Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PayStatement D0655147

Caricato da

Anonymous O61KvPgDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PayStatement D0655147

Caricato da

Anonymous O61KvPgCopyright:

Formati disponibili

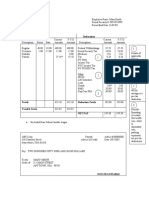

05/03/2019 D0655147

ADVICE OF DEPOSIT - NON-NEGOTIABLE $3,536.02

MICHELE D MCILVAIN

775 STRATFORDE DR.

ALPHARETTA, GA 30004

USM 301 28301 AOCA-1-

NON-NEGOTIABLE

Employee Emp ID Social Security Status Fed-Res-Work Exempt/Allow Number

MICHELE D MCILVAIN 230626 XXX-XX-XXXX US-M GA-M US-0/0 GA-3/0 D0655147

Code Paygroup Division Department Hire Date Period Start Period End Pay Date

CCH23 5 301 28301 07/31/95 04/20/19 05/03/19 05/03/19

Earnings Rate Units Current Year To Date Direct Deposit Accounts Amount

Regular Pay 70.3116 56.00 3,937.45 40,203.04 Checking - XXXXXX6010 3,536.02

Paid Time Off 70.3116 24.00 1,687.48 3,937.45

Floating Days - - - 562.49

Jury + Witness Duty Pay - - - 551.46 Memo Entries Current Year To Date

Discretionary Bonus - - - 18,352.70 Expense Reimbursement 477.78 1,047.78

Group Term Life > $50,000 - - 17.62 158.58 Company Paid Expenses 1,713.09 3,003.70

Prior Year Float - - - 517.00

Reclass PTO - - - 4,135.98

Total 5,642.55 68,418.70 Current Year To Date

W2 Gross 4,590.42 59,057.10

Taxes Current Year To Date

Federal Income Tax 587.59 9,183.23

Social Security (FICA) 336.92 4,125.68

Federal Medicare 78.80 964.88

Georgia Income Tax 243.60 3,212.64

Total 1,246.91 17,486.43

Pre-Tax Deductions Current Year To Date

401(k) Savings Plan 843.74 7,486.09

FSA Health Care 101.93 917.37

Pretax Dental 3.71 33.39

Pretax Medical 99.22 892.98

PRETAX VISION 3.53 31.77

Total 1,052.13 9,361.60

After-Tax Deductions Current Year To Date

401(k) Loan 4 265.79 2,392.11

AD & D Optional Insurance 1.86 16.74

Group Term Life>$50000 Offset 17.62 158.58

Total 285.27 2,567.43

Net Pay 3,536.02

PTO and AZ/CA/NJ Paid Sick

is tracked in EDTC on

torrancepayroll.com

Wolters Kluwer Health, Inc. - 20101 Hamilton Avenue Torrance, CA 90502 - (310) 800-9300

Potrebbero piacerti anche

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeDa EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNessuna valutazione finora

- 02475792798Documento1 pagina02475792798Edwin Zamora PastorNessuna valutazione finora

- E-Statement 20131018 00027Documento1 paginaE-Statement 20131018 00027Renee0430100% (1)

- Non - Negotiable: Notification of DepositDocumento1 paginaNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့Nessuna valutazione finora

- Earnings: Hourly OT On CallDocumento1 paginaEarnings: Hourly OT On CallpabloNessuna valutazione finora

- Carissa Baker: Employee Info Tax DataDocumento2 pagineCarissa Baker: Employee Info Tax Datawhat is thisNessuna valutazione finora

- Non Negotiable - This Is Not A Check - Non NegotiableDocumento1 paginaNon Negotiable - This Is Not A Check - Non NegotiableAlexa PribisNessuna valutazione finora

- Full Payroll Summary: Net PayDocumento2 pagineFull Payroll Summary: Net PayJuan Ignacio Ramirez JaramilloNessuna valutazione finora

- July Pay2Documento1 paginaJuly Pay2CresteynTeyngNessuna valutazione finora

- PsDocumento1 paginaPsCarrie EvansNessuna valutazione finora

- Hersey K Delynn PayStubDocumento1 paginaHersey K Delynn PayStubSharon JonesNessuna valutazione finora

- KPQooo 001266420000 R 07112758 C846621Documento1 paginaKPQooo 001266420000 R 07112758 C846621Jonathan GutierrezNessuna valutazione finora

- Robert C Binson Sept 02 2022 Oct 01 2022Documento1 paginaRobert C Binson Sept 02 2022 Oct 01 2022Ticket Master100% (1)

- November 2019Documento4 pagineNovember 2019Astrid MeloNessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-NegotiableTJ JanssenNessuna valutazione finora

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Documento1 paginaMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNessuna valutazione finora

- Pay StubsDocumento14 paginePay Stubsapi-341301555Nessuna valutazione finora

- Check Ais-3Documento1 paginaCheck Ais-3JOHNNessuna valutazione finora

- 7258a013 9ad0 496f 8340 2b6368 PDFDocumento1 pagina7258a013 9ad0 496f 8340 2b6368 PDFLadis andradeNessuna valutazione finora

