6: Change in estimates

(Rs cr) Earlier estimates Revised estimates Upgrade/(downgrade) (%)

FY11E FY12E FY11E FY12E FY11E FY12E

Net sales 113,849 119,171 115,961 121,410 1.9 1.9

EBITDA 14,266 15,255 15,996 17,327 12.1 13.6

EBITDA margin (%) 12.5 12.8 13.8 14.3 126bp 147bp

PBT 7,059 7,089 8,732 10,034 23.7 41.5

Net income 5,406 5,074 6,483 7,158 19.9 41.1

Net margin (%) 4.7 4.3 5.6 5.9 84bp 164bp

Source: Company, Angel Research

August 13, 2010 6

Tata Steel | 1QFY2011 Result Update

Exhibit 7: EPS – Angel forecast vs. consensus

Year (%) Angel forecast Bloomberg consensus Variation (%)

FY2011E 73.1 63.0 16.1

FY2012E 80.7 77.1 4.8

Source: Bloomberg, Angel Research

Exhibit 8: EV/EBITDA band

200,000

180,000

160,000 10x

140,000

8x

120,000

(Rs cr)

100,000 6x

80,000

60,000 4x

40,000 2x

20,000

0

Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10

Source: Bloomberg, Angel Research

Exhibit 9: P/BV band

1,000

900

800 2.0x

700

600

1.4x

(Rs)

500

400

300 0.8x

200

100 0.2x

0

Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10

Source: Bloomberg, Angel Research

August 13, 2010 7

Tata Steel | 1QFY2011 Result Update

Exhibit 10: Recommendation summary

Companies CMP Target Price Reco. Mcap Upside P/E (x) P/BV (x) EV/EBITDA (x) RoE (%) RoCE (%)

(Rs) (Rs) (Rs cr) (%) FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E FY11E FY12E

SAIL 193 - Neutral 79,572 - 12.7 11.2 2.1 1.8 8.3 7.3 17.9 17.6 16.3 16.9

Tata Steel 527 702 Buy 46,734 30.7 7.2 6.5 1.4 1.2 5.9 5.2 21.2 19.7 13.2 14.1

JSW Steel 1,113 1,344 Buy 28,447 20.7 14.6 11.2 1.4 1.3 6.9 5.4 13.9 12.4 12.5 12.6

Sesa Goa 355 - Neutral 29,459 - 7.0 7.2 2.5 1.8 3.8 3.0 45.9 31.5 43.7 34.7

NMDC 257 - Neutral 101,754 - 15.3 12.0 5.2 3.9 9.5 6.9 39.3 37.1 52.2 49.2

Hindalco 166 204 Buy 31,795 22.8 8.8 8.2 1.2 1.1 6.1 5.8 15.1 14.2 10.3 10.0

Nalco 439 316 Sell 28,276 (28.0) 27.8 23.5 2.6 2.4 16.1 12.6 9.7 10.7 10.7 12.5

Sterlite 161 228 Buy 53,995 41.9 11.3 8.2 1.2 1.1 5.9 4.0 11.6 14.2 11.1 14.1

Hindustan Zinc 1,118 1,227 Accumulate 47,226 9.8 11.6 9.0 2.2 1.8 6.8 4.4 20.4 21.6 20.7 22.3

