Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ASTM C129 2011 Non Load Bearing Concrete Masonry

Caricato da

Kamille Anne GabaynoCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ASTM C129 2011 Non Load Bearing Concrete Masonry

Caricato da

Kamille Anne GabaynoCopyright:

Formati disponibili

April 30, 2019

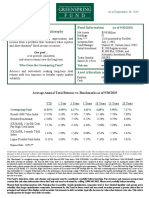

PAMI HORIZON FUND, INC.

FUND FACT SHEET

Historical Performance1 Investment Objective

3 The investment objective is to achieve capital growth and to generate steady income.

FUND 1 MO 1 YR 3 YRS 5 YRS S.I.

Cumulative -1.23% -6.98% 2.36% 2.67% 244.77% The recommended timeframe for the fund is 7 years or more. This fund is suitable for

investors who: have a medium term investment horizon; want a diversified portfolio of

Annualized -6.98% 0.78% 0.53% 6.17%

investment in fixed income and equity securities; and/or are willing to take moderate

YTD 2018 2017 2016 2015 risk for potentially moderate capital return over the medium term.

Calendar Year 1.64% -9.92% 11.60% -1.45% -4.59%

Benchmark2 1 MO 1 YR 3 YRS 5 YRS S.I.3

Cumulative -1.63% -1.95% 11.51% 21.16% 439.07%

Top Five Equity Holdings

Annualized -1.95% 3.70% 3.91% 8.49% SM INVESTMENTS CORP 6.54%

YTD 2018 2017 2016 2015 AYALA LAND INC 5.71%

Calendar Year 3.95% -7.55% 13.88% 0.74% -0.70% SM PRIME HOLDINGS INC 4.42%

1. Returns are net of fees. Past performance is not indicative of future returns. AYALA CORPORATION 4.01%

2. 50% Philippines Composite (Total Return) + 40% Bloomberg Philippine Sovereign Bond Index

AI + 10% Phil 30 Days Savings Rate General Avg (Net of 20% WHT) as of 04/30/2019

BDO UNIBANK INC 3.71%

3. Since Inception (July 1, 1998)

Top Five Fixed Income Holdings

FXTN 2020 3.625% DUE 21MAR2033 6.54%

Key Figures and Statistics PHILIPPINE TBILL 0% 02/10/2019 5.71%

Net Asset Value per Share (NAVPS) 3.6835 GB R25-1 DUE 6.125% 24OCT2037 4.42%

Total Fund Size (in Millions) 806.28 FXTN 2511 4.625% DUE 09SEP40 4.01%

YOY Return as of 04/30/2019 -6.98% FXTN 25-8 8.125% DUE 16DEC2035 3.71%

Benchmark YOY Return as of 04/30/2019 -1.95%

Annualized Volatility 9.78%

Inception Date July 1, 1998

Fund Allocation

Fund Classification Balanced Fund

Risk Profile Moderate

Fixed

Fund Currency Philippine Peso Income,

Equities,

Domicile Philippines 48.8%

51.2%

Min. Initial Investment Php5,000.00

Min. Transaction Php1,000.00

Min. Holding Period Six Months

Redemption Notice Period Three Days

Valuation Method Marked-to-Market

Custodian Bank Citibank N.A.

NAVPS Graph

Transfer Agent Philam Asset Management, Inc. 5

3

4/30/2019

2

0

10/1/98 10/1/01 10/1/04 10/1/07 10/1/10 10/1/13 10/1/16

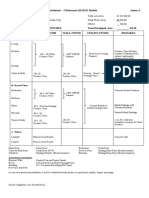

Commentary

Equities

Market should be expected to weaken as we enter May. This is seasonally regarded as a weak month in any calendar year. Also, we have a potential outflow of foreign capital due to MSCI inclusion of China A

share and subsequently, a reduction in Philippine weighting. We also have a mid-term election and we expect a result that will be favorable to markets. We regard this weak period as an opportunity to buy. We

believe that May is an inflection point in the headwinds we have discussed in the months before. The expected weak GDP number of Q1 2019 will be a one-time thing and the weakness, will encourage the BSP

to loosen monetary policy. We continue to expect earnings growth of 8-10% this year and expect a bulk of those earnings to come in 2H 2019. What could be a further dampener for May and beyond is the

recent threat of US President Trump threatened to hike interest tariffs on US$200Bn worth of China imports to 25% if China does not agree to latest demands of US in the trade talks. This sent shockwaves to

global markets particularly the US and Chinese markets. So far, effect to the Philippines is still muted but further escalation to this tension will not spare the Philippine market from any sell down.

