Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

AircraftCommerce - MRO IT Market Survey

Caricato da

khalidsnTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

AircraftCommerce - MRO IT Market Survey

Caricato da

khalidsnCopyright:

Formati disponibili

40 I MAINTENANCE & ENGINEERING

The MRO management & flight operations software products of 50 vendors

are reviewed in this survey. There are a number of new-entry companies and

some long-standing companies have ceased trading or disappeared from

most competitions.

MRO IT market

vendors survey

T

here remains a wide range of omissions are inevitable. Vendors were impressive achievement for a company

software solutions available to provided with a questionnaire and asked that numbers only 14 people. The

improve commercial aviation to respond to the same set of questions AIRPACK suite includes a range of

MRO efficiency and for purposes of consistency. Vendors that discrete solutions called AIRTIME,

effectiveness. This is a bi-annual survey did not provide responses are marked ‘no AIRSTOCK, AIRUSER, AIRDOC and

that reviews the systems available on the data’. AIRSTAT. Together these offer an

market. The discussion of solutions is in four integrated capability for managing:

The scope of systems is widening as categories: ‘pure-play MRO solutions’, maintenance; inventory control; security;

new point-solutions emerge to address which are the main vendors in the electronic documentation; and fleet and

niche requirements. Some new companies market; ‘specialist point solutions’, which equipment reliability. The market for this

are offering applications written usually augment pure-play solutions; product appears to be relatively small

specifically for the iPhone for example. ‘enterprise resource planning (ERP) operators like Air Tahiti Nui, which puts

This follows a growing trend for smaller, solutions’, which provide extended it right at the edge of a tier-one, pure-play

simpler solutions available on mobile capability in finance and human MRO company. The company claims an

devices written for open platforms. resources; and ‘tier-two MRO solutions’, installed base in all types of customers,

Whether these types of solutions ever which typically target smaller including airlines, third-party MRO

challenge the established software organisations. Vendors are surveyed in facilities, and component maintenance

companies is yet to be seen. alphabetical order. Some vendors declined shops. The AIRPACK suite also claims to

This survey has been carried out at a to respond to the survey, or simply did have full links to Boeing AHM and

time of economic hardship and financial not return a report, so they have been Airbus products, along with an electronic

belt-tightening at all the major airlines included for completeness but their data flight bag (EFB), which is again very

and related maintenance companies. This are limited. impressive for such a small company. The

is causing increased competition for fewer product technology is .NET which

opportunities, with many of the major positions it well for the future.

airlines having already selected MRO Pure-play solutions

systems over the past five years. Normally This category of solution is a

there would be a natural shake-out of the complete offering of functionality to meet Applied Database Technologies

MRO software vendor market in this most of the needs of an airline or third- One of the recent newcomers to the

situation, but unusually there are a party MRO provider seeking to renew or full pure-play MRO vendor segment, and

number of strong new entrants that want replace its business systems. The majority one of the few growing success stories,

to break into this intensely competitive of the pure-play MRO software this Turkey- and US-based company has

world. companies in this category have the grown to 34 people and has a live airline

2011 also sees the end of a technology capabilities to respond legitimately to customer base of 25, up from 14 in 2009.

step-change into the full web airlines of any size and MRO facilities During the past 12 months they have

environment, with the majority of seeking a new software solution. secured five new customers. Applied

software companies now offering their Database Technologies works with

applications on Java, .NET or both. Oracle and Turkish-based Formalis to

Vendors that have failed to invest in new AD Software implement its solution.

technology migration risk being left AD Software is a company based in The company’s product, called Wings,

behind in the race for new contracts. France, with offices in South Africa and has the following modules: Fleet

As in previous years, Aircraft Thailand serving these regions. It has Management; Engineering; Aircraft

Commerce categorises vendors and tries been in business for 12 years selling its Maintenance Planning; Aircraft and

to explain the range and depth of AIRPACK suite of products, and Component Reliability; Technical

functionality on offer. The survey also continues to grow: from 17 customers in Documentation Library; Work Order

looks at company credentials of longevity our last survey in 2009, to 38 as of the Management; Heavy Maintenance; Line

and customer base. As with other surveys end of 2010, with eight of them being Maintenance; Shop Management

not every single vendor is covered, and signed in the last year alone. This is an (Component Repair); Tooling

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

41 I MAINTENANCE & ENGINEERING

Management; Labor Tracking; Time & extending to a page for an EFB. product based upon the Microsoft

Attendance; Invoicing (A/R); Purchasing Dynamics technology.

and Vendor Management; Inventory The 50-man company claims British

Control; Receiving and Shipping; Quality Cambridge Online Airways, FedEx, Continental Airlines,

Assurance & Audits; Employee Master Cambridge Online (COLS) is a Japan Air Services, Singapore Airlines,

Definitions; Employee Trainings; diversified company providing Philippine Airlines, and FLS Aerospace

Employee Certifications; Open Interfaces professional information technology (IT) among its customers, although this

– Gateways; Bar Code Printing & systems and services to a wide range of appears to be an old customer list. It is

Technology; Digital Attachments commercial and academic organisations. also unclear which modules of the

(Archiving); and Wings Mobile Solutions. Based in Cambridge, UK it serves product capability are being used by

The product is built on Java customers throughout the UK and customers. COLS has been in business for

technology and has integration points to overseas. COLS is a Microsoft GOLD more than 30 years, and is now part of

both Boeing and Airbus suites of tools, Certified Partner and offers the NAVair the Microsoft reseller network.

such as AHM. The customer base is

largely cargo airlines and low-cost or

charter carriers.

Aerosoft Systems Inc

Aerosoft continues to sell into the

smaller regional airline market. In 2010 it

signed a marketing deal with Sabre, and

later last year with Hexaware, to assist in

implementations and to provide an ASP

offering to the market. Aerosoft has 22

staff, and is based in Toronto Canada,

with further offices in Miami, US (the old

Rene Perez company) and Austria.

Aerosoft acquired the maintenance

product, PMI, in early 2004 from SITA.

In fact there are several offers of

overlapping capabilities, DigiMAINT and

WebPMI. The WebPMI product is a

modernised version of the original PMI

product. DigiMAINT is the original

Aerosoft product and is now available as

a Java application. These products have

been augmented with a new series of

AeroBUY and AeroREPAIR. These

electronically manage requests for

Quotations, Purchase/Repair Orders and

Invoices for Vendors that participate in e-

business logistics. It is designed around

the requirements of the ATA standard

Spec 2000.

Aerosoft has added two new airlines

to its existing 30 customers in the past 12

months. The company still qualifies as a

tier-one supplier.

CALM

C.A.L.M. Systems Inc is a smaller-

scale provider of MRO software. CALM

(Computerised Aircraft Log Manager) is

featured for the first time in this survey.

Although it is one of the smaller

providers, with only six staff, it has been

in business for 22 years. Based in the US,

CALM is 100% focused on the airline

market. It claims customers in all the

market segments, from airlines to MRO

shops and component shops. In some

cases only certain modules are used for

specific purposes, acting almost like a

low- cost specialist point solution. For

example, American Eagle uses its data

management module in the technical

library. In spite of its small size, CALM

has a wide range of capabilities,

ISSUE NO. 74 • FEBRUARY/MARCH 2011 AIRCRAFT COMMERCE

42 I MAINTENANCE & ENGINEERING

COLS’ product is sold either by partnership with Bayer Aviation Invoice Passing; Full Invoicing Module;

concurrent user or by fleet size. Its place Consulting in Malaysia. OASES Job Scheduler; and Integrated

in the pure-play solution space is Management Planning Tool.

uncertain given the intense competition

that exists. It continues to evolve new Commsoft

capabilities, such as the Production Like many of the smaller software IBS

Control Consoles. vendors, Commsoft seems to have made IBS Software Services is an Indian

the successful transition into modern web company headquartered in Trivandrum.

technology. It started as a software house It has offices around the world, including

Cimber Air Data 40 years ago in the UK, before winning Australia, the UK, United Arab Emirates

Cimber Air Data has released a Java its first airline contract in 1975. It also (UAE) and the USA.

version of the long standing AMICOS has a presence in Australia. The IBS iFlight MRO is part of a

product. It was first implemented in OASES has been moved from client- portfolio of IBS products aimed at airline

Cimber Air as a mini computer system in server to Java and is supported by a total operations. The other products are:

1987. The company claims to have 20 company of 29 people. This new product AvientCrew for airline crew management;

airline customers, but does not appear to technology may be the reason why the AvientFleet for airline fleet management;

have secured contracts with any new company has added six new customers in and TopAir for integrated flight

customers in 2010. the past 12 months, which is important operations. With a relatively small

The AMICOS Next Generation for its long-term success. It seems that number of live customers at 14, IBS is

product is a result of a 10-man company Commsoft is now targeting its product at making progress with iFlight, and added

migrating a successful software product smaller organisations. The largest two new customers in 2010. The product,

over into a modern technology. It customer has 70 aircraft. OASES’ formerly the client-server VISaer, is now

comprises a full range of modules mainstay customer used to be the BMI in .NET. China Southern is the largest

spanning the full scope of normal airline Group, but it has now switched to Swiss live customer with 350 aircraft,

and MRO requirements. These include: AMOS. indicating the breadth and depth of

Engineering; Planning; Reliability and OASES modules include: Reliability; iFlight.

