Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Art of Deduction (WEB)

Caricato da

Derrie SuttonTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Art of Deduction (WEB)

Caricato da

Derrie SuttonCopyright:

Formati disponibili

The art of deduction

A small minority of people are spending large sums

of money to aggressively minimise the tax they pay

Author: Matt Grudnoff

February 2019

Introduction

The issue of tax concessions and tax loopholes has grown in prominence in recent

years. Growing inequality has put the focus on those who seek to avoid paying their

fair share in our progressive taxation system. These tax loopholes include excess

franking credits that see mainly wealthy retirees who have paid no tax get a tax refund

from the government.

The tax statistics give us an insight into how a small minority of people are spending

very large sums of money in order to find and take advantage of tax loopholes. When

we look at people’s income before it is reduced by tax deductions we see that some

people are able to substantially reduce the amount of tax they pay. But this comes at a

large cost.

Looking just at people with gross incomes (incomes before tax deductions) of more

than a million dollars we see that those with the largest deductions spend considerable

more on managing their tax affairs. Figure 1 breaks those with gross incomes above a

$1 million into three groups. The first group is those who don’t have sufficient

deductions to reduce their taxable income below $1 million and so their gross income

and their taxable income are above $1 million. The second group are those who did

have sufficient deductions to reduce their taxable income below $1 million, so their

gross income is above $1 million but their taxable income is below $1 million. The third

group is those that had enough deductions to reduce their taxable income below the

tax-free threshold. This group had a gross income of more than $1 million but paid no

tax.

The art of deduction 1

Figure 1 – Difference in average amount spent on managing tax affairs for very high

income earners

$200,000

$180,000

$160,000

$140,000

$120,000

$100,000

$80,000

$60,000

$40,000

$20,000

$0

Gross $1m+ Taxable Gross $1m+ Taxable Gross $1m+ Zero tax

$1m+ less than $1m

Source: Australian Tax Office (2018) Taxation Statistics 2015-16 – Individuals, available at

<https://data.gov.au/dataset/ds-dga-d170213c-4391-4d10-ac24-b0c11768da3f/details>

Those with a gross income of a million or more who did not get enough deductions to

reduce their taxable income below $1 million spent on average the least managing

their tax affairs. They spent on average $7,476. Those with a gross income of a million

or more who did get sufficient deductions to reduce their taxable income to below $1

million paid on average $26,124, or three and half times more than the first group.

Those with a gross income of $1 million or more who got enough deductions to pay no

tax at all paid on average $174,201, or 23 times more than the first group.

Managing your tax affairs

The tax system is complex, and many Australians employ tax agents to help manage

their tax affairs. These expenses are tax deductable, and taxation statistics show that

six million Australians claimed about $2.3 billion for managing their tax affairs in 2015-

16 (the latest statistics available). The vast majority of these people are likely to be

income earners paying their local tax agent to fill out their tax returns.

A small minority of people spend considerably more money managing their tax affairs

to aggressively minimise the amount of tax they pay. Australia Institute research

showed that in 2011-12 there were 75 individuals that earned more than a million

dollars in gross income but found such large deductions that they reduced their

The art of deduction 2

taxable income to below the tax-free threshold and so paid no tax.1 These 75

individuals claimed an average deduction of $860,000 for the cost of managing their

tax affairs.

An industry that charges large fees to reduce client’s taxable income is problematic not

only because it undermines our progressive income tax system, but also because it is

highly inefficient. Money spent avoiding tax could be more productively spent

elsewhere and some of our brightest people spend their energies on unproductive

work when they could be producing more socially desirable goods and services.

In response to these concerns, the Labor party has promised if elected to cap

deductions for managing tax affairs to $3,000.2 This is designed to reduce the incentive

for those with high gross incomes to spend large sums of money in order to

aggressively reduce their taxable income.

Gross income refers to the total income an individual earns in a year. Taxable income is

gross income minus all the individuals’ deductions. Taxable income is the income the

individual pays tax on.