- UL PayStub 2019.01.15Documento1 paginaUL PayStub 2019.01.15Marcus GreenNessuna valutazione finora

- Pay Stub Template 03 PDFDocumento1 paginaPay Stub Template 03 PDFchairgraveyardNessuna valutazione finora

- Earnings Statement Only Non NegotiableDocumento1 paginaEarnings Statement Only Non NegotiableLiz MatzNessuna valutazione finora

- Paystub 80280Documento1 paginaPaystub 80280AngelaNessuna valutazione finora

- Non-Negotiable: Nvidia CorporationDocumento1 paginaNon-Negotiable: Nvidia CorporationSteven LinNessuna valutazione finora

- Nieves 1Documento1 paginaNieves 1carterNessuna valutazione finora

- Earnings: Hourly OT On CallDocumento1 paginaEarnings: Hourly OT On CallpabloNessuna valutazione finora

- Chime Checking Statement May 2021 PDFDocumento3 pagineChime Checking Statement May 2021 PDFKalila JamesNessuna valutazione finora

- MR John Doe Date Description Type Amount Available: Debit Account TransactionsDocumento3 pagineMR John Doe Date Description Type Amount Available: Debit Account Transactionsdavid chenNessuna valutazione finora

- Paystub 80280Documento1 paginaPaystub 80280AngelaNessuna valutazione finora

- LT Check Printing Report. 5-5pdfDocumento1 paginaLT Check Printing Report. 5-5pdfKelton ShieldsNessuna valutazione finora

- Eusserlene Johnson - GCWooo005116430000r065AF579E5F521Documento1 paginaEusserlene Johnson - GCWooo005116430000r065AF579E5F521Jennifer Revelo VelascoNessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-NegotiableYanet AlvarezNessuna valutazione finora

- Cesar Simon Abreu Suarez 7320 SW 72Nd Avenue Miami FL 33143-4203Documento4 pagineCesar Simon Abreu Suarez 7320 SW 72Nd Avenue Miami FL 33143-4203CESAR ABREUNessuna valutazione finora

- 3.31 Paystub 1Documento1 pagina3.31 Paystub 1disipiw20Nessuna valutazione finora

- Get Payslip by OffsetDocumento1 paginaGet Payslip by OffsetDarryl WhiteheadNessuna valutazione finora

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Documento1 paginaMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNessuna valutazione finora

- Deaconess Homecare Inc: Payroll Advice OnlyDocumento4 pagineDeaconess Homecare Inc: Payroll Advice OnlyDREE DREENessuna valutazione finora

- DirectDeposit 2021 08 31 1424Documento1 paginaDirectDeposit 2021 08 31 1424Holliday L RuffinNessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-NegotiableSrilatha YagniNessuna valutazione finora

- Earnings Statement: Pay Period: Nov 5, 2021 - Nov 18, 2021 Pay Day: Nov 29, 2021Documento2 pagineEarnings Statement: Pay Period: Nov 5, 2021 - Nov 18, 2021 Pay Day: Nov 29, 2021Aditya AgrawalNessuna valutazione finora

- Statement of Earnings: NON NegotiableDocumento1 paginaStatement of Earnings: NON NegotiableireneNessuna valutazione finora

- Reference QB SupportDocumento10 pagineReference QB SupportTiffanyNessuna valutazione finora

- Paystub 202303Documento1 paginaPaystub 202303carinaNessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-Negotiablesivajyothi1973Nessuna valutazione finora

- Sspofadv 4Documento1 paginaSspofadv 4Antoni Zelaya0% (1)

- Kennedy Paystub 2Documento1 paginaKennedy Paystub 2Hannah RobinsonNessuna valutazione finora

- Gil Rental Payroll - 105 - 022019Documento1 paginaGil Rental Payroll - 105 - 022019Steven LinNessuna valutazione finora

- Green Dot: Debit Account Transactions Date Description Type Amount AvailableDocumento3 pagineGreen Dot: Debit Account Transactions Date Description Type Amount AvailableAlex MandelNessuna valutazione finora

- Document 3Documento1 paginaDocument 3Chris AcostaNessuna valutazione finora

- 26 Estat PDFDocumento4 pagine26 Estat PDFRicky CazaresNessuna valutazione finora

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocumento4 pagineGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNessuna valutazione finora

- Earnings: Our Lady of Peace Ruth MbaDocumento1 paginaEarnings: Our Lady of Peace Ruth MbaNanga wolosoNessuna valutazione finora

- View Paycheck: Employee InformationDocumento4 pagineView Paycheck: Employee InformationJohn January0% (1)

- PDF DocumentDocumento1 paginaPDF DocumentjoelNessuna valutazione finora

- Pay StatementDocumento1 paginaPay Statementjmatos_297262Nessuna valutazione finora