Source: Company, Angel Research

August 13, 2010 8

Tata Steel | 1QFY2011 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E

Net sales 17,552 131,091 147,329 102,393 115,961 121,410

Other operating income - - - - - -

Total operating income 17,552 131,091 147,329 102,393 115,961 121,410

% chg 15.4 646.9 12.4 (30.5) 13.3 4.7

Total expenditure 10,579 113,751 129,202 94,350 99,965 104,082

Net raw materials 3,490 58,580 74,914 44,752 48,703 50,992

Other mfg costs 2,039 10,968 11,982 9,601 10,436 10,927

Personnel 1,455 16,900 17,975 16,463 17,394 18,211

Other 3,595 27,304 24,331 23,535 23,431 23,952

EBITDA 6,973 17,340 18,128 8,043 15,996 17,327

% chg 17.4 148.7 4.5 (55.6) 98.9 8.3

(% of Net sales) 39.7 13.2 12.3 7.9 13.8 14.3

Depreciation 819 4,137 4,265 4,492 4,549 4,786

EBIT 6,154 13,203 13,862 3,551 11,446 12,541

% chg 19.2 114.5 5.0 (74.4) 222.3 9.6

(% of Net sales) 35.1 10.1 9.4 3.5 9.9 10.3

Interest charges 174 4,085 3,290 3,022 3,294 3,114

Other income 434 919 266 1,186 580 607

(% of PBT) 6.8 9.2 2.5 69.2 6.6 6.0

Share in profit of asso. - - - - - -

Recurring PBT 6,414 10,036 10,838 1,715 8,732 10,034

% chg 21.2 56.5 8.0 (84.2) 409.2 14.9

Extra. Inc/(Expense) (152) 6,335 (4,095) (1,684) 0 0

PBT (reported) 6,262 16,371 6,743 31 8,732 10,034

Tax 2,040 4,049 1,894 2,152 2,358 3,010

(% of PBT) 32.6 24.7 28.1 - 27.0 30.0

PAT (reported) 4,222 12,322 4,849 (2,121) 6,374 7,024

Add: Earnings of asso. - 168 61 127 125 150

Less: Minority interest - (140) 41 (15) (16) (16)

Extra. Expense/(Inc.) - - - - - -

PAT after MI (reported) 4,222 12,350 4,951 (2,009) 6,483 7,158

ADJ. PAT 4,326 6,276 9,045 (326) 6,483 7,158

% chg 22.1 45.1 44.1 - - 10.4

(% of Net sales) 24.6 4.8 6.1 (0.3) 5.6 5.9

Basic EPS (Rs) 73.8 176.8 66.1 (24.9) 73.1 80.7

Fully Diluted EPS (Rs) 73.8 162.6 59.0 (25.0) 73.1 80.7

% chg 16.4 120.5 (63.7) - - 10.4

August 13, 2010 9

Tata Steel | 1QFY2011 Result Update

Balance Sheet (Consolidated)

Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E

SOURCES OF FUNDS

Equity share capital 580 730 730 887 887 887

Reserves & surplus 14,042 33,444 26,984 27,033 32,497 38,516

Shareholders’ funds 14,622 34,174 27,714 27,920 33,384 39,403

Share warrants 17.5 17.5 17.5 17.5 17.5 17.5

Minority interest 598 833 895 895 895 895

Total loans 24,926 53,593 59,901 57,901 54,901 51,901

Deferred tax liability 793 2,465 1,786 1,786 1,786 1,786

Prov. for Employee Separation 1,118 1,080 1,042 1,042 1,042 1,042

Total liabilities 42,075 92,162 91,355 89,560 92,025 95,044

APPLICATION OF FUNDS

Gross block 20,084 96,229 99,459 103,959 110,959 113,959

Less: Acc. depreciation 9,190 63,162 63,083 67,575 72,124 76,910

Net Block 10,894 33,067 36,376 36,384 38,834 37,048

Capital work-in-progress 3,326 8,896 8,930 10,430 11,430 11,930

Goodwill 227 18,060 15,365 15,365 15,365 15,365

Investments 16,498 3,367 6,411 6,411 6,411 6,411

Current assets 18,444 61,467 53,871 47,643 49,928 56,670

Cash 10,888 4,232 6,148 7,941 7,359 8,365

Loans & advances 1,980 15,465 13,016 14,016 16,016 16,016

Other 5,576 41,770 34,707 25,687 26,553 32,289

Current liabilities 7,524 32,852 30,251 27,326 30,598 33,034

Net current assets 10,920 28,615 23,620 20,317 19,331 23,636

Mis. exp. not written off 209.8 155.6 653.3 653.3 653.3 653.3

Total assets 42,075 92,162 91,355 89,560 92,025 95,044

August 13, 2010 10

Tata Steel | 1QFY2011 Result Update

Cash flow statement (Consolidated)

Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E

Profit before tax 6,262 16,371 6,743 31 8,732 10,034

Depreciation 819 4,137 4,265 4,492 4,549 4,786

Change in WC (731) 24,343 (6,910) (5,095) (405) 3,300

Less: Other income

Direct taxes paid 2,040 4,049 1,894 2,152 2,358 3,010

Cash flow from

4,310 40,802 2,205 (2,725) 10,519 15,110

operations

(Inc.)/ Dec. in fixed

(3,432) (27,743) (3,342) (6,000) (8,000) 1,286

assets

(Inc.)/ Dec. in

(13,019) 13,130 (3,044) - - -

investments

(Inc.)/ Dec. in loans and

- - - - - -

advances

Other income - - - - - -

Cash flow from

(16,451) (14,613) (6,386) (6,000) (8,000) 1,286

investing

Issue of equity 4,340 19,552 - 2,335 5,464 6,019

Inc./(Dec.) in loans - 28,667 6,308 (2,000) (3,000) (3,000)