What people spend managing their tax affairs

The average amount claimed for those with a taxable income between $6,000 and

$250,000 was $322.3 Those with a taxable income between $6,000 and $250,000 make

up the vast majority of claims (96%).

Those with taxable incomes of more than $250,000 spend considerably more, on

average, managing their tax affairs. Those with taxable incomes between $250,000

and $500,000 spend on average $1,460 (four and a half times more than those with

taxable incomes between $6,000 and $250,000). Those with taxable incomes between

$500,000 and $1 million spend on average $2,951 (nine times more) and those with

taxable incomes of more than $1 million spend $7,476 (23 times more). The average

amount spent managing their tax affairs by various taxable income groups is shown in

Figure 2.

1

Grudnoff M (2015) Closing the tax loopholes: A Buffet rule for Australia, The Australia Institute, April,

available at <http://www.tai.org.au/sites/default/files/Buffett%20Rule%20Final_0.pdf>

2

Janda M (2017) Tax deductions for advice should be capped at $3,000: Australia Institute, ABC News,

22 May, available at <https://www.abc.net.au/news/2017-05-22/tax-deductions-for-advice-should-be-

capped/8546170>

3

Australian Tax Office (2018) Taxation Statistics 2015-16 – Individuals, available at

<https://data.gov.au/dataset/ds-dga-d170213c-4391-4d10-ac24-b0c11768da3f/details>

The art of deduction 3

Figure 2 – Average amount spent managing tax affairs by various taxable income

groups

$8,000

$7,000

$6,000

$5,000

$4,000

Taxable income

$3,000

$2,000

$1,000

$0

$6k or less $6k to $250k to $500k to $1m or

$250k $500k $1m more

Source: Australian Tax Office (2018) Taxation Statistics 2015-16 – Individuals, available at

<https://data.gov.au/dataset/ds-dga-d170213c-4391-4d10-ac24-b0c11768da3f/details>

It might be expected that people with larger incomes pay more to manage their tax

affairs. As someone’s income rises there is an increasing chance they will have more

complex financial arrangements. What is unusual is that people with a taxable income

of less than $6,000 spend on average $1,003 managing their tax affairs, which is three

times more than people with taxable incomes between $6,000 and $250,000 spend. If

tax affairs get more complex as income grows, people with taxable incomes that are

less than $6,000 should spend relatively little managing their tax affairs.

One explanation as to why people with such low taxable incomes are spending on

average $1,003 managing their tax affairs could be that their gross incomes are much

higher and they are spending considerable sums of money to aggressively minimise

the amount of tax they pay.

Gross income

Another way to look at people’s spending on managing their tax affairs is to look at it

by gross income rather than taxable income. Gross income is income before

deductions. When we compare gross income and taxable income by the average

deduction for managing tax affairs, we see some differences. Figure 3 shows the

difference between gross income and taxable income for various income groups by the

average deduction for managing tax affairs.

The art of deduction 4

Figure 3 – Difference in average deduction for managing tax affairs between gross

and taxable income for various income groups

$10,000

$9,000

$8,000

$7,000

$6,000

$5,000 Taxable income

$4,000 Gross income

$3,000

$2,000

$1,000

$0

$6k or $6k to $250k to $500k to $1m or

less $250k $500k $1m more

Source: Australian Tax Office (2018) Taxation Statistics 2015-16 – Individuals, available at

<https://data.gov.au/dataset/ds-dga-d170213c-4391-4d10-ac24-b0c11768da3f/details>

For the vast majority of people, those earning between $6,000 and $250,000, the

average amount is almost identical. People with higher gross incomes spend more on

average than people on higher taxable incomes spend. This shows that people who

spend more managing their tax affairs are successfully lowering their taxable income.

For the very bottom income group we see the reverse, where people with taxable

incomes of less than $6,000 spend considerable more than people with gross incomes

of less than $6,000 spend. This is also consistent with tax minimisation. People with a

taxable income of less than $6,000 that claim large amounts in deductions clearly have

far higher gross incomes but have spent considerable sums reducing their taxable

incomes to below $6,000.

