Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)

Caricato da

Ashutosh GargTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)

Caricato da

Ashutosh GargCopyright:

Formati disponibili

Term Wise Syllabus (Session 2019-20)

Class-XII

Subject- Accountancy (Code No. 055)

I TERM CONTENTS

April 2019 Part A: Accounting for Not-for-Profit Organizations, Partnership Firms and

to Companies

September Unit 1: Financial Statements of Not-for-Profit Organizations

2019 • Not-for-profit organizations: concept

• Receipts and Payments Account: features and preparation.

• Income and Expenditure Account: features, preparation of

income and expenditure account and balance sheet from the given receipts

and payments account with additional information

Scope:

(i) Adjustments in a question should not exceed 3 or 4 in number and

restricted to subscriptions, consumption of consumables and sale of assets/ old

material.

(ii) Entrance/admission fees and general donations areto be treated as

revenue receipts.

(iii) Trading Account of incidental activities is not to beprepared.

Unit 2: Accounting for Partnership Firms

Partnership: features, Partnership Deed

•Provisions of the Indian Partnership Act 1932 in the absence of partnership

deed.

•Fixed v/s fluctuating capital accounts.

Preparation of Profit and Loss Appropriation account- division

of profit among partners, guarantee of profits

• Past adjustments (relating to interest on capital, interest on drawing, salary

and profit sharing ratio)

• Goodwill: nature, factors affecting and methods of valuation - average

profit, super profit and capitalization

Note: Interest on partner's loan is to be treated as a charge against profits.

Goodwill to be adjusted through partners capital/current account or by raising

and writing off goodwill (AS 26)

YUVA-2.22 more Joyful Learning

Accounting for Partnership firms - Reconstitution and Dissolution.

• Change in the Profit Sharing Ratio among the existing partners -

sacrificing ratio, gaining ratio, accounting for revaluation of assets and

reassessment of liabilities and treatment of reserves and accumulated profits.

Preparation of revaluation account and balance sheet

Admission of a partner - effect of admission of a partner on change in the

profit sharing ratio, treatment of goodwill (as per AS 26), treatment for

revaluation of assets and re- assessment of liabilities, treatment of reserves

and accumulated profits, adjustment of capital accounts and preparation of

balance sheet.

• Retirement and death of a partner: effect of retirement / death of a partner

on change in profit sharing ratio, treatment of goodwill (as per AS 26),

treatment for revaluation of assets and reassessment of liabilities, adjustment

of accumulated profits and reserves, adjustment of capital accounts and

preparation of balance sheet. Preparation of loan account of the retiring

partner.

Calculation of deceased partner’s share of profit till the date of death.

Preparation of deceased partner’s capital account and his executor’s account.

YUVA-3.1 Attitude is Everything!

Dissolution of a partnership firm: meaning of dissolution of partnership and

partnership firm, types of dissolution of a firm. Settlement of accounts - preparation

of realization account and other related accounts: capital accounts of partners and

cash/bank a/c (excluding piecemeal distribution, sale to a company and insolvency

of partner(s)).

Note:

(i) The realized value of each asset must be given at the time of dissolution.

(ii) In case, the realization expenses are borne by a partner, clear indication should

be given regarding the payment thereof.

Unit-3 Accounting for Companies

Accounting for Share Capital

Share and share capital: nature and types.

YUVA-3.3 My Principles are my Strength!

• Accounting for share capital: issue and allotment of equity and preferences

shares. Public subscription of shares- over subscription and under subscription of

shares; Issue at par and at premium, calls in advance and arrears (excluding

interest), issue of shares for consideration other than cash.

Concept of Private Placement and Employee Stock Option Plan (ESOP)

Accounting treatment of forfeiture and re-issue of shares.

Disclosure of share capital in the Balance Sheet of a company.

YUVA-3.5 Meditation and Pre-Examination Stress

Mid Term Examinations

II TERM CONTENTS

October Accounting for Debentures

2019 Debentures: Issue of debentures at par, at a premium and at a discount, issue

to of debentures for consideration other than cash; Issue of debentures with terms of

February redemption; debentures as collateral security-concept, interest on debentures.

2020 Writing off discount / loss on issue of debentures.

Note: discount or loss on issue of debentures to be written off in the year

debentures are allotted from security premium reserve (if it exists and then

from statement of profit and loss as financial cost (AS 16)

• Redemption of debentures-Method: Lump sum, draw of lots.