Quality Control; Technical Records; Technical Log and Defects; Workcards The IBS offering is unique among the

Material Planning; Cost Control; and Planning; Line Maintenance Control; MRO software marketplace in that it

Purchasing; 3rd Party Work; Inventory; Inventory and Purchasing; Electronic offers a complete airline solution set.

Sales; Loan Order Management; and Demand Handling; AD/SB (Airworthiness Functionally, the maintenance product

MRO which includes project cost control Directive / Service Bulletin) contains a complete range of modules

and invoicing. Evaluation/Analysis; AMP (Approved covering engineering, maintenance and

Cimber Air Data continues to expand Maintenance Programme) Revision; material management. iFlight does not

its capabilities, and will be including links Technical Records; Shop Floor Data have an IPC/AMM browsing function,

to both Boeing AHM and Airbus airN@v Capture and Work in Progress; Request but this is under development, since there

next year. It also has an implementation For Quotations; Sales Order Processing; are links to Boeing AHM. There is no

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

44 I MAINTENANCE & ENGINEERING

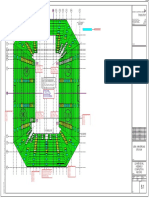

MRO & FLIGHT OPERATIONS SOFTWARE VENDOR COMPANY DETAILS

Company Website Contact Contact Current Production Size Years in No of New

person details product technology - people business airlines customers

in 2010 in 2010

PURE-PLAY MRO SOLUTIONS

AD Software www.adsoftware.fr Frederic Ulrich f.ulrich@adsoftware.fr AIR suite no data no data no data no data no data

+33 450894850

ADT www.adbtech.com Alan Yagiz sales@adbtech.com Wings Java 34 18 25 5

+90 533 4216646

Aerosoft www.aerosoftsys.com Thanos Kaponeridis thanos@aerosoftsys.com DigiMAINT, Java 22 13 30 2

+1 905 678 9564 WebPMI, DigiDOC

CALM Systems www.calm-systems.com Errol Friedman errol@calm-systems.com C.A.L.M. Visual FoxPro 6 22 no data no data

+1 8474809750

Cambridge Online www.cosl.co.uk Mark Thompson mark.thompson@cosl.co.uk Navair Microsoft 50 32 1 1

+44 1233 422 600 Dynamics

Cimber Air Data www.amicos.com Rune Hagen rune.hagen@amicos.com AMICOS Java 10 25 20 0

+47 93009854 Next Generation

Commsoft www.commsoft.co.uk Nick Godwin nsg@commsoft.co.uk OASES Java 29 39 47 6

+441621 817425

IBS Software Svs www.ibsplc.com David Spellman david.spellman@ibsplc.com iFlight MRO .NET 1800 13 14 2

+1 678 391 6080

IFR www.ifrfrance.com Philippe Lakhdar philippe.lakhdar@ifrfrance.com AMASIS IBM iPower 64 23 79 3

+33 5 62747400 + JAVA GUI

Infospectrum www.info-spectrum.com no data solutions@info-spectrum.com infoTRAK no data no data no data no data no data

MIRO Technologies www.mirotechnologies.com Mark Ogren mark.ogren@mirotechnologies.com GOLDesp JAVA / 85 30 5 6

+1512 868 5177 / AuRA Client-server

MRO Software(IBM) www.mro.com no data no data Maximo JAVA no data no data no data no data

MXi Technologies www.mxi.com Steve Morris info@mxi.com (613) 747 4698 Maintenix JAVA 250 14 22 2

Pentagon 2000SQL www.pentagon2000.com Kirk Baugher kirk.baugher@pentagon2000.com no data no data 60 no data no data no data

+1 212 629 7521

RUSADA www.rusada.com Hugh Revie hugh.review@rusada.com Envision .NET / FoxPro 95 23 55 4

+41 21 533 0334

RAMCO Systems www.ramco.com Thomas DeLuca tdeluca@rsc.ramco.com Ramco M&E / MRO JAVA / .NET 250 21 34 5

+ 1 718 835 2112 Enterprise / Analysis

EFB / ePubs

SaSiMS www.sasims.com no data sales@sasims.com +353 61711400 SaSiMS no data no data no data no data no data

SWISS www.swiss-as.com Marketing dept. marketing@swiss-as.com AMOS JAVA 76 21 86 13

Aviation Software +41 615827294

Tracware www.tracware.co.uk Patrick Walker Patrick_Waker@tracware.co.uk no data no data no data no data no data no data

+44 1983 567574

TRAX www.trax.aero Chris Reed sales@trax.aero TRAX Java / .NET 100 13 99 11

+1 305 662 7400 Maintenance

Ultramain www.ultramain.com Katherine Cox kcox@ultramain.com Ultramain no data no data no data no data no data

+1 505 828 9000

Volartec www.volartec.com Manuel Roché mroche@voalrtec.aero Alkym .NET 30 7 26 8

+54 351 4809710

SPECIALIST POINT SOLUTIONS

AerData www.aerdata.com Jaap van Dijk jaap.van.dijk@aerdata.com STREAM, .NET 75 3 20 15

+31 20 6559030 EFPAC

ARMAC www.armacsystems.com Michael Armstrong michael.armstrong@armacsystems.com RIOsys Java no data no data no data no data

+353 41 9877480

AviIT www.aviit.com David Brown dbrown@aviit.com eMan no data no data no data no data no data

+44 1383 620 922

Bytron www.bytron.aero Sarah Allen sva@bytron.aero skybook eFB no data no data 26 no data no data

+44 1652 228060 / SkylightES

Component Control www.componentcontrol.com Kimberley Bret k.bret@componentcontrol.com Quantum Control Aviation suite no data no data no data no data

Conduce www.conduce.net Paul Saunders paul.saunders@conduce.net Fatigue Reporting, .NET 5 1 0 5

+44 333 888 4066 MyTechLog,

various iPhone/iPad apps

EmpowerMX www.empowermx.com Stan Melling stan.melling@empowermx.com FleetCycle Java no data 11 7 0

+1 651 788 8846

Enigma www.enigma.com John Snow johnsnow@enigma.com Enigma 3C / Java 100 18 no data no data

+1 781 265 3636 InService suite

Euroscript www.euroscript.com Benoit Laxenaire benoit.laxenaire@euroscript.com E-FOS suite Java / XML 1350 23 3 18

+33 6 03 97 31 05 / XSL / CSS

iBaseT www.solumina.com no data no data Solumina no data no data no data no data no data

IDMR Solutions www.idmr-solutions.com no data no data InForm & eMAT no data no data no data no data no data

Infotrust Group www.infotrustgroup.com Terry McNicholas tmcnicholas@infotrustgroup.com TechSight / X Various 230 16 40 8

+1 949 732 7530

MINT Software www.media-interactive.de Ilka Gerlach ilka.gerlach@media-interactive.de MINT Suite Java / Delphi 29 12 20 3

Systems +494315302150

Omega www.omegaair.com Michael Formby mformby@omegair.com AMES .NET / C# 15 19 20 3

+1 9727753693

Servigistics www.servigistics.com Giacomo Squintani Giacomo.sqintani@servigistics.com PARTS Java no data no data no data no data

+44 1454 419191

Smart4Aviation www.smart4aviation.aero Dirk Jan Baas info@smart4aviation.aero Smart Suite Java 52 1 8 2

+316 4216 2431

Superstructure www.superstructuregroup.com Azam Begg azam.begg@superstructuregroup.com AQD Safety .NET 20 11 95 10

+44 7972 610 594 Management

T&A Systeme www.systeme.de Juergen Glaeser juergen.glaeser@systeme.de Logipad .NET 50 16 5 1

+492324 9258170

AMT Flightman www.flightman.com Diogo Serradas diogo.serradas@flightman.com Flightman no data no data no data no data no data

+3531 806 1000

Boeing/Jeppesen www.jeppesen.com no data no data no data no data no data no data no data no data

Osys www.o-sys.com Susyn Conway conways@0-sys.com Core Wing, Java no data no data no data no data

+1 703 889 1329 Core Fleet, EHM

Skypaq www.skypaq.com John Corrigan john.corrigan@skypaq.com no data no data no data no data no data no data

+353 44 9350 360

Teledyne www.teledyne-controls.com Scott Chambers schambers@teledyne.com no data no data no data no data no data no data

(303) 470 1525

ERP SOLUTIONS

IFS www.ifsworld.com no data no data IFS MRO Java / .NET 2630 no data no data no data

HCL-Axon (SAP) www.hcl-axon.com Allan Bachan allan.bachan@hcl-axon.com iMRO SAP JAVA / 7500 34 75 6