Very high income earners and the cost of managing tax

affairs

At the very top of the income distribution there is an even larger disparity. If we look

at just those with a gross income above $1 million, we can split them into three

groups. The first group is those with a gross income above $1 million and a taxable

income above $1 million. The second group is those with a gross income of over $1

million but a taxable income of less than $1 million. The final group is those who

earned above $1 million but reduced their taxable income below the tax-free

The art of deduction 5

threshold and therefore paid no tax. If the increase in the cost of managing tax affairs

increases as income increases because those on high incomes have more complex tax

affairs, then the average cost of managing tax affairs should be similar for all three

groups.

As Figure 4 shows this is not the case. There are very large differences between each

group that again grows as the size of the deductions grows.

Figure 4 – Difference in average amount spent on managing tax affairs for very high

income earners

$200,000

$180,000

$160,000

$140,000

$120,000

$100,000

$80,000

$60,000

$40,000

$20,000

$0

Gross $1m+ Taxable Gross $1m+ Taxable Gross $1m+ Zero tax

$1m+ less than $1m

Source: Australian Tax Office (2018) Taxation Statistics 2015-16 – Individuals, available at

<https://data.gov.au/dataset/ds-dga-d170213c-4391-4d10-ac24-b0c11768da3f/details>

Those with a gross income of a million or more who did not get enough deductions to

reduce their taxable income below $1 million spent on average the least managing

their tax affairs. They spent on average $7,476. Those with a gross income of a million

or more who did get sufficient deductions to reduce their taxable income to below $1

million paid on average $26,124, or three and half times more than the first group.

Those with a gross income of $1 million or more who got enough deductions to pay no

tax at all paid on average $174,201, or 23 times more than the first group.

Conclusion

The taxation statistics show us that most people who pay for help managing their tax

affairs spend a few hundred dollars, but there is a very small minority who are

spending considerable sums of money to manage their tax affairs. These people are

The art of deduction 6

more likely to have large gross incomes and some of them have been very successful in

reducing the amount of tax they pay.

It is in the public good to discourage high income individuals from spending large sums

of money to find tax loopholes. Doing so will not only make the taxation system fairer

and more progressive, it will also discourage the largely unproductive industry focusing

on finding and using complex tax loopholes.

The art of deduction 7

Potrebbero piacerti anche

- Landlord Tax Planning StrategiesDa EverandLandlord Tax Planning StrategiesNessuna valutazione finora

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformDa EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNessuna valutazione finora

- HDFC Bank Request For Credit Card UpgrdeDocumento2 pagineHDFC Bank Request For Credit Card UpgrdeDhavalNessuna valutazione finora

- Leaving Main StreetDocumento1 paginaLeaving Main StreetRabie Cordoba0% (1)

- Your Fake Money and Making You Poorer: Written by Robert Kiyosaki - Tuesday, April 16, 2019 Read Time: 5 MinDocumento9 pagineYour Fake Money and Making You Poorer: Written by Robert Kiyosaki - Tuesday, April 16, 2019 Read Time: 5 MinAnonymous HsoXPyNessuna valutazione finora

- Money PadDocumento15 pagineMoney PadAnvita_Jain_2921Nessuna valutazione finora

- Money PadDocumento20 pagineMoney PadRahul PurohitNessuna valutazione finora

- Crypto Graf IDocumento14 pagineCrypto Graf I思恩Nessuna valutazione finora

- Refinancing GuideDocumento4 pagineRefinancing GuideSteven Mah Chun HoNessuna valutazione finora

- Atms: Automated Teller MachinesDocumento31 pagineAtms: Automated Teller MachinesOnkar KanadeNessuna valutazione finora

- RewardsCardBooklet Feb2019Documento18 pagineRewardsCardBooklet Feb2019Debbie Jamielyn Ong0% (1)

- 2020 BBB Employmentscams ReportDocumento8 pagine2020 BBB Employmentscams ReportTMJ4 NewsNessuna valutazione finora

- Professional Banker Certificate - The Business of Banking and The Economic Environment (Chapter 1)Documento38 pagineProfessional Banker Certificate - The Business of Banking and The Economic Environment (Chapter 1)KALKIDAN KASSAHUNNessuna valutazione finora