Creation of Debenture Redemption Reserve

Note: Related sections of the Companies Act, 2013 will apply.

Part B: Financial Statement Analysis

Unit 4: Analysis of Financial Statements

Financial Statements of a Company: statement of Profit and Loss and Balance

Sheet in prescribed form with major headings and sub headings (as per

Schedule III to the Companies Act, 2013).

Note: Exceptional items, extraordinary items and profit(loss) from discontinued

operations are excluded

Financial Statement Analysis: Objectives, importance and limitations

Tools for Financial Statement Analysis:

Comparative statements, common size statements, cash flow analysis, ratio analysis.

Accounting Ratios: Meaning, Objectives classification and computation.

Liquidity Ratios: Current ratio and Quick ratio.

Solvency Ratios: Debt to Equity Ratio, Total Asset to Debt Ratio, Proprietary Ratio

and Interest Coverage Ratio.

Activity Ratios: Inventory Turnover Ratio, Trade Receivables Turnover Ratio,

Trade Payables Turnover Ratio and Working Capital Turnover Ratio

Profitability Ratios: Gross Profit Ratio, Operating Ratio, Operating Profit Ratio,

Net Profit Ratio and Return on Investment.

Note: Net Profit Ratio is to be calculated on the basis profit before and after

tax.

YUVA-.3 Chase your Dreams

Unit 5: Cash Flow Statement

Meaning, objectives and preparation (as per AS 3 (Revised) (Indirect Method

only)

Note:

(i) Adjustments relating to depreciation and amortization, profit or loss

on sale of assets including investments, dividend (both final and

interim) and tax

(ii) Bank overdraft and cash credit to be treated as short term borrowings.

(iii) Current Investments to be taken as Marketable securities unless

otherwise specified.

Note: Previous years’ Proposed Dividend to be given effect, as prescribed in

AS-4, Events occurring after the Balance Sheet date. Current years’

Proposed Dividend will be accounted for in the next year after it is declared

by the shareholders.

Part C: Project Work

Note: Kindly refer to the Guidelines published by the CBSE.

YUVA-12.6 The Power of effective Communication

Project Work and Revision for Mock Test (with the support material available) and

solution of mock test paper in classroom

YUVA-12.9 Let Everyonelive!

Revision for Pre-Board Examination (with the support material available) and

solution of pre-board exam paper in class room

YUVA-12.12 Facing and managing changes

Revision for CBSE Annual Examination

YUVA-12.5 I can improve my performance in the coming Board Exam

NOTE: SYLLABUS SHOULD BE COMPLETED BY NOVEMBER 2019.

Annual Examination

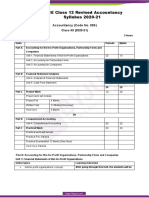

Accountancy (Code No. 055)

Class-XII (2019-20)

Theory: 80 Marks Duration: 3 Hours

Project: 20 Marks

Units Periods Marks

Part A Accounting for Not-for-Profit Organizations, Partnership

Firms and Companies

Unit 1. Financial Statements of Not-for-Profit Organizations 25 10

Unit 2. Accounting for Partnership Firms 90 30

Unit 3. Accounting for Companies 35 20

150 60

Part B Financial Statement Analysis

Unit 4. Analysis of Financial Statements 30 12

Unit 5. Cash Flow Statement 20 8

50 20

Part C Project Work 20 20

Project work will include:

Project File 4 Marks

Written Test 12 Marks (One Hour)

Viva Voce 4 Marks

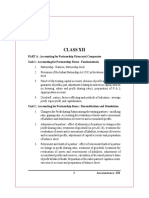

Suggested Question PaperDesign

Accountancy (Code No. 055)

Class XII(2019-20)

Theory: 80 Marks Duration: 3hrs.

Project: 20 Marks

S Objective Short Short Long Long

No. Typology of Questions Type/ MCQ Answer I Answer II Answer I Answer II Marks

1 Mark 3 Marks 4 Marks 6 Marks 8 Marks

1 Remembering: Exhibit memory 5 1 1 1 - 18

of previously learned material by

recalling facts, terms, basic

concepts, and answers.

2 Understanding: Demonstrate 5 1 1 1 1 26

understanding of facts and ideas

by organizing, comparing,

translating, interpreting, giving

descriptions, and statingmain

ideas

3 Applying: Solve problems to 5 - 2 1 - 19

new situations by applying

acquired knowledge, facts,

techniques and

rules in a different way.

