Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Differences of Format: Accounting Standards

Caricato da

Lương Vân TrangTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Differences of Format: Accounting Standards

Caricato da

Lương Vân TrangCopyright:

Formati disponibili

1.

Differences of format

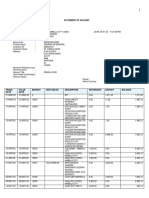

Accounts 2013 2014

Assets Current investment no

Non- current assets no Deposits & prepayment

Liabilities Devidend payable no

Income statement Gain on foreign exchange no

( ở phần Gross profit)

Statement of Shareholders # formmat # format

Equity

Cash flow - Cash paid for loan No

+ Cash flows from management fee

financing activities

No - Repayment of

debentures

+ Supplemental cash flow No - Dividend receivables

information from subsidiaries

2. Note (Method)

a/Financial reporting standards that became effective in the current accounting year

Accounting standards:

TAS 12 Income Taxes

TAS 20 (revised 2009) Accounting for Government Grants and Disclosure of Government Assistance

TAS 21 (revised 2009) The Effects of Changes in Foreign Exchange Rates

Financial Reporting Standard:

TFRS 8 Operating Segments

Accounting Standard Interpretations:

TSIC 10 Government Assistance - No Specific Relation to Operating Activities

TSIC 21 Income Taxes - Recovery of Revalued Non-Depreciable Assets

TSIC 25 Income Taxes - Changes in the Tax Status of an Entity or its Shareholders

b/Financial reporting standards that became effective in the current accounting year

Conceptual Framework for Financial Reporting (revised 2014)

Accounting Standards:

TAS 1 (revised 2012) Presentation of Financial Statements

TAS 7 (revised 2012) Statement of Cash Flows

TAS 12 (revised 2012) Income Taxes

TAS 17 (revised 2012) Leases

TAS 18 (revised 2012) Revenue

TAS 19 (revised 2012) Employee Benefits

TAS 21 (revised 2012) The Effects of Changes in Foreign Exchange Rates

TAS 24 (revised 2012) Related Party Disclosures

TAS 28 (revised 2012) Investments in Associates

TAS 31 (revised 2012) Interests in Joint Ventures

TAS 34 (revised 2012) Interim Financial Reporting

TAS 36 (revised 2012) Impairment of Assets

TAS 38 (revised 2012) Intangible Assets

Financial Reporting Standards:

TFRS 2 (revised 2012) Share-based Payment

TFRS 3 (revised 2012) Business Combinations

TFRS 5 (revised 2012) Non-current Assets Held for Sale and Discontinued Operations

TFRS 8 (revised 2012) Operating Segments

Accounting Standard Interpretations:

TSIC 15 Operating Leases – Incentives

TSIC 27 Evaluating the Substance of Transactions Involving the Legal Form of a Lease

TSIC 29 Service Concession Arrangements: Disclosures

TSIC 32 Intangible Assets – Web Site Costs

Financial Reporting Standard Interpretations:

TFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities

TFRIC 4 Determining whether an Arrangement contains a Lease

TFRIC 5 Rights to Interests arising from Decommissioning, Restoration and Environmental

Rehabilitation Funds

TFRIC 7 Applying the Restatement Approach under

TAS 29 Financial Reporting in Hyperinflationary Economies

TFRIC 10 Interim Financial Reporting and Impairment

TFRIC 12 Service Concession Arrangements

TFRIC 13 Customer Loyalty Programmes

TFRIC 17 Distributions of Non-cash Assets to Owners

TFRIC 18 Transfers of Assets from Customers

1.Accounting Standards:

In 2013, there are three account :

- TAS 12 Income Taxes

- TAS 20 (revised 2009) Accounting for Government Grants and Disclosure of Government

Assistance

- TAS 21 (revised 2009) The Effects of Changes in Foreign Exchange Rates

In 2014, we have :