- Pharmacist, Pharmacy & Pharmaceutical Company Health Care Fraud in South Carolina and The U.S. - A Review For SC Fraud Lawyers, SC Whistleblower Attorneys & SC Law FirmsDocumento11 paginePharmacist, Pharmacy & Pharmaceutical Company Health Care Fraud in South Carolina and The U.S. - A Review For SC Fraud Lawyers, SC Whistleblower Attorneys & SC Law FirmsJoseph P. Griffith, Jr.Nessuna valutazione finora

- Cash Larceny From The DepositDocumento3 pagineCash Larceny From The DepositFajria OktavianiNessuna valutazione finora

- Consumer Investigations IRE 2019Documento15 pagineConsumer Investigations IRE 2019ABC News PoliticsNessuna valutazione finora

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocumento4 pagineCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNessuna valutazione finora

- Company Law FiracDocumento6 pagineCompany Law FiracRohan PatelNessuna valutazione finora

- Index ViewsDocumento4 pagineIndex ViewspallikachopraNessuna valutazione finora

- Manufacturing Money, and Global Warming: Executive SummaryDocumento35 pagineManufacturing Money, and Global Warming: Executive SummarynsloueyNessuna valutazione finora

- NJ Expungement Attorneybmbdx PDFDocumento2 pagineNJ Expungement Attorneybmbdx PDFgramnerve32Nessuna valutazione finora

- In The Realm of Hacking: by Chaelynne M. Wolak Wolakcha@scsi - Nova.eduDocumento8 pagineIn The Realm of Hacking: by Chaelynne M. Wolak Wolakcha@scsi - Nova.edukarmaNessuna valutazione finora

- Loan Cheat Sheet by Jocelyn PredovichDocumento1 paginaLoan Cheat Sheet by Jocelyn PredovichJocelyn Javernick PredovichNessuna valutazione finora

- Paycheck ScriptDocumento142 paginePaycheck ScriptDinila Rajesh0% (1)

- Presentation PDFDocumento61 paginePresentation PDFshaunNessuna valutazione finora

- CardConnect Final CC 5Documento3 pagineCardConnect Final CC 5Juan Pablo MarinNessuna valutazione finora

- Ebook A Complete Guide To Conversion Rate OptimizationDocumento50 pagineEbook A Complete Guide To Conversion Rate OptimizationBIlel MaDINessuna valutazione finora

- List of Outstanding Springfield Property TaxesDocumento3 pagineList of Outstanding Springfield Property TaxesMassLive100% (1)

- How Bitcoin Casinos WorkDocumento2 pagineHow Bitcoin Casinos WorkAnonymous Bitcoin CasinosNessuna valutazione finora

- How To File Accounts To Companies House UK - A Guide BookDocumento36 pagineHow To File Accounts To Companies House UK - A Guide Bookprincessz_leoNessuna valutazione finora

- Money PadDocumento15 pagineMoney PadSubhash PbsNessuna valutazione finora

- The BlueprintDocumento11 pagineThe BlueprintCIO White PapersNessuna valutazione finora

- ScamsDocumento69 pagineScamsAnil PatelNessuna valutazione finora

- Equifax Breach ClaimDocumento3 pagineEquifax Breach ClaimMichael MillerNessuna valutazione finora

- Scams and FruadsDocumento12 pagineScams and FruadsAnish KanojiyaNessuna valutazione finora

- AAM - High 50 Dividend Strategy 2019-3QDocumento4 pagineAAM - High 50 Dividend Strategy 2019-3Qag rNessuna valutazione finora

- Corporate Fraud and Employee Theft: Impacts and Costs On BusinessDocumento15 pagineCorporate Fraud and Employee Theft: Impacts and Costs On BusinessAkuw AjahNessuna valutazione finora

- Christopher Andrews Equifax Data Breach Class Action ObjectionDocumento43 pagineChristopher Andrews Equifax Data Breach Class Action ObjectionAnonymous iYvc6KHNessuna valutazione finora

