Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Budget Analysis - Service Tax

Caricato da

ChiragTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Budget Analysis - Service Tax

Caricato da

ChiragCopyright:

Formati disponibili

BUDGET ANALYSIS 2016-17

SERVICE TAX

Prepared & Presented by

CA SWAPNIL MUNOT &

TEAM S M MUNOT & ASSOCIATES,

CHARTERED ACCOUNTANTS

Cell : 90212 65137/91569 46463

Mail : munotswapnil@gmail.com

©All Rights Reserved

BUDGET ANALYSIS 2016-17 : CENTRAL EXCISE

CONTENT : Changes in

• Finance Act 1994

• Service Tax Rules 1994

• Exemption Notification

• Reverse Charge Mechanism

• Abatement Provisions

• Point of Taxation Rules

• Miscellaneous Provisions

Prepared By CA Swapnil Munot

Cell : +91 9012 65137/ Email : munotswapnil@gmail.com

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

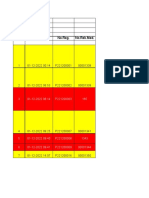

SERVICE TAX RATE:

For the purposes of “Financing and promoting initiatives to improve agriculture”, additional Cess called as “Krishi Kalyan Cess” is to be levied on

all Taxable Services at 0.5% of value of service from 1st June 2016. Therefore Total Service Tax Rate will become 15%. For details, refer below

table:

TYPE OF SERVICE TAX RATE UPTO RATE FROM

31ST MAY 2016 1ST JUNE 2016

BASIC SERVICE TAX 14% 14%

SWACHH BHARAT CESS 0.5% 0.5%

KRISHI KALYAN CESS - 0.5%

TOTAL SERVICE TAX RATE 14.5% 15.0%

NOTE:

In Budget Speech, Honorable Finance Minister Shri Arun Jaitly categorically mentioned that “Input Tax Credit will be available for

payment of Krishi Kalyan Cess”. However required amendment in Cenvat Credit Rules 2004 is not yet made allowing utilization of

credit for payment of Krishi Kalyan Cess. Therefore one has to wait for Notification in this regards, so as to get clarity. But as assured

in budget speech, government will give credit utilization benefit for payment of Krishi Kalyan Cess

BUDGET ANALYSIS 2016-17: FINANCE ACT 1994 (SERVICE TAX PROVISIONS)

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

CHANGES MADE IN CHAPTER V OF FINANCE ACT 1994 ( SERVICE TAX PROVISIONS) BY FINANCE BILL 2016:

(EFECTIVE DATE: Except otherwise provided in this document, Provision of Finance bill 2016 will be applicable from the when President of India

gives ascent to same and Finance Act 2016 is enacted and same is published in official gazette)

TYPE OF

SECTION SUMMARY OF CHANGES ANALYSIS

AMENDMENT

Omitted Sec 66D deals with Negative List of Services i.e. However these services is now covered in

Sec 65B(11), Services which are out of purview of service. Exempted list of Services. ( For details, see

Sec 66D(l), our Analysis on Exempted Service )

Sec 66D(o)(i) Now Below services are removed from Negative List

Sec 66D (p)(ii) Services: Therefore on such services, there will not be

services tax. However in future if government

Services by way of : wish to make such services taxable, then it

can made by just issue of Notification and

a) pre-school education and education up to there will not be requirement of amendment

higher secondary school or equivalent to the Finance Act 1994.

b) Education as a part of a curriculum for

obtaining a qualification recognized by any law

for the time being in force

c) Education as a part of an approved vocational

education course

d) Transportation of passengers, with or without

accompanied belongings, by a stage carriage (

This clause is deleted with effect from

01.06.2015)

e) Transportation of goods by an aircraft from a

place outside India upto the customs station of

clearance in India. ( This clause is deleted with

effect from 01.06.2015)

BUDGET ANALYSIS 2016-17: FINANCE ACT 1994 (SERVICE TAX PROVISIONS)

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

TYPE OF

SECTION SUMMARY OF CHANGES ANALYSIS

AMENDMENT

Sec 66E(j) Clause Inserted Sec 66E deals with declared list of Services. In order to avoid litigation, it is now provided

that “Assignment by the Government of the

Now below service is included in list of declared right to use the radio-frequency spectrum

services: and subsequent transfers thereof” will be

“Assignment by the Government of the right to use the service and service tax will be payable on the

radio-frequency spectrum and subsequent transfers same.

thereof”

Sec 67A(2) Sub Section Sec 67A deals with date of determination of rate of Point of Taxation Rule, 2011 have been

inserted service tax and value. Now below sub section is framed under provisions of Sec 94(2)(a) & Sec

inserted: 94(2)(hhh). Now specific powers is also

obtained under section 67A(2) to make rules

“(2) The time or the point in time with respect to the regarding point in time of rate of service tax.

rate of service tax shall be such as may be prescribed.” Thus, any doubt about the applicability of

service tax Rate or apparent contradiction

between section 67A and POTR would be

taken care of.