4 Analysing and Evaluating: 5 - 1 - 1 17

Examine and break information

into parts by identifying motives

or causes. Make inferences and

find evidence to support

generalizations.

Present and defend opinions by

making judgments about

information, validity of ideas, or

quality of work based on a set of

criteria.

Creating: Compile information

together in a different way by

combining elements in a new

pattern or proposing alternative

solutions.

TOTAL 20x1=20 2x3=6 5x4=20 3x6=18 2x8=16 80 (32)

There will be internal choice in questions of 3 marks, 4 marks, 6 marks and 8 marks. All

questions carrying 8 marks will have an internal choice.

Potrebbero piacerti anche

- 12 Accountancy Eng 2023 24Documento5 pagine12 Accountancy Eng 2023 24Gaurav KumarNessuna valutazione finora

- Cbse Class 12 Accountancy SyllabusDocumento8 pagineCbse Class 12 Accountancy SyllabusKunj PatelNessuna valutazione finora

- Cbse Accountancy - SrSec - 2022-23Documento8 pagineCbse Accountancy - SrSec - 2022-23Sneha DubeNessuna valutazione finora

- All Subject Syllabus Class 12 CBSE 2020-21Documento51 pagineAll Subject Syllabus Class 12 CBSE 2020-21Bear BraceNessuna valutazione finora

- CBSE Class 12 Accountancy SyllabusDocumento6 pagineCBSE Class 12 Accountancy Syllabusrkmobile58627Nessuna valutazione finora

- 12 Revised Accountancy 21Documento10 pagine12 Revised Accountancy 21sarvodayaeducationalgroupNessuna valutazione finora

- ACCOUNTANCY (Code No. 055) : RationaleDocumento10 pagineACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNessuna valutazione finora

- CBSE 2015 Syllabus 12 Accountancy NewDocumento5 pagineCBSE 2015 Syllabus 12 Accountancy NewAdil AliNessuna valutazione finora

- Grade 12 AccountancyDocumento8 pagineGrade 12 AccountancyPeeyush VarshneyNessuna valutazione finora

- Accountancy (Code No. 055) : Class-XII (2019-20)Documento6 pagineAccountancy (Code No. 055) : Class-XII (2019-20)naveenaNessuna valutazione finora

- Must Do Content Accountancy Class XiiDocumento46 pagineMust Do Content Accountancy Class XiiHigi SNessuna valutazione finora

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Documento8 pagineCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNessuna valutazione finora

- Cbse Accountancy Class XIi Sample Paper PDFDocumento27 pagineCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- CBSE Class 12 Accountancy Syllabus 2022 23Documento8 pagineCBSE Class 12 Accountancy Syllabus 2022 23SanakhanNessuna valutazione finora

- Accountancy (Code No. 055) Class-XII (2018-19)Documento7 pagineAccountancy (Code No. 055) Class-XII (2018-19)saurabhNessuna valutazione finora

- 2022 23 Accountancy 12-MinDocumento8 pagine2022 23 Accountancy 12-MinShajila AnvarNessuna valutazione finora

- CBSE Class 12 Accountancy Syllabus 2023 24Documento8 pagineCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424Nessuna valutazione finora

- Cbse Class 12 Syllabus 2019 20 AccountancyDocumento10 pagineCbse Class 12 Syllabus 2019 20 AccountancyDhanbad TalksNessuna valutazione finora

- Prachi CUET-UG AccountancyDocumento22 paginePrachi CUET-UG AccountancySmriti Saxena100% (1)

- Part B: Computerised AccountingDocumento6 paginePart B: Computerised AccountingSonakshi JainNessuna valutazione finora

- 15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionDocumento1 pagina15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionKhushiNessuna valutazione finora

- Xii - 2022-23 - Acc - RaipurDocumento148 pagineXii - 2022-23 - Acc - RaipurNavya100% (1)

- Reduced SyllabusDocumento333 pagineReduced SyllabusRaj Rajeshwer Gupta100% (1)

- 2013 Syllabus 12 AccountancyDocumento4 pagine2013 Syllabus 12 Accountancybhargavareddy007Nessuna valutazione finora

- Accounting 12Documento140 pagineAccounting 12sainimanish170gmailc0% (2)

- Final Question Bank Xii Accoutancy-2022-23Documento206 pagineFinal Question Bank Xii Accoutancy-2022-23Khushi Sharma100% (1)