Dividend paid 45 13,978 6,951 0 9,103 10,050

Others (17,541) 67,087 (6,741) (10,182) (3,538) 8,360

Cash flow from

21,836 (32,846) 6,098 10,517 (3,100) (15,391)

financing

Inc./(Dec.) in cash 9,695 (6,656) 1,917 1,792 (581) 1,005

Opening cash bal. 1,193 10,888 4,232 6,148 7,941 7,359

Closing cash bal. 10,888 4,232 6,148 7,941 7,359 8,365

August 13, 2010 11

Tata Steel | 1QFY2011 Result Update

Key ratios

Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E

Valuation ratio (x)

P/E (on FDEPS) 7.1 3.2 8.9 - 7.2 6.5

P/CEPS 6.0 2.4 4.8 18.8 4.2 3.9

P/BV 2.1 1.2 1.6 1.7 1.4 1.2

Dividend yield (%) 3.7 3.5 1.6 - 1.9 2.2

EV/Sales 2.5 0.7 0.7 0.9 0.8 0.4

EV/EBITDA 6.3 5.2 5.4 12.0 5.9 5.2

EV/Total assets 1.1 1.0 1.1 1.1 1.0 0.9

Per share data (Rs)

EPS (Basic) 73.8 176.8 66.1 (24.9) 73.1 80.7

EPS (fully diluted) 73.8 162.6 59.0 (25.0) 73.1 80.7

Cash EPS 88.1 217.1 109.8 28.0 124.4 134.7

DPS 19.3 18.4 8.3 - 10.3 11.3

Book value 255.4 450.0 330.2 314.9 376.5 444.4

DuPont analysis

EBIT margin 35.1 10.1 9.4 3.5 9.9 10.3

Tax retention ratio (%) 67.4 75.3 71.9 - 73.0 70.0

Asset turnover (x) 2.1 6.1 2.4 1.2 1.4 1.5

RoIC (Post-tax) 49.8 46.1 16.1 - 10.1 10.6

Cost of debt (post tax) 1.4 9.7 4.6 - 4.9 4.8

Leverage (x) 1.0 1.4 1.9 1.8 1.4 1.1

Operating RoE 96.3 98.6 38.4 - 17.4 17.0

Returns (%)

RoCE (Pre-tax) 22.6 21.0 15.4 5.2 13.2 14.1

Angel RoIC (pre-tax) 88.2 30.1 33.9 20.5 32.6 34.2

RoE 33.9 50.6 16.0 - 21.2 19.7

Turnover ratios (x)

Asset turnover (gross

1.0 2.3 1.5 1.0 1.1 1.1

block)

Inventory (days) 132 73 60 60 55 65

Receivables (days) 35 51 32 35 35 40

Payables (days) 37 27 26 25 25 25

WC cycle (days) 8 34 52 53 38 41

Solvency ratios (x)

Net debt to equity 1.0 1.4 1.9 1.8 1.4 1.1

Net debt to EBITDA 2.0 2.8 3.0 6.2 3.0 2.5

Interest coverage 35.4 3.2 4.2 1.2 3.5 4.0

August 13, 2010 12

Tata Steel | 1QFY2011 Result Update

Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please

refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and

its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement Tata Steel

1. Analyst ownership of the stock No

2. Angel and its Group companies ownership of the stock Yes

3. Angel and its Group companies' Directors ownership of the stock No

4. Broking relationship with company covered No

Note: We have not considered any Exposure below Rs 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns) : Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Reduce (-5% to 15%) Sell (< -15%)

August 13, 2010 13

Potrebbero piacerti anche

- Following the Trend: Diversified Managed Futures TradingDa EverandFollowing the Trend: Diversified Managed Futures TradingValutazione: 3.5 su 5 stelle3.5/5 (2)

- Tata Steel: Performance HighlightsDocumento6 pagineTata Steel: Performance Highlightsmd.iet87Nessuna valutazione finora

