Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FAR 2614-2616 Ref

Caricato da

Mark Domingo Mendoza0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

40 visualizzazioni3 paginesaassa

Titolo originale

FAR 2614-2616 ref

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentosaassa

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

40 visualizzazioni3 pagineFAR 2614-2616 Ref

Caricato da

Mark Domingo Mendozasaassa

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

2614-2616 a.

deposits credited by the bank but not yet

recorded by the company

Borrowing Costs; Cash and Cash Equivalents; Bank

b. outstanding checks

Reconciliation

c. deposits in transit

1. Capitalization of borrowing costs should cease d. bank charges not yet recorded by the company

a. when the asset is brought into use.

6. If the cash balance shown in a company’s

b. during periods in which active development is

accounting records is more than the correct cash

interrupted.

balance and neither the company nor the bank has

c. when expenditures are being incurred, borrowing

made any errors, there must be

costs are being incurred and activities that are

a. deposits credited by the bank but not yet

necessary to prepare the asset for its intended use

recorded by the company

or sale are in progress.

b. bank charges not yet recorded by the company

d. when substantially all of the activities necessary

c. outstanding checks

to prepare the asset for its intended use or sale are

d. deposits in transit

complete.

7. Maganda Co.’s accountant is preparing its March

2. PAS 23 does not apply to

bank reconciliation and has collected the ff data:

a. borrowing costs directly attributable to the

acquisition, construction, or production of Per books Per bank

inventories that are manufactured, or otherwise Mar. 1 bal P 11,600 P 10,000

produced, in large quantities on a repetitive basis. Mar. deposits 25,800 21,200

b. actual or imputed cost of equity, including Mar. O.Checks 27,800 29,000

preferred capital not classified as a liability. Note collected

c. borrowing costs directly attributable to the (inc. 10% interest) - 4,400

acquisition, construction, or production of a Mar. service charge - 20

qualifying asset measured at fair value. Mar. 31 bal 9,600 6,580

d. all of the above

Additionally, deposits in transit of P4,400 and

3. Which of the following is not a basic characteristic outstanding checks of P2,800 were from February’s

of a system of cash control? reconciliation. The correct cash balance at March 31

a. internal audits at irregular intervals should be:

b. use of a voucher system a. P13, 980 c. P11, 180

c. weekly deposit of all cash received b. P12, 780 d. P10, 960

d. segregated responsibility for handling and

For the next two questions.

recording cash

The following information is available from the cash

4. Which statement is true?

records of Hanu Company:

a. savings accounts are usually classified as cash on

the statement of financial position. April 31 Bank Reconciliation

b. cash equivalents are investments with original Bal per bank P262, 460

maturities of six months or less. DIT 19, 200

c. certificates of deposit are usually classified as cash OC 38, 000

on the statement of financial position. Bal per books P243, 660

d. companies include postdated checks and petty

cash funds as cash May Results Per bank Per book

May, deposits P107,840 P158,890

5. If the cash balance in a company’s bank statement May, checks 111,000 100,800

is more than the correct cash balance and neither May, bank charge 350 -

the company nor the bank has made any errors, May, note collected 30, 000 -

there must be Balance May 31 279,950 303,550

8. The deposits in transit as of May 31 is Interest rate swap receivable 50,000

a. P72, 050 c. P51, 050 Prepaid rent 50,000

b. P70, 250 d. P42, 050

a. P4, 600, 000 c. P2, 550, 000

9. The outstanding checks as of May 31 is b. P4, 550, 000 d. P2, 600, 000

a. P27, 800 c. P37, 150

13. On 1 January 2016, Bibi, Inc. signed a fixed-price

b. P27, 600 d. P31, 750

contract to have Rising Towers construct a plant

10. The following items were included as cash in the facility at a cost of P4M. Also on the same date, Bibi

books of Benching Co.: borrowed P4M payable in ten annual installments of

P400,000 plus interest at the rate of 10%, to finance

Savings acct at BDO P5,359

the construction cost. It was estimated that it would

Checking acct at Metro bank (1,100)

take three years to complete the project. During

Checking acct at BPI used for

2016, Bibi made deposits and payments and realized

payment of salaries 5,800

an investment income of P250,000. What amount

Postage stamps 107

should be reported as capitalized interest at

Postal money order 500

December 31, 2016?