- Bba Amity AccountsDocumento1 paginaBba Amity AccountsDeepak BatraNessuna valutazione finora

- Cbse Board Accountancy SyllabusDocumento4 pagineCbse Board Accountancy Syllabusapi-139761950Nessuna valutazione finora

- Final Accountancy 12 March 2023Documento5 pagineFinal Accountancy 12 March 2023happilyakshitaNessuna valutazione finora

- ACCOUNTANCYDocumento176 pagineACCOUNTANCYSUDHA GADADNessuna valutazione finora

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocumento380 pagine1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNessuna valutazione finora

- 301 AccountancyDocumento4 pagine301 AccountancyAlkaNessuna valutazione finora

- Accountancy - XII Cbse 2013Documento35 pagineAccountancy - XII Cbse 2013Zeus GhoshNessuna valutazione finora

- Final Chapter 3.pmdDocumento4 pagineFinal Chapter 3.pmdMANISH SINGHNessuna valutazione finora

- Accountancy Ebook - Class 12 - Part 1Documento130 pagineAccountancy Ebook - Class 12 - Part 1JitNessuna valutazione finora

- Accountancy Arihant CBSE TERM 2 Class 12 Question BanksDocumento240 pagineAccountancy Arihant CBSE TERM 2 Class 12 Question BanksAT SPiDY71% (7)

- Accounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)Documento2 pagineAccounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)singhankit257Nessuna valutazione finora

- Accountancy 12 English Main PDFDocumento173 pagineAccountancy 12 English Main PDFAshu SinghNessuna valutazione finora

- Profit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership FirmDocumento10 pagineProfit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership Firmd-fbuser-65596417Nessuna valutazione finora

- H.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyDocumento2 pagineH.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyAnurag DeyNessuna valutazione finora

- C Apre6 Spectrans Module 2 PDFDocumento11 pagineC Apre6 Spectrans Module 2 PDFSittie Ainna Acmed UnteNessuna valutazione finora

- ACCOUNTANCY (Code No. 055)Documento2 pagineACCOUNTANCY (Code No. 055)Ashish GangwalNessuna valutazione finora

- Must Do Content Accountancy Class XiiDocumento45 pagineMust Do Content Accountancy Class XiiPratham Malhotra0% (1)

- Accountancy Second Year Revised Syllabus W.E.F. Session 2023 24Documento5 pagineAccountancy Second Year Revised Syllabus W.E.F. Session 2023 24uttamsonowal084Nessuna valutazione finora

- Accountancy XIIDocumento30 pagineAccountancy XIIrajNessuna valutazione finora

- Paper 5 Revised PDFDocumento576 paginePaper 5 Revised PDFameydoshiNessuna valutazione finora

- 3 Partnership AccountsDocumento93 pagine3 Partnership AccountsCA K D Purkayastha100% (1)

- Paper 5new PDFDocumento600 paginePaper 5new PDFAbhi100% (1)

- Accounting For Partnership - Additional Notes On FormationDocumento26 pagineAccounting For Partnership - Additional Notes On Formation海豚海豚Nessuna valutazione finora

- Higher Secondary Accounts Syllabus NewDocumento10 pagineHigher Secondary Accounts Syllabus NewBIKASH166Nessuna valutazione finora

- CA Ajay Rathi Accounts BookDocumento449 pagineCA Ajay Rathi Accounts BookNkume Irene100% (1)

- 1030120969session 2015-16 Class Xi Accountancy Study Material PDFDocumento189 pagine1030120969session 2015-16 Class Xi Accountancy Study Material PDFharshika chachan100% (1)

- Accountancy First Year Revised Syllabus W.E.F. Session 2023 24Documento3 pagineAccountancy First Year Revised Syllabus W.E.F. Session 2023 24sarsengmesNessuna valutazione finora

- Account Unit3 MbaDocumento27 pagineAccount Unit3 MbaAnantha KrishnaNessuna valutazione finora

- 61809bos50279 cp7 U1Documento61 pagine61809bos50279 cp7 U1Sukhmeet Singh100% (1)

- Corporate-Accounting-bk GoelDocumento3 pagineCorporate-Accounting-bk Goeltanisha kochharNessuna valutazione finora

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- Accountancy Worksheet - 1 (A) TheoryDocumento3 pagineAccountancy Worksheet - 1 (A) TheoryShalu AgarwalNessuna valutazione finora