- Bharat Forge: Performance HighlightsDocumento13 pagineBharat Forge: Performance HighlightsarikuldeepNessuna valutazione finora

- Titan Industries: Performance HighlightsDocumento10 pagineTitan Industries: Performance Highlightscbz786skNessuna valutazione finora

- Ashok Leyland: Performance HighlightsDocumento9 pagineAshok Leyland: Performance HighlightsSandeep ManglikNessuna valutazione finora

- Tata Motors: Performance HighlightsDocumento10 pagineTata Motors: Performance HighlightsandrewpereiraNessuna valutazione finora

- Blue Star: Performance HighlightsDocumento8 pagineBlue Star: Performance HighlightskasimimudassarNessuna valutazione finora

- IVRCL Infrastructure: Performance HighlightsDocumento11 pagineIVRCL Infrastructure: Performance HighlightsPratik GanatraNessuna valutazione finora

- Alembic Angel 020810Documento12 pagineAlembic Angel 020810giridesh3Nessuna valutazione finora

- IVRCL Infrastructure: Performance HighlightsDocumento7 pagineIVRCL Infrastructure: Performance Highlightsanudeep05Nessuna valutazione finora

- Exide Industries: Performance HighlightsDocumento4 pagineExide Industries: Performance HighlightsMaulik ChhedaNessuna valutazione finora

- Cipla: Performance HighlightsDocumento8 pagineCipla: Performance HighlightsKapil AthwaniNessuna valutazione finora

- Colgate-Palmolive: Performance HighlightsDocumento4 pagineColgate-Palmolive: Performance HighlightsPrasad DesaiNessuna valutazione finora

- Amara Raja Batteries: Performance HighlightsDocumento10 pagineAmara Raja Batteries: Performance HighlightssuneshsNessuna valutazione finora

- Tata MotorsDocumento5 pagineTata Motorsapi-3826612Nessuna valutazione finora

- Inox RU4QFY2008 110608Documento4 pagineInox RU4QFY2008 110608api-3862995Nessuna valutazione finora

- Enil 25 8 08 PLDocumento12 pagineEnil 25 8 08 PLapi-3862995Nessuna valutazione finora

- Bharat Forge StoryDocumento4 pagineBharat Forge Storysoni_rajendraNessuna valutazione finora

- Performance Highlights: NeutralDocumento10 paginePerformance Highlights: Neutralvipin51Nessuna valutazione finora

- JSW Steel LTD PDFDocumento10 pagineJSW Steel LTD PDFTanzy SNessuna valutazione finora

- LS India Cements Q1FY11Documento2 pagineLS India Cements Q1FY11prateepnigam355Nessuna valutazione finora

- Ashok Leyland: CMP: INR115 TP: INR134 (+17%)Documento10 pagineAshok Leyland: CMP: INR115 TP: INR134 (+17%)Jitendra GaglaniNessuna valutazione finora

- Voltamp Transformers 26112019Documento5 pagineVoltamp Transformers 26112019anjugaduNessuna valutazione finora

- Foodothe 20090319Documento12 pagineFoodothe 20090319nareshsbcNessuna valutazione finora

- Angel Broking - BHELDocumento5 pagineAngel Broking - BHELFirdaus JahanNessuna valutazione finora

- Angel Broking M&MDocumento5 pagineAngel Broking M&Mbunny711Nessuna valutazione finora

- Larsen & Toubro: Performance HighlightsDocumento14 pagineLarsen & Toubro: Performance HighlightsrajpersonalNessuna valutazione finora

- Indian Overseas Bank: Performance HighlightsDocumento6 pagineIndian Overseas Bank: Performance HighlightsHarshil MathurNessuna valutazione finora

- Greaves +angel+ +04+01+10Documento6 pagineGreaves +angel+ +04+01+10samaussieNessuna valutazione finora

- Amara Raja Batteries LTD: 1Q FY11 ResultsDocumento5 pagineAmara Raja Batteries LTD: 1Q FY11 ResultsveguruprasadNessuna valutazione finora

- CYIENT Kotak 22102018Documento6 pagineCYIENT Kotak 22102018ADNessuna valutazione finora

- B D E (BDE) : LUE ART XpressDocumento18 pagineB D E (BDE) : LUE ART XpresshemantNessuna valutazione finora

- Airtel AnalysisDocumento15 pagineAirtel AnalysisPriyanshi JainNessuna valutazione finora