A check marked “DAIF” 1,250

a. P190, 000 c. P150, 000

IOU from an employee 200

b. P165, 000 d. P440, 000

Petty cash fund (P324 in

expense receipts) 500 14. On 1 January 2018, Dante Company borrowed

Certificate of time deposit 5,000 P6M at an annual interest rate of 10% to finance the

costs of building a major power plant. Construction

The correct cash amount that should be reported is

commenced on the same date and cost P6M. The

a. P11, 835 c. P16, 511

excess borrowed funds were invested in short-term

b. P11, 011 d. P11, 511

securities from which the company generated

11. Ongki Corporation had the following account interest income of P60,000. The project was

balances at December 31, 2017: completed on November 30, 2018. What is the

carrying amount of the plant at November 30, 2018?

Cash in bank and on hand P1,500,000 a. P6, 550, 000 c. P6, 490, 000

Cash restricted for bonds payable b. P6, 000, 000 d. P6, 520, 000

due on June 30, 2018 3,000,000

Savings deposit set aside for 15. Based on the preceding question, the correct

dividends payable on journal entry is

June 30, 2018 500,000 a. Debit, Interest Income 60, 000

Time deposit 1,000,000 b. Debit, Property Plant Equipment 550, 000

c. Credit, Interest Expense 600, 000

The total cash and cash equivalents to be reported d. Credit, Interest Income 60, 000

as of December 31, 2017 is

a. P5, 000, 000 c. P6, 500, 000

b. P6, 000, 000 d. P5, 500, 000

12. Compute for the total amount considered as

financial assets using the given data below:

Cash P1,000,000

Accounts receivable 2,000,000

Furniture and Fixture 1,500,000

Investment in associate 300,000

Investment in shares-trading 500,000

Investment in debt securities-AFS 400,000

Investment in debt securities-HTM 350,000

SOLUTIONS: Investment in shares-trading 500,000

Investment in debt securities-AFS 400,000

1.) D. (2614 handout #7)

Investment in debt securities-HTM 350,000

2.) D. (2614 handout DIY #1) Interest rate swap receivable 50,000

TOTAL P4,600,000

3.) C. (2615 handout #18)

13.) C. (2614 handout DIY #4)

4.) A. (2615 handout DIY #1)

Specific cost P4,000,000

5.) B. (2616 handout #2) Interest rate * 10%

6.) B. (2616 handout #3) P 400,000

Realized income ( 250,000)

*computations Capitalized Interest P 150,000

7.) A. (2616 handout DIY #3) 14.) C. (2614 handout #10)

End bal. per book P 9,600 Specific cost P6,000,000

DIT (last month) 4,400 Interest rate * 10%

Service charge ( 20) P 600,000

Mar 31 correct cash bal. P 13,980 * 11/12

8.) B. (2616 handout #13) P 550,000

Less: Interest income ( 60,000)

DIT beg. P 19,200 Capitalized Interest P 490,000

Collec. this period 158,890 Cost 6,000,000

Total P178,090 Carrying Amount P6,490,000

Deposits credited by bank this prd. (107,840)

DIT end P 70,250 15.) A.

9.) A. (2616 handout #14) Journal Entry:

OC beg. P 38,000 Property, Plant, Equipment 490,000

Checks issued this prd. 100,800 Interest Income 60,000

Total P138,800 Interest Expense 550,000

Checks paid by bank this prd. ( 111,000)

OC end P 27,800

10.) A. (2615 handout DIY #5)

Savings acct at BDO P 5,359

Checking acct at BPI used for

payment of salaries 5,800

Postal money order 500

Petty cash fund 176

Total cash and cash equi. P 11,835

11.) B. (2615 handout #10)

All items are cash and cash equi. P6,000,000

12.) A. (2615 handout #3)

Cash P1,000,000

Accounts receivable 2,000,000

Investment in associate 300,000

Potrebbero piacerti anche

- 03 Quiz 1Documento9 pagine03 Quiz 1Camille MadlangbayanNessuna valutazione finora

- FAR.2917 Bank-ReconciliationDocumento4 pagineFAR.2917 Bank-ReconciliationmarielleNessuna valutazione finora

- ARC-FAR May 2022 Batch - 1st PreboardDocumento11 pagineARC-FAR May 2022 Batch - 1st PreboardjoyhhazelNessuna valutazione finora