Fixed Income

After a sharp rally in March, local bond trading slowed down as average trading volume decreased compared to the previous month. Local bond yields corrected by as much as 30bps as investors locked in gains

from last month, given the lack of direction from BSP on policy rate. Meanwhile, yield curve remained inverted as liquidity crunch kept short-term rates elevated. The short to belly securities increased by an

average of 20bps M/m, while the 10-yr and 20-yr benchmark yields rose 32ps and 27bps M/m, respectively.

Interest rates are inclined to resume its downward trend after a pullback in April. Key data on 1Q19 GDP is forecasted to decelerate at or below 6%, which may steer the BSP to initiate trimming the bank

reserves and/or cut policy rates by .25% to 4.50%

Potrebbero piacerti anche

- Investment Objective Historical Performance: Pami Horizon Fund, IncDocumento1 paginaInvestment Objective Historical Performance: Pami Horizon Fund, IncRamil MontealtoNessuna valutazione finora

- Investment Objective Historical Performance: Philam Fund, IncDocumento1 paginaInvestment Objective Historical Performance: Philam Fund, IncWeas ChuckNessuna valutazione finora

- Ffs Pfi Jun 30 2019Documento1 paginaFfs Pfi Jun 30 2019Ramil MontealtoNessuna valutazione finora

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncDocumento1 paginaFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoNessuna valutazione finora

- Investment Objective NAVPS Graph: Philam Bond Fund, IncDocumento1 paginaInvestment Objective NAVPS Graph: Philam Bond Fund, IncRamil MontealtoNessuna valutazione finora

- I Balanced Fund Apr 23Documento3 pagineI Balanced Fund Apr 23mid_cycloneNessuna valutazione finora

- MP - 3 - Peso Growth FundDocumento2 pagineMP - 3 - Peso Growth FundFrank TaquioNessuna valutazione finora

- Asset Allocation Fund (5) : Hybrid Hybrid BalancedDocumento2 pagineAsset Allocation Fund (5) : Hybrid Hybrid BalancedHayston DezmenNessuna valutazione finora

- Annual Investment Report 2016-17Documento15 pagineAnnual Investment Report 2016-17DARSHANNessuna valutazione finora

- Peso Emperor Fund - Fund Fact Sheet - October - 2020Documento2 paginePeso Emperor Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNessuna valutazione finora

- Peso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Documento3 paginePeso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Jayr LegaspiNessuna valutazione finora

- Peso Emperor Fund - Fund Fact Sheet - December - 2020Documento2 paginePeso Emperor Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNessuna valutazione finora

- AD15 June11Documento2 pagineAD15 June11Alvin LimNessuna valutazione finora

- Fund Fact Sheets NAVPU Captains FundDocumento1 paginaFund Fact Sheets NAVPU Captains FundJohh-RevNessuna valutazione finora

- Conservative at Least Five (5) Years: Account of The ClientDocumento2 pagineConservative at Least Five (5) Years: Account of The ClientkimencinaNessuna valutazione finora

- 9-17-19 TR Presentation (9!16!19 Market Update) - UnlockedDocumento58 pagine9-17-19 TR Presentation (9!16!19 Market Update) - UnlockedZerohedge100% (3)

- ML Participating Fund Letter PDFDocumento4 pagineML Participating Fund Letter PDFFredrick TimotiusNessuna valutazione finora

- Johore Tin (Johotin-Ku) : Average ScoreDocumento11 pagineJohore Tin (Johotin-Ku) : Average ScoreIqbal YusufNessuna valutazione finora

- Hybrid Fund Completes 5 Years NoteDocumento3 pagineHybrid Fund Completes 5 Years NoteMohamed Rajiv AshaNessuna valutazione finora

- ATRAM Phil Equity Smart Index Fund Fact Sheet Jan 2022Documento2 pagineATRAM Phil Equity Smart Index Fund Fact Sheet Jan 2022jvNessuna valutazione finora

- Strategic Bond Fund (59) : Fixed Income Investment GradeDocumento2 pagineStrategic Bond Fund (59) : Fixed Income Investment GradeHayston DezmenNessuna valutazione finora

- Peso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Documento2 paginePeso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNessuna valutazione finora

