Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Class Xii Money Banking

Caricato da

Anuj0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

230 visualizzazioni2 pagine1. The document outlines the key concepts related to money and banking that will be covered in the Economics class for grade 12. It includes definitions of important terms like central bank, fiat money, commercial bank, and money supply.

2. The document lists various questions students will need to answer related to concepts like transaction money, barter systems, functions of central banks, and credit creation by commercial banks. It categorizes the questions as knowledge-based, understanding-based, or higher-order thinking skills questions.

3. Students will need to demonstrate understanding of how commercial banks create money through the multiplier effect as well as the various quantitative and qualitative tools central banks use to regulate money supply and credit in the economy

Descrizione originale:

Ig

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documento1. The document outlines the key concepts related to money and banking that will be covered in the Economics class for grade 12. It includes definitions of important terms like central bank, fiat money, commercial bank, and money supply.

2. The document lists various questions students will need to answer related to concepts like transaction money, barter systems, functions of central banks, and credit creation by commercial banks. It categorizes the questions as knowledge-based, understanding-based, or higher-order thinking skills questions.

3. Students will need to demonstrate understanding of how commercial banks create money through the multiplier effect as well as the various quantitative and qualitative tools central banks use to regulate money supply and credit in the economy

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

230 visualizzazioni2 pagineClass Xii Money Banking

Caricato da

Anuj1. The document outlines the key concepts related to money and banking that will be covered in the Economics class for grade 12. It includes definitions of important terms like central bank, fiat money, commercial bank, and money supply.

2. The document lists various questions students will need to answer related to concepts like transaction money, barter systems, functions of central banks, and credit creation by commercial banks. It categorizes the questions as knowledge-based, understanding-based, or higher-order thinking skills questions.

3. Students will need to demonstrate understanding of how commercial banks create money through the multiplier effect as well as the various quantitative and qualitative tools central banks use to regulate money supply and credit in the economy

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

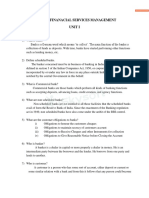

KIIT WORLD SCHOOL, PITAMPURA - SESSION 2019-20

CLASS: XII SUBJECT: ECONOMICS

Unit- 2 Money and Banking

Sr. No. Knowledge Based Marks

1 State components of transaction money. 1each

2 What is barter? 1

3 What is a central bank? 1

4 Define CRR, SLR, Bank rate, Open market operation. 1 each.

5 Define bank money. 1

6 Define fiat money. 1

7 What is a commercial bank? 1

8 Define money supply. 1

9 Which are the qualitative monetary measures? 1

10 Mention the quantitative monetary measures available to the central bank 1

11 What is high powered money? 1

12 Which measure of money supply is most liquid and why? 1

13 Currency and coins is also termed as ‘Legal Tender Money’. State true or false 1

with reason.

14 Identify a commercial bank from the following:

a) LIC b) UTI c) SBI d) None of the above

15 Mention any three defects of barter system 3

16 State whether money is stock variable or flow variable.

17 State any three main functions of Central Bank. Describe and one of them 3

18 Define the following: 3

a) Moral suasion

b) Legal Reserve Ratio

c) Bank of issue.

19 Distinguish between Central Bank and Commercial Bank. 3

20 What is a barter system? What are its drawbacks? 3

21 What are the cost associated with lack of double coincidence of wants? 3

22 State whether money is stock variable or flow variable. 3

23 What do you understand by marginal reserve requirements?

S. No. Understanding Based

1 What is meant by double coincidence of wants? 3

2 ‘Legal tender money is also known as fiat money.’ Why? 3

3 How is high powered money (H) different from money (M)? 4

4 Do you consider a commercial bank as ‘creator of money’ in the economy? Give 4

reasons for your answer.

5 Elaborate the following functions of central bank: 4

Issue of currency

Banker to the govt .