- Assets MCDocumento19 pagineAssets MCpahuyobea cutiepatootieNessuna valutazione finora

- 6 Mock FAR Compre ExamDocumento12 pagine6 Mock FAR Compre ExamNatalia LimNessuna valutazione finora

- Cash and Cash Equivalents Mock TestDocumento3 pagineCash and Cash Equivalents Mock Testwednesday addamsNessuna valutazione finora

- FAR.2917 - Bank Reconciliation PDFDocumento4 pagineFAR.2917 - Bank Reconciliation PDFEyes Saw0% (1)

- This Study Resource Was: Quiz On Receivable FinancingDocumento3 pagineThis Study Resource Was: Quiz On Receivable FinancingKez MaxNessuna valutazione finora

- Auditing and Assurance Principles Pre TestDocumento9 pagineAuditing and Assurance Principles Pre TestKryzzel Anne JonNessuna valutazione finora

- Ap2904 Cash and Cash EquivalentsDocumento8 pagineAp2904 Cash and Cash EquivalentsMa Yra YmataNessuna valutazione finora

- Ap2904 Cash and Cash EquivalentsDocumento8 pagineAp2904 Cash and Cash EquivalentsMa Yra YmataNessuna valutazione finora

- Holy Cross College: B. Cause and EffectDocumento12 pagineHoly Cross College: B. Cause and EffectSam VeraNessuna valutazione finora

- Practical Accounting Problems IIDocumento12 paginePractical Accounting Problems IIRodNessuna valutazione finora

- Theory of Accounts - Multiple Choices: Cash Flows?Documento20 pagineTheory of Accounts - Multiple Choices: Cash Flows?Babylyn Navarro0% (1)

- AP.2904 - Cash and Cash Equivalents.Documento7 pagineAP.2904 - Cash and Cash Equivalents.Eyes Saw0% (1)

- Cash and Cash EquivalentsDocumento5 pagineCash and Cash EquivalentsSarah CaballeroNessuna valutazione finora

- Cash and Cash EquivalentDocumento6 pagineCash and Cash EquivalentNicole RC Del RosarioNessuna valutazione finora

- Steps in The Accounting Process (Cycle) : Lecture NotesDocumento2 pagineSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNessuna valutazione finora

- Unit 3 Exam Review - Chapters 7-9Documento6 pagineUnit 3 Exam Review - Chapters 7-9Vhia Rashelle GalzoteNessuna valutazione finora

- ACCTG102 MidtermQ1.5 Cash Make Up ExamDocumento6 pagineACCTG102 MidtermQ1.5 Cash Make Up ExamBarrylou Manayan100% (1)

- UCC MockBoardExam 2021 FAR 70Documento15 pagineUCC MockBoardExam 2021 FAR 70Y JNessuna valutazione finora

- ICARE Preweek APDocumento15 pagineICARE Preweek APjohn paulNessuna valutazione finora

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocumento3 pagineDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNessuna valutazione finora

- Intermediate Accounting 1Documento12 pagineIntermediate Accounting 1Walter Peralta100% (1)

- Audit of CashDocumento9 pagineAudit of CashRizzel SubaNessuna valutazione finora

- AP.3404 Audit of Cash and Cash EquivalentsDocumento5 pagineAP.3404 Audit of Cash and Cash EquivalentsMonica GarciaNessuna valutazione finora

- Rey Ocampo Online! Auditing Problems: Audit of InvestmentsDocumento4 pagineRey Ocampo Online! Auditing Problems: Audit of InvestmentsSchool FilesNessuna valutazione finora

- Elimination Questions Elimination QuestionsDocumento4 pagineElimination Questions Elimination QuestionsasffghjkNessuna valutazione finora

- ExtAud 3 Midterm Exam W AnswersDocumento12 pagineExtAud 3 Midterm Exam W AnswersJANET ILLESESNessuna valutazione finora

- Quiz 2nd YearDocumento4 pagineQuiz 2nd YearJeryco Quijano BrionesNessuna valutazione finora

- Advanced Financial Accounting and ReportingDocumento10 pagineAdvanced Financial Accounting and ReportingMary Rose RamosNessuna valutazione finora

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocumento3 pagineDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNessuna valutazione finora

- FAR 003 Financial Assets Part 1 PDFDocumento17 pagineFAR 003 Financial Assets Part 1 PDFGabriel JacaNessuna valutazione finora