+1 817 235 1955 NetWeaver

2MoRO (SAP) www.2moro.com Jacques Beauchesne david.ferrier@2moro.fr Aero-Webb Java / .NET 24 6 9 3

+33 559013005 / Aero One SAP

Oracle www.oracle.com Christopher Evans christopher.evans@oracle.com cMRO Java / .NET no data no data no data no data

+1 330 286 0253

SAP www.sap.com Phil Te Hau Phil.te.hau@sap.com SAP R/3 Java / .NET no data no data no data no data

+1 610 661 3557

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

45 I MAINTENANCE & ENGINEERING

MRO & FLIGHT OPERATIONS SOFTWARE VENDOR PRODUCT CAPABILITIES

ASP Airline Airline Third- Engine Component Engineering Supply Purchasing Native Manpower Manpower Native Electronic Links to Links to Company

offered (EASA/ (EASA/FAR party overhaul maint. & maint. modules modules authoring/ time & detailed finance & Tech Log/ Boeing Airbus airN@v

FAR OPS 1) OPS 1& 145) facilities shop shop modules printing attendance planning accounting Flight Bag AHM /Airman

PURE-PLAY MRO SOLUTIONS

no data Yes Yes Yes Yes Yes Yes Yes AD Software

No Yes Yes Yes No Yes Yes Yes Yes Yes Yes Yes Interface Yes Yes Yes ADT Wings

No Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes No No Yes No No Aerosoft

No Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes No No CALM Systems

no data Yes Yes Yes No No no data no data no data Yes Yes Yes Yes No No No Cambridge Online

Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes interface Yes interface Yes No Cimber Air Data

No Yes Yes Yes No No Yes Yes Yes Yes interface No No Yes No No Commsoft

Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes No No No IBS Software Services

Yes Yes Yes Yes No Yes Yes Yes Yes Interface Yes interface Yes interface No Yes IFR

no data no data no data no data no data no data Yes Yes Yes no data no data no data no data no data no data no data Infospectrum

Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes interface Yes interface interface interface No MIRO

no data no data no data no data no data no data Yes Yes Yes no data Yes Yes no data no data no data no data MRO Software

No Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Mtce only No Yes Yes MXi

no data no data no data no data no data Yes Yes Yes Yes no data no data no data no data no data no data no data Pentagon 2000SQL

Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Rusada

Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes No Yes RAMCO

no data no data no data no data no data no data Yes Yes Yes no data no data no data no data no data no data no data SaSIMS

No Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes interface interface No No SWISS AMOS

no data no data no data no data no data no data Yes Yes Yes no data no data no data no data no data no data no data Tracware

No Yes Yes Yes No No Yes Yes Yes Yes Yes Yes Yes No Yes Yes TRAX

no data no data no data no data no data no data Yes Yes Yes no data no data no data no data no data no data no data Ultramain

No Yes Yes Yes No No Yes Yes Yes Yes Yes Yes No No No No Volartec

SPECIALIST POINT SOLUTIONS

No Yes Yes Yes Yes No Aerdata

no data no data no data Yes no data no data Yes ARMAC

no data no data no data no data no data no data Yes Yes Yes AviIT

No no data no data no data no data no data Yes Bytron

No Yes No Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Component Control

No No No No No No No No No No No No No Yes No No Conduce

Yes No Yes Yes No No Yes No No Yes Yes Yes Yes Yes No No EmpowerMX

Yes No Yes Yes Yes Yes Yes Yes Enigma

No Yes No No No Yes Yes Yes Euroscript

no data no data no data Yes no data no data Yes Yes iBaseT

no data Yes Yes No No No Yes Yes Yes IDMR Solutions

Yes Yes Yes Yes Yes Yes Yes interface interface interface Yes Yes Yes Infotrust

Yes Yes Yes Yes Yes Yes Yes Yes Yes MINT Media Interactive

No Yes Yes Yes No No Yes Omega

No No Yes Yes Yes Yes interface Yes interface Servigistics

Yes Yes No No No No Yes Smart4

No Yes Yes Yes Superstructure

No Yes No No No No Yes Yes T&A Systems

no data Yes Yes No No No Yes No No No No No No Yes no data no data AMT Flightman

no data Yes Yes No No No Yes No No No No No No Yes Yes no data Boeing/Jeppesen

Yes Yes Yes Yes No No Yes Yes Yes Osys

no data Yes no data No No No Yes No No No No No No Yes no data no data Skypaq

no data Yes Yes No No No Yes No No No No No No Yes no data no data Teledyne

ERP SOLUTIONS

Yes no data no data no data no data no data Yes Yes Yes no data no data no data no data no data no data no data IFS

Yes Yes Yes Yes Yes Yes Yes Yes Yes No Yes Yes Yes No Yes Yes HCL-Axon

no data No Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes No No No 2MoRO

no data no data no data no data no data no data Yes Yes Yes Yes Yes Yes Yes No No No Oracle

no data No Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes no data no data no data SAP

ISSUE NO. 74 • FEBRUARY/MARCH 2011 AIRCRAFT COMMERCE

46 I MAINTENANCE & ENGINEERING

EFB, but it is available through an providers. Modules include: Routine list that includes major original

interface. Maintenance; Assembly/Sub-assembly; equipment manufacturers (OEMs) and

Scheduled Maintenance; SB & AD defence contractors such as AAR, BAE

Management; Logistics; Finance; e- Systems, Boeing, Honeywell, ITT,

IFR documentation; Automatic Provisioning; Lockheed Martin, L-3, Northrop

IFR France has been in business for Labour Manhours; Technical Library; Grumman, Pratt & Whitney (P&W) and

over 20 years, and is a European Barcode; Data Import-Export; and Rolls Royce (RR). In addition, military

Aeronautic Defence & Space (EADS) Business Intelligence (new). The system organisations on four continents rely on

company, based in France with other links to the Airbus suite of products and Miro’s technology as a key element in

offices in Russia and Spain. It provides also has a native link to a project their defence system sustainment strategy.

maintenance software alongside catering planning tool. A link to Boeing’s AHM is Miro also currently has five airline

and flight operations systems. It has 79 under development. customers, including SAS and ExpressJet

airline customers, many of them from Airlines.

former French colonies, and added three GOLDesp is Miro’s flagship COTS

more in 2010. Infospectrum product for Aerospace & Defense, with

The maintenance product is AMASIS, InfoTrak is the MRO product from the AuRA application serving the needs

which is sold alongside catering and Infospectrum. Headquartered in India of the commercial MRO industry. In

operations systems. The solution is and USA, and with an office also in Oslo, recent years, Miro has focused its

offered as a hosted Application Service Norway, Infospectrum bought the Avexus research and development (R&D) and

Provider (ASP) system and is used by 21 product several years ago. With no data product marketing efforts on the

airlines, which makes it the most provided by the company, there are few migration of the GOLD product line to

successful ASP provided by any of the details available, and it is hard to clarify an SOA and Java (Web 2.0) platform.

vendors. the number of existing or new customers Reports from Miro indicate that

The technology migration story for from the current website. The company AuRA airline functionality will be

IFR France is interesting. In our last also has a SAP practice. integrated into a future version of

report it was migrating to .NET, but it GOLDesp. AuRA functional modules

now states that its technology is a include: Enterprise/Organisational

combination of IBM iPower for AS400 MIRO Technologies Modelling; Engineering;

and a Java GUI. This indicates that the Miro has been supplying aviation Materials/Warehouse; Procurement;

company seems to have decided to put a MRO systems for almost 30 years. Planning and Scheduling; Line

web veneer on an older mainframe Headquartered in California, USA the Maintenance; Maintenance Operations –

technology. company also opened a large office in Hangar Maintenance; Shop Maintenance;

AMASIS is used mainly by airlines Saudi Arabia in 2009. Miro has 90 Quality Control/Quality Assurance;

and some third-party maintenance employees and has a fast-growing client Training; Licenses and Certifications;

AMOS

A STORY OF SUCCESS

–

“THE BEST FIT IN TERMS OF FUNCTIONALITY,

PRICE AND MARKET STANDING,” STATES EASYJET

READ MORE ABOUT THE WORLD-CLASS M&E SOFTWARE SYSTEM AT

SWISS-AS.COM

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

47 I MAINTENANCE & ENGINEERING

Financial Interface; and Tools & Ground MXi continues to make progress,

Support Equipment Management. with sales in 2010 to at least two carriers, Pentagon 2000SQL

including Ethiopian Airlines. This is The company is still active on the

presumably as part of the 787 Dreamliner web, but no responses were returned by

IBM GOLDCare deal that Mxi has signed Pentagon 2000. Little is known about the

No information was received from with Boeing. The Maintenix customer company or their product.