Sec 73 Amendment Sec 73 deals with recovery of service tax not levied/not Section 73 is being amended so as to increase

paid/short levied/short paid. the period of limitation from 18 month to 30

month in cases not involving fraud,

In case of ‘No fraud case’, service tax officer can serve suppression of facts, willful mis-statement,

notice for recovery of tax not paid within 18 months. etc.

Now said period of 18 months is amended to 30

months.

Sec 78A Explanation Sec 78A deals with penalty proceeding against Relief to Director/Manager/officer in charge.

added director, manger or other officer who knowing Now no need to pay penalty by said person, if

concerned with offences mentioned in Sec 78A. matter under litigation is concluded.

Now Explanation is added to clarify,

Where any Service tax not levied/not paid/short

levied/short paid/erroneously refunded and

BUDGET ANALYSIS 2016-17: FINANCE ACT 1994 (SERVICE TAX PROVISIONS)

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

TYPE OF

SECTION SUMMARY OF CHANGES ANALYSIS

AMENDMENT

proceeding in respect of such offence is completed (

i.e. issue of SCN & payment of duty), then proceedings

pending under Sec 78A against

director/manager/other officer for said offence shall

also be deemed to have been concluded

Sec 89 Amendment Sec 89 deals with penalty in case of prescribed So now for small amount of Offence which is

offences. It was provided that In case, amount of less than Rs 200 lakhs, there will not be

specified offence exceeds Rs 50 lakhs, then person imprisonment.

who committed offence was liable for Imprisonment

for a term which may extend to 3 years.

Now punishment of Imprisonment will be applicable if

amount of offence is greater than Rs 200 lakhs.

Sec 93A Amendment Sec 93A deals with power to grant rebate of service tax Amendment is made to allow government to

paid on input services for goods/services exported. issue Notification u/s 93A for grant of Rebate

Now it is provided that manner of such rebate will be

specified by notification

BUDGET ANALYSIS 2016-17: FINANCE ACT 1994 (SERVICE TAX PROVISIONS)

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

CHANGES MADE IN SERVICE TAX RULES 1994 BY NOTIFICATION NO 19/2016 ST DATED 1ST March 2016:

All below explained amendment will be applicable from 1st April 2016

TYPE OF

RULE SUMMARY OF CHANGES ANALYSIS

AMENDMENT

Substitution This rule defines the person liable for paying service Now senior advocate has to charge

tax. Below changes are made : service tax on its invoice.

In last fiscal budget (Budget 2015-16),

Rule 1) Earlier it is provided that In case of service of it was provided that is case of services

2(1)(d)(i)(D)(II) Individual Advocate or Firm of advocate to of mutual fund agent/distributor to

Business entity, recipient of service is liable to Mutual Fund/Asset Management

pay service tax. Company, recipient of service will be

However now in case service are provided by liable to pay service tax.

senior advocate to business entity, then such However this amendment is exactly

advocate is supposed to charge and pay service opposite to what was incorporate in

tax to government. last budget.

Consequent to above changes,

Rule 2) Earlier it was provided that in relation to necessary amendment is also made in

2(1)(d)(i)(EEA) service provided by a mutual fund agent or reverse charge Notification No

distributor to a mutual fund or asset 30/2012 through Notification No

management company, the recipient of the 18/2016 ST dt 1.3.16

service is liable to pay service tax

However now it is provided that henceforth

such agent/distributor will charge & pay service

tax to government

Proviso to Proviso It is now provided that, HUF was unnecessarily deprived off

Rule 6(1) Substituted benefit of quarterly payment facility

1) quarterly service tax payment benefit is of service tax till date, unlike

available to: individual or Firm.