TAS 1 (revised 2012) Presentation of Financial Statements

TAS 7 (revised 2012) Statement of Cash Flows

TAS 12 (revised 2012) Income Taxes

TAS 17 (revised 2012) Leases

TAS 18 (revised 2012) Revenue

TAS 19 (revised 2012) Employee Benefits

TAS 21 (revised 2012) The Effects of Changes in Foreign Exchange Rates

TAS 24 (revised 2012) Related Party Disclosures

TAS 28 (revised 2012) Investments in Associates

TAS 31 (revised 2012) Interests in Joint Ventures

TAS 34 (revised 2012) Interim Financial Reporting

TAS 36 (revised 2012) Impairment of Assets

TAS 38 (revised 2012) Intangible Assets

As we can see, in two years have the same income taxes: In 2013 and 2014, it was revised in 2009

and 2012, respectively. Besides, there are two speacial account relating accounting for Government

Grants and Disclosure of Government Assistance and the effects of changes in Foreign Exchange

Rates in 2013. It effects that accounting treatment guidance for transfers of financial assets. These

accounting standards, financial reporting standard, accounting standard interpretations and

accounting treatment guidance do not have any significant impact on the financial statements.

But in 2014, These financial reporting standards were amended primarily to align their contents with

the corresponding International Financial Reporting Standards (IFRS). Most of the changes were

directed towards revision of wording and terminology, and provision of interpretations and

accounting guidance to users of the accounting standards. These financial reporting standards do

not have any significant impact on the financial statements.

Potrebbero piacerti anche

- Certificado Inshur SH - 2Documento1 paginaCertificado Inshur SH - 2ukmagicoNessuna valutazione finora

- p.21 Case 1-1 Ribbons An' Bows, IncDocumento3 paginep.21 Case 1-1 Ribbons An' Bows, Incrajo_onglao50% (2)

- The Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFDocumento62 pagineThe Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFalec.black13997% (33)

- Business Finance AssignmentDocumento14 pagineBusiness Finance AssignmentTatiana Elena CraciunNessuna valutazione finora

- Restatement of Property:MortgagesDocumento771 pagineRestatement of Property:Mortgagesmason rush100% (1)

- Ias 1 & Ias 2-Bact-307-Admin-2019-1Documento35 pagineIas 1 & Ias 2-Bact-307-Admin-2019-1Letsah BrightNessuna valutazione finora

- Ch. 1 FrameworkDocumento42 pagineCh. 1 FrameworkLucas LuluNessuna valutazione finora

- Wuling Motors - Announcement of Final Results For The Year Ended 31 December 2012 PDFDocumento32 pagineWuling Motors - Announcement of Final Results For The Year Ended 31 December 2012 PDFalan888Nessuna valutazione finora

- Financial Statements & Analysis 2024 SPCCDocumento29 pagineFinancial Statements & Analysis 2024 SPCCSaturo GojoNessuna valutazione finora

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Documento50 pagineChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888Nessuna valutazione finora

- Electronic Way Bill Under GSTDocumento46 pagineElectronic Way Bill Under GSTDeepak WadhwaNessuna valutazione finora

- CH 05Documento38 pagineCH 05Abdulelah AlhamayaniNessuna valutazione finora

- Analytical Income Statement and Balance SheetDocumento38 pagineAnalytical Income Statement and Balance SheetSanjayNessuna valutazione finora

- Lecture 3 - Slide-Deck of Pre-Recorded VideosDocumento31 pagineLecture 3 - Slide-Deck of Pre-Recorded VideosYaonik HimmatramkaNessuna valutazione finora

- Value Ifrs PLC 2021Documento223 pagineValue Ifrs PLC 2021Daisy Truong100% (1)

- PwC-IFRS-FS-2020-IFRS - VN - Part 1Documento27 paginePwC-IFRS-FS-2020-IFRS - VN - Part 1Hung LeNessuna valutazione finora