- Vital Records Revised Policies Same Sex CouplesDocumento2 pagineVital Records Revised Policies Same Sex Couplesdave_dfwNessuna valutazione finora

- Lis6773 Assignment 3 - Preservation Planning by Crystal StephensonDocumento6 pagineLis6773 Assignment 3 - Preservation Planning by Crystal Stephensonapi-470886892Nessuna valutazione finora

- Starting A Small Scale BusinessDocumento26 pagineStarting A Small Scale BusinessMariam Oluwatoyin CampbellNessuna valutazione finora

- Supports and Information For The Self-EmployedDocumento32 pagineSupports and Information For The Self-EmployedAhmedTagAlserNessuna valutazione finora

- Disclosure and Release Form-SignedDocumento2 pagineDisclosure and Release Form-SignedDalitsoChapemaNessuna valutazione finora

- Expat World: It'S Time To Fight Back For Your Financial PrivacyDocumento20 pagineExpat World: It'S Time To Fight Back For Your Financial Privacygalt67Nessuna valutazione finora

- Principles of Prescription Order WritingDocumento18 paginePrinciples of Prescription Order WritingJohn OmandacNessuna valutazione finora

- The Biggest Loophole in The Free-Market SystemDocumento18 pagineThe Biggest Loophole in The Free-Market SystemCervino InstituteNessuna valutazione finora

- Commercial Private Equity Has Made Securing Hard Money Loans Easier and More Accessible For Borrowers Throughout The USDocumento4 pagineCommercial Private Equity Has Made Securing Hard Money Loans Easier and More Accessible For Borrowers Throughout The USPR.comNessuna valutazione finora

- Q. 8 Governments BondsDocumento2 pagineQ. 8 Governments BondsMAHENDRA SHIVAJI DHENAKNessuna valutazione finora

- Filed Stamped Copy - Complaint 20cv2396 0Documento30 pagineFiled Stamped Copy - Complaint 20cv2396 0MichaelPatrickMcSweeneyNessuna valutazione finora

- Credit ActivityDocumento2 pagineCredit Activityamo53Nessuna valutazione finora

- Fi 10032020Documento46 pagineFi 10032020CA. (Dr.) Rajkumar Satyanarayan AdukiaNessuna valutazione finora

- How To Buy A Used Car MiniDocumento20 pagineHow To Buy A Used Car MiniStarr NewmanNessuna valutazione finora

- Do Not Use Doubtful Sources of InformationDocumento21 pagineDo Not Use Doubtful Sources of InformationMallick Sajid KhanNessuna valutazione finora

- A Faa Fraud HandbookDocumento75 pagineA Faa Fraud HandbookAmira HerreraNessuna valutazione finora

- Steps Followed in Establishing A Home Furnishing Unit/ Design StudioDocumento5 pagineSteps Followed in Establishing A Home Furnishing Unit/ Design StudioshashikantshankerNessuna valutazione finora

- Palace Entertainment EE Handbook - 2011Documento54 paginePalace Entertainment EE Handbook - 2011Jake C. SchneiderNessuna valutazione finora

- Get rich by investing in P2P loans: Wealth accumulation through investment P2P lending | Get a passive income and secure financial independence | optimal Use of Leverage for p2p paymentsDa EverandGet rich by investing in P2P loans: Wealth accumulation through investment P2P lending | Get a passive income and secure financial independence | optimal Use of Leverage for p2p paymentsNessuna valutazione finora

- Mike Huckabee's Media Acquisition DisasterDocumento110 pagineMike Huckabee's Media Acquisition DisasterBill WallerNessuna valutazione finora

- Make Money OnlineDocumento3 pagineMake Money OnlineAgustin RudasNessuna valutazione finora

- Income and Business TaxationDocumento24 pagineIncome and Business TaxationFerdinand Carlos B. DadoNessuna valutazione finora

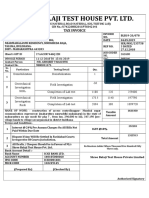

- RIL Tax InvoiceDocumento2 pagineRIL Tax InvoiceD K YadavNessuna valutazione finora