IBM, so this entry is gathered from public base includes 22 live airlines. Like many

sources. Operating in several market of the larger MRO software companies,

segments, IBM’s Maximo product is sold MXi’s product runs on Java technology. Rusada

to support everything from computer The Maintenix modules include: Rusada is headquartered in

assets to facilities, power stations and Maintenance Program Management; Switzerland, with offices in the UK and

aircraft. The range of customers using the AD/SB Management; Configuration India. The company started in business in

application in a live environment today is Management; Records Management; 1987, and now has 95 staff. Rusada’s

believed to be wide, and includes airlines Diagnostics & Repair Modelling; Long- Envision product is built upon .NET and

as well as component maintenance Range Planning; Asset Maintenance FoxPro technologies, and now has a live

providers. Planning; Maintenance Control; Line installed base of 55 airlines, four of which

Maintenance; Maintenance Operations; were added in 2010. Rusada’s customers

Production Planning & Control; Hangar are regional or low-cost airlines, and use

MXi Maintenance; Engineering Support; Shop a combination of its full range of airline

MXi is one of the larger, tier-one Scheduling & Repair Routing; Shop MRO modules. Its largest airline

pure-play MRO software providers with Productions Control; Shop Maintenance customer operates a fleet of 75 aircraft.

over 250 employees (although this is Execution; Material Planning; Material Modules include: Configuration;

down from 306 in 2009). Founded in Procurement; Warehouse Management; System and Resource Manager;

1996, the company is based in Ottawa, Warranty Management; Material Receipt; Engineering Manager; Document and

Canada, but it also has offices elsewhere Demand Management; Tool Control & Records Manager; Quality Manager,

in the world: Washington and Seattle, Ground Support Equipment (GSE); Materials Manager; Maintenance

USA; Amsterdam, Netherlands; and Compliance Reporting; Quality Manager; Operations Manager; Finance

Sydney, Australia. More than 70% of Assurance; Reliability Analysis; Manager; Training Manager; Analytical

MXi’s business involves airline and third- Maintenance Cost Tracking; Financial Manager; and Safety Manager.

party commercial MRO. The company Reporting; and Human Resources (HR). Envision links to Boeing AHM and

works with implementation partners The Maintenix product has the Airbus airN@v and with a partner EFB.

worldwide including Pythian, Envision, capability to integrate with EFBs, the Unlike some of the other MRO software

TATA Consulting, Hexaware and Milcon Airbus Airman product and Boeing vendors, Envision includes a native

Gulf Group. AHM. finance and accounting capability and job

AMOS

A STORY OF SUCCESS

–

“AMOS HAS CLEARLY MET THE EXPECTATIONS AS A FULL SYSTEM FOR

MAINTENANCE OPERATIONS,” SAYS FINNISH AIRCRAFT MAINTENANCE

READ MORE ABOUT THE WORLD-CLASS M&E SOFTWARE

SYSTEM AT SWISS-AS.COM

ISSUE NO. 74 • FEBRUARY/MARCH 2011 AIRCRAFT COMMERCE

48 I MAINTENANCE & ENGINEERING

MXi integrates with Interactive Electronic

Technical Publications (IETPs) to provide a

seamless paperless environment for airline

operators. The company has a deal with Boeing

on Goldcare for the 787.

MROs and engine shops. Swiss-AS sells

exclusively in the commercial aviation

market and has no military customers.

The largest airline using the product is

Ryanair, which has a fleet of more than

250 aircraft.

TracWare

No data are available from the

company directly as part of this survey.

Based in the UK, the company still has an

internet presence and seems to be

growing.

card authoring. SaSiM, it is hard to comment on whether

it remains a true tier-one pure-play

solution provider. It is believed that the TRAX

Ramco Systems company offers: Maintenance and In 2010, TRAX was one airline away

After a strong growth phase in 2009, Engineering; Aircraft Configuration; from having 100 customers. In the past

Ramco has had a slower rate of new Component Maintenance; Inventory year, 11 new customers have selected the

customer uptake compared with the Module; Component Control; SB/AD new TRAX offering, which is now

market leaders like TRAX and Control; Tool Management; available on Java and .NET technology.

SwissAMOS, although it still managed to Publication/Library Control; Staff The company is leading the market with

secure five new customers, including Air Recording; and The Log Book. There is Swiss AviationSoftware, and continues to

India, during 2010. no recent news on their website. battle in a hard-fought market segment.

It continues to offer a wide range of The significant move into web technology

solutions on a technology-agnostic for TRAX was crucial to its continued

platform, which includes Java or .NET. Swiss AviationSoftware survival against the growing competition

The Group headquarters is in India, With 86 live airlines (and nine more from Swiss.

with the aviation division based in in the process of implementation), Swiss TRAX’s oldest customer remains Air

Lawrenceville, New Jersey. Ramco has AviationSoftware is hot on the heels of Atlanta, but a significant win was

more than 250 staff, with the main group TRAX as having the largest installed live registered in the past 18 months with Air

selling ERP solutions into the finance and customer base with true fully integrated Canada selecting TRAX to replace Mxi

manufacturing sectors as well as aviation. MRO software. Significant successes in in its home market. The range of TRAX

RAMCO is offered as an ASP with two 2010 include: the BMI Group, where it is customers includes airlines and MRO

small airlines live on the system. replacing Commsoft; and Royal Brunei, facilities.

Ramco implements its solutions itself, where it is replacing AMICOS. Unlike some of the other vendors, the

rather than through partners. It has live In 2010 AMOS added 13 new company does not offer an EFB but it has

customers in all the aviation market customers and expanded its functional a full range of modules including:

segments, including engine and footprint. The company works on Materials Management; Customer (Sales)

component overhaul. RAMCO continues implementation with Lufthansa Systems Orders; Requisitions; Orders; Receiving;

to have a marketing relationship with Americas, Singapore Technology Inventory; Picklist; Packing & Shipping;

Sabre Airline Solutions to sell the Ramco Aerospace and CrossConsense. Fleet Management; Engineering; MX

application as part of its own portfolio of Available modules include: Material Planning; MX Controller; Production;

solutions. Management; Engineering; Planning; Shop; Quality Assurance; Reliability;

Functionally, the modules on offer Production; Maintenance Control; Technical Records; Component

include: Customer Management; Component Maintenance; Quality Management; P/N Planning; P/N

Quoting; Part Sales Management; Control; Human Resources; Financial Engineering; P/N Shop; P/N Reliability;

Customer Order Management; Management; and Interfaces to numerous P/N Quality Assurance; Technical

Engineering; Materials Procurement; outside systems. Publications; Library (Tech Pubs); MEDL

Maintenance Projection; Planning & AMOS offers a Financial (Mfg Electronic Data Loader); TRAXDoc

Scheduling; Maintenance Operations – Management & Billing Module, (Document Management); Resource

Hangar Maintenance; Engine/Shop including Contract Management and Management; Training; Labor Capacity;

Maintenance & Line Maintenance; Financial Reports, but it does not replace Site (Hangar) Capacity; Shop Capacity

Quality Control/Quality Assurance; a proper general ledger system. AMOS Management; Electronic Data

Maintenance Human Resources; Licences interfaces to other financial accounting Interchange; B2B (Sales, Exchanges, and

& Certifications; Maintenance Financials; systems, for example SAP Finance. Repairs); and Manufacturer Onboard

Tools & Special Equipment Management; The technology underpinning AMOS Toolboxes.

and EFB. is Java, and the product has evolved over The Manufacturer Onboard Systems

21 years from an initial internal Swiss Air are offered via Web Services to allow for

Lines project. The AMOS product is used the exchange of data between the airline

SaSiM right across the spectrum of commercial and its ground-based systems. TRAX

With no data returned this year from aviation, from airlines to third-party offers interfaces for all the major aircraft

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

50 I MAINTENANCE & ENGINEERING

Rusada is one of the few vendors to favour the

Microsoft .NET technology platform.

a presence in the market place and seems

to continue to gain new customers and

expand its business for parts and

inventory optimisation. The other real

competition in this segment comes from

Servigistics and MCA.

AviIT

AviIT is a small UK-based company

that provides a library-management

solution for airlines and a low-cost

Aircraft Communications Addressing &

manufacturers. solutions addressing specific niche Reporting System (ACARS) message

requirements around the edge of aircraft decoder. The latest customer was Era

maintenance and logistics management. Helicopters, which selected the eMan

Ultramain There are even new entrants offering Solution in early 2011. No data were

No data were returned by Ultramain iPhone apps which may be an interesting received from AviIT, but it remains an

so this entry is gathered from public trend in the future. Easy integration is interesting point solution for airline

sources. The latest website does not always one of the keys to success in this maintenance departments.

indicate any new customers since the last market segment.

survey in 2009, but does indicate that the

product is moving to Java. Bytron

AerData UK-based Bytron offers the Skybook,

In March this year AerData, a Dutch- Skybook.aero and Skylight solutions to

Volartec based software provider for aircraft asset the airline market. Survey data was

Argentina’s Volartec continues to managers announced that it had acquired sketchy, but the company, formed in

grow rapidly and is a vendor worth a majority stake in Waviatech, the UK- 1984, is a niche player in the emerging

keeping an eye on. The .NET product, provider of STRAM for Aircraft Records, EFB market.

with the odd name Alkym, now has 26 and renamed the company under the Skybook modules available include:

live airlines, eight of which were added in AerData brand. Techlog; Flight Folder; Voyage; Library;

2010. The company has established an AerData also owns the EFPAC engine Cabin Crew; and additional applications.

office in Ireland in order to open the management software, and now For Skybook.aero, modules include:

European market place to this new combines the two offerings to the market Dispatch Monitor; Flight Briefing; Cabin

product. place. This is an interesting, and Crew Briefing; Operational Notices;

The company has 30 employees, of somewhat logical, move for AerData, Weather/NOTAM (Notice to Airmen)

whom 10 are software developers. which has a large customer base in the Watch; Digital Library; Analytics;

Alkym’s modules comprise: Maintenance engine- and aircraft-leasing business. It Dashboard; Global Situational Display

Control; Planning; Engineering; combines these two software products (GSD); and Flight Record Vault (FRV).