- Savaria Quarterly Report 2022 Q1Documento33 pagineSavaria Quarterly Report 2022 Q1Marcela CairoliNessuna valutazione finora

- IFRS Disclosure Checklist: October 2012Documento164 pagineIFRS Disclosure Checklist: October 2012Nizam Uddin MasudNessuna valutazione finora

- Corporate GovernanceDocumento22 pagineCorporate Governanceroman empireNessuna valutazione finora

- Published AccountsDocumento31 paginePublished AccountsGraceii Mecayer CuizonNessuna valutazione finora

- International Financial Reporting StandardsDocumento132 pagineInternational Financial Reporting Standardsqzkhokhar100% (1)

- 2020q1 ReportDocumento67 pagine2020q1 ReportntNessuna valutazione finora

- ' Chapter 2 Lecture Notes STUDENTS SEPT 2023Documento19 pagine' Chapter 2 Lecture Notes STUDENTS SEPT 2023evelyngoveaNessuna valutazione finora

- Superhero Corporation Inc: Financial Statements For The Year Ended 31 December 2009Documento9 pagineSuperhero Corporation Inc: Financial Statements For The Year Ended 31 December 2009shazNessuna valutazione finora

- Pa e q323 FinsuppDocumento56 paginePa e q323 FinsuppJ JuniorNessuna valutazione finora

- Meadville Financial Statements 2022Documento18 pagineMeadville Financial Statements 2022api-278699601Nessuna valutazione finora

- Financial Statements: Amrit Nakarmi Lecture #8 Financial Management Msespm 06 Feb 2020Documento18 pagineFinancial Statements: Amrit Nakarmi Lecture #8 Financial Management Msespm 06 Feb 2020RabinNessuna valutazione finora

- Fourth Quarter 2012 Financial Results Conference Call: February 5, 2013Documento22 pagineFourth Quarter 2012 Financial Results Conference Call: February 5, 2013Nicholas AngNessuna valutazione finora

- Accounting For Companies Part 2Documento45 pagineAccounting For Companies Part 2Moo Jhan FaiNessuna valutazione finora

- Page 0118Documento1 paginaPage 0118Micheal AdediranNessuna valutazione finora

- Procter & Gamble Hygiene and Health Care Limited: Annual Report 2020-21Documento14 pagineProcter & Gamble Hygiene and Health Care Limited: Annual Report 2020-21parika khannaNessuna valutazione finora

- Chapter - 1 & 2 (Presentations On Introduction To Accounting & The Accounting Equation)Documento52 pagineChapter - 1 & 2 (Presentations On Introduction To Accounting & The Accounting Equation)Sattaki RoyNessuna valutazione finora

- Empire Brandy FSDocumento4 pagineEmpire Brandy FSStephanie DoceNessuna valutazione finora

- Financial Planning - ForecastingDocumento4 pagineFinancial Planning - ForecastingPrathamesh411Nessuna valutazione finora

- Lecture 5Documento37 pagineLecture 5Rebel X HamzaNessuna valutazione finora

- CRM Q4 FY24 Earnings Press Release W FinancialsDocumento16 pagineCRM Q4 FY24 Earnings Press Release W FinancialsSean IsaiahNessuna valutazione finora

- Directors Report FinalDocumento5 pagineDirectors Report FinalAbhishek RaiNessuna valutazione finora

- Quarter 2 Lesson 1Documento11 pagineQuarter 2 Lesson 1Gilbert NarvasNessuna valutazione finora

- Lagos State Audited Financial Statements, 2018Documento62 pagineLagos State Audited Financial Statements, 2018Justus OhakanuNessuna valutazione finora

- WCL Annual Report 2011 - 12Documento92 pagineWCL Annual Report 2011 - 12shah1703Nessuna valutazione finora

- Pyrogenesis Canada Inc.: Financial StatementsDocumento43 paginePyrogenesis Canada Inc.: Financial StatementsJing SunNessuna valutazione finora