- AP.2904 - Cash and Cash EquivalentsDocumento7 pagineAP.2904 - Cash and Cash EquivalentsRNessuna valutazione finora

- Audit of Cash and Cash Equivalents: Internal Control Measures For CashDocumento7 pagineAudit of Cash and Cash Equivalents: Internal Control Measures For CashmoNessuna valutazione finora

- Auditing Problems Ap.401 Audit of Cash and Cash Equivalents: Internal Control Measures For CashDocumento9 pagineAuditing Problems Ap.401 Audit of Cash and Cash Equivalents: Internal Control Measures For CashMarjorie PonceNessuna valutazione finora

- Far: Mock Qualifying Quiz 2 (Cash and Cash Equivalents & Loans and Receivables)Documento8 pagineFar: Mock Qualifying Quiz 2 (Cash and Cash Equivalents & Loans and Receivables)RodelLaborNessuna valutazione finora

- Steps in The Accounting Process (Cycle) : Lecture NotesDocumento12 pagineSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNessuna valutazione finora

- Mock Qualifying Exam PDFDocumento21 pagineMock Qualifying Exam PDFAngel Madelene BernardoNessuna valutazione finora

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocumento9 pagine2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNessuna valutazione finora

- Discussion Problems: FAR.2955-Accounting Process OCTOBER 2020Documento3 pagineDiscussion Problems: FAR.2955-Accounting Process OCTOBER 2020Edmark LuspeNessuna valutazione finora

- Nfjpia R11 Cup 1 - Fundamentals of Accounting EasyDocumento9 pagineNfjpia R11 Cup 1 - Fundamentals of Accounting EasyBlessy Zedlav LacbainNessuna valutazione finora

- Problem Solving (With Answers)Documento12 pagineProblem Solving (With Answers)sunflower100% (1)

- Journalizing To Adjusting Entries QuizDocumento3 pagineJournalizing To Adjusting Entries QuizNemar Jay Capitania100% (1)

- Bsa 1201-Financial Accounting and Reporting Preliminary Departmental Exam Reviewer Topic CoverageDocumento15 pagineBsa 1201-Financial Accounting and Reporting Preliminary Departmental Exam Reviewer Topic CoverageChjxksjsgskNessuna valutazione finora

- Fin ManDocumento7 pagineFin ManRyan Malanum AbrioNessuna valutazione finora

- Review of Accounting CycleDocumento4 pagineReview of Accounting CycleBrit NeyNessuna valutazione finora

- Pilot TestDocumento5 paginePilot Testkhanhhung1112004Nessuna valutazione finora

- Quiz 1Documento11 pagineQuiz 1Sam VeraNessuna valutazione finora

- 5.1 Seatwork Quiz Receivable FinancingDocumento2 pagine5.1 Seatwork Quiz Receivable FinancingSean Aaron Segucio0% (1)

- Long Quiz 1 Acc 205Documento6 pagineLong Quiz 1 Acc 205Philip LarozaNessuna valutazione finora

- Far Eastern University - Makati: Discussion ProblemsDocumento2 pagineFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNessuna valutazione finora

- RTP Accounting CA Foundation May 18Documento35 pagineRTP Accounting CA Foundation May 18kanishk bahetiNessuna valutazione finora

- Afar 2019Documento10 pagineAfar 2019mameneses.upNessuna valutazione finora

- 6836 Note Payable and Debt RestructureDocumento2 pagine6836 Note Payable and Debt RestructureJeslyn Kris Alobba SaguiboNessuna valutazione finora

- 1st Long Exam (Summer 2022) WITHOUT ANSWERDocumento10 pagine1st Long Exam (Summer 2022) WITHOUT ANSWERDaphnie Kitch CatotalNessuna valutazione finora

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Da EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Da EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Valutazione: 5 su 5 stelle5/5 (1)

- 21St Century Computer Solutions: A Manual Accounting SimulationDa Everand21St Century Computer Solutions: A Manual Accounting SimulationNessuna valutazione finora

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsDa EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNessuna valutazione finora

- When To Be RECOGNIZED?: A. Current LiabilitiesDocumento10 pagineWhen To Be RECOGNIZED?: A. Current LiabilitiesMark Domingo MendozaNessuna valutazione finora