BUDGET ANALYSIS 2016-17: SERVICE TAX RULES 1994

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

TYPE OF

RULE SUMMARY OF CHANGES ANALYSIS

AMENDMENT

a) Individual / Proprietary Firm Late but finally HUF is now allowed

b) Partnership Firm quarterly payment facility.

c) HUF However HUF is still required to make

d) One Person Company, whose total taxable service tax payment on accrual basis

value of service in preceding year is less than as per Point of Taxation Rules and not

Rs 50 lakhs. as per cash basis.

Boost to One Person Company (OPC)

Service Tax liability on cash basis ( that is Service Tax concept. Now OPC can also pay

will be payable, when payment for service is received service tax quarterly, provided his

and not on accrual basis) facility is now allowed to: turnover in preceding year is less than

Rs 50 lakhs.

a) Individual / Proprietary Firm Also OPC can pay service tax only after

b) Partnership Firm payment received for services.

c) One Person Company,

whose total taxable value of service in preceding

year is less than Rs 50 lakhs.

Rule 6(7a)(ia) Clause Inserted Insurer carrying on life Insurance Business shall have Service tax liability on single premium annuity

below additional option to pay tax: policies is being rationalized and the effective

alternative service tax rate is being prescribed

“In case of single premium annuity policies other than @ 1.4 % of the total premium charged.

(i) above, 1.4 percent of the single premium charged

from the policy holder”

Rule 7(3A), Sub-rule Inserted Rule 7 provides for service tax returns. Annual Service Tax Return is introduced as

(3B) step towards GST and in line with Excise

Now Annual Service Tax Return is incorporated in Annual Return Requirement.

service tax to be filed before 30th November of the

succeeding financial year. Form of Annual Return Form is yet to be

prescribed

BUDGET ANALYSIS 2016-17: SERVICE TAX RULES 1994

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

TYPE OF

RULE SUMMARY OF CHANGES ANALYSIS

AMENDMENT

Rule 7B(2) Sub-rule Inserted This Rule provides that revised Annual Return can be Revised Return facility is also allowed for

filed within one month from date of submission of Annual Return.

original Annual Return, provided original return is

submitted within due date.

Rule 7C(2) Sub-rule inserted This Rule provides that, if Annual Return is filed after Penalty for delayed filing of Annual Return is

due date, then penalty is payable as under: incorporated in line with ST 3 Return.

a) Rs 100 per day delay in filing of Annual Return

b) Subject to maximum of Rs 20,000/-

BUDGET ANALYSIS 2016-17: SERVICE TAX RULES 1994

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

CHANGES MADE IN EXEMPTED LIST OF SERVICES IS AS UNDER:

(Amendment to Mega Exemption Notification 25/2012 ST is made vide Notification No 9/2016 ST dt 1 st March 2016)

TYPE OF Entry APPLICABLE

PARTICULARS OF SERVICE

CHANGE No. FROM

9B Service provided by the Indian institute of the Management to their students by way of education programs except 1st March 2016

Executive Development Program,

9C Services of assessing bodies empanelled centrally by Directorate General of Training, Ministry of Skill Development 1st April 2016

and Entrepreneurship by way of assessments under Skill Development Initiative (SDI) Scheme.

9D Services provided by training providers (Project implementation agencies) under Deen Dayal Upadhyaya Grameen 1st April 2016

Kaushalya Yojana by way of offering skill or vocational training courses;

12A Services provided to the Government, a local authority or a governmental authority by way of construction, erection, 1st March 2016

commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of –

1) a civil structure or any other original works meant predominantly for use other than for commerce, industry, or

any other business or profession;

NEW

2) a structure meant predominantly for use as (i) an educational, (ii) a clinical, or(iii) an art or cultural establishment;

EXEMPTIONS 3) a residential complex predominantly meant for self-use or the use of their employees or other persons specified

in the Explanation 1 to clause (44) of section 65 B of the said Act;

Under a contract which is entered prior to 01.03.2015 and on which appropriate stamp duty as applicable is paid

prior to such date.

provided that nothing contained in this entry shall apply on or after the 1st April, 2020

(This exemption was withdrawn last year wide Notification No 06/2015 ST dtd 01.03.2015)

13(ba) Services provided by way of construction, erection, commissioning, installation, completion, fitting out, repair, 1st March 2016

& (bb) maintenance, renovation, or alteration of,-

1. (ba) a civil structure or any other original works pertaining to the In-situ rehabilitation of existing slum

dwellers using land as a resource through private participation, only for existing slum dwellers.

BUDGET ANALYSIS 2016-17: SERVICE TAX EXEMPTION

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

TYPE OF Entry APPLICABLE

PARTICULARS OF SERVICE

CHANGE No. FROM

2. (bb) a civil structure or any other original works pertaining to the Beneficiary-led individual house

construction / enhancement.