- Appendix D Comprehensive Test SolutionDocumento4 pagineAppendix D Comprehensive Test Solutionchinum1Nessuna valutazione finora

- JSW Steel Financial AssessmentDocumento32 pagineJSW Steel Financial AssessmentMAHIPAL CHANDANNessuna valutazione finora

- 2020 Draft FS FormatDocumento26 pagine2020 Draft FS Formatankit surtiNessuna valutazione finora

- 2011 Model Fs No Early AppDocumento132 pagine2011 Model Fs No Early AppcrystalroselleNessuna valutazione finora

- Chapter 7Documento55 pagineChapter 7oakleyhouNessuna valutazione finora

- Tamam FS - 2020 - EnglishDocumento27 pagineTamam FS - 2020 - EnglishDhanviper NavidadNessuna valutazione finora

- DR Nizam Latha Incorporated 2020 AFSDocumento11 pagineDR Nizam Latha Incorporated 2020 AFShumayra.m16Nessuna valutazione finora

- Accounting Resource 2019Documento20 pagineAccounting Resource 2019simphiwemotaung671Nessuna valutazione finora

- Illustrative Example PDFDocumento16 pagineIllustrative Example PDFTanvir AhmedNessuna valutazione finora

- Amended Annual Report 2012 ATI - A17A - Dec2012Documento106 pagineAmended Annual Report 2012 ATI - A17A - Dec2012cuonghienNessuna valutazione finora

- FXCM Q3 Slide DeckDocumento20 pagineFXCM Q3 Slide DeckRon FinbergNessuna valutazione finora

- Statement of Changes in Financial PositionDocumento17 pagineStatement of Changes in Financial PositionAbdul MoinNessuna valutazione finora

- BBPW3103 - Topic02 - EnglishDocumento67 pagineBBPW3103 - Topic02 - EnglishclairynaNessuna valutazione finora

- Statement of Cash Flows - CRDocumento24 pagineStatement of Cash Flows - CRMzingaye100% (1)

- 1.0 CFI - FS Primer PDFDocumento10 pagine1.0 CFI - FS Primer PDFSarthak NautiyalNessuna valutazione finora

- Financial StatementDocumento115 pagineFinancial Statementammar123Nessuna valutazione finora

- Financial Statements AnalysisDocumento36 pagineFinancial Statements AnalysisinasNessuna valutazione finora

- Lesson 4 Investment ClubDocumento26 pagineLesson 4 Investment ClubVictor VandekerckhoveNessuna valutazione finora

- Statement of Cash Flows - CRDocumento24 pagineStatement of Cash Flows - CRsyed100% (1)

- Banking Regulation & Policy Department Bangladesh Bank Head Office DhakaDocumento17 pagineBanking Regulation & Policy Department Bangladesh Bank Head Office DhakaAnik Kumar MallickNessuna valutazione finora

- Padenga 2021 FY Financial Results Audit ReportDocumento13 paginePadenga 2021 FY Financial Results Audit ReportCatherine Cat OscullivanNessuna valutazione finora

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- International School: Application Form For Scientific Research StudentDocumento13 pagineInternational School: Application Form For Scientific Research StudentLương Vân TrangNessuna valutazione finora

- review lý thuyết corporate fianance Dương TrangDocumento4 paginereview lý thuyết corporate fianance Dương TrangLương Vân TrangNessuna valutazione finora

- review lý thuyết corporate fianance Dương TrangDocumento4 paginereview lý thuyết corporate fianance Dương TrangLương Vân TrangNessuna valutazione finora

- review lý thuyết corporate fianance Dương TrangDocumento4 paginereview lý thuyết corporate fianance Dương TrangLương Vân TrangNessuna valutazione finora

- review lý thuyết corporate fianance Dương TrangDocumento4 paginereview lý thuyết corporate fianance Dương TrangLương Vân TrangNessuna valutazione finora

