Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Symptoms of A Poor Operating Model PDF

Caricato da

ميلاد نوروزي رهبرTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Symptoms of A Poor Operating Model PDF

Caricato da

ميلاد نوروزي رهبرCopyright:

Formati disponibili

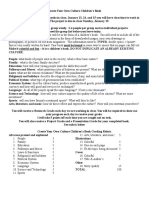

Symptoms of a Poor Operating Model

An Operating Model workshop took place at OEE Consulting’s Future of Service Conference

November 2015. The attendees were asked “How can you tell that your Operating Model design

needs fixing?” The delegates combined responses were collated into Table 1.

Table 1: Symptoms of a poor operating model

Element Potential indicator

Customer • Persistent difficulty in meeting contractual requirements

experience • Low customer loyalty due to high customer effort

• Customer dissatisfaction with service aspect, e.g. channel options

• Significant percentage of service demand hard to fulfil because operating model

does not align

• Team (and customers) do not understand proposition

Journey and • Excess process complexity and numbers of processes

Process • Large unpredictable backlogs due to incorrect process categorisation

• Persistent customer complaints / regulator issues – lack of control

• Persistent / increasing failure demand and costs

• Gap between proposition and real demand (voice of the customer) or in legal

requirements

Locations, • Long lead and response times due to excess hand-offs and ‘bounce backs’

functions and • Slow, ineffective, end to end collaboration and improvement

teams • Teams have insufficient view of big picture and end to end customer journey

• Excessive costs for simple services and/or insufficient empathy and expertise for

high discretion services

Technology • Technology drives high error rates and cost of ‘work arounds’, exceptions, and

and duplications

Infrastructure • Lack of work visibility, cost of multiple systems, fragility

• Stalled innovation and inability to adapt to changing needs

• System fragility and high cost / transaction

People, • Organisational conflict – low trust, loyalty and advocacy

culture and • Blame culture – lack of transparency, accountability and understanding

organisation • Slow decision making

• Insufficient skills – inability develop and train in right areas fast enough

• High staff turnover / absence rates – particularly managers

• Incentives drive wrong behaviours. Integrity issues

• Persistent communication failures. Low staff engagement and morale

Management • Inability to measure, forecast and match capacity to demand

Framework • Significant swings between over / under capacity

• Measures are all green but customers are unhappy

• Costly and ineffective improvement, risk and change management

Attendees

Spicerhaart, UKAR, FCA, Continua, Tesco Bank, RBS, Lloyds Banking Group, Imperial College, Aberdeen Asset

Management, NFU Mutual, Old Mutual International Limited, Allied Healthcare, NHS Property Services,

KnightAM Limited, OM Wealth, Mencap, Lloyds Banking Group, Compass Group, Plymouth University, Royal

Air Force, HP, ABN Amro, UKAR, VKD, Visa.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Philosophy of LawDocumento8 paginePhilosophy of LawEm Asiddao-DeonaNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Growth Handbook For CEOs Henrik Jan Van Der Pol PDFDocumento28 pagineThe Growth Handbook For CEOs Henrik Jan Van Der Pol PDFميلاد نوروزي رهبرNessuna valutazione finora

- Psychoanalytical Impact On O Neill S Long Day S Journey Into NightDocumento2 paginePsychoanalytical Impact On O Neill S Long Day S Journey Into NightKinaz Gul100% (1)

- English Notes For Class 8 and 9 CHPTR 1 To 15Documento76 pagineEnglish Notes For Class 8 and 9 CHPTR 1 To 15Anonymous QbjqmG8cg80% (87)

- Daily Lesson Log Ucsp RevisedDocumento53 pagineDaily Lesson Log Ucsp RevisedAngelica Orbizo83% (6)

- Assertion Inventory For Use in Assessment and ResearchDocumento2 pagineAssertion Inventory For Use in Assessment and ResearchnerissarvnNessuna valutazione finora

- Model Risk Management at Investment Management OrganizationsDocumento9 pagineModel Risk Management at Investment Management Organizationsميلاد نوروزي رهبرNessuna valutazione finora

- DLP in Elements of Short StoryDocumento7 pagineDLP in Elements of Short StoryMc Callueng100% (2)

- Psychopaths Among Us, by Robert HerczDocumento13 paginePsychopaths Among Us, by Robert HerczZiyishi WangNessuna valutazione finora

- Outlier Detection: Techniques and Applications: N. N. R. Ranga Suri Narasimha Murty M G. AthithanDocumento227 pagineOutlier Detection: Techniques and Applications: N. N. R. Ranga Suri Narasimha Murty M G. Athithanميلاد نوروزي رهبرNessuna valutazione finora

- Reference Data Sales & Service Operations & Execution Risk & Compliance Business SupportDocumento1 paginaReference Data Sales & Service Operations & Execution Risk & Compliance Business Supportميلاد نوروزي رهبرNessuna valutazione finora

- Deloitte Digital Era Tom v1 PDFDocumento68 pagineDeloitte Digital Era Tom v1 PDFميلاد نوروزي رهبرNessuna valutazione finora

- Deloitte Digital Era Tom v1 PDFDocumento68 pagineDeloitte Digital Era Tom v1 PDFميلاد نوروزي رهبرNessuna valutazione finora

- Inovasi Pembelajaran Berbasis Tik Di Sekolah 3T Provinsi Papua Dan Papua Barat Melalui Pendampingan Jarak JauhDocumento22 pagineInovasi Pembelajaran Berbasis Tik Di Sekolah 3T Provinsi Papua Dan Papua Barat Melalui Pendampingan Jarak JauhJurnal KwangsanNessuna valutazione finora