14(ca) Services by way of construction, erection, etc., of original works pertaining to low cost houses up to a carpet area of 1st March 2016

60 sq.mtr. per house in a housing project approved by the competent authority under the “Affordable housing in

partnership” component of PMAY or any housing scheme of a State Government are being exempted from service

tax.

14A Services by way of construction, erection, commissioning, or installation of original works pertaining to an airport or 1st March 2016

port provided under a contract which had been entered into prior to 1st March, 2015 and on which appropriate

stamp duty, where applicable, had been paid prior to such date:

provided that Ministry of Civil Aviation or the Ministry of Shipping in the Government of India, certifies that the

NEW

contract had been entered into before the 1st March, 2015:

EXEMPTIONS

provided further that nothing contained in this entry shall apply on or after the 1st April, 2020;”

23(bb) Transport of passengers, with or without accompanied belongings, by Stage carriage other than air-conditioned 1st June 2016

stage carriage

26(q) Services of general insurance business provided under “Niramaya‟ Health Insurance Scheme implemented by 1st April 2016

Trust constituted under the provisions of the National Trust for the Welfare of Persons with Autism, Cerebral

Palsy, Mental Retardation and Multiple Disabilities Act, 1999 (44 of 1999).”

26C Services of life insurance business provided by way of annuity. 1st April 2016

49 Services provided by Employees‟ Provident Fund Organization (EPFO) to persons governed under the 1st April 2016

Employees‟ Provident Funds and Miscellaneous Provisions Act, 1952 (19 of 1952);

50 Services provided by Insurance Regulatory and Development Authority of India (IRDA) to insurers under the 1st April 2016

Insurance Regulatory and Development Authority of India Act, 1999 (41 of 1999)

BUDGET ANALYSIS 2016-17: SERVICE TAX EXEMPTION

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

TYPE OF Entry APPLICABLE

PARTICULARS OF SERVICE

CHANGE No. FROM

NEW 51 Services provided by Securities and Exchange Board of India (SEBI) set up under the Securities and Exchange 1st April 2016

EXEMPTIONS Board of India Act, 1992 (15 of 1992) by way of protecting the interests of investors in securities and to promote

the development of, and to regulate, the securities market;

52 Services provided by National Centre for Cold Chain Development under Ministry of Agriculture, Cooperation 1st April 2016

and Farmers Welfare by way of cold chain knowledge dissemination

53 Services by way of transportation of goods by an aircraft from a place outside India upto the customs station of 1st June 2016

clearance in India.

EXEMPTION 23(c) Transport of passengers, with or without accompanied belongings, by ropeway, cable car or aerial tramway; 1st June 2016

WITHDRAWN

6(b) A Partnership firm of advocates or individual advocate other than a senior advocate, by way of legal services to- 1st April 2016

(i) an advocate or partnership firm of advocates providing legal services;

(ii) any person other than a business entity; or

(iii) a business entity with a turnover up to rupees ten lakh in the preceding financial year; or

6(c) A senior advocate by way of legal services to a person other than a person ordinarily carrying out any activity relating 1st April 2016

to industry, commerce or any other business or profession;”;

EXEMPTION 14(a) Services by way of construction, erection, commissioning, or installation of original works pertaining to railway 1st March 2016

excluding monorail and metro

AMENDED

Explanation.-The services by way of construction, erection, commissioning or installation of original works pertaining

to monorail or metro, where contracts were entered into before 1st March, 2016, on which appropriate stamp duty,

was paid, shall remain exempt.”

16 "Services by an artist by way of a performance in folk/classical art forms of (i) music, or (ii) dance, or (iii) theatre, if 1st April 2016

the consideration charged for such performance is not more than one lakh and fifty thousand rupees,

Provided that the exemption shall not apply to service provided by such artist as a brand ambassador"

BUDGET ANALYSIS 2016-17: SERVICE TAX EXEMPTION

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

DEFINITIONS INSERTED/AMEDNED W.R.T EXEMPTION NOTIFICATION:

Approved vocational (i) A course run by an industrial training institute or an industrial training Centre affiliated to the National Applicable from

education course means Council for Vocational Training or State Council for Vocational Training offering courses in designated date when

trades notified under the Apprentices Act, 1961 (52 of 1961); or Finance Bill

(ii) A Modular Employable Skill Course, approved by the National Council of Vocational Training, run by a receive ascent

person registered with the Directorate General of Training, Ministry of Skill Development and of President of

