Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Question

Caricato da

Haziq ZulkeflyCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Question

Caricato da

Haziq ZulkeflyCopyright:

Formati disponibili

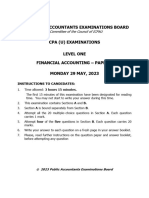

Assignment 2:

Answer all the questions and show your detailed workings clearly and systematically.

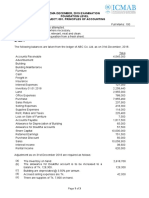

Absolute Berhad prepared the following unadjusted trial balance on 31 December 2018

for its first year of operation:

Accounts Debit (RM) Credit (RM)

Cash 31,050

Accounts receivable 202,500

Supplies 48,600

Motor vehicles 1,023,300

Account payable 47,250

Unearned revenue 54,000

Capital 702,000

Drawings 40,500

Revenue 1,221,750

Salary expense 283,500

Petrol expense 24,300

Rent expense 72,000

Insurance expense 144,000

Utilities expense 155,250

Total 2,025,000 2,025,000

An analysis of the accounts shows the following:

(i) Supplies in hand on 31 December were RM10,800.

(ii) Depreciation on motor vehicles was estimated to be RM36,900.

(iii) Unbilled revenue on 31 December was RM15,975.

(iv) The amount of unearned revenue in the above balance represents all the advanced

payments received from customers during the year for booking services. Sixty

percent of the services have been provided by the end of the year.

(v) Unpaid bills on utilities on 31 December amounted to RM5,400.

Required:

a) Prepare the adjusting entries for the above transactions at 31 December 2018.

(10)

b) Prepare the adjusted trial balance as at 31 December 2018 for Absolute Berhad as at

31 December 2018.

(10)

c) From the adjusted trial balance in b), prepare the income statement for the year

ended 31 December 2018 and balance sheet as at 31 December 2018.

(20)

[Total: 40 marks]

Potrebbero piacerti anche

- 44652Documento5 pagine44652ايه ساراNessuna valutazione finora

- Minicases 5Documento3 pagineMinicases 5dini sofiaNessuna valutazione finora

- Tutorial 5 QuestionsDocumento4 pagineTutorial 5 QuestionsChigoziem OnyekawaNessuna valutazione finora

- Bac 2211 Cat&assignment Sep 2023Documento5 pagineBac 2211 Cat&assignment Sep 2023toniruii98Nessuna valutazione finora

- Bbfa1103 Assigment Question 2023Documento13 pagineBbfa1103 Assigment Question 2023Bdq ArrogantNessuna valutazione finora

- Ias 1 - Questions..Documento8 pagineIas 1 - Questions..Timothy KawumaNessuna valutazione finora

- MC 5 Cash-1Documento4 pagineMC 5 Cash-1lim qsNessuna valutazione finora

- ETFR-BM-21 sec-EFDocumento4 pagineETFR-BM-21 sec-EFSourabh KumarNessuna valutazione finora

- Use The Following Information For The Next Two (2) QuestionsDocumento37 pagineUse The Following Information For The Next Two (2) QuestionsAbdulmajed Unda Mimbantas50% (4)

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocumento14 pagineUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNessuna valutazione finora

- Assignment QuestionDocumento13 pagineAssignment QuestionShalini DeviNessuna valutazione finora

- Week 3 NotesDocumento8 pagineWeek 3 NotescalebNessuna valutazione finora

- Assignment/ TugasanDocumento9 pagineAssignment/ TugasanmelNessuna valutazione finora

- Abfa1513 220518Documento6 pagineAbfa1513 220518CRYSTAL NGNessuna valutazione finora

- HPS 2202HBC 2204 Financial Accounting Ii Introduction To Accounting IiDocumento4 pagineHPS 2202HBC 2204 Financial Accounting Ii Introduction To Accounting IiFRANCISCA AKOTHNessuna valutazione finora

- 301 AFA II PL III Question CMA June 2021 Exam.Documento4 pagine301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNessuna valutazione finora

- Extra Questions - A LevelDocumento8 pagineExtra Questions - A LevelMUSTHARI KHANNessuna valutazione finora

- MAN1068 Exam Paper 2021-22Documento16 pagineMAN1068 Exam Paper 2021-22Praveena RavishankerNessuna valutazione finora

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocumento4 pagineAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationUsama RajaNessuna valutazione finora

- B7AF102 2021 OMD1 First Sitting Exam PaperDocumento10 pagineB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)Nessuna valutazione finora