Reliability; Purchasing & Repairs; with the CMS software for aircraft lease

Inventory; Receiving & Shipping; Sales; and asset management. It will be

Technical Library; System Configuration; interesting to watch for further Component Control

Quality Assurance; and Human acquisitions in the future, since AerData Component Control is one of the

Resources. Alkym also includes a native may decide to move into the full MRO oddities of the airline MRO software

job card authoring capability, and a software domain. world. It provides a low-cost and light

manpower planning and scheduling tool. AerData is a relatively new 75-strong capability, mainly aimed at parts traders,

The company is currently developing an company operating from Amsterdam, small fixed-base operators (FBOs) and

interface to Boeing AHM and Airbus which has 20 airlines live using the component overhaul facilities. It remains

airN@v. STREAM and EFPAC products. This hugely successful in this market segment,

Volartec’s oldest customer is Pluna includes 15 new contracts that were having an almost monopolistic hold over

Uruguay, and the largest is the signed in the past 12 months. The the market. No data were received from

Venezuelan Air Force. Volartec carries company uses .NET technology for its the company, but it is confirmed that it

out all its own implementations. products. continues to flourish.

Specialist point solutions ARMAC Conduce Software

There has been a growth in the While no data were received for this Like a growing number of new

market for new specialist software year’s survey, ARMAC continues to have entrants into the aviation MRO point-

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

52 I MAINTENANCE & ENGINEERING

UK-based Commsoft is at the smaller end of the

pure-play segment. It continues to sell into

regional airlines, low-cost carriers and smaller

start-ups.

services, and energy and environment.

Headquartered in Luxembourg, the

company offers customers like Air France

the E-FOS suite of documentation

management solutions. The company has

added 18 new clients in the past 12

months, and while airlines account for

only 5% of its business at the moment, it

has three live airlines and is expecting to

add more.

The product is Java-based and is

developed by a team of over 80 staff out

of a total of 1,350. The E-FOS products

are used for browsing the illustrated parts

catalogue (IPC) and aircraft maintenance

solution space, Conduce is a year old and Manager. The product is Java-based and manual (AMM) and for integration into

provides a range of iPhone apps ranging the company’s customers include large an EFB.

from Fatigue Reporting to Technical airlines like US Airways and American

Logbook. While the company admits that Airlines. It currently has seven live

no customers are live yet, it has gained customers, and offers the solution as an iBaseT

five orders from customers, and is seeking ASP option. The company has been in With no data it is hard to comment

to break into the segment. The solutions business for 11 years and is based in the on the Solumina product set this year.

are offered as bespoke software through USA. The company is still marketing to the

to Software as a Service (SaaS). The aerospace and defence market for MRO

company is based in the UK, and the and PLM as a competitor to the other

software division comprises five staff, Enigma S1000D content providers, but it is hard

with a total of 20 in the parent company There are several Enigma products to determine from public announcements

Conduce Group. This is one of several available from the 100-man company how successful it continues to be.

young companies that are worth keeping based in the USA, Israel and Sweden.

an eye on. InService MRO, InService Job Card

Generator, InService Revision Manager, IDMR Solutions

InService EPC and Enigma 3C serve the IDMR Solutions Inc. Aviation

Corena technical publications niche market for Services group develops customised

One of only a handful of S1000D airlines and MRO shops. The company airline software designed to address

technical publication solution providers, has close ties to SAP and Oracle maintenance documentation needs. The

Corena continues to sell into the implementations, and the product can be company started developing customised

aerospace, automotive, energy and offered as an ASP option to reduce the desktop applications in 1998 and now

maritime industries. No data were cost of ownership and speed up offers a range of Maintenance and

returned for the survey, but from public implementation time. About half of Planning, Records, Flight Ops, and

domain information, Corena continues to Enigma’s business is in the airline Ground Ops products. No survey data

compete with the likes of InfoTrust, industry. Started in 1992, the product has were received from the company, but its

Enigma, Euroscript, iBaseT and PTC for evolved into Java technology. The website claims jetBlue and AtlasAir

aerospace contracts. product suite also aims to improve the among its customers.

scheduling of resources and links to

electronic tech logs and EFBs, with

EmpowerMX customers like KLM and FedEx. Infotrust

Unique among the point solutions InfoTrust continues to offer content

providers, EmpowerMX provides the management and aviation-specific job

maintenance half of a complete Euroscript card authoring and printing, as well as

engineering and supply solution to the Euroscript International provides work-content planning tools to the airline

airline market. This limits its market solutions for content lifecycle market place, which accounts for about

somewhat to larger airlines that have yet management that help customers design, 60% of sales. It also targets the non-

to invest heavily in a fully integrated build and run content management aviation sectors, which make up about

MRO solution, but just want to update operations of all sizes. With a market 10% of its business, with the balance

and modernise their maintenance presence in over 15 countries, Euroscript being military markets.

operation. Modules available include: serves customers in a variety of business The company started in 1994 and

Production Manager; Line Manager; sectors including the public sector, now has 230 staff based in the USA.

Maintenance Program Manager; aerospace, defence and transport, InfoTrust’s product set includes: Content

Maintenance Intelligence; and Planning manufacturing, life sciences, financial Management Systems

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

53 I MAINTENANCE & ENGINEERING

One of the companies in the leading pack of full,

integrated and deep-level software vendors is

SwissAviation Software. The company favours

JAVA technology and has large customers as well

as smaller operators.

(ATA/MilSpec/S1000D); Content Viewers

(ATA/MilSpec/S1000D); Tech Pubs

(Airlines/MRO - ATA/S1000D); Tech Ops

(EOs, EAs, Workcards - Airline/MRO -

ATA/S1000D); and Flight Ops (Ground

& EFB - ATA/Spec2300). The products

are offered as an ASP with three

customers using this form of product

delivery.

InfoTrust has a long history in the

airline market, with customers like

American Airlines using the products for

over a decade. The largest customer is

United Airlines and eight new customers

have been added in the past 12 months to

bring the company’s total airline Manage/m® is provided at no extra modules are also used in MINT TMS. It

customers to 40. This places it as one of costs to every customer holding an MRO is mainly MRO organisations that

the leaders in the field of content contract with Lufthansa Technik. The leverage its functionalities as a stand-

management and delivery for commercial modules of manage/m® comprise a alone system in order to manage

aviation. complete range of support functions that regulatory compliance. Using MINT

The InfoTrust product set covers a enable operators to manage their WebAssistant lays the foundation for

wide range of needs, and includes regulatory responsibilities. Quality MINT Shifts. The products are based

integration with manpower planning and monitoring, reliability trends, status upon Java and Delphi technologies.

finance systems. EFB functionality is reports, documentation and tracking of

available and it links to Boeing AHM and shop events in real-time are just a few of

Airbus airN@v. the products available as web services. Omega

The company claims to have secured Omega Airline Software from Texas,

25 new customers in past 12 months, USA has grown slightly to 15 employees

Jeppesen which is an impressive uptake, and may and 20 live customers, with three airlines

While no survey response was indicate a trend in the current climate being added in 2010. Now a .NET-based

available from Jeppesen, recent public towards ASP/SaaS type solutions to maintenance scheduling tool, AMES is

reports of NetJets’ subsidiary Executive software requirements. the product sold and implemented for

Jet Management indicates that it has commercial airlines. Advanced Planning

received US Federal Aviation and Scheduling is always a difficult task

Administration (FAA) approval to use an MINT Software Systems and Omega does well to serve a very

Apple iPad App from Jeppesen as an MINT has changed its name, but still specialist niche requirement.

alternative to paper aeronautical maps. offers a set of specialist tools for training Airlines joining the AMES community

This seems to be a precedent-setting move and regulatory compliance management in the past few years include Southwest

that will set the stage for this portable for aviation MRO organisations. This and Air Canada. Continental remains a

EFB solution to be rolled out by business year it teamed with SkySoft which long-standing customer with Delta being

and commercial aircraft operators alike. provides SimUnity, a small-scale software the largest user of AMES.