- Intermediate Term Bond FundDocumento1 paginaIntermediate Term Bond FundYannah HidalgoNessuna valutazione finora

- Greenspring Fund Philosophy Fund Information: (As of 9/30/2019)Documento2 pagineGreenspring Fund Philosophy Fund Information: (As of 9/30/2019)Anonymous TtkcZvPNessuna valutazione finora

- Philequity Peso Bond Fund: Navps As of Dec 27, 2019Documento1 paginaPhilequity Peso Bond Fund: Navps As of Dec 27, 2019Marlon DNessuna valutazione finora

- 2021 DECEMBER Fund-Fact-SheetDocumento41 pagine2021 DECEMBER Fund-Fact-SheetRyan Jacob SolisNessuna valutazione finora

- Singapore Dynamic Bond Fund: Investment ObjectiveDocumento2 pagineSingapore Dynamic Bond Fund: Investment ObjectiveXavier Alexen AseronNessuna valutazione finora

- BF Fund Fact Sheet Sep 2023Documento2 pagineBF Fund Fact Sheet Sep 2023DAR RYLNessuna valutazione finora

- I Income Fund Apr 23Documento3 pagineI Income Fund Apr 23mid_cycloneNessuna valutazione finora

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Documento2 paginePeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNessuna valutazione finora

- Investmentz AugustDocumento11 pagineInvestmentz AugustAnimesh PalNessuna valutazione finora

- Old Mutual Global Macro Equity StrategyDocumento2 pagineOld Mutual Global Macro Equity StrategyTeboho QholoshaNessuna valutazione finora

- Market Highlights PDFDocumento8 pagineMarket Highlights PDFPranati BhattacharjeeNessuna valutazione finora

- ALFM Peso Bond FundDocumento2 pagineALFM Peso Bond FundkimencinaNessuna valutazione finora

- 3-17-2020 Jeffrey Gundlach Total Return Presentation-UnlockedDocumento82 pagine3-17-2020 Jeffrey Gundlach Total Return Presentation-UnlockedZerohedge100% (3)

- Eq Uitf Bpi Gefof Nov 2017Documento4 pagineEq Uitf Bpi Gefof Nov 2017Jelor GallegoNessuna valutazione finora

- Fact Sheet Affin Hwang World Series - China Allocation Opportunity FundDocumento1 paginaFact Sheet Affin Hwang World Series - China Allocation Opportunity FundHenry So E DiarkoNessuna valutazione finora

- Government Money Market I Fund (6) : Fixed Income Stable ValueDocumento2 pagineGovernment Money Market I Fund (6) : Fixed Income Stable ValueiuxhpccxNessuna valutazione finora

- Conf Call TranscriptDocumento28 pagineConf Call Transcriptsandy_caponeNessuna valutazione finora

- India's No.1 Portfolio Management Services PortalDocumento1 paginaIndia's No.1 Portfolio Management Services Portalrahul patelNessuna valutazione finora

- Fund Fact Sheets - Prosperity Bond FundDocumento1 paginaFund Fact Sheets - Prosperity Bond FundJeuz Llorenz Colendra-ApitaNessuna valutazione finora

- AlchemyDocumento8 pagineAlchemyAshwin HasyagarNessuna valutazione finora

- PIALEFDocumento1 paginaPIALEFEileen LauNessuna valutazione finora

- Bpi Us Equity Index Feeder Fund Key Information and Investment Disclosure Statement As of July 31, 2018 Fund FactsDocumento3 pagineBpi Us Equity Index Feeder Fund Key Information and Investment Disclosure Statement As of July 31, 2018 Fund FactsMartin MartelNessuna valutazione finora

- 6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Documento3 pagine6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Nonami AbicoNessuna valutazione finora

- Capital Appreciation - All Equity PortfolioDocumento2 pagineCapital Appreciation - All Equity PortfolioDwi Rizki Anisa PandiaNessuna valutazione finora

- Growth & Guarantee Is Now Reality: Diamond Saving PlanDocumento2 pagineGrowth & Guarantee Is Now Reality: Diamond Saving PlanMaulik PanchmatiaNessuna valutazione finora

- H Strategic BondDocumento2 pagineH Strategic BondDaniel GauciNessuna valutazione finora

- 2q19 Eaof LetterDocumento13 pagine2q19 Eaof LetterDavid BriggsNessuna valutazione finora

- First Metro Save and Learn Fixed Income FundDocumento1 paginaFirst Metro Save and Learn Fixed Income FundkimencinaNessuna valutazione finora