Entrepreneurship India

Educational Institution (i) Pre-school education and education up to higher secondary school or equivalent; Applicable from

means education as a part of a curriculum for obtaining a qualification 4recognized by any law for the time date when

being in force; Finance Bill

(ii) Education as a part of an approved vocational education course;”; receive ascent

of President of

India

Senior Advocate means It has the meaning assigned to it in section 16 of the Advocates Act, 1961 (25 of 1961) 1st April 2016

BUDGET ANALYSIS 2016-17: SERVICE TAX EXEMPTION

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

CHANGES MADE IN REVERSE CHARGE PROVISION ( NOTIFICATION NO 30/2012 ST) BY NOTIFICATION NO 18/2016 ST DT 1ST March

2016

(Below provisions are effective from 1st April 2016)

Service of Mutual Fund Agent/ distributor: Now in case services provided by Mutual Fund Agent / distributor to Mutual Fund or Asset

Management Company, then reverse charge is not applicable. Accordingly such agent/distributor will charge service tax on its invoices

for services provided to Mutual Fund / Asset Management Company.

Services of Lotter Agents:

Provisions upto 31st March 2016 Provisions from 1st April 2016 Analysis

Reverse charge is applicable in case of :- Reverse charge is applicable in case of:- Now reverse charge is applicable

- In relation to lottery in any manner.

Service provided or agreed to be provided Services provided or agreed to be provided by a - Such service is provided by agent to

by a selling or marketing agent of lottery selling or marketing agent of lottery tickets in Lotter distributor/selling agent of

tickets to a lottery distributor or selling relation to a lottery in any manner to a lottery the State Government under the

agent distributor or selling agent of the State provisions of the Lottery

Government under the provisions of the Lottery (Regulations) Act, 1998

(Regulations) Act, 1998 (17 of 1998)

Services of Advocate:

Provisions upto 31st March 2016 Provisions from 1st April 2016 Analysis

Reverse charge is applicable in case of :- Reverse charge is applicable in case of:- Now in case of services of Senior Advocate

to Business entity, reverse charge is not

Service is provided or agreed to be provided Service is provided or agreed to be provided by applicable.

by Individual Advocate or Firm of advocate Firm of advocate or Individual Advocate OTHER

by way of legal services to any business THAN SENIOR ADVOCATE by way of legal

entity located in Taxable Territory. services to any business entity located in Taxable

Territory.

BUDGET ANALYSIS 2016-17: REVERSE CHARGE MECHANISM UNDER SERVICE TAX

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell: +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

CHANGES MADE IN NOTIFICATION NO. 26/2012 ST ( ABATEMENT NOTIFICATION) OF SERVICE TAX BY NOTIFICATION NO 8/2016 DT

1ST MAR 2016 :

(All below provisions are EFFECTIVE FROM 1ST April 2016 unless otherwise provided in this document)

SR. NO IN DESCRIPTION OF TAXABLE ABATED CONDITION

ANALYSIS OF AMENDMENT

NOTIFICATION TAXABLE SERVICE VALUE VALUE

2 Transport of Goods by 30% 70% Earlier credit of Input service was also not

Rail( other than service allowed along with Inputs & Capital Goods.

specified below) However now Cenvat credit of Input

Service is allowed

2A Transport of goods in 40% 60% This is newly inserted entry.

Cenvat Credit of Input &

containers by rail by any

Capital Goods used for

person other than Indian

providing the said service is

Railways not availed

3 30% 70% Earlier credit of Input service was also not

Transport of passengers, allowed along with Inputs & Capital Goods.

with or without However now Cenvat credit of Input

accompanied belongings, Service is allowed

by rail

7 Services of goods 30% 70% Cenvat Credit of Input, Input Earlier this is applicable for “Services of

transport agency in Service & Capital Goods used goods transport agency in relation to

relation to transportation for providing the said service is transportation of goods”. So, all goods

of goods OTHER THAN not availed including household goods were covered.

USED HOUSEHOLD Now same is omitted from this Entry &

GOODS separate entry No 7A is provided for the

same.