Executive Jet, which is the first product for airline simulator Omega Airline Software is a privately

publicly-disclosed customer of Jeppesen’s maintenance. MINT is a 29-strong owned company with headquarters in

so-called Mobile TC (terminal charts) German company which has offices in Dallas, USA. Airline maintenance

iPad App - which turns the tablet into a Colombia and UAE. Its largest client is software veteran Richard Reno founded

Class 1 kneeboard EFB - is now using United Airlines, and recently the the company in 1992, after 20 years

the solution as the sole reference for company added Thales and N3 Engine working in maintenance planning and

electronic charts. Overhaul Services as the latest customers. information technology for American and

It now has a total of 20. Continental Airlines.

Compliance & Training Management

Lufthansa Technik MINT TMS is applied to improve

Lufthansa Technik diversified into the management of Flight and Cabin Crew Superstructure

MRO point solution market several years Training, as well as Technical and Air Serving the Quality Assurance, Risk

ago with a bundled software package to Navigation Service Provider (ANSP) Management and Flight Safety market,

enhance and facilitate the execution of its Training. The Compliance Management Superstructure is a New-Zealand-based

third-party maintenance contracts. The & Shift Planning Suite MINT MRO is company with offices in the UK. It boasts

technical operations websuite, called used by MRO organisations to help them an impressive list of 95 airlines for its

manage/m®, allows commercial aircraft achieve regulatory compliance with the .NET Aviation Quality Database (AQD)

operators to manage all core functions of aviation authorities. MINT WebAssistant product, 10 of which were added in 2010

their fleet’s technical operations as an and MyMint are tools for staff alone. Customers range across the world

entirely web-based system online. qualification record keeping. These including US, European, Middle East and

ISSUE NO. 74 • FEBRUARY/MARCH 2011 AIRCRAFT COMMERCE

54 I MAINTENANCE & ENGINEERING

Point solutions, such as Smart4, are a growing

segment for airline maintenance operators to

consider adding to their existing MRO solutions.

This includes a growing number of iPhone

applications.

the data below are public domain

information.

IFS

IFS seems to have gone quiet in the

aviation MRO space, both commercial

airline and aerospace and defence. It is

hard to tell from their website which new

customers were added in 2010, or the size

of the installed customer base. It seems

Alitalia Maintenance Systems was the last

customer to be signed, as recently as this

year, with other customers quoted as

Bristow Helicopters, Aero-Dienst GmbH,

Asian airlines, and most recently the Smart EFB; Smart eFORMS; Smart K&L Microwave, Hawker Pacific, Ensign

Royal Saudi Air Force. PERFORMANCE; Smart LOAD; Smart Bickford, Todd Pacific Shipyards and

The company was formed in 1999 HUB; Smart ONTIME; Smart FUEL Lufthansa Technik Qantas.

and is staffed by 20 people. AQD MANAGER; Smart MISSION Previously known for deeper level

includes functional modules for: Safety MANAGER; Smart ALERT; Smart functionality for third-party MROs and

Management; Quality Management; Risk COMM; and Smart VIEW+. component overhaul shops, perhaps there

Management; Compliance Management; Smart4Aviation is an interesting new is a continued trend away from expensive

Remote Workbench; Offline Capture; entrant to watch out for in the EFB and ERP back towards pure-play software

Automatic Email Alerts; Flight Data maintenance/operations market space. and point solutions. Indeed aerospace &

Monitoring Integration; and Data Export defence (A&D) MRO represents only a

Utility (IATA STEADES). Superstructure’s small fraction of IFS’s total business in

customers include airlines and third-party T&A Systems other industry verticals.

MRO shops that have implemented the This German company, which started

tool in order to improve their in 1994, is an IT service and solution

maintenance error management and risk provider. 2MoRO (SAP)

management using the Jim Reason ‘Swiss T&A Systems has built up Started in 2004, this 24-man French

Cheese’ model of organisational risk methodologies and expertise in designing implementation and development team

analysis. solutions, especially in the areas of: approaches the aviation MRO market

network design; operations; storage and with Aero One, Aero-Webb and Bfly as a

backup systems; as well as Identity-, range of packaged solutions. The

SMART4 Resource- and Information-Management. company claims to have nine live

Smart4Aviation was formed in 2010 For aviation it offers Class 1 and Class 2 customers, including Safran (Turbomeca)

and is already staffed by a workforce of EFBs and supporting software modules which has been a user for four years.

40. The company’s headquarters are for line maintenance staff. The product, Indeed, Safran also represents 2MoRO’s

based in Amsterdam, but it also has Logipad, is developed in .NET and is live largest customer, managing an impressive

offices in Canada, India and Poland. The at five airlines. 20,000 engines on the system.

product is called SmartSuite and is The launch customer was LTU, which 2MoRO Solutions also works with

written in Java, aiming at the EFB and is still a user. The largest customer is other implementation partners, currently

line management functions including Etihad. The 50-strong company has an CapGemini, Viseo and Grupo Sypsa.

fuelling and flightcrew briefing. interesting partnership with Ultramain The solutions include job card

Customers already include Air and Jeppesen. management and a comprehensive

Canada, KLM Dutch Airlines, Finnair, Offerings include: Logipad Ground manpower planning capability. Of course

Emirates, flydubai, Thomas Cook and Air Service Module; Class-I Device; Class-II SAP R/3 has a powerful finance

Canada Jazz. Martinair was the initial Device; Cabin Device; Maintenance functional footprint, which is one of the

customer for the product set. The Device; Internet Update Module; and strengths of a full ERP solution. The

company is teamed with navAero, a long- eReporting Module. 2MoRO SAP solution currently lacks an

standing player in the EFB market, TFM EFB or integration with Boeing AHM or

Aviation, which is a fuel management Airbus airN@v.

consultancy, and the Polish IT company ERP solutions

AzimuthIT. These products offer a complete end-

The SmartSuite products include: to-end enterprise-wide software package, HCL-Axon (SAP)

Smart BRIEF; Smart BRIEF CABIN; hence the name enterprise resource AXON and HCL came together in

Smart NOTAM MANAGER; Smart planning (ERP) solutions. As with recent years to form a tailor-made

FUELING; Smart VIEW; Smart MET; previous surveys, this market segment aviation version of SAP R/3 called iMRO.

Smart OPS; Smart DOC; Smart EFF; yielded very low response rates. Most of It utilises the core of SAP R/3 and the

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

56 I MAINTENANCE & ENGINEERING

Component Control provides a low-cost system

for the management of parts. It has almost a

monopoly on this segment of the market.

of TCS’s proprietary solution

accelerators.

Undoubtedly SAP has a long future in

some form within the aviation MRO

market space, but the battle between the

pure-play market leaders and the ERPs

seems to be led firmly by the pure-play

domain.

Tier-two solutions

power of the SAP NetWeaver technology say that cMRO touches 22 applications A range of very small scale solutions

to produce a user-friendly, powerful in the Oracle E-Business Suite to provide continues to be available, but most of

aviation solution. The company claims to an air transportation maintenance and these are not designed for any company

have 75 users among the whole SAP A&D MRO service solution. It is not larger than an operator of light aircraft or

aviation community, with six new clear whether this means that the solution small helicopters. The list includes

customers for iMRO in the past 12 is a collection of other products in a suite, Airline-Software Inc (SPECTRUM),

months. or a collection of modules within a single Amelia, Aviation InterTec Services, AV-

AXON is a UK-based company that framework. Base Systems, Continuum Applied

has partnered with HCL from India, and Nevertheless, the company remains a Technologies (Corridor), Interglobe

has also opened a joint office in the US powerhouse in the ERP world, and is (USA), TRACER Corp, and QAV

and Malaysia. The company seems to therefore a strong contender for a Aviation Systems.

have a flexible approach to partnering for combined ERP and MRO system if a

implementations, quoting 2MoRO (see large organisation were seeking this type

elsewhere in this article) as a company and scope of solution. Summary

that it works with. In addition, HCL- The market situation for MRO

Axon partners with Lufthansa Systems software has evolved rapidly over the

and SAP itself. As Systems Integrators, SAP past two years. The core pure-play

HCL-Axon also works closely with Price Unlike Oracle, SAP’s strategy for the market has seen some movement, with

Waterhouse Coopers. aviation MRO domain seems to have clear front runners beginning to emerge

The iMRO solution is on offer as an been to leave it to partners like HCL- in TRAX and Swiss AviationSoftware.