- Gundlach Pres June 2017Documento57 pagineGundlach Pres June 2017Zerohedge100% (6)

- Mitsubishi UFJ Financial Group Inc MUFG (XNYS) : MUFG Also Reports Modest Uptick in Credit Costs in 3Q We Prefer SMFGDocumento14 pagineMitsubishi UFJ Financial Group Inc MUFG (XNYS) : MUFG Also Reports Modest Uptick in Credit Costs in 3Q We Prefer SMFGAnonymous P73cUg73LNessuna valutazione finora

- GreatlinkenhancerfundDocumento2 pagineGreatlinkenhancerfundswifthawkNessuna valutazione finora

- Bdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 BillionDocumento7 pagineBdo Peso Money Market Fund: As A Percentage of Average Daily NAV For The Month Valued at PHP 85.457 Billionk100% (1)

- Shinhan Supreme Balance FundDocumento1 paginaShinhan Supreme Balance FundhhhahaNessuna valutazione finora

- Equity Fund: % Top 10 Holding As On 31st March 2019Documento1 paginaEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNessuna valutazione finora

- 2015 Ci Harbour F ClassDocumento3 pagine2015 Ci Harbour F ClassMarcelo MedeirosNessuna valutazione finora

- Discovery Fund April 23Documento1 paginaDiscovery Fund April 23Satyajeet AnandNessuna valutazione finora

- Spandana Sphoorty Financial Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocumento7 pagineSpandana Sphoorty Financial Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNessuna valutazione finora

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Da EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Nessuna valutazione finora

- Construction: James L. DulaliaDocumento17 pagineConstruction: James L. DulaliaKamille Anne GabaynoNessuna valutazione finora

- 2021 Schedule of Finishes MAPLE ModelDocumento1 pagina2021 Schedule of Finishes MAPLE ModelKamille Anne GabaynoNessuna valutazione finora

- Commercial, STD, FLORO - Water Reading Monitoring REV 05222021Documento39 pagineCommercial, STD, FLORO - Water Reading Monitoring REV 05222021Kamille Anne GabaynoNessuna valutazione finora

- CHB Inventory: 3-Jun-20 WedDocumento4 pagineCHB Inventory: 3-Jun-20 WedKamille Anne GabaynoNessuna valutazione finora

- Sub-Contractor Accomplishment Report: Ronito MacapazDocumento15 pagineSub-Contractor Accomplishment Report: Ronito MacapazKamille Anne GabaynoNessuna valutazione finora

- Construction: James L. DulaliaDocumento17 pagineConstruction: James L. DulaliaKamille Anne GabaynoNessuna valutazione finora

- Summary of Work May 21 To May 27 ValDocumento2 pagineSummary of Work May 21 To May 27 ValKamille Anne GabaynoNessuna valutazione finora

- Thursday, August 06, 2020, 02:29 PM: Page 1 of 135 C:/Users/Rose/Desktop/work/Structure1.anlDocumento135 pagineThursday, August 06, 2020, 02:29 PM: Page 1 of 135 C:/Users/Rose/Desktop/work/Structure1.anlKamille Anne GabaynoNessuna valutazione finora

- Summary of Work May 21 To May 27 BangaDocumento3 pagineSummary of Work May 21 To May 27 BangaKamille Anne GabaynoNessuna valutazione finora

- Prod Rate Man-HourDocumento10 pagineProd Rate Man-HourKamille Anne GabaynoNessuna valutazione finora

- List of Products NeededDocumento28 pagineList of Products NeededKamille Anne GabaynoNessuna valutazione finora

- Status With PictureDocumento26 pagineStatus With PictureKamille Anne GabaynoNessuna valutazione finora

- Roof Gutter TdsDocumento3 pagineRoof Gutter TdsKamille Anne GabaynoNessuna valutazione finora

- Angeluz Memorial ParkDocumento2 pagineAngeluz Memorial ParkKamille Anne GabaynoNessuna valutazione finora

- Weekly Accomplishment Report: Nucum Orcullo Dela CruzDocumento3 pagineWeekly Accomplishment Report: Nucum Orcullo Dela CruzKamille Anne GabaynoNessuna valutazione finora

- Angeluz Memorial ParkDocumento4 pagineAngeluz Memorial ParkKamille Anne GabaynoNessuna valutazione finora

- Butchery Business Plan-1Documento12 pagineButchery Business Plan-1Andrew LukupwaNessuna valutazione finora