- How To Leverage OKR If Your Company Is Not GoogleDocumento7 pagineHow To Leverage OKR If Your Company Is Not Googleميلاد نوروزي رهبرNessuna valutazione finora

- Magic Quadrant For Enterprise Low-Code Application PlatformsDocumento1 paginaMagic Quadrant For Enterprise Low-Code Application Platformsميلاد نوروزي رهبرNessuna valutazione finora

- Card Payment Overview Diagram: Appears OnDocumento1 paginaCard Payment Overview Diagram: Appears Onميلاد نوروزي رهبرNessuna valutazione finora

- Insights On It Risk 2012 08 02 en PDFDocumento20 pagineInsights On It Risk 2012 08 02 en PDFميلاد نوروزي رهبرNessuna valutazione finora

- Deploying Jupyter Notebooks For Students and ResearchersDocumento35 pagineDeploying Jupyter Notebooks For Students and Researchersميلاد نوروزي رهبرNessuna valutazione finora

- Save The Children Job Ad - Project Officer - Skills To Succeed 2Documento2 pagineSave The Children Job Ad - Project Officer - Skills To Succeed 2Jera CaballesNessuna valutazione finora

- Medieval TortureDocumento7 pagineMedieval TortureCarolina ThomasNessuna valutazione finora

- Create Your Own Culture Group ProjectDocumento1 paginaCreate Your Own Culture Group Projectapi-286746886Nessuna valutazione finora

- How To ReadddDocumento5 pagineHow To ReadddDylan GuedesNessuna valutazione finora

- De On Thi Dai Hoc Mon Anh Van Nam 2011 de 6Documento9 pagineDe On Thi Dai Hoc Mon Anh Van Nam 2011 de 6Chi Minh50% (2)

- Utilitarianism: John Stuart MillDocumento13 pagineUtilitarianism: John Stuart MillChiqui CabelaNessuna valutazione finora

- Niversity: Course Outline: Business CommunicationsDocumento2 pagineNiversity: Course Outline: Business CommunicationsKamran SheraziNessuna valutazione finora

- P3 Business Analysis 2015 PDFDocumento7 pagineP3 Business Analysis 2015 PDFDaniel B Boy NkrumahNessuna valutazione finora

- Case Analysis - The Food TerminalDocumento3 pagineCase Analysis - The Food Terminalpramilaojha0% (1)

- GRADES 1 To 12 Daily Lesson Log: Write The LC Code For EachDocumento1 paginaGRADES 1 To 12 Daily Lesson Log: Write The LC Code For EachIrene Tayone GuangcoNessuna valutazione finora

- QUARTER 1 FBS LHT 2 Align One's PECs With Those of A Practitioner EntrepreneurDocumento7 pagineQUARTER 1 FBS LHT 2 Align One's PECs With Those of A Practitioner EntrepreneurLORNA NELLASNessuna valutazione finora

- Categorical Interview Questions W.IDocumento3 pagineCategorical Interview Questions W.ISalcedo, Angel Grace M.Nessuna valutazione finora

- Group 1 BARC CaseDocumento14 pagineGroup 1 BARC CaseAmbrish ChaudharyNessuna valutazione finora

- Essay On EducationDocumento4 pagineEssay On EducationElok SorayaNessuna valutazione finora

- WEEK 1 DLL Math7Documento9 pagineWEEK 1 DLL Math7GLINDA EBAYANessuna valutazione finora

- Attitude & ValuesDocumento35 pagineAttitude & ValuesSarvesh MishraNessuna valutazione finora

- Psychology - Workshop Day 1 Prakhar Ke Pravachan Fundamental of PsychologyDocumento14 paginePsychology - Workshop Day 1 Prakhar Ke Pravachan Fundamental of PsychologyYash DeshmukhNessuna valutazione finora

- Angeles University Foundation: Cea-Csc A.Y. 2018-2019Documento9 pagineAngeles University Foundation: Cea-Csc A.Y. 2018-2019Bhern BhernNessuna valutazione finora

- Title Defense For MastersDocumento15 pagineTitle Defense For MastersDauntless KarenNessuna valutazione finora

- Autism, Impulsivity and Inhibition A Review of The LiteratureDocumento52 pagineAutism, Impulsivity and Inhibition A Review of The Literaturecsepulveda10Nessuna valutazione finora

- Proficiency Testing RequirementsDocumento5 pagineProficiency Testing RequirementssanjaydgNessuna valutazione finora

- Hector Cruz, Matthew Gulley, Carmine Perrelli, George Dunleavy, Louis Poveromo, Nicholas Pechar, and George Mitchell, Individually and on Behalf of All Other Persons Similarly Situated v. Benjamin Ward, Individually and in His Capacity as Commissioner of the New York State Department of Correctional Services, Vito M. Ternullo, Individually and in His Capacity as Director of Matteawan State Hospital, Lawrence Sweeney, Individually and in His Capacity as Chief of Psychiatric Services at Matteawan State Hospital, 558 F.2d 658, 2d Cir. (1977)Documento15 pagineHector Cruz, Matthew Gulley, Carmine Perrelli, George Dunleavy, Louis Poveromo, Nicholas Pechar, and George Mitchell, Individually and on Behalf of All Other Persons Similarly Situated v. Benjamin Ward, Individually and in His Capacity as Commissioner of the New York State Department of Correctional Services, Vito M. Ternullo, Individually and in His Capacity as Director of Matteawan State Hospital, Lawrence Sweeney, Individually and in His Capacity as Chief of Psychiatric Services at Matteawan State Hospital, 558 F.2d 658, 2d Cir. (1977)Scribd Government DocsNessuna valutazione finora