ASP option, with one customer using it in Axon over the past two or three years. Other software companies, like Miro and

this mode. It offers the full range of SAP Again no direct data were returned as IFS and SAP, for example, seem to be

functionality, together with integration to part of the survey, so publicly available concentrating more on military

a third-party job card system, integration information has been used for this customers.

with Boeing AHM and Airbus airN@v. summary. Most vendors have completed the

Lufthansa is quoted as its largest It appears that the latest entrant into latest round in technology refreshes, but

customer. the ‘packaged SAP’ solution is Tata it is almost certain that the next

Consultancy Services (TCS) from India. A development from Java/.NET web

press release in late 2010 announced that technology is just around the corner, and

Oracle TCS had joined forces with British vendors will need to have well funded

Little is known about the Oracle Airways to launch ‘SWIFT MRO’. This R&D departments if they are to continue

cMRO solution, since the company has brought to the market a solution, based as realistic players.

not provided any data for the survey. on the latest SAP platform, which Another fascinating trend is the

Nevertheless, it is believed to be leverages British Airways’ best practices growth in point solutions around the

implemented in Korean Airlines, through a simplified Graphical User edges. Some like Smart4 offer iPhone

American Eagle, Siberian Airlines, Interface (GUI). applications. This lower cost of

OGMA, Mexicana Airlines, MRS TCS and British Airways claim to be development technology may spawn even

Logistica Brazil and the US Air Force. bringing this product to the MRO more diversity as niche solutions are

Oracle cMRO integrates service industry so that other organisations can provided to niche aviation MRO and

supply chain planning, scheduling, and benefit from an end-to-end solution, operations challenges.

fleet configuration management which can be scaled to support both the Any omissions or inaccuracies will be

capabilities in a single, real-time current and future needs of the industry. rectified in the next survey. Please contact

information system. The company’s The most interesting aspect of the press us to update our database in the

website sells the solution as a part of the release was the claim that the SWIFT meantime.

Oracle E-Business Suite, an integrated set MRO pre-configured solution provides

To download 100s of articles

of applications that automates business significant cost savings in terms of

like this, visit:

processes, and delivers reliable implementation when compared to

www.aircraft-commerce.com

information in one place. It goes on to competing solutions, because of the use

AIRCRAFT COMMERCE ISSUE NO. 74 • FEBRUARY/MARCH 2011

Potrebbero piacerti anche

- Aircraft IT MRO V9.1Documento76 pagineAircraft IT MRO V9.1Andy Lener Moran ColanNessuna valutazione finora

- Up in the Air: How Airlines Can Improve Performance by Engaging Their EmployeesDa EverandUp in the Air: How Airlines Can Improve Performance by Engaging Their EmployeesNessuna valutazione finora

- Aviation Maintenance Software - Something For Everyone - AVM June - July 2015Documento9 pagineAviation Maintenance Software - Something For Everyone - AVM June - July 2015Vierna Chiu LiganNessuna valutazione finora

- MRO IT Market Suppliers Survey PDFDocumento11 pagineMRO IT Market Suppliers Survey PDFadelNessuna valutazione finora

- Aicraft Commerce MRO IT SurveyDocumento19 pagineAicraft Commerce MRO IT SurveyPaul Saunders100% (1)

- Aircraft IT MRO Feb-Mar2015 4.1 PDFDocumento52 pagineAircraft IT MRO Feb-Mar2015 4.1 PDFkiran_prakash_11100% (1)

- List Aircraft IT VendorDocumento6 pagineList Aircraft IT VendorbudiaeroNessuna valutazione finora

- MRO Report-FINAlDocumento60 pagineMRO Report-FINAlKeval8 VedNessuna valutazione finora

- MCTF FY2016 Report PublicDocumento26 pagineMCTF FY2016 Report PublicfernandoNessuna valutazione finora

- Airline Inventory PoolingDocumento10 pagineAirline Inventory PoolingopoloplusNessuna valutazione finora

- GAT MRO Presentation June 2015Documento25 pagineGAT MRO Presentation June 2015Louis CarterNessuna valutazione finora

- Aircraft Spare PartsDocumento24 pagineAircraft Spare PartsLocatoryNessuna valutazione finora

- Aircraft IT Ops V10.4 - SEPTEMBER-OCTOBER 2021 - V10.4Documento77 pagineAircraft IT Ops V10.4 - SEPTEMBER-OCTOBER 2021 - V10.4TajouryNessuna valutazione finora

- Maximus Air ACMI Solutions - Jan2013Documento27 pagineMaximus Air ACMI Solutions - Jan2013Juan Carlos Letona100% (1)

- Boeing's E-Enabled AdvantageDocumento10 pagineBoeing's E-Enabled AdvantageGuwa BangetNessuna valutazione finora

- Mro 2022 12Documento32 pagineMro 2022 12PAULO SOUZA100% (1)

- A320 Maintenance MarketDocumento5 pagineA320 Maintenance MarketshotguntigerNessuna valutazione finora

- Full Service Airline Fleet MaintenanceDocumento7 pagineFull Service Airline Fleet Maintenancecurt013Nessuna valutazione finora

- Aircraft Commerce MK 13Documento6 pagineAircraft Commerce MK 13romixrayzenNessuna valutazione finora

- IT Strategies For Aircraft Configuration ManagementDocumento5 pagineIT Strategies For Aircraft Configuration Managementa1rm4n1Nessuna valutazione finora

- Aircraft ManagementDocumento176 pagineAircraft Managementnsmco4100Nessuna valutazione finora

- Airlines Investing in MRO IT, But Carefully - MRO Content From Aviation WeekDocumento7 pagineAirlines Investing in MRO IT, But Carefully - MRO Content From Aviation WeekFlapNessuna valutazione finora

- IATA Technical Reference Manual (ITRM) Ed01Rev01-2009Documento86 pagineIATA Technical Reference Manual (ITRM) Ed01Rev01-2009Francisco Carrasco0% (1)

- Industry Forecast MRO PDFDocumento29 pagineIndustry Forecast MRO PDFtwj84100% (2)

- RJ Vs Tprop Fuel Burn AnalysisDocumento7 pagineRJ Vs Tprop Fuel Burn Analysisavianova100% (1)

- Fleet Planning 2 SampleDocumento6 pagineFleet Planning 2 SampleAlbert DNessuna valutazione finora

- MRO - WhitepaperDocumento36 pagineMRO - Whitepaperrameshnathan100% (3)

- Sample ReportDocumento15 pagineSample ReportDuong Tong0% (1)

- Brochure Management Manual - EN PDFDocumento45 pagineBrochure Management Manual - EN PDFbudiaeroNessuna valutazione finora

- COVID 19 Outlook For Airlines' Cash BurnDocumento12 pagineCOVID 19 Outlook For Airlines' Cash BurnTatiana RokouNessuna valutazione finora

- Airworthiness Directive MGMTDocumento10 pagineAirworthiness Directive MGMTYousif Jamal MahboubaNessuna valutazione finora

- CAR M TRAINING Final EditedDocumento180 pagineCAR M TRAINING Final EditedAakash SinghNessuna valutazione finora

- Air India Cargo Finalised NewDocumento37 pagineAir India Cargo Finalised NewHrishikesh RaneNessuna valutazione finora

- The Economics of Low Cost Airlines - The Key Indian Players and Strategies Adopted For Sustenance.Documento51 pagineThe Economics of Low Cost Airlines - The Key Indian Players and Strategies Adopted For Sustenance.Suyog Funde100% (2)

- Redelivery Considerations in Aircraft Operating Leases v1Documento39 pagineRedelivery Considerations in Aircraft Operating Leases v1msm100% (1)

- Aircraft Maintenance & Engineering SystemDocumento30 pagineAircraft Maintenance & Engineering SystemAmeer Hamza100% (1)

- Basics of Aircraft Maintenance Reserve Development and ManagementDocumento35 pagineBasics of Aircraft Maintenance Reserve Development and ManagementJuan LopezNessuna valutazione finora

- Airline Schedules Planning and Route DevelopmentDocumento15 pagineAirline Schedules Planning and Route DevelopmentKIPYEGON KORIR100% (1)

- Jet Airways FactsheetDocumento34 pagineJet Airways FactsheetSonal JainNessuna valutazione finora

- Sample - MRO Software Market - Global Forecast To 2025Documento13 pagineSample - MRO Software Market - Global Forecast To 2025Shaji KumarNessuna valutazione finora

- Airline Business Process OptimizationDocumento26 pagineAirline Business Process OptimizationPeggytaBruinhart100% (1)

- Cost Benefit AnalysisDocumento99 pagineCost Benefit AnalysisAmulay OberoiNessuna valutazione finora

- Global OutsourcingDocumento11 pagineGlobal OutsourcingGraciete MariaNessuna valutazione finora

- MainDocumento41 pagineMainAastha ChhatwalNessuna valutazione finora

- Aircraft Maintenance Reserve PDFDocumento13 pagineAircraft Maintenance Reserve PDFKrishna RamlallNessuna valutazione finora

- Baggage TraceDocumento2 pagineBaggage TraceRahimi YahyaNessuna valutazione finora

- Aircraft Economic Life WhitepaperDocumento9 pagineAircraft Economic Life WhitepaperFlankerSparrowNessuna valutazione finora

- Values and Valuers: An Assessment of The Aircraft Valuation BusinessDocumento16 pagineValues and Valuers: An Assessment of The Aircraft Valuation BusinessMarius AngaraNessuna valutazione finora

- Research Article: Fleet Planning Decision-Making: Two-Stage Optimization With Slot PurchaseDocumento13 pagineResearch Article: Fleet Planning Decision-Making: Two-Stage Optimization With Slot PurchaseTrung HiếuNessuna valutazione finora