- Greendot StatementDocumento1 paginaGreendot StatementSiobhan76Nessuna valutazione finora

- Earnings Statement: SSN: XXX-XX-2691Documento1 paginaEarnings Statement: SSN: XXX-XX-2691emily ambrosino0% (2)

- Payroll 08142020Documento2 paginePayroll 08142020Shana RushNessuna valutazione finora

- Statements 0201Documento4 pagineStatements 0201Lena VvarNessuna valutazione finora

- Paystub For Oct 2020Documento1 paginaPaystub For Oct 2020bahadarkhan591Nessuna valutazione finora

- Formulario WolfsbergDocumento3 pagineFormulario WolfsbergAndrea VeitNessuna valutazione finora

- B&A ProfileDocumento4 pagineB&A ProfileHittMan BajgainNessuna valutazione finora

- IRC SP 118-2018 Manual For Planning and Development of Urban Roads and StreetsDocumento88 pagineIRC SP 118-2018 Manual For Planning and Development of Urban Roads and StreetsjitendraNessuna valutazione finora

- 100 TechDocumento25 pagine100 TechgowtamakrishnaNessuna valutazione finora

- Internet Enabled BusinessesDocumento17 pagineInternet Enabled BusinessesAnuj TanwarNessuna valutazione finora

- Introduction To Financial ServicesDocumento10 pagineIntroduction To Financial ServicesjainvaishaliNessuna valutazione finora

- Marketing Plan Draft Seabank - Adnindira IsmaraDocumento14 pagineMarketing Plan Draft Seabank - Adnindira IsmaraAdnindira IsmaraNessuna valutazione finora

- Sample Exam - ACT-113X (2014)Documento7 pagineSample Exam - ACT-113X (2014)Jamie ToriagaNessuna valutazione finora

- QB Answers Ia 1 18ai733Documento11 pagineQB Answers Ia 1 18ai733Sahithi BhashyamNessuna valutazione finora

- CGS10BT Final ProjectDocumento4 pagineCGS10BT Final ProjectAlex SanchezNessuna valutazione finora

- Brazil Freight ScenariosDocumento26 pagineBrazil Freight ScenariosMauricio MaedaNessuna valutazione finora

- Drill ListeningDocumento3 pagineDrill ListeningTrang Choi ChoiNessuna valutazione finora

- Bajaj Allianz ProjectDocumento57 pagineBajaj Allianz ProjectNischithNessuna valutazione finora

- H.265 1HDD 5ch NVR: TC-R3105 Spec: I/B/K/V3.0Documento3 pagineH.265 1HDD 5ch NVR: TC-R3105 Spec: I/B/K/V3.0Slah SmichiNessuna valutazione finora

- Financial Inclusion - Micro Credit - Risk Management by Ramesh SubramanianDocumento8 pagineFinancial Inclusion - Micro Credit - Risk Management by Ramesh Subramanianijr_journalNessuna valutazione finora

- Chapter 2 Healthcare Delivery and EconomicsDocumento3 pagineChapter 2 Healthcare Delivery and EconomicsTee WoodNessuna valutazione finora

- Cradle Point CTR35 DatasheetDocumento2 pagineCradle Point CTR35 DatasheetHunterNessuna valutazione finora

- 20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Documento3 pagine20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Dustar Ali HaideriNessuna valutazione finora

- 2 Tourism CompaniesDocumento3 pagine2 Tourism CompaniesKZANDRA JEMIMA TEODORONessuna valutazione finora

- NGN - PLANNED NLD INDIA March 2009Documento155 pagineNGN - PLANNED NLD INDIA March 2009Senthilkumar JayaveluNessuna valutazione finora

- Chapter 2 Problem SolvingDocumento20 pagineChapter 2 Problem SolvingJohn LucaNessuna valutazione finora

- Comparative Study On Personal Banking of SBI and HDFCDocumento14 pagineComparative Study On Personal Banking of SBI and HDFCsaurabhm707Nessuna valutazione finora

- Registration Form - : Federal Government AgencyDocumento2 pagineRegistration Form - : Federal Government AgencySadiq JalalNessuna valutazione finora

- MTCNADocumento8 pagineMTCNARama Start ChildNessuna valutazione finora

- Module B Professional Ethics Learning ObjectivesDocumento26 pagineModule B Professional Ethics Learning ObjectivesHashim Zaman100% (1)

- GST ChallanDocumento2 pagineGST ChallanrajorajisunnyNessuna valutazione finora

- Life Insurance - Wikipedia PDFDocumento77 pagineLife Insurance - Wikipedia PDFTonu SPNessuna valutazione finora

- Funda 2Documento20 pagineFunda 2Lorraine Miralles67% (3)

- Capacity and Level of ServiceDocumento16 pagineCapacity and Level of ServiceBismilNessuna valutazione finora

- Thesis Paper On Mobile Banking in BangladeshDocumento8 pagineThesis Paper On Mobile Banking in Bangladeshaflnzefdqbrevm100% (2)