- A. Invested Cash in The Business, P 60,000Documento3 pagineA. Invested Cash in The Business, P 60,000Mark Domingo Mendoza100% (1)

- Retail SIPF 18july22Documento12 pagineRetail SIPF 18july22Mark Domingo MendozaNessuna valutazione finora

- Advanced Financial Accounting and ReportingDocumento7 pagineAdvanced Financial Accounting and ReportingMark Domingo MendozaNessuna valutazione finora

- Bir Form1901Documento4 pagineBir Form1901Mark Domingo MendozaNessuna valutazione finora

- December 8 DiscussionDocumento6 pagineDecember 8 DiscussionMark Domingo MendozaNessuna valutazione finora

- Audit - Mock Board Examinations - Answer Keys - Sy19-20Documento1 paginaAudit - Mock Board Examinations - Answer Keys - Sy19-20Mark Domingo MendozaNessuna valutazione finora

- SssssDocumento26 pagineSssssMark Domingo MendozaNessuna valutazione finora

- AP Problems 2016Documento26 pagineAP Problems 2016RosejaneLim100% (1)

- The Environment in Which Projects OperateDocumento4 pagineThe Environment in Which Projects OperateMark Domingo MendozaNessuna valutazione finora

- ProjectManagement-1 16 21Documento47 pagineProjectManagement-1 16 21Mark Domingo MendozaNessuna valutazione finora

- Aud FeDocumento11 pagineAud FeMark Domingo MendozaNessuna valutazione finora

- Regulatory Framework For Business Transactions: ST NDDocumento9 pagineRegulatory Framework For Business Transactions: ST NDMark Domingo MendozaNessuna valutazione finora

- Far FeDocumento9 pagineFar FeMark Domingo Mendoza100% (1)

- Types of Business According To Activities: (WEEK 5)Documento12 pagineTypes of Business According To Activities: (WEEK 5)Mark Domingo MendozaNessuna valutazione finora

- Midterm Exams - 1ST YrDocumento7 pagineMidterm Exams - 1ST YrMark Domingo MendozaNessuna valutazione finora

- FW: Covid-19 Official Test Result: 1 MessageDocumento3 pagineFW: Covid-19 Official Test Result: 1 MessageMark Domingo MendozaNessuna valutazione finora

- Plus For Midterm Exams.Documento1 paginaPlus For Midterm Exams.Mark Domingo MendozaNessuna valutazione finora

- Consideration of Internal ControlDocumento21 pagineConsideration of Internal ControlMark Domingo MendozaNessuna valutazione finora

- Auditing and Assurance Principles (Aud 1)Documento15 pagineAuditing and Assurance Principles (Aud 1)Mark Domingo MendozaNessuna valutazione finora

- Auditing and Assurance Principles: Chapter Two: The Professional StandardsDocumento25 pagineAuditing and Assurance Principles: Chapter Two: The Professional StandardsMark Domingo MendozaNessuna valutazione finora

- Financial Accounting and ReportingDocumento3 pagineFinancial Accounting and ReportingMark Domingo MendozaNessuna valutazione finora

- Audit - Mock Board Examination - Sy2019-20Documento15 pagineAudit - Mock Board Examination - Sy2019-20Mark Domingo MendozaNessuna valutazione finora

- Specification of Chuwi Herobook ProDocumento1 paginaSpecification of Chuwi Herobook ProMark Domingo MendozaNessuna valutazione finora

- 2ND Year QualiDocumento4 pagine2ND Year QualiMark Domingo MendozaNessuna valutazione finora

- Far 05 - Long Quiz2Documento11 pagineFar 05 - Long Quiz2Mark Domingo MendozaNessuna valutazione finora

- QuizDocumento15 pagineQuizMark Domingo Mendoza100% (1)

- ABM1 Week1 LPS1 Introduction To AccountingDocumento4 pagineABM1 Week1 LPS1 Introduction To AccountingMark Domingo MendozaNessuna valutazione finora

- Far 05 - Prelim ExamsDocumento5 pagineFar 05 - Prelim ExamsMark Domingo MendozaNessuna valutazione finora

- Corporate Income TaxDocumento6 pagineCorporate Income TaxMark Domingo MendozaNessuna valutazione finora

- Group 1 - Tactical Accounting and Financial Information Systems PDFDocumento9 pagineGroup 1 - Tactical Accounting and Financial Information Systems PDFX BorgNessuna valutazione finora