- Dimensions of CFM Shipping Stands - 1 PDFDocumento2 pagineDimensions of CFM Shipping Stands - 1 PDFHerix FerrerNessuna valutazione finora

- 767 PDFDocumento7 pagine767 PDFMag Leandre100% (1)

- The Aircraft Depreciation DilemmaDocumento19 pagineThe Aircraft Depreciation DilemmaAdyb A SiddiqueeNessuna valutazione finora

- IBM Maximo For Aviation Solution OverviewDocumento22 pagineIBM Maximo For Aviation Solution OverviewAamir MalikNessuna valutazione finora

- Aircraft Leasing and Financing Into IndiaDocumento9 pagineAircraft Leasing and Financing Into Indiajayshree.kariaNessuna valutazione finora

- Technical Operations: Preparing For Return To Service: Wed. 10 June 2020 8am (EDT) /2pm (CET)Documento29 pagineTechnical Operations: Preparing For Return To Service: Wed. 10 June 2020 8am (EDT) /2pm (CET)hero111983Nessuna valutazione finora

- IAA COM - Issue - 05 - Rev 00 Apr 2018 PDFDocumento453 pagineIAA COM - Issue - 05 - Rev 00 Apr 2018 PDFHarapan RachmanNessuna valutazione finora

- Aircraft Life Cycle CostDocumento18 pagineAircraft Life Cycle CostArun SasiNessuna valutazione finora

- Scheduling and Routing Models For Airline Systems - Simpson - MITDocumento175 pagineScheduling and Routing Models For Airline Systems - Simpson - MITEmmanuelNessuna valutazione finora

- Airline Route Profitability ModellingDocumento14 pagineAirline Route Profitability ModellingJulio PazNessuna valutazione finora

- SQL - Using Checkboxes in An Interactive Report With Primary Key - Stack OverflowDocumento3 pagineSQL - Using Checkboxes in An Interactive Report With Primary Key - Stack OverflowkhalidsnNessuna valutazione finora

- Cause and Effect Analysis Using The Ishikawa Fishbone & 5 WhysDocumento4 pagineCause and Effect Analysis Using The Ishikawa Fishbone & 5 WhyskhalidsnNessuna valutazione finora

- Candidate HandBookDocumento25 pagineCandidate HandBookkhalidsnNessuna valutazione finora

- OPENXAVA GuideDocumento10 pagineOPENXAVA GuidekhalidsnNessuna valutazione finora

- APEX Office Print ManualDocumento197 pagineAPEX Office Print ManualkhalidsnNessuna valutazione finora

- AutoCount Bill of MaterialDocumento12 pagineAutoCount Bill of MaterialkhalidsnNessuna valutazione finora

- SQL - Understanding Oracle Apex - Application.g - FNN and How To Use It - Stack OverflowDocumento4 pagineSQL - Understanding Oracle Apex - Application.g - FNN and How To Use It - Stack OverflowkhalidsnNessuna valutazione finora

- Upgrading Developer 6i With Oracle Applications 11i - 1 (ID 125767.1)Documento11 pagineUpgrading Developer 6i With Oracle Applications 11i - 1 (ID 125767.1)khalidsnNessuna valutazione finora

- Best Practices For Performance For Concurrent Managers in E-Business Suite (ID 1057802.1)Documento3 pagineBest Practices For Performance For Concurrent Managers in E-Business Suite (ID 1057802.1)khalidsnNessuna valutazione finora

- Attribute Management White Paper 11-5-10 PlusDocumento42 pagineAttribute Management White Paper 11-5-10 PluskhalidsnNessuna valutazione finora

- Procurement Contracts in R12 StepsDocumento45 pagineProcurement Contracts in R12 Stepskhalidsn75% (4)

- Tangerine - Breakfast Set Menu Wef 16 Dec UpdatedDocumento3 pagineTangerine - Breakfast Set Menu Wef 16 Dec Updateddeveloper louNessuna valutazione finora

- KDE11SSDocumento2 pagineKDE11SSluisgomezpasion1Nessuna valutazione finora

- A Content Analysis of SeabankDocumento13 pagineA Content Analysis of SeabankMarielet Dela PazNessuna valutazione finora

- SPC FD 00 G00 Part 03 of 12 Division 06 07Documento236 pagineSPC FD 00 G00 Part 03 of 12 Division 06 07marco.w.orascomNessuna valutazione finora

- Conducting Focus GroupsDocumento4 pagineConducting Focus GroupsOxfam100% (1)

- Lab 3 Arduino Led Candle Light: CS 11/group - 4 - Borromeo, Galanida, Pabilan, Paypa, TejeroDocumento3 pagineLab 3 Arduino Led Candle Light: CS 11/group - 4 - Borromeo, Galanida, Pabilan, Paypa, TejeroGladys Ruth PaypaNessuna valutazione finora

- OT Initial Assessment (OTIA) 2022-11-15Documento2 pagineOT Initial Assessment (OTIA) 2022-11-15funtikarNessuna valutazione finora

- How Chargers WorkDocumento21 pagineHow Chargers WorkMuhammad Irfan RiazNessuna valutazione finora

- IM1 Calculus 2 Revised 2024 PUPSMBDocumento14 pagineIM1 Calculus 2 Revised 2024 PUPSMBEunice AlonzoNessuna valutazione finora

- SEILDocumento4 pagineSEILGopal RamalingamNessuna valutazione finora

- Caring For Women Experiencing Breast Engorgement A Case ReportDocumento6 pagineCaring For Women Experiencing Breast Engorgement A Case ReportHENINessuna valutazione finora

- Evidence Prove DiscriminationDocumento5 pagineEvidence Prove DiscriminationRenzo JimenezNessuna valutazione finora

- Educationusa 2022globalguide Final Reduced SizeDocumento84 pagineEducationusa 2022globalguide Final Reduced SizeAnna ModebadzeNessuna valutazione finora

- Mueller Hinton Agar (M-H Agar) : CompositionDocumento2 pagineMueller Hinton Agar (M-H Agar) : CompositionRizkaaulyaaNessuna valutazione finora

- The Turning Circle of VehiclesDocumento2 pagineThe Turning Circle of Vehiclesanon_170098985Nessuna valutazione finora

- AISOY1 KiK User ManualDocumento28 pagineAISOY1 KiK User ManualLums TalyerNessuna valutazione finora

- Carnegie Mellon Thesis RepositoryDocumento4 pagineCarnegie Mellon Thesis Repositoryalisonreedphoenix100% (2)

- Multinational MarketingDocumento11 pagineMultinational MarketingraghavelluruNessuna valutazione finora

- MFE Module 1 .Documento15 pagineMFE Module 1 .Adarsh KNessuna valutazione finora

- XII CS Material Chap7 2012 13Documento21 pagineXII CS Material Chap7 2012 13Ashis PradhanNessuna valutazione finora

- Imabalacat DocuDocumento114 pagineImabalacat DocuJänrëýMåmårìlSälängsàngNessuna valutazione finora

- Module 5 What Is Matter PDFDocumento28 pagineModule 5 What Is Matter PDFFLORA MAY VILLANUEVANessuna valutazione finora

- Crypto Wall Crypto Snipershot OB Strategy - Day Trade SwingDocumento29 pagineCrypto Wall Crypto Snipershot OB Strategy - Day Trade SwingArete JinseiNessuna valutazione finora

- Simran's ResumeDocumento1 paginaSimran's ResumesimranNessuna valutazione finora

- CH-5 Further Percentages AnswersDocumento5 pagineCH-5 Further Percentages AnswersMaram MohanNessuna valutazione finora

- European Asphalt Standards DatasheetDocumento1 paginaEuropean Asphalt Standards DatasheetmandraktreceNessuna valutazione finora

- Nikos MIDI Pack - Chord Progression GuideDocumento5 pagineNikos MIDI Pack - Chord Progression GuideSamuel ThompsonNessuna valutazione finora

- SDSSSSDDocumento1 paginaSDSSSSDmirfanjpcgmailcomNessuna valutazione finora

- SW OSDocumento11 pagineSW OSErnest OfosuNessuna valutazione finora

- 18-MCE-49 Lab Session 01Documento5 pagine18-MCE-49 Lab Session 01Waqar IbrahimNessuna valutazione finora

- Hero Found: The Greatest POW Escape of the Vietnam WarDa EverandHero Found: The Greatest POW Escape of the Vietnam WarValutazione: 4 su 5 stelle4/5 (19)

- Sully: The Untold Story Behind the Miracle on the HudsonDa EverandSully: The Untold Story Behind the Miracle on the HudsonValutazione: 4 su 5 stelle4/5 (103)

- Dirt to Soil: One Family’s Journey into Regenerative AgricultureDa EverandDirt to Soil: One Family’s Journey into Regenerative AgricultureValutazione: 5 su 5 stelle5/5 (125)

- The Fabric of Civilization: How Textiles Made the WorldDa EverandThe Fabric of Civilization: How Textiles Made the WorldValutazione: 4.5 su 5 stelle4.5/5 (58)