Bankers bank and supervisor

Controller of credit and money supply

Lender of last resort

Clearing house

Custodian of foreign exchange

Exchange controller

KIIT WORLD SCHOOL, PITAMPURA - SESSION 2019-20

CLASS: XII SUBJECT: ECONOMICS

6 Define money multiplier. How is the value of multiplier determined? What 4

ratios play an important role in determining the value of money multiplier?

8 Differentiate between commercial bank and central bank. 4

9 How is the value of multiplier determined?

10 What are the monetary policy instruments of central bank for credit control? 4

Application

1 Explain the process of credit creation by commercial banks. With numeric 4

example.

2 State the quantitative and qualitative instruments of controlling quantity of 4

credit.

3 How does RBI control the availability of credit by setting the bank Rate? Explain 4

4 How do commercial banks control the availability of credit by open market 4

operations? Explain

5 Changes in CRR affect credit creation and credit availability. How? 4

6 Calculate and show the working of money creation by commercial banks if 4

Primary deposits is Rs1250crore and LRR is 10%

7 If the money created by the banks is Rs500 and the legal reserve ratio is 20%, 4

find the value of primary deposit?

8 If the money created by the banking system is Rs 1000 and the primary deposit

is Rs250, what is the value of deposit multiplier and the legal reserve ratio?

S.No. HOTS

1 How bank Rate is different from Repo rate and reverse repo rate? 3

2 Differentiate quantitative instruments of credit control from qualitative 3

instruments.

3 Whether the following changes by the Reserve Bank will increase the money 3

supply or decrease the money supply?

a) Rise in CRR

b) Purchase of securities in open market

c) RBI increases the margin from 40% to 60%.

d) RBI reduces the statutory liquidity ratio.

e) Decrease in bank rate.

4 Calculate the legal reserve requirements if initial deposit is Rs1200 crore leads

to creation of total deposits of Rs6000 crore.

Potrebbero piacerti anche

- Money and Banking-Question BankDocumento6 pagineMoney and Banking-Question BankHari prakarsh NimiNessuna valutazione finora

- Money and Banking - WorksheetDocumento1 paginaMoney and Banking - WorksheetHarsh VermaNessuna valutazione finora

- Stryker Corporation: Capital BudgetingDocumento4 pagineStryker Corporation: Capital BudgetingShakthi RaghaviNessuna valutazione finora

- Economics Money and Banking Worksheet Set BDocumento6 pagineEconomics Money and Banking Worksheet Set Bdennis greenNessuna valutazione finora

- Unit - Vii: Money and Banking: Material Downloaded From SUPERCOP 1/6Documento6 pagineUnit - Vii: Money and Banking: Material Downloaded From SUPERCOP 1/6Aasif NengrooNessuna valutazione finora

- 12 Economics Notes Macro Ch02 Money and BankingDocumento6 pagine12 Economics Notes Macro Ch02 Money and BankingRitikaNessuna valutazione finora

- (123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Documento10 pagine(123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Công MinhNessuna valutazione finora

- Xii MB Ui1 QBDocumento15 pagineXii MB Ui1 QBMishti GhoshNessuna valutazione finora

- BankDocumento12 pagineBankjesimayasminj131Nessuna valutazione finora

- Board Based QuestionsDocumento1 paginaBoard Based Questions23 Alaniya SiviNessuna valutazione finora

- Worksheet - Money & Banking - 1Documento2 pagineWorksheet - Money & Banking - 1Alans TechnicalNessuna valutazione finora

- 17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingDocumento4 pagine17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingSimon JosephNessuna valutazione finora

- Quick Revision (M&B PDFDocumento4 pagineQuick Revision (M&B PDFTrijal SehgalNessuna valutazione finora

- SuggestionDocumento6 pagineSuggestionMeheraf ShamimNessuna valutazione finora

- English WorksheetDocumento31 pagineEnglish WorksheetBinoy TrevadiaNessuna valutazione finora

- Concept Classes: No. 202 Second Floor E Block Market, Vikas PuriDocumento3 pagineConcept Classes: No. 202 Second Floor E Block Market, Vikas PuriKunal SardanaNessuna valutazione finora