- Prospect Theory - Bounded RationalityDocumento57 pagineProspect Theory - Bounded RationalityalishehzadNessuna valutazione finora

- Complying With Ohio Consumer Law - A Guide For BusinessesDocumento32 pagineComplying With Ohio Consumer Law - A Guide For BusinessesMike DeWineNessuna valutazione finora

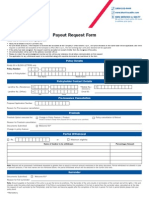

- Payout Request FormDocumento2 paginePayout Request FormSATHISHLATEST2005100% (11)

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Documento58 pagineConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNessuna valutazione finora

- International Finance PresentationDocumento29 pagineInternational Finance PresentationY.h. TariqNessuna valutazione finora

- Income Tax Payment Procedures in TanzaniaDocumento3 pagineIncome Tax Payment Procedures in Tanzaniashadakilambo100% (1)

- Abandono de PozosDocumento60 pagineAbandono de PozosIvan Reyes100% (1)

- Green REIT PLC Annual Report 2016Documento176 pagineGreen REIT PLC Annual Report 2016Mihir JoshiNessuna valutazione finora

- Accounting For Franchise Operations2Documento21 pagineAccounting For Franchise Operations2Jaira Mae AustriaNessuna valutazione finora

- Daily Sales Calls - RM RA - CMNV BlankDocumento7 pagineDaily Sales Calls - RM RA - CMNV BlankSatou SakieNessuna valutazione finora

- Abm 2 DiagnosticsDocumento2 pagineAbm 2 DiagnosticsDindin Oromedlav LoricaNessuna valutazione finora

- Mock Licensure Examination For CPA Final Room AssignmentDocumento3 pagineMock Licensure Examination For CPA Final Room AssignmentAndrew ManaloNessuna valutazione finora

- Capital StructureDocumento4 pagineCapital StructureNaveen GurnaniNessuna valutazione finora

- Managerial and Legal Economics: Debarchana ShandilyaDocumento28 pagineManagerial and Legal Economics: Debarchana ShandilyaPritam RoyNessuna valutazione finora

- Conceptual Framework For Financial Reporting ReviewerDocumento7 pagineConceptual Framework For Financial Reporting ReviewerPearl Jade YecyecNessuna valutazione finora

- Sip Project SBI HomeloanDocumento45 pagineSip Project SBI HomeloanAkshay RautNessuna valutazione finora

- Synopsis of Project GSTDocumento4 pagineSynopsis of Project GSTamarjeet singhNessuna valutazione finora

- Question Bank With Answers: Module-1Documento52 pagineQuestion Bank With Answers: Module-1kkvNessuna valutazione finora

- KPK Tehsil Municipal Officer (TMO) Syllabus 2017-2018Documento1 paginaKPK Tehsil Municipal Officer (TMO) Syllabus 2017-2018Hidayat UllahNessuna valutazione finora

- Ejercicios Clase 3-1-1Documento1 paginaEjercicios Clase 3-1-1Antoine LoefflerNessuna valutazione finora

- MONEY Laundering and Hawala TransactionDocumento22 pagineMONEY Laundering and Hawala Transactionsamad_bilgi3552100% (4)

- Answers 142-162Documento19 pagineAnswers 142-162AKHLAK UR RASHID CHOWDHURYNessuna valutazione finora

- What Is Reconstruction?: Need For Internal ReconstructionDocumento31 pagineWhat Is Reconstruction?: Need For Internal Reconstructionneeru79200079% (14)

- Case 2Documento4 pagineCase 2Chris WongNessuna valutazione finora

- Abm Acctg2 Reading Materials 2019Documento27 pagineAbm Acctg2 Reading Materials 2019Nardsdel RiveraNessuna valutazione finora

- Test 1 Ma2Documento15 pagineTest 1 Ma2Waseem Ahmad Qurashi63% (8)

- LawDocumento10 pagineLawTannaoNessuna valutazione finora

- DS700 Carer Alllowance Claim FormDocumento28 pagineDS700 Carer Alllowance Claim FormHassan Mussa KhamisNessuna valutazione finora

- The West Bengal Land Reforms Act, 1955 PDFDocumento121 pagineThe West Bengal Land Reforms Act, 1955 PDFaditya dasNessuna valutazione finora