- Bir Form 2307Documento8 pagineBir Form 2307Alex CalannoNessuna valutazione finora

- January 2024 PayslipDocumento1 paginaJanuary 2024 PayslipSilas AnkorahNessuna valutazione finora

- Smetka Za Karta PDFDocumento1 paginaSmetka Za Karta PDFMence PendevskaNessuna valutazione finora

- Tax InvoiceDocumento1 paginaTax InvoiceAnkur RatheeNessuna valutazione finora

- Calamba Steel Center v. CIR - DigestDocumento2 pagineCalamba Steel Center v. CIR - Digestcmv mendozaNessuna valutazione finora

- IRSDoc6209 2003Documento665 pagineIRSDoc6209 2003EheyehAsherEheyehNessuna valutazione finora

- Rates Fees and Charges PCA and JCADocumento3 pagineRates Fees and Charges PCA and JCAcryptoarbitrager001Nessuna valutazione finora

- Flat FileDocumento1 paginaFlat FileEr Sundeep RachakondaNessuna valutazione finora

- Tata Cliq 1Documento1 paginaTata Cliq 1timus677850% (2)

- TO: Atty. Stephen Yu FROM: Maria Ludica B. Oja DATE: January 13, 2017 Subject: Transfer Pricing Transfer Pricing DefinedDocumento4 pagineTO: Atty. Stephen Yu FROM: Maria Ludica B. Oja DATE: January 13, 2017 Subject: Transfer Pricing Transfer Pricing DefinedLudica OjaNessuna valutazione finora

- Emaran Bill at TarangDocumento6 pagineEmaran Bill at TarangKamakhya MallNessuna valutazione finora

- Qantas Airways: Name: Institution Affiliation: DateDocumento8 pagineQantas Airways: Name: Institution Affiliation: DatePhuong NhungNessuna valutazione finora

- Combined Defence Services Examination (II) 2016 11634644335 सं यु त रा से वा परा (II) 2016Documento2 pagineCombined Defence Services Examination (II) 2016 11634644335 सं यु त रा से वा परा (II) 2016Pratik SharwanNessuna valutazione finora

- Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocumento1 paginaSl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountAnirudhNessuna valutazione finora

- PercentagesDocumento2 paginePercentagessamdhathriNessuna valutazione finora

- Call in AdvanceDocumento2 pagineCall in AdvanceOberoi MalhOtra MeenakshiNessuna valutazione finora

- Case Digest Cir Vs SC JohnsonDocumento4 pagineCase Digest Cir Vs SC JohnsonHannah Desky100% (1)

- Income Collection Deposit System With ConversionDocumento5 pagineIncome Collection Deposit System With ConversionRichel ArmayanNessuna valutazione finora

- Withdraw PayPal Money in Malaysia SolutionDocumento16 pagineWithdraw PayPal Money in Malaysia Solutionafarz2604Nessuna valutazione finora

- ITAD Ruling 14-01Documento5 pagineITAD Ruling 14-01Ylmir_1989100% (1)

- Notice Concerning Fiduciary Relationship: IdentificationDocumento2 pagineNotice Concerning Fiduciary Relationship: IdentificationRenn DallahNessuna valutazione finora

- Well KidDocumento1 paginaWell Kidtahirliayla0Nessuna valutazione finora

- Withholding Tax ProcedureDocumento22 pagineWithholding Tax ProcedureDinesh BabuNessuna valutazione finora

- Account Statement From 1 Dec 2021 To 8 Jul 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento15 pagineAccount Statement From 1 Dec 2021 To 8 Jul 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVIVEK CHAUHANNessuna valutazione finora

- Invoice 90003740Documento1 paginaInvoice 90003740Halis CanNessuna valutazione finora

- 120619ER63130633Documento2 pagine120619ER63130633Prakalp TechnologiesNessuna valutazione finora

- InvoiceDocumento1 paginaInvoicewidya fotoNessuna valutazione finora

- Account Statement PDFDocumento12 pagineAccount Statement PDFBull's EyeNessuna valutazione finora