7A Services of goods 40% 60% Cenvat Credit of Input, Input This is newly inserted entry.

transport agency in Service & Capital Goods used

relation to transportation for providing the said service is

not availed

BUDGET ANALYSIS 2016-17: SERVICE TAX ABATEMENT

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell: +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

SR. NO IN DESCRIPTION OF TAXABLE ABATED CONDITION

ANALYSIS OF AMENDMENT

NOTIFICATION TAXABLE SERVICE VALUE VALUE

of USED HOUSEHOLD

GOODS

8 Services provided by a 70% 20% Cenvat Credit of Input, Input This is newly inserted entry.

foreman of chit fund in Service & Capital Goods used

relation to chit for providing the said service is (This entry was there earlier. However was

not availed omitted by Notification No 8/2015 ST dt

01.03.2015)

9 Transport of passengers, 40% 60% Cenvat Credit of Input, Input New Clause (c) at Entry No 9 is inserted

with or without Service & Capital Goods used

accompanied belongings, for providing the said service is This new clause is effective from 1st June

by- not availed 2016

a) a contract carriage

other than motor cab.

b) a radio taxi

c) a Stage carrier

10 Transport of goods in a 30% 70% Cenvat Credit of Input & Capital Earlier credit of Input service was also not

vessel Goods used for providing the allowed along with Inputs & Capital Goods.

said service is not availed However now Cenvat credit of Input

Service is allowed

12 Construction of a 30% 70% (i) CENVAT credit on inputs This entry was earlier also in existence,

complex, building, civil used for providing the taxable however it includes categories such case

structure or a part service has not been availed. carpet area less than 2000 sq ft or more

thereof, intended for a (ii) The value of land is included than that etc.

sale to a buyer, wholly or in the amount charged from the

partly except where service receiver. However now these categories are

entire consideration is removed and such taxable service is

received after issuance of charged at 30% of total value.

completion certificate by

the competent authority

BUDGET ANALYSIS 2016-17: SERVICE TAX ABATEMENT

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell: +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

SR. NO IN DESCRIPTION OF TAXABLE ABATED CONDITION

ANALYSIS OF AMENDMENT

NOTIFICATION TAXABLE SERVICE VALUE VALUE

11 Services by a tour (i) CENVAT credit on inputs, CG

operator in relation to,- & input services other than

input services of a tour

(i) a tour, only for the 10% 90% operator, used for providing

purpose of arranging or the taxable service is not

booking accommodation availed.

for any person (ii) The invoice issued indicates

that it is towards the charges

for such accommodation.

(iii) This exemption shall not

Earlier there were three category in Tour

apply in such cases where the

Operator Services for the purpose of

invoice issued by the tour

deriving taxable value.

operator includes only the

service charges for arranging

However category Package Tour is omitted

accommodation but does not

& accordingly definition of package tour is

include cost of such

also deleted.

accommodation.

Now there is exist only two category in

ii) Tours other than (i) 30% 70% (i) CENVAT credit on inputs,

case of service of tour operator.

above capital goods and input services

other than input services of a

tour operator, used for

providing the taxable service is

not availed.

(ii) The invoice issued for this

purpose indicates that it is

inclusive of charges for such a

tour and the amount charged in

the bill is the gross amount

charged for such a tour.

BUDGET ANALYSIS 2016-17: SERVICE TAX ABATEMENT

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell: +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

Explanation No BA in inserted for SERVICES OF RENTING OF MOTOR CAB ( Entry No 9 in Notification No 26/2012), which is

mentioned below:

“For the purposes of exemption at Serial number 9, the amount charged shall be the sum total of the amount charged for the

service including the fair market value of all goods (including fuel) and services supplied by the recipient(s) in or in relation to

the service, whether or not supplied under the same contract or any other contract

Provided that the fair market value of goods and services so supplied may be determined in accordance with the generally

accepted accounting principles.”

BUDGET ANALYSIS 2016-17: SERVICE TAX ABATEMENT

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

CHANGES MADE IN POINT OF TAXATION RULES 2011 (POTR) BY NOTIFICATION NO 10/2016 ST DATED 1ST March 2016:

TYPE OF Applicable

RULE SUMMARY OF CHANGES ANALYSIS

AMENDMENT w.e.f

Opening Amendment Now opening paragraph of POTR is read as under: POTR , 2011 have been framed under provisions 1 st March

Paragraph of Sec 94(2)(a) & Sec 94(2)(hhh), now specific 2016

“In exercise of the powers conferred under sub- powers is also obtained under section 67A to

section (2) of section 67A and clause (a) and clause make rules regarding point in time of rate of

(hhh) of subsection (2) of section 94 of the Finance service tax. Thus, any doubt about the

Act, 1994, the Central Government hereby makes applicability of service tax Rate or apparent

the following rules for the purpose of collection of contradiction between section 67A and POTR

service tax and determination of rate of service tax would be taken care of.