- Chapter 3Documento5 pagineChapter 3Elsa Mendoza50% (2)

- ASP Zakat PPT FinalDocumento13 pagineASP Zakat PPT FinalDionysius Ivan HertantoNessuna valutazione finora

- Lect 12 EOQ SCMDocumento38 pagineLect 12 EOQ SCMApporva MalikNessuna valutazione finora

- Company DetailsDocumento8 pagineCompany DetailsVikash Kumar SinghNessuna valutazione finora

- Unka VAT WithholdingDocumento1 paginaUnka VAT WithholdingGar KooNessuna valutazione finora

- Answers in English For Academic and Professional Purposes: Name: Grade and Section: 1 TeacherDocumento22 pagineAnswers in English For Academic and Professional Purposes: Name: Grade and Section: 1 TeacherSherilyn DiazNessuna valutazione finora

- White Revolution in IndiaDocumento57 pagineWhite Revolution in IndiaPiyush Gaur0% (3)

- Fractional Share FormulaDocumento1 paginaFractional Share FormulainboxnewsNessuna valutazione finora

- Entrepreneurship 11/12 First: Learning Area Grade Level Quarter DateDocumento4 pagineEntrepreneurship 11/12 First: Learning Area Grade Level Quarter DateDivine Mermal0% (1)

- FINAL REPORT 2-1 Final FinalDocumento24 pagineFINAL REPORT 2-1 Final FinalDecoy1 Decoy1Nessuna valutazione finora

- Ashish Chugh Reveals Top Secrets To Finding Multibagger StocksDocumento10 pagineAshish Chugh Reveals Top Secrets To Finding Multibagger StocksSreenivasulu E NNessuna valutazione finora

- An Assignment: Case Study of Dell Inc.-Push or Pull?Documento3 pagineAn Assignment: Case Study of Dell Inc.-Push or Pull?Shahbaz NaserNessuna valutazione finora

- Cost Management Cloud: Receipt AccountingDocumento14 pagineCost Management Cloud: Receipt Accountinghaitham ibrahem mohmedNessuna valutazione finora

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Documento4 pagineĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuNessuna valutazione finora

- NBP HR Report-FinalDocumento58 pagineNBP HR Report-FinalMaqbool Jehangir100% (1)

- Induction Acknowledgement-1Documento3 pagineInduction Acknowledgement-1aal.majeed14Nessuna valutazione finora

- Conferring Rights On Citizens-Laws and Their Implementation: Ijpa Jan - March 014Documento11 pagineConferring Rights On Citizens-Laws and Their Implementation: Ijpa Jan - March 014Mayuresh DalviNessuna valutazione finora

- Session 3 Unit 3 Analysis On Inventory ManagementDocumento18 pagineSession 3 Unit 3 Analysis On Inventory ManagementAyesha RachhNessuna valutazione finora

- Appendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearDocumento1 paginaAppendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearKAshif UMarNessuna valutazione finora

- Ap Macroeconomics Syllabus - MillsDocumento6 pagineAp Macroeconomics Syllabus - Millsapi-311407406Nessuna valutazione finora

- AU Small Finance Bank - Research InsightDocumento6 pagineAU Small Finance Bank - Research InsightDickson KulluNessuna valutazione finora

- Review 105 - Day 17 P1: How Much of The Proceeds From The Issuance of Convertible Bonds Should Be Allocated To Equity?Documento10 pagineReview 105 - Day 17 P1: How Much of The Proceeds From The Issuance of Convertible Bonds Should Be Allocated To Equity?sino akoNessuna valutazione finora

- Case 7Documento2 pagineCase 7Manas Kotru100% (1)

- Chapter 4Documento2 pagineChapter 4Dai Huu0% (1)

- Revenue Memorandum Circular No. 07-96Documento2 pagineRevenue Memorandum Circular No. 07-96rnrbac67% (3)

- Week 14: Game Theory and Pricing Strategies Game TheoryDocumento3 pagineWeek 14: Game Theory and Pricing Strategies Game Theorysherryl caoNessuna valutazione finora

- Global SOUTH & Global NORTHDocumento13 pagineGlobal SOUTH & Global NORTHswamini.k65Nessuna valutazione finora

- Foundation of Economics NotesDocumento16 pagineFoundation of Economics Notesrosa100% (1)

- Wave SetupsDocumento15 pagineWave SetupsRhino382100% (9)