- Money and BankingDocumento7 pagineMoney and BankingBishal GuptaNessuna valutazione finora

- Answer Scheme TUTORIAL CHAPTER 4Documento13 pagineAnswer Scheme TUTORIAL CHAPTER 4niklynNessuna valutazione finora

- The Economics Of: Central BankingDocumento32 pagineThe Economics Of: Central Bankingelizabeth bernalesNessuna valutazione finora

- Chapter Fifteen Money and Banking: Answers To End-Of-Chapter QuestionsDocumento7 pagineChapter Fifteen Money and Banking: Answers To End-Of-Chapter QuestionsnickNessuna valutazione finora

- Banking & Its Operation: Finance SpecialisationDocumento4 pagineBanking & Its Operation: Finance SpecialisationManojkumar HegdeNessuna valutazione finora

- Interview Questions For Bank in BangladeDocumento7 pagineInterview Questions For Bank in BangladeKhaleda Akhter100% (1)

- 2moneybanking 211118133229Documento33 pagine2moneybanking 211118133229geetaNessuna valutazione finora

- Money and Banking ANSWER KEYDocumento11 pagineMoney and Banking ANSWER KEYmeeraNessuna valutazione finora

- Indian Banking Sector ReportDocumento59 pagineIndian Banking Sector Reportraviawade100% (2)

- Banking Finanacial Services Management Unit I: Two Mark QuestionsDocumento21 pagineBanking Finanacial Services Management Unit I: Two Mark QuestionsIndhuja MNessuna valutazione finora

- Banking Finanacial Services Management Unit I: Two Mark QuestionsDocumento10 pagineBanking Finanacial Services Management Unit I: Two Mark QuestionsBose GRNessuna valutazione finora

- Money and BankingDocumento5 pagineMoney and BankingAlans TechnicalNessuna valutazione finora

- Finance 1Documento12 pagineFinance 1Mary Ann AntenorNessuna valutazione finora

- Topic 1 BNK 501Documento39 pagineTopic 1 BNK 501Veronica MishraNessuna valutazione finora

- Leec103 Pages 5Documento3 pagineLeec103 Pages 5sdsdsd72Nessuna valutazione finora

- Chap 1 - Material (Student)Documento2 pagineChap 1 - Material (Student)Nguyễn TuấnNessuna valutazione finora

- CHAP - 01 - An Overview of Banking Sector - Revised PDFDocumento47 pagineCHAP - 01 - An Overview of Banking Sector - Revised PDFQuỳnh TrangNessuna valutazione finora

- Revision Notes For Class 12 Macro Economics Chapter 3 - Free PDF DownloadDocumento7 pagineRevision Notes For Class 12 Macro Economics Chapter 3 - Free PDF DownloadVibhuti BatraNessuna valutazione finora

- Monetary Economics Problem SetDocumento3 pagineMonetary Economics Problem SetRibuNessuna valutazione finora

- Bank Interview Question For Business GraduateDocumento7 pagineBank Interview Question For Business GraduateHumayun KabirNessuna valutazione finora

- FM - 19bsp3027Documento20 pagineFM - 19bsp3027unnati khandelwalNessuna valutazione finora

- Merchant Banking and Financial ServicesDocumento5 pagineMerchant Banking and Financial ServicespecmbaNessuna valutazione finora

- Banking Important Exam Question and TermsDocumento3 pagineBanking Important Exam Question and TermsAnkit JajalNessuna valutazione finora

- Chapter 1Documento16 pagineChapter 1koushik kumarNessuna valutazione finora

- Money and BankingDocumento17 pagineMoney and BankingHydra_x1gNessuna valutazione finora

- Central Bank and Its FunctionsDocumento7 pagineCentral Bank and Its FunctionsayushNessuna valutazione finora

- FSBI Important QuestioinsDocumento6 pagineFSBI Important QuestioinsNagarjuna SunkaraNessuna valutazione finora

- Probable Ques3 &4Documento3 pagineProbable Ques3 &4avikumar001Nessuna valutazione finora