- ACC 281 SEMINAR QUESTIONS Version 2Documento8 pagineACC 281 SEMINAR QUESTIONS Version 2Joel SimonNessuna valutazione finora

- Midterm - Far2 - AmendedDocumento2 pagineMidterm - Far2 - AmendedmellNessuna valutazione finora

- 73507bos59335 Inter p1qDocumento7 pagine73507bos59335 Inter p1qRaish QURESHINessuna valutazione finora

- 2accounting Questions Nov Dec 2019 CL PDFDocumento3 pagine2accounting Questions Nov Dec 2019 CL PDFRazib Das RaazNessuna valutazione finora

- Cambridge International AS & A Level: ACCOUNTING 9706/31Documento4 pagineCambridge International AS & A Level: ACCOUNTING 9706/31caiexpertcontactNessuna valutazione finora

- (EN) Problem Mojakoe AK1Documento11 pagine(EN) Problem Mojakoe AK1gebbyNessuna valutazione finora

- 2019-12 ICMAB FL 001 PAC Year Question December 2019Documento3 pagine2019-12 ICMAB FL 001 PAC Year Question December 2019Mohammad ShahidNessuna valutazione finora

- A221 MC 5 - StudentDocumento6 pagineA221 MC 5 - StudentNajihah RazakNessuna valutazione finora

- Soalan Tugasan Perakaunan BBAW2103Documento9 pagineSoalan Tugasan Perakaunan BBAW2103Ina RawaNessuna valutazione finora

- Accountancy & Auditing-IDocumento4 pagineAccountancy & Auditing-Izaman virkNessuna valutazione finora

- A222 Tutorial 2QDocumento5 pagineA222 Tutorial 2Qchong huisinNessuna valutazione finora

- BBF 313 Financial Reporting, Analysis and Planning: Code of The Name of The Module Date of Exam Time of Exam SetDocumento4 pagineBBF 313 Financial Reporting, Analysis and Planning: Code of The Name of The Module Date of Exam Time of Exam Setkp107416Nessuna valutazione finora

- MTP 3 14 Questions 1680520270Documento7 pagineMTP 3 14 Questions 1680520270Umar MalikNessuna valutazione finora

- Tutorials Topic 7Documento9 pagineTutorials Topic 7haniNessuna valutazione finora

- Accountancy Auditing 2020Documento6 pagineAccountancy Auditing 2020Abdul basitNessuna valutazione finora

- Problem Set 3 Financial Statements BS SE S18Documento8 pagineProblem Set 3 Financial Statements BS SE S18Nust Razi100% (1)

- Financial Accounting BBAW 2103Documento26 pagineFinancial Accounting BBAW 2103VignashNessuna valutazione finora

- QUESTION 6 Financial Reporting May 2021 KOLIDocumento6 pagineQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNessuna valutazione finora

- Acc. For D.M. MQP April 2021Documento4 pagineAcc. For D.M. MQP April 2021Rohith RNessuna valutazione finora

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocumento5 pagineFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNessuna valutazione finora

- Cuac208 Tests and AssignmentsDocumento8 pagineCuac208 Tests and AssignmentsInnocent GwangwaraNessuna valutazione finora

- Tutorial - Financial StatementDocumento18 pagineTutorial - Financial StatementmellNessuna valutazione finora

- B7AF102 Financial Accounting May 2023Documento11 pagineB7AF102 Financial Accounting May 2023gerlaniamelgacoNessuna valutazione finora

- ACCOUNTING P1 GR12 QP JUNE 2023 - EnglishDocumento11 pagineACCOUNTING P1 GR12 QP JUNE 2023 - Englishfanelenzima03Nessuna valutazione finora

- B7AF102 Financial Accounting May 2020Documento9 pagineB7AF102 Financial Accounting May 2020dayahNessuna valutazione finora

- MC 4 - Deferred Tax - A231Documento4 pagineMC 4 - Deferred Tax - A231Patricia TangNessuna valutazione finora

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocumento7 pagineTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNessuna valutazione finora

- MBAP - AF101-Accounting and Finance - 10 Nov 23Documento6 pagineMBAP - AF101-Accounting and Finance - 10 Nov 23aqueelahadam786Nessuna valutazione finora

- Assignment/ TugasanDocumento21 pagineAssignment/ Tugasanhafiz azuanNessuna valutazione finora

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Documento3 pagine2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNessuna valutazione finora