- Vietnam National University, Hanoi: International SchoolDocumento24 pagineVietnam National University, Hanoi: International SchoolLương Vân TrangNessuna valutazione finora

- review lý thuyết corporate fianance Dương TrangDocumento4 paginereview lý thuyết corporate fianance Dương TrangLương Vân TrangNessuna valutazione finora

- review lý thuyết corporate fianance Dương TrangDocumento4 paginereview lý thuyết corporate fianance Dương TrangLương Vân TrangNessuna valutazione finora

- Review CORPORATE-FINANCEDocumento5 pagineReview CORPORATE-FINANCELương Vân TrangNessuna valutazione finora

- Review CORPORATE-FINANCEDocumento5 pagineReview CORPORATE-FINANCELương Vân TrangNessuna valutazione finora

- Vietnam National University, Hanoi: International SchoolDocumento24 pagineVietnam National University, Hanoi: International SchoolLương Vân TrangNessuna valutazione finora

- NCKH Report Final - Financial DistressDocumento38 pagineNCKH Report Final - Financial DistressLương Vân TrangNessuna valutazione finora

- Vietnam National University, Hanoi: International SchoolDocumento24 pagineVietnam National University, Hanoi: International SchoolLương Vân TrangNessuna valutazione finora

- Review CORPORATE-FINANCEDocumento5 pagineReview CORPORATE-FINANCELương Vân TrangNessuna valutazione finora

- Vietnam National University, Hanoi: International SchoolDocumento24 pagineVietnam National University, Hanoi: International SchoolLương Vân TrangNessuna valutazione finora

- Group 6 COTECCONS Risk and Risk Analysis Assignement 1Documento17 pagineGroup 6 COTECCONS Risk and Risk Analysis Assignement 1Lương Vân TrangNessuna valutazione finora

- Mau 08. Bao Cao Tong Ket (Eng)Documento3 pagineMau 08. Bao Cao Tong Ket (Eng)Lương Vân TrangNessuna valutazione finora

- Vietnam National University, Hanoi: International SchoolDocumento24 pagineVietnam National University, Hanoi: International SchoolLương Vân TrangNessuna valutazione finora

- Vietnam National University, Hanoi: International SchoolDocumento24 pagineVietnam National University, Hanoi: International SchoolLương Vân TrangNessuna valutazione finora

- PurposeDocumento2 paginePurposeLương Vân TrangNessuna valutazione finora

- Báo Cáo NCKH 2018-2019Documento34 pagineBáo Cáo NCKH 2018-2019Lương Vân TrangNessuna valutazione finora

- Final ReportDocumento28 pagineFinal ReportLương Vân TrangNessuna valutazione finora

- Báo Cáo NCKH 2018-2019Documento34 pagineBáo Cáo NCKH 2018-2019Lương Vân TrangNessuna valutazione finora

- DocxDocumento10 pagineDocxLương Vân TrangNessuna valutazione finora

- Risk and Risk AnalysisDocumento11 pagineRisk and Risk AnalysisLương Vân TrangNessuna valutazione finora

- Group 3 Thaco Case Study Report Edited Version 2Documento21 pagineGroup 3 Thaco Case Study Report Edited Version 2Lương Vân Trang100% (2)

- 2010-09-03 165824 Week 51Documento15 pagine2010-09-03 165824 Week 51Tasya IndahNessuna valutazione finora

- 2010 08 21 - 023852 - E15 18Documento3 pagine2010 08 21 - 023852 - E15 18Lương Vân TrangNessuna valutazione finora

- Risk and Risk AnalysisDocumento11 pagineRisk and Risk AnalysisLương Vân TrangNessuna valutazione finora

- Differences Between Vietnam and Thailan: Brief Intro of SectionDocumento5 pagineDifferences Between Vietnam and Thailan: Brief Intro of SectionLương Vân TrangNessuna valutazione finora

- Satia Industry Training Report.Documento57 pagineSatia Industry Training Report.Deep zaildarNessuna valutazione finora