- Annual Report of Info Edge by Icici SecurityDocumento12 pagineAnnual Report of Info Edge by Icici SecurityGobind yNessuna valutazione finora

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocumento13 pagineIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaNessuna valutazione finora

- Hero Honda: Performance HighlightsDocumento6 pagineHero Honda: Performance HighlightsamitkumaraxnNessuna valutazione finora

- Ashok Leyland Kotak 050218Documento4 pagineAshok Leyland Kotak 050218suprabhattNessuna valutazione finora

- Motherson Sumi System DataDocumento4 pagineMotherson Sumi System DataNishaVishwanathNessuna valutazione finora

- Union Bank of India: Performance HighlightsDocumento7 pagineUnion Bank of India: Performance HighlightsKarthik SpNessuna valutazione finora

- Bajaj Hindusthan: Performance HighlightsDocumento9 pagineBajaj Hindusthan: Performance HighlightsAshish PokharnaNessuna valutazione finora

- JBM Auto (Q2FY21 Result Update)Documento7 pagineJBM Auto (Q2FY21 Result Update)krippuNessuna valutazione finora

- Sbkuch 1Documento8 pagineSbkuch 1vishalpaul31Nessuna valutazione finora

- Ambuja Cement: Weak Despite The BeatDocumento8 pagineAmbuja Cement: Weak Despite The BeatDinesh ChoudharyNessuna valutazione finora

- Escorts: CMP: INR1,107 TP: INR 1,175 (+6%) Strong Operating Performance Led by Cost ManagementDocumento12 pagineEscorts: CMP: INR1,107 TP: INR 1,175 (+6%) Strong Operating Performance Led by Cost ManagementdfhjhdhdgfjhgdfjhNessuna valutazione finora

- Voltamp Transformers LTD: CMP: INR 1,145 Rating: Buy Target Price: INR 1,374Documento5 pagineVoltamp Transformers LTD: CMP: INR 1,145 Rating: Buy Target Price: INR 1,374Darwish MammiNessuna valutazione finora

- Tvs Motor PincDocumento6 pagineTvs Motor Pincrajarun85Nessuna valutazione finora

- Ashok Leyland: Robust Volume GuidanceDocumento4 pagineAshok Leyland: Robust Volume GuidancemittleNessuna valutazione finora

- Educomp Solutions LTD - : Result TableDocumento4 pagineEducomp Solutions LTD - : Result TableritzchavanNessuna valutazione finora

- China Ritar Power Corp.: Global Energy & Industrials: ChinaDocumento5 pagineChina Ritar Power Corp.: Global Energy & Industrials: Chinaanalyst_reportsNessuna valutazione finora

- Provogue - Anand RathiDocumento2 pagineProvogue - Anand RathiBhagwan BachaiNessuna valutazione finora

- VA Tech Wabag-KotakDocumento9 pagineVA Tech Wabag-KotakADNessuna valutazione finora

- Tata Steel: Performance HighlightsDocumento13 pagineTata Steel: Performance HighlightsAngel BrokingNessuna valutazione finora

- Anant Raj Industries: Performance HighlightsDocumento11 pagineAnant Raj Industries: Performance HighlightsPraveen Kumar DusiNessuna valutazione finora

- Proton Holdings BHD: New Inspiration From InspiraDocumento5 pagineProton Holdings BHD: New Inspiration From InspiraikrambambangNessuna valutazione finora

- Tata Motors (TTMT IN) : Q1FY21 Result UpdateDocumento6 pagineTata Motors (TTMT IN) : Q1FY21 Result UpdatewhitenagarNessuna valutazione finora

- Reliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Documento18 pagineReliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Abhiroop DasNessuna valutazione finora

- Sterlite Technologies (STEOPT) : Growth Delayed Long Term Growth IntactDocumento6 pagineSterlite Technologies (STEOPT) : Growth Delayed Long Term Growth IntactAtul RajoraNessuna valutazione finora

- AC Penetration Accross CountriesDocumento21 pagineAC Penetration Accross Countrieshh.deepakNessuna valutazione finora

- ABG+Shipyard 11-6-08 PLDocumento3 pagineABG+Shipyard 11-6-08 PLapi-3862995Nessuna valutazione finora

- Hero Motocorp: CMP: Inr3,707 TP: Inr3,818 (+3%)Documento12 pagineHero Motocorp: CMP: Inr3,707 TP: Inr3,818 (+3%)SAHIL SHARMANessuna valutazione finora