- Banking: 1. Commercial BankDocumento6 pagineBanking: 1. Commercial BankAryan RawatNessuna valutazione finora

- Unit 2 Banking 12thDocumento42 pagineUnit 2 Banking 12thachulakshmymadhuNessuna valutazione finora

- 01 - What Is MoneyDocumento38 pagine01 - What Is MoneyEdric JadeNessuna valutazione finora

- Treasury & Risk Management: Post Graduate Diploma in Management (ePGDM)Documento9 pagineTreasury & Risk Management: Post Graduate Diploma in Management (ePGDM)Jitendra YadavNessuna valutazione finora

- Banking Law Questions - 024016Documento4 pagineBanking Law Questions - 024016Nanditha SwamyNessuna valutazione finora

- Session 1.1Documento41 pagineSession 1.1Saugat DangalNessuna valutazione finora

- ch-2 MONEY andBANKINGDocumento19 paginech-2 MONEY andBANKINGKkNessuna valutazione finora

- The Punjab National Bank: Nirav Modi Scam, 2018: International Journal of Advanced Research and DevelopmentDocumento3 pagineThe Punjab National Bank: Nirav Modi Scam, 2018: International Journal of Advanced Research and DevelopmentTejaswiniNessuna valutazione finora

- Princ Ch29monetarysystem 141116093415 Conversion Gate02 PDFDocumento55 paginePrinc Ch29monetarysystem 141116093415 Conversion Gate02 PDFDila OthmanNessuna valutazione finora

- ASSIGNMENT 2 Financial Market &institution - Docx To BeDocumento2 pagineASSIGNMENT 2 Financial Market &institution - Docx To BealemayehuNessuna valutazione finora

- Money and BankingDocumento39 pagineMoney and BankingVijay ARNessuna valutazione finora

- Chapter 1Documento2 pagineChapter 1khanjiNessuna valutazione finora

- Fooled You Lol 4Documento33 pagineFooled You Lol 4stynx784Nessuna valutazione finora

- MerchantbankingDocumento36 pagineMerchantbankingsalhotraonlineNessuna valutazione finora

- Lost Spring NotesDocumento2 pagineLost Spring NotesAnujNessuna valutazione finora

- Keeping Quiet AssignmentDocumento2 pagineKeeping Quiet AssignmentAnujNessuna valutazione finora

- A Roadside Stand 2019-20Documento5 pagineA Roadside Stand 2019-20AnujNessuna valutazione finora

- A Roadside Stand 2019-20Documento5 pagineA Roadside Stand 2019-20AnujNessuna valutazione finora

- Chapter 1 Relation and FunctionsDocumento4 pagineChapter 1 Relation and FunctionsAnujNessuna valutazione finora

- Chapter 1 Relation and Functions - Docx-ModifiedDocumento4 pagineChapter 1 Relation and Functions - Docx-ModifiedAnujNessuna valutazione finora

- My Mother at Sixty Six 2019-20Documento4 pagineMy Mother at Sixty Six 2019-20Anuj100% (3)

- Chapter 1 Relation and Functions - Docx-ModifiedDocumento4 pagineChapter 1 Relation and Functions - Docx-ModifiedAnujNessuna valutazione finora

- Formal Letters - SamplesDocumento6 pagineFormal Letters - SamplesAnuj100% (3)

- Month-End Exam (April) - XII-SET BDocumento2 pagineMonth-End Exam (April) - XII-SET BAnujNessuna valutazione finora

- CBSE Class 12 English Report or Factual DescriptionDocumento7 pagineCBSE Class 12 English Report or Factual DescriptionAnujNessuna valutazione finora

- 17 CentralBankDocumento16 pagine17 CentralBankGhulam HassanNessuna valutazione finora

- FullfaithandcreditDocumento4 pagineFullfaithandcreditJavis Blalock100% (4)

- Lemann Center Annual Report 2019-2020Documento26 pagineLemann Center Annual Report 2019-2020Lemann CenterNessuna valutazione finora