- Email Id of CEO's Life Insurance - IBAI ORGDocumento3 pagineEmail Id of CEO's Life Insurance - IBAI ORGdheerajdb99Nessuna valutazione finora

- Banks - Sector Update - 22 Dec 21Documento86 pagineBanks - Sector Update - 22 Dec 21Kaushal ShahNessuna valutazione finora

- A Guide To UK Oil and Gas TaxationDocumento172 pagineA Guide To UK Oil and Gas Taxationkalite123Nessuna valutazione finora

- Additional Bank Recon QuestionsDocumento4 pagineAdditional Bank Recon QuestionsDebbie DebzNessuna valutazione finora

- Quantitative Problems Chapter 5Documento5 pagineQuantitative Problems Chapter 5Fatima Sabir Masood Sabir ChaudhryNessuna valutazione finora

- A Trader S Astrological Almanac 2014 - Galactic Investor (Pdfdrive)Documento23 pagineA Trader S Astrological Almanac 2014 - Galactic Investor (Pdfdrive)ky Le100% (1)

- Government Finance Statistics (GFSX) : Valuation of TransactionsDocumento2 pagineGovernment Finance Statistics (GFSX) : Valuation of TransactionsKhenneth BalcetaNessuna valutazione finora

- Ja TinderDocumento6 pagineJa TinderHitlisted VasuNessuna valutazione finora

- Pag Ibig Foreclosed Properties Pubbid 2016-09-14 NCR No DiscountDocumento11 paginePag Ibig Foreclosed Properties Pubbid 2016-09-14 NCR No DiscountChristian D. OrbeNessuna valutazione finora

- Corporate Treasury ManagementDocumento9 pagineCorporate Treasury Managementdhanush_sophieNessuna valutazione finora

- Afar 02 P'ship Operation QuizDocumento4 pagineAfar 02 P'ship Operation QuizJohn Laurence LoplopNessuna valutazione finora

- Fin 4600 Practice Mid Term Exam 1 Robert UptegraffDocumento12 pagineFin 4600 Practice Mid Term Exam 1 Robert UptegraffNguyễn Thanh TùngNessuna valutazione finora

- 1099TaxForm PDFDocumento1 pagina1099TaxForm PDFJennifer WalkerNessuna valutazione finora

- Opportunity Cost in Finance and AccountingDocumento8 pagineOpportunity Cost in Finance and AccountingMary Grace GonzalesNessuna valutazione finora

- Introduction To PPPDocumento25 pagineIntroduction To PPPswatiNessuna valutazione finora

- Fed Foreclosure PetitionDocumento80 pagineFed Foreclosure PetitionudhayaisroNessuna valutazione finora

- InflationDocumento40 pagineInflationmaanyaagrawal65Nessuna valutazione finora

- 02 Project SelectionDocumento32 pagine02 Project SelectionShamsul AlamNessuna valutazione finora

- Riiitzaiit6F5T-L I: R1 Official Form 1) (12/11Documento41 pagineRiiitzaiit6F5T-L I: R1 Official Form 1) (12/11Chapter 11 DocketsNessuna valutazione finora

- Section 14 Unab Rid Dged Written VersionDocumento17 pagineSection 14 Unab Rid Dged Written VersionPrashant TrivediNessuna valutazione finora

- Bangladesh BankDocumento35 pagineBangladesh Bankihshourov60% (5)

- Export 09 - 07 - 2020 00 - 39Documento59 pagineExport 09 - 07 - 2020 00 - 39Kalle AhiNessuna valutazione finora

- Lecture3 Sem2 2023Documento35 pagineLecture3 Sem2 2023gregNessuna valutazione finora

- Schedule of New Fees - RetooledDocumento2 pagineSchedule of New Fees - RetooledRaymund Fernandez CamachoNessuna valutazione finora

- CFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameDocumento20 pagineCFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameVaibhav SarinNessuna valutazione finora