- TAS5431-Q1EVM User's GuideDocumento23 pagineTAS5431-Q1EVM User's GuideAlissonNessuna valutazione finora

- Rating SheetDocumento3 pagineRating SheetShirwin OliverioNessuna valutazione finora

- Blade Torrent 110 FPV BNF Basic Sales TrainingDocumento4 pagineBlade Torrent 110 FPV BNF Basic Sales TrainingMarcio PisiNessuna valutazione finora

- Departmental Costing and Cost Allocation: Costs-The Relationship Between Costs and The Department Being AnalyzedDocumento37 pagineDepartmental Costing and Cost Allocation: Costs-The Relationship Between Costs and The Department Being AnalyzedGeorgina AlpertNessuna valutazione finora

- TSR KuDocumento16 pagineTSR KuAngsaNessuna valutazione finora

- Reverse Engineering in Rapid PrototypeDocumento15 pagineReverse Engineering in Rapid PrototypeChaubey Ajay67% (3)

- Are Groups and Teams The Same Thing? An Evaluation From The Point of Organizational PerformanceDocumento6 pagineAre Groups and Teams The Same Thing? An Evaluation From The Point of Organizational PerformanceNely Noer SofwatiNessuna valutazione finora

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDocumento2 pagineEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaNessuna valutazione finora

- SM Land Vs BCDADocumento68 pagineSM Land Vs BCDAelobeniaNessuna valutazione finora

- General Financial RulesDocumento9 pagineGeneral Financial RulesmskNessuna valutazione finora

- Intermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Documento11 pagineIntermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Jericho PedragosaNessuna valutazione finora

- Pneumatic Fly Ash Conveying0 PDFDocumento1 paginaPneumatic Fly Ash Conveying0 PDFnjc6151Nessuna valutazione finora

- Astm E53 98Documento1 paginaAstm E53 98park991018Nessuna valutazione finora

- Interruptions - 02.03.2023Documento2 pagineInterruptions - 02.03.2023Jeff JeffNessuna valutazione finora

- Uppsc Ae GSDocumento18 pagineUppsc Ae GSFUN TUBENessuna valutazione finora

- 4 Bar LinkDocumento4 pagine4 Bar LinkConstance Lynn'da GNessuna valutazione finora

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADocumento10 pagineResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXNessuna valutazione finora

- Subqueries-and-JOINs-ExercisesDocumento7 pagineSubqueries-and-JOINs-ExerciseserlanNessuna valutazione finora

- Analysis of Material Nonlinear Problems Using Pseudo-Elastic Finite Element MethodDocumento5 pagineAnalysis of Material Nonlinear Problems Using Pseudo-Elastic Finite Element MethodleksremeshNessuna valutazione finora

- Amare Yalew: Work Authorization: Green Card HolderDocumento3 pagineAmare Yalew: Work Authorization: Green Card HolderrecruiterkkNessuna valutazione finora

- What Is Retrofit in Solution Manager 7.2Documento17 pagineWhat Is Retrofit in Solution Manager 7.2PILLINAGARAJUNessuna valutazione finora

- Dissertation On Indian Constitutional LawDocumento6 pagineDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Documento4 pagineEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNessuna valutazione finora

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Documento16 pagineOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoNessuna valutazione finora

- Engine Diesel PerfomanceDocumento32 pagineEngine Diesel PerfomancerizalNessuna valutazione finora

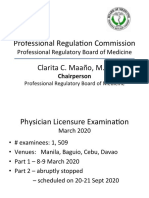

- Professional Regula/on Commission: Clarita C. Maaño, M.DDocumento31 pagineProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartNessuna valutazione finora

- Notifier AMPS 24 AMPS 24E Addressable Power SupplyDocumento44 pagineNotifier AMPS 24 AMPS 24E Addressable Power SupplyMiguel Angel Guzman ReyesNessuna valutazione finora

- Office Storage GuideDocumento7 pagineOffice Storage Guidebob bobNessuna valutazione finora

- Check Fraud Running Rampant in 2023 Insights ArticleDocumento4 pagineCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchNessuna valutazione finora

- ICSI-Admit-Card (1) - 230531 - 163936Documento17 pagineICSI-Admit-Card (1) - 230531 - 163936SanjayNessuna valutazione finora