Rule 5(b) Explanation Rule 5 deals with Point of Taxation in case of New 1st March

Inserted service taxed first time. Now In rule 5, after clause 2016

(b), below Explanation is added to bring clarity Rule 5 of POTR applies when a new service is

taxed first time. Although in the case of new

Explanation 1- This rule shall apply mutatis levy, service tax is applicable, however in

mutandis in case of new levy on services. past, doubts have been raised regarding its

applicability in case of new levy. Therefore,

an Explanation is being inserted.

Explanation 2- New levy or tax shall be payable It is provided in Rule 5 that, in two specified

on all the cases other than specified above. situations the service tax is not applicable in

case of new levy.

Now Explanation is inserted stating that,

service tax will be applicable on all cases

except two specified cases given in Rule 5.

BUDGET ANALYSIS 2016-17: POINT OF TAXATION RULES 2011

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

CHANGES MADE IN INTEREST RATE FOR DELAYED PAYMENT OF SERVICE TAX BY NOTIFICATION NO 13/2016 ST & 14/2016 ST

DATED 1ST March 2016:

NOTIFICATION TYPE OF APPLICABLE

SUMMARY OF CHANGES ANALYSIS

NO. AMENDMENT FROM

Notification Amendment Earlier Notification No 12/2014 ST read with Sec Welcome move and great relief to Industry Applicable from the

13/2016 ST 75 of FA 1994, provides service tax Interest rate as Interest rate of 30% was very much high day when Finance

of 18% / 24% & 30% in case of delayed payment Bill 2016 receives

of service tax. the Ascent of

President of India.

However Now, Interest rates on delayed

payment of tax made uniform at 15%

Except in case of service tax collected but not

deposited with the Central Government, in which

case the rate of interest will be 24% from the

date on which the service tax payment became

due.

Notification Amendment Notification No 8/2006 ST read with Sec 73B Welcome move Applicable from the

14/2016 CT provides for Interest in case of amount collected day when Finance

in excess will be 18%. Bill 2016 receives

the Ascent of

President of India.

Now such interest rate is reduced to 15%.

BUDGET ANALYSIS 2016-17: SERVICE TAX INTEREST RATE

Budget Analysis by S M MUNOT & ASSOCIATES CA Swapnil Munot

Cell : +91 90212 65137

CHARTERED ACCOUNTANTS

Mail: munotswapnil@gmail.com

CLARIFICATION BROUGHT IN ‘INFORMATION TECHNOLOGY SOFTWARE’ W.R.T LEVY OF EXCISE DUTY OR SERVICE TAX BY

NOTIIFCATION NO 11/2016 ST DT 1.3.16 & NOTIFICATION NO 11/2016 CE DT 1.3.16

SUMMARY OF ABOVE NOTIFICATION IS EXPLAINED AS UNDER:

CASE (I) In such case, EXCISE DUTY IS APPLICABLE subject to

Service in relation to Information Technology Software condition that:

o which is recorded on media and o Value of package of such media has been determined

o coming under chapter 85 of First Schedule of CETA 1985 under Sec 4A of CEA 1944 for the purpose of payment

and of Excise Duty or Custom Duty in case of imported

o on which it is required to declare Retail Sale Price ( under software media.

Legal Metrology Act, 2009) o Appropriate Duties of Excise/Custom is paid

o Declaration is made by service provider on invoice

( In nutshell, it means, Packaged Software) that No amount in excess of RSP mentioned on media

is recovered.

CASE (II) In such case, SERVICE TAX IS APPLICABLE subject to

Service in relation to Information Technology Software condition that:

o which is recorded on media and o Person liable to pay service tax is registered under

o coming under chapter 85 of First Schedule of CETA 1985 service tax

and o Such person shall make declaration to Principal

o on which it is NOT required to declare Retail Sale Price ( Commissioner or Commissioner or Central Excise in

under Legal Metrology Act, 2009) Annexure I ( Format given in Notification) regarding

value of software recorded in media which is liable to

( In nutshell, it means, Customized Software / Tailor-made Service Tax

Software )

BUDGET ANALYSIS 2016-17: INFORMATION TECHNOLOGY SOFTWARE RECORDED ON MEDIA

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Stomach CancerDocumento19 pagineStomach CancerChristofer MadrigalNessuna valutazione finora