- Philippine National Bank vs. F.F. Cruz and Co., Inc. 654 SCRA 333 (JULY 25, 2011)Documento7 paginePhilippine National Bank vs. F.F. Cruz and Co., Inc. 654 SCRA 333 (JULY 25, 2011)Biboy GSNessuna valutazione finora

- NBFC ProjectDocumento97 pagineNBFC Projectsanjaydesai173_8631850% (2)

- Economic ReportDocumento25 pagineEconomic ReportFA20-BBA-032 (ABDUR REHMAN) UnknownNessuna valutazione finora

- This Content Downloaded From 14.139.245.68 On Wed, 02 Dec 2020 17:57:13 UTCDocumento33 pagineThis Content Downloaded From 14.139.245.68 On Wed, 02 Dec 2020 17:57:13 UTCBidyut Bhusan PandaNessuna valutazione finora

- Financial Awareness From Last 6 Months 1 92 PDFDocumento28 pagineFinancial Awareness From Last 6 Months 1 92 PDFTania MajumderNessuna valutazione finora

- Greenspan InterviewDocumento5 pagineGreenspan InterviewZerohedge100% (1)

- Summer Training Report at HDFC BankDocumento117 pagineSummer Training Report at HDFC Banktasneem subhan89% (38)

- Bank Audit ProjectDocumento87 pagineBank Audit Projectlaxmi sambre78% (9)

- Export Overdues Export Overdues: Prepared By: Hina MukarramDocumento24 pagineExport Overdues Export Overdues: Prepared By: Hina MukarramAnonymous NM8Ej4mONessuna valutazione finora

- Black BookDocumento53 pagineBlack BookDev jangid72% (18)

- Session 7Documento18 pagineSession 7Digvijay SinghNessuna valutazione finora

- Foreign Exchange MarketDocumento16 pagineForeign Exchange MarketAmarveer GillNessuna valutazione finora

- Fractional Reserve BankingDocumento10 pagineFractional Reserve Bankingyoutube watcherNessuna valutazione finora

- Major Activities of RBIDocumento9 pagineMajor Activities of RBIPrateek GuptaNessuna valutazione finora

- Monetary Policy and Economic Growth in Nigeria: A Critical EvaluationDocumento10 pagineMonetary Policy and Economic Growth in Nigeria: A Critical EvaluationInternational Organization of Scientific Research (IOSR)Nessuna valutazione finora

- Pictet Report 3 May 2010 EnglishDocumento36 paginePictet Report 3 May 2010 EnglishmarcosvillaruelNessuna valutazione finora

- International Flow of FundsDocumento42 pagineInternational Flow of FundsIrfan Baloch100% (1)

- Literature Review of Banking SectorDocumento6 pagineLiterature Review of Banking Sectorc5r3aep1100% (1)

- Reformina v. Tomol, Jr.Documento11 pagineReformina v. Tomol, Jr.aitoomuchtvNessuna valutazione finora

- Frictional & Instrumen Kebij MoneterDocumento41 pagineFrictional & Instrumen Kebij MoneterBagus GilangNessuna valutazione finora

- Modern Money MechanicsDocumento40 pagineModern Money MechanicsEdgar Ricardo Ortega Pineda100% (4)

- BAM Quiz 6Documento15 pagineBAM Quiz 6Nads MemerNessuna valutazione finora

- Epaper 31 August 2023Documento32 pagineEpaper 31 August 2023gerald majoniNessuna valutazione finora

- Q1 2022 Global MA ReportDocumento20 pagineQ1 2022 Global MA ReportAkbaraly KevinNessuna valutazione finora

- Economics Slide Ch14Documento25 pagineEconomics Slide Ch14Busiswa MsiphanyanaNessuna valutazione finora

- Basil J Moores Horizontalists and Verticalists AnDocumento9 pagineBasil J Moores Horizontalists and Verticalists AnAdemir CaetanoNessuna valutazione finora

- BIS Papers - Survey On Central Bank Digital CurrenciesDocumento19 pagineBIS Papers - Survey On Central Bank Digital Currencieswbechara103Nessuna valutazione finora