- Summary of Richard A. Lambert's Financial Literacy for ManagersDa EverandSummary of Richard A. Lambert's Financial Literacy for ManagersNessuna valutazione finora

- Selecting Entry ModeDocumento22 pagineSelecting Entry ModeandiNessuna valutazione finora

- Presentation 08 Mishkin - Econ12eGE - CH07 To TeacherDocumento25 paginePresentation 08 Mishkin - Econ12eGE - CH07 To TeacherKutman PamirovNessuna valutazione finora

- Kuwait Finance House AustDocumento2 pagineKuwait Finance House AustchairunnisanovNessuna valutazione finora

- A Comparative Study On Dividend Policy of Everest A Comparative Study On Dividend Policy of Everest Bank Limited and Bank of KathmanduDocumento103 pagineA Comparative Study On Dividend Policy of Everest A Comparative Study On Dividend Policy of Everest Bank Limited and Bank of KathmanduRaju Rimal77% (22)

- Madam LimDocumento50 pagineMadam LimHendra Budianto100% (1)

- A Presentation On "Blades Inc. Case (Direct Foreign Investment) "Documento10 pagineA Presentation On "Blades Inc. Case (Direct Foreign Investment) "devrajkinjal100% (2)

- Chapter 5 Homework From LectureDocumento13 pagineChapter 5 Homework From Lecturejimmy_chou1314100% (1)

- Analysis of Commodity Market With Respect To Silver and SugarDocumento90 pagineAnalysis of Commodity Market With Respect To Silver and SugarSorabh JainNessuna valutazione finora

- International Portfolio InvestmentsDocumento39 pagineInternational Portfolio InvestmentsAshish SaxenaNessuna valutazione finora

- Christine Guthrie Was Recently Hired by S S Air Inc ToDocumento2 pagineChristine Guthrie Was Recently Hired by S S Air Inc ToAmit PandeyNessuna valutazione finora

- Ch2-3 Cash & Cash Equivalent and Bank Recon TablesDocumento1 paginaCh2-3 Cash & Cash Equivalent and Bank Recon TablesEUNICE NATASHA CABARABAN LIMNessuna valutazione finora

- Bodie Investments 12e SM CH11Documento9 pagineBodie Investments 12e SM CH11elvin andriNessuna valutazione finora

- Term Paper Final - SanjoyDocumento25 pagineTerm Paper Final - SanjoyChoton AminNessuna valutazione finora

- What Is NS 5Tx5T?: Investment Universe, Process & StrategyDocumento2 pagineWhat Is NS 5Tx5T?: Investment Universe, Process & StrategyBina ShahNessuna valutazione finora

- Cash Flow Statement: Projected Income Statement and Balance SheetDocumento14 pagineCash Flow Statement: Projected Income Statement and Balance SheetAagam SakariaNessuna valutazione finora

- Niger Seed OilDocumento16 pagineNiger Seed Oilbig johnNessuna valutazione finora

- Introduction To T24 - Treasury - R10.1Documento34 pagineIntroduction To T24 - Treasury - R10.1Gnana Sambandam50% (2)

- Metallgesellschaft AG: A Case StudyDocumento24 pagineMetallgesellschaft AG: A Case StudyTariq KhanNessuna valutazione finora

- Solar Park BrochureDocumento9 pagineSolar Park BrochurejawadmohsinNessuna valutazione finora

- Tally Ledger ListDocumento7 pagineTally Ledger ListShaluNessuna valutazione finora

- Three Momentum AlgorithhmDocumento70 pagineThree Momentum AlgorithhmShreekanth HebbarNessuna valutazione finora

- Chapter 1Documento37 pagineChapter 1Elma UmmatiNessuna valutazione finora

- Capital BudgetingDocumento64 pagineCapital BudgetingNiaz AhmedNessuna valutazione finora

- Stock Cheat SheetDocumento6 pagineStock Cheat SheetalishaNessuna valutazione finora

- BBFH202Documento196 pagineBBFH202Tawanda Tatenda Herbert100% (1)

- Bus - Valuation - StudentDocumento5 pagineBus - Valuation - StudentMilan TilvaNessuna valutazione finora

- Daniel Turner, A Reckless Big ScammerDocumento8 pagineDaniel Turner, A Reckless Big ScammerTrollbitNessuna valutazione finora

- Bourse Stock ExchangeDocumento20 pagineBourse Stock ExchangeSiva IddipilliNessuna valutazione finora