- Bangladesh National Building Code 2012 Part 07 - Construction Practices and SafetyDocumento83 pagineBangladesh National Building Code 2012 Part 07 - Construction Practices and SafetyPranoy Barua100% (3)

- The Magnetic GazeDocumento126 pagineThe Magnetic GazeTomico TTNessuna valutazione finora

- Blessed Are Those Who MournDocumento7 pagineBlessed Are Those Who MournPatrick MabbaguNessuna valutazione finora

- List of Job Specific Safety PPE Used On Site.Documento2 pagineList of Job Specific Safety PPE Used On Site.Aejaz MujawarNessuna valutazione finora

- (2022) Loneliness Is Associated With Maladaptive Schema Modes in Patients With Persistent Depressive DisorderDocumento5 pagine(2022) Loneliness Is Associated With Maladaptive Schema Modes in Patients With Persistent Depressive DisorderJúlio César SouzaNessuna valutazione finora

- Kovach 1987Documento10 pagineKovach 1987Quyen ta thi nhaNessuna valutazione finora

- Sara Salon and SpaDocumento4 pagineSara Salon and Spasania zehraNessuna valutazione finora

- Lappasieugd - 01 12 2022 - 31 12 2022Documento224 pagineLappasieugd - 01 12 2022 - 31 12 2022Sri AriatiNessuna valutazione finora

- Low Back Pain Anatomy of Thoracolumbar SpineDocumento10 pagineLow Back Pain Anatomy of Thoracolumbar SpineMNessuna valutazione finora

- Work Family Conflict Dengan KinerjaDocumento11 pagineWork Family Conflict Dengan KinerjaNinaerizaNessuna valutazione finora

- Manufacturing ProcessDocumento6 pagineManufacturing Processbro nawalibmatNessuna valutazione finora

- Arc Flash ProtectionDocumento11 pagineArc Flash ProtectioncastrojpNessuna valutazione finora

- Understand TSGLI BenefitsDocumento2 pagineUnderstand TSGLI BenefitsJoseph LawerenceNessuna valutazione finora

- 10893259-PIB 背钳弹簧保持架垫片落物事件Documento2 pagine10893259-PIB 背钳弹簧保持架垫片落物事件xlzyydf2015Nessuna valutazione finora

- Communicating Across AgesDocumento35 pagineCommunicating Across AgesConrad TarihoranNessuna valutazione finora

- Piping and Valves Trim MaterialsDocumento2 paginePiping and Valves Trim MaterialsDmitriy RybakovNessuna valutazione finora

- Recent Developments in Carbapenems: ReviewDocumento16 pagineRecent Developments in Carbapenems: ReviewFrancielleNessuna valutazione finora

- English Based On Latest PatternDocumento13 pagineEnglish Based On Latest PatternAtish ToppoNessuna valutazione finora

- Multiple Choice RadioactivityDocumento4 pagineMultiple Choice RadioactivityGodhrawala AliasgerNessuna valutazione finora

- 04 Refrigerated CargoDocumento33 pagine04 Refrigerated Cargosaurabh1906100% (1)

- AquaNereda Brochure 1017 WebDocumento4 pagineAquaNereda Brochure 1017 WebdmnNessuna valutazione finora

- Hedging The Risk of Portfolio by Using Index Option ContractDocumento3 pagineHedging The Risk of Portfolio by Using Index Option ContractAlina MalikNessuna valutazione finora

- The Dukan Diet by Dr. Pierre Dukan - ExcerptDocumento8 pagineThe Dukan Diet by Dr. Pierre Dukan - ExcerptCrown Publishing Group15% (20)

- 360 Joints PDFDocumento9 pagine360 Joints PDFelimz0100% (1)

- Electrical: Mep Project Progress ReportDocumento11 pagineElectrical: Mep Project Progress ReportAvinash GuptaNessuna valutazione finora

- Usos HummusDocumento36 pagineUsos HummusAlisson FernandaNessuna valutazione finora

- Full Test 14 (Key) PDFDocumento4 pagineFull Test 14 (Key) PDFhoang lichNessuna valutazione finora

- Guerra, Germae Joyce - Media JournalDocumento2 pagineGuerra, Germae Joyce - Media JournalGERMAE JOYCE GUERRANessuna valutazione finora

- TLE Pre-Assessment Most & Least Learned SkillsDocumento7 pagineTLE Pre-Assessment Most & Least Learned SkillsRd DavidNessuna valutazione finora