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocumento7 pagineTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNessuna valutazione finora

- 1 2 3 4 5 6 7 8 MergedDocumento78 pagine1 2 3 4 5 6 7 8 MergedKartik GuptaNessuna valutazione finora

- CPA Paper 1 Financial Accounting 2Documento9 pagineCPA Paper 1 Financial Accounting 2philipisingomaNessuna valutazione finora

- University of Mauritius: Faculty of Law and ManagementDocumento11 pagineUniversity of Mauritius: Faculty of Law and ManagementMîñåk Şhïï0% (1)

- Financial Accounting and Reporting: Page 1 of 4Documento4 pagineFinancial Accounting and Reporting: Page 1 of 4ebshuvoNessuna valutazione finora

- Mini Exercise Answer KeyDocumento3 pagineMini Exercise Answer KeyKaren TumabiniNessuna valutazione finora

- Fragment M 11Documento7 pagineFragment M 11sm munNessuna valutazione finora

- April AssignmentDocumento9 pagineApril AssignmentMehrunisaChNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- BIMSTEC Trade Facilitation Strategic Framework 2030Da EverandBIMSTEC Trade Facilitation Strategic Framework 2030Nessuna valutazione finora

- BBEK4203 Principles of Macroeconomics CDocumento269 pagineBBEK4203 Principles of Macroeconomics CHaziq Zulkefly100% (1)

- Tarikh-Tarikh Penting Sem September 2019Documento1 paginaTarikh-Tarikh Penting Sem September 2019Haziq ZulkeflyNessuna valutazione finora

- Assignment/ Tugasan - BBAW2103 Financial Accounting Perakaunan Kewangan May Semester 2019Documento1 paginaAssignment/ Tugasan - BBAW2103 Financial Accounting Perakaunan Kewangan May Semester 2019Haziq ZulkeflyNessuna valutazione finora

- Sept Registration FormDocumento3 pagineSept Registration FormHaziq ZulkeflyNessuna valutazione finora

- Oumm3203 EtikaDocumento5 pagineOumm3203 EtikaHaziq Zulkefly100% (1)

- BBPM2203 Bi PDFDocumento236 pagineBBPM2203 Bi PDFHaziq ZulkeflyNessuna valutazione finora

- Cover PageDocumento1 paginaCover PageHaziq ZulkeflyNessuna valutazione finora

- CBCT2203 Basic Concepts of IT Chapter 1 - 5Documento119 pagineCBCT2203 Basic Concepts of IT Chapter 1 - 5Haziq ZulkeflyNessuna valutazione finora

- CBCT2203 Basic Concepts of IT Chapter 1 - 5Documento119 pagineCBCT2203 Basic Concepts of IT Chapter 1 - 5Haziq ZulkeflyNessuna valutazione finora

- QuestionDocumento4 pagineQuestionHaziq ZulkeflyNessuna valutazione finora

- CBCT2203 Basic Concepts of IT Chapter 6 - 10Documento115 pagineCBCT2203 Basic Concepts of IT Chapter 6 - 10Haziq ZulkeflyNessuna valutazione finora

- QuestionDocumento2 pagineQuestionHaziq Zulkefly100% (1)

- Tugasan OUMH1303 English For Oral Communication May 2019 SemesterDocumento4 pagineTugasan OUMH1303 English For Oral Communication May 2019 SemesterHaziq ZulkeflyNessuna valutazione finora

- QuestionDocumento2 pagineQuestionHaziq Zulkefly100% (1)

- QuestionDocumento2 pagineQuestionHaziq Zulkefly100% (1)

- QuestionDocumento2 pagineQuestionHaziq Zulkefly100% (1)

- QuestionDocumento2 pagineQuestionHaziq Zulkefly100% (1)

- MorningOPDRoster PDFDocumento3 pagineMorningOPDRoster PDFMahesh ThapaliyaNessuna valutazione finora

- Consent Form - Jan 2022Documento2 pagineConsent Form - Jan 2022Akmal HaziqNessuna valutazione finora

- ENTREPRENEURSHIP QuizDocumento2 pagineENTREPRENEURSHIP QuizLeona Alicpala100% (2)

- OPEN For Business Magazine June/July 2017Documento24 pagineOPEN For Business Magazine June/July 2017Eugene Area Chamber of Commerce CommunicationsNessuna valutazione finora

- Environmental Politics Research Paper TopicsDocumento7 pagineEnvironmental Politics Research Paper Topicszeiqxsbnd100% (1)

- Laws of Tanzania Chapter The LawsDocumento9 pagineLaws of Tanzania Chapter The LawsSTEVEN TULA100% (7)

- DR Sebit Mustafa, PHDDocumento9 pagineDR Sebit Mustafa, PHDSebit MustafaNessuna valutazione finora

- Lebogang Mononyane CV 2023Documento3 pagineLebogang Mononyane CV 2023Mono MollyNessuna valutazione finora

- No Child Left Behind - A Neoliberal Repackaging of Social DarwinismDocumento18 pagineNo Child Left Behind - A Neoliberal Repackaging of Social DarwinismDomagoj Mihaljević100% (1)

- X7 User Manual With ConnectionDocumento15 pagineX7 User Manual With Connectionanup nathNessuna valutazione finora

- Wohnt Der Teufel in Haus 2 ? Amigo Affäre V Sicherheeeit ! Der Mecksit Vor Gericht Und Auf Hoher See..Documento30 pagineWohnt Der Teufel in Haus 2 ? Amigo Affäre V Sicherheeeit ! Der Mecksit Vor Gericht Und Auf Hoher See..Simon Graf von BrühlNessuna valutazione finora

- Laffitte 2nd Retrial Motion DeniedDocumento6 pagineLaffitte 2nd Retrial Motion DeniedJoseph Erickson100% (1)

- Chinese Dipping SauceDocumento11 pagineChinese Dipping Sauceb.dutta100% (1)

- Cadet Basic Training Guide (1998)Documento25 pagineCadet Basic Training Guide (1998)CAP History LibraryNessuna valutazione finora

- Sales Agency and Credit Transactions 1Documento144 pagineSales Agency and Credit Transactions 1Shaneen AdorableNessuna valutazione finora

- MD - IMO - 269 - EU of ACS2 Sys. Cont.Documento1 paginaMD - IMO - 269 - EU of ACS2 Sys. Cont.remakermaritime.cgpNessuna valutazione finora

- Mita Lifestyle Agenda ContentDocumento263 pagineMita Lifestyle Agenda Contentnacentral13517Nessuna valutazione finora

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocumento2 pagineCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNessuna valutazione finora

- StarBucks (Case 7)Documento5 pagineStarBucks (Case 7)Александар СимовNessuna valutazione finora

- Arthur N. J. M. Cools, Thomas K. M. Crombez, Johan M. J. Taels - The Locus of Tragedy (Studies in Contemporary Phenomenology) (2008)Documento357 pagineArthur N. J. M. Cools, Thomas K. M. Crombez, Johan M. J. Taels - The Locus of Tragedy (Studies in Contemporary Phenomenology) (2008)Awan_123Nessuna valutazione finora

- Q3 2023 Investor Conference Call DetailsDocumento2 pagineQ3 2023 Investor Conference Call DetailsDionnelle VillalobosNessuna valutazione finora

- Data-Modelling-Exam by NaikDocumento20 pagineData-Modelling-Exam by NaikManjunatha Sai UppuNessuna valutazione finora

- Food Court ProposalDocumento3 pagineFood Court ProposalJoey CerenoNessuna valutazione finora

- Group Session-Week 2 - Aldi Case StudyDocumento8 pagineGroup Session-Week 2 - Aldi Case StudyJay DMNessuna valutazione finora

- Dalisay vs. SSS - Action To Quiet Title - Dacion en PagoDocumento28 pagineDalisay vs. SSS - Action To Quiet Title - Dacion en PagohlcameroNessuna valutazione finora

- Abm 12 Marketing q1 Clas2 Relationship Marketing v1 - Rhea Ann NavillaDocumento13 pagineAbm 12 Marketing q1 Clas2 Relationship Marketing v1 - Rhea Ann NavillaKim Yessamin MadarcosNessuna valutazione finora

- Financial Accounting Harrison 10th Edition Test BankDocumento24 pagineFinancial Accounting Harrison 10th Edition Test BankNicoleHallrktc100% (46)

- Anil ShuklaDocumento3 pagineAnil ShuklaPratibha ChopraNessuna valutazione finora

- Chinese Erotic Art by Michel BeurdeleyDocumento236 pagineChinese Erotic Art by Michel BeurdeleyKina Suki100% (1)

- JHCSC Dimataling - Offsite Class 2 Semester 2021 Summative TestDocumento1 paginaJHCSC Dimataling - Offsite Class 2 Semester 2021 Summative TestReynold TanlangitNessuna valutazione finora